Académique Documents

Professionnel Documents

Culture Documents

AKPK-Money $ense PDF

Transféré par

Ting Sie Kim0 évaluation0% ont trouvé ce document utile (0 vote)

182 vues20 pagesGetting Smart with Your Money - Getting out of financial trouble Sign of financial troubles: credit card -pay the minimum balance, over credit limit, take cash advance loans -take another loan to cover first loans saving - no saving, or use it all Expenses - depend on part time job, or always asking when is the payday.

Description originale:

Titre original

AKPK-Money $ense.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentGetting Smart with Your Money - Getting out of financial trouble Sign of financial troubles: credit card -pay the minimum balance, over credit limit, take cash advance loans -take another loan to cover first loans saving - no saving, or use it all Expenses - depend on part time job, or always asking when is the payday.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

182 vues20 pagesAKPK-Money $ense PDF

Transféré par

Ting Sie KimGetting Smart with Your Money - Getting out of financial trouble Sign of financial troubles: credit card -pay the minimum balance, over credit limit, take cash advance loans -take another loan to cover first loans saving - no saving, or use it all Expenses - depend on part time job, or always asking when is the payday.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 20

Money $ense

Getting Smart with Your Money

AKPK Agensi Kaunseling dan Pengurusan

Kredit

Kenapa perlu Perancangan Kewangan (PK)?

Ketua Kumpulan, sila pinjam buku ini di Pusat KoK

pada hari Isnin, 8-12-2014

5 steps in financial planning

Nilai diri anda sekarang

Tetapkan matlamat

Buat Pelan kewangan

Laksana pelan K

Pantau pelan K dan nilai semula

Peringkat umur keperluan wang berlainan

Time Value of Money money grow with time

Save 10K, for 10years, 5% --- RM16,289

Power of compounding interest

Bab 2

Set your financial goal

Write down your goal buy car after grad

Break goal into ST, MT and LT goal

Calculate your Net Worth (NW)

NW=Asset-Liabilities

Track your spending

Living within means

Chapter 3: Financial Products and

Sevices

Banking: SA, CA,

PIDM insures your deposit up to 250K

FMB settle disputes bet you and your financial

provider

Islamic Banking

Internet Banking

Chapter 4: Building Wealth

Saving habit-automatic

Increase your NW

Risk and return

Dont put your egg in one basket

Types of investments: Cash, shares, unit trust

funds, property, bond

Financial Scams

Ponzi Scheme: Pyramid money scheme

Nigerian Scheme

Not easy to get money no easy money

Chapte 5-insurance

Protection for something bad that can happen

How does insurance works?

Types of insurance: life, term life, endownment

(protection+saving), medical and health

General Insurance motor, house, travel dan

property

Takaful shariah principles, aqad

Before buying insurance:

Know the diff types

Coverage

Conditions (Syarat-syarat)

Premium

Claim procedure police report

Chapter 6: borrowing basics

Credit card-ask: do you need it?

Money lenders-licensed, along

PTPTN

Personal loan

Car loan: Hire Purchase

Housing loan

CCRIS-central credit reference info system

Chapter 7: Living your life

Your student loan

Income tax IRB

Buying car

Buying house location

Mariages

Retirement

Balanced life money is not everythings!

Chapter 8: Getting out of financial

trouble

Sign of financial troubles:

Credit card pay the minimum balance, over credit

limit, take cash advance

Loans take another loan to cover first loans

Saving no saving, or use it all

Expenses depend on part time job, or always

asking when is the payday

Ignorance dont want to discuss with people

Where to find help?

Go to AKPK

Financial education

Financial counselling

Debt Management Programme (DMP)

www.akpk.org.my

Appendixes

Pg 129 invest now, 15K, at 55 you will have

300K (at 10% interest amanah saham)

Vous aimerez peut-être aussi

- Handbook On CreditDocument185 pagesHandbook On CreditPanna100% (1)

- Young Gay Boys Free Gay Porn Pics and Gay Sex Movies With Young Nude Gay Boys Only!Document10 pagesYoung Gay Boys Free Gay Porn Pics and Gay Sex Movies With Young Nude Gay Boys Only!anon-19879050% (2)

- Aus June WebDocument52 pagesAus June WebStudy Breaks StevePas encore d'évaluation

- Bear Mais Magazine 59 - PreviewDocument20 pagesBear Mais Magazine 59 - Previewicimdekiayi25% (4)

- Bent Mag-Oct 2008Document80 pagesBent Mag-Oct 2008EcarvalhoStad0% (4)

- Dna 204 2017.01Document112 pagesDna 204 2017.01marcoscalbarrosPas encore d'évaluation

- Study Breaks Magazine - April 2013, San AntonioDocument38 pagesStudy Breaks Magazine - April 2013, San AntonioStudy Breaks StevePas encore d'évaluation

- "Completely Stripped" Press Release For Art Anthology From Bruno GmunderDocument1 page"Completely Stripped" Press Release For Art Anthology From Bruno GmunderRené Capone0% (1)

- Sexy Full Abs Naked PDFDocument4 pagesSexy Full Abs Naked PDFKenyan0% (1)

- Introduction To Management AKW103Document8 pagesIntroduction To Management AKW103Ting Sie KimPas encore d'évaluation

- Attitude - 2019-05Document164 pagesAttitude - 2019-05Daniel SilvaPas encore d'évaluation

- Bed Sheets 31Document98 pagesBed Sheets 31sabina5045100% (1)

- DNA Acts of DesireDocument4 pagesDNA Acts of DesireMarijan Begic0% (1)

- Herstein Abstract Algebra Student's Solution ManualDocument69 pagesHerstein Abstract Algebra Student's Solution ManualPaul Benedict91% (33)

- DNA Magazine - Issue 253 - 23 January 2021Document127 pagesDNA Magazine - Issue 253 - 23 January 2021Sỹ NguyễnPas encore d'évaluation

- BARtab March 2011Document32 pagesBARtab March 2011Scott W. WazlowskiPas encore d'évaluation

- Dna 207 2017.04Document106 pagesDna 207 2017.04marcoscalbarrosPas encore d'évaluation

- Next Door Taboo Update - Spin The Bottle - Next Door Studios Porn VideosDocument2 pagesNext Door Taboo Update - Spin The Bottle - Next Door Studios Porn Videosalessandro regiani50% (2)

- Lavender Issue 390Document72 pagesLavender Issue 390Lavender Magazine100% (1)

- CELEBRITYDocument1 pageCELEBRITYbentleyhenry5555Pas encore d'évaluation

- Alphas Magazine 009Document81 pagesAlphas Magazine 009Drakov SergeyPas encore d'évaluation

- Gay Times 2014-07.bak PDFDocument148 pagesGay Times 2014-07.bak PDFWong Lee BengPas encore d'évaluation

- DNA Magazine #090Document84 pagesDNA Magazine #090marcoscalbarrosPas encore d'évaluation

- Dna 192 2016.01Document116 pagesDna 192 2016.01marcoscalbarrosPas encore d'évaluation

- Adon MagazineDocument70 pagesAdon MagazinemarcoscalbarrosPas encore d'évaluation

- Addictions & Porn - For Men OnlyDocument3 pagesAddictions & Porn - For Men OnlyDavid Moore, PhD CDP100% (1)

- 730N-RHR Users GuideDocument213 pages730N-RHR Users GuideSteve FaidleyPas encore d'évaluation

- Metro Weekly - 01-14-16 - Pre-MAL PupsDocument48 pagesMetro Weekly - 01-14-16 - Pre-MAL PupsMetroWeeklyPas encore d'évaluation

- Volume 43, Issue 23 - June 8, 2012Document100 pagesVolume 43, Issue 23 - June 8, 2012BladePas encore d'évaluation

- AKPK Power - Chapter 2 - Borrowing BasicsDocument20 pagesAKPK Power - Chapter 2 - Borrowing BasicsEncik Anif100% (1)

- AKPK - Power Eng Appendix and Test AnswerDocument16 pagesAKPK - Power Eng Appendix and Test AnswerEncik AnifPas encore d'évaluation

- AKPK Power - Chapter 6 - Managing Your DebtsDocument24 pagesAKPK Power - Chapter 6 - Managing Your DebtsEncik Anif100% (2)

- 2010 NakeycyclistsDocument13 pages2010 NakeycyclistsgregglesrocksPas encore d'évaluation

- AKPK Power - Chapter 3 - Wise Usage of Credit CardDocument20 pagesAKPK Power - Chapter 3 - Wise Usage of Credit CardEncik AnifPas encore d'évaluation

- Mpu3323 Mceb 113 Answer BookletDocument2 pagesMpu3323 Mceb 113 Answer BookletYogashiniPas encore d'évaluation

- Catálogo PPU 2018Document26 pagesCatálogo PPU 2018adriyleo87Pas encore d'évaluation

- State Magazine, April 2014Document44 pagesState Magazine, April 2014State MagazinePas encore d'évaluation

- Nofap Hosts ListDocument11 pagesNofap Hosts ListBarry SmithPas encore d'évaluation

- DiyaMagazine May2008sDocument92 pagesDiyaMagazine May2008srkolluri100% (3)

- Sora198010 - Profile On True NudistsDocument1 pageSora198010 - Profile On True NudistsAnimashaun BoluwatifePas encore d'évaluation

- Property Capital Gains Tax 2013Document145 pagesProperty Capital Gains Tax 2013Ernest O'BrienPas encore d'évaluation

- Van Wylde Halle Hayes Roommates With Fuck Buddy BenefitsDocument43 pagesVan Wylde Halle Hayes Roommates With Fuck Buddy BenefitsClaudiu DănilăPas encore d'évaluation

- Bear Mais Magazine 55 - PreviewDocument20 pagesBear Mais Magazine 55 - Previewicimdekiayi0% (2)

- Gallery-Settings May 24, 2022Document2 pagesGallery-Settings May 24, 2022Knight-Ally89Pas encore d'évaluation

- Peugeot 206 BrochureDocument11 pagesPeugeot 206 BrochureKBEscalonaPas encore d'évaluation

- Lavender 392Document199 pagesLavender 392Lavender MagazinePas encore d'évaluation

- WPS Results Table Amsterdam 2013Document18 pagesWPS Results Table Amsterdam 2013WPSdatabase75% (4)

- LunaCovenn Webcam Show SexforTokensDocument1 pageLunaCovenn Webcam Show SexforTokensPelunmi IyanuPas encore d'évaluation

- CFP PresentationDocument38 pagesCFP PresentationSumanjeet DasPas encore d'évaluation

- Managing Your Small Business Finances: Use Financial Management Skills To Help Your BusinessDocument17 pagesManaging Your Small Business Finances: Use Financial Management Skills To Help Your BusinessMilds LadaoPas encore d'évaluation

- Group 1 - CQ-CL-03 Final Group Presentation.Document43 pagesGroup 1 - CQ-CL-03 Final Group Presentation.Dilru RasanjalikaPas encore d'évaluation

- A Report On Bank Loan Product HDFC (Personal Loan)Document11 pagesA Report On Bank Loan Product HDFC (Personal Loan)Kunal YadavPas encore d'évaluation

- Document For Lesson 4 (Educ 10)Document8 pagesDocument For Lesson 4 (Educ 10)Salazar KarenPas encore d'évaluation

- Devendra Singh Yadav-Project ReportDocument50 pagesDevendra Singh Yadav-Project Reporthemant kandpalPas encore d'évaluation

- Financial Planning For Young InvestorsDocument44 pagesFinancial Planning For Young InvestorsSitaramanjaneyulu ManthaPas encore d'évaluation

- NHUNG - C 2 - Part 1-Personal Financial Services - SVDocument8 pagesNHUNG - C 2 - Part 1-Personal Financial Services - SVHoàng NhiPas encore d'évaluation

- Consumer CreditDocument57 pagesConsumer Creditmanik_mittal3Pas encore d'évaluation

- Savings Schemes of BanksDocument36 pagesSavings Schemes of BanksRebecca Mendes100% (1)

- Financial LiteracyDocument18 pagesFinancial LiteracyStephanie Cartajenas SagapePas encore d'évaluation

- PW - Financial Management For Young AdultsDocument26 pagesPW - Financial Management For Young AdultsDanielPas encore d'évaluation

- Intro & SwotDocument26 pagesIntro & SwotPuneet Singh DhaniPas encore d'évaluation

- InnerView2017 18Document204 pagesInnerView2017 18Ting Sie KimPas encore d'évaluation

- 20190226141832SGS Postgraduate Student HandbookDocument52 pages20190226141832SGS Postgraduate Student HandbookTing Sie KimPas encore d'évaluation

- Ib Educator and Leadership Certificates: University DirectoryDocument126 pagesIb Educator and Leadership Certificates: University DirectoryJason FranklinPas encore d'évaluation

- Familiarization of AICB Online Exam - V4 PDFDocument62 pagesFamiliarization of AICB Online Exam - V4 PDFTing Sie KimPas encore d'évaluation

- Statistical TableDocument10 pagesStatistical TableTing Sie KimPas encore d'évaluation

- 20200412085917second Semester 20192020Document2 pages20200412085917second Semester 20192020Ting Sie KimPas encore d'évaluation

- Guidelines-For-Msc New PDFDocument1 pageGuidelines-For-Msc New PDFTing Sie KimPas encore d'évaluation

- 15appliedscience PDFDocument297 pages15appliedscience PDFTing Sie KimPas encore d'évaluation

- Project Submission PDFDocument1 pageProject Submission PDFTing Sie KimPas encore d'évaluation

- MSC in Statistics: Project Registration FormDocument1 pageMSC in Statistics: Project Registration FormTing Sie KimPas encore d'évaluation

- Pigeon HoleDocument12 pagesPigeon HoleTing Sie KimPas encore d'évaluation

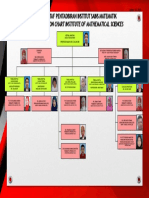

- Carta Pentadbiran Dan Sokongan 2020-Updated 1.10.2020 - WEBSITE PDFDocument1 pageCarta Pentadbiran Dan Sokongan 2020-Updated 1.10.2020 - WEBSITE PDFTing Sie KimPas encore d'évaluation

- Application For Postgraduate Programme For Semester 1 (September) 2020/2021 SessionDocument31 pagesApplication For Postgraduate Programme For Semester 1 (September) 2020/2021 SessionTing Sie KimPas encore d'évaluation

- HPW 102 Latihan AnsDocument12 pagesHPW 102 Latihan AnsTing Sie KimPas encore d'évaluation

- 20200602181256kalender Akademik Siswazah 20201 New 2Document2 pages20200602181256kalender Akademik Siswazah 20201 New 2Ting Sie KimPas encore d'évaluation

- 20190219144538second Semester 20192020 PDFDocument1 page20190219144538second Semester 20192020 PDFNafis SolehPas encore d'évaluation

- Group Rings For Communications: Ted HurleyDocument32 pagesGroup Rings For Communications: Ted HurleyTing Sie KimPas encore d'évaluation

- Smart Luggage - Global Sample ReportDocument21 pagesSmart Luggage - Global Sample ReportTing Sie KimPas encore d'évaluation

- 20200508152831TUITION FEE LocalDocument8 pages20200508152831TUITION FEE LocalTing Sie KimPas encore d'évaluation

- Tutorial4 Que PDFDocument1 pageTutorial4 Que PDFTing Sie KimPas encore d'évaluation

- L 1Document52 pagesL 1Ting Sie KimPas encore d'évaluation

- Bachelor of Science 2014Document225 pagesBachelor of Science 2014Ting Sie Kim0% (1)

- Tutorial 3 Suggested AnswerDocument9 pagesTutorial 3 Suggested AnswerTing Sie KimPas encore d'évaluation

- Panduan Rak Phs April 2016Document16 pagesPanduan Rak Phs April 2016Ting Sie KimPas encore d'évaluation

- Akw 104Document8 pagesAkw 104Ting Sie KimPas encore d'évaluation