Académique Documents

Professionnel Documents

Culture Documents

Tax2 - Local Taxation Reviewer

Transféré par

cardeguzman89%(9)89% ont trouvé ce document utile (9 votes)

5K vues4 pagestax2

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenttax2

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

89%(9)89% ont trouvé ce document utile (9 votes)

5K vues4 pagesTax2 - Local Taxation Reviewer

Transféré par

cardeguzmantax2

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

RTDG - ausl local taxation reviewer

LOCAL GOVERNMENT TAXATION

Q: What is the source of the local taxing power of the

government?

It is granted by the Constitution under Section 5, Article X

of the 1987 Constitution. It is not inherent in the Local

Government.

In Meralco v. Province of Laguna [May 5, 1999], the

Supreme Court held that the taxing power of LGUs is a

direct grant of the Constitution, and is not a delegated

power of Congress.

Q: What is the legal basis of the grant of local taxing

power under the LGC?

Section 129 of the LGC. Each local government unit shall

have the power to create its own sources of revenues and

to levy taxes, fees and charges subject to such guidelines

and limitations as the Congress may provide, consistent

with the basic policy of local autonomy. Such taxes, fees,

and charges shall accrue exclusively to the local

governments.

Q: Who has the authority to prescribe penalties for

local tax violations?

The Sanggunian of a LGU is authorised to prescribe fines

or other penalties for violation of tax ordinances. (Sec. 516,

LGC)

Q: Who may grant local tax exemptions?

The LGU may, through ordinance duly approved, grant tax

exemptions, incentives or reliefs under such terms and

conditions, as they may deem necessary. (Sec. 192, LGC)

Q: What entities are still exempt from local taxes?

(1) Local Water Districts

(2) Cooperatives duly registered under RA 6938

(3) Non-stock and non-profit hospitals

(4) Educational institutions

Q: May the government grant tax exemption to

taxpayers whose previous exemption has been

withdrawn?

YES. In PLDT v. City of Davao [August 22, 2001], the

Supreme Court held that withdrawal of a tax exemption

does not prohibit future grants of tax exemption. (Sec. 193,

LGC)

Q: Who has the authority to adjust local tax rates?

The LGU have the authority to adjust local tax rates.

However, it should not be more than once every 5 years

and in no case shall such adjustment exceed 10% of the

rates fixed under the Code. (Sec. 191, LGC)

Q: Who has the authority to issue local tax ordinance?

The power to impose a tax, fee, or charge or to generate

revenue shall be exercised by the Sanggunian of the LGU

concerned through an appropriate ordinance. (Sec. 132,

LGC)

Q: What is the significance of a local tax ordinance?

Page 1

What determines tax liability is the tax ordinance. The LGC

is simply the enabling law for the local legislative body. In

Yamane v. BA Lepanto Condominium Corp [October

25, 2005], at issue was whether the City Government of

Makati can hold condominium corporations liable to pay

business taxes. The Supreme Court pointed out that in

issuing a notice of assessment, reference to the local tax

ordinance is vital because the power of LGUs to impose

local taxes is exercised through the appropriate ordinance

enacted by the Sanggunian and not by the LGC.

Q: Can an ordinance with has been declared void for

failure to publish for 3 weeks be remedied by passing

another ordinance with purports to amend the

ordinance that has been declared null and void?

NO. In Coca-Cola Bottlers v. City of Manila [June 27,

2006], the Supreme Court held that the new ordinance is

still void since it cannot cure something which had never

existed in the first place as the same was void ab initio.

Q: Is publication/posting of an ordinance fixing the

assessment levels for different classes of real property

in a LGU necessary?

YES. In Figuerres v. CA [March 25, 1999], the Supreme

Court held that the publication/posting requirement under

Section 188 of the LGC must be complied with in case of

an ordinance imposing real property taxes, as well as an

ordinance fixing the assessment levels for different classes

of real property.

Q: What is the Principle of Pre-emption or

Exclusionary Rule?

When the national government elects to tax a particular

area, it is impliedly withholding from the LGU the delegated

power to tax the same field.

Q: What is the taxing power of the following LGUs: (a)

Province; (b) Municipalities; (c) Cities; and (d)

Barangays?

(A) Province

(1) Local Transfer Tax

(2) Business Tax on Printing and Publication

(3) Local Franchise Tax

(4) Tax on Sand, Gravel and other Quarry

Resources

(5) Professional Tax

(6) Amusement Tax

(7) Tax on Route Delivery Truck or Vans

(B) Municipalities

(1) Local Business Tax

(2) Fees on business and occupation

(3) Fees on selling and licensing of weights and

measures

(4) Fishery rentals, fees and charges

(C) Cities

- they may levy taxes which the province and

municipality may impose. The tax rates, fees, and charges

which the city may levy may exceed the maximum rates

allowed for the province or municipality by not more than

RTDG - ausl local taxation reviewer

50% except the rates of professional and amusement

taxes.

(D) Barangays

(1) Taxes on stores with fixed business

establishment

(2) Service fees for use of barangay-owned

properties and services rendered

(3) Barangay clearance

(4) Other fees and charges for (a) commercial

breeding of fighting cocks, cockpits and cockfighting; (b) on

places of recreation with admission fees; (c) billboards,

signboards and outdoor advertisements

Q: What are not covered by the local transfer tax of

real property?

The sale, transfer or other disposition of real property

pursuant to the Agrarian reform Program shall be exempt

from local transfer tax. (Sec. 135, LGC)

Q: What is not covered by the business tax on printing

and publication?

The receipts from the printing and/or publishing of books or

other reading materials prescribed by the DepEd as

schools texts or references shall exempt from business tax.

(Sec. 136, LGC)

Q: May the tax be imposed on extractions from private

lands?

NO. In Province of Bulacan v. CA [November 27, 1998],

the tax be imposed only to those extracted from public

lands or public waters within its territorial jurisdiction.

Private lands are excluded. (Sec. 138, LGC)

Q: What is the situs of professional tax?

Professional tax is payable in the province where the

taxpayer practices his profession or where the principal

office is located in case he practices his profession in

several places. (Sec. 139, LGC)

Q: Is the amusement tax on admission tickets to PBA

games a national or local tax?

It is a national tax. In PBA v. CA [August 8, 2000], the

Supreme Court held that it was the National Government

which could collect amusement taxes from the PBA. While

Section 13 of the Local tax Code mentions other places of

amusement, professional basketball games are definitely

not within its scope under the principle of ejusdem generis.

Q: How are the sales of route trucks and vans taxed?

If the sale is made in a place with a branch office: the sale

is reported in the LGU where the branch office is located.

If the sale is made in a place without a branch office: the

sale is reported in the LGU where the sales are withdrawn.

Q: The City of Cebu imposed a gross sales tax on

sales of matches stored by Philippine Match Co. in

Cebu City but delivered to customers outside the city.

Is the imposition valid?

Page 2

YES. As held in Philippine Match Co. v. City of Cebu

[January 18, 1978], the city can validly tax the sales of

matches to customers outside of the city as long as the

orders were booked and paid for in the companys branch

office in the city. Those matches can be regarded as sold in

the city because the matches were delivered to the carrier

in Cebu City. Generally, delivery to the carrier is delivery to

the buyer.

Q: ABC Bottlers Inc. maintained a bottling plant in

Pavia, Iloilo but sold softdrinks in Iloilo City by means

of a fleet of delivery trucks called rolling stores which

went directly to customers. Iloilo City passed an

ordinance imposing a municipal license tax on

distributors/sellers in the area. Is ABC liable under the

tax ordinance?

YES. In Iloilo Bottlers Inc. v. City of Iloilo [August 19, 1988],

the Supreme Court found that the bottling company was

engaged in the business of selling/distributing softdrinks in

Iloilo City through its rolling stores where sales transactions

with customers were entered into and sales were perfected

and consummated by route salesmen. Hence, the

company was subject to municipal license tax.

Q: Who are covered by the local business tax?

(1) Manufacturers, assemblers and producers

(2) Wholesalers, dealers and distributors

(3) Exporters, manufacturers of essential commodities

(4) Retailers

(5) Contractors

(6) Banks and other financial institutions

(7) Peddlers

(8) Other business not specified

(Sec. 143, LGC)

Those already subject to tax under (1) to (7) can no longer

be subject to tax under (8) otherwise it will be deemed

double taxation. City of Manila v. Coca-Cola Bottlers

[August 4, 2009]

Q: What is the ceiling on business tax imposed on

municipalities within Metro Manila?

The municipalities in Metro Manila may levy taxes at rates

which shall not exceed by 50% the maximum rate

prescribed in Section 143, LGC.

Q: May a municipality impose a professional tax?

NO. The municipality may impose and collect such

reasonable fees and charges on business and occupation

and on the practice of any profession or calling except

professional tax which is reserved to the province. (Sec.

147, LGC)

Q: What are the limitations on the taxing power of

LGUs?

As provided in Sec. 133 of the LGC, LGUs cannot impose

the following:

(1) income tax

(2) documentary stamp tax

(3) estate and donors tax

(4) customs duties

RTDG - ausl local taxation reviewer

Page 3

(5) taxes on goods passing through the LGU

(6) taxes on agricultural and aquatic products sold by

marginal farmers and fisherman

(7) taxes on board of investments registered enterprises

(8) excise taxes and taxes on petroleum products

(9) percentage tax and VAT

(10) taxes on gross receipts of transportation contractors

(11) taxes on premium paid by way of reinsurance

(12) taxes on registration of motor vehicles

(13) taxes on Philippine products actually exported

(14) taxes on Countryside and Barangay business

enterprises and cooperatives

(15) taxes and fees on the National Government

Q: When are local taxes paid?

General Rule: Within the first 20 days of January or of

each subsequent quarter, as the case may be

Exception: For Justifiable reason or cause, the

Sanggunian may extend the time for payment without

surcharge or penalties but only for a period not exceeding

6 months. (Sec. 167, LGC)

Q: Is municipal ordinance imposing fees on goods

(corn) that pass through a municipality;s territory

valid?

NO. As held in Palma Devt. Corp. v. Zamboanga Del Sur

[October 16, 2003], LGUs through their Sanggunian, may

impose taxes for the use of any public road such as a

service fee imposed on vehicles using municipal roads to a

wharf. In this case, the LGU cannot tax the goods even in

the guise of police surveillance fees.

REMEDIES AVAILABLE TO THE TAXPAYERS

Q: What are the remedies available to the taxpayer

prior to assessment?

(1) To question the constitutionality or legality of tax

ordinances or revenue measures on appeal

(Administrative Remedy)

(2) Petition for declaratory relief as and when applicable

(Judicial Remedy)

Q: Petron maintains a depot or bulk plant at the

Navotas Fishport Complex where it engages in the

selling of diesel fuels to vessels used in commercial

fishing. Navotas City levied business taxes on its sale

of petroleum products. Can the LGU levy the business

tax on the sale of petroleum?

NO. the LGU cannot impose any local tax on petroleum

products. As held in Petron Corp. v. Tiangco [April 16,

2008], the prohibition with respect to petroleum products

extends not only to excise taxes but all taxes, fees and

charges.

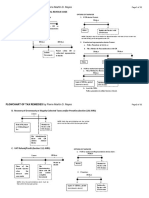

PROCESS ON HOW AN APPEAL INVOLVING

QUESTIONS OF CONSTITUTIONALITY OR LEGALITY

OF TAX ORDINANCES

(1) Appeal to the Secretary of Justice within 30 days from

effectivity

(2) The Secretary of Justice has 60 days to decide but an

appeal does not suspend the effectivity of the

ordinance

(3) Within 30 days from the Secretary of Justices decision

or after 60 days inaction, an appeal may be filed with

the RTC

Q: What is the rationale for the exemption of common

carriers from local taxes?

AS held in First Philippine Industrial Corp (FPIC) v. CA

[December 29, 1998], the legislative intent in excluding

from the taxing power of the LGU the imposition of

business tax against common carriers is to prevent a

duplication of the so-called common carriers tax.

Q: What authority is given to the Secretary of Justice with

respect to review of tax ordinances?

The Secretary of Justice can declare an ordinance void for

not having followed the requirements of the law but he

cannot replace it with his own law or he cannot say that it is

unwise. In Drilon v. Lim [August 4, 1994], then Secretary

of Justice Drilon set aside the Manila Revenue Code on

two grounds, namely the inclusion of certain ultra vires

provisions and its non-compliance with the prescribed

procedure in its enactment. In ruling that the act of then

Secretary Drilon was proper, the Supreme Court noted that

when the Secretary alters or modifies or sets aside a tax

ordinance, he is not allowed to substitute his own judgment

for the judgment of the LGU that enacted the measure. In

the said case, Secretary Drilon only exercised supervision

and not control.

Q: Are broadcasting and telecommunication

companies liable to pay local transfer taxes?

NO. As held in both Smart Communication v. City of

Davao [September 16, 2008] and Quezon City v. ABSCBN Broadcasting Corp. [October 6, 2008], these

franchise holders are now subject to VAT.

Q: What is the tax period for local taxes?

The tax period of all local taxes, fees and charges shall be

the calendar year. Such taxes, fees, and charges may be

paid in quarterly instalments. (Sec. 165, LGC)

Q: When do local taxes accrue?

General Rule: On January 1

Exception: New taxes which will accrue in the 1st day of

the next quarter following effectivity of the ordinance.

Q: What penalties are imposable on failure to pay local

taxes?

The penalty of 25% surcharge and 2% interest per month

not to exceed 36 months (or a maximum of 72%) may be

imposed. (Sec. 168, LGC)

Q: X, a taxpayer who believes that an ordinance

passed by the City Council of Pasay is

unconstitutional for being discriminatory against him

wants to know from you, his tax lawyer, whether or not

he could file an appeal. In the affirmative, he asks you

where such appeal should be made: The Secretary of

Finance, the Secretary of Justice or the CTA or the

RTDG - ausl local taxation reviewer

Regular Courts. What would your advice be to your

client?

The appeal should be made with the Secretary of Justice.

Any question on the constitutionality or legality of a tax

ordinance may be raised on appeal with the Secretary of

Justice within 30 days from the effectivity thereof.

Hagonoy Market Vendor Assoc. v. Municipality of

Hagonoy [February 6, 2002]

Q: When may an action for declaratory relief be filed?

When there is such an obscurity, declaratory relief would

be applicable. This remedy is open to determine any

question of construction or validity of a tax law and/or the

declaration of taxpayers liabilities thereunder.

Q: What are the rules on assessments?

General Rule: An assessment must be made within 5 years

from the date they become due.

Exception: If there is fraud or intent to evade payment of

the tax, the assessment may be made within 10 years from

discovery of fraud or intent to evade. (Sec. 194, LGC)

Q: What is the rule on collection?

Collection must be within 5 years from assessment.

Q: What are the remedies available to the taxpayer

after assessment?

(1) Protest of assessment (Sec. 195, LGC)

(2) Claim for refund (Sec. 196, LGC)

(1)

(2)

(3)

(4)

(5)

(6)

PROCEDURE IN PROTEST OF LOCAL TAX

ASSESSMENT

Assessment notice issued by local treasurer

File written protest with the local treasurer within 30

days from date of payment

The Treasurer has to decide within 60 days

An appeal to the RTC is then available upon denial or

60 days inaction by the treasurer

The RTC decision is appealable to the CTA En Banc

Appeal to the SC within 15 days from receipt of

resolution

Q: What is the rule on refunds?

The taxpayer must file a written claim within 2 years from

the date of payment of tax or from the date when the

taxpayer is entitled to refund.

REMEDIES AVAILABLE TO THE LOCAL GOVERNMENT

Q: What are the civil remedies available to the LGU for

collection of revenues?

(1) Administrative Action

- Distraint of personal property

- Levy upon real property

- Compromise

(2) Judicial Action

Q: How is the administrative remedy of distraint or levy

exercised?

By administrative action thru distraint of goods, chattels, or

effects, and other personal property or whatever character,

including stocks and other securities, debts, credits, bank

Page 4

accounts and interest in and rights to personal property,

and by levy upon real property snd interest in or rights to

real property. (Sec. 174, LGC)

Q: How is the remedy of judicial action exercised?

The LGU concerned may institute an ordinary civil action

with the regular courts for the collection of delinquent taxes

within 5 years from the date the taxes, fees or charges

become due. (Sec. 194, LGC)

Vous aimerez peut-être aussi

- Reviewer On Taxation - MamalateoDocument128 pagesReviewer On Taxation - MamalateoVada De Villa Rodriguez94% (17)

- Criminal Case Evidence SummaryDocument3 pagesCriminal Case Evidence Summarycardeguzman80% (5)

- Taxation Law 2 Reviewer (Long)Document44 pagesTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- TAX ASSESSMENT AND REMEDIESDocument6 pagesTAX ASSESSMENT AND REMEDIESLemuel Angelo M. Eleccion100% (2)

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoPas encore d'évaluation

- Comparison Train Law and NircDocument37 pagesComparison Train Law and Nircczabina fatima delica89% (19)

- LOCAL TAX 2014 - Atty. DabuDocument12 pagesLOCAL TAX 2014 - Atty. DabuEwendel GatdulaPas encore d'évaluation

- Local Government Tax CodeDocument22 pagesLocal Government Tax CodeCarl AdrianPas encore d'évaluation

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies Flowchart (Revised)Document6 pagesTax Remedies Flowchart (Revised)GersonGamas0% (1)

- Tax Remedies in Flowchart 102019Document2 pagesTax Remedies in Flowchart 102019Cecilbern ayen BernabePas encore d'évaluation

- Tax Judicial Remedies of GovernmentDocument34 pagesTax Judicial Remedies of GovernmentNoullen Banuelos100% (5)

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaPas encore d'évaluation

- Cpar Tax Problems ReviewerDocument8 pagesCpar Tax Problems ReviewerAnonymous swtSOYwLrMPas encore d'évaluation

- TAX87 16 Local Preferential With Answers PDFDocument5 pagesTAX87 16 Local Preferential With Answers PDFJohn Carlo CruzPas encore d'évaluation

- Taxation 2 InglesDocument151 pagesTaxation 2 InglesJoseph Rinoza Plazo100% (11)

- Tax 2 (Remedies & CTA Jurisdiction)Document13 pagesTax 2 (Remedies & CTA Jurisdiction)Monice RiveraPas encore d'évaluation

- Tax Review Q and A Quiz 1 and 2 FinalsDocument19 pagesTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaPas encore d'évaluation

- Taxation 2 ReviewerDocument24 pagesTaxation 2 ReviewerAnna Jo100% (1)

- Film analysis of A Few Good MenDocument2 pagesFilm analysis of A Few Good Mencardeguzman50% (2)

- EthicsDocument2 pagesEthicscardeguzmanPas encore d'évaluation

- Special Proceeding Reviewer (Regalado)Document36 pagesSpecial Proceeding Reviewer (Regalado)Faith Laperal91% (11)

- Land DispositionDocument27 pagesLand Dispositioncardeguzman100% (1)

- Splunk-Certification-Handbook-v 8 31 2018Document30 pagesSplunk-Certification-Handbook-v 8 31 2018Devang VohraPas encore d'évaluation

- AFN 132 Homework 1Document3 pagesAFN 132 Homework 1devhan12Pas encore d'évaluation

- Grievance Machinery ReportDocument16 pagesGrievance Machinery ReportRoseMantuparPas encore d'évaluation

- TaxationBarQ26A LocalGovernmentTaxDocument18 pagesTaxationBarQ26A LocalGovernmentTaxCire GeePas encore d'évaluation

- Tax 2 ReviewerDocument164 pagesTax 2 ReviewerKaye Mendoza100% (1)

- Taxation - 8 Tax Remedies Under NIRCDocument34 pagesTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- Gross Estate ReviewerDocument8 pagesGross Estate ReviewerCharles RiveraPas encore d'évaluation

- Tax Remedies Quiz ReyesDocument4 pagesTax Remedies Quiz ReyesMary Therese Gabrielle Estioko100% (2)

- Tax2 - Real Property Tax ReviewerDocument5 pagesTax2 - Real Property Tax Reviewercardeguzman100% (1)

- VAT ReviewerDocument11 pagesVAT ReviewerMarianne AgunoyPas encore d'évaluation

- Taxation 2Document112 pagesTaxation 2cmv mendoza100% (7)

- Tax Exemption Granted Under Consti and Tax Code With ProblemsDocument11 pagesTax Exemption Granted Under Consti and Tax Code With ProblemsOSCAR VALERO100% (1)

- Tax Remedies ReviewerDocument9 pagesTax Remedies ReviewerheirarchyPas encore d'évaluation

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesPas encore d'évaluation

- Tax Administration Powers and RemediesDocument16 pagesTax Administration Powers and Remediescristiepearl100% (6)

- RemediesDocument45 pagesRemediesCzarina100% (1)

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiPas encore d'évaluation

- Local Government TaxationDocument7 pagesLocal Government TaxationCeresjudicataPas encore d'évaluation

- 17.-GCRO Top250 PG March2019Document214 pages17.-GCRO Top250 PG March2019Mikee Baliguat Tan100% (1)

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaPas encore d'évaluation

- Tax Case DigestsDocument21 pagesTax Case Digestsannamariepagtabunan100% (3)

- Philippine Transfer Taxes and Value Added Tax-2011Document54 pagesPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Business and Transfer Taxes P1 Exam Key Answers PDFDocument16 pagesBusiness and Transfer Taxes P1 Exam Key Answers PDFJamaica DavidPas encore d'évaluation

- Chapter 18 - Tax Remedies: Multiple Choice - Theory 1Document12 pagesChapter 18 - Tax Remedies: Multiple Choice - Theory 1Emmanuel PenullarPas encore d'évaluation

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- Taxation Quiz - ADocument2 pagesTaxation Quiz - AKenneth Bryan Tegerero TegioPas encore d'évaluation

- Tax Finals ReviewerDocument51 pagesTax Finals ReviewerCelestino Law100% (2)

- Final Tax ExamDocument10 pagesFinal Tax ExamGerald RojasPas encore d'évaluation

- 1st Semester Transfer Taxation Module 2 Estate TaxationDocument16 pages1st Semester Transfer Taxation Module 2 Estate TaxationNah Hamza100% (1)

- Special Itemized Deductions, NOLCO & OSDDocument13 pagesSpecial Itemized Deductions, NOLCO & OSDdianne caballero100% (1)

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzPas encore d'évaluation

- VAT ReviewerDocument18 pagesVAT ReviewerNash Ortiz LuisPas encore d'évaluation

- TAX 2 BAR Q&A For MidtermDocument5 pagesTAX 2 BAR Q&A For MidtermMike E DmPas encore d'évaluation

- Tax2 Local Taxation Reviewer - CompressDocument4 pagesTax2 Local Taxation Reviewer - CompressDela cruz, Hainrich (Hain)100% (1)

- Tax2 Local Taxation Reviewer PDFDocument4 pagesTax2 Local Taxation Reviewer PDFaeron_camaraoPas encore d'évaluation

- TAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanDocument6 pagesTAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanPatrick GuetaPas encore d'évaluation

- PM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)Document9 pagesPM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)dodong123Pas encore d'évaluation

- Finals Notes LOCAL TAXATION 5.6.23Document13 pagesFinals Notes LOCAL TAXATION 5.6.23Raissa Anjela Carman-JardenicoPas encore d'évaluation

- Local Government Taxation (Bangcal, Eleccion) - PresentationDocument116 pagesLocal Government Taxation (Bangcal, Eleccion) - PresentationFiliusdeiPas encore d'évaluation

- PLM Tax II 2016 2017 Local Taxation Local Government Taxation Real Property Taxation Full Notes 09 March 2017Document49 pagesPLM Tax II 2016 2017 Local Taxation Local Government Taxation Real Property Taxation Full Notes 09 March 2017Mark DungoPas encore d'évaluation

- Local Government Taxation Powers and LimitationsDocument28 pagesLocal Government Taxation Powers and LimitationsFunnyPearl Adal GajuneraPas encore d'évaluation

- Taxation Law Questions and AnswersDocument12 pagesTaxation Law Questions and AnswersHenry M. Macatuno Jr.Pas encore d'évaluation

- Local TaxesDocument19 pagesLocal TaxesKennethQueRaymundoPas encore d'évaluation

- Ladia Corpo Lecture Part 4 (June 8)Document8 pagesLadia Corpo Lecture Part 4 (June 8)Khaiye De Asis AggabaoPas encore d'évaluation

- GPS Tracking An Invasion of PrivacyDocument11 pagesGPS Tracking An Invasion of PrivacycardeguzmanPas encore d'évaluation

- Anti-Illegal Drugs Special Operations Task Force ManualDocument97 pagesAnti-Illegal Drugs Special Operations Task Force ManualAntonov FerrowitzkiPas encore d'évaluation

- Ladia Corpo Lecture 1 (June 9)Document9 pagesLadia Corpo Lecture 1 (June 9)Ruel Benjamin BernaldezPas encore d'évaluation

- Armed Conflict and DisplacementDocument34 pagesArmed Conflict and DisplacementcardeguzmanPas encore d'évaluation

- Jurisdiction in Civil CasesDocument8 pagesJurisdiction in Civil CasesChester Pryze Ibardolaza TabuenaPas encore d'évaluation

- Land Titling PDFDocument51 pagesLand Titling PDFcardeguzmanPas encore d'évaluation

- Dratw Philippines 2011 PDFDocument59 pagesDratw Philippines 2011 PDFcashielle arellanoPas encore d'évaluation

- Civ 2 CaseDocument40 pagesCiv 2 CasecardeguzmanPas encore d'évaluation

- Partnership and Agency Digests For Atty. CochingyanDocument28 pagesPartnership and Agency Digests For Atty. CochingyanEman Santos100% (3)

- Waiver of RightsDocument1 pageWaiver of RightscardeguzmanPas encore d'évaluation

- Film Analysis Guilty by SuspicionDocument2 pagesFilm Analysis Guilty by SuspicioncardeguzmanPas encore d'évaluation

- Responsibility of non-state actors for protecting internally displaced personsDocument2 pagesResponsibility of non-state actors for protecting internally displaced personscardeguzmanPas encore d'évaluation

- Appellate's BriefDocument32 pagesAppellate's BriefcardeguzmanPas encore d'évaluation

- Full Legres CasesDocument58 pagesFull Legres Casescardeguzman100% (1)

- Appellate TableDocument2 pagesAppellate TablecardeguzmanPas encore d'évaluation

- EthicsDocument2 pagesEthicscardeguzmanPas encore d'évaluation

- LTD Outline Land TitlingDocument51 pagesLTD Outline Land TitlingClaire Roxas100% (2)

- Civ Pro Mid Term Exam - Flattened-1Document10 pagesCiv Pro Mid Term Exam - Flattened-1cardeguzmanPas encore d'évaluation

- Arellano Outline Land ClassificationDocument6 pagesArellano Outline Land ClassificationZan BillonesPas encore d'évaluation

- Land Titling Guide for the PhilippinesDocument48 pagesLand Titling Guide for the PhilippinescardeguzmanPas encore d'évaluation

- Cases in Land RegistrationDocument3 pagesCases in Land RegistrationcardeguzmanPas encore d'évaluation

- Estate, donor, VAT, excise tax reviewerDocument3 pagesEstate, donor, VAT, excise tax reviewercardeguzmanPas encore d'évaluation

- Aban Tax 1 Reviewer PDFDocument67 pagesAban Tax 1 Reviewer PDFcardeguzmanPas encore d'évaluation

- 10-Cisa It Audit - BCP and DRPDocument27 pages10-Cisa It Audit - BCP and DRPHamza NaeemPas encore d'évaluation

- BasketballDocument24 pagesBasketballnyi waaaah rahPas encore d'évaluation

- Solomon Islands School Certificate 2007 New Testament Studies Question BookletDocument14 pagesSolomon Islands School Certificate 2007 New Testament Studies Question BookletAndrew ArahaPas encore d'évaluation

- UNM Findings Letter - FinalDocument37 pagesUNM Findings Letter - FinalAlbuquerque JournalPas encore d'évaluation

- Darcy's LawDocument7 pagesDarcy's LawArt RmbdPas encore d'évaluation

- International Aviation Safety Assessment Assessor’s ChecklistDocument23 pagesInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaPas encore d'évaluation

- AFAR04. Long Term Construction ContractsDocument4 pagesAFAR04. Long Term Construction ContractsJohn Kenneth BacanPas encore d'évaluation

- AACC and Proactive Outreach Manager Integration - 03.04 - October 2020Document59 pagesAACC and Proactive Outreach Manager Integration - 03.04 - October 2020Michael APas encore d'évaluation

- Caoile EFT Authorization Form - EnglishDocument2 pagesCaoile EFT Authorization Form - EnglishSaki DacaraPas encore d'évaluation

- FOI Disclosure Log 374 AnnexDocument1 204 pagesFOI Disclosure Log 374 AnnexSAMEERPas encore d'évaluation

- Vol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandDocument10 pagesVol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandPMVPas encore d'évaluation

- SENSE AND SENSIBILITY ANALYSIS - OdtDocument6 pagesSENSE AND SENSIBILITY ANALYSIS - OdtannisaPas encore d'évaluation

- Application For Membership: Insert CCT MBA Logo Here 6/F Joshua Center, Taft Ave, Ermita, Metro ManilaDocument2 pagesApplication For Membership: Insert CCT MBA Logo Here 6/F Joshua Center, Taft Ave, Ermita, Metro ManilaAnne florPas encore d'évaluation

- Compassion and Choices Fall 2015Document27 pagesCompassion and Choices Fall 2015Kathleen JaneschekPas encore d'évaluation

- Schedule of Classes (2nd Sem AY 18-19)Document2 pagesSchedule of Classes (2nd Sem AY 18-19)Anne Lorraine DioknoPas encore d'évaluation

- Echegaray Vs Secretary of JusticeDocument12 pagesEchegaray Vs Secretary of JusticeCherry BepitelPas encore d'évaluation

- Cornell Notes Financial AidDocument3 pagesCornell Notes Financial AidMireille TatroPas encore d'évaluation

- Terminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsDocument1 pageTerminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsTrần Long VũPas encore d'évaluation

- Acc311-Midterm Paper: Solved by AhsanDocument46 pagesAcc311-Midterm Paper: Solved by Ahsanamarjaved1Pas encore d'évaluation

- Prof. EthicsDocument141 pagesProf. EthicsMohammed MuzamilPas encore d'évaluation

- Applications Forms 2 EL BDocument2 pagesApplications Forms 2 EL Bilerioluwa akin-adeleyePas encore d'évaluation

- ASEAN Integration Opens Philippines to Regional Economic GrowthDocument40 pagesASEAN Integration Opens Philippines to Regional Economic GrowthTESDA Korea-Phil. Information Technology Training CenterPas encore d'évaluation

- Feleccia vs. Lackawanna College PresentationDocument8 pagesFeleccia vs. Lackawanna College PresentationMadelon AllenPas encore d'évaluation

- LG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Document66 pagesLG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Our HomePas encore d'évaluation

- VAT: Value-Added Tax BasicsDocument42 pagesVAT: Value-Added Tax BasicsRobert WeightPas encore d'évaluation

- Dizon vs. CA - GR No. 101929 - Case DigestDocument2 pagesDizon vs. CA - GR No. 101929 - Case DigestAbigail Tolabing100% (1)

- Skill Assessment Evidence GuideDocument13 pagesSkill Assessment Evidence Guiderahul.ril1660Pas encore d'évaluation