Académique Documents

Professionnel Documents

Culture Documents

VAT 100 Print

Transféré par

Swamy HNDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

VAT 100 Print

Transféré par

Swamy HNDroits d'auteur :

Formats disponibles

3/11/2016

VAT100Print

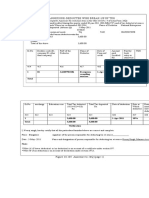

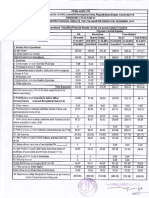

FORMVAT100

[SeeRules38]

RETURN

ReturnREF.No.:3142185272

1.GeneralInformation

31

SEP2015

ORIGINAL

20/10/2015

29640731913

AISHWARYASILKS

609,1STFLOORAVENUEROAD,NEXTTORICEMEMORIALCHURCH

BANGALORE560002

1.1)LVOCODE

1.2)TaxPeriod(Month/Quarter)

1.3)ReturnType

1.4)FilingDate

1.5)TIN

1.6)FullNameofthedealer

1.7)Addressofthedealer

1.8)Taxinvoicesissuedinthemonth:

2.ParticularsofTurnover

Local

InterState

2)TotalTO

2.1)Ret.,disc.,lab.chg.etcrel.tosalesofthe

month

2.1.1)Salesreturnsofprev.sixmonth(rel.tax

valuemaybeenteredat4.6.1)

232533 3)TotalTO(Interstate/Export)

24086 3.1)Ret.,disc.,lab.chg,etc.

0 3.1.1)Salesreturnofprev.sixmonth

2.2)Const.Sales/C.A.Sales

0 3.2)ST/Cons.Sales

2.3)TaxColl.(VAT)

0 3.3)ExemptedSales

208447 3.4)DirectExports

2.4)ExemptedSales

2.5)Others

0 3.5)DeemedExports(againstHForm)

2.6)TaxableTO(Local)[Box2less(Box2.1to

Box2.5)]

0 3.6)SalesinTransit(EI,E2)

3.7)Salesinthecourseofimport(including

HighSeaSales)

3.8)CSTCollected

3.9)Taxableturnover(Interstate)[BoxNo.3

less(TotalofBox3.1toBox3.8)]

0

0

4.NetTaxPayable

Amount

4.1)OutputTaxPayable(ReferBoxNo.8.3)

4.2)B/fcreditofinputtaxofpreviousmonth(ReferBox4.10)

4.3)Inputtaxcredit(ReferBoxNo.11)

4.4)TaxPayable[BoxNo.4.1(BoxNo.4.2+BoxNo.4.3)]

4.5)Taxdeductedatsource(Certificate/sEnclosed)

4.6)Taxalreadypaidintheoriginal/revised/correctedreturn&ITAdjst.ofPrev.6months

4.7)BalanceTaxPayable[BoxNo.4.4(Box.No.4.5+Box.No.4.6)]

4.8)AdjustmentofanyexcesscredittowardsKST/KTEG/KSTECG

4.9)Refundclaiminoriginalreturn

4.10)Credit/excesspaymentcarriedforwardinoriginalreturn

4.11)NetTaxrefundasperInc.Notf.

5.TaxPaymentDetails

Details

Amount

5.1)TaxPayableasperBox.No.4.7

5.2)Interest

5.3)Others

5.4)TotalofBoxNo.5.1toBoxNo5.3

http://164.100.80.100/vat2/VatReturn/VAT100Print.aspx?mode=fromPrint

1/3

3/11/2016

VAT100Print

6.DetailsofLocalSales/URDPurchasesandOutputTax/PurchaseTaxPayable

6.1)TaxableTOofsalesat1%

0 6.11)O/ptaxPayable(rel.toBNo.6.1)

6.2)TaxableTOofsalesat4%

0 6.12)O/ptaxPayable(rel.toBNo.6.2)

6.3)TaxableTOofsalesat5%

0 6.13)O/ptaxPayable(rel.toBNo.6.3)

6.3.1)TaxableTOofsalesat5.5%

0 6.13.1)O/ptaxPayable(rel.toBNo.6.3.1)

6.4)TaxableTOofsalesat13.5%

0 6.14)O/ptaxPayable(rel.toBNo.6.4)

6.14.1)O/ptaxPayable(rel.toBNo.6.4.1)

6.4.2)TaxableTOofsalesat14.5%

0 6.14.2)O/ptaxPayable(rel.toBNo.6.4.2)

6.5)TaxableTOofsalesat15%

0 6.15)O/ptaxPayable(rel.toBNo.6.5)

6.5.1)TaxableTOofsales@17%

0 6.15.1)O/ptaxPayable(rel.toBNo.6.5.1)

6.6)Others,ifany(pleasespecify)

0 6.16)O/ptaxPayable(rel.toBNo.6.6)

6.7)TaxableTOofURDpurc.at5%

0 6.17)O/ptaxPayable(rel.toBNo.6.7)

6.7.2)TaxableTOofURDpurc.at5.5%

0 6.17.2)O/ptaxPayable(rel.toBNo.6.7.2)

6.8)TaxableTOofURDpurc.at13.5%

0 6.18)O/ptaxPayable(rel.toBNo.6.8)

6.8.1)TaxableTOofURDpurc.at14%

6.18.1)O/ptaxPayable(rel.toBNo.6.8.1)

0 6.18.2)O/ptaxPayable(rel.toBNo.6.8.2)

0 6.19)O/ptaxPayable(rel.toBNo.6.9)

0 6.20)TotalO/ptaxpayable(6.11to6.19)

0

0

0

7.1)TaxableTOofISSat1%

0 7.10)O/ptaxpayable(rel.toBNo.7.1)

7.2)TaxableTOofISSagainstCFormsat2%

0 7.11)O/ptaxpayable(rel.toBNo.7.2)

7.3)TaxableTOofISSwithoutCFormsat1%

0 7.12)O/ptaxpayable(rel.toBNo.7.3)

7.4)TaxableTOofISSwithoutCformsat4%

0 7.13)O/ptaxpayable(rel.toBNo.7.4)

7.5)TaxableTOofISSwithoutCformsat5%

0 7.14)O/ptaxpayable(rel.toBNo.7.5)

7.5.1)TaxableTOofISSwithoutCformsat

5.5%

7.6)TaxableTOofISSwithoutCformsat

13.5%

7.6.1)TaxableTOofISSwithoutCformsat

14%

7.6.2)TaxableTOofISSwithoutCformsat

14.5%

0 7.14.1)O/ptaxpayable(rel.toBNo.7.5.1)

0 7.15)O/ptaxpayable(rel.toBNo.7.6)

6.4.1)TaxableTOofsalesat14%

6.8.2)TaxableTOofURDpurc.at14.5%

6.9)TaxableTOofURDpurc.atother

rate(specifyrate)

6.10)Total(BoxNo.6.1to6.9)

7.DetailsofInterstateSales(ISS)andCSTPayable

7.15.1)O/ptaxpayable(rel.toBNo.7.6.1)

0 7.15.2)O/ptaxpayable(rel.toBNo.7.6.2)

7.7)TaxableTOofISSwithoutCformsat15%

0 7.16)O/ptaxpayable(rel.toBNo.7.7)

7.7.1)TaxableTOofISSwithoutCformsat

17%

0 7.16.1)O/ptaxpayable(rel.toBNo.7.7.1)

7.8)Others,ifany(SpecifyRateofTax)

0 7.17)O/ptaxpayable(rel.toBNo.7.8)

7.9)Total(ofBNo.7.1to7.8)

7.18)Totalo/ptaxpayable(Totalof7.10to

0

7.17)

8.1)TotalOutputTax(TotalofBNo.6.20andBNo.7.18)

8.2)OutputTaxdeferredtoIndustriesasperIncentiveNotifications

8.3)NetOutputTaxPayable(BNo.8.1BNo.8.2)

9.DetailsofPurchasesandInputTax

9.1)Netvalueofpurchasesat1%

0 9.14)Inputtax(rel.toBNo.9.1)

9.2)Netvalueofpurchasesat4%

0 9.15)Inputtax(rel.toBNo.9.2)

9.3)Netvalueofpurchasesat5%

0 9.16)Inputtax(rel.toBNo.9.3)

9.3.1)Netvalueofpurchasesat5.5%

0 9.16.1)Inputtax(rel.toBNo.9.3.1)

9.4)Netvalueofpurchasesat13.5%

0 9.17)Inputtax(rel.toBNo.9.4)

9.4.1)Netvalueofpurchasesat14%

9.17.1)Inputtax(rel.toBNo.9.4.1)

0 9.17.2)Inputtax(rel.toBNo.9.4.2)

0 9.18)Inputtax(rel.toBNo.9.5)

0 9.18.1)Inputtax(rel.toBNo.9.5.1)

0

0

0

9.4.2)Netvalueofpurchasesat14.5%

9.5)Netvalueofpurchasesat15%

9.5.1)Netvalueofpurchasesat17%

9.6)ValueofURDpurc.totheext.used/soldduringthe

Month/Quarter

http://164.100.80.100/vat2/VatReturn/VAT100Print.aspx?mode=fromPrint

2/3

3/11/2016

VAT100Print

9.6.1)B/FfromPrev.period

9.6.2)Rel.toCurr.period

9.6.3)Total(9.6.1+9.6.2)

0 9.19)Inputtax(rel.toBNo.9.6.3)

9.7)Others,ifany(pl.specify)

0 9.20)Inputtax(rel.toBNo.9.7)

0

0

9.8)ValueofURDpurc.totheext.notused/sold

9.8.1)B/FfromPrev.period

9.8.2)Rel.toCurr.taxperiod

9.8.3)Total(9.8.1+9.8.2)

9.21)Inputtaxcarriedforward(rel.toBNo.

9.8.3)

41840

9.9)Val.ofVATexemptedgoods.

9.10)valueofPurchasefromCompositiondealer

9.11)Valofgoodsimp/purc.inthecourseof

Import/Export/InterstatetradeincludingEI&

EIIpurchases

9.12)Valofgoodsreceivedbystock

transfer/consignmenttransfer

9.12.1)Purchasereturnofprev.sixmonth

9.13)Totalvalueofpurchases(BNo.9.1to

9.5,9.7,9.6.2,9.8.2and9.9to9.12)

41840

9.22)Totalinputtax

(BNo9.14to9.20)

10.IneligibleInputTaxCredit

10.1)Nondeductibleinputtaxbeingrestrictedu/s11

10.2)Nondeductibleinputtaxpreregistrationpurchasesu/s13ofVATAct

10.3)Nondeductibleinputtaxunderspecialrebatingschemeu/s14readwithSection11

10.4)Nondeductibleinputtaxunderpartialrebatingschemeu/s17ofVATAct

10.5)Nondeductibleinputtaxrelatingtoreturnofgoodspurchased

10.6)Others,PleaseSpecify

10.7)TotalIneligibleInputTaxCredit(BNo.10.1to10.6)

11.EligibleInputTaxCredit[BNo.9.22BNo.10.7]

11.1)Capitalgoodsvalueinrespectofwhichinputtaxcreditisnotavailedduringcurrentmonth/taxperiod

11.2)Capitalgoodsrelatedtax

11.3)Capitalgoodsvalueinrespectofwhichthebroughtforwardinputtaxcreditisavailedduringthecurrent

month/taxperiodbeingrestrictedu/s11

11.4)Capitalgoodsrelatedtaxinrespectof11.3

0

PaymentDetails

Remarks:

NoPreviousPayment

I/Weherebydeclarethattheparticularsfurnishedabovearetrueandcompleteinallrespects.

Date:.................

Signature:.....................................

Place:................

Nameanddesignation:...................

http://164.100.80.100/vat2/VatReturn/VAT100Print.aspx?mode=fromPrint

Exit

3/3

Vous aimerez peut-être aussi

- June ReturnDocument3 pagesJune ReturnPavan JayaprakashPas encore d'évaluation

- Vat 100 Mistake On WebsiteDocument1 pageVat 100 Mistake On WebsitesaurabhtechiePas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Public Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012Document72 pagesPublic Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012got.mikePas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- SMIC - Quarterly Report (Q2 2016)Document73 pagesSMIC - Quarterly Report (Q2 2016)mikhail_flores_2Pas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- BallCorporation 10Q 20130506Document57 pagesBallCorporation 10Q 20130506doug119Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Comtaxup - Gov.in Upvatforms EsancharanFD38 frm38pdf - Aspx PDFDocument2 pagesComtaxup - Gov.in Upvatforms EsancharanFD38 frm38pdf - Aspx PDFDeepaPas encore d'évaluation

- Annual ReportDocument1 pageAnnual ReportAnup KallimathPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Baba Markting Form Vat 240 2010-2011Document5 pagesBaba Markting Form Vat 240 2010-2011arunupadhyaPas encore d'évaluation

- Rectification On Financial Results For The Period Ended June 30, 2015. (Result)Document2 pagesRectification On Financial Results For The Period Ended June 30, 2015. (Result)Shyam SunderPas encore d'évaluation

- Sidvin Pharma - Form Vat 105 - July-11Document4 pagesSidvin Pharma - Form Vat 105 - July-11Lakshmi NarayanaPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Vat3 FormDocument2 pagesVat3 FormMacharia MainaPas encore d'évaluation

- Form E.R.-8 Original/DuplicateDocument4 pagesForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులPas encore d'évaluation

- HTTP 164.100.80.99 Vat2 VatReturn VAT100PrintDocument3 pagesHTTP 164.100.80.99 Vat2 VatReturn VAT100PrintAnonymous 1uGSx8bPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Adv Tax Interest 234 CDocument4 pagesAdv Tax Interest 234 CnavinluharukaPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For December 31, 2015 (Result)Document4 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Fiscal Documents Annex 1 (FINAL)Document10 pagesFiscal Documents Annex 1 (FINAL)danielPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- 2nd SranDocument1 page2nd SranHarkrishan SinghPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Tttjyj PDFDocument70 pagesTttjyj PDFgvPas encore d'évaluation

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Sumona Chakraborty 2010Document6 pagesSumona Chakraborty 2010LoveSahilSharmaPas encore d'évaluation

- Quick Guide To Using This Utility For EreturnsDocument18 pagesQuick Guide To Using This Utility For EreturnsAadish JainPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsPas encore d'évaluation

- Cit 50 PDFDocument8 pagesCit 50 PDFMook Kitty BerryPas encore d'évaluation

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Trash - CPDocument74 pagesTrash - CPgroup3 cgstauditPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Tnvat Form WW Fy 15-16Document30 pagesTnvat Form WW Fy 15-16samaadhuPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- BIR Form 1702 (November 2011)Document18 pagesBIR Form 1702 (November 2011)Jecon BonsucanPas encore d'évaluation

- ASSESSEE PROFILE FORMAT BlankDocument6 pagesASSESSEE PROFILE FORMAT BlankThanga Pandian SPas encore d'évaluation

- Submitted By:: Finance+marketingDocument15 pagesSubmitted By:: Finance+marketingpsd_vidPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document5 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Markets for CommoditiesD'EverandFinancial Markets for CommoditiesJoel PriolonPas encore d'évaluation

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsD'EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsPas encore d'évaluation

- SOCIAL SECURITY SYSTEM EMPLOYEES ASSOCIATION Vs CADocument4 pagesSOCIAL SECURITY SYSTEM EMPLOYEES ASSOCIATION Vs CAM Azeneth JJPas encore d'évaluation

- Form PDFDocument1 pageForm PDFFaisal KhanPas encore d'évaluation

- Felix Musembi Kyalo, A200 578 009 (BIA Sept. 6, 2013)Document4 pagesFelix Musembi Kyalo, A200 578 009 (BIA Sept. 6, 2013)Immigrant & Refugee Appellate Center, LLCPas encore d'évaluation

- Chua vs. Padillo, 522 SCRA 60Document10 pagesChua vs. Padillo, 522 SCRA 60Maryland AlajasPas encore d'évaluation

- Prosecution RebuttalDocument2 pagesProsecution RebuttalTasneem C BalindongPas encore d'évaluation

- The Law of Employees' Provident Funds - A Case Law PerspectiveDocument28 pagesThe Law of Employees' Provident Funds - A Case Law PerspectiveRamesh ChidambaramPas encore d'évaluation

- Public Administration - Study Plan For CSSDocument13 pagesPublic Administration - Study Plan For CSSMuhammad Faisal Ul Islam67% (3)

- Scan 001Document7 pagesScan 001Circuit MediaPas encore d'évaluation

- United States v. Alexander Matthews, 4th Cir. (2015)Document4 pagesUnited States v. Alexander Matthews, 4th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- Cruz v. JacintoDocument6 pagesCruz v. JacintoPaul Joshua Torda SubaPas encore d'évaluation

- RAYYANDocument24 pagesRAYYANRizki HardiansahPas encore d'évaluation

- Joint Venture Agreement - Real Estate - CaDocument15 pagesJoint Venture Agreement - Real Estate - CaJon DeerPas encore d'évaluation

- Prosecutors Filing Against Jessica Watkins ReleaseDocument6 pagesProsecutors Filing Against Jessica Watkins ReleaseThe Columbus DispatchPas encore d'évaluation

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Document3 pagesAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocPas encore d'évaluation

- Senate Censure of Joseph McCarthy 1954Document1 pageSenate Censure of Joseph McCarthy 1954Anonymous nYwWYS3ntVPas encore d'évaluation

- Form 15ca FormatDocument4 pagesForm 15ca FormattejashtannaPas encore d'évaluation

- Salient Features of The Revised Guidelines For Continuous Trial of Criminal CasesDocument3 pagesSalient Features of The Revised Guidelines For Continuous Trial of Criminal Casesczabina fatima delicaPas encore d'évaluation

- Doctrine of State ResponsibilityDocument7 pagesDoctrine of State ResponsibilityJulia EdralinPas encore d'évaluation

- In The State of Texas, Raphael Holiday Is Innocent of Capital MurderDocument178 pagesIn The State of Texas, Raphael Holiday Is Innocent of Capital MurderNancy Lockhart100% (1)

- Bio - Data G. Kumar Naik 14.12.11Document2 pagesBio - Data G. Kumar Naik 14.12.11Charles Kothary100% (1)

- MCQ'S Practies: Direct TaxDocument12 pagesMCQ'S Practies: Direct TaxTina AggarwalPas encore d'évaluation

- 29 Fabie v. Gutierrez DavidDocument1 page29 Fabie v. Gutierrez Davidcrisanto m. perezPas encore d'évaluation

- Trulove ComplaintDocument49 pagesTrulove ComplaintEthan BrownPas encore d'évaluation

- How To Understand Managers Investors Liability in BrazilDocument38 pagesHow To Understand Managers Investors Liability in BrazilPedro AlePas encore d'évaluation

- Affidavit of Adverse Claim1Document2 pagesAffidavit of Adverse Claim1Samuel CorpuzPas encore d'évaluation

- Areola Vs MendozaDocument4 pagesAreola Vs MendozaIrang GandiaPas encore d'évaluation

- Paras Notes For ObliconDocument38 pagesParas Notes For ObliconBelle Cabal100% (1)

- Chapter 2 CODEDocument22 pagesChapter 2 CODESarah Yatco100% (1)

- 13 Diamond Forms v. SPFL-Workers of DARBMUPCODocument2 pages13 Diamond Forms v. SPFL-Workers of DARBMUPCOGabrielle Adine SantosPas encore d'évaluation

- LAW ENFORCEMENT-WPS OfficeDocument30 pagesLAW ENFORCEMENT-WPS OfficeRina CabsabaPas encore d'évaluation