Académique Documents

Professionnel Documents

Culture Documents

Abbott Piramal Deal

Transféré par

Abhishek Kumar100%(1)100% ont trouvé ce document utile (1 vote)

65 vues2 pagesAbbott Piramal Deal questions

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAbbott Piramal Deal questions

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

65 vues2 pagesAbbott Piramal Deal

Transféré par

Abhishek KumarAbbott Piramal Deal questions

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

FINANCIAL RATIONALE BEHIND ABBOTT PIRAMAL DEAL

The deal between US Pharma giant Abbott and Piramal Healthcare

involved the purchase of latters Healthcare Solutions unit for $3.72

billion. According to the agreement, the purchase of assets was

through a $2.12 billion up front payment with $400 million annual

payments for four years beginning 2011. The deal not only made

Abbott the largest pharma company in India but also bolstered the

emerging markets growth for the company.

The deal resulted in Abbott becoming the market leader in India

with a 7 percent stake in the market. According to market analysis,

the pharma sector sales were as high as $8 billion in 2010 and were

expected to double by 2015. Analysts from Abbott predicted that

the resulting deal with Piramal Healthcare will help the firm grow at

20 percent year on year and the sales will reach $2.5 billion by

2020.

The deal with Piramal was not the first acquisition for Abbott as it

had purchased Belgian chemical giant Solvay in September 2009,

which allowed it to strengthen its presence in emerging markets in

Asia. The deal also allowed Abbott a control to the Indian subsidiary

of Solvay, Solvay Pharma India.

The main reasons for Abbotts purchase of Piramal can be identified

as follows

1. Reduction in expenses in forms of approvals from regulatory

authorities, which is also a time consuming process.

2. Abbott gained access to markets of Tier 3 cities, where it

was not present and along with this it was able to leverage the

sales force of nearly 7000 employees of the combined entity.

3. Abbott had revenues of about 950 crores from India and was

at 18th position in the Indian Pharma market. The deal saw

Abbotts revenues rising through to 2950 crores in a short

duration and allowed the firm to reach the paramount position

in the Indian pharma market.

4. Other advantages for Abbott include

a. Lower Production Costs Production costs in India are

nearly 50% lower than those in US

b. Plant construction costs (FDA approved) are lower in

India (30-50%) as compared to US

c. Manpower costs in India are nearly 1/10th of those in US.

Thus the acquisition resulted in reduction of nearly 90%

of production costs. (The cost savings are applicable

across all hierarchical levels i.e. from operators,

research scientist etc.)

d. Savings in Raw Materials Bulk drugs in India can be

manufactured at 40-50% of the ethical costs as

compared to US. A lot of raw materials are available

locally thus reducing the manufacturing costs. Also, the

Excipients and Intermediaries are sourced locally at 2030% lower costs.

Piramals plans for Deal Proceeds

1. Piramal paid capital gains tax of 22%

2. The firm used the balance to pay off 1300 crore debt

3. The remainder was available for providing funds to expand

existing businesses and for undertaking new businesses

4. Piramal sold branded generics and retained the technology

driven businesses.

EPILOGUE

Today Global pharmaceutical companies are no longer looking at

acquisition merely as a tool to achieve cost optimization but as a

means to grow through portfolio expansion as they face the

mounting pressure of several drugs going off patent in matured

markets. The deal between Piramal and Abbott is considered to be

as one the most successful deals in the Indian Pharmaceutical

industry. Both the parties were in a win-win situation at the

completion of the deal. From Abbotts point of view, it got access to

all the Piramals branded drugs. It bolstered its growth strategy in

the Asiatic developing regions and got a great market reach. From

Piramals point of view, the biggest advantage was that it got a very

high value for its business and was able to reduce its debt

obligations and besides this they were able to work on the

expansion plans for their other businesses with ease due to the cash

inflow.

The deal also helped bringing in Indian pharmaceutical sector in a

good light after the debacle of Daichi and Ranbaxy deal, where

there was a lack of clarity, undisclosed facts between the two

companies, and a sub standard due diligence for the deal.

Vous aimerez peut-être aussi

- Piramal Abbott WhartonDocument5 pagesPiramal Abbott Whartonanilnair88Pas encore d'évaluation

- Abbott Piramal DealDocument9 pagesAbbott Piramal DealAkshay AggarwalPas encore d'évaluation

- Abbott-Piramal Healthcare - Deal AnalysisDocument2 pagesAbbott-Piramal Healthcare - Deal AnalysishellohimaniPas encore d'évaluation

- Piramal Health For $3.72 BN: Abbott Acquires India'sDocument2 pagesPiramal Health For $3.72 BN: Abbott Acquires India'sjigarchhatrolaPas encore d'évaluation

- The Abbott Piramal Merger: Abbott Laboratories Bought Piramal Healthcare Ltd.'s Branded GenericDocument4 pagesThe Abbott Piramal Merger: Abbott Laboratories Bought Piramal Healthcare Ltd.'s Branded GenericPratik MehtaPas encore d'évaluation

- Internship Report On Malladi PharmaceuticalsDocument57 pagesInternship Report On Malladi PharmaceuticalsRaju Veluru100% (2)

- Abbott Piramal AgreementDocument88 pagesAbbott Piramal AgreementHemanth NandigalaPas encore d'évaluation

- Pharma Industry AnalysisDocument26 pagesPharma Industry Analysisanurag0% (1)

- Swot Analysis of Indian Pharmaceutical IndustryDocument3 pagesSwot Analysis of Indian Pharmaceutical Industrybalakumar8688Pas encore d'évaluation

- Abbott LaboratoriesDocument3 pagesAbbott LaboratoriessubhasisuwPas encore d'évaluation

- Pharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaDocument9 pagesPharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaGurudas RaghuramPas encore d'évaluation

- indian Pharmaceutical Industry:-: 1) Introduction: - HistoryDocument13 pagesindian Pharmaceutical Industry:-: 1) Introduction: - HistoryPRASH43Pas encore d'évaluation

- WackhardDocument72 pagesWackhardAbuzar AhmadPas encore d'évaluation

- Employee Retension Abrob PharmaDocument43 pagesEmployee Retension Abrob Pharmathella deva prasadPas encore d'évaluation

- Summer Internship Project (Pharma)Document8 pagesSummer Internship Project (Pharma)Sadiya ZaveriPas encore d'évaluation

- Economics BackgroundDocument3 pagesEconomics BackgroundKshitij ChananaPas encore d'évaluation

- Indian Pharmaceutical SectorDocument6 pagesIndian Pharmaceutical SectorAnkitPas encore d'évaluation

- History of PharmaDocument11 pagesHistory of PharmaYogendra PanditPas encore d'évaluation

- Granules India PDFDocument29 pagesGranules India PDFP VinayakamPas encore d'évaluation

- Anand Winter Tranning ReportDocument45 pagesAnand Winter Tranning ReportAnand Narayn DubeyPas encore d'évaluation

- Pharmaceutical Industry-IIM Lucknow-Team LDocument8 pagesPharmaceutical Industry-IIM Lucknow-Team LGaurav MittalPas encore d'évaluation

- Overview of Pharmaceutical Industry 24-11Document23 pagesOverview of Pharmaceutical Industry 24-11ahemad_ali10Pas encore d'évaluation

- The Indian Pharmaceutical Industry - An Overview On Cost Efficiency Using DEADocument23 pagesThe Indian Pharmaceutical Industry - An Overview On Cost Efficiency Using DEASaurabh SharmaPas encore d'évaluation

- Patent CliffDocument2 pagesPatent CliffKrishna MeenakshisundaramPas encore d'évaluation

- Case StudyDocument4 pagesCase StudyPrarthana Sharma BordoloiPas encore d'évaluation

- India PHARMA Report-Mid Year 03Document44 pagesIndia PHARMA Report-Mid Year 03Sylvia GracePas encore d'évaluation

- A Project Report On "Financial Analysis of Indian Pharma Sector"Document56 pagesA Project Report On "Financial Analysis of Indian Pharma Sector"Anmol Sharma DadhichPas encore d'évaluation

- Role of Pharmaceutical in IndiaDocument13 pagesRole of Pharmaceutical in IndiaRepala PraveenPas encore d'évaluation

- Srikant Final ProjectDocument80 pagesSrikant Final ProjectSrikant TiwariPas encore d'évaluation

- Indian Pharmaceutical IndustryDocument9 pagesIndian Pharmaceutical IndustryAshish GondanePas encore d'évaluation

- Pharma Distribution System IndiaDocument24 pagesPharma Distribution System IndiaSgk SrikanthPas encore d'évaluation

- Financial Analysis of Pharma IndustryDocument82 pagesFinancial Analysis of Pharma IndustrySudheer Gadey100% (2)

- Nutra Plus ProductsDocument82 pagesNutra Plus ProductssavaninikunjdPas encore d'évaluation

- List of Pharmacutical ProductsDocument5 pagesList of Pharmacutical ProductsKrishnashis MondalPas encore d'évaluation

- Report Capital Structure UPHOS Sharad PatelDocument3 pagesReport Capital Structure UPHOS Sharad PatelsharadgpatelPas encore d'évaluation

- Pharmaceutical IndustryDocument18 pagesPharmaceutical IndustryKrishna PrasadPas encore d'évaluation

- 10 Summary PDFDocument16 pages10 Summary PDFAnonymous XXKx1IvPas encore d'évaluation

- Economic Analysis of CiplaDocument24 pagesEconomic Analysis of Ciplapramod23sept100% (2)

- What Is GMP in India?: Pharmadirections, IncDocument4 pagesWhat Is GMP in India?: Pharmadirections, IncbhavikashettyPas encore d'évaluation

- Pharmacuitical Industry ProfileDocument9 pagesPharmacuitical Industry ProfileGanesh BobbiliPas encore d'évaluation

- PharmaceuticalDocument23 pagesPharmaceuticalSushank AgrawalPas encore d'évaluation

- DR Reddy'sDocument6 pagesDR Reddy'sViraat Lakhanpal0% (1)

- Sun Pharma Report.Document26 pagesSun Pharma Report.knowledge_power67% (15)

- A Project Report OnDocument7 pagesA Project Report OnVivek AlaiPas encore d'évaluation

- Industry Profile: 1.1.1 Overview of Pharmaceutical SectorDocument52 pagesIndustry Profile: 1.1.1 Overview of Pharmaceutical Sectormuruges88100% (1)

- Indias Pharmaceutical IndustryDocument27 pagesIndias Pharmaceutical IndustrySanket AnandPas encore d'évaluation

- Indian Pharmaceutical Sector 2007 Format1dskDocument24 pagesIndian Pharmaceutical Sector 2007 Format1dskPravez Kumar KarnaPas encore d'évaluation

- Pharma Dolat Capital ReportDocument60 pagesPharma Dolat Capital ReportAbhi SuriPas encore d'évaluation

- Brand Management-Pharmaceutical IndustryDocument83 pagesBrand Management-Pharmaceutical IndustrySrinivasan ThangathirupathyPas encore d'évaluation

- Indoco RemediesDocument29 pagesIndoco RemediesArti IyerPas encore d'évaluation

- Equity Master Report 2015-16Document3 pagesEquity Master Report 2015-16Aalokek KumarPas encore d'évaluation

- Cipla Analysis: Case Analysis Report - SeekersDocument4 pagesCipla Analysis: Case Analysis Report - SeekersShubhayan ModakPas encore d'évaluation

- The Indian Pharmaceutical Industry Has Been Witnessing Phenomenal Growth in Recent YearsDocument6 pagesThe Indian Pharmaceutical Industry Has Been Witnessing Phenomenal Growth in Recent YearsAnkit ShahPas encore d'évaluation

- Pharmaceuticals 270111Document34 pagesPharmaceuticals 270111Sidd SinghPas encore d'évaluation

- GMP in Pharmaceutical Industry: Global cGMP & Regulatory ExpectationsD'EverandGMP in Pharmaceutical Industry: Global cGMP & Regulatory ExpectationsÉvaluation : 5 sur 5 étoiles5/5 (2)

- Marketing Management Worked Assignment: Model Answer SeriesD'EverandMarketing Management Worked Assignment: Model Answer SeriesPas encore d'évaluation

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)D'EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Pas encore d'évaluation

- Summary of The Goal: by Eliyahu M. Goldratt and Jeff Cox | Includes AnalysisD'EverandSummary of The Goal: by Eliyahu M. Goldratt and Jeff Cox | Includes AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Goal: A Process of Ongoing Improvement by Eliyahu M. Goldratt and Jeff Cox | Key Takeaways, Analysis & ReviewD'EverandThe Goal: A Process of Ongoing Improvement by Eliyahu M. Goldratt and Jeff Cox | Key Takeaways, Analysis & ReviewPas encore d'évaluation

- Escario Vs NLRCDocument10 pagesEscario Vs NLRCnat_wmsu2010Pas encore d'évaluation

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkPas encore d'évaluation

- Unit 1Document3 pagesUnit 1beharenbPas encore d'évaluation

- Recommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityDocument49 pagesRecommended Practices For Developing An Industrial Control Systems Cybersecurity Incident Response CapabilityJohn DavisonPas encore d'évaluation

- Daraman vs. DENRDocument2 pagesDaraman vs. DENRJeng GacalPas encore d'évaluation

- Profile On Sheep and Goat FarmDocument14 pagesProfile On Sheep and Goat FarmFikirie MogesPas encore d'évaluation

- Financial Derivatives: Prof. Scott JoslinDocument44 pagesFinancial Derivatives: Prof. Scott JoslinarnavPas encore d'évaluation

- Channel Tables1Document17 pagesChannel Tables1erajayagrawalPas encore d'évaluation

- Hotel Reservation SystemDocument36 pagesHotel Reservation SystemSowmi DaaluPas encore d'évaluation

- Building and Other Construction Workers Act 1996Document151 pagesBuilding and Other Construction Workers Act 1996Rajesh KodavatiPas encore d'évaluation

- Presentation Report On Customer Relationship Management On SubwayDocument16 pagesPresentation Report On Customer Relationship Management On SubwayVikrant KumarPas encore d'évaluation

- PLT Lecture NotesDocument5 pagesPLT Lecture NotesRamzi AbdochPas encore d'évaluation

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Document20 pagesSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoPas encore d'évaluation

- Amerisolar AS 7M144 HC Module Specification - CompressedDocument2 pagesAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniPas encore d'évaluation

- Seminar On Despute Resolution & IPR Protection in PRCDocument4 pagesSeminar On Despute Resolution & IPR Protection in PRCrishi000071985100% (2)

- Discover Mecosta 2011Document40 pagesDiscover Mecosta 2011Pioneer GroupPas encore d'évaluation

- Methodical Pointing For Work of Students On Practical EmploymentDocument32 pagesMethodical Pointing For Work of Students On Practical EmploymentVidhu YadavPas encore d'évaluation

- MRT Mrte MRTFDocument24 pagesMRT Mrte MRTFJonathan MoraPas encore d'évaluation

- Year 9 - Justrice System Civil LawDocument12 pagesYear 9 - Justrice System Civil Lawapi-301001591Pas encore d'évaluation

- 4th Sem Electrical AliiedDocument1 page4th Sem Electrical AliiedSam ChavanPas encore d'évaluation

- Address MappingDocument26 pagesAddress MappingLokesh KumarPas encore d'évaluation

- Wiley Chapter 11 Depreciation Impairments and DepletionDocument43 pagesWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇Pas encore d'évaluation

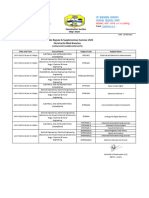

- Accomplishment ReportDocument1 pageAccomplishment ReportMaria MiguelPas encore d'évaluation

- MMC Pipe Inspection RobotDocument2 pagesMMC Pipe Inspection RobotSharad Agrawal0% (1)

- ST JohnDocument20 pagesST JohnNa PeacePas encore d'évaluation

- 6 V 6 PlexiDocument8 pages6 V 6 PlexiFlyinGaitPas encore d'évaluation

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDocument3 pagesMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezPas encore d'évaluation

- Basic Vibration Analysis Training-1Document193 pagesBasic Vibration Analysis Training-1Sanjeevi Kumar SpPas encore d'évaluation

- Termination LetterDocument2 pagesTermination Letterultakam100% (1)

- 5 Star Hotels in Portugal Leads 1Document9 pages5 Star Hotels in Portugal Leads 1Zahed IqbalPas encore d'évaluation