Académique Documents

Professionnel Documents

Culture Documents

Macrooverview - October Week 2

Transféré par

api-278033882Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Macrooverview - October Week 2

Transféré par

api-278033882Droits d'auteur :

Formats disponibles

Macroeconomic Overview

U.S. Markets

The past trading week was very active in the markets, with the S&P 500 recording its largest weekly gain of

the year. The index finished the week at 2,014.89, a 3.3% increase over the week. Meanwhile, the Dow Jones

Industrial Average closed at 17,084.49, up 0.2% for the day and 3.27% for the week, and the NASDAQ

Composite finished the week at 4,830.47, up 2.61% over the past 5 days. Small cap stocks, as measured by the

Russell 2000 Index, slightly outperformed large caps with a weekly gain of 4.60% at 1,165.36. Out of those

indices, only the NASDAQ Composite has gained year-to-date, with a modest increase of just under 2%. The

past week was also characterized by a drastic decrease in volatility, as measured by the VIX index, which

dropped 18.43% to 17.08 and reached a level not seen since August 19. This marked the ninth consecutive

day of decline for the common fear gauge, its longest declining streak in four years. Gold and silver rallied

2.02% and 3.45% respectively over the

week, and crude oil gained almost 9% at

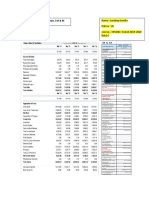

Index

Weekly % Change YTD % Change

$49.63/bbl, after briefly crossing the $50

S&P 500

+3.3%

-2.14% threshold not seen since mid-July.

Dow Jones Industrial

+3.27%

-4.13% Minutes of the September FOMC

NASDAQ Composite

+2.61%

+1.99% meeting were released on Thursday, and

Russell 2000

+4.60%

-3.27% even though they showed that Fed

VIX

-18.43%

-11.03% officials are still feeling quite confident

about the economy, the tone seemed

cautious as the outlook for global growth slows down. Traders now see a 39% chance for a rate hike by the

end of the year, as opposed to 45% the day before the minutes were released. The economic calendar was

fairly light for the past week, and the few releases did not seem to put a dent in a mostly technical rally in the

markets. The week also kicked off third quarter earnings season, with a rather disappointing report by Alcoa

sending its shares tumbling 6.81% to $10.26. Next week, 37 S&P 500 companies are expected to report

earnings, including Johnson & Johnson, Intel, Bank of America and General Electric. Several economic

reports are expected during the coming week, with the publication of September retail sales and Producer

Price Index - Final Demand (PPI-FD), as well as August Business Inventories, all due on Wednesday. On

Thursday, the New York Fed will release its Empire State Manufacturing Survey before the markets open at

8:30, and the EIA will release its weekly petroleum report at 10:00. On Friday, the Federal Reserve will release

its September Industrial Production report at 9:15, followed by the Department of Labors JOLTS report at

10:00.

International Markets

International markets also experienced a strong rally during the past week, with the Bloomberg European 500

and Stoxx Europe 600 indices posting gains of 4.08% and 2.51% respectively. The outlook for Europe

remains positive, with Mario Draghi declaring on Saturday that he was satisfied with the effects of the

monetary stimulus, and that he was confident the Eurozone would reach the inflation target of 2% set by the

ECB. The MSCI EAFE index gained 5.44% to close at 1,759.7, and the MSCI Emerging Markets closed up

6.87% at 859.32. Chinese markets reopened on Thursday after a weeklong national holiday, and investors

were eager to push the Shanghai Composite up 4.27% to 3,183.15, and the Shenzhen Composite index up

5.52% to 1,811.63.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Macroeconomic Overview April Week 4Document2 pagesMacroeconomic Overview April Week 4api-278033882Pas encore d'évaluation

- Macro-Bond Feb WK 4-17Document3 pagesMacro-Bond Feb WK 4-17api-278033882Pas encore d'évaluation

- Macro4 18Document2 pagesMacro4 18api-278033882Pas encore d'évaluation

- Market Report FinalDocument2 pagesMarket Report Finalapi-278033882Pas encore d'évaluation

- Macro March WK 3Document2 pagesMacro March WK 3api-278033882Pas encore d'évaluation

- Macro11 6Document2 pagesMacro11 6api-278033882Pas encore d'évaluation

- Thesis Summary Template FinalDocument4 pagesThesis Summary Template Finalapi-278033882Pas encore d'évaluation

- Thesis Nov WK 1Document2 pagesThesis Nov WK 1api-278033882Pas encore d'évaluation

- Thesis Summary TemplateDocument1 pageThesis Summary Templateapi-278033882Pas encore d'évaluation

- Macro Nov WK 3Document2 pagesMacro Nov WK 3api-278033882Pas encore d'évaluation

- Bond Report Final Week 6Document2 pagesBond Report Final Week 6api-278033882Pas encore d'évaluation

- Thesis Summary Week 10Document4 pagesThesis Summary Week 10api-278033882Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Equity Smile A Monte-Carlo ApproachDocument2 pagesEquity Smile A Monte-Carlo ApproachSol FernándezPas encore d'évaluation

- Financial Accounting Chapter 7Document57 pagesFinancial Accounting Chapter 7Waqas MazharPas encore d'évaluation

- KPJ - 180817 - 2Q18 - AdbsDocument5 pagesKPJ - 180817 - 2Q18 - AdbsMohdRizalFitriPas encore d'évaluation

- Dabur RepositioningDocument11 pagesDabur RepositioningsaurabhPas encore d'évaluation

- Rakesh Jhunjunwala and His Strategies: A Comparison With Warren Buffet's StrategiesDocument13 pagesRakesh Jhunjunwala and His Strategies: A Comparison With Warren Buffet's StrategiesswapnaPas encore d'évaluation

- Icic Demat ProjectDocument7 pagesIcic Demat ProjectmaniPas encore d'évaluation

- SPAN ExplanationDocument18 pagesSPAN Explanationjigsan5Pas encore d'évaluation

- Ebook IOP PDFDocument125 pagesEbook IOP PDFamruta ayurvedalayaPas encore d'évaluation

- Chapter 8 QuestionsDocument7 pagesChapter 8 QuestionsVinay YevatkarPas encore d'évaluation

- XYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsDocument3 pagesXYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsMisu NguyenPas encore d'évaluation

- Chapter 1 Basic Consid & Formation FinalDocument50 pagesChapter 1 Basic Consid & Formation FinalTheresa Timonan86% (14)

- Pro Forma Financial StatementsDocument13 pagesPro Forma Financial StatementsAlex liaoPas encore d'évaluation

- Decision-Making For Investors 052404 - Michael MauboussinDocument20 pagesDecision-Making For Investors 052404 - Michael Mauboussintatsrus1100% (1)

- Seth Klarman CFA Presentation PDFDocument11 pagesSeth Klarman CFA Presentation PDFRam Narayanan100% (1)

- 2009-01-14Document16 pages2009-01-14Tufts DailyPas encore d'évaluation

- ETF Trading Strategies RevealedDocument44 pagesETF Trading Strategies Revealedpsoonek100% (1)

- Statement of Financial PositionDocument3 pagesStatement of Financial Positionlyka0% (1)

- Business Cycle Sector ApproachDocument10 pagesBusiness Cycle Sector ApproachWafer on my vanilla yayPas encore d'évaluation

- Section 1 Technical Analysis and The Dow TheoryDocument16 pagesSection 1 Technical Analysis and The Dow TheoryshadapaaakPas encore d'évaluation

- Chapter 2 - Correction of Errors PDFDocument12 pagesChapter 2 - Correction of Errors PDFRonald90% (10)

- ISDA Equities Derivatives 2011 DefinitionsDocument333 pagesISDA Equities Derivatives 2011 Definitionsdafoozz100% (2)

- O'NeilDocument99 pagesO'NeilNita JosephPas encore d'évaluation

- Chapter 8 PDFDocument36 pagesChapter 8 PDFRoan CalimdorPas encore d'évaluation

- .Project of Nse and BseDocument77 pages.Project of Nse and BseRavi SutharPas encore d'évaluation

- Difference Between IGAAP and Ind-ASDocument84 pagesDifference Between IGAAP and Ind-ASRohan SinghPas encore d'évaluation

- Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice QuestionsDocument26 pagesChapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questionsnikhil diwan75% (4)

- Ssga Regimes, Risk Factors, and Asset AllocationDocument29 pagesSsga Regimes, Risk Factors, and Asset Allocationleongold100100% (1)

- Marriott Corporation Case SolutionDocument4 pagesMarriott Corporation Case SolutionAsif RahmanPas encore d'évaluation

- Chapter 11 - Sources of CapitalDocument21 pagesChapter 11 - Sources of CapitalArman100% (1)

- Assignment 1Document10 pagesAssignment 1Sandeep SunthaPas encore d'évaluation