Académique Documents

Professionnel Documents

Culture Documents

TEST III-Question No. 3-Use The Table Below To Compute The Tax Due Tax Table If Taxable Income Is: Tax Due Is

Transféré par

Ren A Eleponio0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues2 pagesDINA DALE, married with 4 minor children, chiefly dependent to her spouse and signed a waiver in favor of her husband to claim additional exemption. She had the following data on income and expenses: Salaries, net of SSS, pag-ibig contributions and Philhealth in the amount of P3,400, 1,200 and 2400, respectively.

Description originale:

Titre original

Revised Exam

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDINA DALE, married with 4 minor children, chiefly dependent to her spouse and signed a waiver in favor of her husband to claim additional exemption. She had the following data on income and expenses: Salaries, net of SSS, pag-ibig contributions and Philhealth in the amount of P3,400, 1,200 and 2400, respectively.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues2 pagesTEST III-Question No. 3-Use The Table Below To Compute The Tax Due Tax Table If Taxable Income Is: Tax Due Is

Transféré par

Ren A EleponioDINA DALE, married with 4 minor children, chiefly dependent to her spouse and signed a waiver in favor of her husband to claim additional exemption. She had the following data on income and expenses: Salaries, net of SSS, pag-ibig contributions and Philhealth in the amount of P3,400, 1,200 and 2400, respectively.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

TEST III-Question No.

3- Use the table below to compute the tax due

TAX TABLE

If TAXABLE INCOME is:

Not over P 10,000

TAX DUE is:

5%

Over P 10,000 but not over P 30,000 P 500 + 10% of the excess over P 10,000

Over P 30,000 but not over P 70,000 P 2,500 + 15% of the excess over P 30,000

Over P 70,000 but not over P

140,000

P 8,500 + 20% of the excess over P 70,000

Over P 140,000 but not over P

250,000

P 22,500 + 25% of the excess over P

140,000

Over P 250,000 but not over P

500,000

P 50,000 + 30% of the excess over P

250,000

Over P 500,000

P 125,000 + 32% of the excess over P

500,000

MS. DINA DALE, married with 4 minor children, chiefly dependent to her spouse and

signed a waiver in favor of her husband to claim additional exemption. She is a

citizen and resident of the Philippines. She had the following data on income and

expenses:

Salaries, net of SSS, Pag-Ibig contributions and

Philhealth in the amount of P3,400, 1,200 and 2400, respectively

188,000.00

Thirteenth month pay-net of late and absences

15,500.00

Allowances

Gain on Sale of Capital asset

16,000.00

10,000.00

Compute the Income Tax due on December 31, 2014.

TEST IV- Enumerate the following:

1.4 -Give the four sources of Income

5-7 -Three kinds of Corporation

8-10- Give the basic and additional exemptions of the following;

BASIC

ADDITIONAL

a. Married Individual with two kids

P

b. Head of the Family with Dependent

Other than children

c. Single with dependent four

Minor children

11-15- Enumerate the classification of Individual taxpayers as to

Citizenship and Aliens

16-17- Kinds of exemptions for Individual taxpayers

18-20- Give the three classifications of Special nonresident foreign

corporation.

Vous aimerez peut-être aussi

- Income Tax Rate Table For Individual Taxpayers in The PhilippinesDocument1 pageIncome Tax Rate Table For Individual Taxpayers in The PhilippinesJan Mae LumiaresPas encore d'évaluation

- Personal Exemptions TotalDocument3 pagesPersonal Exemptions TotalMajorie Rose M. GarciaPas encore d'évaluation

- What Is The Income Tax Rate in The Philippines?Document4 pagesWhat Is The Income Tax Rate in The Philippines?Anonymous zQNRQq2YPas encore d'évaluation

- Income and Business TaxationDocument69 pagesIncome and Business TaxationMarie CarreraPas encore d'évaluation

- TRAIN Law On Income Tax For Individuals, Partnerships & Corporations - Part 1Document44 pagesTRAIN Law On Income Tax For Individuals, Partnerships & Corporations - Part 1ranichi14Pas encore d'évaluation

- Dan Joseph P. Sta. Ana Bsa Iv - 1 Six Certified Public Accountant Board Licensure Examination SubjectsDocument6 pagesDan Joseph P. Sta. Ana Bsa Iv - 1 Six Certified Public Accountant Board Licensure Examination SubjectsDan Joseph Sta AnaPas encore d'évaluation

- Abm Fabm2 Module 8 Lesson 2 Income and Business TaxationDocument24 pagesAbm Fabm2 Module 8 Lesson 2 Income and Business TaxationMelody Fabreag76% (25)

- Train Law and Poverty: How Does TRAIN Law Affect The Minimum Wage Earners? How Much Income Taxes Would Be Unburdened?Document5 pagesTrain Law and Poverty: How Does TRAIN Law Affect The Minimum Wage Earners? How Much Income Taxes Would Be Unburdened?Roy Paolo RealPas encore d'évaluation

- Study of The New Income Tax Schedule of The TRAIN LawDocument16 pagesStudy of The New Income Tax Schedule of The TRAIN LawJeannie de leon82% (17)

- Fundamentals of Accountancy, Business and Management 2: Senior High SchoolDocument21 pagesFundamentals of Accountancy, Business and Management 2: Senior High SchoolLee ann ReyesPas encore d'évaluation

- INCOME AND BUSINESS TAXATION FinalsDocument21 pagesINCOME AND BUSINESS TAXATION FinalsAbegail BlancoPas encore d'évaluation

- Orca Share Media1613096356709 6765816501330676436Document9 pagesOrca Share Media1613096356709 6765816501330676436Mara Gianina QuejadaPas encore d'évaluation

- Learn How To Compute Income Tax Lumina HomesDocument1 pageLearn How To Compute Income Tax Lumina HomesLady Diane AntazoPas encore d'évaluation

- Module 8.2Document28 pagesModule 8.2Yen AllejePas encore d'évaluation

- Abm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)Document11 pagesAbm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)edjay.mercado85Pas encore d'évaluation

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimPas encore d'évaluation

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Tax6148-Income Taxation Assignment 001Document30 pagesTax6148-Income Taxation Assignment 001Regine VegaPas encore d'évaluation

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionPas encore d'évaluation

- Tax6148 Reviewer (Autorecovered)Document37 pagesTax6148 Reviewer (Autorecovered)Regine VegaPas encore d'évaluation

- Handout 4Q - Philippine Individual Income Tax TableDocument1 pageHandout 4Q - Philippine Individual Income Tax Tablekathy143100% (5)

- A. Individuals and Hufs I. Individual (Other Than Ii and Iii Below) and HufDocument4 pagesA. Individuals and Hufs I. Individual (Other Than Ii and Iii Below) and HufNaveen JatianPas encore d'évaluation

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoPas encore d'évaluation

- 111Document5 pages111Din Rose GonzalesPas encore d'évaluation

- Exercise 9Document4 pagesExercise 9Norhanifa CosignPas encore d'évaluation

- Indrum INDRUMARI - CH2 - Notes - Pdfari - Ch2 NotesDocument8 pagesIndrum INDRUMARI - CH2 - Notes - Pdfari - Ch2 Notesgeta71Pas encore d'évaluation

- Individual Compute INCOME TAXDocument1 pageIndividual Compute INCOME TAXattymanekaPas encore d'évaluation

- TAX6148-Reviewer (Auto Recovered) TAX6148 - Reviewer (Auto Recovered)Document31 pagesTAX6148-Reviewer (Auto Recovered) TAX6148 - Reviewer (Auto Recovered)lizellePas encore d'évaluation

- Income Taxation and Tax Rates in The PhilippinesDocument1 pageIncome Taxation and Tax Rates in The PhilippinesjionxiyuPas encore d'évaluation

- Individuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Document4 pagesIndividuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Saurabh AkarePas encore d'évaluation

- Tax Rate Card Salaried TY 2014Document1 pageTax Rate Card Salaried TY 2014Danish FahimPas encore d'évaluation

- Tax - Income Tax Individuals (Easy)Document28 pagesTax - Income Tax Individuals (Easy)Kristine Lirose BordeosPas encore d'évaluation

- Income Taxation 2 Bsa 2Document259 pagesIncome Taxation 2 Bsa 2Jaycie Escuadro100% (1)

- Chapter 8 Income TaxationDocument7 pagesChapter 8 Income TaxationChristine Joy Rapi MarsoPas encore d'évaluation

- Chapter 11 (Income Tax of Individuals)Document12 pagesChapter 11 (Income Tax of Individuals)libraolrackPas encore d'évaluation

- How To Compute Your Philippine BIR Withholding Tax Monthly Using The Latest BIR Withholding Tax Table?Document2 pagesHow To Compute Your Philippine BIR Withholding Tax Monthly Using The Latest BIR Withholding Tax Table?rizzle88Pas encore d'évaluation

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- TRAIN Law On Income Tax - Part 1Document53 pagesTRAIN Law On Income Tax - Part 1KC EvangelistaPas encore d'évaluation

- Old BIR Income Tax Rates (Used Until 2017)Document2 pagesOld BIR Income Tax Rates (Used Until 2017)Sean Mitch Ibañez LangubPas encore d'évaluation

- CHAPTER 2 3 BIR and Individual TaxpayerDocument31 pagesCHAPTER 2 3 BIR and Individual TaxpayerAisha A. UnggalaPas encore d'évaluation

- Individual Taxpayers Tax Filing ExercisesDocument3 pagesIndividual Taxpayers Tax Filing ExercisesKIM RAGAPas encore d'évaluation

- Fortnightly Tax Table AuDocument12 pagesFortnightly Tax Table AujaeadaPas encore d'évaluation

- Assessment of Individuals and Assessment of Firms: Dr. Sugandh Rawal DSPSRDocument8 pagesAssessment of Individuals and Assessment of Firms: Dr. Sugandh Rawal DSPSRAnshu kumarPas encore d'évaluation

- Income and TaxationDocument37 pagesIncome and TaxationStephanie Mharie EugenioPas encore d'évaluation

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegrePas encore d'évaluation

- Income Tax For IndividualsDocument37 pagesIncome Tax For IndividualsKristine Aubrey AlvarezPas encore d'évaluation

- Tax Reform For Acceleration and Inclusion LawDocument28 pagesTax Reform For Acceleration and Inclusion LawGloriosa SzePas encore d'évaluation

- Fabm Week 1 Asnd 2Document5 pagesFabm Week 1 Asnd 2John Calvin GerolaoPas encore d'évaluation

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemCrisanta MariePas encore d'évaluation

- A Guide To Australian Government Payments 2014Document44 pagesA Guide To Australian Government Payments 2014Wing ChuPas encore d'évaluation

- Group 1 - Sec. 23 24 NIRC Matrix PDFDocument4 pagesGroup 1 - Sec. 23 24 NIRC Matrix PDFDenise DuriasPas encore d'évaluation

- Taxation On IndividualsDocument16 pagesTaxation On IndividualsCachel Eunez Calderon100% (1)

- Income Tax Slab RatesDocument5 pagesIncome Tax Slab RatesBaibhav JauhariPas encore d'évaluation

- Philippine Fiscal PolicyDocument11 pagesPhilippine Fiscal PolicyHoney De LeonPas encore d'évaluation

- Income Taxation and Tax Rates in The PhilippinesDocument3 pagesIncome Taxation and Tax Rates in The Philippinesओतगो एदतोगसोल एहपोीूदPas encore d'évaluation

- Income Taxation: Under The Train LAWDocument9 pagesIncome Taxation: Under The Train LAWcerayPas encore d'évaluation

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemMelvin Franco San Gabriel60% (5)

- The Trump Tax Cut: Your Personal Guide to the New Tax LawD'EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawPas encore d'évaluation

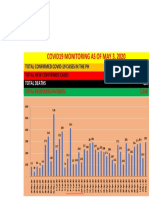

- Covid19-Monitoring-May 3 2020Document1 pageCovid19-Monitoring-May 3 2020Ren A EleponioPas encore d'évaluation

- Biodigester MaterialsDocument1 pageBiodigester MaterialsRen A EleponioPas encore d'évaluation

- 1987 Constitution of The Republic of The PhilippinesDocument52 pages1987 Constitution of The Republic of The PhilippinesRen A EleponioPas encore d'évaluation

- CERTIFICATION TCG 2019Document1 pageCERTIFICATION TCG 2019Ren A EleponioPas encore d'évaluation

- RR 18 2012Document5 pagesRR 18 2012JA LogsPas encore d'évaluation

- Notarized AFFIDAVIT OF CLOSURE - TCCDocument1 pageNotarized AFFIDAVIT OF CLOSURE - TCCRen A EleponioPas encore d'évaluation

- Contract of Lease - FinalDocument3 pagesContract of Lease - FinalRen A EleponioPas encore d'évaluation

- Leung Vs o BrienDocument14 pagesLeung Vs o BrienRen A EleponioPas encore d'évaluation

- CoopDocument21 pagesCoopRen A EleponioPas encore d'évaluation

- DSTDocument2 pagesDSTRen A EleponioPas encore d'évaluation

- Mabanag Vs Lopez VitoDocument1 pageMabanag Vs Lopez VitoRen A EleponioPas encore d'évaluation

- People vs. PerfectoDocument2 pagesPeople vs. PerfectoRen A EleponioPas encore d'évaluation

- Psa 210 PDFDocument22 pagesPsa 210 PDFLuzz LandichoPas encore d'évaluation

- Auto Bus Transport Systems Vs NLRC - ReadDocument6 pagesAuto Bus Transport Systems Vs NLRC - ReadRen A EleponioPas encore d'évaluation

- Royal Lines, Inc. Vs CADocument4 pagesRoyal Lines, Inc. Vs CAAnonymous 5iujercb9Pas encore d'évaluation

- 2 - Mariwasa Siam Vs Sec of LaborDocument7 pages2 - Mariwasa Siam Vs Sec of LaborRen A EleponioPas encore d'évaluation

- Adille Vs CADocument5 pagesAdille Vs CARachelle DomingoPas encore d'évaluation

- People of The Philippines vs. Carlito de Leon (Law On Arson)Document5 pagesPeople of The Philippines vs. Carlito de Leon (Law On Arson)Ren A EleponioPas encore d'évaluation

- 4-FVC LaborDocument6 pages4-FVC LaborRen A EleponioPas encore d'évaluation

- True or False Questions Plus Multiple ChoiceDocument9 pagesTrue or False Questions Plus Multiple ChoiceRen A EleponioPas encore d'évaluation

- CooperativeDocument4 pagesCooperativeRen A EleponioPas encore d'évaluation

- Sayco v. People, Agote v. Lorenzo, People v. Dela Rosa, People v. LadjaalamDocument30 pagesSayco v. People, Agote v. Lorenzo, People v. Dela Rosa, People v. LadjaalamRen A EleponioPas encore d'évaluation

- Estate TaxDocument9 pagesEstate TaxRen A EleponioPas encore d'évaluation

- 1-Gregorio Araneta Inc V TuazonDocument19 pages1-Gregorio Araneta Inc V TuazonRen A EleponioPas encore d'évaluation

- Vergara Vs Coca ColaDocument4 pagesVergara Vs Coca ColaRen A EleponioPas encore d'évaluation

- Tax2 Midterm Exam-SentDocument12 pagesTax2 Midterm Exam-SentRen A EleponioPas encore d'évaluation

- Tax2 Midterm ExamDocument13 pagesTax2 Midterm ExamRen A Eleponio100% (2)

- 3-Palay Inc Vs ClaveDocument7 pages3-Palay Inc Vs ClaveRen A EleponioPas encore d'évaluation

- DONOR's Tax Multiple Choice QuestionDocument13 pagesDONOR's Tax Multiple Choice QuestionRen A Eleponio83% (12)