Académique Documents

Professionnel Documents

Culture Documents

Forensic Report of Reading, PA

Transféré par

Reading_Eagle0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues37 pagesAudit by Baker Tilly LLC on Feb. 29, 2016

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAudit by Baker Tilly LLC on Feb. 29, 2016

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues37 pagesForensic Report of Reading, PA

Transféré par

Reading_EagleAudit by Baker Tilly LLC on Feb. 29, 2016

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 37

Forensic Investigation

City of Reading

February 29, 2016

s

BAKER TILLY

Candor. Insight. Results.

Sw erec srs

AKER TITLY

INTERNATIONAL

ines!) ideal he) deed ee) td tid tet ie Ot a tt

Mayor Wally Scott

City of Reading

Forensic Investigation

This plan is consistent with the Mayor's campaign promise to implement a forensic audit

to ensure that budget figures are accounted for and he will enact positive change for the

City,

Baker Tily has structured this proposal to identify specific areas of risk for the City to

focus its forensic investigation, as well as identifying other financial and operational risks

the City faces to assist the effort of implementing Positive Change for the City. Our

response is structured as follows:

Beker Tily Qualifications

~ About Beker Tilly

~ Forensic Accounting

Governmental Accounting

~ Internal Controls

‘Our Understanding of Your Needs

~ Initial Concerns and Observations

» Operational and Financial Areas of Risk

‘+ Cash Receipts and Cash Disbursements

+ Cash Reconciliation Process

+ Off Balance Sheet Bank Accounts

+ Accounts Receivables

+ Fix Assets

© Loans / Grants

+ Revenue

+ Expenditures

©. Pension Reporting

© Time Card Approval

© P-Card Activity

How Baker Tily Can Help

Phase |

~ Phase Il

~ Phase Ill

~ Estimate of Costs

In addition to focusing the investigation on financial and operations risks at the City, the

Mayor has also requested Baker Tilly to perform a forensic investigation of the

operational and financial records at the Reading Parking Authority (the "Parking

Authority’) and the Reading Area Water Authority (the “Water Authority’). Baker Tilly

intends to structure a similar process for both the Parking Authority and the Water

Authority by analyzing the historical financial performance to identify and assess the

financial and operational risks that exist. Baker Tilly will reate proposals for the Parking

Authority and Water Authority to address the risks and exposure to fraud, waste and

abuse.

nie

on co

ela hela heel

Mayor Wally Scott

City of Reading

Forensic Investigation

Baker Tilly also recommends that the City consider employing legal counsel for the

forensic investigation. This is an important consideration for the investigation because

the relationship between accountants and clients does not provide the same protection

that is provided in the attorney and client relationship.

‘Above all, Baker Tilly believes the City deserves exceptional service and a plan to

‘address specific areas of risk for the City to ensure Positive Change occurs at the City

We look forward to the opportunity to discuss the details of our proposal and answer any

‘questions you may have through the process. Please do not hesitate to contact us with

‘any questions or concerns.

Regards,

BAKER TILLY VIRCHOW KRAUSE, LLP

_—

Lu Mp amt Mr

David Duffus, CPA/ABVICFF, CFE James T. O'Brien, CPAICFF

Partner Partner

P: 412607 6404 215972 2308,

Email: ¢ Email james chrien@takertily com

BAKER TILLY QUALIFICATIONS i

INITIAL CONCERNS AND PRELIMINARY OBSERVATIONS.

HOW BAKER TILLY CAN HELP

eae rer

OTN a cy

Contents

=

BAKER TILLY

Parer enero ees ry

etre

7.

cee Colom enc

Baker Tily Vechow Krause, LLP Is an independently owned and managed member of Baker Tily International

tte

1

Lhd

Baker Tilly Qualifications

About Baker Tilly

Baker Tilly is a top twelve accounting firm per Accounting Today's 2014 "Top 100 Firm:

list, with 2 reputation for deep industry knowledge, technical expertise, and leadership.

Baker Tily is a partnership, with 292 partners in 29 cities across the country, including

Philadelphia, Pittsburgh, Reading, New York, Washington, DC, Chicago, Detroit,

Minneapolis, and Dallas. Clients from around the country receive fraud, forensic, audit,

advisory, and tax services from Baker Tily's more than 2,500 experienced professionals.

‘These clients span numerous industries including a large client base within the public

sector.

Baker Tilly was founded in 1931 and has since grown steadily, broadening our services

and expanding our geographic presence to meet the evolving needs of our clients. Our

ccentral objective is to use our industry specialization to help our clients improve their

businesses.

Originally, @ regional certified public accounting firm, Baker Tilly has over the years,

broadened its service offerings and expanded its geographic presence to meet the

evolving needs of its clients. AS an independent member of Baker Tilly Intemational, we

bring you access to market-specific knowledge in 133 countries.

FLVS Practice

‘The forensic accountant's world consists of assisting attomeys and their clients in the

financial matters of a dispute for commercial tigation, an insurance claims, or a forensic

investigation that is documenting and reconstructing the financial activity. Typically,

forensic accountants research, quantify and present the financial impact of a dispute as it

relates to a legal action. In order to be effective, forensic accountants must communicate

their findings in a simple, clear and easy to understand manner.

We believe our forensic investigation approach is cost effective, while at the same time

also being comprehensive to appropriately address our client's needs. Our investigative

process involves continual communication with our client as we unravel and document

the alleged fraud. Investigating allegations of fraud involves interviewing witnesses,

assembling evidence and writing expert reports while always being aware that the

findings may be introduced into the legal system with our team acting as expert

witnesses or in @ consulting capacity. Our team follows the Fraud Theory Approach;

analyzing data, creating and testing a hypothesis and refining and amending that

hypothesis as the circumstances dictate. Inherent in this approach are efficiencies that

allow our team to never stray far from “point,” finding out all the facts necessary to

resolve the allegation(s) and quantify the damages suffered.

With offices in Philadelphia, Pittsburgh, New York City, Dallas, Chicago, and Atlanta , our

Forensic, Litigation & Valuation Services (FLVS) practice group operates on a national

platform serving clients across the United States and intemationally. Our professionals:

have been qualified and have provided expert testimony in state and federal courts

throughout the United States.

at et

ee

(Our FLVS professionals have diverse skills and vast experience, Our assembled team of

‘experienced forensic accounting professionals has been retained to assist counsel and

their clients on complex matters throughout the country. Our team consists of

professionals who have experience in providing investigations in the following areas:

Financial investigations» Employee ThefvEmbezzlement

‘Asset Misappropriation > Expense Reporting Schemes

Medicare Fraud Inventory Losses

Money Laundering Insurance Fraud

Healthcare Billing Bani/Mortgage Fraud

Improprieties Whistleblower Suits

Ponzi Schemes Kickback arrangements

Phony Vendor Scams Procurement Fraud

Governmental Accounting Practice

Baker Tilly's audit and accounting practice is organized by industry specialization,

allowing our professionals to offer clients 2 deep understanding of their respective

industries. Our Government Accounting Practice has a decades-long record of providing

forensics, consulting, advisory services, and single auditfinancial management

consulting services to a variety of similarly sized municipal entities.

Baker Tily understands the issues governments face, providing more than 225,000

hours, annually, to the public sector. Our extensive experience provides us with the

‘specialized knowledge and insight to find effective solutions. In addition, the Government

‘Accounting Practice’s success and experience working with other public sector clients

enable them to apply strategies and techniques that have been successful with similar

cents

Our government clients rely on our expertise to meet their specific auditing, accounting,

forensic and operational needs. From helping you manage and optimize your resources

to clearly and accurately reporting your funding sources and patterns, you can expect a

practical approach, technical insight, and a thorough understanding of the governmental

accounting world to work on the City’s behalf, delivering the precise services you need,

when you need them,

‘Across the United States, our governmental clients include 346 municipalities and 50

counties. Our public sector specialists are active in national and state organizations,

participate in ongoing continuing education to obtain industry certifications, and speak

{and author articles on industry trends

Internal Audit

‘Our Baker Tily Internal Audit team has extensive experience in partnering with

‘organizations to create, maintain, and grow successful, long lasting, and flexible internal

audit functions.

(On more than 1,000 engagements, our work as intemal auditors and consultants has

helped senior management to attain diverse benefits including

‘Baker Tity chow Krause, LLP isan Independently owned and managed member of Baker Tily International

i

se

ad

| Enhanced controls;

Improved risk mitigation;

7 Increased efficiencies;

a Better strategic alignment with the organization's objectives;

Streamlined processes and risk management approaches, resulting in cost savings;

Better reporting

Integration of leading practices into operations and internal control environments; and

Access to tools, templates, and resources not available internally.

We are continually working witn organization to help eveluate their contol stucture and

related organizational design to enable them to achieve their mission and attan thei

1 internal aust goals via outsourcing and co-sourcing arrangements

Benefits of Working with Baker Tilly

| a a i ca cae ls ee

i with the Mayor and the City to pursue the Positive Change as a forward-looking,

ee cancel Cue ace ee

a ee Se

Boker Tily Virchow Krause, LLP is an independently owned and managed member of Bake Tity Intemational

Ne

@

anh

Initial Concerns and Preliminary

Observations

Mayor Scott raised concerns surrounding limited oversight with respect to the

procurement process for capital projects. The Mayor raised these concems as a result of

the FBI's focus on the City’s contracting process, specifically the allegations surrounding

Mayor Spencer's "pay to play’ process. As discussed more fully below, we have

conducted preliminary analyses through review of selected contract documents, analyses,

of publicly available information, and discussions with City personnel, including Mayor

Scott. Based upon those preliminary analyses, we have identified a number of issues

that cause concern, particularly in light of the ongoing FBI investigation. Specifically, we

have identified:

Potentially overlapping contracts related to the construction at the Waste Water

‘Treatment Plant (‘WWTP’) on Fritz Island,

Ineffective and circumvented internal controls surrounding contract related

disbursements.

Expenditures related to the construction of the WWTP, which to date have exceeded

$60,000,000, and which may have provided limited benefit to the City.

‘Allack of overall controls surrounding contracting, which has left the City with the

inability to review contracts prior to award, and to identity the population of contracts

that have been awarded.

‘Material weaknesses in the internal financial controls at the City, which in many

situations have been identified by the City's outside aucitors since at least 2008, and

which have yet to be remediated.

In our opinion, these are major issues that put the City at risk for fraud, waste and abuse

related to City assets,

Operational and Financial Areas of Risks

We also analyzed the schedule of findings that was included as part of the annual

financial statement audit of the City, The period 2006 through 2014 identified significant

control deficiencies and material weaknesses within the financial and operational

departments of the City, including with respect to disbursements.” The nature of the

findings during the audit and the number of years that the deficiency existed is alarming,

Further, some of the most basic accounting functions are not being performed which

raises additional questions and concems regarding the competency of the City personnel

and their abilty to properly execute and report the City's financial activities.

Based upon our analyses, research, discussions with Mayor Scott and our experience on

similar engagements, the identified deficiencies surrounding the contracting processes

‘and various financial activities represent areas that the City needs to address in order to

8 The 2007 Audited Financial Statements were not available online.

Section Header

‘mitigate the operational and financial risks as well as exposure to fraud, waste and

abuse.

j Operational Risk — Contracting Process

] implementation of the pretreatment program.

Due to the complexity and magnitude of this project, several contracts have been

‘awarded and the amount that has already been spent by the City is @ significant concern

for the Mayor. Specifically, the Mayor has raised concems surtounding the costs

incurred to date, which exceed $60,000,000, and the limited progress that has been

]

1; oie

J

In the course of our preliminary site work, we analyzed @ small sample of the City’s

‘Accounts Payable Forms related to WWTP contracts and disbursements. Based upon

that preliminary analysis, it appears that concerns about the contracting process are well

founded. For example, we identified instances where purchases outside the purchase

order process exceeded $10,000, which requires multiple sign-offs for proper approval

Unfortunately, the signature approvals, as required on the forms, were not present. As a

result, we are concemed that the operating effectiveness of the controls over cash

disbursements does not exist, which has been an ongoing issue for the City since at least

2008 based upon findings communicated to the City by its external auditor. Due to the

lack of oversight of the contracting process, and deficiencies regarding the appropriate

approval and monitoring of purchases, the City is at a heightened risk of paying

significant amounts for out of scope’ services, or for purchasing items that are

inappropriate for the City operations. Furthermore, with the limited historical oversight,

We are concemed that the City may experience delays in construction process which

Could result in contractor disputes and costly Itigation.

Financial Areas of Risk

In addition to the preliminary analyses that we conducted around the City's contracting

process, we analyzed communications received from the City's outside auditors.’ In

performing those analyses we have identified that since at least 2008, the City has been

Notified of material deficiencies within the internal control environment, including the

following key areas.

Ce a

“As of the date of this proposal, the 2015 audit has not been performed; therefore, our

observations are based on the audit reports available through December 31, 2014

a

‘] eer wien cause LAP aninpenenty oo and managed mere ae Thy erator!

Smt te

Se ae)

01

Section Header

Segregation of Duties - Cash Receipts and Cash Disbursements

For the past 7 years, the financial reports from the City's outside auditor have identified

segregation of duties as an area of concem. For example, the assistant fo the director of

administrative services was given the responsibility to sign on behalf of numerous other

individuals, thus eliminating critical review steps in the control process. As a result, there

were instances where no documentation existed to evidence that certain members of

management had reviewed numerous disbursements which was required under the

policy.

We are concerned that the City has not addressed the lack of segregation of duties with

respect to disbursements for over 7 years. As a result, we believe the risk is s0 prevalent

throughout the City that the likelihood of the ability to misappropriate assets is

substantial. Furthermore, the fact that this was a control deficiency that was identified in

every year between 2008 and 2014 and no one was held accountable or responsible for

remediating the significant control weakness is alarming. Management asserted as part

of their action plans that the segregation of duties issues would be remediated; however,

the same issue was reported year after year. Management did not hold personnel

accountable and action plans were not implemented as evidenced by the repeated

findings. Managements’ responses year after year were as follows:

2010 ~ As of December 2010, a City Controller was added to the Administrative

Services Department. A new procedure has been put into place where the Controller

and Purchasing Coordinator sign off on all Accounts Payables and Purchase Orders

The Director of Administrative Services signs off on all Accounts Payables and

Purchase orders over $4,000 and the Managing Director signs off on Accounts

Payables and Purchase Orders over $10,000. Each Department Director must sign

ff on all of their Accounts Payables and Purchase Orders.

2011 — A new procedure has been put into place where the Controller and

Purchasing Coordinator signs off on all Accounts Payable and Purchase Orders. The

Director of Administrative Services signs off Accounts Payable and Purchase orders

‘over $4,000 and the Managing Director signs off Accounts Payables and Purchase

Orders over $10,000 respectively. Each Department Director must sign off on all of

their Accounts Payables and Purchase Orders

2012 — Management is requiring all authorized signers to be responsible for

reviewing payments. Dollar thresholds for the review process are being reviewed for

improved efficiency.

2013 - Management is requiring all authorized signers to be responsible for

reviewing payments. The assistant to the finance director is no longer permitted 10

sign on behalf of other individuals and changes to dollar thresholds have been made.

The City continues to increase the use of electronic purchase orders, with the

Administrative Services department directing that City departments to make use of

the electronic purchase order process whenever possible,

2014 - The City will enhance its controls over disbursements while improving the

timeliness and efficiency of its payment to vendors.

‘Baker Tily Virchow Krause, LLP is an independently owed and managed member of Baker Tiy International

Baker Tily chow

mks

Section Header

Cash Reconailiation Process

‘The 2012, 2013 and 2014 audits identified that the preparation of bank reconciliations for

the main operating account did not occur. This is @ major red flag concem which also

‘exposed the City to fraud, waste and abuse. Most receipts and disbursements flowed

through the main operating account and the response from finance regarding the lack of

reconciliation was tumover in finance personnel, a lack of undersianding of all the

transactions that are accounted for through the account, and a lack of standard operating

procedures prevented the City from accurately reconciling the account.

The reconciling of bank accounts is one of the most basic tasks an accounting

department performs, as well as one of the most important control functions preventing

fraud, waste and abuse. It is alarming that this is an issue that is presented in the

findings year after year with nothing ever changing. Management asserted as part of

their action plans that the bank reconciliation issues would be remediated; however, the

audit finding never changed. Management did not hold personnel accountable and

action plans were not implemented as evidenced by repeated findings. Managements’

responses year after year were as follows:

2012 — Management has assigned responsibility to personnel to prepare the bank

reconciliations and agree to the associated trial balance accounts.

2013 - Management has accepted the auditor's recommendation and is currently

‘conducting bank account reconciliations on a monthly basis.

2014 — Management is establishing the operating procedures for preparing a timely

‘bank reconciliation, and will be setting up a training for all staff members involved in

‘activity affecting the GDA bank account in order to streamline the reconciliation

process, and aid in preparing a timely reconciliation

Without accurate bank reconciliations, the City cannot be sure that the financial activity is

being recorded properly with the general ledger and also increases the risk for

misappropriation of assets to go undetected

‘The schedule of findings indicated that reconciliations were completed in August 2015 for

the months ended November and December 2014, as well as January and February

2015 noting a consistent variance of approximately $250,000. We believe a variance of

$250,000 is significant

Off Balance Sheet Bank Accounts

In 2014 the audit also identified that an off balance sheet bank account was discovered.

‘Specifically, the City assumed collection of delinquent recyciing accounts back from a

third party collector. These receipts were deposited into a bank account in order to track

them separately. The transactions within this account became material, totaling over

{$200,000 of receipts during the year, but no account activity was reported within the

‘general ledger until transfers were made to move the money into the recycling fund bank

account. Having cash accounts off the general ledger can increase the risk of

misappropriation of assets and compromise the accuracy of financial reporting,

The issues identified around cash are significant and evidence @ weak internal control

environment within the accounting department

Krause, LLP isan independent owned and managed member of Baker Ty Intersstonal

Accounts Receivable

Based on discussion with Mayor Scott, additional concerns exist regarding the collections

of delinquent accounts related to property and ACT 511 Taxes (eamed income tax). The

2010 and 2071 audit identified that there were inadequate support of the accounts

receivable balance for water and sewer operations as of the balance sheet date. The

report that was generated by management did not appear to accurately reflect the

outstanding balances at year-end. In addition, there was no evidence that anyone was

monitoring or analyzing the report information throughout the year as evidenced by the

unadjusted balances in the tral balance received.

‘Management asserted as part of their action plans that this issue would be remediated,

however, the issue was reported in 2010 and then again in 2011. Management did not

hold personnel accountable and action plans were not implemented as evidenced by the

following responses

2010 — As of August 2011, the outstanding bill report is run monthly. Also, the

Citizens Service Center has a process in place that will begin collection efforts as

‘soon ag an account is considered in arrears,

2011 - As of 6/1/12, the billing function for water and sewer has been moved to the

Reading Area Water Authority (RAWA). The Controller and Director of Administrative

Services are working closely with RAWA through the transition process.

Furthermore, it is our understanding based upon the auditors’ findings that there were

other issues associated with accounts receivable that exist that raise concems of the

financial operations at the City. Specifically, during 2014 it was identified that the

accounting department only records accounts receivable at year-end for governmental

funds,

‘The lack of appropriate monitoring and recording of accounts receivable throughout the

year is @ significant cause for concern, Specifically, minimal monitoring of receivables

Can result in weak collection efforts and understated revenue, leaving the City with the

risk of being underfunded,

Fixed Assets

In 2013 and 2014, the reporting of fixed assets was also identified as an internal control

weakness. Specifically. expenses relating to construction in process were not tracked

and capitalized in the proprietary funds during the year. In 2013 the auditors identified

that the City had a process in place whereas larger invoices that were paid were

segregated by the accounts payable clerk for further review by the accounting and

treasury manager. During the 2013 fiscal year, no further procedures were performed on

these invoices to determine whether they should be capitalized and tracked for ongoing

projects, or expensed. It was also noted that depreciation was not calculated or reported

throughout the year. Finance suggested that given the turnover in several key finance

epariment positions, the schedules for governmental fixed assets were not maintained

throughout the year and were not received until August 2015. Utimately, the City was

riot in compliance with generally accepted accounting principles related to reporting

capitalized assets, The reporting of fixed assets and properly recording depreciation are

some of the basic functions and responsibilities of the accounting department. The lack

of continuity of personnel in this department coupled with the lack of proper oversight of

‘Boker TilyVrchow Krause, LLP is an independently owned and managed membar o Boker Ty Inernational

4 Section Header

financial reporting and tracking of fixed assets exposes the City to risk of

misappropriation of assets and material misstatement of the financial statements

Loans / Grants

There are concerns that the City is not spending taxpayer money prudently and failing to

take advantage of grants and loans available. Further, there were concerns surrounding

the reporting of grant receipts, expenses and timely applying for reimbursements.

Specifically, in 2010, 2011, 2012 and 2013 the auditors noted that certain grant funds

were received by the City and passed-through to the sub recipients without the proper

documentation for expenses and other reports being received to properly monitor the

grant. Instances were also noted where the actual award and its related expenditures

were not recorded on the City’s general ledger in full nor was the grant coordinator aware

of grant extensions that were processed by others.

Additionally, during 2012 other concems were raised with respect to the compliance with

grant requirements. Specifically, a monthly reconciliation from the program expenses to

the related drawdowns was not completed accurately and timely throughout the year, and

therefore no control was in place to prevent expenses being incurred within the proper

draw down taking place timely. There was also no procedure in place that appointed &

specific individual to be responsible for the cash management requirement of the Federal

Highway Grant,

In 2014, the auditors identified that the City was approved for an H2O grant totaling

$1,000,000 from the Pennsylvania Department of Community and Economic

Development. This grant was to be used to reimburse 66 percent of the eligible costs up

to $1,000,000 for the rehabilitation of a digester at the sewer treatment plant. As of

December 31, 2014, over $850,000 had been spent on the project, but no requests for

payment were submitted and approved by the grantor. Therefore, the City is using

texpayer money to fund the rehabiltation as opposed to utilize grant funds that have

been allocated for that purpose.

In 2014, the auditors identified that the City was also awarded a PENNVEST loan in the

‘amount of $10,013,950 to support the 42° sewer force-main project. Total draw downs on

the loan through December 31, 2014 were $508,043 while the City incurred project costs

in excess of $12,800,000.

Management asserted as part of their action plans that the grant issues would be

remediated; however, grant issues were reported year after year. Management did not

hold personnel accountable and action plans were not implemented as evidenced by the

following responses:

2010 ~ The City recently added a grants accountant to staff. This accountant will

work closely with the Grants Coordinator to ensure that proper documentation is

retained, Staff will prepare and maintain a comprehensive listing of awards.

Coordination between Reading Redevelopment Authority and grants staff will be

improved

2011 = The Grants Accountant will work closely with the Grants Coordinator to

ensure that proper documentation is retained. Staff will prepare and maintain a

comprehensive listing of awards. Coordination between reading Redevelopment

Authority and grants staff will be improved.

pm

Section Header

2012 — Management has assigned responsibilty and scheduled timing of the

preparation of the schedule of grants with the appropriate accounting personnel and

has developed a process to review the report for completeness and accuracy and to

reconcile the detailed report to the general ledger.

‘The City has been paying for the costs incurred on both projects noted above without the

timely filing of the required reports to obtain reimbursement funds. This delay in receiving

funds has @ negative effect on the City’s cash flow and could jeopardize the receipt of

future funding, The lack of monitoring of grants is a significant concern and suggests

that the City is using taxpayer money to fund projects, instead of grant and loan money

that have been awarded specifically for projects.

Revenue

As previously discussed, the completeness of revenue and collection efforts by the City is

another area of exposure. Specifically, with respect to real estate tax revenue, in 2011 it

was discovered that no reconciliation of the taxes levied to the taxes collected was being

performed to monitor the collection activity. The City lacked documentation for the

ascessed taxes, collected taxes and outstanding taxes. Real estate taxes are a material

source of revenue for the City and the lack of monitoring over the collections is @ major

concer

During 2014 an account that held collections from delinquent recycling accounts was

discovered to be held separately from the City's general ledger. These were funds that

could have benefited the City and its operations; however, they were unaccounted for

which increases the risk of misappropriate of assets. There are also concerns whether or

not there are other accounts that are not recorded on the general ledger that could be

conduits for inappropriate activity

Expenditures

Segregation of duties with respect to cash disbursements has been an audit finding

during every audit since 2008 and based on our preliminary review of accounts payable

forms, policies and procedures are not being followed

Pension Reporting

‘The auditors reported every year between 2008 and 2014 that there had been turnover in

the pension administrator position as well as the payroll process migrating from an

internal payroll process to an external payroll processor. This tumover and change in

payroll process has not allowed any individual to gain comfort with the requirements of

the Form AG-385 and an understanding of the reports necessary to camplete the form

‘accurately. Throughout the audit, several instances were identified where the pension

eligible pay reported on the AG-385 report did not agree to the pensionable wages

‘amounts reported from the payroll processing company. Management asserted as part

of their action plans that this issue would be remediated; however, the issue was reported

year after year. Management did not hold personnel accountable and action plans were

rot implements as evidenced by the following responses:

2010 - The Pension Office has a new Pension Coordinator and she meets on a

weekly basis with the Administrative Services Director. The preparation of the

AG385 for 2010 involved the Pension Coordinator, City Auditor, Controller,

‘Boker Tily Virchow Krause, LLP isan independently owned and managed member of Baker ily Intomational

Section Header

‘Acoounting Manager, Administrative Services Director and his Confidential Secretary.

Staff expects the fling to be error free.

2011 - The preparation of the AG385 for 2011 involved the Pensions Coordinator,

City Auditor, Controller, and Accounting Manager. Staff expects the 2011 fling to be

error free,

2012 ~ Management will assign a person to review AG 385 for accuracy.

2013 - Management is in the process of developing and documenting operating

procedures within the administration area which includes the pension functions,

Cross training will be provided to a member of the management team.

2014 - Management has developed and documented operating procedures within

the administration area which includes the pension function, Cross training has

‘occurred so multiple staff are trained in the process

Due to the lack of competence at the pension administrator level, the City is at risk of

overpaying pension benefits ifthe pensionable pay is overstated

Furthermore, in 2013, the City pension boards procured one actuarial firm to perform all

three Act 208 actuarial studies, Previously each plan had a separate actuary, During the

time period in which the report was being filed, the pension coordinator position was.

vacated leaving others to assemble the required documentation. In addition, since the

last valuation, the City has also changed payroll processing procedures from an internally

performed process to an external payroll processing company. With the change in

actuaries, personnel, and payroll systems, the City was unable to complete the required

report by the March 2014 deadline. The report was submitted to the Commonweaith at

the beginning of July 2014. The tardiness of the report could have delayed the state

pension aid calculation for the City. The lack of oversight and reporting issues icentified

in this area raises concerns over the controls around payroll processing and the risks

associated with ghost employees, unauthorized access, lack of segregation of duties, etc.

Lastly, pension compliance issues were identified within the 2008, 2009, 2010, 2011 and

2012 audits, Specifically, numerous benefits have been granted to union employees that

‘were not within the parameters of the established codes. The City has granted benefits

that are out of compliance with state code for third class cities. As a result, the pension

subsidy from the Commonwealth covers a smaller portion of the pension obligation since

it will not factor the excess benefits into its calculation. This ultimately results in higher

costs to the City. Management asserted as part of their action plans that this issue would

be remediated; however, the issue was reported year after year. Management did not

hold personnel accountable and action plans were not implemented as evidenced by the

following responses:

2010 ~ The Act 47 Recovery Plan is taking an active role in all negotiations which

results in negotiating new labor contracts that comply with all applicable state and

local laws.

2011- The Act 47 Recovery Plan is taking an active role in all negotiations which

results in negotiating new labor contracts that comply with all applicable state and

local laws.

Boker Tily Vichow Krause, LLP isan independently onned and managed member of Baker Tily Intemational

a a ee

ee ee

Section Header

2012 - The pension compliance issue will be reviewed as part of the ongoing and

future labor contract negotiations with Act 47 guidelines.

Without the proper oversight of the pension reporting and compliance the City could be

liable for excess costs that are not appropriate and could have been avoided.

Time Card Approval

In each year between 2010 and 2013, the audit identified several instances of unsigned

and unapproved time cards through the testing of payroll. It was determined that the

hours were properly allocated based on the time cards; however, a lack of supervisory

‘approval was noted. Management asserted as part of their action plans that this issue

would be remediated; however, the issue was reported year after year. Management did

rot hold personnel accountable and action plans were not implemented as evidenced by

the following responses:

2010 - Management is looking into switching payroll systems and as part of this,

electronically collect time and require management to authorize time records. This

will replace the need for timesheets. In the meantime, the timekeepers will be

periodically reminded that all timesheets should be signed prior to being sent to

payroll. The City Auditor will be asked to periodically review time sheets for proper

authorization

2011 — As of September 1, 2012, the City will no longer host payroll software. The

processing of payroll will be conducted by ADP. One of the changes includes

electronic time capture. As part of the process an employee will “clock’ in and out for

the day using a biometric machine. This will become the employee's electronic

approval. Also, all time will need to be electronically approved by 2 supervisor or

manager before being sent to payroll

2012 — Management is currently working through a transition process onto an

electronic time capture platform whereby employees will clock in and out of work

Using a paperless process. Time data will be approved electronically by supervisory

personnel

2013 - Management will ensure, via operating procedure, that a review, approval

{and signature by the employee’s cupervisor of one’s time occurs.

‘The lack of supervisory approval can allow errors in the time charged or allocated among

divisions to pass undetected and lead to possible misappropriation of funds, More

specifically, this could infitrate departments where significant overtime occurs, such as

the fire and police departments, which represent the largest expenditures to the City.

‘The lack of contro's over the approval process for overtime exposes the City to the risk of

overtime reporting abuse and excess costs.

Procurement Card (“P Card”)

During the 2010 and 2011 audit, purchasing cards that were in possession of certain

department directors were only being approved by the same director before payment. No

‘monitoring review wes being performed at the upper management level to ensure only

allowable costs were being charged. Due to turnover in key management positions, this

monitoring activity was not taking place for a good portion of the year. Management

[Baker ily Vichow Krause, LLP is an independenty cuned and managed member of Baker TityInernational

Section Header

asserted as part of their action plans that this issue would be remediated; however, the

issue was reported over multiple years. Management did not hold personnel accountable

and action plans were not implemented as evidenced by the following responses:

2010 - The Managing Director and the Director of Administrative Services will review

‘monthly card statements for propriety.

2011 ~ In addition to the new policy that requires the Director of Admin Services to

sign off on all changes, another policy is being developed which will define what is

considered to be an acceptable charge.

\without the proper segregation of duties and independent approval, misappropriation of

assets may occur without being detected. P Cards are an area within an organization

that generally has @ lot of exposure to risk of abuse, The lack of approvals and

segregation of duties with respect to P Cards could be prevalent throughout the City and

could lead to excess costs:

Nem e

i

J] wie tey verze i pnt ant gi rent Ty ers

ee

Mamba

_How Baker Tilly Can Help

Baker Tilly believes that the most cost effective solution to provide the City with an

efficient work plan is a phased approach that includes a plan to implement the positive

change for the City with its financial and operational activity, Establishing the work scope

and areas of focus up front will allow the City to understand the process, while ensuring

that our work is focused on the areas deemed to be the highest risk. Our goal is to

address the City's concerns, identify areas of exposure and mest the objectives of the

City in an efficient and effective manner. The following section provides details of our

preliminary planned procedures.

We envision that Phase | will Include an analysis of the following

Overall Contracting Process;

All Contracts Associated with and Payments to Date with Respect to the WWTP;

Cash Reconciliation Process;

Cash Disbursements;

Procurement Process;

Payroll

Revenue Collection Process;

Pension; and

Grant and Other Contributions.

Phase I! will include:

Comprehensive reporting of findings & recommendations,

Phase Il will include:

‘Ongoing monitoring of capital projects;

‘Ongoing monitoring of financial operations; and

> Internal contra! documentation and remediation procedures

Phase |

Baker Tily’s FLVS team will focus its Phase | investigation on the City's contracting

process, WWTP and the financial operations. Baker Tilly has incorporated into our

Phase | plan the expertise and experience of members from our Government audit team.

Baker Tilly serves over 1,000 government and municipal authorities. Our audit team is

familiar with the challenges that government organizations face and has experience

providing operational support and assisting clients in improving internal controls and

ensuring the accounting department is operating effectively. We anticipate that the our

eliverable for Phase | will be reporting of our procedures, observations, findings and.

recommendations.

meta

Section Header

Risk(s):

‘The lack of oversight and monitoring of capital projects, the contract process and the lack of

Iransparency with respect to the terms and conditions of outstanding contracts exposes the City fo

the following risks:

Uncisclosed related party transactions;

Kickback schemes;

No-bid awards;

Excessive change orders

Delays,

Contract overiap,

Unnecessary contracts; and

‘Accountablity for the Project,

Forensic Objective:

To identify inappropriate activity surouncing the contracting process, identify intemel control

‘weaknesses, implement strong internal controls and ensure contols are operating effectively.

Scope: thrae — five years

Koy Activites:

Perform a walkthrough ofthe bidding / contracting process

(Obtain alsting ofall outstanding contracts

‘Analyze selected contracts (selections based on dollar value, nature of the services provided,

relationship with vendor, etc.)

‘Analyze payments to vendors / contractors to determine the appropriateness of disbursements

Review and analyze change orders issued to contractors / vendors and

Interview procurement personnel to understand the contract scope of work, roles and

responsibilies of contractors and to determine if related party relatonships exst

Deliverable:

A database of all outstanding contracts and @ summary oftheir terms and 2 reporting of our

findings and recommendations

Analysis of the WWTP Project

Risk(s):

‘The lack of oversight and monitoring of capital projects and contract process as well asthe lack of

transparency with respect tothe terms and conditions of outstanding contracts exposes the City to

the rks of:

Undisclosed related party transactions

Kickeack schemes

No-bid awards

Excessive change orders

‘Baker Tily Virchow krause, LLP isan independently owned and managed member of Baker TilyInemational

‘Section Header

Analysis of the WWTP Project

Delays (project deaciine is February 28, 2018)

Non compliance with the Consent Decree

Misuse of grant funding

Contract overlap

‘Scope: Entire Project

Objective:

‘Obtain an understanding of the bidding / contract awarding process, and snalyze the project costs,

to determine whether the contract achieved the desired results. In addtion, our forensic analysis,

will focus on determining whether inapproptate activity hes occurred surrounding the WWTP

projects and provide the City withthe tools to mitgate the future risks related to fraud, waste and

abuse.

Koy Activities:

(Obtain and analyze all contracts associated with the WWTP,

‘Analyze payments to vendors / contractors to determine the nature of the disbursements and

whether they comply with the contractual requirements;

Review and analyze change orders issued to contractors / vendors;

Interview procurement personnel to understand the contract scone of work, roles and

responsibiities of contractors and to determine if related party relationships exist, and

Provide recommendations to strengthening controls and propose / implement ongoing

‘monitaring activities to monitor construction projecis and mitigate the risk of fraud, waste and

abuse,

Deliverable:

Create a database of all outstanding contracts and a summary oftheir terms and reporting of our

findings ang recommendations regarding the contracts and reisted spending.

POET eokerculcccs

Riskis):

Historically, the City has felled to perform reconciliations between the bank accounts and the

‘general ledger. The falure to perform reconcliabons exposes the city to the risk of cash larceny,

‘skimming, and the enistence of off balance sheet accounts that could be the conduit for

inappropriate activities. Further, the financial statements are at risk of being materially misstated

because of the potential for inaccurate information that is recorded in the general ledger.

‘Scope: 20/2 ~ present

Objective:

Identity any inappropriate activity with respect to the cash reconciliation process, implement

policies and procedures that wil ensure that cash reconciliations are performed appropriately,

timely and are reviewed and approved by appropriate personnel

Key Activities:

With the assistance of the BT Government audit team, the forensic team will perform 2

‘Baker Tily Vechow Krause, LLP is an independently onned and managed member of Baker Tily International

al

_

Cn ee ee ee eee

Section Header

URIS uare

walkthrough of the monthly reconciliation process and assess the internal controls;

‘Analyze the reconciliation between the general ledger and the bank statement,

‘Analyze the appropristeness ofthe reconciling items; and

Implement policies and procedures to contralto effectively reconcile the bank accounts

Deliverable:

Reporting of our findings and recommendations.

Rooke ete eae

Risk(s):

Historically, there have been numerous issues with respact to segregation of duties and the proper

‘Suppor, review and approvals of cash disbursements. Additionally, there have historically been

Issues with approvals for procurement card reimbursements,

“The lack of proper oversight of cash disbursements and procurement can expose the City to

larceny of cash, fettious vendors, kickback schemes, collusion and misappropration of assets.

‘Scope: 2013 ~ Present — Based on finding, we may need to analyze adcitional years,

Objective:

To identity inappropriate activity, identify internal control weaknesses, and ensure that controls are

implemented around the procurement and vendor approvals processes. n addition, Baker Tilly wil

‘StUGtUre a process to ensure controls are operating effectively on a go forward basis.

Key Activities

With the assistance of the BT Government audit team, the forensic team will perform

walkthrough of the policies and procedures in place surrounding cash disbursements,

Obtain the bank statements from the City's operating accounts,

‘Analyze cash disbursements per the bank statements and determine whether the transaction

‘was appropriate and adequate suppor forthe transaction exists,

‘Analyze disbursements associated with the significant line items on the financial statements 10

Understand the nature and determine whether the transaction was sppropriate and adequate

‘suppor forthe transaction exists,

Analyze the completeness of the vendor list by determine whether the vendors identiied

through our cash disbursements testing and analysis of contract payments thet vendors are

included on the master ls

‘The BT Government audit team will perform 2 walkthrough of the cash disbursements

procedures to obtain an understanding ofthe intemal controls, and

Identty any wesknesses in intemal control and provide recommendations

Deliverable

Reporting of our findings and recommendations.

‘Boker TilyVrchow Krause, LLP is an indeperdenty oomed and managed member of Baker Tay iterations

eel

fee ea Ls

het

Section Header

eee beeen)

Risk(s):

Historically there were issues surrounding capitalizing and depreciating fied assets. By not

capitalizing and depreciation assets appropriately, the City is at risk of asset misappropriation and

‘material misstatements on the financial statements

Scope: 2013 and 2014

Objective:

‘To identty inappropriate activity, verily the existence of fixed assets, determine whether fixed asset

‘additions are captured appropriately, identify internal control weaknesses and ensure that internal

‘contro are implemented properly snd operating effectively on a go forward basis.

Key Activities

= With the assistance ofthe BT Government aucit team, the forensic team wil perform a

walkthrough of the policies and procedures in place surrounding cash disoursements,

= Through our testing of expenditures / cash disbursements we wil also verfy that

expenses were recorded properly,

= Obiain the listing of fixed assets and fixed asset additions and verify that items exist.

Deliverable

Reporting of our findings and recommendations.

Enea neue

Risk(s):

Dee to the history of turnover, the transition from internal payroll process to ADP and lack of

approvals on timecards, the City is at risk of misappropriation of funds through payroll schemes,

‘such as fraudulent overtime, ghost employees, and pay rate compliance.

Additionally, due to the lack of competency of personnel, the City has had issues with complying

‘with the fotm AG-385 reporting requirements, Form AG-385 is used to compute the City’s allocation

Of state aid for pension plans andior volunteer frefighiers’ relie! associations. False statements

made on form AG-385 is punishable under 18 Pa. CS Section 4904, Further, in the past benefits

‘were granted to union workers outside the parameters of the established codes. The lack of

competency and oversight could lead to overpayment of pension benefits and material

misstatements on the financial statements,

‘Scope: 2012— Present

Objecti

To understand the payroll process, the current policies and procedures and how employees are

added to the system, To understand the overlme approval process, identify any inappropriate

activity, internal control weaknesses, and ensure that controls are implemented and operating

effectively on 3 go forward basis. With respect o the pension reporting process, our objective

‘would be to understand From AG-385 reporting process, the reconciliations of the internal pension

reporting to ADP and identify internal control weaknesses, and ensure that controls are

Implemented and operating effectively on a go forward basis,

Key Actvties:

\With the assistance of the BT Government audit team, the forensic team will perform a

walkthrough ofthe polices and procadures in place surrounding payroll and the pensions

‘Baker Tily Virenow Krause, LLP is an intopendenty owned and manage member of Baker Tily International

eae

on a eo ae |

faker Tily Vechow Krause, LLP isan independently ownes and mar

Section Header

ede Lee een)

reporting process;

= Analyze overtime payments and determine i the appropriate policies and procedures

wore followed:

= Perform an analysis ofall payroll activity to identity the possibilty for ghost employees es

well 8s confirmation of the approved pay scale for employees:

= Analyze the Form-385 for accuracy and completeness and reconcile to payroll records;

‘and

= Analyze pension benefits granted

Deliverable:

Reporting of our findings and recommendations.

eae hee a

Riok(e):

Historically there have been issues with the lack of reconciliation between taxes levied and taxes.

Collected, as well as a lack of documentation supporting the assessed taxes, collected taxes and

outstanding taxes, Tax revenue is a major funding source for the City and without the proper

policies and procedures in place the City is at risk of miseppropriation of funds, and significant

‘wrte-ofs of receivables which could lead to underfunding ofthe City's operations.

Scope: 2013 present

Objective: To understand the collection process, identify any inappropriate activity, identity

missing documentation, and ensure that the City has the procedures in place to collect the revenue

that itis owed.

Koy Activities

With the assistance of the BT Govemment audit team, the forensic teamBaker Tilly will

perform a walkthrough of the policies and procedures in place surrounding the revenue

collection process;

Obtain an understanding of the City's revenue collection efforts; and

Analyses ofthe taxes levied and collected, accounts receivable, and delinquent accounts,

Deliverable: Reporting of our findings and recommendations.

eee

Risk(e):

‘The city participates in state or federally assisted grant programs that are subject to program

‘compliance audits by the grantors or their representatives. The City is potentialy liable for any

‘expenditure which may be disellowed pursuant to the terms of these grant programs.

Given the City’s history of compliance issues with respect to grant awards and expenditures not

being properly decument or reportad on the general ledger, the City could be liable for unexpected

expencitures as a result of issued identified during a compliance auctt

14 member of Baker Tit Intemational

Le

Section Header

reece!

‘Scope: 2013 - Present

Objective:

Determine whether inappropriate actvty has occurred with respect to the use of grant funds,

‘assess intemal controls recording the sources and uses of grant funds and ensure the City is in

‘compliance on a go forward basis.

Key Activitios

Obtain a listing of all grants the City has been awarded

‘Analyze the uses of grant funds and determine whether the appropriate documentation is

maintained to support the expenses

‘The Beker Tily Government audt team will perform a walkthrough of the cash disbursements,

procedures to obtain an understanding of the intemal controls,

Identity any weaknesses in internal control and provide recommendations,

Deliverable:

Reporting of our findings and recommendations, Assistance with the implementaton of

recommendations and manitaring of cash reconciliation process on a go forward basis.

Phase II

Rone)

‘Scope: We expect at the completion of our Phase | work to provide the City with a comprehensive

report setting forth our findings, observations and recommendations related to the Phase | areas of

‘analyses. The specific format and contents ofthe report wil be dictated by our Phase | work

Phase lil

Pena)

Risk(s)

‘Without the proper oversight of ongoing capital projects, the City is at risk of cost overruns, out of

scope changes, excessive change orders and potential Contractor disputes that could lead to costly

litigation,

‘Scope: Evaluation of selected historically and newly awarded contracts,

Key Activities:

To ensure that contract terms are followed to protect the City from unexplained cost overruns,

‘Beker Tily Vicnow Krause, LLP s an independently owned and managed member of Baker Tly International

eee

— —

a re |

—

Section Header

eae een)

‘costly delays, and mitigate the risk of inappropriate activity

Analyze of contract terms

‘Analyze of payments and progress to date

Review and analysis of change orders

Perform ongoing reviews of payment applications and change orders throughout the

‘construction process

Deliverable

‘Status updates with management and periodic repors of our findings and recommendations

eee ean eaae)

Risk(s):

City personne! fail to implement polices end procedures recommended by Baker Tilly as a result

the forensic investigation,

Scope:

Control improvement recommendations provided as @ result ofthe Baker Tily forensic analysis of

cash receipts, cash disbursements, fixed asset report, grants, pension reporting, and payroll,

Key Activities:

To ensure that any new or improved policies and procedures are implemented by City personnel

‘our BT Government auditing team wil

Assist the City with implementation and training,

Monitor the operating effectiveness of controls; and

Perform ongoing revions and tosting of transactions.

Deliverable

‘Status updates with management and periodic reports of our observations.

eon aol ete ecu ee

‘A byproduct of a forensic investigation is the identification of gaps and weaknesses in intemal

Controls based upon any inappropriate activty identified. AS @ result, recommendations for

improving internal controls are provides. However, our Phase | investigation only targets speciic

‘areas within the City, A comprehensive intemal control assessment may be necessary to ensure

thatthe proper policies and procedures are dacumented and controls are in place to mitigate the

risk associated with inappropriate activity throughout all of the financial operations at the City

Risk(s):

Without the proper policies and procedures in place, there is an increased risk for inappropriate

activity to occur,

‘Scope:

Following is a complete list of ress our internal control team is capable of assessing. The internal

‘control team will leverage the FLVS team's knowledge of the internal controls assessed during

‘Baker Till Vrchow Krause, LLP san independenty owned and manages member of Baker ily Intemational

Vous aimerez peut-être aussi

- 13 Reading Gang Members IndictedDocument53 pages13 Reading Gang Members IndictedReading_EaglePas encore d'évaluation

- Letter To Legislative LeadersDocument2 pagesLetter To Legislative LeadersReading_EaglePas encore d'évaluation

- BoyertownLetter Busing 20210921Document1 pageBoyertownLetter Busing 20210921Reading_EaglePas encore d'évaluation

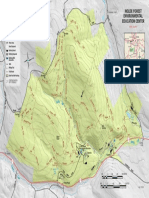

- Nolde Forest Trail MapDocument1 pageNolde Forest Trail MapReading_EaglePas encore d'évaluation

- Accidental Shootings by Police (The Associated Press)Document125 pagesAccidental Shootings by Police (The Associated Press)Reading_Eagle100% (1)

- F&M Poll Release October 2019Document34 pagesF&M Poll Release October 2019Reading_EaglePas encore d'évaluation

- Bail LawsuitDocument19 pagesBail LawsuitReading_EaglePas encore d'évaluation

- Service Animal Definitions Compared by The U.S. Department of TransportationDocument13 pagesService Animal Definitions Compared by The U.S. Department of TransportationReading_EaglePas encore d'évaluation

- U.S. Sen. Bob Casey and U.S. Rep. Chrissy Houlahan's Letter To ICEDocument5 pagesU.S. Sen. Bob Casey and U.S. Rep. Chrissy Houlahan's Letter To ICEReading_EaglePas encore d'évaluation

- Losing The News The Decimation of Local Journalism and The Search For SolutionsDocument114 pagesLosing The News The Decimation of Local Journalism and The Search For SolutionsReading_EaglePas encore d'évaluation

- Bail LawsuitDocument19 pagesBail LawsuitReading_EaglePas encore d'évaluation

- Dog Attack SurveyDocument9 pagesDog Attack SurveyReading_EaglePas encore d'évaluation

- F&M Poll Release: March 2019Document33 pagesF&M Poll Release: March 2019Reading_EaglePas encore d'évaluation

- 2019.7.1 ED v. Sharkey - 3d Cir OpinionDocument16 pages2019.7.1 ED v. Sharkey - 3d Cir OpinionReading_EaglePas encore d'évaluation

- Pennsylvania Game Commission Draft CWD Response PlanSept122019Document37 pagesPennsylvania Game Commission Draft CWD Response PlanSept122019Reading_EaglePas encore d'évaluation

- Pennsylvania Game Commission Draft CWD Response Plan Public Comment FormDocument2 pagesPennsylvania Game Commission Draft CWD Response Plan Public Comment FormReading_EaglePas encore d'évaluation

- W. Glenn Steckman LawsuitDocument9 pagesW. Glenn Steckman LawsuitReading_EaglePas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Canine Parvovirus ExplainedDocument2 pagesCanine Parvovirus ExplainedReading_EaglePas encore d'évaluation

- Kevin Barnhardt - Berks Co. Residential Center AnnouncementDocument2 pagesKevin Barnhardt - Berks Co. Residential Center AnnouncementReading_EaglePas encore d'évaluation

- RE Purchase AgreementDocument163 pagesRE Purchase AgreementReading_Eagle0% (1)

- Ruling On I-LEAD Charter School's Tax-Exempt StatusDocument29 pagesRuling On I-LEAD Charter School's Tax-Exempt StatusReading_Eagle100% (1)

- Letter Regarding Citizens' Petition 4-2-19Document2 pagesLetter Regarding Citizens' Petition 4-2-19Reading_EaglePas encore d'évaluation

- Berks Heim PollDocument36 pagesBerks Heim PollReading_EaglePas encore d'évaluation

- Grace Packer ReportDocument34 pagesGrace Packer ReportReading_Eagle100% (1)

- Bankruptcy - CreditorsDocument4 pagesBankruptcy - CreditorsReading_EaglePas encore d'évaluation

- Operation Ice DogDocument14 pagesOperation Ice DogReading_EaglePas encore d'évaluation

- OperationShattered 03-14-19Document36 pagesOperationShattered 03-14-19Reading_EaglePas encore d'évaluation

- Official Form 206sum: Summary of Assets and Liabilities For Non-IndividualsDocument1 pageOfficial Form 206sum: Summary of Assets and Liabilities For Non-IndividualsReading_EaglePas encore d'évaluation

- Reading Eagle Company OwnersDocument5 pagesReading Eagle Company OwnersReading_EaglePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)