Académique Documents

Professionnel Documents

Culture Documents

101

Transféré par

AHMADrazaali0 évaluation0% ont trouvé ce document utile (0 vote)

46 vues3 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

46 vues3 pages101

Transféré par

AHMADrazaaliDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

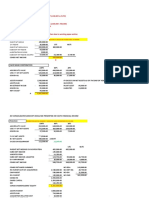

Adjustment Entries

Adjustment Entry # 1 Hyper Star Traders

Income Statement

Particular’s As of Dec Debit Amount

31, 2009 Credit Amount Rs.

Rs.

Bank Charges A/C Rs Rs

Interest

Sales on Loan A/C 150

924,000

Return Inwards 500

8,000

Net Sales 916,000

Due Bank Charges

150

A/C

Cost of Sales

Due Interest on loan

Opening Stock 120,000 500

A/C

Purchases 650 650

680,000

Return Outwards

Adjustment Entry to record the4,800

due payment not yet recorded in the bank books

Net Purchases 675,200

675,200

Total Stock available

Adjustment Entry # for

2 sale 795,200

Debit Amount

Particulars Credit Amount Rs.

Closing Stock Rs. 200,000

Net Cost of Sales 595,200

Accrued dividend Receivable A/C 2,000

Gross Profit 320,800

Dividend Income A/C 2,000

Operating Expenses

Adjustment Entry for the dividends accrued receivable on Dec 31,09

Salaries 48,000

Wages 45,200

Adjustment

Carriage out Entry # 3 3,600

Commission Debit Amount 2,000Amount Rs.

Particulars Credit

Rs.

Insurance Paid 2,800

House Rent 5,000

Bad Debts on Sundry Debtors A/C 5,000

Bank Charges 150

Interest on Loan 500

Sundry Debtors A/C 5,000

Bad Debts on Sundry Debtors 5,000

Written off Plant Value - wear& Tear 40,000

Recording the bad debts on sundry debtors (100,000 x 5 % = 5,000)

Total Operating Expenses 152,250

Adjustment Entry # 4

Debit Amount

Particulars Credit Amount Rs.

Rs.

House Rent Expense A/C 5,000

Operating Income

Interest Received

(800)

Dividend Income

(2,000)

Total Operating Income

(2,800)

149,450 320,800

Net income transfer to balance

171,350

sheet

Hyper Star Traders

Balance Sheet

As of Dec 31, 2009

Liabilities & Owner's Equity Assets

Current Liabilities Amount in Current Assets Amount in

Rs. Rs.

Bills Payable 20,000 Cash in Hand 4,000

Sundary Creditors 160,000 Bank Balance 36,000

Bank Charges/Interest Due 650 Sundary Debtors 100,00

0

Bad Debts 5,00

0

Net Sundary 95,00 95,000

Debtors 0

Bills Receivables 44,000

Dividend Receivable recorded (2,000)

Closing Stock 200,000

Total current Liabilities 180,650 Total current Assets 377,000

Owners Equity Fixed & Long Term Assets

Long Term Investment 60,000

Capital 280,000 Furniture 40,000

Drawing (Credited) 5,000 Plant 200,00

0

Net Capital 285,000 285,000 Wear & Tear of 40,00

plant 0

Net Plant Value 160,00 160,000

0

Net Retained Earning from P&L 171,350

Total Capital & Retained Earning 456,350 Total Fixed & Long Term 260,000

Assets

Total Liabilities & Owners Equity 637,000 Total Assets 637,000

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Topic 3 Long-Term Construction Contracts ModuleDocument20 pagesTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayPas encore d'évaluation

- Institute of Chartered Accountants - Ghana (ICAG) Paper 3.1 Corporate Reporting Final Mock Exam 1Document20 pagesInstitute of Chartered Accountants - Ghana (ICAG) Paper 3.1 Corporate Reporting Final Mock Exam 1humphrey daimon100% (1)

- Bharti Airtel Limited Integrated Report Annual Financial Statements 2018 19Document2 pagesBharti Airtel Limited Integrated Report Annual Financial Statements 2018 19Ankit ViraPas encore d'évaluation

- Balance SheetDocument9 pagesBalance SheetShubhrajit MukherjeePas encore d'évaluation

- LSBF Sbrclassnotesseptember2018 June2019 Final PDFDocument230 pagesLSBF Sbrclassnotesseptember2018 June2019 Final PDFfab homePas encore d'évaluation

- PDF - Group 4Document20 pagesPDF - Group 4Sarthak KumarPas encore d'évaluation

- Notes of AccountsDocument68 pagesNotes of AccountsChandrasekhar ReddyPas encore d'évaluation

- Financial Management - Financial Statements, Cash Flow and TaxesDocument16 pagesFinancial Management - Financial Statements, Cash Flow and TaxesDonna ZanduetaPas encore d'évaluation

- Suhani Mehta BM IADocument47 pagesSuhani Mehta BM IAAdvait rocksPas encore d'évaluation

- Quiz On Non Current LiabilitiesDocument3 pagesQuiz On Non Current LiabilitiessilentwattpadreaderPas encore d'évaluation

- Plan de AfacereDocument18 pagesPlan de AfacereYani CanciuPas encore d'évaluation

- T2sch100-Fill-20e - Balance Sheet InformationDocument2 pagesT2sch100-Fill-20e - Balance Sheet Informationnh nPas encore d'évaluation

- Insurance Company AccountDocument8 pagesInsurance Company AccountRidoy100% (1)

- Pom Chapter 5 ControllingDocument12 pagesPom Chapter 5 ControllingNUR ANIQAHPas encore d'évaluation

- Reading 19 Understanding Balance SheetsDocument20 pagesReading 19 Understanding Balance SheetsAminePas encore d'évaluation

- Final - MS Janani Foam Ghar - SMEReportDocument17 pagesFinal - MS Janani Foam Ghar - SMEReportআদনান স্বজনPas encore d'évaluation

- 1.1 Background of The EnterpriseDocument25 pages1.1 Background of The EnterpriseBARBO, KIMBERLY T.Pas encore d'évaluation

- CFA - 6, 7 & 9. Financial Reporting and AnalysisDocument3 pagesCFA - 6, 7 & 9. Financial Reporting and AnalysisChan Kwok WanPas encore d'évaluation

- Barringer E3 PPT 08Document35 pagesBarringer E3 PPT 08jtopuPas encore d'évaluation

- Stempeutics Research PVT LTDDocument5 pagesStempeutics Research PVT LTDIndia Business ReportsPas encore d'évaluation

- GR3 Withdrawal or Retirement of A PartnerDocument22 pagesGR3 Withdrawal or Retirement of A PartnerAngeline RoquePas encore d'évaluation

- Project Report On: Sinhgad College Submitted in Partial Fulfillment ofDocument71 pagesProject Report On: Sinhgad College Submitted in Partial Fulfillment ofansari naseem ahmadPas encore d'évaluation

- MarketingDocument12 pagesMarketingRahul agarwalPas encore d'évaluation

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiPas encore d'évaluation

- ACCM343 Advanced Accounting 2011 by Guerrero PeraltaDocument218 pagesACCM343 Advanced Accounting 2011 by Guerrero PeraltaHujaype Abubakar80% (10)

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHPas encore d'évaluation

- Audit of Accounting ReceivablesDocument9 pagesAudit of Accounting ReceivablesHelix HederaPas encore d'évaluation

- Fast Food Restaurant PreFeasibility SMEDADocument24 pagesFast Food Restaurant PreFeasibility SMEDAAdnan FiyazPas encore d'évaluation

- Bir60 EguideDocument15 pagesBir60 Eguidekumar.arasu8717Pas encore d'évaluation

- ch14 TestDocument43 pagesch14 TestDaniel HunksPas encore d'évaluation