Académique Documents

Professionnel Documents

Culture Documents

Resa Pw-At

Transféré par

Charry Ramos100%(1)100% ont trouvé ce document utile (1 vote)

2K vues24 pagesauditing theory

Titre original

RESA PW-AT

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentauditing theory

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

2K vues24 pagesResa Pw-At

Transféré par

Charry Ramosauditing theory

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 24

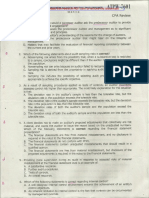

ATPW-28: PREWEEK QUESTIONS

In the international arena, this body oversees the IFAC's standard-setting activities in the areas of auditing

assurance, ethics and education. ri ad

‘A. Monitoring Group (MG)

B. Public Interest Oversight Board (PIOB)

C. IFAC Regulatory Liaison Group (IRLG)

D. Intemational Auditing and Assurance Standards Board (IAASB)

2. One of the government auditing standards which is not observed by independent CPAs in the private sector is:

‘A. the audit is to be adequately planned and assstants are to be properly supervised. e

B. a review shall be made of compliance with legal and statutory requirements.

C. an evaluation shalt be made of the system of internal control,

D. sufficient competent evidential matter shall be obtains through inspection, observation, inquites and

confirmations.

3, A requirement of the application of PSAs is for the auditor:

‘A. Not to obtain clients by solicitation.

B. To undertake @ proper study and evaluation of the existing internal control.

C. To charge fees fairly and in relation to time and cost of the engagement.

D. To inspect all fixed assets acquired during the year.

4. A professional accountant who does not consider and apply the guidance included in a relevant Practice

Statement should be prepared to:

‘A. Explain to the Board of Accountancy tribunal why the practice statement was not complied with

B, Bear the consequences of such non-compliance, such as suspension or revocation of license, plus

imprisonment of not more than two (2) years.

C. Face the shareholders of the entity, and explain in the meeting why such practice statement was

‘Rot complied with, provided that the explanation is also put in writing, and signed in the presence of

the Chairperson of the Auditing and Assurance Standards Council.

Explain how the basic principles and essential procedures in the Engagement Standards addressed

by the Practice Statements have been complied with.

'5. The Core Competencies of CPAs include:

‘A. Assurance and information integrity. C. Strategic and critical thinking skis,

B. Objectivity. ©. Pursuit of life-long leaning and excellence.

AA violation of the profession's ethical standards would most likely occur when a CPA who

‘A. {5 also admitted to the Bar represents on letterhead to be both an attorney and a CPA.

B. Writes 2 newsletter on financial management also permits a publishing company to solicit

subscriptions by direct mail.

C. is controller of a bank permits the bank to use the controller's CPA title in the listing of officers in its

publications.

D. forms a partnership for accountancy practice with non-CPA’s.

7. Which of the following describes most completely how the profession defines independence?

‘A. performing an audit from the public’s point of view

B. avoiding the appearance f a significant interest in an audit client's interest

CC. resisting a client's reluctance to reveal evidence

=D. accepting responsiblity to act professionally and in accordance with the professional Code of Conduct

‘8. What kind of threats are created by virtue of a close business relationship with assurance clients?

‘A. Soff interest threat CC. Seif interest and self-review threat

8, Self-interest and intimidation threat D. No threats are created.

9. Family and personal relationships between a member of the assurance team and a director, an officer or certain

‘employees, depending on their role, of the assurance client, least likely create

‘A. Self-interest threat. C. Intimidation threat.

.B. Seff-review threat. D. Famitarity threat,

10, If firm, oF network firm, personnel providing such assistance make management decisions, the seif-review

thveat created could not be reduced to an acceptable level by any safeguards. Examples of such managerial

decisions include the following, except

‘A. Determining or changing journal entries, or the classifications for accounts or transactions or other

‘accounting records without obtaining the approval ofthe aucit cients.

18. Authorizing or approving transactions.

Preparing source documents or originating data (including decisions on evaluation assumptions), or

‘making changes to such documents or data.

= D. Assisting an audit dient in resolving account reconciliation problems.

Secale, ies atl tl anal hii aia Seen &.

4 _ 1. The provision of accounting and bookkeeping services to audit clients in emergency or other unusual situations,

when it is impractical for the audit client to make other arrangements, woul! not be considered to pose an

‘unacceptable threat to independence provided:

‘A. The firm or network firm, does not assume any managerial role or make any managerial decisions.

B. The audit clent accepts responsibilty for the results ofthe work.

a C, Personnel providing the services are not members of the assurance team.

D.Allof the above.

12. If the valuation services involves the valuation of matters material to the financial statements and the valuation

involves a significant degree of subjectivity, the sel-review threat created (choose the incorrect one)

Could not be reduced to an acceptable level by the application of any safeguard.

Could be reduced to an acceptable level by the application of safeguards.

Such valuation services should not be provided.

The assurance team should withdraw from the audit engagement, if the team opted to perform the

valuation services.

‘Tp 13. Waste Management and Enron are classic cases wherein the media was critical that auditors:

‘A. Were ignorant of the existing audit and assurance standards.

B. Have failed to plan the audit engagements properly.

CC. Overlooked suspicions of earnings management reported In the Wall Street Journal.

1D. Received significant consulting fees relative to audit fees.

4 ACPA purchased stock im a clent corporation and placed I in a trust as an educational fund for the CPA's minor

Child. “The trust securities were not material to the CPA but were material to the child's personal and worth.

‘Would the independence of the CPA be considered to be impaired with respect to the client?

‘A. Yes, because the stock would be considered a ditect financial interest and, consequently, materiality is

not a factor.

B. Yes, because the stock would be consilered: an indirect financial interest that is material to the CPAs

chi

C. No, because the CPA would not be considered to have a direct financial interest in the client.

1D. No, because the CPA would not be considered to have a material indirect financial interest in the client.

15. The Code of Professional Ethics would most likely be violated if an auditor:

‘A. Owns a buikding and leases floor space to an assurance client.

B. Has an insured account with a brokerage firm audit client.

C.__Is engaged by an audit cient to identify potential acquisitions.

D. Screens candidates for an audit clent’s vacant controllership position, :

B 16. Pupung, CPA, is an audit manager of the Dom, Day and Jordan, CPAs, accounting firm. He has just been

assigned to the aucit of the Lugao Money Market Fund, Pupung has maintained a money market account with

MMF since it opened in 2005. All his savings, amounting to 75% of his total assets, are in this account, which

Days the highest interest available in money market funds. However, his account constitutes only 0.00001

percent of the fund's assets. Is the audit firm's independence impaired in this situation?

A. Yes. Pupung is considered a member of the assurance team, since he i a manager and will provide

‘audit services to LMMF. The firm’s independence is impaired since Pupung holds a material indirect

financial interest,

B. Yes, Pupung is considered a member of the assurance team, since he is a manager and will provide

audt services to LMMF. The firm's independence is impaired since Pupung holds a direct fancial

interest.

CC. No. Pupung, despite being a "member of the assurance team" holds only 0.00001 percent of the fund's

assets. His financial interest in CMMF is irrelevant to the question on independence,

. No. Pupung, despite being a "member of the assurance team” holds only 0.00001 percent of the fund's

assets. It is the audlt partner in charge of the LMMF engagement (and not Pupung) who should be

checked for any direct or material indirect financial interest in the audit clent.

(Numbers 17 to 19 follow) CPA Dagut's wife owns 20 percent of the ordinary shares of Pugad Company, which

wants Dagul to perform the audit for the calendar year ended December 31, 2009.

C17, May Dagul perform the auatit of Pugad Company for the calendar year ended December 31, 2009?

‘A. Yes, since itis Dagul's wife who owns the shares and not Dagul.

B. Yes, because the interest is less than 50 percent and therefore Dagul is considered independent.

. No, since Dagut's wife's interest is attributed to him, and he would not be independent.

D. No, since Daguls wie's interest constitutes significant influence and gives rise to an intimidation

* threat,

goe>

18. Assume that Dagu's wife gave her shares to their dependent 10-year-old daughter, Tiny, on July 1, 2009. May

A. Dagul now perform the audit of Pugad Company forthe calendar year ended December 31, 2003?

‘A. No, for as fong as Tiny & a dependent child. The financial interest is considered direct.

B. Yes, because Dagul is now considered independent since iis his daughter who row owns the shares,

CC. No, for as iong as Tiny ts @ dependent child, ‘The financial interest is consklered indirect.

D.. Yes, because under the Code of Ethics, the interest in Pugad Company is no longer relevant to Dagul's

‘decision whether to accept or decline the audit engagement.

D

19. Ascunte Authew that Nay, acting through an appropriate custodian, sold the shares to her grandfather Lolo Dom

‘4 August 1, 2008, Yits purchase, a6 an accommodation, took two: thitds of his eettement savings. May Dagul

‘woo per fo4m the aul OF Puugad Company for the calendar year ended December 31, 2000?

A Yes tui ont iF Loks Dom #6 not Daguls fatter (ic, Lolo Dom is Daguls father-in-iaw).

UL No. The apywnarance of independerice fs impaired. Moreover, the grandfather's investment is material

(08.67 percent) tn relation to his net financial resources,

Yes Paiqul may now accept the engagement since there is no impairment of independence. Lolo Dom is

‘conitered a tton-dopendent close relative

No

The elopencleace ia mental attitude is impaired. Moreover, the grandfather's investment is

"material (06.67 percent) In relation to his net financial resources,

20,

‘Oh Auuust 20, 2009, Mar Bonafe, CPA and partner, was offered and accepted the engagement to audit the

annual Frnclal statements of ABC Corporation for the fiscal and calendar years ended December 31, 2009,

The audit teua on September 15, 2009, and ended on March 17, 2010. ABC Corporation is regulated by the

NIC. Konate served as controler of ABC Corporation from November 5, 2002 until January 12, 2009, at which

{une he teminated Inis employment with ABC.

(Mar Bonafe owned! a material amount of ABC Corporation's ordinary shares from November 5, 200? until August

45, 2008, at Which tine he sold the shares. Is Mar Bonafe in violation of the Code of Ethics due to impairment

‘of independence?

‘A. Yes, because Mar Bonate owned ABC shares at the start of the audit for December 31, 2009.

B. Yes, because Mar Bonafe served as a controler for ABC Corporation in previous years.

Yes, because Mar Bonafe had an empbyient relationship with the dient during part of the period

covered by the financial statements,

dB

Yes, beviause itis stil less than a year since Mar Bonafe has owned shares in ABC Corporation,

‘The provision of services by a firm or network firm to an audit client that involve the design and implementation

‘Of financial information technokoay systems that are used to generate information forming part of a client's

Financial statements may mast likely create

‘AL Self interest threat, c

1B Seif-review threat, D.

a

Intimidation threat.

Familiarity threat.

22. The lending of staff by a firm, or network firm, to an audit client may create a threat when the

individual is in a position to influence the preparation of a client’s accounts or financial statements.

‘A, Sellinterest threat, C._Tatimidation threat,

B. Self-review threat, D. Familiarity threat,

23, These services may Include such activities as acting as an expert witness, calculating estimated damages or

‘other amounts that might become receivable or payable as the result of itigation or other legal dispute, and

assistance with document management and retrieval in relation to a dispute or litigation.

‘A. Paralegal services C.Client representation services.

B. Litigation support services. D. Corporate finance and similar activities,

24. Legal services are defined as

‘A, The making of assumptions with regard to future developments, the application of certain methodologies

‘and techniques, and the combination of both in order to compute a certain value, or range of values, for

an asset, a hability oF for a business a5 a Whole. Vatic}ix Few

B.A broad range of services, including compliance, planning, provision of formal taxation opinions and

assistance i the resolution of tax disputes. Tay Ge eyivee

C. May include such’ activities as acting as an expert witness, calculating estimated damages ‘or other

amounts that might become receivable or payable as the result of litigation or other legal dispute, and

assistance with document management and retrieval in relation to a dispute or tigation, tis.t=. sy

1D. Any services for which the person providing the services must either be admitted to practice before the

Courts of the jurisdiction in which such services are to be provided or have the required legal training to

practice law.

. The recruitment of senior management for an assurance client, such as those in a position to affect the subject

Of the assurance engagement may least likely create

‘A. Seff-interest threat, C. Intimidation threat.

B. Advocacy threat. D. Familiarity threat.

26. CPA Ela Santos performs the audit of the local symphony society. Because of her good work, she was elected

‘an honorary member of the board of directors. Ela will not be considered independent unless:

A B c D

= The position is in fact purely honorary Yes Yes Yes Yes

+ Listings of directors show she is an honorary director, No Yes Yes No

+ She restricts participation strictly to the use of her name, Yes No Yes No

= She does not vote or participate in management functions Yes. Yes Yes Yes

27. Rita, CPA 1s in charge of the audit of Mabuhay Resort, Inc. Seven young members of the audit firm's

professional staff are working with Rita on this engagement, all of which are avid divers, Mabuhay Resort owns

{wo condominiums in Boracay, which it uses primarily to entertain clients, The controller of Mabuhay Resort

‘nas tokd Ms, Rita that her whole team is welcome to use the condominiums at no charge any time that they are

ot already in use, How should Rita, CPA, respond to this offer?

a

A. Rita shouk! withdraw from the engagement due to a significant threat to independence.

B Rita abwoo may aevept the offer, buLher stat may not use the condominiums.

Rita shout eine the offer, both for herself and her staff

DL Ria may avept the offer, but only tt favor of her staff; she cannot use the condominiums because as

Panties, Rita will sn the report,

28, This refers to fearing which uses course manuals or accredited learning modules.

A. Masteral degree In-service training

Continuing professional education D.Self-directed learning package

29, Generatty, advertising and puibieity in any mextiun are acceptable provided (select the exception):

AC TT has as its objective the notification to the public or such sectors of the public as are concerned, of

mattors oF fact (2g, name, address, contact numbers, services offered) In a manner that 6 false,

aunkanting oF deceptive

Bo IES in good taste

IC avorls frequent repetition of, and any undue prominence being given to the name of the firm or

Drofesstonal accountant in public practice

D. Tes not professionally dignited

Wiiet of the following & allowed! under the revised rules on advertising?

A. Putlishing services in billboard (e.g, tarpaulin, streamers, etc.) advertisements

B._ Using words oF phrases which are hand to define and even more difficult to substantiate objectively

Giving to much emphasis on competitive differences

1D. None of these are allowed forms of advertising,

31, Asser Tamayo, CPA, has iisted his practice in a directory. Which of the following cannot be included in the

tistng? dan OE a

‘A. Complete name

B. Address and contact number

CC. Professional description and services offered

1D. Allof these may be included in the directory listing.

32. Antonio, CPA and partner of Dayag and Lee auditing firm, is being Interviewed by Chris Espenilla, CPA in his

oontime business show, “Chris per Minute”. During the course of the interview, which of the following

responses by Antonio would be a violatont of the revised rules on Advertising?

‘A. “Derivatives require higher accounting knowledge, but they are relatively easy with study and practice.”

B. “PERS No. 3 covers business combinations, It as been the recent subject of the IASB Improvements

Project.”

G. “Alnght, T would be more than willing to entertain accounting questions from the audience.”

BD. “Dayag and Lee offers audit and other assurance services, and also management consulting services,

{including creation and installation of accounting systems. Our cents include top universities and

‘manufacturing companies in the Luzon area” =) 30 hse oe yay

33, An individual (whether internal or extemal to the firm) who has a reasonable understanding of (a) audit

processes, (D) PSAs and appicable legal and regulatory requirements, (c) the business environment in which

the entity operates, and (0) auditing and financial reporting issues relevant to the entity's industry.

‘A. Suttably qualified person C. Experienced auditor

8. Engagement quality control reviewer D. Expert or speciaist

34. This fs the date selected by the practitioner to date the report.

A. Dual date G._Date of report

B. Date of signing D. Last day of field work

35. A network Is:

A 8 ¢ 2

+ Thats aimed at cooperation Yes No Yes No

+ That is clearly almed at profit or cost-sharing or shares

‘common ownership, control or management, common

quality control policies and procedures, common business,

strategy, the use of a common brand name, or a

significant part of professional resources Yes Yes No No

36. The firm shall establish policies and procedures designed to provide it with reasonable assurance that

‘engagements are performed in accordance with professional standards and regulatory and legal requirements,

‘and that the firm or the engagement partner issue reports that are appropriate in the cicumstances,’ Such

policies and procedures shall include:

A. Matters relevant to promoting consistency in the quality of engagement performance

B. Supervision responsibilities

C. Review responsibilities

‘1D. All of the choices.

37. In reviewing the audit work performed, the engagement partner:

‘A, Must review all audit documentation.

'B. Need not review all audit documentation, but may do so.

a

C._Need not review all audit documentation.

1D. Must ask the staff performing the audit work to Sign the audit report.

38. The incoming auditor is also known asthe auditor:

A. Successor 8, Principal © other D. Proposed

39. One of the major parts of audit planning is pre-plsnning. Which of the following 1s NOT involved dunng the

‘pre-planning phase?

‘A. Deciding whether to accept or continue ths cent.

8. Obiaining information about clent’s legal obligabons.

C._ Selecting staf for the engagement.

D. Obtaining an engagement Ketter.

40, Which of the following matters 6 east likely to be discussed in an engagement letter? 9% soso}

‘A. the fact that the financial statements are the responsibilty of management.

8, the fact that an auditor does not plan to detect matenal imegularities.

C. assistance to be provided by client personnel

D.__tening of the performance of the examination,

41. To obtain an understanding of a continuing chent’s business in planning an audit, an auditor most likely would

‘A. Perform tests of details of transactions and balances,

B. Review prior-year working papers and the permanent file for the client.

CC. Read specialized industry journals.

D. Reevaluate client’ internal control environment.

42, Ordinarily, predecessor auditor permits the successor to review the predecessor's working paper analyses,

relating to

Balance sheet Balance sheet

Contingencies accounts Contingencies ‘accounts

A Yes Yes c No Yes

a Yes No D. No No

43. ACPA may reduce the audit work on a first time audit by reviewing the working papers of the predecessor

auditor. The predecessor should permit the successor to review working papers relating to matters of

continuing significance such as those that reiate 10

‘A. extent of reliance on the work of specialists. CC. analyss of contingencies.

B. fee arrangements and summanes of payments. _D. _staff hours required to complete the engagement.

44, The following statements relate to audit programs. Which statement is true?

‘A. The FRSC publishes a standard audit program and encourages the adoption for general use.

8. The preparation of an audit program ts not influenced by the state of the chent’s internal control system.

CC. An audit program would not contain documentation of the system being reviewed.

1D. The audit plan and related program should no longer be changed once the audit 6 started.

45, This means the amount or amounts set by the auditor at less than materiality for the FS as a whole to reduce to

an appropriately low level the probabilty that the aggregate of uncorrected and undetected misstatements

‘exceeds materalty for the FS as a whole.

'A. Allowance for sampiing risk C. Standard deviation

8B, Planning materiality ©. Performance materiality

46. Which of the following statements best describes why an auditor makes a preliminary estimate of materiality?

‘A. an estimate i required by generally accepted auditing standards

B. the estimate provides a basis for evaluating hkely msstatements

C._ the estimate helps the auditor plan the appropriate evidence to accumulate

©. estimating materiality early helps the auditor avoid legal habiity

47. Which of the following discoveries by the auditor would NOT raise the red flag of increased inherent risk?

‘A. Management bonuses are based on a percentage of net income,

B.A bond indenture requires a current ratio of at least three to one.

CC. Client makes extensive use of notes receivable and notes payable rather than buying and selling on

‘open-account basis.

D. Client isa parent company with a subsidiary. me

48. While performing an audit, Conrad, CPA, decides to restrict the, risk of material misstatement to 3%. What

‘must the acceptable level of detection risk be if inherent risk és 25% and control risk is 40%?

A 0.3% 30.0%

B 12.0% D. 33.3%

49. The systems approach to an audit is least likely to be appropriate for: ler an v Rk

‘A. Clients with weak internal control. CC. Clients in specialized industries.

B. Clients that are large in size. D. Clients that are publicly sted.

50. One of the auditor's major concerns is to ascertain whether the internal control structure és designed to provide

reasonable assurance that

‘A. Profit margins are maximized, and operational efficiency is optimized, +

B. The chief accounting officer reviews all accountng transactions,

C. Corporate morale problems are addressed immediately and effectively.

1D, Transactions are executed in accordance with management's general or specific authorization,

51. Which of the following would be feast tIkely to be consktered an objective of the internal control structure?

A. Checking the accuracy and reliability of accounting data,

8. _Detexting management fraud

Encouraging axtherence to managerial polices,

D. Safeguarding assets.

52. Which Of the following comes CLOSEST to outlining the auditor's responsibilty for internal control on all

nancial statement aucits? cf

‘A. An-undeystanding of the control environment and the accounting system is necessary; an understanding

‘of the contiol procedures is necessary for areas in which the auditor is performing tests of control.

8, The auditor must obtain an understanding of each of the five internal control elements sufficient to plan

the aud.

When tests of controls have been performed, control risk must be assessed at a level less than the

maximum,

D, An understanding of the control environment is necessary, but not of the accounting system or control

Drocexlures unless Control risk & to be assessed at a level less than the maximum.

53. An objective of a walk-through isto:

‘A, Verily that the structure has been placed in operation.

B. Replace tests of controls.

Evaluate the inajor strengths and weaknesses in the clients structure.

, Identity weaknesses to be communicated to management in the management letter.

54. Which of the following ts an advantage of describing internal control through the use of a standardized

questionnaire?

‘A. Questionnaires highlight weaknesses in the system.

BL Questionnaires are more flexible than other methods of describing internal control

C. Questionnaires usually identify situations in which internal control weaknesses are compensated for by

other strengths in the system.

D. Questionnaires provide a clearer and more specific portrayal of a client's system than other methods of

describing internal control.

55: Which ofthe folowing statements isnot corect?

‘A. Tt would be unusual to use both a narrative and a flowchart to describe the same system.

B The use of both questionnaire and flowcharts on the same engagement is highly desirable for

understanding the client's system,

C. The advantage of the narrative description Is the ease of describing the details of the internal control

structure.

1D. When reliable and understandable narratives, flowcharts, and questionnaires are available from the

‘cient, its desirable to use them rather than have the auditor prepare his/er own documents,

C56. The overall attitude and awareness of an entity's board of directors conceming the importance of the internat

control structure usually s reflected in ts:

‘A. Computer-based controls. Control environment.

8 System of segregation of duties. D. Safeguards over access to assets.

1B 57. Internal contro! és a function of management, and effective control is based upon the concept of charge and

‘discharge of responsibilty Or duty. Which of the following & one of the overriding principles of internal control?

‘A. _ Responsibility for accounting and financial duties should be assigned to one responsible officer.

B, _Responsibllty for the performance of each duty must be fixed.

C._ Responsibility for the accounting duties must be borne by the auch committe of the company.

1. _Responsibilty for accounting activities and duties must be assigned only to employees who are bonded.

58: which of he folowing not walt concep fea conto?

When one person is responsible for all phases of a transaction, there should be a clear designation of that

Person's responsibilty.

1B, The recorded accountability for assets should be compared with the existing assets at reasonable

intervals and appropriate action should be taken it there are differences.

C. Accounting control procedures may appropriately be applied on a test basis in some circumstances.

1D. Procedures designed to detect errors and imegularives should be performed by persons other than those

in a position to perpetuate ireegularives.

59. Control procedures do nok encompass:

‘A. Comparison of assets with recorded accountability.

B. Design and use of documents.

C._ Proper safeguards over access to assets,

1D. Aninternal audit function. Compre *f tmtel Ensicenmtn

160. This term means "to analyze Klenified risks to conclude on their significance”:

A Estimate, B. Assess, C. Measure.

1D 61. which ofthe folowing is nok 2 valid Sequence of steps Inthe aust process?

ra

Analyze.

Se ee ap are T + ‘ieee,

0

>

A. performing certain analytical procedures, assessing ihherent tsk, avsvany Cont

8. Choosing auait risk, assessing control rk, determming Getetion nee nd nel ek

CC. choosing audit risk, performing certain analytical procedures, meksyany erent tk

D. determining detection risk, assessing inherent isk, performing veram ataltial procedres

62. A defeny internal cont ets when:

a Non dene, pened ocperated sh 8 Wa

, aed Suh a ay ha 8 une prevent, Fda ad

Correct, misstatements in the financial statements on a timely baste, ! :

8. A control necessary to prevent, or detect and correct, snrsstaten

ce Dea ect, Mratatements in the financial statements on a

There i a defeleicy oF combination of defences in Itenal

: nation of dite ia enna contol that, ne autor’ psec

Judgment, of sufcent mportance to mest te atten of tha charged ih unernce

D. Alor these chokes decibea decency ternal conte

63. The audtor shal conmunkate stent dienes i ternal conc ened ding

ees i ten Jee cng the aut theme

charged with governance on a timely basis. Such commuination: _ mB Pee

‘May be done orator n wring.

Mist be done ory

Must be monte.

D._ ot vaqured by Pipine Standards in Aung.

64. In order to ensure unbiased information, record-keeping i typically included in a separate department under the:

‘A. VP-operations 8, -—Treasurer Controller D. Internal auditor

65. Transaction cycles begin and end:

‘A. At the beginning and end of the fiscal period.

B. At the balance sheet date.

At January 1 and December 31

B. At the ongin and final dispositon of the company,» 7

66. The authority to accept incoming goods in ceiving should be hased on a(n):

‘A. Vendors invoice. C. Bil of lading.

B. Matenals requsstion. D. Approved purchase order.

67. Input documents are typically the responsibilty of the:

‘A. User department that transmits the documents to accounting before processing.

B. Accounting department which prepares and records them.

C_ Production and quality control department to see that they are prepared properly.

D. Computer department since they will have to be responsible for inputting them.

68. “Contr activities" include procedures that pertain to physical controls over access to and use of assets and

records. A departure from the purpose of such procedures is that:

‘A. Access to the safe-depost box requires two officers.

B. Only storeroom personnel and line supetuisors have access to the raw materials storercom.

The mail clerk compiles alist ofthe checks recewed in the incoming mai.

1D. Only salespersons and sales supervisors use sales department vehicles,

69. Effective internal control requites organizational independence of departments. Organizational independence

‘would be impaired in which of the following situations?

'A. The internal auditors report to the audit committee of the board of directors,

'B.._ The controller reports to the vice president for production,

C._ The payroll accounting department reports to the chief accountant,

1D. The cashier reports to the treasurer.

70. Which of the following statements is true? i

‘A. Accounting for the sequence of pre-numbered documents is a control procedure intended to achieve

‘specific control objectives related to validity.

8. Incompatible functions are those that place any person in a position to perpetuate errors or irregularities.

CIF comparison reveals that the assets do not agree with the recorded accountability, it provided evidence

°.

‘of unrecorded or improperly recorded transactions.

[A chart of accounts is generally prepared in detail to enable the controller to pinpoint budget variance

‘and trace it to a specific department or area of responsibilty

71. The frequency of the comparison of recorded accountablity with assets (for the purpose of safeguarding

assets) should be determined by:

'A. The amount of assets without reference to the cost of the comparison,

'B._ The nature and amount of the asset and the cost of making the comparison.

C) The cost of the comparison and whether the susceptiblity to 15s results from unintentional errors or

intentional irregularties andjor defalcations..

1D. The auditor in consultation with client management,

(Numbers 72 and 73) Geiine Hardware Wholesalers sels hardware and small apphances, to selected retalens

throughout the Phiippines. Terms are 2/10, n/30. In addition to customer accounts, Geline’s accounts recenvabie

Includes employee receivables, customer credit’ balances, and other non-trade receivables, such a5 returnable

Container deposits, utility deposits, and amounts receivable from sale of assets other than snventory,

Og a ee

‘These other amounts are considered materia, but no effort ks made to idently them separately for ether interim oF

‘annual financial statement purposes.

72, Identity any internal control weakness present in Gelie Hardware Wholesales. Is the internal contro!

2.

74,

7.

7.

78.

73.

81.

82.

83.

weakness relevant to the audit?

A. Yes, because i affects the completeness and cut-off assertions related to the revenue-receivables-cash

receipts cycie.

8. No, since the weakness in internal control affects only the classification of accounts in the tral balance

and the financial statements,

C. Yes, because i affects the presentation and disclosure assertions related to the revenue-receivables-

cash receipts cycle.

D, Cannot be answered without additional information.

Which of the folowing substantive audit procedures would most likely address the intemal control weakness

ientified in umber 43?

‘A. Reviewing transactions at and near year-end to ascertain the propriety of cut-off procedures by the

lent,

B., __ Tracing entries in the sales journal to the related invoices and shipping documents.

© Selecting sample sales invoices and shipping documents and checking them against entries in the sales

journal and the accounts recewable account,

©. Checking the propriety of classification of items in accounts receivable and proposing reclassification

entries as necessary.

‘The use of fidelity bonds protects a company from embezzlement losses and ako:

‘A. Allows the company to substitute the fidelity bonds for various parts of internal control,

B. Reduces the company’s need to obtain expensive business interruption insurance.

C. Minimizes the possibilty of employing persons with dubious records in positions oF trust.

Protects employees who made unintentional erors from possible monetary damages resulting from such

errors.

Which one of these is not a type of evidence that would be used for both obtaining an understanding of the

control structure and testing the controls? .

‘A. Inquiries, B. Inspection, © Observation, D. —_Reperformance.

‘An error fn which an item is posted to the wrong personal account, or the incorrect cakulation of an amount

constituting an original entry is a(n):

‘A. Error of omission C. Error of principle

B. Error of commission D. Counterbalancing error

In the consideration of internal control, the effectiveness of the design of controls i tested by:

A. Flowchart, C.- Substantive tests,

BL Tests of contro. D. Decision tables.

‘Tests of controls, for efficiency, are frequently done at the same time as:

‘A. Analytical procedures. C. Substantive tests of transactions.

8. Compliance tests. D. Substantive tests of balances,

The test for recorded sales for which there were no actual shipments, the auditor traces from the:

‘A. Bill of lading to the sales journal

8. Sales journal tothe bil of ading recorded

. Sales journal to me accounts recewable subsidiary ledger Sites —v thipad ?

D. Bll of lading tothe supporting customer order and sales order. or

To test the possibility of a shipment to a fictitious customer, the auditor traces from the OS hing Oe

‘A. Bil of iading tothe credit authorization Bp, 30 RY

B. Credit authorization to the bill of lading i

CC. Accounts receivable ledger to the bil of aging Boe Joerg Pa Gah ae

1. Sales journal to the accounts receivable eiger

‘An effective procedure to test for unbilled shipments is to trace from the:

‘A. Sales Journal to the shipping documents Dpmads — bill?

8, Shipping documents to the sales journal

C, Sales journal to the accounts receivable ledger Pree Pr SE fs

. Sales Journal to the general ledger slaes account

‘A CPA auditing an electric utlity wishes to determine whether all customers are being billed. The CPA's best

direction of test 1s from the Weg ° ;

‘A. Meter department record to the billing (sales) register eben paki, —a biog she went J eyator

B. Billing (sales) register to the meter department records

C. Accounts receivable ledger to the billing (sales) register

1. Bling (sales) register to the accounts recewable ledger

‘An auditor concludes during the planning and internal control phase that the client is not auditable because of

‘deficient accounting records. Under such circumstances, the auditor must NOT:

‘A. Withdraw from the engagement without issuing a report.

B. Issue a disclaimer of opinion.

»

°

oe

oe

&

C._ Issue an adverse opinion.

D. Send the client a bil for services renctered,

84. In the revenue and collection cycle, of the order of activites listed, which is In the best order of a typical

sequence of actives?

‘A. Delivering goots, piling customers, credit granting, collection activity.

B. Customer ordering, delivering goods, biliag customer, cash receipts.

CC. Customer ordering, delivening goods, credit granting, collection activity,

D, Credit granting, biling customers, delivering Gouxts, cash receipts,

85. The customer's request for merchandise, the customer order, would be In the form of:

A. An cral request C._A vwritten request on pre-printed form.

8. Awniten request on customers letterhead, D. Any of these formats,

£86. A document for recording the description, quantity, and related information for goods ordered by a customer Is

the: ene odd by atle

A. Customer order B, Sales order C. Shipping document, Remittance advice

87, Sales order forms and invoice blanks should be controled in the:

‘A. Sales order section ofthe sales department C. Credit manager in the credit department.

8. _Biling clerk in the accounting department. D. Sales manager in the sales department.

88. Before goods are shipped on account, a properly authorized person must:

‘A. Prepare the sales invoice. G.Approve credit

8. Approve the journal entry, D. Very that the unit price is accurate

89. Which one of the following ts not an auditor's concern about a key authorization point In the revenue/receipts

oycle?

‘A. The receiving room must have authorization before releasing Items to inventory control.

8B. Credit must be authorized before the sale,

C. Goods must be shipped after the authorization,

D. Prices must be authorized,

‘90. For most firms, the function of indicating credit approval is recorded on the

A. Customer order 8, Sales order . Sales invoice D. Remittance advice

91. A document prepared to initiate shipment of the goods sok Is the:

‘A. Sales order 8, Billof lading C. Sales Invoice D. Customer order

92, The document used to indicate to the customer the amount of a sale and due date of the payment isthe:

A. Sales order 8, Bilof lading . Shipping document —D. Sales invoice

‘93, Most companies recognize sales when a/the:

‘A. Merchandise i received by the customer, C. Customer order is received.

B. Merchandise & shipped. D. Cash i received on account.

‘94, When posting to the sales journal, details of a journal are posted to X and journal totals are posted to Y. What

15x? What's 7

X sob diary Ye Gemiaad byes femal hot y

‘A. Sales account se 6 General ledger C.Sales account AR subsidiary ledger

B. AR master file General edger D. ARGL account Sales GL account

95. The report which typically includes Information analyzed by key components as sales person, product, and

terttory is the:

‘A. Remittance advice. C. Accounts receivable master file,

B. Summary sales report, D.Monthiy statement,

96. A flle for recording individual sales, cash receipts, and sales returns and alowances for each customer isthe:

‘A. Sales journal. . General tedger.

B. Cash receipts journal, ©. Accounts receivable subsidiary ledger.

97. A document sent to each customer showing their beginning accounts recelvable balance and the amount and.

{date of each sale, cash payment received, credit memo issued, and the ending accounts receivable balance Is

the:

‘A. Recounts receivable subsidiary ledger, C. Remittance advice,”

8. Monthly statement. D. Sales invoice,

‘98. Which one of the following would the auditor's concern with when examining the billing function of the client?

\.._ All shipments made have been billed,

8. No shipment has been biled more than once.

C.Each shipment has been billed for the proper amount.

D, All of the above are of concern to the auditor,

99. To achieve good internal contro, which department should perform the activites of matching shipping

documents with sales orders and preparing daily sales summaries?

A BID /Ru Ay eg 8. Shipping ©. Great D, ‘Sales order

aaneap-nerustbremees=drussvenasmansaea Soon =

A 100

@ 1%

a

108

14

A 10s

C106,

yr,

108,

pm.

Bu.

ut.

c

pe

| ps

jc

|

|

Which of the fotlowing control procedures may prevent the failure to bill customers for some shipments?

‘A, Fact shipment should be supported by a pre-numbered sales invoice that is accounted for,

1B, Lach sales order should be approved by authorized personnel.

CC. Sals journal entries should be reconcied to daily sales summaries

D, Each sales invoice should be supported by a shipping document.

The document which supports reductions in accounts receivable is the:

‘A, Remittance advee—B. Credit meno . Sales invoice D. Monthly statement

‘The document whict accompanies the customer's payment is the:

A. Remittance adve — 8B. Credit memo . Sales invoke D. Monthly statement

When a customer fails to inclide a remittance advice with a payment, itis common practice for the person

‘opening the mail to prepare one, Consequently, mail should be opened by which of the following four company

employees?

‘A. Credit manager. B. Receptionist, . Sales manager, D. AR clerk.

Internal control over cash receipts 1s weakened when an employee who receives customer mail receipts also:

‘A, Prepanes initial Cash receipts records,

B, Records credits to individual accounts receivable,

C. Prepares bank depost sips forall mail receipts.

D, Maintains a petty cash fund.

The most difficult type of cash defalcation for the auditor to detect és that which occurs:

‘A. Before the cash 1s recorded.

1B. After cash 1s recorded but before It oes to the bank.

C, Out of the balance kept in the cash register.

1. In amounts under F100,

Which of the following would be the best protection for a company that wishes to prevent the “lapping” of trade

accounts receivable?

‘A, Seureyate duties so that the bookkeeper in charge of the general ledger has no access to incomming mal

B, Segregate duties so that no employee has access to both checks from customers and currency from daily

‘ash receipts,

C. Have customers send payments directly to the company’s depository bank.

1. Request that customer’s payment checks be made payable to the company and addressed to the treasurer.

When accounts receivable is considered uncollectible, the person who generally authorizes the write-off is the:

‘A. Credit manager 'B. Treasurer C. Accountant D. Sales manager

‘The two most important considerations the auditor should keep in mind in the verification of the write-off of

Individual uncoechible accounts are:

‘A. Cut off and completeness. C.__Validty and authorization,

8. Cut-off and authorization. D. Validity and completeness.

Tn the purchasing/aisb Leyce, ofthe order of activites listed, which isin the best order of a typical

sequence of activities? ~

'A. Ordering goods, receiving vendor's invoice, selecting authorized vendor, payment activity,

B, Ordering goads, receiving goods, recewing vendor’ invoice, cash payments,

C.Oraering goods, receiving vendor's Invoice, recelving goods, payment actity

D. Selecting authorized vendor, recewving vendors invoke, receiving goods, payment activity.

‘A request by an authorized employee for goods or services is made on the:

‘A. Purchase order. Debit memo,

B. Purchase requisition. 1D. Acquisition transaction file,

Proper authorization for acquisitions ensures that the client will not;

‘A. Be overbilled by the vendor.

B, Run out of stock before the next shipment arrives,

CC. Purchase excessive or unnecessary items.

D, All three of the above.

The purchase order, usually In writing, is a legal document that

‘A. Abinding agreement between client and vendor.

B. An offer to buy.

CC. Not enforceable if iis not in writing.

1D. Am acceptance of a vendor's catalog offer to sel,

‘The receipt of goods and services in the normal course of business represents the date clients normally

recognize:

‘A. Income, B, The habilty, C. Warranty assets. ——_D._Expenses,

‘The personne! in the Receiving Department should:

‘A. Be supervised by the head of the storeroom, since iti the storeroom personnel who are responsible for the

Physical contro! of goods,

8, Be supervised by the Accounting Department, since ws the accounting personnel who are responsible for

the accuracy of the records about the goods,

C.__ Be indepencient of both the storeroom and accounting functions.

D. Be supervised by the Shipping Department since the receiving docks and the shipping docks are in dose

proximity. 5 Powe 7

115, An auditor usually examines receiving reports to support entries in the 5

“A. Voucher register and sales returns journal, . Voucher register and sales journal,

8. Sales journal and sales returns journal. ©. Check register and sales journal

116, The document which specifies the amount of money owed to the vendor for an acquisition ist

A. Receiving report. B. Purchase order. . Vendor's invoice. D. AP trial balance.

117. A file for recording individual acquisitions, cash disbursements and acquisition returns and all

A me gon aca ‘and allowances for each

‘A. Accounts payable master file. C. Acquisitions transactions file

8. Cash disbursements transactions file. D. Summary acquisitions report.

118. The cients accounts payable master ile stould be the same asthe vendor’ statement, except forthe

following:

‘A. Disputed amounts B, Timing differences. C, Bothaand b 1D. None of the answers

119. An important control in the accounts payable and IT departments is to require that those personnel who record

‘acquisitions do not have access to the:

‘A. sts of vendor's names and addresses. Vendor's price lists.

B. Cash, trading securities, and other assets, 1D. The accounts payable master file,

120. The accounts payable department usually has responsibilty for verifying the propriety of acquisitions. by

comparing the details on thi

‘A. Vendor's invoice and the purchase requisition. -N

B. Vendor’ invoice and the receiving report.

CC. Purchase requisition, purchase order and receiving report.

D. Purchase order, receiving report, and vendor's invoice.

121. In assessing control risk for purchases, an auditor vouches a sample of entries in the voucher register to the

‘supporting documents. Which assertion would ths test of controls most likely pertain to?

Poder they = Pecalee

A. Completeness. ype f Efe C.Valuation or allocation,

B. Exstence or occurrence, " =~ ©. Rights and obligations.

122. A document indicating a reduction in the amount owed to a vendor because of returned goods is known as:

‘A. Vendor-issued credit memo. C. Receiving room report.

B. Purchase adjustment slip, D. Shipping room report.

123. For good internal control, the person who should sign checks is the:

‘A. Person preparing the checks. C. Accounts payable clerk.

8. Purchasing agent. D. Treasurer.

124, The maling of disbursement checks and remittance advices should be controlled by the employee

‘A. Who signed the checks last.

8. Who approved the vouchers for payment.

C. Who matched the receiving reports, purchase orders, and verdor’s invokes.

1. Who verified the mathematical accuracy of the vouchers and remittance advices,

125. When processing and recording cash disbursements, itis important to have a method of canceling the

‘supporting documents to prevent their reuse as support for another check at a later time. A common method is

i

A. Shred the documents so they can’t be reused.

B. Transfer possession of the documents to a bank vault such as a safety deposit box.

C. Move the documents to a permanent off-site facility such as a warehouse.

D. Write the check number on the supporting documents,

126. Bell’s accounts payable clerk has a brother who is one of Bell's vendors. The brother will often invoice Bell

twice for the same delivery. The accounts payable clerk removes the receiving report for the first invoice from

the pald-vouchers file and uses it for support of payment for the duplicate invoke. The most effective

procedure for preventing this activity to:

A. Use pre-numbered receiving reports.

B. Mail signed checks without allowing them to be returned to the accounts payable clerk.

C. Cancel vouchers and supporting documents when payment is made.

'D, Use dual signatures. .

127. In the personnel and payroll cycle, ofthe order of activities listed, which is the best order of a typical sequence

of activities?

‘A. Attendance and work, payroll accounting, cash disbursement, payroll distribution.

B, Personnel hiring, labor relations, attendance and work, payroll accounting. 4 Pays disk bu-hew-

C. Personne! hiring, attendance and work, payroll distribution, payroll accounting.

1. Labor relations, personnel hiring, payrat distribution, payroll accounting.

A

a

A

A

A

D

c

A

i eeeniinaiaemasonaiasiiickedlasabaanigate Tee

126, The tot ofthe india employe eamings in the pyro master Me eu te:

Total balance of gross payroll in the general kxiger accounts,

B Toto the checks cree emetoyces for pay

CC. Total gross payroll plus the total contributed by the empkiyer for payrall axes,

D. Total gross pay for the current week’s payroll.

129, The most common control deficlency in the personnel and payroll cycle is the;

‘A. Attitude of management towards control,

B. Inadequate segregaton of dutes.

C. Unlimited access to the payroll system.

D.._ Little comparison of personnel and payroll records.

130. Which of the foliowing best describes proper internal control over payroll?

‘A. The preparation of the payroll must be under the control of the personnel department.

B. The confidentiaity of employee payroll data should be carefully protected to prevent fraud,

C.__ The duties of hiring, payroll computation, and payment to employees should be segregated,

D. The payment of cash to employees should be replaced with payraent by checks,

131, For appropriate segregation of duties, ournalzng and posting summary payol transactions shoul! be aged

“he The wensuers searemant, C. Payroll accounting,

B. General accounting. D. The timekeeping department,

132. For internal control purposes, which of the following individuals should preferably be responsible for the

distribution of payroll checks?

‘A. The company paymaster. C. A bank representative,

B. Amember of the accounting department D. The internal auditor,

133, To minimize the opportunities for fraud, unclaimed cash payroll should be

‘A. Deposited in a safe deposit box. CC. Deposited in a special bank account.

B. Held by the payrol custodian. con. a4, D. Held by the controller,

134. Which of the fotiowing departments most ikely would approve changes in pay rates deductions from employee

salanes?

‘A. Personnel B. Treasury C. Controller D. Payroll

135. Which of the following controls would be the most appropriate means to ensure that terminated employees

have been removed from the payroll?

‘A. Mailing checks to employees’ residences.

BL Establishing direct deposit procedures with the employees’ banks,

Reconciling payroll and time-keeping records

D. Establishing computerized limit checks on payroll rates.

136, The auditor's test of the adequacy of physical controls over raw materials, workin process, and finished goods

must be restricted to:

‘A. Observation and inquiry. ©. Documentation and confirmation,

B. Documentation and observation, D. Documentation and inquiry,

137, The objectives of the internal structure for a production cycle are to provide assurance that transactions are

property executed and recorded, and that

‘A. Custody of work in process and of finished goods és properly maintained,

B. Production orders are pre-numbered and signed by a supervisor.

C._ Independent internal verification of activity reports is established.

D. Transfers to finished goods are documented by a completed production report and a quality control report.

138, Which of the following procedures is most likely to ensure that employee job time tickets are accurate?

‘A. Make sure that the number of hours per week on each employee's fob time ticket IS not more than 40

hours.

B. Keep employment information in the human resources department.

CC. Approve the payroll voucher in the accounts payable department.

1D. Check the employee time cards against the job time tickets.

139. A major dificuty in the verification of inventory cost records 's determining the reasonableness of

‘A. The direct labor hourly rate. C. The cost allocations,

B. The raw materials cost per unit, ©. Allof the answers.

140. Which of the following control procedures could best prevent direct labor from being charged to manufacturing

‘overhead?

‘A. Comparison of daily journal entries with factory labor summary.

B. Examination of routing tickets from finished goods on delivery.

C._Reconcilation of work in process inventory with cost records.

1D. Re-computation of direct labor based on inspection of time cards,

oO

@

141. An auditor's tests of a client’s cost accounting system are designed primarily to

marty to determine that:

‘A. Quantities on hand have been computed based on acc thods that reasonaly

quantities on hand ‘Sule methods a eaorayappronmate acta

8B. Physical invertones substantially apre wth bok mentors,

. The system complies with generally accepted accounting principles and functions as plan

©. Costs nave been asigned properly to fished goods, Work I process, nd cost ef goons oe

142, Perpetual inventory master fs provide a recor

A. Of tems on hand.

8. Of the use of raw materials and the sale of finished goods,

C. That can be used to pinpoint responsibilty for custody.

D. For all three of the above,

143. When perpetual inventory records are maintained in quantities and in pesos, and internal procedt

‘over inventory are deficient, the auditor would probably: Saal ates

‘A. Want the client to schedule the physical inventory count at the end of the year.

B, Insist that the cient perform physical counts of inventory items several times during the year.

. Increase the extent of tests for unrecorded labiltes at the end of the year.

1D. Have to disclaim an opinion on the income statement that year.

144. A useful starting point for becoming familiar with the client's inventory is for the auditor to:

‘A. Read the PICPA's Industry Audit Guide.

B. Review accounting theory covering special problems such as oll and gas accounting, or accounting for

lease-purchase agreements,

C. Read the client’s accounting manual.

D. Tour the client's facilities.

145. The emphasis in auditing manufacturing equipment is on the verification of:

‘A. The balance carried forward in the account from the previous period (beginning balance).

8. The current period's acquisitions and retirements.

CC. The balance in the account after the current year’s activites are recorded (ending balance.

D. All three.of the above.

146.-An effective internal control procedures covering fixed asset additions should require:

‘A. Classification as investments of those fixed asset additions that are not used in the business.

B. Capitalization of the cost of fixed asset addition in excess of a specific peso amount.

CC. Performance of recurring fixed asset maintenance work solely by company maintenance staff.

D. Authonzation and approval of major fired asset additions.

147. Which ofthe folowing & an internal contro weakness related tothe acquistion of equipment?

A Kavence exclave approves are requ fr equpmenteciustons

B Setances Between setorzed equipment expenditures and actual costs ae to be immediatly reported to

management

._Depreration poles are reviewed only once a year.

B. Acquisitions are to be made through and approved by the department in need of the equipment.

148, To. strengthen control procedures over the custody of heavy mobile equipment, the client wouk! most likely

institute a poley requiring 2 peroxic

‘A. Increase in insurance coverage.

B. Verification of ens, pledges, and collateralizations.

C_Recounting for work orders.

Serre Pt guipent and reconcilton with accountng recor.

A holds bearer bonds as a short-term investment (Le. trading secunty). Responsibility for custody of

148. Coma rot coupons or periodic interest clections probably shouldbe delegated tothe

A. Chief accountant. B. Internal auditor. C. Cashier. D. Treasurer.

, secures

150. A company has additional funds to invest. The Board of Directors decided to purchase investment

A company Nis 2 ese and sake ecole (0 @ responsible Mana excitve. The DES Person(s)

make periodic reviews of the investment activity should be .

TA B00 investment committe. ©. The corporate controler.

B. The chief operating officer. OL The treasurer.

151: Notes payable which have been rea in ful should be:

ee epee tat they wl nt be pal! again inadvertently.

B. Canceled and destroyed.

Canceled and returned to the creditor.

DL Canceled and retained by an authorized company official, e

152. Which of the folowing questions would an auditor most likely include on an internal control questionnalre

notes payable? ;

Paya eoings on notes payable authored y the board of dretos

FA ee signatures requred on checks that repay notes payable?

asses?

the proceeds from notes payable used for the purchase of noncurrent 5,

ee eon colateratae nets payable crtically needed forthe ents continued existence

poe

Oo

&

1st.

154.

155

156.

157.

158,

159.

160.

161.

162.

163.

164,

Chee ge falewing types of owners enuity ansactions would require authorization by the board of

rectOs OF A CoMranny?

A fan OF shine capital © Dectaration of dividends.

8, Repurchase of stun capital, D. Alot the atowe.

When ne independent stock transfer ayputs ae employed and the corporation tues its own stocks and

maintains stork records, canceled ster certifies shold

‘A. Nl be defaced but seyregated from other stock certificates and retained in a canceled ceruicates fie,

8, Bee desitoyed ts prevent fraudulent reeeasance

G._ Be detacess anil sent to Ibe ‘ee tobany of State

Ds Be detaced to prevent rekauance and attacied to thelr corresponding stubs.

These generally include the records of inital entries and supporting records, such as checks and records of

electronic fund traimters; Invokes; contracts, the general and subsidiary ledgers; journal entries and other

adjustments ta the financial statements that are not sefiected in formal yournal entries; and records such as

work sheet and spreadtieels supporting cost allocations, Computations, reconcikabons and disclosures.

AL Accounting system, Accounting records,

B, Source documents, D. Audit evitence.

Amounts and other di insures relating to the current period,

A. Notes 10 the financial statements, C Bxisting disclosures

B, Current period figures, D. Financial statement ancilaries

Which one of the following statements bs true? In deciding on substantive tests of transactions,

A. some procedures. are commonly empliyed on every audit regardiess of the circumstances

8B. all procedures are dependent on the adequacy the controls and the results of the tests of controls

CC. results oblamed in the pine year’s audit will net affect the procedures. used this year

D, the materiality of the tem will not mfluence the choice of procedures used

The general audit objectives of valaity and completeness emphasize opposite audit concerns:

A. Validity deals with potential overstatement and completeness deals with understatement.

8, Validity deals with potential understatement and completeness deals with overstatement.

C.Valisity and completeness may each deal with overstatements or understatements, but not in the same

transaction,

D. Validity always deals with overstatements only,

‘The strongest criticism of the reliability of audit evidence that the auditor physically observes is that

‘A. the client may conceal items forin the auditor.

8. the auditor may not be qualified to evaluate the kems which he or she is observing.

CC. such evidence is too costly in relation to ts relability.

D. the observation must occur at a specific time, which is often difficult to arrange

‘According to the PSA Glossary of Terms, this means to inquire into matters arising trom other procedures to

resolve them.

‘A. Confirm, B. Valkate, c Venty. D. Investigate

‘The most reliable form of evidence, other than test of subsequent cash receipts, concerning the validity of a

note receivable balance is a(n):

A. Bill of lading CC. Customer putchase order

B. External confirmation reply. D. Sales invoice

Which of the following Is one of the better auditing techniques that might be used by an auditor to detect kiting

‘between intercompany banks?

‘A. Review composition of authenticated deposit tips.

B. Review subsequent bank statements,

C. Prepare a schedule of the bank transfers.

D. Prepare a year-end bank reconciliation.

‘An auditor should be able to collect and evaluate documentary evidence. When evaluating and interpreting

evidence, the auditor must be on guard against the possibility of drawing unwarranted conclusions. AN

‘example of a valid conclusion is:

‘A. Correct inventory valuation a5 determined from observation of the physical count,

8. Client ownership determined from third-party inquires about consigned goods.

C. Existence of a company travel vehicle determined from the examination of the paid invoice for the said

vehicle.

0, — Proper accounts payable cut-off at reporting date as determined by a review of raw materials

requisitions.

describes the overall approach used when performing a cut-off review?

rac ee eerie ree tom ae

been accounted for in the proper accounting period

8. Confirm year-end transactions with regular customers

2 evereaeeemereeres

D. Analyze transactions occurring within a few days before and after year end

165. An entity’ financial statements were mestatel Ovi & Period OF years dl to large amuunts Of ren being

Fevomted in journal entries thal involved debits aid credit to an lyical Combination of aveounte, The auriton

COURT MSE Hkely have been alerted to Us inegulatly by

‘A. Scanning the general journal for unusual entries,

Performing a revenue cut aff test at yen end,

Tracing a sample of journal entries to the genoral lodger

D, Examining documentary evidence of sales returts and allowances recorded after year end,

166, An entity has leased an asset ant appropriately recorded a finance lease because of the extstence of a bargain

Purchase option, In addition, the entity expressed thal it certain to exercise the upbon, The auditor shuld

determine:

‘A, Whether the interest rate used in computing the present value of the minimum lease payments is the

Interest rate imple In the lease,

8, That reconted cost in the Iessee's books fs the same as the carrying value of the property in the books

of the lessor immediately before the lease

That the leased property Is being depreciated over the lease term,

That the minimum lease payments inchide contingent rent and executory costs:

167. For which of the following account balances are substantive tests of details least likely to be performed unless

analytical procedures indicate the need to extend detail testing?

A. Payroll expense C.-Research and development costs

B. Marketable securities D. Legal expense

168. One payroll audit objective is to determine whether the employees received pay in amounts recorded in the

payroll journal, To achieve this objective, the auditor should:

‘A. Determine whether a proper segregation of duties exists between recording payroll and reconciling the

payroll bank account,

8. Requesting that a company offical distribute all paychecks,

Reconcile the payroll bank account

1D. Compare cancelled payroll checks with the payroll ournal

169. Which of the fotlowing income statement accounts Is least likely to be verified in conjunction with the audit of a

balance sheet account?

‘A. Depreciation expense, . Travel and entertainment.

B, Interest revenue, D, Uncollectible accounts expense.

170. The following are purposes of analytical procedures, except:

‘A. Assist the auditor in planning the nature, timing and extent of other audit procedures

B. As a test to obtam audit evidence about the suitabilty of design and effective operation of internal

‘controts

CAS a substantive procedure when their use can be more effective or efficient than tests of details in

reducing detection risk for specifi financial statement assertions

D. AS an overall review of the financial statements in the final review stage of the audit

171. The physical count of Inventory of realy was higher than shown by the perpetual records. Which ofthe

following could explain the diference? Count

‘A. Inventory tems had been counted but the tags placed on the ems had not been taken off the items and

‘added to the inventory accumulation sheets, %

B, Credit memos for several items returned by customers had not been recorded. ay

C. No journal entry had been made on the retailer's books for several Items returned to its suppliers.

'D. An item purchased "F.0.8. shipping point” had not arrived at the date of the inventory court and had not!”

been reflected in the perpetual records, a5

172. In a CIS environment, which ofthe following isnot a control objective, associated with processing controls?

‘A. transactions are authorized

8, processing is complete

C. all changes to computer records are accurate

1. access to computer files is limited to authorized personnel

173. A manufacturer of complex electronic equipment such es oscilloscopes and microscopes has been shipping its

products with thick paper manuals but wants to reduce the cost of producing and shipping this documentation.

‘The best medium for the manufacturer to use to accomplish this is __ technology.

‘A Write once, read many C. Compact dsc/read-only memory

B. _Dhgital audio tape ©. Computer output-o-microtim

174, Which of the following statements Is correct regarding the Internet as a commercially viable network?

‘A. Organizations must use firewalls they wish to maintain security over internal data.

8, Companies must apply to the Internet to gain permission to create a homepage to engage in electronic

commerce,

© Companies that wish to engage in electronic commerce on the Intemet must meet required security

‘Standards established by the coalition of Internet providers,

D. Allof the above.

A

175, whic ofthe folowing represents a type of appkallons software that a

arge client Is most to use?

A. Enterprise resource planning C. Central processing unit a

8 Opewtns sytem . Vawueaed network

176. Contos that the serve organization which assumes, athe desk of in

ents and, mecensry to ahve contol objectives ate ented nthe Gesamte

‘A Complmentay ser ently convo

8. Seer audio conom

©. General conrob over the sere organization

©. End-user henge aprecnen cone

177. A Type II report és a report that comprises the following:

‘A. A description, prepared by management of the service organization, of the service organization's

system, control objectives and related controls, their design anid implementation as at a specified date

(oF throughout @ specified period and, In some cases, their operating effectiveness throughout @

specified period.

B. A repoit by the service auditor with the objective of conveying reasonable assurance that includes the

‘service auditor’s opinion on the description of the service organization's system, control objectives and

related contro’, the sultabilty of the design of the controls to achieve the specified control objectives,

and the operating effectweness of the controls,

CA description of the service auditor's tests of the controls and the results thereof,

1D. Allof these

178. An, auditor who, at the request of the service organization, provides an assurance reppt.on the controls of a

service organization, Caen

‘A. Requested auditor Service auditor cleed Set

B. Subservice auditor D. Practitioner | \

179, An auditor who audits and reports on the financial statements of a user entity. Vane gtimie

A. Requested auditor C. Service auditor Fy 1 “ipo

B. User auditor D. Practitioner te

180. Which of the following phrases best describes a service organization?

‘A.A third-party organization (or segment of a third-party organization) that provides services to user

entities that are part of those entives’ information systems relevant to financial reporting.

8. The policies and procedures designed, implemented and maintained by the service organization to

provide user entities with the services covered by the service auditor's report.

C._Asservice organization used by another service organization to perform some of the services provided to

User entities that are part of those user entities’ information systems relevant to financial reporting. Ss

1D. Amentity that uses a service organization and whose financial statements are beng audlted. vx «14,

181. Many clents now have their data processed at an independent computer service center rather than have their

‘own computer. The défculty the independent audtor faces when a computer service center fs used 8:

'A. Gaining the permission of the service center to review their work.

B._ Finding compatible programs that will analyze the service center programs.

C__ In trying to abide by the Code of Ethics to maintain the secunty and confidentiality of the client's data.

1. In determining the adequacy of the service centers internal controls.

4182, The policies and procedures that the entity implements and the IT infrastructure (hardware, operating systems,

etc.) and application software that it uses to support business operations and achieve business strategies.

A. IT environment. 'B. Internal control. C. General controls. D. Application controls.

183. The use of computer in data processing systems frequently eliminates the basic Internal contro! of:

‘A. Using vouchers for authorization of disbursements —C, Information processing

B. Appropriate segregation of duties D. Cost should not exceed benefit

184, When the IT system is significant, the auditor should also obtain an understanding of the IT environment and

whether it may influence the assessment of

Le eel

‘A. Inherent and control risks. Inherent and detection risks.

B. Control and detection risks. . General and application controls.

185. These are economical yet powerful self-contained general purpose computers.

choy suerempuer Pesan comptes oF FCS.

'B. Pentium computers and multimedia station. ,_RISOgraph photocopy machines.

D186. A personal computer can be used in any of the following configurations, except:

een stand-alone workstation operated by a single users or @ number of users atthe different times.

B.A workstation which is part of a local area network of personal computers.

CA workstation connected to a server.

1D. Aserver connected to another server.

187. The following are common characteristics of personal computers, ‘except:

‘A. Provide users with substantial computing capabilities.

B.Portabilty (small enough to be transportable),

C. Relatvely inexpensive.

D. Must be configured for a fong time before use. i

palane:

els Nd EB Att _—_— 2 —o

188. This is an arrangement where two or more personal computers are inked together through the use of special

Software and communication lines. This may also be referred to as a distributed system.

‘A. Local area network. C. World Wide Web.

BR Wide area network. 1D. Unit to unit workstation.

189. The two requirements crucial to achieving audit eMciency and effectiveness WIth @ personal computer are.

selecting:

‘A. The appropriate audit tacks for personal computer applications and the appropriate sofware to perform

the selected audit tasks.

B. The appropriate software to perform the selected audit tasks and data that can be accessed by the