Académique Documents

Professionnel Documents

Culture Documents

Part8 - Financial Accounting

Transféré par

Nithus Nate ApimonbutraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Part8 - Financial Accounting

Transféré par

Nithus Nate ApimonbutraDroits d'auteur :

Formats disponibles

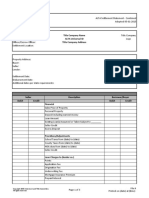

Integrated business processes with SAP ERP

Script 8: Financial accounting in SAP ERP

Prof. Dr. Heimo H. Adelsberger

Dipl.-Wirt.-Inf. Pouyan Khatami

Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Table of contents

Table of contents ........................................................................................................................ 2

Table of figures .......................................................................................................................... 4

Copyright .................................................................................................................................... 6

1

Financial accounting in SAP ERP ...................................................................................... 7

1.1 Unit objectives financial accounting in SAP ERP ................................................... 7

1.2 Scenario ....................................................................................................................... 8

2

Financial accounting with SAP ERP ................................................................................ 10

2.1 Theory Duties in financial accounting.................................................................... 10

2.1.1 Integration of G/L accounts in financial accounting .......................................... 11

2.1.2 Financial accounting versus management accounting ....................................... 12

2.2 Theory Organizational levels in financial accounting ............................................ 14

2.2.1 Company codes .................................................................................................. 14

2.2.2 Business areas .................................................................................................... 14

2.2.3 Controlling area .................................................................................................. 15

2.3 Practical application Organizational levels in financial accounting ....................... 17

2.3.1 Definition: Customizing ..................................................................................... 17

2.3.2 Organizational structures in accounting ............................................................. 20

2.3.3 Questions ............................................................................................................ 20

2.3.3.1

Currency in company code 1000 ................................................................ 21

2.3.3.2

Cross-company code cost accounting ......................................................... 22

2.3.3.3

Fiscal year variant ....................................................................................... 23

2.3.3.4

Operating concern ....................................................................................... 24

2.3.3.5

Cost center accounting ................................................................................ 25

2.4 Theory General ledger accounting ......................................................................... 26

2.4.1 Chart of accounts ................................................................................................ 26

2.4.1.1

Chart of account assignment ....................................................................... 26

2.4.1.2

G/L account master record .......................................................................... 27

2.4.1.3

Account groups for G/L accounts ............................................................... 28

2.4.1.4

Reconciliation accounts and sub-ledgers .................................................... 28

2.4.2 Advantages of the new general ledger in the SAP ERP system ......................... 29

2.4.2.1

Advantages in detail: Extended data structure ............................................ 30

2.4.2.2

Advantages in detail: Document splitting (online split) ............................. 30

2.4.2.3

Advantages in detail: Real-time integration FI CO ............................... 32

2.4.2.4

Advantages in detail: Parallel accounting ................................................... 33

2.4.3 G/L account posting ........................................................................................... 34

2.4.3.1

Posting key .................................................................................................. 35

2.4.3.2

Account data ............................................................................................... 35

2.5 Practical application general ledger ........................................................................ 37

2.5.1 Chart of accounts ................................................................................................ 37

2.5.1.1

Display the chart of accounts ...................................................................... 38

2.5.1.2

Assign the chart of accounts ....................................................................... 38

2.5.1.3

Displaying the accounts of the chart of accounts ........................................ 39

2.5.2 G/L accounts ...................................................................................................... 40

2.5.2.1

Create a G/L account................................................................................... 40

2.5.2.2

Create G/L account in a company code ...................................................... 40

2.5.2.3

Enter G/L account document ...................................................................... 41

page 2

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.5.2.4

Check account ............................................................................................. 42

2.6 Theory Accounts payable ....................................................................................... 44

2.6.1 The vendor master record ................................................................................... 44

2.6.2

Procurement process from an accounting point of view .................................... 44

2.6.3 Integration with materials management ............................................................. 45

2.6.4 AP credit/invoice memo entry............................................................................ 45

2.6.5 Elements of the payment process ....................................................................... 46

2.6.6 Overview of the payment program ..................................................................... 47

2.7 Practical application accounts payable .................................................................... 48

2.7.1 Vendor invoice ................................................................................................... 48

2.7.1.1

Enter vendor invoice ................................................................................... 48

2.7.1.2

Display open items of the vendor ............................................................... 49

2.7.2 Automatic payment ............................................................................................ 50

2.7.3 Display cleared items of the vendor ................................................................... 53

2.8 Theory Accounts receivable ................................................................................... 55

2.8.1 The customer master record ............................................................................... 55

2.8.2 IDES credit control area ..................................................................................... 55

2.8.3

Credit management master record ...................................................................... 56

2.8.4 Sales process and integration ............................................................................. 57

2.8.5 Sales order process from an accounting point of view ....................................... 58

2.8.6 Credit control process ......................................................................................... 58

2.8.7

Incoming payments in Accounts receivable ....................................................... 59

2.9 Practical application Accounts receivable .............................................................. 60

2.9.1 Credit management ............................................................................................ 60

2.9.1.1

Customer with missing credit data .............................................................. 60

2.9.1.2

Maintain credit management master data ................................................... 60

2.9.2 Enter sales order ................................................................................................. 61

2.9.3 Release blocked sales and distribution document .............................................. 61

2.10

Theory Fixed asset accounting............................................................................ 63

2.10.1 Assets in financial accounting organizational units ........................................... 63

2.10.2 Asset class .......................................................................................................... 63

2.10.3 Asset transactions ............................................................................................... 64

2.10.4 Transaction type ................................................................................................. 65

2.10.5 Asset explorer ..................................................................................................... 65

2.10.6 Depreciation areas .............................................................................................. 66

2.10.7 Depreciation run ................................................................................................. 67

2.11

Practical application asset accounting................................................................. 68

2.11.1 Asset master record ............................................................................................ 68

2.11.2 Post asset acquisition .......................................................................................... 68

2.11.3 Asset Explorer .................................................................................................... 69

2.12

Theory balance sheet and profit & loss statement .............................................. 71

2.12.1 Create balance sheet and P&L statement ........................................................... 71

2.12.2 Balance sheets an alternative........................................................................... 72

2.13

Practical application balance sheet and profit & loss statement ......................... 73

2.13.1 Balance sheet and P&L statement structure ....................................................... 73

2.13.2 Create balance sheet and P&L statement report ................................................. 75

3

Completion ....................................................................................................................... 77

4

Reflections ........................................................................................................................ 78

4.1 Questions ................................................................................................................... 78

4.2 Standard solution ....................................................................................................... 80

page 3

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Table of figures

Figure 1: Process overview: Financial accounting ..................................................................... 9

Figure 2: Duties in financial accounting .................................................................................. 11

Figure 3: Integration of G/L accounts in financial accounting ................................................ 12

Figure 4: Financial accounting versus managerial accounting ................................................ 13

Figure 5: Company codes ......................................................................................................... 14

Figure 6: Business areas ........................................................................................................... 15

Figure 7: Organizational levels ................................................................................................ 15

Figure 8: Controlling area ........................................................................................................ 16

Figure 9: Process overview: Customizing of the companys structure in FI and CO .............. 17

Figure 10: IMG - Step 1: SAP system screenshot .................................................................... 18

Figure 11: IMG - Step 2: SAP system screenshot .................................................................... 18

Figure 12: Implementation guide - customizing menu: SAP system screenshot ..................... 19

Figure 13: Relationship of customizing and easy access menu; Rimmelspacher (2004) ........ 19

Figure 14: Organizational structures in accounting; Rimmelspacher (2004)........................... 20

Figure 15: No authorization: SAP system screenshot .............................................................. 20

Figure 16: Company code - Step 1: SAP system screenshot ................................................... 21

Figure 17: Company code - Step 2: SAP system screenshot ................................................... 21

Figure 18: Controlling area - Step 1: SAP system screenshot ................................................. 22

Figure 19: Controlling area - Step 2: SAP system screenshot ................................................. 22

Figure 20: Controlling area - Step 3: SAP system screenshot ................................................. 23

Figure 21: Controlling area Step 1: SAP system screenshot ................................................. 23

Figure 22: Controlling area Step 2: SAP system screenshot ................................................. 24

Figure 23: Operating concern - Step 1: SAP system screenshot .............................................. 24

Figure 24: Cost center accounting - Step 1: SAP system screenshot ....................................... 25

Figure 25: Cost center accounting - Step 2: SAP system screenshot ....................................... 25

Figure 26: Chart of accounts .................................................................................................... 26

Figure 27: Chart of account assignment ................................................................................... 27

Figure 28: G/L account master record ...................................................................................... 27

Figure 29: Account groups for G/L accounts ........................................................................... 28

Figure 30: Reconciliation accounts and sub-ledger ................................................................. 29

Figure 31: Advantages of the new general ledger .................................................................... 29

Figure 32: Extended data structure ........................................................................................... 30

Figure 33: Document splitting (1) (online split) ...................................................................... 31

Figure 34: Document splitting (2) (online split) ...................................................................... 32

Figure 35: Real-time integration FI - CO ................................................................................. 33

Figure 36: Parallel accounting.................................................................................................. 34

Figure 37: G/L account posting ................................................................................................ 34

Figure 38: Posting key.............................................................................................................. 35

Figure 39: Account data ........................................................................................................... 36

Figure 40: Process overview: General ledger accounting ........................................................ 37

Figure 41: INT chart of accounts: SAP system screenshot ...................................................... 38

Figure 42: Chart of accounts INT: SAP system screenshot ..................................................... 39

Figure 43: Enter G/L account document: SAP system screenshot........................................... 42

Figure 44: Display balance in general ledger: SAP system screenshot ................................... 43

Figure 45: The vendor master record ....................................................................................... 44

Figure 46: Procurement process from an accounting point of view......................................... 45

Figure 47: Integration with materials management .................................................................. 45

Figure 48: Vendor invoice and credit memo ............................................................................ 46

Figure 49: Elements of the payment process ........................................................................... 47

page 4

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 50: Overview of the payment program ......................................................................... 47

Figure 51: Process overview: Accounts payable ...................................................................... 48

Figure 52: Enter vendor invoice: SAP system screenshot ....................................................... 49

Figure 53: Open items of the vendor: SAP system screenshot ................................................ 50

Figure 54: Automatic payment run (1): SAP system screenshot ............................................. 51

Figure 55: Automatic payment run (2): SAP system screenshot ............................................. 52

Figure 56: Automatic payment run (3): SAP system screenshot ............................................. 53

Figure 57: Cleared items of the vendor: SAP system screenshot ............................................ 54

Figure 58: The customer master record .................................................................................... 55

Figure 59: IDES credit control area ......................................................................................... 56

Figure 60: Credit management master record .......................................................................... 57

Figure 61: Sales process and integration .................................................................................. 57

Figure 62: Sales order process from an accounting point of view ........................................... 58

Figure 63: credit control process .............................................................................................. 59

Figure 64: Incoming payments in Accounts receivable ........................................................... 59

Figure 65: Process overview: Accounts receivable .................................................................. 60

Figure 66: Release blocked SD document: SAP system screenshot ........................................ 62

Figure 67: Assets in FI organizational units............................................................................. 63

Figure 68: Asset class ............................................................................................................... 64

Figure 69: Asset transactions ................................................................................................... 64

Figure 70: Transaction type...................................................................................................... 65

Figure 71: Asset explorer ......................................................................................................... 66

Figure 72: Depreciation areas................................................................................................... 66

Figure 73: Depreciation run ..................................................................................................... 67

Figure 74: Process overview: Asset accounting ....................................................................... 68

Figure 75: Post asset acquisition: SAP system screenshot ....................................................... 69

Figure 76: Asset Explorer: SAP-System-Screenshot ............................................................... 70

Figure 77: Create balance sheet and P&L statement ................................................................ 71

Figure 78: Balance sheets an alternative ............................................................................... 72

Figure 79: Process overview: Balance sheet and profit & loss statement ................................ 73

Figure 80: Financial statement version: SAP system screenshot ............................................. 74

Figure 81: Change financial statement version: SAP system screenshot ................................. 75

Figure 82: Balance sheet and P&L statement report: SAP system screenshot ........................ 76

page 5

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Copyright

-

This document is mostly based on publications for the TERP10 course mySAP ERP

integrated business processes those parts are subject to the copyright of SAP AG.

All figures used within this course are created in the style of TERP10, if not labeled

else wise. Those parts are subject to the copyright of SAP AG.

All screenshots used within this document, even if displayed in extracts, are subject to

the copyright of SAP AG.

Distribution and reproduction of this document or parts of this document in any

form is prohibited without the written permission of Prof. Dr. Heimo H.

Adelsberger, Dipl.-Wirt.-Inf. Pouyan Khatami, and Dipl.-Wirt.-Inf. Taymaz

Khatami.

page 6

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

1 Financial accounting in SAP ERP

1.1 Unit objectives financial accounting in SAP ERP

This unit aims at giving you an understanding of financial accounting in the SAP ERP system.

At the conclusion of this unit, you will be able to

- explain the organizational structures and master data used in financial accounting,

- explain the functionality of the new general ledger,

- execute typical accounting operations in the application components of financial

accounting,

- name the links to sales and distribution, materials management, internal accounting,

and controlling,

- understand assets accounting, and

- create financial reports

Note:

It is vital for the successful completion of this case study that you are familiar with the

navigation basics in SAP ERP systems (cf. unit Introduction/Navigation). This includes that

you are able to handle the SAP Easy Access Menu as well as an understanding of the SAP

transaction concept. Your knowledge about help options and further documentation is to

enable you to mostly discover the complexity and potential of the system independently

albeit you have to study with given scenarios.

Note:

Please avoid to merely clicking through the described steps of the case studies without

thinking carefully about what you are doing to make sure you achieve sustained learning

success. Try to clarify at each step what is done and why it is done. Therefore, you should

regularly use the F1 and F4 help functions as well as the SAP online librarys help menu

(cf. introduction chapter, Help) to display further information and explanations regarding the

particular processes. Since we arranged the case studies neatly, not all entries that you need

to enter on the different screens can be explained in detail. Thus, you should try to get a

profound knowledge using the F1 and F4 keys regarding the meaning of the particular fields

and entries.

Please unconditionally use the SAP Easy Access Menu instead to the transaction codes. Thus,

you will quickly understand the structure and logic of SAP ERP. When you are a bit more

experienced using the SAP system, it is advisable to use the transaction codes. Please read the

case studies and advises carefully, since careless mistakes causing huge problems happen

quite often.

page 7

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

1.2 Scenario

In the practical application section of this unit, you will focus on the enterprise structures of

financial accounting and controlling in customizing. Consequently, you will get a short

overview of the chart of accounts. Tasks related to the chart of accounts are predominantly

carried out in customizing (IMG: implementation guide) of the SAP ERP system even if it

belongs to the general ledger topic-wise. Moreover, you will create an impersonal account in

the general ledger and carry out postings to this account.

In the accounts payable section, you will enter an invoice from your vendor and trigger the

automatic payment of the open item. In account receivable, you will focus on credit

management. At this point, you will also access the SD module. In asset accounting, you will

enter a new asset and take a look at its posting and depreciation in the asset explorer. Finally,

you will deal with the balance sheet and profit and loss statement of your company.

In the following figure, you can see the entire process that you will deal with independently in

the practical application section of this unit using the SAP ERP system. Except for the

enterprise structures in customizing and entering a sales order, you will focus exclusively on

the functional area financial accounting.

page 8

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 1: Process overview: Financial accounting

page 9

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2 Financial accounting with SAP ERP

2.1 Theory Duties in financial accounting

Financial accounting predominantly focuses on maintaining and processing the general

ledger, processing receivables, and asset accounting. Important tasks of financial accounting

are the recording of monetary- and value flows as well as valuation of inventories.

In the general ledger (GL), all business transactions relevant to accounting are recorded on

G/L accounts from a business perspective. The general ledger is structured according to a

chart of accounts. A chart of accounts contains structured definitions of all G/L accounts in

the general ledger. These definitions include the account number, the G/L account

designation, and the categorization of the G/L account as income statement or balance sheet

account. Due to clarity reasons, the general ledger usually contains collective positions. In

these cases, posting data are represented in more detail in so-called subledgers, from where

data are transferred in compressed form to the general ledger. Using reconciliation accounts,

subledgers are linked to the general ledger in real-time, i.e., when a posting is made to a

subledger, the same posting is carried out on the respective reconciliation account in the

general ledger.

There are four subledgers in the SAP ERP system:

- The accounts payable accounting (AP) contains all business events concerning

relationships to suppliers. Thereby, the main source of data is purchasing (MM,

materials management).

- The accounts receivable accounting (AR) records all business events concerning

customer relationship. Main source of data is sales and distribution (SD).

- The asset accounting (AA) records all business events concerning asset management.

- The bank ledger (BL) supports posting cash flows.

page 10

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 2: Duties in financial accounting

2.1.1 Integration of G/L accounts in financial accounting

The general ledger is managed on company code-level. From accounts movements in the

general ledger, the balance sheet and the P/L statement are created, as required by law.

Assets of a company are separated into assets (application of funds) and liabilities (source of

funds). Business events that are recorded in the subledgers (AP, ARP, etc.), in materials

management (material stock), or in treasury (management of financial resources), are

considered in the balance sheet in real time for integration reasons.

The treasury component (TR) focuses on functions such as payment means, treasury

management (including, for example, financial resources, foreign currency, derivatives, and

shares), loans, and market risk management.

The recording of business events aims at the creations of a balance sheet and P/L statement

in form of a report. These reports need to be adjusted to specific national requirements and

laws.

Since a company can be subject to different reporting requirements regarding balance sheet

and P/L statement, different balance sheet and P/L statement structures can be created. With

these structures, you can determine which accounts appear in which balance sheet items; they

are delivered with the SAP standard installation already.

Financial reports required for external reporting purposes (e.g., balance sheet, P/L statement)

are created in FI. These external reporting requirements are provided by general accounting

standards such as US-GAAP or IAS, according to the respective law requirements of financial

authorities.

page 11

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 3: Integration of G/L accounts in financial accounting

2.1.2 Financial accounting versus management accounting

This chapter focuses on financial accounting, which aims at legal reporting. Balance sheets

and P/L statements can be created at the level of legal units. In turn, management accounting

serves the purpose of informing the company-internal management regarding cost and

revenue.

The level on which financial accounting is required is predominantly determined by law

(e.g., commercial code) since it is an external obligation. Correspondingly, financial

accounting is carried out differently in distinct countries.

Costs and revenue from financial accounting are used in management accounting. In

management accounting, these financial data can be assigned via multiple department

boundaries (financial accounting). Usually, you want to ensure that results of financial

accounting are comparable to the results of management accounting (reconciliation). In

contrast to financial accounting, management accounting focuses predominantly on planning,

controlling, and coordination of valued business processes to increase corporate performance.

Determined information is used for the objective foundation of management decision-making.

Therefore, sources of corporate success are analyzed and aggregated, especially using cost

accounting and investment appraisal, to an encompassing controlling concept.

The following elements are part of financial accounting:

- Accounts receivable (AR),

- Accounts payable (AP),

- Fixed asset accounting (AA),

- Bank accounting (BL), and

- General ledger (GL),

providing an encompassing picture of financial accounting and accounts. Further components

are:

- Cash journal accounting

- Inventory accounting

- Tax accounting

- Accrual accounting

page 12

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Due to simplification reasons, cash management, which actually belongs to financial supply

management, was included in financial accounting.

Management accounting features advanced measures of cost monitoring within a company

(cf. next unit).

Figure 4: Financial accounting versus managerial accounting

page 13

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.2 Theory Organizational levels in financial accounting

2.2.1 Company codes

For each country, at least one individual company code is used. A company code must be

created according to tax law, commercial law, and other accounting-specific criteria.

The company code is the smallest organizational unit in SAP ERP for which you can issue a

balance sheet and a P/L statement. Within the productive environment, at least one company

code must be present so that a company can be productive within the SAP ERP system (i.e.,

the system can be implemented and you can go live). The company code key is a four-digit

alphanumeric field.

Figure 5: Company codes

2.2.2 Business areas

You can create several business areas in the SAP ERP system to which you can assign

postings from a company code defined in a client.

Business areas can be used to facilitate segment reporting. They cover the central operation

areas (product lines, subsidiaries) whenever required by law.

Implementing business areas is optional in case no external business segment reporting is

required and flexible within business area definition.

The business area key a four-digit alphanumeric field.

page 14

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 6: Business areas

Generally, business areas are independent of company codes, i.e., you can post to them from

all company codes. For example, the following figure shows the business areas mechanical

engineering, plant engineering and automotive used commonly by different company codes

(USA, Canada, and Mexico).

Figure 7: Organizational levels

2.2.3 Controlling area

A controlling area is an independent organizational structure for which you can manage and

allocate costs and revenues. It is a separate unit of cost accounting.

You can assign one or several company codes to a controlling area. Thus, you can carry out

cross-cost center postings between company codes. However, this is only possible when the

assigned company codes and controlling areas feature the same operating chart of accounts

and the same business year.

page 15

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 8: Controlling area

page 16

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.3 Practical application Organizational levels in financial

accounting

In the following section, you will focus on the organizational levels of financial accounting in

the SAP ERP system. Accounting generally and in SAP ERP as well, is separated into

financial accounting and management accounting (or controlling, respectively). The main

focus of this chapter is on financial accounting. However, you will learn about organizational

levels of controlling (controlling area, operating concern) since management accounting and

financial accounting is closely linked to each other. For this reason, it would not be helpful to

consider them separately.

Figure 9: Process overview: Customizing of the companys structure in FI and CO

During this chapter, you should answer the following questions. Answering these questions is

supposed to increase your learning progress.

1. Which currency is assigned to company code 1000?

2. Is there cross-company code cost accounting in controlling area 1000?

3. Which company codes are assigned to controlling are 1000? List five of them.

4. What is a fiscal year variant?

5. Which fiscal year variant is assigned to controlling area 1000?

6. Which operating concern is assigned to controlling area 1000?

7. Can you carry out cost center accounting in controlling area 1000?

To answer these questions, go to customizing in the SAP ERP system.

2.3.1 Definition: Customizing

When a company decided to implement a SAP ERP system, the software needs to be adjusted

to the business requirements. Customizing is carried out in SAP ERP using the

implementation guide (IMG). In customizing, relationships, selection options, etc. for the

application menu are determined (Which functions are executable in the menu?).

Customizing can be called up with transaction <SPRO> and then by choosing the SAP

reference IMG (F5); or alternatively, by selecting the SAP easy access menu:

page 17

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 10: IMG - Step 1: SAP system screenshot

Figure 11: IMG - Step 2: SAP system screenshot

Browsing in customizing consists initially of a tree structure:

page 18

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 12: Implementation guide - customizing menu: SAP system screenshot

Relationship of customizing and easy access:

Customizing determines the functionality of the SAP ERP system.

Figure 13: Relationship of customizing and easy access menu; Rimmelspacher (2004)

Settings in customizing determine the functionalities in the SAP easy access menu.

Consequently, you can determine all basic data and structures in customizing. Thus, you

can find the information regarding the organizational structure relevant for answering the

questions above there.

page 19

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.3.2 Organizational structures in accounting

From an accounting perspective, you can gain the following overview of a company:

Figure 14: Organizational structures in accounting; Rimmelspacher (2004)

As you can see from the figure above, the company codes 1, 2 and 3 use the same operational

chart of accounts. The operational chart of accounts is used by FI and CO commonly, i.e.,

primary cost and revenue elements in CO are revenue and expense accounts in FI

simultaneously. Consequently, a controlling area takes over the chart of accounts of the

assigned company codes. In cross-company code cost accounting (e.g., common product

controlling across several company codes), controlling area and all assigned company codes

must use the same chart of accounts.

2.3.3 Questions

Coming back to answering the questions: All tasks in this part of the case study start in

customizing. Since you are already experienced in SAP customizing from the previous case

studies, you are supposed to process the questions independently. You will find an approach

to solve each task at its end that you can use if necessary.

Due to restrictions of your account, you do not need to worry about, for example, unintended

momentous changes to the IDES group, since you are authorized to read, but you do not have

a writing authorization.

Figure 15: No authorization: SAP system screenshot

page 20

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.3.3.1 Currency in company code 1000

Question 1: Which currency is assigned to company code 1000?

Approach for question 1:

Figure 16: Company code - Step 1: SAP system screenshot

Figure 17: Company code - Step 2: SAP system screenshot

page 21

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.3.3.2 Cross-company code cost accounting

Question 2: Is there cross-company code cost accounting in controlling area 1000?

Question 3: Which company codes are assigned to controlling area 1000? List five of them.

Approach for questions 2 and 3:

Figure 18: Controlling area - Step 1: SAP system screenshot

Figure 19: Controlling area - Step 2: SAP system screenshot

page 22

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 20: Controlling area - Step 3: SAP system screenshot

2.3.3.3 Fiscal year variant

Question 4: What is a fiscal year variant?

Question 5: Which fiscal year variant is assigned to controlling area 1000?

Approach for questions 4 and 5:

Figure 21: Controlling area Step 1: SAP system screenshot

page 23

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 22: Controlling area Step 2: SAP system screenshot

2.3.3.4 Operating concern

Question 6: Which operating concern is assigned to controlling area 1000?

Approach for question 6:

Figure 23: Operating concern - Step 1: SAP system screenshot

page 24

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.3.3.5 Cost center accounting

Question 7: Can you carry out cost center accounting in controlling area 1000?

Approach for question 7:

Figure 24: Cost center accounting - Step 1: SAP system screenshot

Figure 25: Cost center accounting - Step 2: SAP system screenshot

page 25

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.4 Theory General ledger accounting

2.4.1 Chart of accounts

A general ledger in SAP ERP is created based on a chart of accounts. A chart of accounts

contains the definition of all G/L accounts in structured form. The definition of a G/L account

includes predominantly the account number, the G/L account name, and the G/L account type

(P&L type account or balance sheet type account).

You can define an unlimited number of charts of accounts in the SAP system. Many countryspecific charts of accounts are included in the standard version of the system.

Figure 26: Chart of accounts

2.4.1.1 Chart of account assignment

Each company code must feature a chart of accounts for the general ledger, since it is an

independent accounting entity. This chart of accounts is assigned to the company code. A

chart of accounts can be used by several company codes (see figure). Consequently, the

general ledgers of these company codes are set up identically.

page 26

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 27: Chart of account assignment

2.4.1.2 G/L account master record

A G/L account master record contains two segments.

The first segment is the accounts segment. In the accounts segment, control features are

defined on high level. For example, you can determine the account description, i.e., whether it

is a balance sheet account or a P&L account (that controls the company code segment fields),

and the number of the consolidation account.

The second segment is the company code segment, which described how the company code

that used the specific account manages this account. This segment contains control elements

for the following functions:

- account control

- account management

- financial details

- joint ventures

- interest calculation

- document control

Figure 28: G/L account master record

page 27

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.4.1.3 Account groups for G/L accounts

Using account groups, G/L account can be structured in user-defined segments. Within these

account groups, the number rages of the accounts are determined that are considered in the

user-defined segments.

The field status of the company code segment is determined in the master record at the time

of creating, changing, or displaying the same. The four field statuses of a field in the G/L

master record are suppress, required, display, and optional. You can determine in

customizing, which field status a field has at the time of its creation.

Figure 29: Account groups for G/L accounts

2.4.1.4 Reconciliation accounts and sub-ledgers

Reconciliation accounts conduce to real-time integration of a sub-ledger with the general

ledger. The reconciliation account itself is not meant for direct postings, i.e., no business

transactions can be posted directly to a reconciliation account. For example, customer

receivables are debited to the customer account of the customer sub-ledger. The balance of the

customer account is transferred to reconciliation account 140000 in the general ledger. Thus,

the reconciliation between sub-ledger and general ledger is always ensured. In the general

ledger, postings are restricted by the usage of account types to reconciliation accounts.

You are already familiar with reconciliation accounts (e.g., 140000) from the customer master

data and the vendor master data. These are used to directly record liabilities and receivables

from the sub-ledgers in the general ledger.

page 28

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 30: Reconciliation accounts and sub-ledger

2.4.2 Advantages of the new general ledger in the SAP ERP system

The new general ledger contains functions to unify the conventional general ledger with the

special ledgers components.

Note: Despite the new functionality, the GUI for data entry and postings are almost identical

to the previous release.

Figure 31: Advantages of the new general ledger

page 29

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.4.2.1 Advantages in detail: Extended data structure

The functional area field is now also stored in the general ledger. Thus, you do not need to

activate the sales ledger cost to create a profit and loss statement according to the cost-of-sale

accounting.

The fields profit center and partner profit center are also recorded in the general ledger.

This means that the general ledger can now also be used for management analysis.

You can use the SAP ERP central component for displaying simplified management

accounting (CO light) in the general ledger. The available objects are cost centers and

primary cost types.

The segment field is a new entity (characteristic/category) and allows for processing segment

reporting. The table structure in the new general ledger is flexibly expandable, i.e., you can

insert own fields and carry out update totals. Standard reports are available for all

mentioned purposes.

Figure 32: Extended data structure

2.4.2.2 Advantages in detail: Document splitting (online split)

The GUI and the creation of accounting documents are similar to the previous release. An

input tax rate of 16 % (German VAT, which in the meantime has raised to 19%) is assumed.

SAP supports now the derivation of segments from profit centers. In turn, profit centers can,

for example, be derived from a cost center, a management accounting internal order, or a

project.

page 30

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 33: Document splitting (1) (online split)

To ensure a continuous split of the segment characteristic, document split must be activated.

Continuous segmentation means that each document for an activated entity comes to the

balance 0 position. In addition to segmentation, inheritance of a segment to the lines vendor

and tax of the document is displayed.

The online split (and inheritance) replaces the period-end activities balance sheet

adjustment (report SAPF180, perform balance sheet adjustment) and profit and loss

adjustment (report SAPF181, perform P/L adjustment).

Document split is carried out using post processing processes as well, e.g., numbers, cash

discount received, and cash discount paid are distributed to entities according to the amount of

the original expense account posting.

Customers invoices are processed the same way, i.e., revenues are distributed to different

entities.

page 31

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 34: Document splitting (2) (online split)

2.4.2.3 Advantages in detail: Real-time integration FI CO

In the following figure, you can see an example of real-time integration (CO-FI) using the

functional area as characteristic or criterion. The real-time integration can also be defined for

the criteria company code, business area, profit center, segment, funds, and receivables. The

selection is not an either-or decision. Real-time integration can also be activated for all these

characteristics at the same time.

What features financial accounting document 2B?

It is posted in real-time (per document). Reconciliation (summary reconciliation per expense

account/cost account) using the reconciliation ledger in cost accounting via transaction KALC

is no longer required.

It is a document that does not require a clearing account. However, clearing accounts are still

required for cross-company code transactions.

You can switch between the document created in FI in real-time and the management

accounting document: traceability of accounting documents.

page 32

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 35: Real-time integration FI - CO

2.4.2.4 Advantages in detail: Parallel accounting

In parallel accounting, one ledger in the new general ledger is the leading ledger. This

ledger is usually used for consolidated financial statements. The leading ledger reflects the

accounting rule, which is used for the consolidated financial statement. It is integrated with all

subledgers and updated for all company codes (provided that it is not posted ledger-specific).

The new general ledger allows for displaying parallel financial reports along with the leading

ledger. This function refers to the ledger solution in the new general ledger. In this context,

ledger does not refer to the special ledger as used in SAP R/3.

Excurse: In the application component special ledgers, the following ledger types are

available:

- Special ledgers are ledgers that are defined in accordance to special business-related

and organizational requirements. They contain only the dimensions you entered. In

the FI_SL-system, you can only create special ledgers.

- Standard ledgers are configured and delivered by SAP and maintained in

applications. You cannot maintain these ledgers with the FI-SL functionality, unless

the functions of the respective applications allow you to do so (e.g., FI-SL posting

function). The standard ledgers include the general ledger, FI-LC/EC-MCs

consolidation ledger, EC-PCAs profit center ledger, and CO-OM-CELs

reconciliation ledger.

Using additional accounts (account solution) you can still display parallel financial reports.

When selecting this option, the general ledger merely contains the general ledger as only

ledger. The ledger solution in the new general ledger and the account solution in SAP ERP

can be considered equivalent.

Display options from previous releases can still be used. For example, you can use the special

ledger and the company code variant, provided that they were available before implementing

SAP ERP. However, they cannot be extended.

page 33

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 36: Parallel accounting

2.4.3 G/L account posting

G/L account documents can be created and posted using a single-screen transaction. The

screen for the creation is divided in two sections (templates and information section).

-

In the work template section, screen variants, account assignment templates, or held

documents can be selected as reference. A held document is a document that a user

saved but that was not posted, yet. The document will be completed and posted later.

Header data are valid for the entire document, for example, the booking date and the

document type. Some header data are only available in display format only or they are

hidden by the user using editing options.

In the line item information section, line items for the document are recorded.

In the information section, debit and credit amounts of the document are displayed.

Figure 37: G/L account posting

page 34

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.4.3.1 Posting key

Each document line item contains a posting key. The posting key is used for internal control

and is used for complex postings. It provides the system with the following information:

- account type to be posted,

- either it is a debit or credit posting, and

- which fields of the line item have or need an entry

In the new ENJOY transaction, the posting key does not need to be entered anymore.

However, it appears in the document and its control functionality is still necessary.

Figure 38: Posting key

2.4.3.2 Account data

Balance display and line item display provide account data. Only if the particular function in

the G/L master record is activated, line item display is possible for a G/L account.

Balance display is an overview of the saved transaction amounts of an account. You can

navigate from the balance display to a list of line items from which the balance is computed.

From this line item report, you can in turn go back to the document containing the respective

line items. By choosing the document overview function, you can display the entire

transaction.

In case a real document is available for this SAP ERP document, which was optically

archived, you can display it as well.

page 35

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 39: Account data

page 36

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.5 Practical application general ledger

You want to create a new G/L account from a FI point of view for department expenses

concerning the new department that you created in the human capital. Prior to this, you need

to focus on the chart of accounts principle in the SAP system. Moreover, you need to

determine, whether the G/L account (account number that you want to create) is already

existent or can be created.

Figure 40: Process overview: General ledger accounting

2.5.1 Chart of accounts

As explained in the theoretical section, a chart of accounts contains all accounts of a company

and structures them according to business-related characteristics. It is used by one or several

company codes for account validation in document posting and it is referred to as operating

chart of accounts.

Excurse: In addition, SAP ERP provides two other types of charts of accounts (alternative

charts of accounts), which reflect the law requirements of different countries and consolidate

reporting on enterprise-level.

The operational chart of accounts is used commonly by financial accounting and cost

accounting. The items of a chart of accounts can be expense or revenue accounts in FI and

cost or revenue elements in cost accounting.

You must assign one chart of accounts to each company code. Moreover, you can assign each

company code to a country-specific chart of accounts. Using the country-specific chart of

accounts, you can fulfill the country-specific accounting requirements and at the same time,

carry out management accounting consistently.

The chart of accounts and country-specific chart of accounts are linked using alternating

account numbers. Since the accounts in financial accounting and management accounting are

managed with an integrated accounting system (i.e., there is no second accounting system for

cost accounting and primary cost types and revenue types are transferred from the P/L

expense accounts), you must consider the charts of accounts of the company codes at the time

of controlling area set-up. The controlling area uses the chart of accounts of the assigned

company code. In cross-company code accounting, the controlling area, and all assigned

company codes must use the same chart of accounts.

In the subsequent section, you will work with the INT (international) chart of accounts of the

SAP standard version. Thus is a pre-defined structuring scheme for recording values and

value flows for appropriate accounting. Multiple accounts are already assigned to the INT

chart of accounts.

page 37

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.5.1.1 Display the chart of accounts

Display the INT chart of accounts. Therefore, choose the following transaction in the

customizing menu.

IMG Financial Accounting (new) General Ledger Accounting (new) Master Data

G/L Accounts

Preparations Edit Chart of Accounts List

Look for the IMG chart of accounts and double-click it.

Figure 41: INT chart of accounts: SAP system screenshot

At this point, you can maintain general control parameters for the chart of accounts. For

example, G/L accounts in the INT chart of accounts have a maximum length of ten digits. In

the G/L accounts of the present chart of accounts, you can also enter additional information

such as an enterprise account number. The system checks whether the enterprise account

number exists in the enterprise chart of accounts. If a chart of account structure is given, for

example, due to national requirements, you can define an enterprise chart of accounts. All

accounts contain an enterprise account number that is the same for equivalent accounts in

different charts of accounts. The definition of balance sheet and P/L statement from an

enterprise point of view can then be carried out using the enterprise account number, as

opposed to individual computation per country. For example, the enterprise chart of accounts

CONS is here assigned to chart of accounts INT.

2.5.1.2 Assign the chart of accounts

Check the assignment of chart of accounts INT to company code.

IMG Financial Accounting (new) General Ledger Accounting (new) Master Data

G/L Accounts Preparations

Assign Company Code to Chart of Accounts

Check whether the INT chart of accounts is assigned to company code 1000. The INT chart of

accounts should be entered in the chart of accounts column. You should see that the INT chart

of accounts is assigned to several company codes. This only means that all these company

codes use the same account scheme. For the definition of G/L accounts in the chart of

page 38

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

accounts, an additional step is required that assigns the G/L account to a company code so that

the account is relevant to this company code in terms of accounting.

Go back to the IMG screen and choose

IMG Controlling General Controlling Organization

Area ( Maintain Controlling Area)

Maintain Controlling

Look for controlling area 1000 and double-click the entry. You can see here as well that the

INT chart of accounts was assigned. Next, focus on the chart of accounts in more detail.

2.5.1.3 Displaying the accounts of the chart of accounts

To check which accounts are included in the INT chart of accounts, display the chart of

accounts report. Therefore, go back to the SAP easy access menu and choose

Information System Accounting Financial Accounting General Ledger Chart

of Accounts (transaction F.10)

Enter INT in the chart of accounts field and choose execute. The system displays all G/L

accounts of the INT chart of accounts.

Figure 42: Chart of accounts INT: SAP system screenshot

page 39

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Look for account 140000 (domestic customer receivables). In the procurement process and

sales order management case studies, you already heard about the subledgers. This account is

a reconciliation account in the general ledger for customer accounts receivables. This account

records all changes regarding money values (receivables and liabilities) for all customers in

the general ledger. For example, if customer-999 claims 10000 Euro, then this amount is

recorded in customer account cutomer-999 (the customer master record is the corresponding

account in the customer sub-ledger as well). This amount is simultaneously recorded in the

general ledger on account 140000. Account 140000 is the standard reconciliation account in

the SAP INT chart of accounts for customers and is entered in the customer master record

when creating the customer in the reconciliation account field. Of course, you can use other

accounts as reconciliation accounts as well or create own accounts.

2.5.2 G/L accounts

2.5.2.1 Create a G/L account

Next, create a G/L account in the INT chart of accounts for expenses of your new department.

It is supposed to be a P/L account. By the end of the year, the balance of this account is closed

via retained earnings account 900000. Assign the account to the account group all G/L

accounts due to organizational reasons. It is assigned with account number 312600 to the

enterprise chart of accounts CONS.

To create the G/L account, choose

Accounting Financial Accounting General Ledger Master Records G/L

Accounts Individual Processing In Chart of Accounts (FSP0)

1. On the Edit G/L Account: Chart of accounts data screen, enter the following data:

a. G/L account

461xyy

b. Chart of accounts

INT

Choose

.

2. In the Type/Descriptions tab, enter the subsequent data:

a. Account group

SAKO General G/L accounts

b. P&L statement acct

select

c. P&L statmt. acct type

X

d. Functional area

0400

e. Short text

expenses SD&M xyy

f. Group account number

312600

Save your entries.

2.5.2.2 Create G/L account in a company code

Make the new G/L account available in company code 1000. Line item display is required for

the new account. For line item display, sorting criteria are document number and fiscal year

(sort key 002). Since it is an expense account, field regarding expenses are supposed to be

displayed when processing document for this account. Assign the account to field status group

G033. Assign the account to commitment item 1423 for cash management reasons. Set the tax

category to input tax -. Set the flag posting without tax permitted.

page 40

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Accounting Financial Accounting General Ledger Master Records G/L

Accounts Individual Processing In Company Code (FSS0)

1. On the Edit G/L Account: Company code data screen, enter the following data:

a. G/L account

461xyy

b. Company code

1000

Choose

.

2. In the control data tab, enter the following data:

a. Tax category

- (only input tax allowed)

b. Posting without tax permitted

select

c. Line item display

select

d. Sort key

002

3. Go to the Create/bank/interest tab

a. Status group

G033

b. commitment item

1423

Choose save.

2.5.2.3 Enter G/L account document

In your new department, expenses amount to 5000 Euro in company code 1000. Therefore,

you need to enter the expenses in the general ledger. To record the expenses, carry out a G/L

account posting. Use account 113100 for the corresponding items. Choose

Accounting Financial Accounting General Ledger Posting Enter G/L Account

Document (FB50)

1. When prompted to do so, enter company code 1000.

2. Enter the following data:

a. Document date

current date

b. currency

EUR

c. G/L account

461xyy

d. D/C

debit

e. Amount in doc. curr

5000

f. Tax

V0

g. G/L account

113100

h. D/C

credit

i. Amount in doc. curr

5000

Save the document and list the document number on your data sheet.

G/L account document: ______________________________________

Note: In case you receive a message, select the second line and choose

from the

lower part of the screen. Enter the current date in the submit on field. Choose

and

save the document again.

Cancel the transaction to leave it.

page 41

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 43: Enter G/L account document: SAP system screenshot

2.5.2.4 Check account

To ensure that the posting was carried out properly, check the balance of account 461xyy in

company code 1000 and go to the document. Choose

Accounting Financial Accounting General Ledger Account Display Balances

(FS10N)

1. Enter the following data:

a. G/L account

b. Company code

c. Fiscal year

d. Business area

2. Choose Execute.

461xyy

1000

current fiscal year

no entry

page 42

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 44: Display balance in general ledger: SAP system screenshot

The accounts balance for the current period is 5000 .

Display the items of account 461xyy by double-clicking the passive balance (debit column)

for the current period.

Is the document number the same as the G/L account document posting?

List the answer on your data sheet. ________________________________________

page 43

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.6 Theory Accounts payable

2.6.1 The vendor master record

The vendor master record contains data for controlling posting and processing of movement

data. This includes all information required for business transactions regarding a vendor.

On client-level, vendor-specific information such as name and address are stored. Each

company code assigned to the client can access this general information.

Company code-specific data record contains the part of the vendor master record that a

company needs to process vendor transactions by the respective company codes. Thus, it is

prevented that the same data are maintained in several company codes.

Goods and services purchased by a purchasing organization are procured from a vendor.

Payment is posted in vendor accounting. Therefore, different purchasing organizations of a

group must store purchasing-specific data in the vendor master record before they can use

the vendor master record.

Figure 45: The vendor master record

2.6.2 Procurement process from an accounting point of view

For individual sub-processes of procurement (purchase to pay), due to several subsequent

postings, the GR/IR clearing account as well as the bank clearing account are finally

balanced again. Short-term liabilities by the payment are cleared. From a balance sheet point

of view, procurement to stock is a material stock increase in combination with a bank

account reduction.

Possible external price volatilities in procurement can be recorded in the profit and loss

statement, depending on price control of the respective material in the master record of the

material.

page 44

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 46: Procurement process from an accounting point of view

2.6.3 Integration with materials management

The two last steps in the following figure can be carried out reversely. Thereby, it is important

whether goods receipt or invoice receipt is first. Using the GR/IR clearing account, you can

ensure that for each invoice receipt, a goods receipt occurred, and vice versa (GR/IR).

Figure 47: Integration with materials management

2.6.4 AP credit/invoice memo entry

Using a single-screen transaction, you can easily create and post a vendor invoice or a credit

memo. A vendor invoice or a credit memo is entered directly in vendor accounting. This type

of invoice is a miscellaneous invoice that does not refer to a purchase order. The screen to

enter vendor invoices is structured as:

page 45

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

-

In work templates, you can choose screen variants, account assignment templates, or

held documents as reference.

In the header and vendor data, document header data and vendor line items are

recorded.

In the line item information, the G/L line items for the document are entered.

In the information area, the document balance and vendor information are displayed.

Using this transaction, you can also create documents in different currencies. The foreign

currency amount is converted in the local currency using defined exchange rates.

Figure 48: Vendor invoice and credit memo

2.6.5 Elements of the payment process

The standard SAP system contains the usual payment methods and corresponding forms that

were entered for each country separately.

page 46

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 49: Elements of the payment process

2.6.6 Overview of the payment program

During the payment program, the system completes the following steps:

- posting payment documents

- clearing open items

- preparing data for printing payment media

Figure 50: Overview of the payment program

page 47

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

2.7 Practical application accounts payable

2.7.1 Vendor invoice

You received a rent invoice of 10000 Euro from your vendor (who is also your hirer due to

simplification reasons) from the procurement process case study. This invoice is dated to

yesterday. Post the invoice to the cost center of your new department CC-MSD-xyy. Use G/L

account 470000 as offset account.

Figure 51: Process overview: Accounts payable

2.7.1.1 Enter vendor invoice

Choose

Accounting Financial Accounting Vendors Document Entry Invoice (FB60)

1. Enter the subsequent data:

a. vendor

number of your vendor from case study 1

b. invoice date

yesterdays data

c. posting date

current date

d. amount

10000

e. tax amount

0

f. tax code

0I (income tax 0%)

g. Text

rent xyy

h. G/L account

470000

i. D/C

debit

j. Amount in doc. curr

10000

k. Cost center

CC-MSD-xyy

2. Choose save and list the document number and the vendor number on your data sheet.

vendor invoice: _______________________________________________

vendor: _________________________________________________________

page 48

Copyright Prof. Dr. Heimo H. Adelsberger/Dipl.-Wirt.-Inf. Pouyan Khatami

/Dipl.-Wirt.-Inf. Taymaz Khatami

Integrated business processes with SAP ERP

Figure 52: Enter vendor invoice: SAP system screenshot

2.7.1.2 Display open items of the vendor

To check whether can open item was created for the vendor when posting your document, use

the report display/change line items. Determine the created open item using the document

number from the previous exercise.

Choose

Accounting Financial Accounting Vendors Account Display/Change Line

Items (FBL1N)

1. Enter the following data:

a. Vendor account

your vendor number

b. Company code

1000

c. Open items

select

d. Open to key date

current date

2. Choose execute.

3. You can see the document from the previous exercise as open line item. Moreover,