Académique Documents

Professionnel Documents

Culture Documents

Tax Gap "Map" Tax Year 2006 ($ Billions) : Tax Paid Voluntarily & Timely: $2,210

Transféré par

MocchiKuciangMande0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues1 pageas

Titre original

06rastg12map

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentas

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues1 pageTax Gap "Map" Tax Year 2006 ($ Billions) : Tax Paid Voluntarily & Timely: $2,210

Transféré par

MocchiKuciangMandeas

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

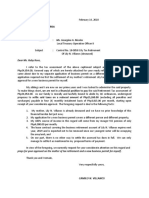

Tax Gap Map

Tax Year 2006 ($ billions)

Total Tax

Liability

$2,660

Tax Paid Voluntarily & Timely: $2,210

Gross Tax Gap: $450

(Voluntary Compliance Rate = 83.1%)

$28

Corporation

Income Tax

#

Employment

Tax

#

Estate

Tax

$3

Excise

Tax

(Tax Never Collected)

(Net Compliance Rate = 85.5%)

Underreporting

$376

Nonfiling

Individual

Income Tax

$25

Net Tax Gap: $385

Enforced & Other

Late Payments of Tax

$65

Individual

Income Tax

$235

Corporation

Income Tax

$67

Employment

Tax

$72

Non-Business

Non-Business

Income

Income

$30.6

$68

Small

Corporations

(assets < $10m)

$19

FICA

Tax on Wages

Business

Business

Income

Income

$65.3

$122

Large

Corporations

(assets > $10m)

$48

Self-Employment

Tax

Adjustments,

Deductions,

Exemptions

$17

#

Credits

$28

Internal Revenue Service, December 2011

$14

Underpayment

$46

Estate

Tax

$2

Individual

Income Tax

$36

Corporation

Income Tax

$4

Categories of Estimates

Actual Amounts

$57

Unemployment

Tax

$1

Excise

Tax

Updated Estimates

#

No Estimates Available

Employment

Tax

$4

Estate

Tax

$2

Excise

Tax

$0.1

Vous aimerez peut-être aussi

- GAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoDocument45 pagesGAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoNational Association of REALTORS®Pas encore d'évaluation

- Payroll and Contribution Rates Employers PDFDocument2 pagesPayroll and Contribution Rates Employers PDFNicquainCTPas encore d'évaluation

- Impact of Proposed 2009 Tax IncreaseDocument1 pageImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- S Corp vs. Sole Prop - LLC Tax Savings CalculatorDocument1 pageS Corp vs. Sole Prop - LLC Tax Savings CalculatorsomdivaPas encore d'évaluation

- Free Australia Personal Income Tax Calculator v1.0.2017Document7 pagesFree Australia Personal Income Tax Calculator v1.0.2017Minh Nguyen Vo NhatPas encore d'évaluation

- Generic PayslipDocument1 pageGeneric Payslipjustinprasetyo19Pas encore d'évaluation

- PP PresDocument25 pagesPP PresAnchal SaxenaPas encore d'évaluation

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfPas encore d'évaluation

- Per Check Per Month Per Year Gross Income TaxesDocument2 pagesPer Check Per Month Per Year Gross Income TaxesinsuranatorPas encore d'évaluation

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDocument21 pagesTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerPas encore d'évaluation

- A Message From The Secretary of The TreasuryDocument26 pagesA Message From The Secretary of The TreasurylosangelesPas encore d'évaluation

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037Pas encore d'évaluation

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiPas encore d'évaluation

- AccountingiifinalDocument2 pagesAccountingiifinalapi-341192980Pas encore d'évaluation

- Department of Finance and Administration: Withholding TaxDocument3 pagesDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaPas encore d'évaluation

- Tax Gap Update 070212Document4 pagesTax Gap Update 070212dipinders87Pas encore d'évaluation

- Parcel 5006128 ParcelDetailHistoryDocument5 pagesParcel 5006128 ParcelDetailHistoryAfuiHJaewfkhBSDPas encore d'évaluation

- Pay Stub - 1 PDFDocument1 pagePay Stub - 1 PDFPankaj DesaiPas encore d'évaluation

- IAS#12Document31 pagesIAS#12Shah KamalPas encore d'évaluation

- Ulster County 2019 Budget SummaryDocument21 pagesUlster County 2019 Budget SummaryDaily FreemanPas encore d'évaluation

- Earnings Statement: Labor Solutions - Staff Right, LLCDocument1 pageEarnings Statement: Labor Solutions - Staff Right, LLCCoro'naado LinPas encore d'évaluation

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloPas encore d'évaluation

- Rev Review Memo June 2014Document1 pageRev Review Memo June 2014tom_scheckPas encore d'évaluation

- $87,000 Income Tax Calculator 2023 - Ontario - Salary After TaxDocument5 pages$87,000 Income Tax Calculator 2023 - Ontario - Salary After TaxEdward Dale LiwanagPas encore d'évaluation

- Econ Math ProjectDocument14 pagesEcon Math ProjectAndy ChiuPas encore d'évaluation

- OdunDocument3 pagesOdunLoco CocoPas encore d'évaluation

- Jose Az Feb StubDocument1 pageJose Az Feb StubCandy CookiesPas encore d'évaluation

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Document3 pagesTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangPas encore d'évaluation

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530Pas encore d'évaluation

- Employee Payroll (January) : Bongolan Estrada Gumaru Lamsis OrdinarioDocument3 pagesEmployee Payroll (January) : Bongolan Estrada Gumaru Lamsis OrdinarioEurich Gibarr Gavina EstradaPas encore d'évaluation

- Business Organization and TaxesDocument22 pagesBusiness Organization and TaxesChieMae Benson QuintoPas encore d'évaluation

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitPas encore d'évaluation

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanPas encore d'évaluation

- Forex Compounding CalculatorDocument8 pagesForex Compounding CalculatorMye RakPas encore d'évaluation

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04Pas encore d'évaluation

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- OregonDocument20 pagesOregonStatesman JournalPas encore d'évaluation

- Financial Statement, Cash Flows and TaxesDocument22 pagesFinancial Statement, Cash Flows and Taxesnumlit1984Pas encore d'évaluation

- Financial PlanDocument12 pagesFinancial PlanNico BoialterPas encore d'évaluation

- Solution of Textbook 1Document4 pagesSolution of Textbook 1BảoNgọcPas encore d'évaluation

- Fin Proj MDDocument5 pagesFin Proj MDKhatab OmerPas encore d'évaluation

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbePas encore d'évaluation

- 2.0 FIN Plan & Forecasting v1Document62 pages2.0 FIN Plan & Forecasting v1Omer CrestianiPas encore d'évaluation

- Earnings Statement Important - Keep For Your Records Mail To EmployesDocument1 pageEarnings Statement Important - Keep For Your Records Mail To EmployesRaimundo MartinezPas encore d'évaluation

- Family BudgetDocument7 pagesFamily BudgetDy Ju Arug ALPas encore d'évaluation

- Multiple Scale ChartDocument6 pagesMultiple Scale ChartabdulrazakyunusPas encore d'évaluation

- TABL2751 Tax Rates 2021 - UpdatedDocument4 pagesTABL2751 Tax Rates 2021 - UpdatedPeper12345Pas encore d'évaluation

- Chapter 5Document21 pagesChapter 5Steve CouncilPas encore d'évaluation

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahPas encore d'évaluation

- Financial Planning Business Plan: 7.1 Important AssumptionsDocument32 pagesFinancial Planning Business Plan: 7.1 Important AssumptionstemesgenPas encore d'évaluation

- Flat Tax Final VersionDocument2 pagesFlat Tax Final VersionStephen GrahamPas encore d'évaluation

- Chapter 7Document20 pagesChapter 7Steve CouncilPas encore d'évaluation

- Financial ReportDocument35 pagesFinancial ReportDaniela Denisse Anthawer LunaPas encore d'évaluation

- Millers' Tax Computati: Known ParametersDocument2 pagesMillers' Tax Computati: Known ParametersYadav_BaePas encore d'évaluation

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StorePas encore d'évaluation

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformD'EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformPas encore d'évaluation

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransD'EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransPas encore d'évaluation

- Inflation Reduction Act of 2022Document755 pagesInflation Reduction Act of 2022Rema RahmanPas encore d'évaluation

- Income From Salaries: 1. Employer-Employee RelationshipDocument25 pagesIncome From Salaries: 1. Employer-Employee RelationshipNanadan S NandaPas encore d'évaluation

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerPas encore d'évaluation

- Taxation ReviewerDocument15 pagesTaxation ReviewerKaren YpilPas encore d'évaluation

- International Compensation System of Multinational CorporationDocument22 pagesInternational Compensation System of Multinational CorporationRaihan RakibPas encore d'évaluation

- Business Taxation Past Paper 2016 B Com Part 2Document3 pagesBusiness Taxation Past Paper 2016 B Com Part 2dilbaz karim0% (1)

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxGirl Lang AkoPas encore d'évaluation

- Taxation Review June 16Document8 pagesTaxation Review June 16Shaiful Alam FCAPas encore d'évaluation

- E NominationDocument2 pagesE NominationHarshit SaxenaPas encore d'évaluation

- Basic Framework of Direct TaxationDocument41 pagesBasic Framework of Direct TaxationKirankumarkvPas encore d'évaluation

- Income Tax Return 2019Document9 pagesIncome Tax Return 2019Sh'Nanigns X3Pas encore d'évaluation

- QC TreasurerDocument2 pagesQC TreasurerFrozen RawPas encore d'évaluation

- Liem Doan - Software EngineerDocument3 pagesLiem Doan - Software EngineerLiêm ĐoànPas encore d'évaluation

- Cfap 5 2019 PKDocument194 pagesCfap 5 2019 PKSummar FarooqPas encore d'évaluation

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaPas encore d'évaluation

- Bar Review Material 2019 TaxDocument41 pagesBar Review Material 2019 Taxsam cadley0% (1)

- E-Circular On Super Top UpDocument3 pagesE-Circular On Super Top UpsankarshanadasPas encore d'évaluation

- Daycare Budget TemplateDocument1 pageDaycare Budget TemplateAngel Naomi Tolentino Backup0% (1)

- The Tax Organization System: The Federal Inland Revenue Authority /FIRADocument46 pagesThe Tax Organization System: The Federal Inland Revenue Authority /FIRAYoseph KassaPas encore d'évaluation

- Global Investment Centre - Statement - DocumentDocument11 pagesGlobal Investment Centre - Statement - DocumentjohnPas encore d'évaluation

- List of Required Documents Under Prime Ministers Assistance PackageDocument6 pagesList of Required Documents Under Prime Ministers Assistance PackageSalman QaiserPas encore d'évaluation

- DOLE Labor Advisory No. 11, Series of 2014 PDFDocument2 pagesDOLE Labor Advisory No. 11, Series of 2014 PDFWilliam Azucena100% (1)

- PF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubDocument4 pagesPF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubNISHA SONARPas encore d'évaluation

- Payslip - 2020 11 26Document1 pagePayslip - 2020 11 26itkrishna1988Pas encore d'évaluation

- Activity 1-NotesDocument2 pagesActivity 1-NotesChandria FordPas encore d'évaluation

- Private & Confidential: (No Pay Point)Document1 pagePrivate & Confidential: (No Pay Point)Michalina WróblewskaPas encore d'évaluation

- Payment of Gratuity Act 1972Document54 pagesPayment of Gratuity Act 1972gauravsingh2385100% (2)

- Chapter 10Document20 pagesChapter 10Jessa LoPas encore d'évaluation

- Au 2023 Guide To Mercer Super For Transferring BT Super EmployersDocument20 pagesAu 2023 Guide To Mercer Super For Transferring BT Super Employersappand11Pas encore d'évaluation

- 11 November and Dec - Cababat Only ActualDocument8 pages11 November and Dec - Cababat Only ActualBPH MaramagPas encore d'évaluation