Académique Documents

Professionnel Documents

Culture Documents

The Bank Nightklub's Statement of Claim

Transféré par

windsorstar0 évaluation0% ont trouvé ce document utile (0 vote)

20K vues13 pagesThe Bank Nightklub's Statement of Claim from Jan. 5, 2016, against their landlord Dante Capaldi and his hired bailiff.

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe Bank Nightklub's Statement of Claim from Jan. 5, 2016, against their landlord Dante Capaldi and his hired bailiff.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

20K vues13 pagesThe Bank Nightklub's Statement of Claim

Transféré par

windsorstarThe Bank Nightklub's Statement of Claim from Jan. 5, 2016, against their landlord Dante Capaldi and his hired bailiff.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 13

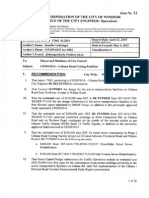

; cour stem. CY- I-A IS

ONTARIO

SUPERIOR COURT OF JUSTICE

BETWEEN:

2340218 ONTARIO LIMITED

Plaintitt

and

1287678 ONTARIO INC. and KAY BAILIFF & ADJUSTMENT INC.

Defendants

STATEMENT OF CLAIM

‘TO THE DEFENDANT(S)

A LEGAL PROCEEDING HAS BEEN COMMENCED AGAINST YOU by the plaintifi(s). The claim

‘made against you is set out in the following pages.

IF YOU WISH TO DEFEND THIS PROCEEDING, you or an Ontario lawyer acting for you must prepare

4 statement of defence in Form 18A prescribed by the Rules of Civil Procedure, serve it on the plaintiffs)

lawyer or, where the plaintif¥(s) do(es) not have a lawyer, serve it on the plaintiffs), and file it, with proof of

service, in this court office, WITHIN TWENTY DAYS after this statement of claim is served on you, if you

are served in Ontario.

If you are served in another province or territory of Canada or in the United States of America, the period

for serving and filing your statement of defence is forty days. If you are served outside Canada and the United

States of America, the period is sixty days,

Instead of serving and filing a statement of defence, you may serve and file a notice of intent to defend in

Form 18B prescribed by the Rules of Civil Procedure. This will entitle you to ten more days within which to

serve and file your statement of defence.

IF YOU FAIL TO DEFEND THIS PROCEEDING, JUDGMENT MAY BE GIVEN AGAINST YOU, IN

YOUR ABSENCE AND WITHOUT FURTHER NOTICE TO YOU. IF YOU WISH TO DEFEND THIS

PROCEEDING BUT ARE UNABLE TO PAY LEGAL FEES, LEGAL AID MAY BE AVAILABLE TO

YOU BY CONTACTING A LOCAL LEGAL AID OFFICE,

TAKE NOTICE: THIS ACTION WILL AUTOMATICALLY BE DISMISSED if it has not been set

down for trial or terminated by any means within five years after the action waStommenced unless otherwise

ordered by the court.

Date: JAN 05 2016 Issued by:

Reghirar

Address of court office:

245 Windsor Avenue

Windsor, Ontario N9A 132

TO: — 1287678 ONTARIO INC.

697 Front Road North

Amherstburg, Ontario NOV 2V6

AND TO: KAY BAILIFF & ADJUSTMENT INC.

4865 Sheppard Avenue E.

‘Scarborough, Ontario M1S 3V8

CLAIM

‘The plaintiff claims for:

a. a Declaration that the defendants have committed an illegal distress, or

alternatively an improper distress, contrary to the provisions of the

‘Commercial Tenancies Act, R.S.0, 1990, Chapter L.7;

b. damages in the amount of $500,000.00;

. Punitive, aggravated and exemplary damages in the further sum of

$100,000.00;

d. A mandatory Order restraining the defendants from removing, selling or

otherwise disposing of any property of the plaintiff currently in the

possession, control or power of the defendants;

©. An Order directing the defendants to return the aforementioned property

to the plaintiff forthwith;

£.pre-judgment interest and post-judgment interest in accordance with the

Courts of Justice Act, R.8.0. 1990, ¢. 43;

8. costs of this action on a substantial indemnity scale or alternative on a

partial indemnity scale; and

h, such farther and other relief as this Honourable Court may deem just.

The plaintiff is a corporation incorporated in accordance with the laws of the Province of

Ontario, and at all material times herein carried on business in the City of Windsor operating

as anightclub and bar under the name The Bank Nightklub (“The Bank”) from the premises

known municipally as 285 Ouellette Avenue, Windsor, Ontario (the “Premises”).

‘The defendant, 1287678 Ontario Inc, (“Ontario”) is a corporation, and at the material times

was the owner of the Premises.

‘The defendant, Kay Bailiff & Adjustment Inc. (“the Bailiff”), isa corporation incorporated in

accordance with the laws of the Province of Ontario, and at all material times herein carried

on business as a private bailiff in and around the Province of Ontario.

In or about October, 2012, the plaintiff and Ontario entered into a Commercial Lease (the

“Lease”) whereby the plaintiff agreed to lease the Premises for a term of Thirty Six (36)

‘months retroactively commencing on the 1* day of September, 2012 and terminating on the

31" day of August, 2015. First and last month rent was paid when the plaintiff took

possession.

‘The Lease further provides that upon expiration of the lease term, the tenancy would revert to

a month to month tenaney until such time as it was terminated by one of the parties.

‘The Lease further provided that the annual base rents for the building were to be $80,000.00

during the first year of the tenaney, $88,000.00 during the second year of the tenancy and

{$96,000.00 during the third year of the tenancy, to be paid in equal monthly instalments on

the first of each month during the term.

10.

12.

Almost immediately upon taking possession of the Premises, the plaintiff discovered that

there were serious and significant deficiencies in the structure of the building. More

particularly, the roof of the building occupied by the plaintiff had effectively failed and

required complete replacement.

‘On numerous occasions thereafter, representatives of the Bank discussed the condition of the

building and the roof with the principle of Ontario, Dante Capaldi (“Capaldi”), however

Ontario and Capaldi failed to take reasonable or proper steps to rectify the roof problem.

‘The Lease specifically provides at paragraph 7 as follows:

(5) For greater certainty the Tenant’s obligation to repair and maintain the premises shall not

extend to matters pertaining to the HVAC system, the roof, the exterior ofthe building or any

‘matter relating to the structural integrity of the building other than those that are considered

routine maintenance. Tenant shall not have to replace any of those elements that are capital

elements of the building.

Based on Ontario and Capaldi’s failure to remedy the deficiencies in the structural elements

of the building at the Premises, Ontario and the plaintiff agreed to an abatement of the rent to

be paid for the use of the Premises.

More particularly, commencing in or around September, 2013, it was agreed that monthly

rental payments would be continued at the same rate as in year one. The Bank continued to

make monthly rental payments in the amount of $6,666.66 for the duration of the tenancy.

13.

14.

15.

16.

17.

Despite numerous requests by the plaintiff and repeated assurances that same would be

forthcoming, at no time did Ontario provide a statement outlining the particulars of the

additional rent due by The Bank pursuant to the Lease.

‘On of about December 21, 2015, Ontario, by its agent the Bailiff, delivered a Notice to

Ontario without any prior demand advising that it was distraining against the Bank’s property

(“Notice of Distress”),

The Notice of Distress claimed that the plaintiff was in arrears of payment of rent in the sum

0f $119,369.18, which is denied by the plaintiff, Included in the amounts claimed by Ontario

were the agreed upon abated rental amounts, purported payments for roof repairs (which

were specifically excluded from the plaintiff’ s obligation to repair as set out in the Lease), as

well as a number of other expenses for additional rent and obligations which were not

properly the responsibility of the plaintiff.

‘The plaintiff states that the sum claimed in the Notice of Distress was wilfully misstated by

Ontario and Capaldi, and that the accounting which was subsequently delivered after being

demanded by the plaintiff was manipulated in an effort to support the improperly claimed

‘sums set out in the Notice.

‘The Notice of Distress further indicated that this was not a forfeiture of the lease and was not

intended in any way to terminate the lease.

18.

19.

20.

21

22.

23.

Notwithstanding that the plaintiff was assured that its ability to access the Premises would

not be hindered, it was thereafter denied entry to the Premii

by Ontario and the Bailiff as

set out below.

Despite the fact that the Notice of Distress had indicated that the lease was not being

terminated, after service of the Notice, Ontario and the Bailiff frustrated the plaintiff s ability

‘to conduct its business at the Premises, and in fact thereafter refused to allow the plaintiff or

its agents access to the Premises.

‘The plaintiff was prohibited from accessing the Premises on December 24, 2015 for the

purpose of hosting a Christmas Eve party, which was ultimately cancelled as a result.

Inaddition, the plaintiff had advertised and pre-sold in excess of four hundred (400) hundred

tickets to a New Year’s Eve celebration planned for and to be held at the Premises.

In.an effort to resolve the matter amicably and with a view to continuing to operate at the

Premises in light of the scheduled New Year's Eve event, the plaintiff’ agents attempted to

arrange for access to the Premises in order to ensure that the event could proceed as planned.

On numerous occasions, Ontario both by its prineipal and directing mind Capaldi, and by its

agent the Bailiff, and more particularly the Bailiff"s agent Steven Tunks (“Tunks”), advised

the plaintiff that it would be allowed to continue to operate at the Premises.

24,

25.

26.

21.

Specific representations were made by both Capaldi and Tunks to the effect that the plaintiff

‘would be at liberty to proceed with the scheduled New Year’s Eve party.

Onor about December 30, 2015, however, Capaldi advised ‘The Bank's agent that its ability

to aceess the Premises in order to proceed with the New Year's Eve celebration was subject

to the following conditions:

i) the plaintiff would be required to immediately make payment of the sum of

$10,000.00;

ii) 100 % of the proceeds ofall liquor sales for the December 31, 2015 event were to be

paid to Ontario;

iii) the plaintiff would be required to pay the Bailiff for his attendance at the Premises

during the event; and

iv) the plaintiff would be required to enter into a new lease for the Premises on terms

substantially similar to the original leasc entered into between the parties fora further

five (5) year period.

In the event that the foregoing terms were not acceptable, the plaintiff was advised that it

‘would not be allowed access to the Premises.

‘The plaintiff states that the imposition of the foregoing terms was tantamount to extortion,

and is an exemplification of the high-handed, malicious, callous, inequitable, arbitrary and

perverse conduct of Ontario and more particularly Capaldi in its dealings with the plaintiff'in

this regard.

28.

29.

30.

31.

In an effort to avoid an incident which would clearly be catastrophic to the plaintiff's

goodwill and reputation ie. failing to open for New Year’s Eve, the plaintiff agreed in

principle to the demands made by Ontario and advised Capaldi of this fact by delivering

confirming email correspondence dated December 30, 2015.

After being advised that The Bank would meet their arbitrary demands, Ontario and Capaldi

then resiled from their position and amended its terms and added further terms to be met by

the plaintiff in order to allow it to open.

More particularly, Tunks advised the plaintiff's agent that Capaldi had increased the required

advance cash payment to $20,000.00, among other things,

Shortly after noon on December 31, 2015, Tunks delivered email correspondence to The

Bank’s agent (the “Extortion Email”) again changing the arbitrary extortion terms that the

Bank would be required to agree to which included, among other things:

i) an acknowledgement that they were not agreeing to the terms under duress, and that it

was The Bank's fault that the matter had not yet been resolved;

ii) am increase in the amount to be paid in advance from $10,000.00 to $20,000.00 plus

the revenues from sales;

iii) an agreement to pay the bailiff at a rate of $200.00 per hour,

iv) an acknowledgement of the alleged arrears, which was completely and entirely

inaccurate and inflated;

32,

34,

35,

¥) providing the landlord with security over all inventory, chattels and equipment to

secure the alleged arrears and future payments of rent; and

vi) provision of an indemnity and proof of insurance for the event.

After delivery of the Extortion Email, The Bank’s agents were unable to reach Capaldi and

Tunks, The Bank’s agents attempted to communicate with Capaldi by electronic mail and

telephone however Capaldi refused to respond or communicate with The Bank and its’

agents.

Again having no altemative but to acquiesce to Ontario, Capaldi and the Bailiff's arbitrary

and ever-changing demands, the plaintiff attended at the Premises on December 31, 2015

with $20,000.00 cash and the required proof of insurance.

‘The Bailiff refused to accept the insurance certificate which provided for $2,000,000.00 in

coverage and demanded a policy demonstrating $5,000,000.00 in coverage and denied the

plaintiff access.

“The Bank’s agents then contacted the Windsor Police Service (“WPS”) in order to attempt to

secure aecess to the Premises. After initially being unable to reach either Capaldi or Tunks,

the officer who was dispatched to the Premises finally spoke with both Tunks and Capaldi at

approximately 9:00 p.m. on December 31, 2015. ‘The Bank’s representatives were advised

by the WPS officer that Capaldi had indicated that the tenancy was terminated and that they

‘would not be allowed access to the Premises.

36.

37.

38.

40.

‘The Bank then immediately refunded all of the tickets purchased for the event to its patrons.

‘As a result of the illegal and improper actions of Capaldi and Tunks, The Bank suffered

significant financial losses arising from their inability to open and host the scheduled

Christmas Party, New Year's Eve party, the additional regular business nights between

December 21 and December 31, 2015, as well as the costs incurred and thrown away for

employee wages, food and other related expenses.

In furtherance of its malfeasance, the Bailiff partook in unsolicited communication with the

Windsor Star for the purpose of denigrating the reputation of the plaintiff and interfering

with its economic relations with its patrons and business associates, for which the plaintiff

seeks payment of general damages.

‘The plaintiff states that its reputation and brand have been irreparably harmed by the

defendants’ improper conduct, which has resulted in a complete loss of the goodwill of the

plaintiff and its corresponding value, for which the plaintiff claims from the defendant the

sum of $150,000.00.

The plaintiff states that the defendants are solely responsible for the damages suffered and

losses aforementioned herein arising out ofthe defendants’ improper or illegal termination or

distraint at the Premises, for all of which the plaintiff seeks payment of the sums set out

herein.

41. In addition, Ontario and the Bailiff has refused to grant access to The Bank to remove its

property and the property of third parties from the Premises notwithstanding that the Lease

has clearly been terminated by the conduct of the defendants and as explicitly stated by

Capaldi.

42. Theplaintiff states that the defendants’ conduct was high-handed, reprehensible and worthy

of condemnation by this court such as to justify a further award on account of aggravated,

exemplary and punitive damages in the further sum of $100,000.00.

43. The plaintiff proposes that this action be tried at Windsor, Ontario,

Date ofissue: JAN 05 2016 KIRWIN PARTNERS LLP

Lawyers

423 Pelissier Street

Windsor, ON N9A 41.2

Gregory D. Wrigglesworth

LSUC #468330

Tel. No.: 519 255 9840

Fax No.: $19 255 1413

Solicitors for the plaintiff

OP8hT “ON AIL

Appaneyd amp 30g siekwe

ETPI-SS7-61S “ON XOL

Chl FXO “OPRE-SST-6IS FON TAL,

OLesoP#ONST

wpromso/3uq\ q K103a15

TP VON NO ‘Ospurm,

IS HOISSIJd EZP

1S pur siasLuDg

ATI SYINLUVd NIMADL

WIV JO INGNGLV.IS

Jospuryy Je paousumt0s BuIpI200%

GOLLSAr 0 LANOD MONIAdAS

OIIVINO

ZGICE sino wane

[#10 “NI OPIVLNO 8291821

stuepuayaq

pue

aap)

narrg |

CALIATT ORIVLNO 81Z0PEz

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Hôtel-Dieu Grace Healthcare 2016 Sunshine ListDocument2 pagesHôtel-Dieu Grace Healthcare 2016 Sunshine ListwindsorstarPas encore d'évaluation

- Memo PDFDocument16 pagesMemo PDFwindsorstarPas encore d'évaluation

- Greater Essex County District School Board Public Salary Disclosure 2016Document8 pagesGreater Essex County District School Board Public Salary Disclosure 2016windsorstarPas encore d'évaluation

- Windsor-Essex Catholic District School Board Public Salary Disclosure 2016Document8 pagesWindsor-Essex Catholic District School Board Public Salary Disclosure 2016windsorstarPas encore d'évaluation

- Windsor Regional Hospital Public Salary Disclosure 2016Document10 pagesWindsor Regional Hospital Public Salary Disclosure 2016windsorstarPas encore d'évaluation

- Charges in Provincial Child Porn SweepDocument7 pagesCharges in Provincial Child Porn Sweepnewsroom7857Pas encore d'évaluation

- Division Street South Heritage Conservation District StudyDocument39 pagesDivision Street South Heritage Conservation District StudywindsorstarPas encore d'évaluation

- CP - Video Workflow Guidelines - V3Document5 pagesCP - Video Workflow Guidelines - V3windsorstarPas encore d'évaluation

- Public School Board Proposal To Close Hugh BeatonDocument161 pagesPublic School Board Proposal To Close Hugh BeatonwindsorstarPas encore d'évaluation

- City of Windsor Sunshine ListDocument18 pagesCity of Windsor Sunshine ListwindsorstarPas encore d'évaluation

- CAS Holiday Postcard 2014Document2 pagesCAS Holiday Postcard 2014windsorstarPas encore d'évaluation

- WPS Auction 2015Document10 pagesWPS Auction 2015windsorstarPas encore d'évaluation

- MEDIA Release - Hospital Planning Update Letter1Document2 pagesMEDIA Release - Hospital Planning Update Letter1windsorstarPas encore d'évaluation

- ACHF 2016 Juror Application FormDocument2 pagesACHF 2016 Juror Application FormwindsorstarPas encore d'évaluation

- Decision On Dorothy NesbethDocument31 pagesDecision On Dorothy NesbethwindsorstarPas encore d'évaluation

- Report On Bike Lanes On Cabana RoadDocument16 pagesReport On Bike Lanes On Cabana RoadwindsorstarPas encore d'évaluation

- Larry Horwitz Campaign DonationsDocument3 pagesLarry Horwitz Campaign DonationswindsorstarPas encore d'évaluation

- October 16, 2014 For Immediate Release Backgrounder: List of Donors To The John Millson CampaignDocument7 pagesOctober 16, 2014 For Immediate Release Backgrounder: List of Donors To The John Millson CampaignwindsorstarPas encore d'évaluation