Académique Documents

Professionnel Documents

Culture Documents

Gatt Declaration For Import

Transféré par

raja0 évaluation0% ont trouvé ce document utile (0 vote)

209 vues1 pageThis document is a declaration form that importers must fill out for goods being imported into the country. It requests information about the importer, supplier, description of goods, country of origin, shipment details, invoice, payment terms, valuation method, costs not included in the invoice price, and a declaration that the information provided is complete and accurate. The customs official may not accept the declared value and will provide reasons for any alternative value assessed, along with reference to previous rulings. Importers must submit this form in duplicate with the original bill of entry.

Description originale:

gatt

Titre original

Gatt Declaration for Import

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document is a declaration form that importers must fill out for goods being imported into the country. It requests information about the importer, supplier, description of goods, country of origin, shipment details, invoice, payment terms, valuation method, costs not included in the invoice price, and a declaration that the information provided is complete and accurate. The customs official may not accept the declared value and will provide reasons for any alternative value assessed, along with reference to previous rulings. Importers must submit this form in duplicate with the original bill of entry.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

209 vues1 pageGatt Declaration For Import

Transféré par

rajaThis document is a declaration form that importers must fill out for goods being imported into the country. It requests information about the importer, supplier, description of goods, country of origin, shipment details, invoice, payment terms, valuation method, costs not included in the invoice price, and a declaration that the information provided is complete and accurate. The customs official may not accept the declared value and will provide reasons for any alternative value assessed, along with reference to previous rulings. Importers must submit this form in duplicate with the original bill of entry.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

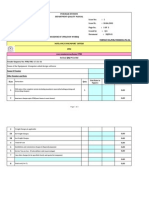

DECLARATION FORM

(See Rule 10 of Customs Valuation Rules 1988)

NOTE : This Declaration shall not be required for goods imported as passenger's Baggage, goods, imported for personal

use upto Value Rs. 10001- samples of no commercial value or where the goods are subject to specific rate of duty.

Importer's Name and address:

2

Supplier's Name and address:

Name and address of the agent, if any:

Description of goods:

Country of origion :

6

7

Port of shipment:

AWBI BL Number and date

IGM Number and date:

Contract number and date:

10

11

Nature of transaction (sale, consignment, hire, gift, etc.)

Invoice number and date:

12

Invoice value:

13

Terms of payment:

14

Currency of payment:

15

Exchange rate:

16

Terms of delivery

17

18

Relationship between buyer and seller [Rule 2(2)]

If related, what is the basis of deClarevalue:

19

Conditions or restriction attached with the sale [RULE 4(2)]

20

Valuation method application (See Rule 4 to 8)

21

Cost and services not included in the invoice value (Rule9)

(a)

Brokerage and Commissions:

(b)

Cost of containers:

(c)

Packing cost:

(d)

Cost of goods and services supplied by the buyer:

(e)

Royalties and licencefees:

(f)

Value of proceeds which accure to seller:

(g)

Freight:

(h)

Insurance:

(i)

Loading, Unloading, handling charges:

U)

Landing charges:

(k)

Other payments, if any:

22.

Assessable value Rs. :

23.

Previous imports of identical 1similar goods, if any:

24.

(a)

Bill of Entry Number and date:

(b)

IGM Number and date:

Any other relevant information (attach separate sheet, if necessary) :

DECLARATION

I/We hereby declare that the information furnished above is true, completed & correct in every respect.

I/We also undertake to bring to the notice of proper officer any particulars which subsequently come to my1

our knowledge which will have a bearing on valuation.

Place:

Date:

Signature of Importer

FOR CUSTOMS HOUSE USE:

1.

2.

3.

4.

5.

Note: 1.

2.

Bill of Entry Number and Date:

Valuation Methods applied (See Rules 4 to 8) :

If declared value not accepted, brief reasons:

Reference number and date of any previous decision / ruling:

Value assessed:

A.a. Assistant Collector. .

Declaration form in duplicate duly signed by the importer should be attached with original Bill of Entry.

In case Order-in-Original (Speaking Order) is required, Importer / CHA are requested to apply within 30

days. No request on this account will be considered after 30 days.

Vous aimerez peut-être aussi

- Gatt Declaration FormDocument1 pageGatt Declaration FormUtsav Ethan PatelPas encore d'évaluation

- GATT Declaration FormDocument2 pagesGATT Declaration FormAmandeep WaliaPas encore d'évaluation

- Gatt DeclarationDocument2 pagesGatt Declarationrupeshkumar084Pas encore d'évaluation

- Form A With DeclarationDocument3 pagesForm A With DeclarationRohish MehtaPas encore d'évaluation

- Specimen ContractsDocument8 pagesSpecimen ContractsK59 Pham Nguyen AnPas encore d'évaluation

- Decleration LetterDocument1 pageDecleration LetterRT WorkPas encore d'évaluation

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharPas encore d'évaluation

- Icc Model International Sale Contract - DetailsDocument8 pagesIcc Model International Sale Contract - Detailsvt010% (1)

- Section III. Bid Data Sheet (W)Document5 pagesSection III. Bid Data Sheet (W)tpromaPas encore d'évaluation

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikPas encore d'évaluation

- Chapter 8Document35 pagesChapter 8Ankush KhuranaPas encore d'évaluation

- Name of The Equipment:Computer Aided Design Software: PartucularsDocument3 pagesName of The Equipment:Computer Aided Design Software: PartucularsemmanuelfrancisPas encore d'évaluation

- Sale and Purchase AgreementDocument7 pagesSale and Purchase AgreementNaval Gupta100% (2)

- Name of The Equipment: Computer Aided Design SoftwareDocument4 pagesName of The Equipment: Computer Aided Design SoftwareemmanuelfrancisPas encore d'évaluation

- SBD - 13 - 2022 Supply and Fix Market ShadesDocument39 pagesSBD - 13 - 2022 Supply and Fix Market Shadestanatsa pikiPas encore d'évaluation

- Wa0008.Document7 pagesWa0008.amyashu22Pas encore d'évaluation

- Agreed Terms & Conditions For Purchase: Annexure-IvDocument4 pagesAgreed Terms & Conditions For Purchase: Annexure-IvadihindPas encore d'évaluation

- Tenders LTE BID DOCUMENT EIS Cable Tray Purchase 22-23-063737e4a014909 71300806Document11 pagesTenders LTE BID DOCUMENT EIS Cable Tray Purchase 22-23-063737e4a014909 71300806Ravikumar GurugubelliPas encore d'évaluation

- Documentary Letter of CreditDocument6 pagesDocumentary Letter of CreditFrederic Le Moing100% (1)

- Advance Import PaymentDocument8 pagesAdvance Import PaymentAshish GargPas encore d'évaluation

- Meaning of Invoice : CharacteristicsDocument1 pageMeaning of Invoice : CharacteristicsRiyad AhsanPas encore d'évaluation

- 1agility Rma FormDocument1 page1agility Rma FormJohn Nen BiniPas encore d'évaluation

- Draft ContractDocument15 pagesDraft Contractlinhtln.org.ecPas encore d'évaluation

- The Proper and Complete ProcessDocument3 pagesThe Proper and Complete ProcessKooking JubiloPas encore d'évaluation

- Internet Service Community SchoolsDocument19 pagesInternet Service Community SchoolsRavi Rokaya (Connecting to Technology)Pas encore d'évaluation

- Chapter 4-Key Documents in Import and ExportDocument38 pagesChapter 4-Key Documents in Import and ExportLe Thi Thuy KieuPas encore d'évaluation

- ICC International Sale and Purchase Contract (DRAFT), March 21th 2011Document3 pagesICC International Sale and Purchase Contract (DRAFT), March 21th 2011De Soares100% (1)

- LKOC Finance WorkshopDocument38 pagesLKOC Finance WorkshoprushdhihPas encore d'évaluation

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Mini Dairy Plant Lumbini 2065Document56 pagesMini Dairy Plant Lumbini 2065fdamaPas encore d'évaluation

- Irrigation Tender Manicaland 2023Document55 pagesIrrigation Tender Manicaland 2023tawandaPas encore d'évaluation

- Invitation For Bids For The (Name of Contract)Document19 pagesInvitation For Bids For The (Name of Contract)Ashish BhandariPas encore d'évaluation

- Rfq-Ndma-Qonqoma Water Pan Fencing & Reticulation SystemDocument26 pagesRfq-Ndma-Qonqoma Water Pan Fencing & Reticulation SystempartoneinvestmentPas encore d'évaluation

- Matebelland 2023 Irrigation TenderDocument40 pagesMatebelland 2023 Irrigation TendertawandaPas encore d'évaluation

- Sale and Purchase Agreement SanitizedDocument16 pagesSale and Purchase Agreement SanitizedMichael KarasPas encore d'évaluation

- Instruction To Bidder PDFDocument11 pagesInstruction To Bidder PDFRadhesh100% (1)

- Irrigation Tender Mash East Province 2023Document41 pagesIrrigation Tender Mash East Province 2023tawandaPas encore d'évaluation

- Special Instructions To BiddersDocument18 pagesSpecial Instructions To BiddersCity AspirePas encore d'évaluation

- Letter of Invitation To Tender - Pressure VessDocument12 pagesLetter of Invitation To Tender - Pressure VessAdewalePas encore d'évaluation

- M/o Completed Scheme Under SZ, NA-II.. Relaying Mud Phaska & Making Platform For Water Tank at Staff Quarters D-6, Vasant Kunj...Document3 pagesM/o Completed Scheme Under SZ, NA-II.. Relaying Mud Phaska & Making Platform For Water Tank at Staff Quarters D-6, Vasant Kunj...NavneekPas encore d'évaluation

- Irrigation Tender Mash Central Province 2023Document37 pagesIrrigation Tender Mash Central Province 2023tawandaPas encore d'évaluation

- GDT V Comptroller of GST 2021 SGGSTDocument35 pagesGDT V Comptroller of GST 2021 SGGSTKW LeonPas encore d'évaluation

- LP Special Terms & Conditions R-14 of 23-09-2022Document4 pagesLP Special Terms & Conditions R-14 of 23-09-2022for anyPas encore d'évaluation

- 2 Section II-Bid Data Sheet Lot 3Document8 pages2 Section II-Bid Data Sheet Lot 3Biniam ShawulPas encore d'évaluation

- Sample in QDocument8 pagesSample in QMOHD SUHAILPas encore d'évaluation

- Irrigation Tender Mash West Province 2023Document27 pagesIrrigation Tender Mash West Province 2023tawandaPas encore d'évaluation

- Anexa 5Document20 pagesAnexa 5Marius AdrianPas encore d'évaluation

- Final - TPDDL-ENGG-ENQ-300003400FY20-21 PDFDocument22 pagesFinal - TPDDL-ENGG-ENQ-300003400FY20-21 PDFjattin0% (1)

- Sri Lanka National Shopping ProcedureDocument13 pagesSri Lanka National Shopping ProcedureIndunil Prasanna Bandara WarnasooriyaPas encore d'évaluation

- Int Sale of Goods Long VerDocument12 pagesInt Sale of Goods Long VerAylin GülümPas encore d'évaluation

- India Interstate Regulatory RequirementsDocument18 pagesIndia Interstate Regulatory RequirementsRohit CharpePas encore d'évaluation

- Draft Invoice RulesDocument6 pagesDraft Invoice RulesSandeep KaundinyaPas encore d'évaluation

- Kala TenderDocument17 pagesKala TenderHamed GeramiPas encore d'évaluation

- I. Preparation: The Proper and Complete ProcessDocument6 pagesI. Preparation: The Proper and Complete ProcessRyan OdioPas encore d'évaluation

- 1supply Deliverty of 173 Laptops and 79 All in One Desktops 17 June 2022Document18 pages1supply Deliverty of 173 Laptops and 79 All in One Desktops 17 June 2022Frank KundeyaPas encore d'évaluation

- Irrigation Tender Midlands Province 2023Document44 pagesIrrigation Tender Midlands Province 2023tawandaPas encore d'évaluation

- Dms TenderDocument69 pagesDms TenderSunsmart SstplPas encore d'évaluation

- Standard Tendering Document Procurement of Works - Small WorksDocument104 pagesStandard Tendering Document Procurement of Works - Small WorksAccess to Government Procurement Opportunities100% (4)

- Spa First DraftDocument6 pagesSpa First Draft_scribd7Pas encore d'évaluation

- Shipping Container Standard Dimensions PDFDocument1 pageShipping Container Standard Dimensions PDFrajaPas encore d'évaluation

- A-Applying For New IEC Number-Kindly Fill Part A, B & D of ThisDocument6 pagesA-Applying For New IEC Number-Kindly Fill Part A, B & D of Thisinduclust100% (2)

- Ices1 5Document50 pagesIces1 5rajaPas encore d'évaluation

- ST Form3Document13 pagesST Form3ishaqmdPas encore d'évaluation

- SVBDocument7 pagesSVBrajaPas encore d'évaluation

- Annexure - A Application For Registration of Shipping Lines / Steamer Agents / Airlines / Consol Agents / Any Other PersonDocument2 pagesAnnexure - A Application For Registration of Shipping Lines / Steamer Agents / Airlines / Consol Agents / Any Other PersonrajaPas encore d'évaluation

- STP I Ex Im Policies and ProceduresDocument36 pagesSTP I Ex Im Policies and ProceduresrajaPas encore d'évaluation

- CustomsDocument2 pagesCustomsrajaPas encore d'évaluation

- Sez Rules2006Document94 pagesSez Rules2006bighnesh_nistPas encore d'évaluation

- Export Value DeclarationDocument1 pageExport Value DeclarationAnish TodarwalPas encore d'évaluation

- Procedure For Setting Up STP UnitsDocument26 pagesProcedure For Setting Up STP UnitsrajaPas encore d'évaluation

- Exim Policy 2007-12Document81 pagesExim Policy 2007-12kinjal_bhayaniPas encore d'évaluation

- Air Cargo FactsDocument15 pagesAir Cargo FactsrajaPas encore d'évaluation

- Chapter I: Provisional Assessment: 1.1 HighlightsDocument22 pagesChapter I: Provisional Assessment: 1.1 HighlightsrajaPas encore d'évaluation

- Cenvat DeclarationDocument1 pageCenvat DeclarationrajaPas encore d'évaluation

- Annex 2 Tariff Schedules - Viet Nam AHTN 2012Document419 pagesAnnex 2 Tariff Schedules - Viet Nam AHTN 2012rajaPas encore d'évaluation

- Export Packing List FormatexportDocument1 pageExport Packing List FormatexportrajaPas encore d'évaluation

- AppendicesDocument239 pagesAppendicesraja0% (1)

- Shipping InstructionsDocument7 pagesShipping InstructionsrajaPas encore d'évaluation

- AppendicesDocument239 pagesAppendicesraja0% (1)

- HandbookDocument160 pagesHandbookrajaPas encore d'évaluation

- 11 - Sez, Eou, STP and Ehtp SchemesDocument23 pages11 - Sez, Eou, STP and Ehtp SchemesSamaresh RoyPas encore d'évaluation

- Indian Nonveg Recipes (9xmobi - Com)Document20 pagesIndian Nonveg Recipes (9xmobi - Com)bhuppi0802Pas encore d'évaluation