Académique Documents

Professionnel Documents

Culture Documents

An Iso 9001: 2000 Certified International B-School

Transféré par

Ravi Mehta0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues1 pageThis document contains an audit course exam with 10 questions covering various topics related to auditing. The questions address:

1) How the auditor's focus has changed from routine audits to value-added services like cost efficiency and decision making, especially with computer environments.

2) How auditors can help charitable trusts, societies, and co-operative societies achieve their objectives and the relevant legal positions.

3) The types of audit reports and that directors prepare accounts but auditors only report on them.

4) The meaning of "True and Fair" versus "True and Correct" under the Companies Act 1956.

5) Three types of audits that are not mandatory under the Income Tax Act

Description originale:

Auditing

Titre original

Auditing

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document contains an audit course exam with 10 questions covering various topics related to auditing. The questions address:

1) How the auditor's focus has changed from routine audits to value-added services like cost efficiency and decision making, especially with computer environments.

2) How auditors can help charitable trusts, societies, and co-operative societies achieve their objectives and the relevant legal positions.

3) The types of audit reports and that directors prepare accounts but auditors only report on them.

4) The meaning of "True and Fair" versus "True and Correct" under the Companies Act 1956.

5) Three types of audits that are not mandatory under the Income Tax Act

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues1 pageAn Iso 9001: 2000 Certified International B-School

Transféré par

Ravi MehtaThis document contains an audit course exam with 10 questions covering various topics related to auditing. The questions address:

1) How the auditor's focus has changed from routine audits to value-added services like cost efficiency and decision making, especially with computer environments.

2) How auditors can help charitable trusts, societies, and co-operative societies achieve their objectives and the relevant legal positions.

3) The types of audit reports and that directors prepare accounts but auditors only report on them.

4) The meaning of "True and Fair" versus "True and Correct" under the Companies Act 1956.

5) Three types of audits that are not mandatory under the Income Tax Act

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

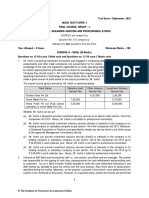

AEREN FOUNDATIONS

Maharashtra Govt. Reg. No.: F-11724

AN ISO 9001 : 2000 CERTIFIED INTERNATIONAL B-SCHOOL

SUBJECT : AUDITING

COURSE : CCA

Total Marks : 80

N.B. : 1) All questions are compulsory

2) All questions carry equal marks.

Q1) Focus of the auditor is no longer on the routine audit but rendering value added services like

cost efficiency and decision making. Critically examine the statement with particular emphasis

on the changing computer environment?

Q2) How can the auditor be useful in achieving the objectives of a Charitable Trust or Society and a

Co-operative Society? What is the legal position under the relevant status?

Q3) It is the job of the directors to prepare the accounts of a company, auditor only reports on it.

Elucidate and describe the types of audit report?

Q4) The thrust area of an auditor is True and Fair and not True and Correct Elucidate in the

light of statutory provisions under the Companies Act 1956.

Q5) Discuss the three types of audits, which although not mandatory under the Income Tax Act

1961, are get done by the assessee to avail certain benefits under the act?

Q6) Examine the changes brought about in the role of an auditor with the growth of information

technology and rapidly changing computer environment?

Q7) The auditor only audits the books of account, he does not guarantee them. Elucidate.

Q8) Tax auditor is a Catalyst of Revenue Collection, function of the State on the one hand, and a

Consultant to the tax payer on the other, discuss?

Q9) Who can be appointed as an auditor of co-operative societies? What are the rights and duties of

auditor under Maharashtra Co-operative Societies Act?

Q10) An auditor is protected from unceremonial removal from office enabling him to maintain his

independence? Do you agree with the statement? If so discuss the position of the auditor in

this regard in the light of statutory provisions under the Companies Act 1956?

Page 1 Out of 1

Vous aimerez peut-être aussi

- Audit Question BankDocument5 pagesAudit Question BankBharatSirveePas encore d'évaluation

- Auditing and Assurance Block Revision Mock 1 (Merge)Document349 pagesAuditing and Assurance Block Revision Mock 1 (Merge)Pöþè'Dennis Köwrëäl DöwshPas encore d'évaluation

- Auditing AnalysisDocument13 pagesAuditing AnalysisAmmarah Rajput ParhiarPas encore d'évaluation

- Chapter 2Document16 pagesChapter 2Sakhawat HossainPas encore d'évaluation

- Paper - 2: Auditing and Assurance QuestionsDocument20 pagesPaper - 2: Auditing and Assurance Questions9331934775100% (1)

- Audit Question BankDocument431 pagesAudit Question Bank3259 ManishaPas encore d'évaluation

- Exam 1 Review SheetDocument12 pagesExam 1 Review SheetjhouvanPas encore d'évaluation

- CA IPCCAuditing & Assurance372722Document11 pagesCA IPCCAuditing & Assurance372722piyushPas encore d'évaluation

- ACC301 Auditing NotesDocument19 pagesACC301 Auditing NotesShakeel AhmedPas encore d'évaluation

- PCC - Auditing - RTP - Nov 2008Document31 pagesPCC - Auditing - RTP - Nov 2008Omnia HassanPas encore d'évaluation

- Auditing&Assurance LL (Lesson1)Document9 pagesAuditing&Assurance LL (Lesson1)BRIAN KORIRPas encore d'évaluation

- Q1. The Following Information of A Company Is Given To YouDocument5 pagesQ1. The Following Information of A Company Is Given To YouAman RastogiPas encore d'évaluation

- Auditing: The Institute of Chartered Accountants of PakistanDocument3 pagesAuditing: The Institute of Chartered Accountants of PakistanadnanPas encore d'évaluation

- Important Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021Document7 pagesImportant Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021punugauriPas encore d'évaluation

- Steps Approach Coopsoc Audit 30062018Document150 pagesSteps Approach Coopsoc Audit 30062018Ritesh AgarwalPas encore d'évaluation

- Principles of Audit and AssuranceDocument20 pagesPrinciples of Audit and AssuranceUnique OfficialsPas encore d'évaluation

- Auditing Ethics Full Test 1 May 2024 Test Paper 1703329935Document22 pagesAuditing Ethics Full Test 1 May 2024 Test Paper 1703329935hersheyys4Pas encore d'évaluation

- Auditing Assurance Practical QuestionsDocument62 pagesAuditing Assurance Practical QuestionsPriyadarshni Seenuvasan100% (1)

- Auditor Interview QuestionsDocument34 pagesAuditor Interview QuestionsZAKA ULLAHPas encore d'évaluation

- Audit ReportDocument21 pagesAudit ReportSahed UzzamanPas encore d'évaluation

- Kes Shroff College of Arts and CommerceDocument24 pagesKes Shroff College of Arts and CommerceSagar ChitrodaPas encore d'évaluation

- Audit1 QADocument8 pagesAudit1 QAAmjath JamalPas encore d'évaluation

- Revision Test Paper CAP III Dec 2017Document121 pagesRevision Test Paper CAP III Dec 2017AAPas encore d'évaluation

- AuditingDocument2 pagesAuditingparthamazumdar93Pas encore d'évaluation

- I1.4 Auditing-AnswDocument16 pagesI1.4 Auditing-Answjbah saimon baptistePas encore d'évaluation

- 1 Role of Regulators in Corporate GovernanceDocument23 pages1 Role of Regulators in Corporate Governancesana khanPas encore d'évaluation

- Screenshot 2023-09-12 at 7.48.02 PMDocument149 pagesScreenshot 2023-09-12 at 7.48.02 PMDisha JainPas encore d'évaluation

- Final - Adv Auditing (O) - Suggested AnsDocument14 pagesFinal - Adv Auditing (O) - Suggested AnsPraveen Reddy DevanapallePas encore d'évaluation

- Stepbystep Approach Co Op Soc AuditDocument118 pagesStepbystep Approach Co Op Soc Auditraj pandeyPas encore d'évaluation

- QB of Corporate Law & Practice ACE 302 - ACM 603 2018-19Document4 pagesQB of Corporate Law & Practice ACE 302 - ACM 603 2018-19isha NarwarPas encore d'évaluation

- Corporate Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument7 pagesCorporate Financial Reporting: © The Institute of Chartered Accountants of IndiaNmPas encore d'évaluation

- ACC311-Final-Term-By Rana Abubakar KhanDocument17 pagesACC311-Final-Term-By Rana Abubakar Khanfari khPas encore d'évaluation

- Audit MTP Nov'22Document22 pagesAudit MTP Nov'22Kushagra SoniPas encore d'évaluation

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument13 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLIPas encore d'évaluation

- 5 - (S2) Aa MP PDFDocument3 pages5 - (S2) Aa MP PDFFlow RiyaPas encore d'évaluation

- Audit Tutorial 2Document10 pagesAudit Tutorial 2Chong Soon Kai100% (1)

- RTP Audit CapiiiDocument33 pagesRTP Audit CapiiiMaggie HartonoPas encore d'évaluation

- Dac 204 Assignment OneDocument6 pagesDac 204 Assignment OneNickson AkolaPas encore d'évaluation

- Project On Audit of BankDocument71 pagesProject On Audit of BankSimran Sachdev0% (2)

- Final Project On Audit of BankDocument39 pagesFinal Project On Audit of BankVaibhav MohitePas encore d'évaluation

- Corporate Governance May Be Defined As FollowsDocument7 pagesCorporate Governance May Be Defined As Followsbarkha chandnaPas encore d'évaluation

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonniePas encore d'évaluation

- Inter-Paper-6-RTPs, MTPs and Past PapersDocument149 pagesInter-Paper-6-RTPs, MTPs and Past Paperssixipa1033Pas encore d'évaluation

- 50 Q AuditingDocument45 pages50 Q Auditingnickle kanthPas encore d'évaluation

- Audit Unit 1finalDocument20 pagesAudit Unit 1finalBinamra SPas encore d'évaluation

- ACC311-Finalterm Solved MCQ'sDocument6 pagesACC311-Finalterm Solved MCQ'sZeePas encore d'évaluation

- Audit Final Suggestion by GKJDocument8 pagesAudit Final Suggestion by GKJAYAN DATTAPas encore d'évaluation

- Auditing and Assurance by Ca Nitin Gupta PDFDocument25 pagesAuditing and Assurance by Ca Nitin Gupta PDFVijaya LaxmiPas encore d'évaluation

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument4 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyPas encore d'évaluation

- ACC311 Fundamental of Accounting Final Term Subjective Prepared by Brave Heart Innocent MishiiDocument4 pagesACC311 Fundamental of Accounting Final Term Subjective Prepared by Brave Heart Innocent MishiiZeePas encore d'évaluation

- Tutorial On AuditingDocument6 pagesTutorial On AuditingSyazliana KasimPas encore d'évaluation

- 74760bos60492 cp1Document42 pages74760bos60492 cp1pushkartiwari0919Pas encore d'évaluation

- CA Inter Audit - CroppedDocument823 pagesCA Inter Audit - CroppedBharath Krishna MVPas encore d'évaluation

- Audit Final Suggestion 16.1.2023Document4 pagesAudit Final Suggestion 16.1.2023Chodon BhikariPas encore d'évaluation

- UntitledDocument52 pagesUntitledYashwant ShigwanPas encore d'évaluation

- Executive Summery: Audit of BankDocument65 pagesExecutive Summery: Audit of BankAditya VermaPas encore d'évaluation

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Bruce R. Hopkins Nonprofit Law Library: Essential Questions and AnswersD'EverandThe Bruce R. Hopkins Nonprofit Law Library: Essential Questions and AnswersPas encore d'évaluation