Académique Documents

Professionnel Documents

Culture Documents

Budget Project

Transféré par

api-311096992Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Budget Project

Transféré par

api-311096992Droits d'auteur :

Formats disponibles

Introduction to Management Accounting

Solutions Manual

Problems: Set A

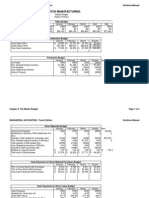

P9-59A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Requirements

1. Prepare a schedule of cash collections for January, February, and March, and for the quarter

in total.

2. Prepare a production budget.

3. Prepare a direct materials budget.

4. Prepare a cash payments budget for the direct material purchases from Requirement 3.

5. Prepare a cash payments budget for conversion costs.

6. Prepare a cash payments budget for operating expenses.

7. Prepare a combined cash budget.

8. Calculate the budgeted manufacturing cost per unit.

9. Prepare a budgeted income statement for the quarter ending March 31.

Solution:

Given

Sales Budget

December

Unit sales

January

7,000

Unit selling price

Total sales Revenue

8,000

10 $

70,000

10

80,000

Req. 1

Cash Collections

cash sales

credit sales

total cash collections

January

$ 24,000.00

$ 56,000.00

$ 80,000.00

February

$27,600

64400

$92,000

Req. 2

Production Budget

unit sales

January

66,667

Chapter 9: The Master Budget and Responsibility Accounting

February

76,667

Introduction to Management Accounting

Solutions Manual

plus: desired ending inventory

total needed

less:beginning inventory

units to produce

17,500

84,167

14,167

17,000

20,000

96,667

26,667

32,000

Req. 3

Direct Materials Budget

units to be produced

x pounds of DM needed per unit

quantity (lbs) needed for production

plus: desired ending inventory of DM

Total quantity (lbs) needed

less: beginning inventory of DM

quantity (lbs) to purchase

x cost per pound

total cost of DM purchases

January

17,000

2

2

3,200

37,200

14,167

2

2

$8,867

February

32,000

2

2

4,260

68,260

26,667

2

2

$14,927

Req. 4

Schedule of Expected Cash DisbursementsMaterial Purchases

december purchases (from acc pay)

january purchases

februrary purchases

march purchases

January

$1,400

$0

9,200

1,980

February

5,600

$1,600

9,200

7,920

total cash payments for direct material

purchases

$1,400

$5,600

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

variable conversion costs

rent (fixed)

other MOH

total payments for conversion costs

January

$9,600

$5,000

3,000

$17,600

February

$11,040

$5,000

3,000

$19,040

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

variable operating expenses

fixed operating expenses

total payments for operating expenses

January

8,000

$1,000

9,000

February

9,200

$1,000

10,200

Req. 7

Combined Cash Budget

cash balance, beginning

add cash collections

total cash available

less cash payments:

direct material purchases

conversion costs

operating expenses

tax payment

equipment purchases

total cash payments

ending cash balance before finanicing

financing:

borrowings

repayments

interest payments

ending cash balance

Total interest

January

$4,500

80,000

84,500

February

$56,500

92,000

148,500

1,400

17,600

9,000

5,600

19,040

10,200

10,000

28,000

56,500

44,840

103,660

56,500

103,660

$280

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

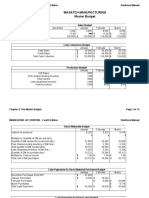

Req. 8

Budgeted Manufacturing Cost per Unit

direct materials cost per unit

conversion costs per unit

fixed manufacuting each unit

budgeted cost of manufacturing each unit

$2.00

$1.20

$1.20

$4.40

Req. 9

Silverman Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales

COGS

gross profit

operating expenses

depreciation

operating income

less interest expense

less provision for income taxes

net income

271,000

119,240

budgeted cost of manufacturing

151,760

30,100

271,000

280

10,000

$111,380

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

(60 min.) P 9-59A

es 2 & 3)

arch, and for the quarter

rom Requirement 3.

udget

February

March

9,200

April

9,900

May

9,700

8,500

10

10 $

10

10

92,000

99,000 $

97,000

85,000

March

$29,700

69300

$99,000

Quarter

$ 81,300.00

$189,700.00

$271,000.00

March

82,500

Quarter

225,833

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

$23,000.00

105,500

35,500

42,600

60,500

286,333

76,333

91,600

March

42,600

2

2

5320

90,520

35,500

2

2

Quarter

91,600

6

6

12,780

195,980

76,333

6

6

$19,520

$43,313

Solutions Manual

terial Purchases

March

0

8,000

9,200

9,900

Quarter

$7,000

$9,600

$27,600

$19,800

$9,980

$16,980

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

nversion Costs

March

$11,880

$5,000

3,000

$19,880

Quarter

$32,520

$15,000

$9,000

$56,520

erating Expenses

March

9,900

$1,000

10,900

March

$103,660

99,000

202,660

9,980

19,880

10,900

40,760

161,900

280

161,620

Quarter

27,100

3,000

30,100

Quarter

$164,660

$271,000

$435,660

$0

$16,980

$56,520

$30,100

$10,000

$0

$113,600

$322,060

$0

$0

$0

$280

$321,780

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

ted cost of manufacturing each unit x number of units sold

Chapter 9: The Master Budget and Responsibility Accounting

Vous aimerez peut-être aussi

- Master Budget Defined & ExplainedDocument20 pagesMaster Budget Defined & ExplainedYsabelle Sacriz100% (1)

- Request Ltr2Bank For OIDsDocument2 pagesRequest Ltr2Bank For OIDsricetech96% (48)

- Auto Finance Industry AnalysisDocument15 pagesAuto Finance Industry AnalysisMitul SuranaPas encore d'évaluation

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraPas encore d'évaluation

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- Chapter - 9: Mcgraw-Hill/IrwinDocument79 pagesChapter - 9: Mcgraw-Hill/IrwinFahim Tajual Ahmed TusharPas encore d'évaluation

- Fa Mod1 Ont 0910Document511 pagesFa Mod1 Ont 0910subash1111@gmail.comPas encore d'évaluation

- NCERT Class 11 Accountancy Part 2Document296 pagesNCERT Class 11 Accountancy Part 2AnoojxPas encore d'évaluation

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Handout: Course Code and Name: Unit Code: Unit TitleDocument10 pagesHandout: Course Code and Name: Unit Code: Unit TitleGabriel ZuanettiPas encore d'évaluation

- Presentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀDocument31 pagesPresentation Flow: Public © 2023 SAP SE or An SAP Affiliate Company. All Rights Reserved. ǀAbhijeet PawarPas encore d'évaluation

- Example - Recovery AmountDocument11 pagesExample - Recovery AmountAAKANKSHA BHATIAPas encore d'évaluation

- Week 2 Assignment Apex ChemicalsDocument4 pagesWeek 2 Assignment Apex ChemicalsSunita Chaudhary0% (1)

- Master Budget ProjectDocument10 pagesMaster Budget Projectapi-268950886Pas encore d'évaluation

- Managerial Accounting ProjectDocument11 pagesManagerial Accounting Projectapi-271746126Pas encore d'évaluation

- Budget AssignmentDocument10 pagesBudget Assignmentapi-248058538Pas encore d'évaluation

- Excel Budget Project Tanya MayDocument10 pagesExcel Budget Project Tanya Mayapi-316478827Pas encore d'évaluation

- Accounting E-Portfolio FinalDocument8 pagesAccounting E-Portfolio Finalapi-310911560Pas encore d'évaluation

- Excel Project P9-59aDocument3 pagesExcel Project P9-59aapi-272100463Pas encore d'évaluation

- ProblemsDocument4 pagesProblemsapi-316770820Pas encore d'évaluation

- TuyjDocument51 pagesTuyjagnesPas encore d'évaluation

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument10 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Wasatch ManufacturingDocument12 pagesWasatch Manufacturingapi-301899907Pas encore d'évaluation

- Characteristics of A Budget: Cash ReceiptsDocument11 pagesCharacteristics of A Budget: Cash ReceiptsMukesh ManwaniPas encore d'évaluation

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Pas encore d'évaluation

- Accounting Chapter 9 Eportfolio ExcelDocument12 pagesAccounting Chapter 9 Eportfolio Excelapi-273030710Pas encore d'évaluation

- Chapter 04 - 12thDocument16 pagesChapter 04 - 12thSarah JamesPas encore d'évaluation

- p9-60 PsimasinghDocument8 pagesp9-60 Psimasinghapi-241811190Pas encore d'évaluation

- Hailey Fernelius ch9 Excel ProjectDocument4 pagesHailey Fernelius ch9 Excel Projectapi-242652884Pas encore d'évaluation

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Pas encore d'évaluation

- Financial PlanDocument54 pagesFinancial PlanTeku ThwalaPas encore d'évaluation

- Budgetary Control and Activity Based Costing ExplainedDocument41 pagesBudgetary Control and Activity Based Costing Explainedanupams3Pas encore d'évaluation

- Complete the Accounting Cycle Case StudyDocument16 pagesComplete the Accounting Cycle Case Studydeepak.agarwal.caPas encore d'évaluation

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Document12 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-249190933Pas encore d'évaluation

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1Pas encore d'évaluation

- Week 3Document14 pagesWeek 3John PerkinsPas encore d'évaluation

- Budgetary Control and Activity Based Costing ExplainedDocument41 pagesBudgetary Control and Activity Based Costing ExplainedRohit ChandakPas encore d'évaluation

- Financial PlanDocument41 pagesFinancial PlanKim Patrick VictoriaPas encore d'évaluation

- Abigail Foss - Comprehensive Problem - Master BudgetDocument15 pagesAbigail Foss - Comprehensive Problem - Master Budgetapi-325954956Pas encore d'évaluation

- CH 04Document52 pagesCH 04indahmuliasariPas encore d'évaluation

- CHAPTER ELEVEN-Financial PlanDocument54 pagesCHAPTER ELEVEN-Financial PlanWan WanPas encore d'évaluation

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaPas encore d'évaluation

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-242429455Pas encore d'évaluation

- Accounting Excel Budget ProjectDocument8 pagesAccounting Excel Budget Projectapi-242531880Pas encore d'évaluation

- CASH BUDGET PREPARATIONS Lesson Material and Activity SheetsDocument8 pagesCASH BUDGET PREPARATIONS Lesson Material and Activity SheetsLee Arne BarayugaPas encore d'évaluation

- Wasatch Manufacturing Master BudgetDocument6 pagesWasatch Manufacturing Master Budgetapi-255137286Pas encore d'évaluation

- EportfolioDocument8 pagesEportfolioapi-220792970Pas encore d'évaluation

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparrePas encore d'évaluation

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mPas encore d'évaluation

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-242720692Pas encore d'évaluation

- A 201 Chapter 12Document14 pagesA 201 Chapter 12blackprPas encore d'évaluation

- NotesDocument40 pagesNotesTicktactoe100% (1)

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument5 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265Pas encore d'évaluation

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-239130031Pas encore d'évaluation

- Excel HomeworkDocument9 pagesExcel Homeworkapi-248528639Pas encore d'évaluation

- Assignment BriefDocument10 pagesAssignment BriefNguyen Dac ThichPas encore d'évaluation

- ACTG101 Adjusting EntriesDocument63 pagesACTG101 Adjusting EntriesPrincess Ann PunoPas encore d'évaluation

- SITXFIN003 - Student Assessment v3.1Document11 pagesSITXFIN003 - Student Assessment v3.1Esteban BuitragoPas encore d'évaluation

- Anggaran Berdasarkan Fungsi Dan AktivitasDocument42 pagesAnggaran Berdasarkan Fungsi Dan AktivitasAri SuryadiPas encore d'évaluation

- Physics ProjectDocument2 pagesPhysics Projectapi-220037346Pas encore d'évaluation

- Grader ProjectDocument7 pagesGrader Projectapi-220037346Pas encore d'évaluation

- Huma e PortfolioDocument4 pagesHuma e Portfolioapi-220037346Pas encore d'évaluation

- Johann Sebastian BachDocument8 pagesJohann Sebastian Bachapi-220037346Pas encore d'évaluation

- Logans Land EthicDocument6 pagesLogans Land Ethicapi-220037346Pas encore d'évaluation

- Peppers ProjectDocument1 pagePeppers Projectapi-220037346Pas encore d'évaluation

- Grader 2 ExcelDocument2 pagesGrader 2 Excelapi-220037346Pas encore d'évaluation

- Drivers of Supply Chain ManagementDocument10 pagesDrivers of Supply Chain Managementalsamuka31100% (1)

- My India in 2047Document3 pagesMy India in 2047Karttikeya Mangalam NemaniPas encore d'évaluation

- Excel AmortizationDocument16 pagesExcel AmortizationLaarnie QuiambaoPas encore d'évaluation

- Mexican Steel 2006 - Consolidation & Growth: AMM ConferencesDocument4 pagesMexican Steel 2006 - Consolidation & Growth: AMM ConferencespdiconpPas encore d'évaluation

- Street Food V/S Restaurant FoodDocument15 pagesStreet Food V/S Restaurant FoodSakthi SaravananPas encore d'évaluation

- S.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingDocument34 pagesS.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingAnant DivekarPas encore d'évaluation

- Documents To Be Checked Before Buying HomeDocument3 pagesDocuments To Be Checked Before Buying HomeTanu RathiPas encore d'évaluation

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiPas encore d'évaluation

- As and Guidance NotesDocument94 pagesAs and Guidance NotesSivasankariPas encore d'évaluation

- Introduction to Accounting EquationDocument1 pageIntroduction to Accounting Equationcons thePas encore d'évaluation

- A Case On Local Entrepreneur 368Document7 pagesA Case On Local Entrepreneur 368Nur-A- Alam Kader Parag -171012084Pas encore d'évaluation

- Diploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementDocument2 pagesDiploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementSruthi KunnasseryPas encore d'évaluation

- Fina 402 - NotesDocument28 pagesFina 402 - NotespopaPas encore d'évaluation

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooPas encore d'évaluation

- Ratio - Proportion - PercentDocument31 pagesRatio - Proportion - PercentRiyadh HaiderPas encore d'évaluation

- Estimating Air Travel Demand Elasticities Final ReportDocument58 pagesEstimating Air Travel Demand Elasticities Final Reportch umairPas encore d'évaluation

- ICODEV Abstract FixDocument49 pagesICODEV Abstract Fixbp bpPas encore d'évaluation

- Montenegro Taxation Chapter 16 PresentationDocument16 pagesMontenegro Taxation Chapter 16 PresentationAngus DoijPas encore d'évaluation

- Kanishk (1) KavdiaDocument3 pagesKanishk (1) Kavdiakanishk_kavdia100% (2)

- Top Companies in Vapi GujaratDocument9 pagesTop Companies in Vapi GujaratNimesh C VarmaPas encore d'évaluation

- Percentage QuestionsDocument16 pagesPercentage QuestionsdokhlabhaiPas encore d'évaluation

- Human Resource Management: Unit - IDocument6 pagesHuman Resource Management: Unit - IpavanstvpgPas encore d'évaluation

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Document17 pagesKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimPas encore d'évaluation