Académique Documents

Professionnel Documents

Culture Documents

Time Value of Money

Transféré par

Christian WashingtonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Time Value of Money

Transféré par

Christian WashingtonDroits d'auteur :

Formats disponibles

REAL ESTATE

REAL ESTATE PRINCIPLES

TIME VALUE OF MONEY

REAL ESTATE

Time Value of Money

You are going to lend $100,000 to somebody.

1 year later, how much do you expect to get back?

$100,000

Today

$100,000 ?

$110,000 ?

1 year later

REAL ESTATE

Time Value of Money

You won $100,000 in the lottery today.

1. Which do you prefer?

$100,000

Or

$100,000 ?

1 year later

Today

2. How about this option?

$100,000

Today

Or

$110,000 ?

1 year later

3

REAL ESTATE

Liquidity Preference and Return

People prefer present cash flow to future cash flow

Why?

Investment opportunity: You can increase your wealth by

investing the money today

Inflation: Purchasing power may decrease

Uncertainty: Future is uncertain and your future cash flow

may not be realized

Your borrower may disappear

Lottery company may go out of business in six months after you

won

REAL ESTATE

Liquidity Preference and Return

People demand a return for the risks involved in

future cash flows

Ex) Bank gives you a 1% return on the money you

keep in your savings account

Ex2) Bank charges you 5% interest on a loan you took

out to purchase your car

REAL ESTATE

Time Value of Money

We want compare

Present cash flows and future cash flows

Our investment options

Tools

1. Future Value(FV)

2. Present Value(PV)

3. Net Present Value(NPV)

4. Internal Rate of Return(IRR)

REAL ESTATE

Time Value of Money

You are going to lend $100,000 to somebody.

1 year later, how much do you expect to get back?

$100,000

Today

$100,000 ?

$110,000 ?

1 year later

REAL ESTATE

Time Value of Money

You won $100,000 in the lottery today.

1. Which do you prefer?

$100,000

Or

$100,000 ?

1 year later

Today

2. How about this option?

$100,000

Today

Or

$110,000 ?

1 year later

8

REAL ESTATE

Time Value of Money

You placed $1,000 in a savings account at your bank.

1 year later, how much do you expect to get back?

$1,000

Today

$1,000 ?

$1,100 ?

1 year later

REAL ESTATE

Future Value

You placed $1,000 into your savings account

Interest rate is 1% per year

How much do you get one year later?

$1,010

How?

$1,000 x 1% = $10

interest

$1,000

principal

$1,010

FV(Future Value)

Or

$1,000 x (1 + 1%) = $1,000 x (1 + 0.01) = $1,010

10

REAL ESTATE

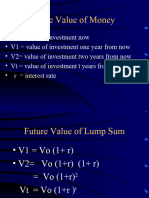

Future Value

Principal:

PV = $1,000

Interest rate: r = 1%

FV = 1,000(1+0.01)

1 year

PV = -1,000

FV = 1,000(1+0.01)(1+0.01)

=1,000(1+0.01)2

2 year

PV = -1,000

FV = 1,000(1+0.01)(1+0.01)(1+0.01)

=1,000(1+0.01)3

3 year

PV = -1,000

FV = 1,000(1+0.01)(1+0.01)(1+0.01)

=1,000(1+0.01)n

n year

n-1

PV = -1,000

11

REAL ESTATE

Future Value

= (1 + )

where

FV : Future value

PV : Input at time 0

r : interest rate

n : number of periods

12

REAL ESTATE

Future Value

= (1 + )

Example

If you save $24,000 at a 1% interest rate today, how much will

this grow to in 6 years?

Ans.)

PV = 24,000, r = 0.01, n = 6

FV = 24,000(1+0.01)6 = $25,476

13

REAL ESTATE

Present Value

You will receive $1,100 from your investment one

year later.

You are able to earn 10% per year return from

another investment

How much is $1,100 one-year-later worth, if you

convert it into todays value (present value)?

14

REAL ESTATE

Present Value

The answer is $1,000.

How can we calculate it?

If you invest PV , you will earn 10% return in a year.

And your FV is $1,100

Thus, FV = $1,100 = PV x (1+0.1)

Reverse procedure of FV(Discount)

PV

$1,100

1 + 0.1

= $1,000

Discount

15

REAL ESTATE

Present Value

Future Cash Flow:

FV = $1,000

Discount rate: r = 10%

FV = 1,000

1 year

PV = 1,000/(1+0.1)

FV = 1,000

2 year

PV = 1,000/[(1+0.1)(1+0.1)]

= 1,000/(1+0.1)2

3 year

FV = 1,000

2

PV = 1,000/[(1+0.1)(1+0.1)(1+0.1)]

= 1,000/(1+0.1)3

n year

FV = 1,000

2

n-1

PV = 1,000/[(1+0.1)(1+0.1)(1+0.1)(1+0.1)]

= 1,000/(1+0.1)n

16

REAL ESTATE

Present Value

FV

PV =

(1 + r)n

where

PV : Present Value

FV : Outcome at time n

r : discount(interest) rate

= opportunity cost

= required return

n : number of periods

17

REAL ESTATE

Present Value

FV

PV =

(1 + r)n

Example

If your investment opportunity will give you $50,000 in 6 years,

how much are you willing to pay today? You are able to earn 10%

return on other investment.

Ans.)

FV = 50,000, r = 0.1, n = 6

PV = 50,000/(1+0.1)6 = $28,224

18

REAL ESTATE

Net Present Value(NPV)

Return of an investment (project) in $ amount, today.

=

Example

If you invest $35,000 today you will receive $7,800 in year 1,

$6,500 in year 2, $11,000 in year 3, $9,988 in year 4 and

$12,000 in year 5. What is the todays value of this investment?

Your discount rate is 5%.

19

REAL ESTATE

Net Present Value(NPV)

7,800

6,500

11,000

9,998

12,000

-35,000

7,429 = 7,800/(1+0.05)

5,896 = 6,500/(1+0.05)2

9,502 = 11,000/(1+0.05)3

8,217 = 9,998/(1+0.05)4

9,402 = 12,000/(1+0.05)5

5,446 = NPV

20

REAL ESTATE

Net Present Value(NPV): Negative case

7,800

6,500

5,000

3,000

12,000

-35,000

7,429 = 7,800/(1+0.05)

5,896 = 6,500/(1+0.05)2

4,319 = 5,000/(1+0.05)3

2,468 = 3,000/(1+0.05)4

9,402 = 12,000/(1+0.05)5

-5,486 = NPV

21

REAL ESTATE

Net Present Value(NPV)

=

General Investment Decision Rules(Not exactly correct)

Only one investment

NPV > 0, then invest

Multiple investment options

Invest at max NPV project.

22

REAL ESTATE

PV of annuity

Net present value of constant cash flows

$500 payment every year for 5 years. Interest rate is 5%

500

500

500

500

500

476= 500/(1+0.05)

454= 500/(1+0.05)2

432= 500/(1+0.05)3

411= 500/(1+0.05)4

392= 500/(1+0.05)5

2,165= PV of annuity

23

REAL ESTATE

PV of annuity

Net present value of constant cash flows

PMT

PMT

PMT

PMT

1 1/(1 + )

=

1 1/(1 + )

24

REAL ESTATE

Internal Rate of Return(IRR)

Annual return of an investment (project) in %, today.

=

=0

=0

(1 + )

IRR

Discount rate which makes NPV = 0 or

At this discount rate, your investment returns you $0.

25

REAL ESTATE

Internal Rate of Return(IRR)

7,800

6,500

11,000

9,998

12,000

-35,000

NPV @ Discount Rate = 5%

NPV = $5,446

NPV @ Discount Rate = 15%

NPV = - $4,393

NPV @ Discount Rate = 10%

NPV = $0

IRR = 10%

?

This investment gives you 10% return.

26

REAL ESTATE

Internal Rate of Return(IRR)

-20,000

-15,000

10,000

15,100

20,000

-10,000

IRR = 0.09%

This investment gives you 0.09% return.

Will you invest?

27

REAL ESTATE

Internal Rate of Return(IRR)

General Investment Decision Rule

IRR > your required return, then invest

28

REAL ESTATE

Time Value of Money(TVM)

= (1 + )

FV

PV =

(1 + r)n

1 1/(1 + )

=

1 1/(1 + )

=

=0

=0

(1 + )

29

REAL ESTATE

Time Value of Money (TVM)

TVM function in Calculator

Your Mortgage

Interest rate : 5% and

N: 30 years

$250,000 = Loan Amount

Payments..

0

$16,263

$16,263

$16,263

20

$16,263

Remaining balance = $125,572

30

REAL ESTATE

Time Value of Money(TVM)

TVM function in Calculator

Interest rate : r %

PV

Payments..

0

PMT

PMT

PMT

PV = f( r, n, PMT, FV)

PMT

FV

Give calculator 4 of 5 elements of TVM and it will calculate

5th element for you.

31

REAL ESTATE

End of Lecture 6

32

Vous aimerez peut-être aussi

- Lecture 2Document21 pagesLecture 2Samantha YuPas encore d'évaluation

- Time Value of Money With Marg TaxDocument31 pagesTime Value of Money With Marg Taxmuriithipeter761Pas encore d'évaluation

- Busi 2401 Week 2 (CH 6)Document48 pagesBusi 2401 Week 2 (CH 6)Jason LeePas encore d'évaluation

- The Time Value of Money ExplainedDocument61 pagesThe Time Value of Money ExplainedAlex AlexPas encore d'évaluation

- Time Value of MoneyDocument73 pagesTime Value of MoneyZeenat NoorPas encore d'évaluation

- The Time Value of Money: (Chapter 9)Document22 pagesThe Time Value of Money: (Chapter 9)ellaPas encore d'évaluation

- Chapter7 The Time Value of MoneyDocument27 pagesChapter7 The Time Value of MoneyShikhar KumarPas encore d'évaluation

- Time Value of MoneyDocument15 pagesTime Value of MoneyJann Aldrin PulaPas encore d'évaluation

- BF3326 Corporate Finance: Time Value of MoneyDocument40 pagesBF3326 Corporate Finance: Time Value of MoneyAmy LimnaPas encore d'évaluation

- Fund - Finance - Lecture 2 - Time Value of Money - 2011Document101 pagesFund - Finance - Lecture 2 - Time Value of Money - 2011lucipigPas encore d'évaluation

- Unit 2 - Time Value of MoneyDocument70 pagesUnit 2 - Time Value of MoneyNolan TitusPas encore d'évaluation

- Time Value of Money ExplainedDocument37 pagesTime Value of Money Explainedansary75Pas encore d'évaluation

- Lecture Time Value of MoneyDocument44 pagesLecture Time Value of MoneyAdina MaricaPas encore d'évaluation

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Document5 pagesTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanPas encore d'évaluation

- The Time Value of MoneyDocument25 pagesThe Time Value of MoneyShveta HastirPas encore d'évaluation

- 2 Time Value of MoneyDocument46 pages2 Time Value of MoneyABHINAV AGRAWALPas encore d'évaluation

- Time Value of MoneyDocument63 pagesTime Value of MoneyKEITH DESOUZAPas encore d'évaluation

- TVM Exercises: - in The First Year: - in The Second YearDocument2 pagesTVM Exercises: - in The First Year: - in The Second YearCu Thi Hong NhungPas encore d'évaluation

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANPas encore d'évaluation

- The Time Value of MoneyDocument29 pagesThe Time Value of Moneymasandvishal50% (2)

- Time Value of MoneyDocument19 pagesTime Value of MoneyAbid AhasanPas encore d'évaluation

- Calculating Present and Future Values of Cash FlowsDocument8 pagesCalculating Present and Future Values of Cash FlowsSashawn Douglas100% (1)

- Concept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyDocument34 pagesConcept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyRasumathi SPas encore d'évaluation

- 1b) Extra Financial Maths Solutions To Practice QuestionsDocument15 pages1b) Extra Financial Maths Solutions To Practice QuestionsWilliam ZhaoPas encore d'évaluation

- TVM Chapter 6 Key ConceptsDocument27 pagesTVM Chapter 6 Key ConceptsMahe990Pas encore d'évaluation

- TIME VALUE OF MONEY EXPLAINEDDocument25 pagesTIME VALUE OF MONEY EXPLAINEDRuchaPas encore d'évaluation

- Chapter 5 Part 1Document6 pagesChapter 5 Part 1das23dasdaPas encore d'évaluation

- CUNY Academic Works: Time Value of Money Modules 3-5Document56 pagesCUNY Academic Works: Time Value of Money Modules 3-5Monydit SantinoPas encore d'évaluation

- Chap4 ModifiedDocument66 pagesChap4 ModifiedRuba AwwadPas encore d'évaluation

- 02 How To Calculate Present ValuesDocument5 pages02 How To Calculate Present ValuesMộng Nghi TôPas encore d'évaluation

- TVM: The Time Value of MoneyDocument42 pagesTVM: The Time Value of MoneyUsman KhanPas encore d'évaluation

- Time Value of MoneyDocument10 pagesTime Value of MoneyAnu LundiaPas encore d'évaluation

- Introduction To Valuation: The Time Value of Money Chapter OutlineDocument10 pagesIntroduction To Valuation: The Time Value of Money Chapter OutlineEman SamirPas encore d'évaluation

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavPas encore d'évaluation

- Financial Management Ii: Chapter 5 (Fundamental of Corporate Finance) Introduction To Valuation: The Time Value of MoneyDocument33 pagesFinancial Management Ii: Chapter 5 (Fundamental of Corporate Finance) Introduction To Valuation: The Time Value of MoneyEldi JanuariPas encore d'évaluation

- Finance - Solved Exercises 2Document7 pagesFinance - Solved Exercises 2safura aliyevaPas encore d'évaluation

- Discounted Cash Flow ValuationDocument35 pagesDiscounted Cash Flow ValuationRemonPas encore d'évaluation

- 1 Valuing Cash FlowsDocument14 pages1 Valuing Cash FlowsdipanajnPas encore d'évaluation

- Chapter 9 Capital Budgeting PDFDocument112 pagesChapter 9 Capital Budgeting PDFtharinduPas encore d'évaluation

- Time Value of Money Explained in 40 CharactersDocument78 pagesTime Value of Money Explained in 40 Charactersneha_baid_167% (3)

- Section OneDocument31 pagesSection OneJehan OsamaPas encore d'évaluation

- TVM Concepts for Financial ManagementDocument32 pagesTVM Concepts for Financial ManagementBhanu PratapPas encore d'évaluation

- Understanding Financial Management: A Practical Guide: Problems and AnswersDocument9 pagesUnderstanding Financial Management: A Practical Guide: Problems and AnswersManuel BoahenPas encore d'évaluation

- Week 5-Chapter 6 Discounted Cash Flow ValuationDocument70 pagesWeek 5-Chapter 6 Discounted Cash Flow ValuationOkura TsukikoPas encore d'évaluation

- Capital Budgeting - Part I PDFDocument83 pagesCapital Budgeting - Part I PDFJannat JavedPas encore d'évaluation

- Compound Interest Explained: Calculating Future and Present Value of AnnuitiesDocument30 pagesCompound Interest Explained: Calculating Future and Present Value of AnnuitiesAshia12Pas encore d'évaluation

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahPas encore d'évaluation

- 1 Time Value of MoneyDocument24 pages1 Time Value of MoneyGeckoPas encore d'évaluation

- 9 Compounding & DiscountingDocument19 pages9 Compounding & Discountingapi-3723612Pas encore d'évaluation

- The Time Value of MoneyDocument28 pagesThe Time Value of MoneyRajat ShrinetPas encore d'évaluation

- Lecture 4 PDFDocument94 pagesLecture 4 PDFsyingPas encore d'évaluation

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022Document33 pagesBCO126 Mathematics of Finance: 3 Ects Spring Semester 2022summerPas encore d'évaluation

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014Pas encore d'évaluation

- Lec 3 - Chapter 03 - 2016Document48 pagesLec 3 - Chapter 03 - 2016Dhanuka NadeeraPas encore d'évaluation

- Practice Worksheet Solutions - IBFDocument13 pagesPractice Worksheet Solutions - IBFsusheel kumarPas encore d'évaluation

- FM - Lecture 2 - Time Value of Money PDFDocument82 pagesFM - Lecture 2 - Time Value of Money PDFMi ThưPas encore d'évaluation

- FM Midterm NotesDocument9 pagesFM Midterm NotesMj NuarinPas encore d'évaluation

- 5 Financial EvaluationDocument22 pages5 Financial EvaluationAdnan RizviPas encore d'évaluation

- Time Value of Money Lecture NotesDocument51 pagesTime Value of Money Lecture NotesOhene Asare PogastyPas encore d'évaluation

- Auto WreckDocument1 pageAuto WreckChristian WashingtonPas encore d'évaluation

- Weary BluesDocument2 pagesWeary BluesChristian WashingtonPas encore d'évaluation

- Herbert Spencer: English Philosopher Who Popularized "Survival of the FittestDocument20 pagesHerbert Spencer: English Philosopher Who Popularized "Survival of the FittestChristian WashingtonPas encore d'évaluation

- Ecological FootprintDocument25 pagesEcological FootprintChristian WashingtonPas encore d'évaluation

- ACT201 Chapter 5Document63 pagesACT201 Chapter 5atqiyaPas encore d'évaluation

- ToaDocument7 pagesToaPrincess Diane PalisocPas encore d'évaluation

- Unit 03Document69 pagesUnit 03Shah Maqsumul Masrur TanviPas encore d'évaluation

- 3b. (NEW) Financing Enterprises 200910 TEXTBOOK 2nd Edn NewDocument355 pages3b. (NEW) Financing Enterprises 200910 TEXTBOOK 2nd Edn NewTrần Linh100% (2)

- Lecture 7 - Stock Valuation Using Discounted Free Cash Flow and MultiplesDocument58 pagesLecture 7 - Stock Valuation Using Discounted Free Cash Flow and Multipleschenzhi fanPas encore d'évaluation

- Mockboard - Practical Accounting 1Document8 pagesMockboard - Practical Accounting 1Jaymee Andomang Os-agPas encore d'évaluation

- Accounting for Corporate Bonds Issued at Par and DiscountDocument72 pagesAccounting for Corporate Bonds Issued at Par and DiscountChan ChanPas encore d'évaluation

- Jun-10, Dec-10, Jun-11, Dec 11Document64 pagesJun-10, Dec-10, Jun-11, Dec 11Celena Daiton83% (6)

- Wealth MaximizationDocument6 pagesWealth Maximizationsanchi_23Pas encore d'évaluation

- Chapter 5 - Bonds Payable Other ConceptsDocument28 pagesChapter 5 - Bonds Payable Other ConceptsAngelica Joy ManaoisPas encore d'évaluation

- Bluefield Solar Income Fund Interim ResultsDocument4 pagesBluefield Solar Income Fund Interim Resultssky22bluePas encore d'évaluation

- Solved Problems in Engineering Economy 2016 - CompressDocument61 pagesSolved Problems in Engineering Economy 2016 - CompressCol. Jerome Carlo Magmanlac, ACP100% (1)

- Ch.09 Solution Manual - Funadmentals of Financial ManagementDocument18 pagesCh.09 Solution Manual - Funadmentals of Financial Managementsarahvillalon100% (2)

- Simple and Discount Interest: Mathematics of InvestmentDocument12 pagesSimple and Discount Interest: Mathematics of InvestmentzahidacaPas encore d'évaluation

- Profit and Loss Question Bank For SSC/BANK ExamsDocument18 pagesProfit and Loss Question Bank For SSC/BANK ExamsStudy IQPas encore d'évaluation

- R31 Non-Current (Long-Term) Liabilities Q BankDocument16 pagesR31 Non-Current (Long-Term) Liabilities Q BankAhmedPas encore d'évaluation

- Morale Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMorale Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000Pas encore d'évaluation

- Short TermDocument4 pagesShort Termjeanniemae100% (2)

- Curro (Assessment 3 2016) (28 Marks)Document3 pagesCurro (Assessment 3 2016) (28 Marks)ZinhleBulelo MvulanePas encore d'évaluation

- Chapter - 31: Working Capital FinanceDocument13 pagesChapter - 31: Working Capital Financepalak bansalPas encore d'évaluation

- CH Fs Volatility Adjustment Under The Loop FinalDocument29 pagesCH Fs Volatility Adjustment Under The Loop FinalSiddharth KumarPas encore d'évaluation

- File 1 - Overview IFRS 17Document30 pagesFile 1 - Overview IFRS 17mcahya82Pas encore d'évaluation

- Actuary India April 2015Document28 pagesActuary India April 2015rahulrajeshanandPas encore d'évaluation

- Monno Ceramic ValuationDocument47 pagesMonno Ceramic ValuationMahmudul HassanPas encore d'évaluation

- AKM 2 Extinguishment Non-Current Liability1Document21 pagesAKM 2 Extinguishment Non-Current Liability1aurellia putriPas encore d'évaluation

- Chart of AccountsDocument3 pagesChart of AccountsOzioma Ihekwoaba0% (1)

- Chapter 3. Advanced Discounted Cash Flow TechniquesDocument16 pagesChapter 3. Advanced Discounted Cash Flow TechniquesHastings KapalaPas encore d'évaluation

- Final Exam - Acc115Document7 pagesFinal Exam - Acc115angelapearlrPas encore d'évaluation

- Financial Accounting and Reporting by Fayieee Prelim To MidtermDocument31 pagesFinancial Accounting and Reporting by Fayieee Prelim To MidtermEnalyn AldePas encore d'évaluation

- Financial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsDocument15 pagesFinancial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsNg Chunye100% (1)