Académique Documents

Professionnel Documents

Culture Documents

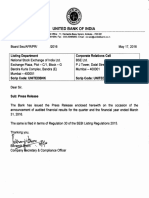

United Bank of India Snapshot 18-Mar-2010

Transféré par

Sunil KajariaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United Bank of India Snapshot 18-Mar-2010

Transféré par

Sunil KajariaDroits d'auteur :

Formats disponibles

Sunil K. Kajaria UNITED BANK OF INDIA (www.unitedbankofindia.

com)

98300-47514

sunilkajaria@gmail.com

PER SHARE DATA Promoters & Management : UBI is a PSU Bank headquartered in Kolkata. It has a pan-India

CMP 18-Mar-10 68.75 Face Value 10 network of 1505 branches. The East & NE are focus areas for the bank with 973 & 258 branches. 100%

Projected EPS (FY10)* 14.60 Equity (Crs) 316.43 of branches have implemented core banking solution. As of Sep-09, the Deposit base is at 65,000 crs and

Last FY EPS* 11.35 M. Cap(Crs) 2175 Advances is at 41,000 Crs. The current work-force strength is at 16,768 employees. The Govt. of India

Forward P/E 4.71 Dividend (Rs.) 0.00 holds 84.20% of the post-issue share capital of the bank

* based on post-issue capital

KEY FINANCIALS FY10(P) FY09(A) FY08(A) QUARTERLY DATA: Q3FY10(9) Q3FY09(9) H1FY10(6) H1FY09(6) Q1FY10(3) Q1FY09(3)

Total Income 5550 4803 4023 Total Income

Op. Profit (bef. P&C) 758 677 467 Op. Profit (bef. P&C)

PBT 628 418 177 PBT QUARTERLY DATA IS NOT AVAILABLE AS THE BANK

PAT 462 359 145 PAT WAS PREVIOUSLY UNLISTED

OPM(%) 13.66% 14.10% 11.61% OPM(%)

NPM(%) 8.32% 7.47% 3.60% NPM(%)

FINANCIAL ANALYSIS:

1) CASA deposits is at 33.96% of total deposits (savings contributes 26.41%) and cost of funds for fiscal 2009 was 5.78% (PSU Bank average was 6.18%)

2) Share of gross NPA as a % of total advances is at 2.48% as on 30th September 2009. This ratio was at 4.66% on 31st March 2006 and has shown a steady decline

INVESTMENT THESIS

1) UBI has just completed its IPO of 5 Cr Shares agg. 325 Cr. The Bank also expects to receive another 550 Cr. from the Govt. in the form of NCPS (part of Tier I Capital)

2) The stock has listed at a mere 4.17% premium to issue price. As post-listing selling recedes, the stock is expected to out-perform going forward

3) Growth will not be an issue going forward as there exists ample head-room to dilute GoI stake in order to raise more tier-I capital.

4) PSU Bank stock prices have traditionally shown a high co-relation to ABV. H1FY10 numbers indicate that a healthy growth in ABV can be expected for the full year

5) The Stock price has listed at a considerable discount to its post-issue book value of Rs. 90/share. Given its NPA profile, the bank is an Attractive Value Buy at this price.

Vous aimerez peut-être aussi

- Banks - BAHL - Result Preview - JSDocument2 pagesBanks - BAHL - Result Preview - JSmuddasir1980Pas encore d'évaluation

- Bank of India, 4th February, 2013Document12 pagesBank of India, 4th February, 2013Angel BrokingPas encore d'évaluation

- Union Bank 4Q FY 2013Document11 pagesUnion Bank 4Q FY 2013Angel BrokingPas encore d'évaluation

- PNC Infratech: Robust ExecutionDocument14 pagesPNC Infratech: Robust ExecutionAnonymous y3hYf50mTPas encore d'évaluation

- Development Credit Bank Limited: February, 2008Document35 pagesDevelopment Credit Bank Limited: February, 2008Ashutosh TiwariPas encore d'évaluation

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Jammu and Kashmir Bank Result UpdatedDocument10 pagesJammu and Kashmir Bank Result UpdatedAngel BrokingPas encore d'évaluation

- UnitedBoI-1QFY2013RU 10 TH AugDocument11 pagesUnitedBoI-1QFY2013RU 10 TH AugAngel BrokingPas encore d'évaluation

- Union Bank, 1Q FY 2014Document11 pagesUnion Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- 6 March 2015Document1 page6 March 2015Ady HasbullahPas encore d'évaluation

- Syndicate Bank 4Q FY 2013Document11 pagesSyndicate Bank 4Q FY 2013Angel BrokingPas encore d'évaluation

- Union Bank, 4th February, 2013Document12 pagesUnion Bank, 4th February, 2013Angel BrokingPas encore d'évaluation

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- South Indian Bank: Performance HighlightsDocument12 pagesSouth Indian Bank: Performance HighlightsPranay SinghPas encore d'évaluation

- Bharat Forge: Greatness vs. AdversityDocument10 pagesBharat Forge: Greatness vs. AdversityAnonymous y3hYf50mTPas encore d'évaluation

- Corporation Bank Q3FY13 Result UpdateDocument5 pagesCorporation Bank Q3FY13 Result UpdateDarshan MaldePas encore d'évaluation

- ICICI Bank, 4th February, 2013Document16 pagesICICI Bank, 4th February, 2013Angel BrokingPas encore d'évaluation

- Indian Bank 4Q FY 2013Document11 pagesIndian Bank 4Q FY 2013Angel BrokingPas encore d'évaluation

- SBI, 19th February, 2013Document14 pagesSBI, 19th February, 2013Angel BrokingPas encore d'évaluation

- Motilal REc ResearchDocument10 pagesMotilal REc ResearchhdanandPas encore d'évaluation

- Results Press Release For March 31, 2016 (Result)Document4 pagesResults Press Release For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Union Bank of India: Performance HighlightsDocument11 pagesUnion Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument12 pagesUCO Bank: Performance Highlightspathanfor786Pas encore d'évaluation

- Central Bank, 4th February, 2013Document10 pagesCentral Bank, 4th February, 2013Angel BrokingPas encore d'évaluation

- PNB, 4th February, 2013Document12 pagesPNB, 4th February, 2013Angel BrokingPas encore d'évaluation

- Sbi, 1Q Fy 2014Document14 pagesSbi, 1Q Fy 2014Angel BrokingPas encore d'évaluation

- Indian Bank, 1Q FY 2014Document11 pagesIndian Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Bank of India: Performance HighlightsDocument12 pagesBank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Abl FMR April 2013Document8 pagesAbl FMR April 2013JonnyCanePas encore d'évaluation

- PNB 4Q Fy 2013Document12 pagesPNB 4Q Fy 2013Angel BrokingPas encore d'évaluation

- State Bank of IndiaDocument16 pagesState Bank of IndiaAngel BrokingPas encore d'évaluation

- Axis Bank: Performance HighlightsDocument10 pagesAxis Bank: Performance HighlightsjigarchhatrolaPas encore d'évaluation

- Dena Bank, 1Q FY 2014Document11 pagesDena Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- SITI Cable Network: CMP: Inr37 TP: INR48 (+30%) BuyDocument10 pagesSITI Cable Network: CMP: Inr37 TP: INR48 (+30%) BuyRajasekhar Reddy AnekalluPas encore d'évaluation

- Des Ti Money Research JISL Reiterating BUYDocument13 pagesDes Ti Money Research JISL Reiterating BUYRajiv BharatiPas encore d'évaluation

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Unity Infra Projects 4Q FY 2013Document11 pagesUnity Infra Projects 4Q FY 2013Angel BrokingPas encore d'évaluation

- Power Grid Corporation: Visible Growth Visible ValueDocument9 pagesPower Grid Corporation: Visible Growth Visible ValueAnonymous y3hYf50mTPas encore d'évaluation

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Indian Bank: Performance HighlightsDocument10 pagesIndian Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Allcargo Global Logistics LTD.: CompanyDocument5 pagesAllcargo Global Logistics LTD.: CompanyjoycoolPas encore d'évaluation

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969Pas encore d'évaluation

- State Bank of India: Performance HighlightsDocument15 pagesState Bank of India: Performance HighlightsRaaji BujjiPas encore d'évaluation

- CMI Business Review 270910 (Fv2)Document58 pagesCMI Business Review 270910 (Fv2)Sophea KimPas encore d'évaluation

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Corporation Bank 4Q FY 2013Document11 pagesCorporation Bank 4Q FY 2013Angel BrokingPas encore d'évaluation

- 2Q09 August 2009 Investor Relations PresentationDocument21 pages2Q09 August 2009 Investor Relations PresentationhobigPas encore d'évaluation

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394Pas encore d'évaluation

- Project FMDocument9 pagesProject FMGagan KarwarPas encore d'évaluation

- ICICI KotakDocument4 pagesICICI KotakwowcoolmePas encore d'évaluation

- Jyoti Structures (JYOSTR) : When Interest Burden Outweighs AllDocument10 pagesJyoti Structures (JYOSTR) : When Interest Burden Outweighs Allnit111100% (1)

- Punjab National Bank: Performance HighlightsDocument12 pagesPunjab National Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of IndiaDocument12 pagesBank of IndiaAngel BrokingPas encore d'évaluation

- Yes Bank 4Q FY 2013Document14 pagesYes Bank 4Q FY 2013Angel BrokingPas encore d'évaluation

- Andhra Bank: Performance HighlightsDocument11 pagesAndhra Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsD'EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsPas encore d'évaluation

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisD'EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisPas encore d'évaluation

- Model Portfolio For FY12Document1 pageModel Portfolio For FY12Sunil KajariaPas encore d'évaluation

- Hindalcosnapshot31 Aug 09Document1 pageHindalcosnapshot31 Aug 09Sunil KajariaPas encore d'évaluation

- ChennaiPetroSnapshot7 Aug 09Document1 pageChennaiPetroSnapshot7 Aug 09Sunil KajariaPas encore d'évaluation

- The Indian Retail StoryDocument13 pagesThe Indian Retail StorySunil KajariaPas encore d'évaluation

- Financial Management II Assignment IDocument4 pagesFinancial Management II Assignment IAdanechPas encore d'évaluation

- There Are Several Types of BondsDocument6 pagesThere Are Several Types of BondsAbhishekPas encore d'évaluation

- Discussion QuestionDocument5 pagesDiscussion QuestionFrancoRodrigoIglesiasRobles100% (1)

- CPA BEC Virtural Class NOTESDocument19 pagesCPA BEC Virtural Class NOTESRamach100% (1)

- AWESOME GUIDE To Elliott Wave Correction Patterns and Rules!!Document20 pagesAWESOME GUIDE To Elliott Wave Correction Patterns and Rules!!SATISH100% (1)

- In A Bind Peak Sealing Technologies' Product Line Extension DilemmaDocument2 pagesIn A Bind Peak Sealing Technologies' Product Line Extension DilemmaAryan GargPas encore d'évaluation

- Abm Applied Economics 12 q1 w3 Mod3Document21 pagesAbm Applied Economics 12 q1 w3 Mod3johnPas encore d'évaluation

- Effects of DevaluationDocument16 pagesEffects of DevaluationMaarij AhmadPas encore d'évaluation

- BKM - Questions Week 1 in The Event of A Firm's BankruptcyDocument11 pagesBKM - Questions Week 1 in The Event of A Firm's BankruptcyElena WangPas encore d'évaluation

- Fundamental Analysis of Forex Markets ExplainedDocument13 pagesFundamental Analysis of Forex Markets ExplainedAar Rageedi0% (1)

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaPas encore d'évaluation

- Ca Foundation Business Economics Additional Question PaperDocument9 pagesCa Foundation Business Economics Additional Question PaperSushant TalePas encore d'évaluation

- The 8 Hidden Costs You Must Know Before Building A HomeDocument7 pagesThe 8 Hidden Costs You Must Know Before Building A HomeAria NickbakhtPas encore d'évaluation

- Tarea V de Inglés Avanzado IiDocument10 pagesTarea V de Inglés Avanzado IiErmil Manuel Adames GómezPas encore d'évaluation

- Sales Revenue Analysis TemplateDocument2 pagesSales Revenue Analysis TemplateandryPas encore d'évaluation

- ATS FormatDocument2 pagesATS FormatZeny BernalPas encore d'évaluation

- Bitcoin Price HistoryDocument3 pagesBitcoin Price HistoryFiras ZahmoulPas encore d'évaluation

- Strategic Management PaperDocument97 pagesStrategic Management PaperElle Woods100% (3)

- Unit 2.3 Market Equilibrium Study NotesDocument5 pagesUnit 2.3 Market Equilibrium Study NotesRichard XunPas encore d'évaluation

- Topic 2 Demand and SupplyDocument27 pagesTopic 2 Demand and SupplyasyilahasmawiPas encore d'évaluation

- Analysis of TechnicalDocument12 pagesAnalysis of TechnicalKhushbu PeshavariaPas encore d'évaluation

- ProMed (Apr 09)Document8 pagesProMed (Apr 09)GANESHPas encore d'évaluation

- Ebook Investment Analysis Portfolio Management PDF Full Chapter PDFDocument67 pagesEbook Investment Analysis Portfolio Management PDF Full Chapter PDFjuanita.diaz864100% (28)

- Kimura K.K. (KKK) : Can This Customer Be Saved? - Group D13Document6 pagesKimura K.K. (KKK) : Can This Customer Be Saved? - Group D13Mayuresh GaikarPas encore d'évaluation

- A Project On PromotionDocument67 pagesA Project On PromotionINSTITUTE OF PROFESSIONAL ACCOUNTANTS100% (1)

- Appplied Behavioural Finance - Insights Into Irrational Minds and Market PDFDocument76 pagesAppplied Behavioural Finance - Insights Into Irrational Minds and Market PDFArun MaxwellPas encore d'évaluation

- Friends Break-Even Analysis - Group10 - B21Document16 pagesFriends Break-Even Analysis - Group10 - B2120Raka Zain SusetyoPas encore d'évaluation

- CHR Yield ManagementDocument20 pagesCHR Yield ManagementJuan José Donayre VasquezPas encore d'évaluation

- Basic Principles of Demand and SupplyDocument9 pagesBasic Principles of Demand and Supplyna2than-1Pas encore d'évaluation

- Wishways Assessment - 1 - Business FinanceDocument12 pagesWishways Assessment - 1 - Business Financewishways srinivasPas encore d'évaluation