Académique Documents

Professionnel Documents

Culture Documents

Condensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015

Transféré par

api-307565920Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Condensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015

Transféré par

api-307565920Droits d'auteur :

Formats disponibles

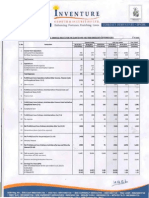

Cementos Progreso, S.A.

, Subsidiaries and Related Companies

Condensed Combined

Interim Financial Statements

September 30, 2015

Cementos Progreso, S.A., Subsidiaries and Related Companies

Content

Condensed Combined Statement of Financial Position

Condensed Combined Statement of Income

Condensed Combined Statement of Comprehensive Income

Condensed Combined Statement of Shareholders Equity

Condensed Combined Statement of Cash Flows

Notes to the Condensed Combined Financial Statements

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Financial Position

As of September 30, 2015 and December 31, 2014

(Expressed in US dollars)

September 30,

2015

US$

December 31,

2014

US$

43,517,447

807,762

64,740,799

49,803,889

698,647

159,568,544

80,378,791

1,368,746

51,846,177

53,195,727

2,969,146

189,758,587

1,394,707,266

28,654,251

1,423,361,517

1,582,930,061

1,257,310,508

28,563,022

1,285,873,530

1,475,632,117

Assets

Current:

Cash and cash equivalents (note 1)

Held-to-maturity investments (note 2)

Accounts receivable, net

Inventories, net

Prepaid expenses

Total current assets

Non-current:

Property, plant and equipment, net (note 3)

Other assets, net (note 4)

Total non-current assets

(Continued)

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Financial Position

As of September 30, 2015 and December 31, 2014

(Expressed in US dollars)

September 30,

2015

US$

December 31,

2014

US$

Current liabilities:

Current portion of long-term debt (note 6)

Accounts payable and accrued expenses

Financial lease operations - current portion

Dividends payable

Income tax payable

Total current liabilities

4,886,267

88,972,770

798,884

19,996,013

4,910,320

119,564,254

5,778,252

72,413,185

755,623

5,041,601

83,988,661

Non-current liabilities:

Long-term bank loans and notes payable, less

current portion (note 6)

Financial lease operations, less current portion

Provision for indemnities (note 7)

Deferred tax liability

Total non-current liabilities

Total liabilities

524,107,640

2,415,082

16,471,872

2,384,620

545,379,214

664,943,468

539,974,187

3,046,044

15,947,213

1,284,132

560,251,576

644,240,237

74,198,560

75,836,141

419,926,263

43,949,809

(65,320)

296,911,934

2,488,819

74,198,560

75,836,141

430,531,389

43,949,809

191,422,992

11,127,420

Liabilities and Shareholders Equity

Shareholders equity:

Paid-in capital (note 8)

Share premium

Revaluation surplus

Legal reserve

Hedging reserve

Retained earnings

Cumulative translation adjustment

Equity attributable to shareholders

of the Group

Non-controlling interest

Total equity

Commitments and contingencies (note 9)

913,246,206

4,740,387

917,986,593

1,582,930,061

827,066,311

4,325,569

831,391,880

1,475,632,117

See notes accompanying the condensed combined interim financial statements.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Income

For the nine-month periods ended September 30, 2015 and 2014

(Expressed in US dollars)

September 30,

2015

US$

September 30,

2014

US$

471,175,481

(269,785,765)

201,389,716

398,050,781

(227,007,264)

171,043,517

Gain on disposal of fixed assets

Administrative and selling expenses (note 10)

Operating profit

1,418,733

(44,729,262)

158,079,187

2,295,105

(38,620,185)

134,718,437

Finance income

Finance costs

Net finance costs

Profit before income tax

814,400

(5,124,878)

(4,310,478)

153,768,709

1,625,432

(4,397,214)

(2,771,782)

131,946,655

(30,908,543)

72,512

(30,836,031)

122,932,678

(27,847,519)

176,164

(27,671,355)

104,275,300

122,603,840

328,838

122,932,678

103,977,403

297,897

104,275,300

Net sales

Cost of sales

Gross profit

Income tax (note 11)

Current

Deferred benefit

Net profit for the period

Attributable to:

Group shareholders

Non-controlling interest

Net profit for the period

See notes accompanying the condensed combined interim financial statements.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Comprehensive Income

For the nine-month periods ended September 30, 2015 and 2014

(Expressed in US dollars)

Net profit for the period

Other comprehensive income for the period

Changes in fair value of hedge contracts

Depreciation for the period of revalued equipment

transferred to non-controlling interest

Increase in revaluation surplus

Foreign currency translation effect

Total other comprehensive income for the

period

Total comprehensive income for the period

Attributable to:

Group shareholders

Non-controlling interest

Total comprehensive income for the period

September 30,

2015

US$

September 30,

2014

US$

122,932,678

104,275,300

(65,320)

63,102

(69,201)

3,402,949

(8,614,236)

16,415,394

(5,345,808)

117,586,870

16,478,496

120,753,796

116,179,895

1,406,975

117,586,870

120,356,964

396,832

120,753,796

See notes accompanying the condensed combined interim financial statements.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Shareholders Equity

For the nine-month periods ended September 30, 2015 and 2014

(Expressed in US dollars)

Balance at January 1, 2015

Comprehensive income for

the period

Net profit for the period

Other comprehensive income

for the period

Depreciation for the period of

revalued equipment

transferred to retained

earnings and to noncontrolling interest

Reserve for valuation of

hedging instruments

Increase in revaluation

surplus

Foreign currency translation

differences for the period

Total other comprehensive

income

Total comprehensive income

for the period

Transactions with owners

recognized directly in

equity

Declared dividends

Balance at September 30, 2015

Paid-in

capital

US$

Share

premium

US$

Revaluation

surplus

US$

Hedging

reserve

US$

Legal

reserve

US$

Retained

earnings

US$

Cumulative

translation

adjustment

US$

Total

US$

74,198,560

75,836,141

430,531,389

43,949,809

191,422,992

11,127,420

827,066,311

4,325,569

831,391,880

122,603,840

122,603,840

328,838

122,932,678

12,885,102

(69,201)

(69,201)

(10,605,126)

74,198,560

75,836,141

419,926,263

(12,885,102)

2,279,976

(10,605,126)

(65,320)

Noncontrolling

interest

US$

Total

equity

US$

(65,320)

2,279,976

1,122,973

3,402,949

(8,638,601)

(8,638,601)

24,365

(8,614,236)

(8,638,601)

(6,423,945)

1,078,137

(5,345,808)

(8,638,601) 116,179,895

1,406,975

117,586,870

(30,000,000)

(992,157)

(30,992,157)

913,246,206

4,740,387

917,986,593

(65,320)

12,885,102

(65,320)

135,488,942

(30,000,000)

(65,320) 43,949,809 296,911,934

2,488,819

(65,320)

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Shareholders Equity

Balance at January 1, 2014

Comprehensive income for

the period

Net profit for the period

Other comprehensive income

for the period

Depreciation of the period of

revalued equipment

transferred to Retained

earnings

Reserve for valuation of

hedging instruments

Foreign currency translation

differences for the period

Total other comprehensive

income

Total comprehensive income

for the period

Transactions with owners

recognized directly in

equity

Declared dividends

Balance at September 30, 2014

Paid-in

capital

US$

Share

premium

US$

Revaluation

surplus

US$

74,198,560

75,836,141

447,524,193

74,198,560

Hedging

reserve

US$

Legal

reserve

US$

(63,102) 43,738,474

Retained

earnings

US$

Cumulative

translation

adjustment

US$

Total

US$

61,718,638 (13,061,148) 689,891,756

Noncontrolling

interest

US$

Total

equity

US$

4,226,461

694,118,217

297,897

104,275,300

103,977,403

103,977,403

12,802,657

63,102

63,102

63,102

16,316,459

16,316,459

98,935

16,415,394

(12,802,657)

63,102

12,802,657

16,316,459

16,379,561

98,935

16,478,496

(12,802,657)

63,102

116,780,060

16,316,459

120,356,964

396,832

120,753,796

75,836,141

434,721,536

(12,802,657)

(30,000,000)

43,738,474 148,498,698

(30,000,000)

3,255,311 780,248,720

(208,832) (30,208,832)

4,414,461 784,663,181

See notes accompanying the condensed combined interim financial statements.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Cash Flows

For the nine-month periods ended September 30, 2015 and 2014

(Expressed in US dollars)

Cash flows from operating activities:

Net profit for the period

Reconciliation items between net profit for the

period and net cash provided by operating activities:

Depreciation

Provision for income tax

Interest expense

Provision for indemnities

Provision for obsolescence of inventories

Foreign currency exchange rate unrealized gains

Provision for doubtful accounts

Gain on disposal of fixed assets

Deferred income tax benefit, net

Net changes in assets and liabilities:

Accounts receivable

Inventories

Prepaid expenses

Other assets

Accounts payable and accrued expenses

Payments of labor indemnities

Income tax payments

Net cash flows provided by operating activities

Cash flows from investing activities:

Purchases of property, plant and equipment

Stripping and site restoration costs

Acquisition of subsidiary, net of cash acquired

Held-to-maturity investments

Proceeds from sale of property, plant and

equipment

Net cash flows used in investing activities

September 30,

2015

US$

September 30,

2014

US$

122,932,678

104,275,300

26,470,640

30,908,543

3,360,744

3,344,572

208,929

330,629

240,268

(1,418,733)

(72,512)

186,305,758

22,441,895

27,847,519

3,429,724

2,397,504

1,544,020

(1,693,667)

295,981

(2,295,105)

(176,164)

158,067,007

(16,524,705)

2,643,395

2,245,120

(203,630)

6,611,067

(2,652,469)

(7,881,222)

(28,160,461)

150,264,075

7,042,433

(911,639)

2,341,430

(258,941)

(3,892,630)

(1,992,511)

2,328,142

(25,457,863)

134,937,286

(158,373,722)

(564,356)

560,984

(104,294,011)

(203,032)

(18,517,597)

(17,360)

2,139,860

(156,237,234)

2,710,923

(120,321,077)

(Continued)

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Cash Flows

Cash flows from financing activities:

Payments of bank loans

Dividends paid

Finance leasing operations

Interest paid

Net cash flows used in financing activities

Net decrease in cash and cash equivalents

Cash and cash equivalents at beginning of period

Effect of exchange rate fluctuations on cash held

Cash and cash equivalents at end of period

September 30,

2015

US$

September 30,

2014

US$

(15,336,006)

(10,992,157)

(549,930)

(3,360,744)

(30,238,837)

(36,211,996)

80,378,791

(649,348)

43,517,447

(1,528,161)

(30,208,832)

(232,296)

(3,429,724)

(35,399,013)

(20,782,804)

111,426,629

2,244,024

92,887,849

Non-monetary transactions

September 30, 2015

The account constructions in process had a net increase of US$18,084,578 as follows:

(1) an increase of US$8,616,855 due to capitalized interest on loans used to finance

the construction of a new cement plant, (2) an increase of US$3,603,055 due to the

exchange rate differential on foreign currency loans used to finance the construction

of a new cement plant, and (3) an increase of US$5,864,668 which is the amount that

at September 30, 2015 corresponds to the final payment of 7.5% of the import

turnkey contract price, to be paid as retention payment by Cementos Progreso to

ThyssenKrupp Industrial Solutions AG for the San Gabriel cement plant when the

Taking-Over Certificate has been signed by both parties (the date of the Taking-Over

Certificate is that when ThyssenKrupp has completed the Project and Cempro

acquires responsibility for the plant).

Plant and equipment increased by US$4,600,986 with a corresponding credit to

revaluation surplus, as a result of the revaluation of equipment of the subsidiary Sacos

del Atlntico, S.A., used to produce paper sacks to bag cement, lime, and dry mix

products. At the same time, accumulated depreciation decreased by US$9,009,864,

related to the original cost of the revalued machinery.

Dividends for the amount of US$30,992,157 were declared to Group shareholders, of

which US$19,996,013 as of September 30, 2015 are pending to be paid at end of year.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Condensed Combined Statements of Cash Flows

September 30, 2014

The account constructions in process had a net decrease of US$2,432,686 as follows:

interest on loans used to finance the construction of a new cement plant increased by

US$5,254,662, and the exchange rate differential on foreign currency loans used to

finance the construction of a new cement plant decreased by US$7,687,348.

On August 2014, the Group acquired 100% of the shares and voting interest in

Agregs International Corporation and Subsidiaries (see note 5).

See notes accompanying the condensed combined interim financial statements.

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

1

Cash and Cash Equivalents

Cash:

In banks - local currency

In banks - foreign currency

On-hand

Total cash

Cash equivalents:

Ready instruments in Morgan Stanley and

Pitctet & CIE Banquiers that do not earn

interest.

September 30,

2015

US$

December 31,

2014

US$

15,981,005

27,408,671

112,615

43,502,291

24,487,412

55,763,509

112,497

80,363,418

15,156

43,517,447

15,373

80,378,791

Held-to-Maturity Investments

These investments are made up of fixed-term certificates of deposit, promissory

notes and mortgage certificates issued by depository institutions, which bear

annual interest rates between 6.25% and 6.75% and with original maturities

greater than 90 days.

10

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

3

Property, Plant and Equipment

Acquisition and disposal:

During the nine-month period ended September 30, 2015 the Group acquired

assets with a cost of US$172,834,533 (US$101,861,325 during the nine-month

period ended September 30, 2014). Additionally, assets with a net carrying

amount of US$4,864,740 were disposed of during the nine-month period ended

September 30, 2015 (US$6,965,100 during the nine-month period ended

September 30, 2014), resulting in a gain on disposal of assets of US$1,418,733 (a

gain of US$2,295,105 during the nine-month period ended September 30, 2014).

Reconciliation of carrying amount:

Nine-month

period ended

September 30,

2015

US$

Year ended

December 31,

2014

US$

Cost

Balance at beginning of period

Additions

Revaluations

Acquisition of subsidiary

Reclassifications

Write-downs

Effect of exchange rate fluctuations

Balance at end of period

1,417,573,994

172,834,533

4,600,986

(17,497,269)

(4,864,740)

(14,733,981)

1,557,913,523

1,208,246,060

152,205,518

37,503,361

(12,500,129)

(10,159,370)

42,278,554

1,417,573,994

Accumulated Depreciation

Balance at beginning of period

Depreciation

Acquisition of subsidiary

Reclassifications

Write-downs

Effect of exchange rate fluctuations

Balance at end of period

160,263,486

26,470,640

(17,497,269)

(4,144,391)

(1,886,209)

163,206,257

128,330,789

30,695,202

18,282,733

(12,500,129)

(9,185,252)

4,640,143

160,263,486

Carrying amounts

Balance at beginning of period

Balance at end of period

1,257,310,508

1,394,707,266

1,079,915,271

1,257,310,508

11

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Impairment loss:

Management of the Group considers there are no indications of impairment of

long-lived tangible and intangible assets and for that reason, no impairment losses

have been recognized in the condensed combined interim financial statements as

of and for the nine-month periods ended September 30, 2015 and 2014.

Capital commitments:

Contract signed with ThyssenKrupp Industrial Solutions AG (formerly known

as ThyssenKrupp Resource Technologies GmbH), a company incorporated in

Germany, for the execution of the works known as Proyecto de la Planta de

Cemento (Cement Plant Project), under a turnkey modality, which will operate

in the district of San Juan Sacatepquez, Department of Guatemala.

ThyssenKrupp will supply the plant or equipment, engineering, supervisory

services, civil works, structural works, mechanical assembly, electrical assembly,

transportation, commissioning tests, training of personnel and commissioning,

technical assistance with production, according to the terms, definitions and

conditions of the contract. The contract came into effect on June 5, 2008 with a

price of Eur114,655,000 plus US$345,517,500, for an approximate total amount

of US$517,500,000 at the reference exchange rate of 1.50 dollar/euro at the time.

On August 28, 2009 an amendment to the contract came into effect through which

by mutual agreement, the parties delayed the completion of the Project until 2015.

On July 31, 2013, the parties subscribed a further amendment to the contract,

whereby they agreed on a revised contract price and a new completion date. The

contract price is comprised of the amount that has been fully paid by Cempro and

the remaining amount to be paid for the execution and completion of the Project.

The agreed total contract price is Eur121,593,312 plus US$352,090,324. At

September 30, 2015 the price that has been fully paid is 95,751,504 plus

US$237,272,291. At September 30, 2015 the remaining price to be paid by

Cempro is 26,021,808 plus US$114,818,032.

The addendum dated July 31, 2013 came into force in August 2013 once Cempro

fulfilled the following conditions: (1) down payments made to ThyssenKrupp,

and (2) ThyssenKrupp having received irrevocable letters of credit to guarantee

the supply of equipment for the total amounts of Eur40,120,000 plus

US$44,178,600. The letters of credit were issued by Deutsche Bank AG New

York Branch. At September 30, 2015, the amounts outstanding under the Letters

of Credit are a total of Eur26,021,808 plus US$20,240,839.

As per the addendum to the contract dated July 31, 2013 the new cement plant

would come on line on February 24, 2017.

12

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

On February 28, 2015, Cempro and ThyssenKrupp mutually agreed to a further

amendment to the contract that came into force on March 15, 2015 whereby the

date of the first clinker is delayed to June 8, 2017. The due date for the issuance

of the Taking-Over Certificate is extended from February 24 to July 8, 2017. The

date of the Taking-Over Certificate is that when ThyssenKrupp has completed the

Project and Cempro acquires responsibility for the plant. The contract price

remains as it was agreed and defined in July 2013. Additionally, Cempro agrees

to pay ThyssenKrupp an additional price for incremental costs that result from

extending the project completion date: (a) Eur300,000 plus US$5,681,000, and

(b) additional costs that may not be determined beforehand and which will be

calculated by ThyssenKrupp once they have been incurred, if additional expenses

arise from incremental internal transportation costs of equipment and other

justifiable expenses derived from extending the project completion date.

Other Assets, net

The summary of this account is as follows:

Goodwill: (a)

Mezcladora, S.A.

Agregs International Corp. and

Subsidiaries (note 5)

Less: accumulated amortization

Effect from exchange rate fluctuations

Employees Solidarity Association (b)

Stripping costs, net

Advance for investments

Other

(a)

September 30,

2015

US$

December 31,

2014

US$

20,290,146

20,707,148

3,488,380

23,778,526

(3,099,525)

739,575

21,418,576

3,488,380

24,195,528

(3,106,072)

551,235

21,640,691

4,473,934

2,014,936

330,220

416,585

28,654,251

4,265,546

1,852,726

330,220

473,839

28,563,022

Impairment Test of Cash Generating Units that Include Goodwill

It is the Groups practice to subject the carrying amount of goodwill to

impairment tests annually or more frequently if there is any indication of

impairment.

For purposes of impairment testing, the goodwill is distributed to the

operative division that represents the smallest level within the Group, in

which it is distributed and monitored for internal management purposes.

13

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

An estimate was thus made of the recoverable amount of net assets

belonging to the cash generating units associated with the goodwill derived

from the acquisitions of the Concrete and Aggregates businesses, which

have been defined as the cash generating units (CGUs).

The recoverable amount of the cash generating units is determined by

calculating the value in use. Financial projections are made in Quetzales and

the calculations of the value in use are based on projections of established

cash flows, on the basis of actual and projected results of operation.

For subsequent periods, these cash flow projections are extrapolated to the

end of the useful life of the essential CGU asset, using a stable long-term

growth rate that does not exceed the total growth of the economy of the

country or the industry in which the cash generating unit operates. The

values assigned to the key assumptions represent the judgments and

expectations of management regarding the future trends of their business

and the market for products used in the construction industry.

Specifically, the value in use was determined by discounted cash flows

estimated for the continuous use of each cash generating unit. The

assumptions used by the Group in performing the goodwill impairment test

were the following:

Cash flows were projected in Quetzales and translated to US$.

The projection period comprehends a 10 year business plan from 2015

to 2024 for the Concrete and Aggregates CGUs.

The expected devaluation of the Quetzal in relation to the US dollar is

2% per annum on average for the valuation period (2015-2024).

The assumptions used in the cash flow projections and the discount rate

used to determine the value in use vary for each CGU.

The annual revenue growth assumption in US dollars, on average, for

the valuation period (2015-2024) is as follows: (a) Concrete 4%, and (b)

Aggregates 3%.

The annual projected gross margin, on average, for the valuation period

(2015-2024) is as follows: (a) Concrete 11%, and (b) Aggregates 28%.

14

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

(b)

The value of the cash flows following 2024 was calculated by using a

terminal value. To calculate this value the cash flows were extrapolated

until the end of the useful life of the essential asset of the cash

generating unit (CGU). Also, a growth rate and a discount rate before

taxes were used in the calculation. In the long term, it is expected that

the cash flows will grow at a similar rate as the economy. Projections

for the growth of the Guatemalan economy were used for the

calculation of the long-term growth rate. The estimated cash flows were

discounted using a discount rate before taxes of: (a) Ready-mix

Concrete 12.7% and (b) Aggregates 11.7%.

The sensitivity analysis does not show a goodwill impairment for the

CGUs: (a) Concrete: using annual volume growths of 2.5%, 3.5% and

4.5% during the valuation period; and (b) Aggregates: using annual

volume growths of 1.7%, 2.7% and 3.7% during the valuation period.

According to this analysis, the estimated recovery value exceeds the

book value of the goodwill derived from the business combinations of

the Concrete and Aggregates CGUs. Therefore, the Groups

management concluded there is no goodwill impairment

The balance of this account refers to refundable contributions that the Group

makes to the Employee Solidarity Association, entity that in turn uses the

proceeds to offer financing to its members. The Association returns the

funds when the employees cease working for the Group. The Group uses

the funds to pay for the labor benefits that the employees have earned up

until their retirement date. Consequently, the balance of this account is

considered a restricted fund for the payment of labor liabilities (see note 7).

Acquisition of subsidiary

In August 2014, the Group acquired 100% of the shares and voting interest in

Agregs International Corporation and Subsidiaries (Agregs). As a result, the

Group obtained control of Agregs.

15

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

6

Bank Loans

The movement of bank loans during the period is the following:

Currency

Balance at

January 1,

2015

Repayments:

Unsecured

loans

Other

movements:

Translation

effect

Balance at

September 30,

2015

Average

interest

rate

Fair

Value

US$

Carrying

amount

US$

545,752,439

7.0% 10.0%

(15,336,006)

(15,336,006)

(1,422,526)

528,993,907

16

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

At September 30, 2015 and December 31, 2014 the maturity of bank loans is as

follows:

Current portion of long-term loans

Long-term portion of bank loans

September 30,

2015

US$

December 31,

2014

US$

4,886,267

524,107,640

528,993,907

5,778,252

539,974,187

545,752,439

The contractual amortizations of loans during the next years are as follows:

2015

US$

65,142

2016

US$

13,356,423

2017

US$

35,796,516

2018

and on

US$

479,775,826

Total

US$

528,993,907

17

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

The summary of bank loans at September 30, 2015 and December 31, 2014 is the

following

Financial entity

Currency Maturity

September

30, 2015

US$

December 31,

2014

US$

Long-term bank loans, less

current portion - Unsecured

Loans:

Cementos Progreso, S.A.

Deutsche Bank AG, London

Branch (a)

Loan syndicated by Banca de

Inversin Bancolombia (b)

Banco Industrial, S.A.

Banco G&T Continental, S.A.

Banco Agromercantil de

Guatemala, S.A.

Financiera Industrial, S.A.

Banco General, S.A.(Panam)

US$

11/06/2023 350,000,000

350,000,000

Q

Q

09/20/2021

09/20/2021

55,472,065

18,920,518

60,591,700

20,666,732

Q

Q

US$

09/20/2021

09/20/2021

09/20/2021

9,641,028

1,530,493

46,250,000

10,530,819

1,671,746

50,000,000

12/30/2023

40,127,522

40,543,654

Mezcladora, S.A.

Arrendamientos e Inversiones

San Miguel, S.A.

06/30/2018

2,377,686

4,146,510

Inversiones Salisbury, S.A.

Arrendamientos e Inversiones

San Miguel, S.A.

08/06/2018

1,514,553

1,678,349

05/01/2019

3,160,042

4,409,123

10/31/2017

Banco Industrial, S.A.

Agregados de Guatemala, S.A.

Banco G&T Continental, S.A.

Banco Agromercantil de

Guatemala, S.A.

Long-term bank loans

Less Current portion of long-term loans

Long-term portion of bank loans

528,993,907

(4,886,267)

524,107,640

1,513,806

545,752,439

(5,778,252)

539,974,187

18

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Following is a summary of the main terms stipulated in bank loan contracts:

(a)

On November 6, 2013, Cementos Progreso, S.A. (Cempro) obtained a

US$350,000,000 senior unsecured loan from Deutsche Bank AG, London

Branch (the Loan), guaranteed on a senior unsecured basis by Inversiones

Sampdoria, S.A. (Sampdoria) (the Loan Guarantee).

On the same date, the Cementos Progreso Trust (the Trust) issued 7.125%

Senior Notes due 2023, payable in US dollars. The net proceeds obtained

from the sale of the Notes were issued by the Trust to acquire a 100%

participation interest the Loan. Payments on the Notes are guaranteed on a

senior unsecured basis by Cempro and Sampdoria, pursuant to Note

Guarantees (the Note Guarantees).

The Loan, the Loan Guarantee and the Note Guarantees constitute general

senior unsecured obligations of Cempro and Sampdoria, as

applicable. The Loan, the Loan Guarantee and the Note Guarantees rank

pari passu in right of payment with all of Cempros and Sampdorias

existing and future senior unsecured indebtedness, except for liabilities

preferred under mandatory provisions of Guatemalan law.

The Loan agreement contains covenants that limit Cempros, Sampdorias

and their restricted subsidiaries ability to, among other things:

-

incur additional indebtedness if Cempro does not meet its Debt to

EBITDA ratios as described further below;

pay dividends on capital stock or redeem, repurchase or retire capital

stock or subordinated indebtedness if Cempro does not meet its Debt to

EBITDA ratios among other exceptions;

make investments excluding those permitted investments such as

investments in businesses in which Cempro and its Restricted

Subsidiaries were engaged at the time the Notes were issued, and any

business reasonably related, incidental, or complementary to Cempro;

also investments that are part of Cempros ordinary course of business

such as investments in cash equivalents, hedging agreements,

extensions of credit to customers, among other permitted investments;

create liens except for permitted liens;

create limitations on the ability of restricted subsidiaries to pay

dividends, make loans or transfer property to Cempro or Sampdoria;

19

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

-

engage in transactions with affiliates outside of the Groups ordinary

course of business and at terms that are not market;

sell assets, including capital stock of subsidiaries; or

consolidate, merge or transfer assets.

These covenants are subject to a number of important limitations and

exceptions. In particular, although the loan agreement contains restrictions

on the incurrence of additional debt, these restrictions are subject to a

number of important qualifications and exceptions, and the debt incurred

in compliance with these restrictions could be substantial. For example,

Cempro may incur debt if, on the date of incurrence, after giving effect to

the incurrence and receipt and application of the proceeds therefrom, the

Debt to EBITDA Ratio is no greater than (i) 3.75 to 1.00 prior to January

1, 2017, (ii) 3.50 to 1.00 from and after January 1, 2017 and prior to

January 1, 2018, (iii) 3.25 to 1.00 from and after January 1, 2018 and prior

to January 1, 2019, and (iv) 3.0 to 1.0 from and after January 1, 2019.

(b)

On September 20, 2011 Cementos Progreso, S.A. (Cempro) as Borrower,

and Inversiones Sampdoria, S.A. (Sampdoria) as Guarantor, subscribed a

ten-year syndicated bank loan with the participation of five financial

institutions (the Lenders). The Lenders are jointly: Banco Industrial, S.A.,

Financiera Industrial, S.A., Banco G&T Continental, S.A., Banco

Agromercantil de Guatemala, S.A., and Banco General, S.A. The loan

was structured and lead by Banca de Inversin Bancolombia. Banco

Industrial, S.A. is the administrative agent.

The loan has two tranches, a local currency tranche for an original amount

of Q710,000,000 plus a US dollar tranche for an original amount of

US$50,000,000.

Repayment:

The first principal payment is due on December 30, 2015. Principal will

be repaid as follows: 10% during the first year counted as of September

30, 2015; 20.7% during the second year; 20.7% during the third year;

20.7% during the fourth year; 20.7% during the fifth year; and 7.2% as of

the last payment of the fifth year counted from September 30, 2015 to

September 20, 2021. Principal payments are due quarterly every year

during the life of the loan.

On June 26, 2015 Cementos Progreso effected a prepayment (without

penalty) equivalent to a 7.5% of the original syndicated loan amount (to

both the US dollar and local currency tranches). As a result, the next

contractual maturity is due on September 30, 2016.

20

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Interest:

On the local currency (quetzales) tranche, interest is paid at an annual

variable interest rate called Tasa Activa Promedio Ponderada (TAPP

from its initials in Spanish) less 6.00%; or a minimum rate of 6.75% p.a.

during the life of the loan. TAPP means the weighted average lending rate

of local currency loans in the Guatemalan banking system. The interest

rate is set quarterly based on TAPP as published by Banco de Guatemala

(the Central Bank) in the website www.banguat.gob.gt on the first day of

the calendar quarter.

On the US dollar tranche, interest is paid at a variable rate of Libor +

3.75%; a minimum rate of 5.00% p.a. is applicable during the life of the

loan. The Libor rate is set on a quarterly basis and recorded the first day of

the calendar quarter.

Financial covenants:

These are measured based on the combined financial statements of the

Borrower and the Guarantor and their subsidiaries:

1) Leverage ratio: Financial Debt/EBITDA of the last 12 months will be

lesser or equal to 3.75 times on each measurement date.

2) Free cash flow debt service coverage ratio: cannot be lesser to 1.20

times on each measurement date. It will be measured only beginning

December 31, 2016 and thereafter during the life of the loan.

3) EBITDA debt service coverage ratio: EBITDA of the last 12 months

over the debt service will be equal or greater than 1.20 times on each

measurement date. It is measured only as of the date of the first

disbursement and up to June 30, 2016.

Financial covenants are measured semiannually during the life of the

Loan, that is, on June 30 and December 31 of each year.

Negative Pledge:

The Borrower is not allowed to pledge any of its assets, without prior

written approval from the Lenders.

The Groups management considers that at September 30, 2015, the companies

are in compliance with contractual clauses in credit agreements.

21

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

7

Provision for Indemnities

At September 30, 2015 and December 31, 2014, the obligation for labor

indemnities is covered as follows:

September 30,

2015

US$

Present value of the obligations

Assets and provisions that cover the obligation:

Employees Solidarity Association (a)

Provision for indemnities (b)

Total coverage of the obligation

December 31,

2014

US$

20,200,675

20,200,675

(4,473,934)

(16,471,872)

(20,945,806)

(4,265,546)

(15,947,213)

(20,212,759)

(a) The subsidiaries of the Group make refundable contributions to the

Employees Solidarity Association. Such contributions are restricted to

cover the payment of labor indemnities to employees of the Group (see note

4).

(b) The movement of the provision for indemnities for the nine-month periods

ended September 30, 2015 and 2014 is as follows:

September 30,

2015

2014

US$

US$

Balance at the beginning of period

Provisions

Acquisition of subsidiary

Payments

Effect of the exchange rate fluctuations

Balance at the end of period

(15,947,213)

(3,344,572)

2,652,469

167,444

(16,471,872)

(13,071,221)

(2,397,504)

(657,517)

1,992,511

(293,798)

(14,427,529)

The actuarial valuation of the provision for labor indemnities is based on the

mathematical-actuarial model especially designed and appropriate for this case,

using the Projected Credit Unit Method to measure the Groups obligations,

which consists of a set of formulas for calculation, biometric hypotheses and

financial hypotheses that overall constitute the technical basis on which the

actuarial valuation is based.

It was assumed that the Groups obligations for the payment of the indemnity to

each employee occur at the time that the worker retires. This obligation remains in

effect throughout the entire period of the workers labor activity until he/she

reaches maximum retirement age. The obligation to pay labor indemnities is

subject to following circumstances: dismissal, total and permanent disability,

death of the employee or reaching maximum retirement age.

22

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

The calculation was made on an individual basis for each of the persons on the

payroll at September 30, 2015 and 2014 respectively, considering their particular

characteristics, such as age, accumulated time of service, sex and average wages

during the last nine months, over-time and/or average commissions of the last

nine months, and the obligatory portion of the year-end and mid-year bonuses.

The actuarial hypotheses taken into consideration for purpose of the calculations

are the following:

Biometric basis

a) Mortality probability rates;

b) Probability rates of total and permanent incapacity; and

c) Probability rates of turnover or premature cessation of employment.

Financial rates

a) Wages growth rate during the period of labor activity of the employee

up to the date of eventual retirement from the company: 2%. This rate

is based on the assumption that future annual wage increases could be

in terms of the countrys estimated average inflationary index.

b)

Discount rate of future values to bring them to present value: 9%

annually. Management considers that these rates are still below the

rate of return on capital of the Group.

Maximum expected age of retirement: 65 years.

Paid-in Capital

The paid-in capital of the Group is made up of 4,389,001 common shares with par

value of Q100 per share (US$16.9055 per share translated at an average historical

exchange rate of Q5.91 = US$1.00).

Commitments, Endorsements and Guarantees and Contingencies

Commitments Other than Capital Commitments

Commitments of the Group other than Capital Commitments are substantially the

same as those disclosed in the annual combined financial statements as of and for

the year ended December 31, 2014.

Contingencies:

At September 30, 2015 there were claims in process made by the Superintendence

of Tax Administration (SAT for its initials in Spanish), through which this

authority notified some adjustments to income tax and value added tax returns and

to import duties and royalties of previous periods. Below are details of the

amounts of such additional tax claims plus the corresponding fines, without

including possible interests:

23

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Tax

Period

Tax

Present status

Tax

US$

Fine

US$

Total

US$

Pea Rubia, S.A.

2009

Royalties

Written response to hearing

184,969

184,969

Agregados de Guatemala, S.A.

2007

Income tax

Written response to hearing

166,064

40,768

206,832

Written response to hearing

Written response to hearing

152,326

109,355

612,714

152,326

109,355

302,449

304,652

218,710

915,163

Mezcladora, S.A.

2014

Income tax

2014

Value added tax

Total

The Group has presented defense arguments before the hearings that have been conferred and estimates that the claims

described above will be resolved in its favor.

24

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

10

Administrative and Selling Expenses

The administrative and selling expenses for the nine-month period ended

September 30, 2015 include non-recurring personnel reorganization expenses of

US$471,084.

11

Income Tax Expense

Income tax expense was recognized based on actual payments made by Cementos

Progreso, S.A. (7% on gross revenue for the nine-month periods ended September

30, 2015 and 2014) as well as on managements best estimate of the tax expected

to be paid by the remaining companies included in the condensed combined

interim financial statements, by applying the statutory tax rates to pre-tax income

of the interim period, plus the tax effect of non-taxable income and nondeductible expenses. The Groups combined effective tax rate for the nine-month

period ended September 30, 2015 was 19.6% (21.7% for the nine-month period

ended September 30, 2014).

The statutory income tax rates in force during the nine-month periods ended

September 30, 2015 and 2014 are detailed as follows:

September 30

2015

2014

Cementos Progreso, S.A. (percentage on gross

revenue)

7%

7%

Other companies included in the condensed

combined interim financial statements

(percentage on pre-tax income)

25%

28%

25

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

12

Balances and Transactions with Related Parties

Following are details of balances with uncombined related companies as of

September 30, 2015 and December 31, 2014; as well as the transactions with

these companies during the nine-month periods ended September 30, 2015 and

2014.

Accounts receivable:

Divisin DMC Guatemala, S.A.

Agromsa de Guatemala, S.A.

Grupo Progreso Ltd. S.A.

Senderos del Norte, S.A.

Inmobiliaria La Pedrera, S.A.

Foro Eventos, S.A.

Instituto del Cemento y Concreto de

Guatemala

Financiera San Miguel, S.A.

Inmobiliaria Alcobendas, S.A.

Consultora Integral Atlanta, S.A.

Vertical Investments International Corp.

Inverpit de Guatemala, S.A.

Other

Accounts payable:

CSC Progreso, S.A.

Grupo Cemcal, S.A.

Central Educativa, S.A.

Seguridad Industrial de Guatemala, S.A.

Comercializadora Electronova, S.A.

Other

September 30,

2015

US$

December 31,

2014

US$

4,192,534

852,653

183,850

149,959

105,267

72,055

2,478,279

718,179

96,424

115,910

37,723

48,832

46,978

132,762

5,784,890

45,363

187,281

220,131

139,364

51,274

35,218

4,125,146

416,909

141,774

45,367

6,426

6,963

617,439

33,570

68,638

5,574,775

12,581

5,689,564

26

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Transactions with related companies:

Nine-month periods

ended September 30,

2015

2014

US$

US$

Purchases:

Electricity

General and administrative services

Interest expense

Rent, hire lease

Raw material and finished goods

Sales:

Cement and lime

Computing services, transportation and other

Electricity

Raw material and finished goods

25,927,343

5,771,717

1,269,440

885,358

33,853,858

26,231,952

5,973,869

967,356

7,346,073

40,519,250

12,009,735

1,422,235

370,346

13,802,316

8,649,328

549,987

363,660

96,208

9,659,183

27

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

13

Combining Schedules of Financial Statements of Cementos Progreso, S.A., Subsidiaries and Related

Companies

Combining Schedule of Statement of Financial Position

September 30, 2015

Cementos

Progreso,

S.A. and

Subsidiaries

US$

Assets

Current:

Cash and cash equivalents

Held-to-maturity investments

Accounts receivable, net

Inventories, net

Prepaid expenses

Total current assets

Non-current:

Property, plant and equipment, net

Other assets

Total non-current assets

Inversiones

Sampdoria,

S.A. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

Total

combined

US$

39,452,973

807,762

64,622,517

42,731,184

434,717

148,049,153

4,064,474

35,360,565

7,072,705

263,930

46,761,674

43,517,447

807,762

99,983,082

49,803,889

698,647

194,810,827

(35,242,283)

(35,242,283)

43,517,447

807,762

64,740,799

49,803,889

698,647

159,568,544

1,346,897,756

9,506,069

1,356,403,825

1,504,452,978

49,502,695

19,148,182

68,650,877

115,412,551

1,396,400,451

28,654,251

1,425,054,702

1,619,865,529

(1,693,185)

(1,693,185)

(36,935,468)

1,394,707,266

28,654,251

1,423,361,517

1,582,930,061

28

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Combining Schedule of Statement of Financial Position (continued)

September 30, 2015

Liabilities and Shareholders Equity

Current liabilities:

Current portion of long-term debt

Accounts payable and accrued expenses

Financial lease operations-current

portion

Dividends payable

Income tax payable

Total current liabilities

Non-current liabilities:

Long-term bank loans and notes

payable, less current portion

Long-term financial lease operations,

less current portion

Provision for labor indemnities

Deferred tax liability

Total non-current liabilities

Total liabilities

Cementos

Progreso,

S.A. and

Subsidiaries

US$

Inversiones

Sampdoria,

S.A. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

Total

combined

US$

4,365,094

89,466,797

521,173

34,748,256

4,886,267

124,215,053

(35,242,283)

4,886,267

88,972,770

19,996,013

2,892,894

116,720,798

798,884

2,017,426

38,085,739

19,996,013

798,884

4,910,320

154,806,537

(35,242,283)

19,996,013

798,884

4,910,320

119,564,254

520,736,574

3,371,066

524,107,640

11,522,662

1,194,431

533,453,667

650,174,465

2,415,082

4,949,210

1,190,189

11,925,547

50,011,286

2,415,082

16,471,872

2,384,620

545,379,214

700,185,751

(35,242,283)

524,107,640

2,415,082

16,471,872

2,384,620

545,379,214

664,943,468

29

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Combining Schedule of Statement of Financial Position (continued)

September 30, 2015

Cementos

Progreso,

S.A. and

Subsidiaries

US$

Shareholders Equity:

Paid-in capital

Share Premium

Revaluation surplus

Hedging reserve

Legal reserve

Retained earnings

Cumulative translation adjustment

Equity attributable to

shareholders of the Group

Non-controlling interest

Total equity

57,580,790

75,836,141

417,786,786

(65,320)

39,678,162

261,117,641

2,344,313

854,278,513

854,278,513

1,504,452,978

Inversiones

Sampdoria,

S.A. and

Subsidiaries

US$

16,617,770

2,139,477

4,271,647

37,487,478

144,506

60,660,878

4,740,387

65,401,265

115,412,551

Sub-total

US$

74,198,560

75,836,141

419,926,263

(65,320)

43,949,809

298,605,119

2,488,819

914,939,391

4,740,387

919,679,778

1,619,865,529

Eliminations

US$

(1,693,185)

(1,693,185)

(1,693,185)

(36,935,468)

Total

combined

US$

74,198,560

75,836,141

419,926,263

(65,320)

43,949,809

296,911,934

2,488,819

913,246,206

4,740,387

917,986,593

1,582,930,061

30

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Combining Schedule of Statement of Income

For the Nine-month period ended September 30, 2015

Cementos

Progreso,

S.A. and

Subsidiaries

US$

Net sales

Cost of sales

Gross profit

Inversiones

Sampdoria,

S.A. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

Total

combined

US$

422,689,161

(231,191,708)

191,497,453

111,848,611

(99,407,112)

12,441,499

534,537,772

(330,598,820)

203,938,952

(63,362,291)

60,813,055

(2,549,236)

471,175,481

(269,785,765)

201,389,716

Gain on disposal of assets

Administrative and selling expenses

Operating profit

1,137,404

(44,640,409)

147,994,448

281,329

(2,638,089)

10,084,739

1,418,733

(47,278,498)

158,079,187

2,549,236

-

1,418,733

(44,729,262)

158,079,187

Net finance costs

Profit before income tax

(3,734,909)

144,259,539

(575,569)

9,509,170

(4,310,478)

153,768,709

(4,310,478)

153,768,709

Income tax:

Current

Deferred, benefit

Income tax expenses

Net profit for the year

(28,783,891)

29,402

(28,754,489)

115,505,050

(2,124,652)

43,110

(2,081,542)

7,427,628

(30,908,543)

72,512

(30,836,031)

122,932,678

(30,908,543)

72,512

(30,836,031)

122,932,678

Attributable to:

Group shareholders

Non-controlling interest

Net profit for the year

115,505,050

115,505,050

7,098,790

328,838

7,427,628

122,603,840

328,838

122,932,678

122,603,840

328,838

122,932,678

31

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

14

Consolidation Schedules of Financial Statements Cementos Progreso, S.A. and Subsidiaries

Consolidation Schedule of Statement of Financial Position

September 30, 2015

Cementos

Progreso,

S.A.

US$

Assets

Current:

Cash and cash equivalents

Held-to-maturity investments

Accounts receivable, net

Inventories, net

Prepaid expenses

Total current assets

Non-current:

Investments in equity-accounted

investees

Property, plant and equipment, net

Other accounts receivable

Other assets

Total non-current assets

Agregs

International

Corp. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

Total

consolidated

US$

38,645,715

807,762

61,086,935

37,092,279

412,867

138,045,558

807,258

4,289,928

5,638,905

21,850

10,757,941

39,452,973

807,762

65,376,863

42,731,184

434,717

148,803,499

(754,346)

(754,346)

39,452,973

807,762

64,622,517

42,731,184

434,717

148,049,153

19,000,000

1,324,136,210

1,302,842

8,394,117

1,352,833,169

1,490,878,727

22,761,546

2,623,572

25,385,118

36,143,059

19,000,000

1,346,897,756

1,302,842

11,017,689

1,378,218,287

1,527,021,786

(19,000,000)

(1,302,842)

(1,511,620)

(21,814,462)

(22,568,808)

1,346,897,756

9,506,069

1,356,403,825

1,504,452,978

32

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Consolidation Schedule of Statement of Financial Position (continued)

September 30, 2015

Liabilities and Shareholders Equity

Current liabilities:

Current portion of long-term debt

Accounts payable and accrued expenses

Dividends payable

Income tax payable

Total current liabilities

Non-current liabilities:

Long-term bank loans and notes

payable, less current portion

Other accounts payable

Provision for labor indemnities

Deferred tax liability

Total non-current liabilities

Total liabilities

Cementos

Progreso,

S.A.

US$

Agregs

International

Corp. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

Total

consolidated

US$

4,365,094

82,719,840

19,996,013

2,625,177

109,706,124

7,501,303

267,717

7,769,020

4,365,094

90,221,143

19,996,013

2,892,894

117,475,144

(754,346)

(754,346)

4,365,094

89,466,797

19,996,013

2,892,894

116,720,798

517,576,530

11,061,264

528,637,794

638,343,918

3,160,044

1,302,842

461,398

1,194,431

6,118,715

13,887,735

520,736,574

1,302,842

11,522,662

1,194,431

534,756,509

652,231,653

(1,302,842)

(1,302,842)

(2,057,188)

520,736,574

11,522,662

1,194,431

533,453,667

650,174,465

33

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Consolidation Schedules of Financial Statements Cementos Progreso, S.A. and Subsidiaries (continued)

Consolidation Schedule of Statement of Financial Position (continued)

September 30, 2015

Cementos

Progreso,

S.A.

US$

Shareholders Equity:

Paid-in capital

Share Premium

Revaluation surplus

Contributions to Capitalize

Hedging reserve

Legal reserve

Retained earnings

Cumulative translation adjustment

Total equity

57,580,790

75,836,141

417,786,786

(65,320)

39,618,293

260,007,532

1,770,587

852,534,809

1,490,878,727

Agregs

International

Corp. and

Subsidiaries

US$

4,852,685

5,000,000

1,421,169

10,685,544

295,926

22,255,324

36,143,059

Sub-total

US$

62,433,475

75,836,141

417,786,786

5,000,000

(65,320)

41,039,462

270,693,076

2,066,513

874,790,133

1,527,021,786

Eliminations

US$

(4,852,685)

(5,000,000)

(1,361,300)

(9,575,435)

277,800

(20,511,620)

(22,568,808)

Total

consolidated

US$

57,580,790

75,836,141

417,786,786

(65,320)

39,678,162

261,117,641

2,344,313

854,278,513

1,504,452,978

34

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to the Combined Financial Statements

Consolidation Schedules of Financial Statements Cementos Progreso, S.A. and Subsidiaries (continued)

Consolidation Schedule of Statement of Income

For the Nine-month period ended September 30, 2015

Cementos

Progreso,

S.A.

US$

Net sales

Cost of sales

Gross profit

Agregs

International

Corp. and

Subsidiaries

US$

Sub-total

US$

Eliminations

US$

(4,143,655)

4,143,655

-

Total

consolidated

US$

396,975,756

(207,682,403)

189,293,353

29,857,060

(27,652,960)

2,204,100

426,832,816

(235,335,363)

191,497,453

422,689,161

(231,191,708)

191,497,453

Gain on disposal of assets

Administrative and selling expenses

Operating profit

1,129,801

(43,494,815)

146,928,339

7,603

(1,145,594)

1,066,109

1,137,404

(44,640,409)

147,994,448

1,137,404

(44,640,409)

147,994,448

Net finance costs

Profit before income tax

(3,519,921)

143,408,418

(214,988)

851,121

(3,734,909)

144,259,539

(3,734,909)

144,259,539

Income tax:

Current

Deferred, benefit

Income tax expenses

Net profit for the year

(28,514,125)

(28,514,125)

114,894,293

(269,766)

29,401

(240,365)

610,756

(28,783,891)

29,401

(28,754,490)

115,505,049

(28,783,891)

29,401

(28,754,490)

115,505,049

35

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

15

Operating Segment

The Group has four reportable segments, as described below, which are the Groups

strategic business units. The strategic business units offer different products and

services, and are managed separately because they require different technology and

marketing strategies. For each of the strategic business units, the Groups CFO reviews

internal management reports on a monthly basis.

The following summary describes the operations in each of the Groups reportable

segments:

Cement: Includes the production and distribution of cement and clinker (raw material

for the production of cement).

Ready-mix Concrete: Includes the production and distribution of ready-mix concrete.

Lime: Includes the production and distribution of lime.

Aggregates: Includes the production and distribution of aggregates.

Other operations include the production and sale of paper sacks used to bag cement,

lime, and dry mix products. None of these segments meet any of the quantitative

thresholds for determining reportable segments.

Information regarding the results of each reportable segment is included in the

following two pages. Performance is measured based on segment profit before income

tax, as included in the internal management reports that are reviewed by the Groups

CFO. Segment profits are used to measure performance as management believes that

such information is the most relevant in evaluating the results of certain segments

relative to other entities that operate within these industries. Inter-segment pricing is

determined on an arms length basis.

36

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Information about Reportable Segments

Nine-month period ended September 30, 2015

(amounts in US dollars)

Cement

Ready-mix

concrete

Lime

Aggregates

Other

External revenue

Inter-segments revenues

Total combined revenue

344,785,021

26,463,385

371,248,406

72,857,017

3,387,256

76,244,273

22,950,496

22,950,496

16,511,533

13,345,527

29,857,060

14,071,414

7,826,843

21,898,257

Finance income

Finance costs

Net finance cost

Depreciation

Profit before income tax

624,324

(4,072,817)

(3,448,493)

(18,046,555)

139,667,862

111,249

(808,653)

(697,404)

(1,727,644)

5,560,064

(3,976,826)

6,279,887

25,668

(240,656)

(214,988)

(2,253,202)

851,121

32,336,479

3,702,523

10,757,943

11,818,892

18,404,671

20,971,060

8,918,301

4,679,201

276,706

3,845,832

1,018,760

22,761,546

6,060,777

7,769,019

6,118,712

Eliminations

Total

(1)

Current assets

110,499,260

Property, plant, and

equipment, net

1,348,470,287

Other non-current assets

4,987,670

Current liabilities

95,773,106

Non-current liabilities

528,730,128

(51,023,011)

(51,023,011)

471,175,481

471,175,481

814,400

(5,124,878)

(4,310,478)

(26,470,640)

153,768,709

15,113,427

(12,841,088)

159,568,544

6,977,340

231,837

4,046,325

1,900,723

(1,307,410)

(12,841,088)

(1,307,410)

1,394,707,266

28,654,251

119,564,254

545,379,214

53,159

(2,752)

50,407

(466,413)

1,409,775

(1) The information included in this column relates to the eliminations of transactions between the companies included in the

combined financial information.

37

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Information about Reportable Segments (continued)

Nine-month period ended September 30, 2014

(amounts in US dollars)

Cement

Ready-mix

concrete

Lime

Aggregates

Other

Eliminations

Total

(1)

External revenue

Inter-segments revenues

Total combined revenue

298,410,438

28,335,347

326,745,785

59,354,138

59,354,138

24,687,434

24,687,434

Finance income

Finance costs

Net finance cost

Depreciation

Profit before income tax

1,235,421

(3,279,693)

(2,044,272)

(15,337,256)

125,371,240

155,231

(864,049)

(708,818)

(2,068,252)

856,890

(3,869,050)

5,144,648

24,781,116

5,092,069

10,675,286

17,839,329

(6,707,228)

195,784,157

10,063,713

18,326,148

17,644,606

8,529,023

8,622,397

263,344

2,774,343

927,980

19,784,457

5,847,735

9,111,239

7,632,754

2,787,497

254,234

4,577,493

843,381

(6,707,228)

-

1,203,982,033

28,029,632

83,614,072

559,518,569

Current assets

144,103,585

Property, plant, and

equipment, net

1,162,723,969

Other non-current assets

3,338,171

Current liabilities

56,213,619

Non-current liabilities

541,585,431

3,244,947

2,426,516

5,671,463

19,898

(86,478)

(66,580)

(347,994)

(51,655)

12,353,824

8,653,453

21,007,277

214,882

(166,994)

47,888

(819,343)

625,532

(39,415,316)

(39,415,316)

398,050,781

398,050,781

1,625,432

(4,397,214)

(2,771,782)

(22,441,895)

131,946,655

(1) The information included in this column relates to the eliminations of transactions between the companies included in the

combined financial information.

38

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Condensed Combined Statements of Comprehensive Income Quarterly Reporter

For the three month

periods ended

September

September

30, 2015

30, 2014

US$

US$

For the nine-month

periods ended

September

September

30, 2015

30, 2014

US$

US$

Net sales

Cost of sales (a)

Gross profit

156,089,026

(90,298,980)

65,790,046

134,008,640

(76,200,448)

57,808,192

471,175,481

(269,785,765)

201,389,716

398,050,781

(227,007,264)

171,043,517

Gain on disposal of assets

Administrative and selling expenses

Operating profit

280,119

(15,201,560)

50,868,605

460,537

(12,367,436)

45,901,293

1,418,733

(44,729,262)

158,079,187

2,295,105

(38,620,185)

134,718,437

432,569

(2,237,446)

(1,804,877)

49,063,728

1,051,936

(1,385,546)

(333,610)

45,567,683

814,400

(5,124,878)

(4,310,478)

153,768,709

1,625,432

(4,397,214)

(2,771,782)

131,946,655

(10,326,291)

15,083

(10,311,208)

38,752,520

(9,030,356)

60,461

(8,969,895)

36,597,788

(30,908,543)

72,512

(30,836,031)

122,932,678

(27,847,519)

176,164

(27,671,355)

104,275,300

(9,206,021)

(7,928,355)

(26,470,640)

(22,441,895)

Finance income

Finance costs

Net finance costs

Profit before income tax

Income tax:

Current

Deferred benefit

Net profit for the period

(a) Include depreciation

39

Cementos Progreso, S.A., Subsidiaries and Related Companies

Notes to Condensed Combined Interim Financial Statements

Condensed Combined Statements of Comprehensive Income Quarterly Reporter (continued)

For the three month

periods ended

September

September

30, 2015

30, 2014

US$

US$

Net profit for the period

38,752,520

36,597,788

For the nine-month

periods ended

September

September

30, 2015

30, 2014

US$

US$

122,932,678

104,275,300

Other comprehensive income for the period

Changes in fair value of hedging instruments

Depreciation for the period of revalued equipment

transferred to non-controlling interest

Increase in revaluation surplus

Foreign currency translations differences foreign

operations

Total other comprehensive income for the period

Total comprehensive income for the period

(69,201)

3,402,949

(5,864,662)

(2,596,234)

36,156,286

10,842,376

10,845,159

47,442,947

(8,614,236)

(5,345,808)

117,586,870

16,415,394

16,478,496

120,753,796

Total comprehensive income attributable to:

Group shareholders

Non-controlling interest

Total comprehensive income for the period

34,938,539

1,217,747

36,156,286

47,287,713

155,234

47,442,947

116,179,895

1,406,975

117,586,870

120,356,964

396,832

120,753,796

(65,320)

2,783

(65,320)

(69,201)

3,402,949

63,102

-

40

Vous aimerez peut-être aussi

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosD'EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosPas encore d'évaluation

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaPas encore d'évaluation

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryPas encore d'évaluation

- Case 1 New (Signal Cable Company)Document6 pagesCase 1 New (Signal Cable Company)nicole100% (2)

- The Economist UK Edition - May 29 2021Document88 pagesThe Economist UK Edition - May 29 2021linh myPas encore d'évaluation

- Bilderberg Group Extra PhotosDocument215 pagesBilderberg Group Extra PhotosbilderbergboysPas encore d'évaluation

- MDRX10 Q 2Document63 pagesMDRX10 Q 2mrjohnsePas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Name:: Account Holder: Opening Balance 0.00 EURDocument1 pageName:: Account Holder: Opening Balance 0.00 EUR13KARAT0% (1)

- Cielo S.A. and SubsidiariesDocument81 pagesCielo S.A. and Subsidiariesb21t3chPas encore d'évaluation

- 2015 3rd Quarter Financial ReportDocument5 pages2015 3rd Quarter Financial ReportNur Md Al HossainPas encore d'évaluation

- FLBHD 2015 Q2 Financial ReportDocument4 pagesFLBHD 2015 Q2 Financial ReportYan KhaiPas encore d'évaluation

- NBP Unconsolidated Financial Statements 2015Document105 pagesNBP Unconsolidated Financial Statements 2015Asif RafiPas encore d'évaluation

- Integrated Micro-Electronics: Q2 Results (Press Release)Document17 pagesIntegrated Micro-Electronics: Q2 Results (Press Release)BusinessWorldPas encore d'évaluation

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванPas encore d'évaluation

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document71 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chPas encore d'évaluation

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document58 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3ch0% (1)

- Financial Report Financial ReportDocument16 pagesFinancial Report Financial Report8001800Pas encore d'évaluation

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlPas encore d'évaluation

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesPas encore d'évaluation

- 5173 PZ Cussons Half-Year Nov 2013 Financial Statements January 2014Document1 page5173 PZ Cussons Half-Year Nov 2013 Financial Statements January 2014Oladipupo Mayowa PaulPas encore d'évaluation

- CAT: Annual ReportDocument131 pagesCAT: Annual ReportBusinessWorldPas encore d'évaluation