Académique Documents

Professionnel Documents

Culture Documents

Trump Tax Bill

Transféré par

crainsnewyorkCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trump Tax Bill

Transféré par

crainsnewyorkDroits d'auteur :

Formats disponibles

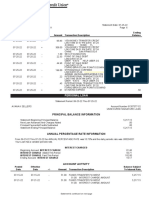

89940171602190100140001NNNP

Property Tax Bill

Quarterly Statement

Activity through February 19, 2016

Mailing address:

TRUMP DONALD J.

66N

721 5TH AVE.

NEW YORK , NY 10022-2523

Owner name: TRUMP DONALD J.

Property address: 721 5 AVENUE 66N

Borough, block & lot: MANHATTAN (1), 01292, 1263

Outstanding Charges

$0.00

New Charges

$0.00

Amount Due

$0.00

Visit us at nyc.gov/finance or call 311 for more information.

001400.01

87160

This statement is for your information only.

$0.00

Total amount due by April 1, 2016

Amount enclosed:

#BWNFFBV

#8994017 160219015#

TRUMP DONALD J.

66N

721 5TH AVE.

NEW YORK NY 10022-2523

Mail payment to:

NYC Department of Finance

P.O. Box 680

Newark, NJ 07101-0680

8994017160219 01 1012921263 0000000000000 0000000000000 160401270081001

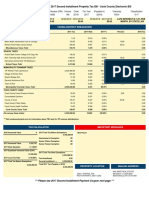

February 19, 2016

Trump Donald J.

721 5 Avenue 66N

1-01292-1263

Page 2

Statement Details

Billing Summary

Activity Date Due Date

Outstanding charges including interest and payments

Amount

$0.00

Total amount due

$0.00

Annual Property Tax Detail

Tax class 2 - Residential, More Than 10 Units

Current tax rate

Tax rate

12.8830%

Co-op/Condo Benefit based on Average Assessed Value of $294,720

Estimated market value $5,206,505

Tax before exemptions and abatements

Basic STAR - School Tax Relief

Tax before abatements

Co-op/Condo Abatement 1 Unit

Annual property tax

Billable assessed

value

$1,653,980

$-2,350

Tax rate

12.8830%

Taxes**

$ 213,082**

$-302**

$212,780**

$-37,236**

$175,544**

** This is your NYS STAR tax savings. It cannot increase more than 2% a year. For more information,

please visit us at nyc.gov/finance or contact 311.

If you own income producing property, you must file a Real Property Income and Expense Statement or a Claim of

Exclusion unless you are exempt by law. The deadline to file is June 1, 2016. Failure to file will result in penalties and

interest, which will become a lien on your property if they go unpaid. To see if you are exempt from this requirement

and to learn more, please visit nyc.gov/rpie.

Home banking payment instructions:

1. Log into your bank or online bill pay website

2. Add the new payee: NYC DOF Property Tax. Enter your account number, which is your boro,

block and lot, as it appears here: 1-01292-1263. You may also need to enter the address for the

Department of Finance. The address is P.O. Box 680, Newark, NJ 07101-0680.

3. Schedule your online payment using your checking or savings account

Did your mailing address change?

If so, please visit us at nyc.gov/changemailingaddress or call 311.

When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic

fund transfer from your account or to process the payment as a check transaction.

Vous aimerez peut-être aussi

- Trump's June 3, 2016 Tax BillDocument2 pagesTrump's June 3, 2016 Tax Billcrainsnewyork67% (3)

- Sonoma County 2017-18 Property Tax BillDocument1 pageSonoma County 2017-18 Property Tax BillChantée Viens EdwardsPas encore d'évaluation

- Suresh Rent Ledger 2018-19 PDFDocument1 pageSuresh Rent Ledger 2018-19 PDFGokul KuwarPas encore d'évaluation

- Beelick FarmsChecking Statement 05312016Document6 pagesBeelick FarmsChecking Statement 05312016Eduardo MenendezPas encore d'évaluation

- Great Depression & New Deal PoliciesDocument6 pagesGreat Depression & New Deal PoliciesWillie HarringtonPas encore d'évaluation

- No Fear!Document5 pagesNo Fear!mikePas encore d'évaluation

- 1964 10 20 Kamala Devi Harris Birth Cert Mother Goplan Shyamala Indian Age 26 Father Donald Jasper Harris Age 26 Jamaican Oakland Alameda CA File No 64 295984 Oct 20 1964Document2 pages1964 10 20 Kamala Devi Harris Birth Cert Mother Goplan Shyamala Indian Age 26 Father Donald Jasper Harris Age 26 Jamaican Oakland Alameda CA File No 64 295984 Oct 20 1964Jan LishmamPas encore d'évaluation

- ASC AMERICA'S SERVICING COMPANY SN/75326061 Wells Fargo Home Mortgage Division Wells Fargo Bank NADocument135 pagesASC AMERICA'S SERVICING COMPANY SN/75326061 Wells Fargo Home Mortgage Division Wells Fargo Bank NAMaryEllenCochranePas encore d'évaluation

- Jason Miller - Financial Affidavit, April 28, 2020Document15 pagesJason Miller - Financial Affidavit, April 28, 2020A.J. DelgadoPas encore d'évaluation

- Davidson Co. Sample BallotDocument7 pagesDavidson Co. Sample Ballotcmwill88Pas encore d'évaluation

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochPas encore d'évaluation

- Not A Certified Copy: Larry SchneiderDocument3 pagesNot A Certified Copy: Larry Schneiderlarry-612445Pas encore d'évaluation

- Tax RecordDocument1 pageTax RecordmicantbabyPas encore d'évaluation

- Electronic Record and Signature DisclosureDocument6 pagesElectronic Record and Signature Disclosurecristie oliveiraPas encore d'évaluation

- Direct / Direct: Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument4 pagesDirect / Direct: Reliance Private Car Vehicle Certificate Cum Policy ScheduleZeeshan KhanPas encore d'évaluation

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallPas encore d'évaluation

- Carsons Deed Tax BillDocument14 pagesCarsons Deed Tax BillBurton PhillipsPas encore d'évaluation

- Apartment Lease Contract: Moving in - General InformationDocument23 pagesApartment Lease Contract: Moving in - General InformationNoel RivasPas encore d'évaluation

- This Is A Legal Document. Please Review It Thoroughly Prior To ExecutionDocument10 pagesThis Is A Legal Document. Please Review It Thoroughly Prior To ExecutionWanda Earnest BullockPas encore d'évaluation

- Paystub 2019 05 31 PDFDocument1 pagePaystub 2019 05 31 PDFAnonymous wkIlICXmQfPas encore d'évaluation

- Pay Stub Edmondson - 1Document1 pagePay Stub Edmondson - 1Mary AndresonPas encore d'évaluation

- Principal Balance Information: Personal LoanDocument1 pagePrincipal Balance Information: Personal LoanAyanna SellersPas encore d'évaluation

- Money transfer receipt from US to PhilippinesDocument1 pageMoney transfer receipt from US to PhilippinesAgatha Dominique BacaniPas encore d'évaluation

- Cody Tuomala Death CertificationDocument1 pageCody Tuomala Death CertificationJeff TuomalaPas encore d'évaluation

- E-Pay StatementsDocument1 pageE-Pay Statementsmasson_kathrynPas encore d'évaluation

- USA SunTrust Bank StatementDocument1 pageUSA SunTrust Bank StatementLiam AbreuPas encore d'évaluation

- Business License PDFDocument1 pageBusiness License PDFsnhd_swpr100% (1)

- 8th Wonder On Lake Superior LLCDocument3 pages8th Wonder On Lake Superior LLCDuluth News TribunePas encore d'évaluation

- Earnings: Hourly OT On CallDocument1 pageEarnings: Hourly OT On CallpabloPas encore d'évaluation

- Branchless Account Opening FormDocument2 pagesBranchless Account Opening FormCarmel DoblePas encore d'évaluation

- 5240 Lafontaine BillDocument2 pages5240 Lafontaine BillAce MereriaPas encore d'évaluation

- WalMart2017 Richton Park Tax Bill 2.4 MillionDocument2 pagesWalMart2017 Richton Park Tax Bill 2.4 MillionBurton PhillipsPas encore d'évaluation

- Unemployment Insurance Application Filing InstructionsDocument12 pagesUnemployment Insurance Application Filing InstructionsEvette M. SolteszPas encore d'évaluation

- Notice Before Collection Action: We Have Not Received All of Your Required PaymentsDocument2 pagesNotice Before Collection Action: We Have Not Received All of Your Required PaymentsjamalsledgePas encore d'évaluation

- Earnings: Hourly OT On CallDocument1 pageEarnings: Hourly OT On CallpabloPas encore d'évaluation

- Rental VerificationDocument1 pageRental VerificationdannytchrnyPas encore d'évaluation

- Amount EnclosedDocument4 pagesAmount EnclosedVicki HillPas encore d'évaluation

- 2021 (2) January Amanda2Document6 pages2021 (2) January Amanda2Amanda ConryPas encore d'évaluation

- C001194C A073972181A 271109194347C: Giorgina OlivaDocument1 pageC001194C A073972181A 271109194347C: Giorgina OlivaShonda DietzPas encore d'évaluation

- Verizon bill detailsDocument8 pagesVerizon bill detailsnitinPas encore d'évaluation

- Document2 PDFDocument1 pageDocument2 PDFErma MoniePas encore d'évaluation

- Andres Henderson Police ReportDocument4 pagesAndres Henderson Police ReportHouston ChroniclePas encore d'évaluation

- NY Drivers License HistoryDocument8 pagesNY Drivers License HistoryMarco De Moor BeyPas encore d'évaluation

- Employee Paystub EditedDocument1 pageEmployee Paystub EditedSandra ChrisPas encore d'évaluation

- 1 Articles R A Cert of Formation File Stamped 01169448xBF97D PDFDocument6 pages1 Articles R A Cert of Formation File Stamped 01169448xBF97D PDFBeing ArethaPas encore d'évaluation

- Jerry CoDocument4 pagesJerry CogarrettloehrPas encore d'évaluation

- 85 Insurance Certificate 2015Document2 pages85 Insurance Certificate 2015SHARP HOA MANAGEMENT, INCPas encore d'évaluation

- MONETARYDETERMINATIONPANDEMICUNEMPLOYMENTASSISTANCE jASONKROLL-3824202010074018 PDFDocument3 pagesMONETARYDETERMINATIONPANDEMICUNEMPLOYMENTASSISTANCE jASONKROLL-3824202010074018 PDFjuanchy12Pas encore d'évaluation

- PDF Document 2 PDFDocument1 pagePDF Document 2 PDFac acPas encore d'évaluation

- Get PDF For Bill ViewDocument4 pagesGet PDF For Bill ViewKrishna8765Pas encore d'évaluation

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochPas encore d'évaluation

- 0149 Atap SK Brgy. Kaulanguhan, CaibiranDocument4 pages0149 Atap SK Brgy. Kaulanguhan, CaibiranOrne PaulPas encore d'évaluation

- Paystub Resilience Lab Medical PC 20231001 20231015Document1 pagePaystub Resilience Lab Medical PC 20231001 20231015samantha.vasquezPas encore d'évaluation

- Pay Stub ExplorationDocument3 pagesPay Stub ExplorationVanessa CooperPas encore d'évaluation

- Proof of home insurance for Riata AustinDocument1 pageProof of home insurance for Riata AustinTascie CookPas encore d'évaluation

- Andhra Pradesh Family Pension Payment Slip April 2021Document1 pageAndhra Pradesh Family Pension Payment Slip April 2021dsnreddyPas encore d'évaluation

- Sensitive Taxpayer Account TranscriptDocument2 pagesSensitive Taxpayer Account TranscriptAshley Marie NicholsPas encore d'évaluation

- CORRECTED (If Checked) : Mortgage Interest StatementDocument2 pagesCORRECTED (If Checked) : Mortgage Interest StatementScott DoePas encore d'évaluation

- Summary of Account Activity Payment InformationDocument4 pagesSummary of Account Activity Payment InformationAnonymous 7DmNfQeSQPas encore d'évaluation

- Property Tax BillDocument2 pagesProperty Tax BillAnonymous GF8PPILW5Pas encore d'évaluation

- HDC Historic Streetscape StudyDocument34 pagesHDC Historic Streetscape StudycrainsnewyorkPas encore d'évaluation

- Proposal For Light Rail On The Lower Montauk BranchDocument19 pagesProposal For Light Rail On The Lower Montauk BranchcrainsnewyorkPas encore d'évaluation

- Who Pays For ParkingDocument86 pagesWho Pays For ParkingcrainsnewyorkPas encore d'évaluation

- LaGuardia Central Terminal Redevelopment PlanDocument36 pagesLaGuardia Central Terminal Redevelopment PlancrainsnewyorkPas encore d'évaluation

- Report On The Garment CenterDocument18 pagesReport On The Garment CentercrainsnewyorkPas encore d'évaluation

- Garodnick and Weprin Letter To de BlasioDocument2 pagesGarodnick and Weprin Letter To de BlasiocrainsnewyorkPas encore d'évaluation

- The Letter Sent To Allan GrodyDocument2 pagesThe Letter Sent To Allan GrodycrainsnewyorkPas encore d'évaluation

- Lawsuit Against Kushner Cos. Over 89 HicksDocument17 pagesLawsuit Against Kushner Cos. Over 89 HickscrainsnewyorkPas encore d'évaluation

- Center For An Urban Future: Creative New York 2015Document68 pagesCenter For An Urban Future: Creative New York 2015crainsnewyork100% (1)

- ComplaintDocument86 pagesComplaintcrainsnewyorkPas encore d'évaluation

- Green Building RoadmapDocument4 pagesGreen Building RoadmapcrainsnewyorkPas encore d'évaluation

- Port Authority RFPDocument149 pagesPort Authority RFPcrainsnewyorkPas encore d'évaluation

- Planning For Autonomous VehiclesDocument76 pagesPlanning For Autonomous Vehiclescrainsnewyork75% (4)

- LaGuardia Gateway PartnersDocument36 pagesLaGuardia Gateway PartnerscrainsnewyorkPas encore d'évaluation

- Possible Plans For Staten Island's Eastern ShoreDocument38 pagesPossible Plans For Staten Island's Eastern ShorecrainsnewyorkPas encore d'évaluation

- Epi Data BriefDocument9 pagesEpi Data BriefcrainsnewyorkPas encore d'évaluation

- BTEA Executive SummaryDocument16 pagesBTEA Executive SummarycrainsnewyorkPas encore d'évaluation

- Read The EmailsDocument153 pagesRead The Emailscrainsnewyork100% (1)

- NYC Transit and Infrastructure Green Growth 6.23.17Document5 pagesNYC Transit and Infrastructure Green Growth 6.23.17crainsnewyorkPas encore d'évaluation

- Smaller Safer Fairer: A Roadmap To Closing Rikers IslandDocument53 pagesSmaller Safer Fairer: A Roadmap To Closing Rikers Islandcrainsnewyork100% (1)

- Growing and Preserving Jobs by Transitioning To Employee Ownership 5.17.17Document7 pagesGrowing and Preserving Jobs by Transitioning To Employee Ownership 5.17.17crainsnewyorkPas encore d'évaluation

- Top Architects Share Visions For The Bronx, Rikers Island and Staten IslandDocument66 pagesTop Architects Share Visions For The Bronx, Rikers Island and Staten Islandcrainsnewyork100% (1)

- Judge's Opinion in Andrew Muchmore's LawsuitDocument44 pagesJudge's Opinion in Andrew Muchmore's LawsuitcrainsnewyorkPas encore d'évaluation

- Citi Habitats 10-Year Rental Report 2007-2016 FINALDocument17 pagesCiti Habitats 10-Year Rental Report 2007-2016 FINALcrainsnewyorkPas encore d'évaluation

- Court RulingDocument7 pagesCourt RulingcrainsnewyorkPas encore d'évaluation

- Grades On-The-GoDocument12 pagesGrades On-The-GoQueens PostPas encore d'évaluation

- LGBTQ Bill of Rights PosterDocument1 pageLGBTQ Bill of Rights PostercrainsnewyorkPas encore d'évaluation

- Prelim Analysis of Trump's Federal 2018 BudgetDocument5 pagesPrelim Analysis of Trump's Federal 2018 BudgetcrainsnewyorkPas encore d'évaluation

- Penn Farley StationDocument17 pagesPenn Farley StationcrainsnewyorkPas encore d'évaluation

- BTEA Policy PaperDocument38 pagesBTEA Policy PapercrainsnewyorkPas encore d'évaluation