Académique Documents

Professionnel Documents

Culture Documents

Kinds of Tax Assessments

Transféré par

Aya Arce0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues1 pageKinds of Tax Assessments

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentKinds of Tax Assessments

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues1 pageKinds of Tax Assessments

Transféré par

Aya ArceKinds of Tax Assessments

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

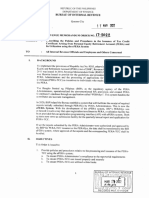

KINDS OF TAX ASSESSMENTS

1.

SELF- ASSESSMENT

This is an assessment wherein the tax is assessed by the taxpayer himself.

2.

DEFICIENCY ASSESSMENT

It is made by the tax assessor himself whereby the correct amount of the tax is determined

after an examination or investigation is conducted. The liability is determined and

assessed for the following reasons:

amount ascertained exceeds that which is shown as the tax by the taxpayer in his

return;

no amount of tax is shown in the return; and

taxpayer did not file any return at all.

3.

ILLEGAL AND VOID ASSESSMENT

It is an assessment wherein tax assessor has no power to assess at all.

4.

ERRONEOUS ASSESSMENT

This is an assessment where the assessor has power to assess but errs in the exercise

thereof.

WHAT IS A DISPUTED ASSESSMENT?

As defined by the Supreme Court in Allied Banking Corp. v. CIR, GR No. 175097:

" A disputed assessment is one wherein the taxpayer or his duly authorized representative

filed an administrative protest against the formal letter of demand and assessment notice within

thirty (30) days from date [of] receipt thereof."

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gopal SPas encore d'évaluation

- MP2 FAQ April15Document3 pagesMP2 FAQ April15rieann09Pas encore d'évaluation

- TreesDocument1 pageTreesAya ArcePas encore d'évaluation

- Unshakable V.1Document10 pagesUnshakable V.1Aya ArcePas encore d'évaluation

- Beautiful Love: Victory WorshipDocument9 pagesBeautiful Love: Victory WorshipAya ArcePas encore d'évaluation

- Group 3 - Solicitation of Legal ServicesDocument52 pagesGroup 3 - Solicitation of Legal ServicesAya ArcePas encore d'évaluation

- Apprentice Progress Report: Ratio To 250 HoursDocument1 pageApprentice Progress Report: Ratio To 250 HoursAya ArcePas encore d'évaluation

- Orient Express Placement Phils. v. NLRCDocument2 pagesOrient Express Placement Phils. v. NLRCAya ArcePas encore d'évaluation

- Gatioan v. GaffudDocument2 pagesGatioan v. GaffudAya ArcePas encore d'évaluation

- Nego - Gsis v. CA & RachoDocument3 pagesNego - Gsis v. CA & RachoAya ArcePas encore d'évaluation

- Parens Patriae Is Latin For "Parent of The Nation." in Law, It Refers To The Public Policy Power ofDocument4 pagesParens Patriae Is Latin For "Parent of The Nation." in Law, It Refers To The Public Policy Power ofAya ArcePas encore d'évaluation

- Alma Jose v. AvellanaDocument7 pagesAlma Jose v. AvellanaAya ArcePas encore d'évaluation

- Fermin v. ComelecDocument11 pagesFermin v. ComelecAya ArcePas encore d'évaluation

- Missouri House Bill No. 1637Document3 pagesMissouri House Bill No. 1637Carl MullanPas encore d'évaluation

- Annex J - Special Account - DomesticDocument4 pagesAnnex J - Special Account - Domesticjaymark canayaPas encore d'évaluation

- 3.1 Protectionism Practice ActivityDocument8 pages3.1 Protectionism Practice ActivityAbhinav Rakesh PatelPas encore d'évaluation

- Book1 PsDocument2 pagesBook1 PsVincent IgnacioPas encore d'évaluation

- How To Release An IRS Wage Garnishment or Bank LevyDocument9 pagesHow To Release An IRS Wage Garnishment or Bank LevyKeith Duke JonesPas encore d'évaluation

- This Study Resource Was: Correction of Errors - ProblemsDocument2 pagesThis Study Resource Was: Correction of Errors - Problemsvenice cambryPas encore d'évaluation

- IT RR Draft v040321 v2Document22 pagesIT RR Draft v040321 v2Jeanette LampitocPas encore d'évaluation

- India Budget Statement 2023 PDFDocument31 pagesIndia Budget Statement 2023 PDFSatyaki RoyPas encore d'évaluation

- RMO No. 17-2022Document7 pagesRMO No. 17-2022Dane ForgerPas encore d'évaluation

- Tax Treaty - Efektif Swiss (Switzerland)Document15 pagesTax Treaty - Efektif Swiss (Switzerland)liforegPas encore d'évaluation

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoPas encore d'évaluation

- Salary Slip (31837722 February, 2019) PDFDocument1 pageSalary Slip (31837722 February, 2019) PDFUsman AwanPas encore d'évaluation

- 0T7517 JULY 2017salary SlipDocument1 page0T7517 JULY 2017salary SlipmukeshkatarnavarePas encore d'évaluation

- Self-Certification For Individual: FATCA/CRS Declaration FormDocument2 pagesSelf-Certification For Individual: FATCA/CRS Declaration FormLeo DennisPas encore d'évaluation

- Robinsons Daiso v. CIRDocument35 pagesRobinsons Daiso v. CIRaudreydql5Pas encore d'évaluation

- Serprobot Invoice 145787Document1 pageSerprobot Invoice 145787Merchandiser JmknitwearPas encore d'évaluation

- AFFIDAVIT Arnold CosipagDocument1 pageAFFIDAVIT Arnold CosipagFernando Tanglao Jr.Pas encore d'évaluation

- Desh BillDocument2 pagesDesh Billappao vidyasagarPas encore d'évaluation

- Prashant Enterprises: Near Parihar Dhaba, Karhal Chauraha, Agra Bye Pass Road Mainpuri-205001 (UP)Document4 pagesPrashant Enterprises: Near Parihar Dhaba, Karhal Chauraha, Agra Bye Pass Road Mainpuri-205001 (UP)Prashant EnterprisesPas encore d'évaluation

- NON ABMBusMath Semis 30 CopiesDocument17 pagesNON ABMBusMath Semis 30 CopiesAnthony John BrionesPas encore d'évaluation

- Practice Questions 308Document9 pagesPractice Questions 308Nidale ChehadePas encore d'évaluation

- Answer Guidance For c6Document13 pagesAnswer Guidance For c6thicknhinmaykhoc100% (1)

- IRS Issues Guidance On State Tax Payments To Help TaxpayersDocument2 pagesIRS Issues Guidance On State Tax Payments To Help TaxpayersMeaghan BellavancePas encore d'évaluation

- Brick Township 2013 Tax Sale ListDocument23 pagesBrick Township 2013 Tax Sale ListTownshipofBrickNJPas encore d'évaluation

- InvoiceDocument1 pageInvoiceChandrika NagarajPas encore d'évaluation

- Accounting Exercises (Management Accounting)Document2 pagesAccounting Exercises (Management Accounting)arvin sibayan100% (1)

- Form - 2 (Editable)Document2 pagesForm - 2 (Editable)Avinash AgrawalPas encore d'évaluation