Académique Documents

Professionnel Documents

Culture Documents

Basics in Finance 9 Questions Homework WarmUps Solutions - PITANJ ZA KOLOKVIJUM ISPIT

Transféré par

Miloš MilenkovićDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Basics in Finance 9 Questions Homework WarmUps Solutions - PITANJ ZA KOLOKVIJUM ISPIT

Transféré par

Miloš MilenkovićDroits d'auteur :

Formats disponibles

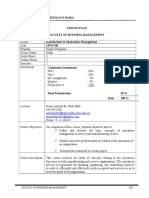

Questions related to Chapter 9

School of Business

True/False Questions

4. The payback period is generally viewed as an unsophisticated

capital budgeting technique, because it does not explicitly consider

the time value of money by discounting cash flows to find present

value.

True

10. The major weakness of payback period in evaluating projects is that

it cannot specify the appropriate payback period in light of the

wealth maximization goal.

True

14. The net present value is found by subtracting a projects initial

investment from the present value of its cash inflows discounted at

a rate equal to the projects internal rate of return.

False

17. The IRR is the compound annual rate of return that the firm will earn

if it invests in the project and receives the given cash inflows.

True

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

18. An internal rate of return greater than the cost of capital guarantees

that the firm earns at least its required return. Such an outcome

should enhance the market value of the firm and therefore the

wealth of its owners.

True

22. On a purely theoretical basis, NPV is the better approach to capital

budgeting than IRR because NPV implicitly assumes that any

intermediate cash inflows generated by an investment are

reinvested at the firms cost of capital.

True

24. Certain mathematical properties may cause a project with a

nonconventional cash flow pattern to have zero or more than one

IRR; this problem does not occur with the NPV approach.

True

25. Net present value (NPV) assumes that intermediate cash inflows

are reinvested at the cost of capital, whereas internal rate of return

(IRR) assumes that intermediate cash inflows can be reinvested at

a rate equal to the projects IRR.

True

28. In general, the greater the difference between the magnitude and

timing of cash inflows, the greater the likelihood of conflicting

ranking between NPV and IRR. True

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

30. Although differences in the magnitude and timing of cash flows

explain conflicting rankings under the NPV and IRR techniques, the

underlying cause is the implicit assumption concerning the

reinvestment of intermediate cash inflowscash inflows received

prior to the termination of a project.

True

32. If the payback period is less than the maximum acceptable payback

period, we would reject a project.

False

37. The payback period of a project that costs $1,000 initially and

promises after-tax cash inflows of $300 for the next three years is

0.333 years.

False

41. A sophisticated capital budgeting technique that can be computed

by subtracting a projects initial investment from the present value of

its cash inflows discounted at a rate equal to the firms cost of

capital is called internal rate of return.

False

45. The NPV of an project with an initial investment of $1,000 that

provides after-tax operating cash flows of $300 per year for four

years where the firms cost of capital is 15 percent is $856.49. False

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

46. The NPV of an project with an initial investment of $1,000 that

provides after-tax operating cash flows of $300 per year for four

years where the firms cost of capital is 15 percent is $143.51.

False

49. A sophisticated capital budgeting technique that can be computed

by solving for the discount rate that equates the present value of a

projects inflows with the present value of its outflows is called

internal rate of return.

True

54. A projects net present value profile is a graph that plots a projects

IRR for various discount rates.

False

58. On a purely theoretical basis, IRR is a better approach when

selecting among two mutually exclusive projects.

False

Multiple Choice Questions

3. Unsophisticated capital budgeting techniques do not

(a)

examine the size of the initial outlay.

(b)

use net profits as a measure of return.

(c)

explicitly consider the time value of money.

(d)

take into account an unconventional cash flow pattern.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

7. Some firms use the payback period as a decision criterion or as a

supplement to sophisticated decision techniques, because

(a)

it explicitly considers the time value of money.

(b)

it can be viewed as a measure of risk exposure.

(c)

the determination of payback is an objectively determined

criteria.

(d)

it can take the place of the net present value approach.

9. A firm is evaluating a proposal which has an initial investment of

$50,000 and has cash flows of $15,000 per year for five years. The

payback period of the project is

(a)

1.5 years.

(b)

2 years.

(c)

3.3 years.

(d)

4 years.

A firm is evaluating two projects that are mutually exclusive with initial

investments and cash flows as follows:

Table 9.1

Project A

Initial

End-of-Year

Investment Cash Flows

$40,000

$20,000

20,000

20,000

Project B

Initial

End-of-Year

Investment Cash Flows

$90,000

$40,000

40,000

80,000

18. If the firm in Table 9.1 has a required payback of two (2) years, they

should

(a)

accept projects A and B.

(b)

accept project A and reject B.

(c)

reject project A and accept B.

(d)

reject both.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

A firm must choose from six capital budgeting proposals outlined below.

The firm is subject to capital rationing and has a capital budget of

$1,000,000; the firms cost of capital is 15 percent.

Table 9.2

Project Initial Investment

1

$200,000

2

400,000

3

250,000

4

200,000

5

150,000

6

400,000

IRR

19%

17

16

12

20

15

NPV

$100,000

20,000

60,000

5,000

50,000

150,000

20. Using the internal rate of return approach to ranking projects, which

projects should the firm accept? (See Table 9.2)

(a)

1, 2, 3, 4, and 5

(b)

1, 2, 3, and 5

(c)

2, 3, 4, and 6

(d)

1, 3, 4, and 6

21. Using the net present value approach to ranking projects, which

projects should the firm accept? (See Table 9.2)

(a)

1, 2, 3, 4, and 5

(b)

1, 2, 3, 5, and 6

(c)

2, 3, 4, and 5

(d)

1, 3, 5, and 6

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

23. A firm is evaluating two independent projects utilizing the internal

rate of return technique. Project X has an initial investment of

$80,000 and cash inflows at the end of each of the next five years

of $25,000. Project Z has a initial investment of $120,000 and cash

inflows at the end of each of the next four years of $40,000. The

firm should

(a)

accept both if their cost of capital is 15 percent at the

maximum.

(b)

accept only Z if their cost of capital is 15 percent at the

maximum.

(c)

accept only X if their cost of capital is 15 percent at the

maximum.

(d)

reject both if their cost of capital is 12 percent at the

maximum.

30. The underlying cause of conflicts in ranking for projects by internal

rate of return and net present value methods is

(a)

the reinvestment rate assumption regarding intermediate

cash flows.

(b)

that neither method explicitly considers the time value of

money.

(c)

the assumption made by the IRR method that intermediate

cash flows are reinvested at the cost of capital.

(d)

the assumption made by the NPV method that intermediate

cash flows are reinvested at the internal rate of return.

32. Comparing net present value and internal rate of return analysis

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

(a)

(b)

(c)

(d)

always results in the same ranking of projects.

always results in the same accept/reject decision.

may give different accept/reject decisions.

is only necessary on mutually exclusive projects.

34. Unlike the net present value criteria, the internal rate of return

approach assumes an interest rate equal to

(a)

the relevant cost of capital.

(b)

the projects internal rate of return.

(c)

the projects opportunity cost.

(d)

the markets interest rate.

35. When evaluating projects using internal rate of return,

(a)

projects having lower early-year cash flows tend to be

preferred at higher discount rates.

(b)

projects having higher early-year cash flows tend to be

preferred at higher discount rates.

(c)

projects having higher early-year cash flows tend to be

preferred at lower discount rates.

(d)

the discount rate and magnitude of cash flows do not affect

internal rate of return.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

37. Which of the following statements is false?

(a)

If the payback period is less than the maximum acceptable

payback period, accept the project.

(b)

If the payback period is greater than the maximum acceptable

payback period, reject the project.

(c)

If the payback period is less than the maximum acceptable

payback period, reject the project

(d)

Two of the above.

39. What is the payback period for Tangshan Mining companys new

project if its initial after tax cost is $5,000,000 and it is expected to

provide after-tax operating cash inflows of $1,800,000 in year 1,

$1,900,000 in year 2, $700,000 in year 3 and $1,800,000 in year 4?

(a)

4.33 years.

(b)

3.33 years.

(c)

2.33 years.

(d)

None of the above.

41. Should Tangshan Mining company accept a new project if its

maximum payback is 3.25 years and its initial after tax cost is

$5,000,000 and it is expected to provide after-tax operating cash

inflows of $1,800,000 in year 1, $1,900,000 in year 2, $700,000 in

year 3 and $1,800,000 in year 4?

(a)

Yes.

(b)

No.

(c)

It depends

(d)

None of the above

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

42. What is the NPV for the following project if its cost of capital is 15

percent and its initial after tax cost is $5,000,000 and it is expected

to provide after-tax operating cash inflows of $1,800,000 in year 1,

$1,900,000 in year 2, $1,700,000 in year 3 and $1,300,000 in year

4?

(a)

$1,700,000

(b)

$371,764

(c)

($137,053)

(d)

None of the above

45. What is the IRR for the following project if its initial after tax cost is

$5,000,000 and it is expected to provide after-tax operating cash

inflows of $1,800,000 in year 1, $1,900,000 in year 2, $1,700,000 in

year 3 and $1,300,000 in year 4?

(a)

15.57%.

(b)

0.00%.

(c)

13.57%.

(d)

None of the above.

47. Which capital budgeting method is most useful for evaluating the

following project? The project has an initial after tax cost of

$5,000,000 and it is expected to provide after-tax operating cash

flows of $1,800,000 in year 1, ($2,900,000) in year 2, $2,700,000 in

year 3 and $2,300,000 in year 4?

(a)

NPV.

(b)

IRR.

(c)

Payback.

(d)

Two of the above.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

49. Consider the following projects, X and Y, where the firm can only

choose one. Project X costs $600 and has cash flows of $400 in

each of the next 2 years. Project B also costs $600, and generates

cash flows of $500 and $275 for the next 2 years, respectively.

Which investment should the firm choose if the cost of capital is 10

percent?

(a)

Project X.

(b)

Project Y.

(c)

Neither.

(d)

Not enough information to tell.

50. Consider the following projects, X and Y where the firm can only

choose one. Project X costs $600 and has cash flows of $400 in

each of the next 2 years. Project B also costs $600, and generates

cash flows of $500 and $275 for the next 2 years, respectively.

Which investment should the firm choose if the cost of capital is 25

percent?

(a)

Project X.

(b)

Project Y.

(c)

Neither.

(d)

Not enough information to tell.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

Essay Questions

Galaxy Satellite Co. is attempting to select the best group of

independent projects competing for the firms fixed capital budget of

$10,000,000. Any unused portion of this budget will earn less than its

20 percent cost of capital. A summary of key data about the proposed

projects follows.

Table 9.7

Project

A

B

C

D

Initial

Investment

$3,000,000

9,000,000

1,000,000

7,000,000

PV of Inflows

at 20%

IRR

21%

25

24

23

$3,050,000

9,320,000

1,060,000

7,350,000

7. Use the NPV approach to select the best group of projects. (See

Table 9.7)

Choose C and D since this combination maximizes NPV at

$410,000 and only requires $8,000,000 initial investment.

8. Use the IRR approach to select the best group of projects. (See

Table 9.7)

Project

B

C

D

A

IRR

25%

24%

23%

21%

Initial Invest

$9,000,000

$1,000,000

$7,000,000

$3,000,000

NPV

$320,000

$ 60,000

$350,000

$ 50,000

Choose B and C, resulting in a NPV of $380,000.

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Questions related to Chapter 9

School of Business

9. Which projects should the firm implement? (See Table 9.7)

Choose C and D.

11. Tangshan Mining Company is considering investing in a new mining

project. The firms cost of capital is 12 percent and the project is

expected to have an initial after tax cost of $5,000,000.

Furthermore, the project is expected to provide after-tax operating

cash flows of $2,500,000 in

year 1, $2,300,000 in year 2, $2,200,000 in year 3 and ($1,300,000)

in year 4?

(a)

Calculate the projects NPV.

(b)

Calculate the projects IRR.

(c)

Should the firm make the investment?

Time

0

1

2

3

4

Cash Flow

$(5,000,000)

$2,500,000

$2,300,000

$2,000,000

$(1,300,000)

PVIF (12%)

1.0000

0.8929

0.7972

0.7118

0.6355

NPV

IRR

Firm should not accept the project.

PV of CF

$(5,000,000)

$2,232,143

$1,833,546

$1,423,560

$ ( 826,174)

$ (336,924)

6.80%

International Management Programme Basics in Finance Prof. Dr. Marcus Labb

Vous aimerez peut-être aussi

- Capital Bud Getting PDFDocument27 pagesCapital Bud Getting PDFBea CruzPas encore d'évaluation

- LESSON PLAN New Syllibus OPM530Document3 pagesLESSON PLAN New Syllibus OPM530che anisPas encore d'évaluation

- Lesson Plan in Technology and Livelihood Education, ICT Computer Hardware Servicing Grade 10Document2 pagesLesson Plan in Technology and Livelihood Education, ICT Computer Hardware Servicing Grade 10Emerson Raz Elardo0% (1)

- Saint Joseph College of Sindangan Incorporated: Pr-Al 1Document16 pagesSaint Joseph College of Sindangan Incorporated: Pr-Al 1Ariel Santos SalavedraPas encore d'évaluation

- Course Syllabus: TAM 542 - Global Leadership and Personal Leadership DevelopmentDocument6 pagesCourse Syllabus: TAM 542 - Global Leadership and Personal Leadership DevelopmentEdison Bitencourt de AlmeidaPas encore d'évaluation

- Gagne's Events of Instruction in MBA ClassroomDocument6 pagesGagne's Events of Instruction in MBA ClassroomInternational Journal in Management Research and Social SciencePas encore d'évaluation

- SyllabusDocument10 pagesSyllabus임민수Pas encore d'évaluation

- A.16 Formation of EthicsDocument27 pagesA.16 Formation of EthicskirangadhariPas encore d'évaluation

- On Becoming A Teacher: Field StudyDocument30 pagesOn Becoming A Teacher: Field StudyKatrine ManaoPas encore d'évaluation

- Class Management & DisciplineDocument22 pagesClass Management & DisciplineAnwaarPas encore d'évaluation

- Ethical and Moral Decision Making Rubric Example1Document1 pageEthical and Moral Decision Making Rubric Example1Farah Sofhia Mohd ZinPas encore d'évaluation

- EDUC 7 - Module 2 (Principle of Teaching & Educ. Tech.)Document5 pagesEDUC 7 - Module 2 (Principle of Teaching & Educ. Tech.)Luis Santos Amatosa Jr.Pas encore d'évaluation

- Indexing Procedure GuidelinesDocument24 pagesIndexing Procedure Guidelinesapi-267019822Pas encore d'évaluation

- Basic FinanceDocument5 pagesBasic FinanceOyi Lorenzo-LibanPas encore d'évaluation

- Ubd Stage 1Document30 pagesUbd Stage 1api-199433354Pas encore d'évaluation

- 2LP-Key Principles of LearningDocument18 pages2LP-Key Principles of LearningNhial AbednegoPas encore d'évaluation

- Assignment 8614Document19 pagesAssignment 8614Mano BiliPas encore d'évaluation

- Abe L5 IbcDocument156 pagesAbe L5 IbcEbooks Prints100% (1)

- A Module For The Teaching Profession Super FinalDocument191 pagesA Module For The Teaching Profession Super FinalShaira May MalonPas encore d'évaluation

- Learning Outcomes and Learning Experiences For Technically Developed Curriculum Projects in TESL Dr. Azadeh AsgariDocument28 pagesLearning Outcomes and Learning Experiences For Technically Developed Curriculum Projects in TESL Dr. Azadeh AsgariDr. Azadeh AsgariPas encore d'évaluation

- L5 OB Manual Advance EditionDocument318 pagesL5 OB Manual Advance EditionEbooks Prints67% (3)

- Trainers Guide Manual PDFDocument26 pagesTrainers Guide Manual PDFLjupchoPas encore d'évaluation

- OBEDocument73 pagesOBEJiwa AbdullahPas encore d'évaluation

- Components of Daily Lesson PlansDocument1 pageComponents of Daily Lesson Plansapi-357377076Pas encore d'évaluation

- PPST: Philippine Teachers' StandardsDocument52 pagesPPST: Philippine Teachers' StandardsRush JaimeerPas encore d'évaluation

- Areas Piaget Vygotsky: Theory ComparisonDocument1 pageAreas Piaget Vygotsky: Theory ComparisonJana Luz Dumam-ag PabalayPas encore d'évaluation

- Implementing Curriculum Pilot TestingDocument10 pagesImplementing Curriculum Pilot Testingclara dupitas100% (1)

- Module 1 Session 3 Teaching Vocation or ProfessionDocument2 pagesModule 1 Session 3 Teaching Vocation or ProfessionCherree MagsPas encore d'évaluation

- Chapter 4Document22 pagesChapter 4Jack FrostPas encore d'évaluation

- St. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Document9 pagesSt. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Cath TacisPas encore d'évaluation

- Mini CaseDocument1 pageMini CaseMaribel ZafePas encore d'évaluation

- K To 12 CG - Nail Care - v1.0Document5 pagesK To 12 CG - Nail Care - v1.0Levi Lico PangilinanPas encore d'évaluation

- PhiloDocument5 pagesPhiloK-Cube MorongPas encore d'évaluation

- Portfolio Table of ContentsDocument1 pagePortfolio Table of Contentsapi-397487642Pas encore d'évaluation

- Portfolio Assessment: A Guide to the Purpose, Types and Development PhasesDocument26 pagesPortfolio Assessment: A Guide to the Purpose, Types and Development PhasessupositionPas encore d'évaluation

- Bangalore University BBM Degree RegulationsDocument68 pagesBangalore University BBM Degree RegulationsmadhutkPas encore d'évaluation

- BS Accountancy graduates' employment surveyDocument6 pagesBS Accountancy graduates' employment surveyJhazzette MirasPas encore d'évaluation

- Distinction Between Curriculum and Other Related Terminologies1. Curriculum and SyllabusDocument3 pagesDistinction Between Curriculum and Other Related Terminologies1. Curriculum and SyllabusGwApz JjOe100% (1)

- MKT 108 Introduction To Marketing PDFDocument104 pagesMKT 108 Introduction To Marketing PDFSeun -nuga DanielPas encore d'évaluation

- Module1 Learner Centered PrinciplesDocument13 pagesModule1 Learner Centered PrinciplesAllysa AvelinoPas encore d'évaluation

- Accounting Teaching TechniquesDocument19 pagesAccounting Teaching TechniquesWaaz BerserkerPas encore d'évaluation

- The Teaching Profession FinalsDocument1 pageThe Teaching Profession FinalsAntonette TagadiadPas encore d'évaluation

- Long Term Investment Decision Making ("Capital Budgeting" An Approach)Document47 pagesLong Term Investment Decision Making ("Capital Budgeting" An Approach)samadhanPas encore d'évaluation

- LPDRMDocument2 pagesLPDRMShelymar Reyes TabbadPas encore d'évaluation

- Core Principles of Effective AssessmentDocument6 pagesCore Principles of Effective AssessmentIrene Futalan LastimosoPas encore d'évaluation

- Final ProjectDocument10 pagesFinal ProjectRolando CastroPas encore d'évaluation

- 8612 PDFDocument267 pages8612 PDFTahir HussainPas encore d'évaluation

- Assessment I Course SyllabusDocument3 pagesAssessment I Course SyllabusKister Quin EscanillaPas encore d'évaluation

- Various Roles of AssessmentDocument29 pagesVarious Roles of Assessmentjepoy swaPas encore d'évaluation

- Marketing Busines and PracticeDocument67 pagesMarketing Busines and PracticeAlina IliseiPas encore d'évaluation

- Introduction To Technology For Teaching and LearningDocument11 pagesIntroduction To Technology For Teaching and LearningJohn elly QuidulitPas encore d'évaluation

- Management 4219 Strategic Management: Ofemb@umsl - EduDocument7 pagesManagement 4219 Strategic Management: Ofemb@umsl - EduMPas encore d'évaluation

- Assessment and Evaluation of Learning Prof - EdDocument20 pagesAssessment and Evaluation of Learning Prof - EdAllan Joneil LataganPas encore d'évaluation

- QME4004 Business Economics and Law IDocument5 pagesQME4004 Business Economics and Law Imaheswaran perumalPas encore d'évaluation

- ACC4002 Fundamental of Fin Acc IDocument6 pagesACC4002 Fundamental of Fin Acc Imaheswaran perumalPas encore d'évaluation

- Module in Financial Management 01Document17 pagesModule in Financial Management 01Karen DammogPas encore d'évaluation

- MBALN-622 - Midterm Examination BriefDocument6 pagesMBALN-622 - Midterm Examination BriefwebsternhidzaPas encore d'évaluation

- Q Finman2 Capbudgtng 1920Document5 pagesQ Finman2 Capbudgtng 1920Deniece RonquilloPas encore d'évaluation

- 09-Capital Budgeting TechniquesDocument19 pages09-Capital Budgeting TechniquesJean Jane EstradaPas encore d'évaluation

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Impact of travel time uncertainties on the solution cost of a two echelon vehicle routing problem with sinchronizationDocument23 pagesImpact of travel time uncertainties on the solution cost of a two echelon vehicle routing problem with sinchronizationMiloš MilenkovićPas encore d'évaluation

- Evaluating the impacts of using cargo cycles on urban logisticsDocument10 pagesEvaluating the impacts of using cargo cycles on urban logisticsMiloš MilenkovićPas encore d'évaluation

- A Decision Making Tool for the Determination of the Distribution Center Location in Humanitarian Logistics NetworkDocument17 pagesA Decision Making Tool for the Determination of the Distribution Center Location in Humanitarian Logistics NetworkMiloš MilenkovićPas encore d'évaluation

- A Survey of Optimization Models For Train Routing and Scheduling PDFDocument25 pagesA Survey of Optimization Models For Train Routing and Scheduling PDFMiloš MilenkovićPas encore d'évaluation

- Inland Intermodal Terminals and Freight Logistics Hubs PDFDocument29 pagesInland Intermodal Terminals and Freight Logistics Hubs PDFMiloš MilenkovićPas encore d'évaluation

- Methodological Framework For The Development of Urban Electric Cargo Bike System in Shipment DistributionDocument10 pagesMethodological Framework For The Development of Urban Electric Cargo Bike System in Shipment DistributionMiloš MilenkovićPas encore d'évaluation

- Fuzzy SA For Project Time Cost Trade Off - MilenkovicDocument14 pagesFuzzy SA For Project Time Cost Trade Off - MilenkovicMiloš MilenkovićPas encore d'évaluation

- Evaluation of Railway Performance Through Quality of ServiceDocument190 pagesEvaluation of Railway Performance Through Quality of ServiceMiloš MilenkovićPas encore d'évaluation

- Fuzzy Modeling Approach To Rail Freight Car Inventory Problem PDFDocument28 pagesFuzzy Modeling Approach To Rail Freight Car Inventory Problem PDFMiloš MilenkovićPas encore d'évaluation

- Econometric Models For The Forecast of Passenger D PDFDocument19 pagesEconometric Models For The Forecast of Passenger D PDFMiloš MilenkovićPas encore d'évaluation

- Survey On Intermodal Transfer Technologies - Za Infrastructure Transport Equipment and Trtansfer Means PDFDocument86 pagesSurvey On Intermodal Transfer Technologies - Za Infrastructure Transport Equipment and Trtansfer Means PDFMiloš MilenkovićPas encore d'évaluation

- Utilization of AI in The Railway SectorDocument6 pagesUtilization of AI in The Railway SectorMiloš MilenkovićPas encore d'évaluation

- 1 s2.0 S009630030600943X MainDocument10 pages1 s2.0 S009630030600943X MainMiloš MilenkovićPas encore d'évaluation

- Integrated Operations Planning and Revenue Management For Rail Freight Transportation PDFDocument20 pagesIntegrated Operations Planning and Revenue Management For Rail Freight Transportation PDFMiloš MilenkovićPas encore d'évaluation

- Optimal Size and Location Planning of Public Terminals PDFDocument16 pagesOptimal Size and Location Planning of Public Terminals PDFMiloš MilenkovićPas encore d'évaluation

- Analytic Model Driven Organizational Design and Experimentation in Adaptive Command and ControlDocument12 pagesAnalytic Model Driven Organizational Design and Experimentation in Adaptive Command and ControlMiloš MilenkovićPas encore d'évaluation

- 2013 IEEE ITSC A Hierarchical MPC For Optimizing Intermodal Container Terminal Operations JLNabais PDFDocument7 pages2013 IEEE ITSC A Hierarchical MPC For Optimizing Intermodal Container Terminal Operations JLNabais PDFMiloš MilenkovićPas encore d'évaluation

- Aircraft Selection ANPDocument5 pagesAircraft Selection ANPMiloš MilenkovićPas encore d'évaluation

- Smoothing Models v6Document23 pagesSmoothing Models v6datass100Pas encore d'évaluation

- 1 s2.0 0959152495959427 MainDocument9 pages1 s2.0 0959152495959427 MainMiloš MilenkovićPas encore d'évaluation

- 003 PacciarelliDocument7 pages003 PacciarelliMiloš MilenkovićPas encore d'évaluation

- 1 s2.0 S0005109801000541 MainDocument8 pages1 s2.0 S0005109801000541 MainMiloš MilenkovićPas encore d'évaluation

- Bining Neural Network Model With Seasonal Time Series ARIMA ModelDocument17 pagesBining Neural Network Model With Seasonal Time Series ARIMA ModelMiloš MilenkovićPas encore d'évaluation

- Application of The AHP in Project ManagementDocument9 pagesApplication of The AHP in Project Managementapi-3707091100% (2)

- Lecture7 8Document33 pagesLecture7 8KingsleyModjadjiPas encore d'évaluation

- Analiza OsetljivostiDocument10 pagesAnaliza OsetljivostiMiloš MilenkovićPas encore d'évaluation

- Ampl TutorialDocument19 pagesAmpl TutorialMiloš MilenkovićPas encore d'évaluation

- Parallel Simulated Annealing Algorithms: N Different Nodes of The Network. The Two Algorithms HaveDocument6 pagesParallel Simulated Annealing Algorithms: N Different Nodes of The Network. The Two Algorithms HaveMiloš MilenkovićPas encore d'évaluation

- Parallel Simulated Annealing Algorithms: N Different Nodes of The Network. The Two Algorithms HaveDocument6 pagesParallel Simulated Annealing Algorithms: N Different Nodes of The Network. The Two Algorithms HaveMiloš MilenkovićPas encore d'évaluation

- Bali villa invoice for 27 night stayDocument4 pagesBali villa invoice for 27 night staymarkPas encore d'évaluation

- Milk ProcessingDocument35 pagesMilk Processingapi-372852175% (4)

- Ernesto Serote's Schema On Planning ProcessDocument9 pagesErnesto Serote's Schema On Planning ProcessPatPas encore d'évaluation

- Estate Tax GuideDocument31 pagesEstate Tax GuideMary Joy DenostaPas encore d'évaluation

- Unit 4 1 - Lesson 4 - Incidence of Subsidies 1Document12 pagesUnit 4 1 - Lesson 4 - Incidence of Subsidies 1api-260512563Pas encore d'évaluation

- Curriculum Vitae: Name Current Position Date of Birth Nationality E-Mail Address Phone NumberDocument4 pagesCurriculum Vitae: Name Current Position Date of Birth Nationality E-Mail Address Phone NumberThang NguyenPas encore d'évaluation

- Written Assignment Unit 2 Fin MGTDocument2 pagesWritten Assignment Unit 2 Fin MGTSalifu J TurayPas encore d'évaluation

- Accounting Adjustments Chapter 3Document4 pagesAccounting Adjustments Chapter 3Alyssa LexPas encore d'évaluation

- Complete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoDocument4 pagesComplete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoΠορφυρογήςPas encore d'évaluation

- Cardinal Utility AnalysisDocument27 pagesCardinal Utility AnalysisGETinTOthE SySteMPas encore d'évaluation

- SOP For DigiDhan FinalDocument17 pagesSOP For DigiDhan FinalsunilPas encore d'évaluation

- Economics QuizDocument13 pagesEconomics QuizBhushan SawantPas encore d'évaluation

- Indonesia HollySys Base-Installation. 11.03.2019Document3 pagesIndonesia HollySys Base-Installation. 11.03.2019Aerox neoPas encore d'évaluation

- Malthusianism WikipediaDocument16 pagesMalthusianism WikipediavalensalPas encore d'évaluation

- Ias 24 Related Party DisclosuresDocument3 pagesIas 24 Related Party DisclosurescaarunjiPas encore d'évaluation

- Role of HRM in Designing Organizational StructureDocument35 pagesRole of HRM in Designing Organizational StructureMuhammad HammadPas encore d'évaluation

- MatheDocument367 pagesMathepearlPas encore d'évaluation

- IIIT A Campus - Fee Deposit Slip Jan Jun15Document5 pagesIIIT A Campus - Fee Deposit Slip Jan Jun15Shaiwal SachdevPas encore d'évaluation

- Syngenta Annual Report 2014 - 2015Document120 pagesSyngenta Annual Report 2014 - 2015Movin Menezes0% (1)

- Metalliferous Mines Regulation, 1961-1Document1 pageMetalliferous Mines Regulation, 1961-1KP S0% (1)

- Kingfisher AirlineDocument13 pagesKingfisher AirlineAbhishek BansalPas encore d'évaluation

- MutiaraVille New PhaseDocument20 pagesMutiaraVille New PhaseBernard LowPas encore d'évaluation

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalPas encore d'évaluation

- Send For RepairDocument13 pagesSend For RepairTauseefAhmedPas encore d'évaluation

- Sowmya DCW ChapterDocument29 pagesSowmya DCW ChapterGopi KrishzPas encore d'évaluation

- Ultratech Cement: Particulars Test Results Requirements ofDocument1 pageUltratech Cement: Particulars Test Results Requirements ofjitendra100% (1)

- Analysis of Improving The Living Standards of The PopulationDocument4 pagesAnalysis of Improving The Living Standards of The PopulationIJRASETPublicationsPas encore d'évaluation

- IT Doesnt MatterDocument5 pagesIT Doesnt MatterHava MalokuPas encore d'évaluation

- PDF Women Entrepreneurship - Timothy MaheaDocument11 pagesPDF Women Entrepreneurship - Timothy MaheaMaheaPas encore d'évaluation

- 25 Most Influential Business Leaders in The PhilippinesDocument8 pages25 Most Influential Business Leaders in The PhilippinesJon GraniadaPas encore d'évaluation