Académique Documents

Professionnel Documents

Culture Documents

Woodyard Investment Analysis NPV

Transféré par

Eric SilvaniTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Woodyard Investment Analysis NPV

Transféré par

Eric SilvaniDroits d'auteur :

Formats disponibles

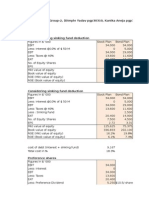

WORLDWIDE PAPER COMPANY

Woodyard Investment Analysis ($000)

Sales Revenue

NWC (ten percent of sales) Change in NWC (cash flow)

Investment:

Capital Outlay

Net Working Capital (10% Sales)

Total Investment

Investment Recovery :

Equipment Salvage

Net Working Capital (full recovery)

ANNUAL NET WORKING CAPITAL

2007

2008

2009

2010

0

4,000 10,000

10,000

400

1000

1000

400

600

0

2013

10,000

1000

0

2008

2009

2010

2011

2012

2013

16000

0

16000

2000

400

2400

0

600

600

0

0

0

0

0

0

0

0

0

0

0

0

(1080)

(1000)

1

0

EBIT

- Taxes (40%)

NOPAT

+ Depreciation

- Investment

= Free Cash Flow

2012

10,000

1000

0

2007

Earnings before Interest and Taxes (EBIT):

Sales Revenue

Cost of Good Sold (75% Sales)

SG&A (5% Sales)

Operating Savings

Depreciation ($18,000/6)

Total Costs & Expenses

2011

10,000

1000

0

(16000)

(16000)

4000

10000

10000

10000

10000

10000

(3000)

(200)

2000

(3000)

(4200)

(7500)

(500)

3500

(3000)

(7500)

(7500)

(500)

3500

(3000)

(7500)

(7500)

(500)

3500

(3000)

(7500)

(7500)

(500)

3500

(3000)

(7500)

(7500)

(500)

3500

(3000)

(7500)

(200)

(80)

(120)

3000

(2400)

480

2500

(1000)

1500

3000

(600)

3900

2500

(1000)

1500

3000

0

4500

2500

(1000)

1500

3000

0

4500

2500

(1000)

1500

3000

0

4500

2500

(1000)

1500

3000

(2080)

6580

WACC = Cost of Debt X debt %(1-Tax)+Cost of Equity X Equity %

WACC using moderate risk level

WACC using lower risk level

WACC using higher risk level

9.66

9.44

9.92

NPV using moderate risk level

NPV using lower risk level

NPV using higher risk level

811.89

984.92

676.69

IRR

11.00%

16029.80

Vous aimerez peut-être aussi

- Worldwide Paper Company: Case Solution Company BackgroundDocument4 pagesWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoPas encore d'évaluation

- Worldwide Paper CompanyDocument2 pagesWorldwide Paper Companyecineko100% (1)

- Worldwide Paper Company New Woodyard InvestmentDocument4 pagesWorldwide Paper Company New Woodyard InvestmentNoor Ji100% (2)

- Worldwide Paper CompanyDocument22 pagesWorldwide Paper Companyroldanvenus89% (9)

- WorldWide Paper CaseDocument8 pagesWorldWide Paper CaseSteve LuPas encore d'évaluation

- Worldwide Paper CompanyDocument2 pagesWorldwide Paper CompanyChenlong LuPas encore d'évaluation

- Case Analysis - Worldwide Paper Company: Finance ManagementDocument8 pagesCase Analysis - Worldwide Paper Company: Finance ManagementVivek SinghPas encore d'évaluation

- SpyderDocument3 pagesSpyderHello100% (1)

- Midland Energy Case StudyDocument5 pagesMidland Energy Case StudyLokesh GopalakrishnanPas encore d'évaluation

- Tottenham Case HBS Financials ValuationDocument14 pagesTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenPas encore d'évaluation

- Hola Cola 111Document261 pagesHola Cola 111Neupane IshaPas encore d'évaluation

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDocument5 pagesTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Capital Budgeting Decision for Hola-Kola's Zero-Calorie Soft DrinkDocument7 pagesCapital Budgeting Decision for Hola-Kola's Zero-Calorie Soft DrinkRivki MeitriyantoPas encore d'évaluation

- Paginas Amarelas Case Week 8 ID 23025255Document4 pagesPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust Incapi-371968794% (16)

- Case Analysis - Beta ManagementDocument7 pagesCase Analysis - Beta ManagementSamir Sharma100% (2)

- Case 9 The Body Shop International PLC 2001 An Introduction To Financial ModelingDocument10 pagesCase 9 The Body Shop International PLC 2001 An Introduction To Financial ModelingSajjad Ahmad0% (1)

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- Stuart Daw questions costing approach transaction basisDocument2 pagesStuart Daw questions costing approach transaction basisMike ChhabraPas encore d'évaluation

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariPas encore d'évaluation

- The Case Solution of AES Tiete: Expansion Plant in BrazilDocument19 pagesThe Case Solution of AES Tiete: Expansion Plant in BrazilParbon Acharjee0% (1)

- UST Debt Policy and Capital Structure AnalysisDocument10 pagesUST Debt Policy and Capital Structure AnalysisIrfan MohdPas encore d'évaluation

- Ferrari DocDocument1 pageFerrari DocFidelPas encore d'évaluation

- Group 6 M&A MellonBNY Case PDFDocument8 pagesGroup 6 M&A MellonBNY Case PDFPrachi Khaitan67% (3)

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143Pas encore d'évaluation

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezPas encore d'évaluation

- New Heritage DollDocument26 pagesNew Heritage DollJITESH GUPTAPas encore d'évaluation

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Continental Carriers financing options analysisDocument11 pagesContinental Carriers financing options analysisNatalie E Wilson100% (3)

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoePas encore d'évaluation

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionAmruta Turmé100% (2)

- McLeod Motors reduces inventory costs with new end shieldDocument6 pagesMcLeod Motors reduces inventory costs with new end shieldAbdul Khan100% (2)

- Science Technology Company Case Memo (TobyOdenheim)Document4 pagesScience Technology Company Case Memo (TobyOdenheim)todenheim100% (1)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALPas encore d'évaluation

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniPas encore d'évaluation

- Case QuestionsDocument10 pagesCase QuestionsJeremy SchweizerPas encore d'évaluation

- UST Debt Recapitalization AnalysisDocument4 pagesUST Debt Recapitalization Analysisstrongchong0050% (2)

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghPas encore d'évaluation

- New DollDocument2 pagesNew DollJuyt HertPas encore d'évaluation

- Hansson Private LabelDocument4 pagesHansson Private Labelsd717Pas encore d'évaluation

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73Pas encore d'évaluation

- Compagnie Du FroidDocument18 pagesCompagnie Du FroidSuryakant Kaushik0% (3)

- Corp Gov Group1 - Sealed AirDocument5 pagesCorp Gov Group1 - Sealed Airdmathur1234Pas encore d'évaluation

- ACFINA2 Case Study HanssonDocument11 pagesACFINA2 Case Study HanssonGemar Singian50% (2)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoPas encore d'évaluation

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- HBR Hannson Final Case AnalysisDocument5 pagesHBR Hannson Final Case AnalysisTexasSWO75% (4)

- Sealed Air's Leveraged Recapitalization Drives Improved PerformanceDocument3 pagesSealed Air's Leveraged Recapitalization Drives Improved Performancenishant kumarPas encore d'évaluation

- Worldwide Paper Company Woodyard Investment AnalysisDocument1 pageWorldwide Paper Company Woodyard Investment AnalysisKritikaPandeyPas encore d'évaluation

- Capital Budgeting PracticeDocument17 pagesCapital Budgeting PracticeMira V.Pas encore d'évaluation

- Hanson CaseDocument14 pagesHanson CaseSanah Bijlani40% (5)

- New Heritage SolutionDocument3 pagesNew Heritage SolutionJosé Luis DíazPas encore d'évaluation

- HWK ADocument6 pagesHWK AStevenMagenheimPas encore d'évaluation

- Mba Thesis Topics in Banking and FinanceDocument6 pagesMba Thesis Topics in Banking and Financegj3vfex5100% (2)

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Document21 pagesBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoPas encore d'évaluation

- FIN410 ProjectDocument44 pagesFIN410 ProjectMahmudul HasanPas encore d'évaluation

- CF Tutorial 8 - Solutions UpdatedDocument11 pagesCF Tutorial 8 - Solutions UpdatedchewPas encore d'évaluation

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyPas encore d'évaluation

- Solutions Manual: Introducing Corporate Finance 2eDocument23 pagesSolutions Manual: Introducing Corporate Finance 2eJeremiahPas encore d'évaluation

- Marriot CaseStudyDocument17 pagesMarriot CaseStudySambhav SamPas encore d'évaluation

- 9 Week of Lectures: Financial Management - MGT201Document13 pages9 Week of Lectures: Financial Management - MGT201Syed Abdul Mussaver ShahPas encore d'évaluation

- Business Finance ExamDocument10 pagesBusiness Finance ExamAstari GatiningtyasPas encore d'évaluation

- Capital Structure and Leverage AnalysisDocument57 pagesCapital Structure and Leverage AnalysisbirhanuPas encore d'évaluation

- Roche Case StudyDocument10 pagesRoche Case Studyasfdga100% (1)

- Chapter 4 Leverage Capital StructureDocument5 pagesChapter 4 Leverage Capital StructureshanksamPas encore d'évaluation

- AssignmentDocument24 pagesAssignmentKwame Tetteh Jnr60% (5)

- P4-SGP-AnswersDocument11 pagesP4-SGP-Answerssabrina006Pas encore d'évaluation

- Corporate Finance PrimerDocument23 pagesCorporate Finance Primernikki thawaniPas encore d'évaluation

- Capital Structure of ENCANADocument6 pagesCapital Structure of ENCANAsujata shahPas encore d'évaluation

- Valuation Methods for Income-Based Asset ValuationDocument17 pagesValuation Methods for Income-Based Asset ValuationMika MolinaPas encore d'évaluation

- Chapter Two: Financing Decisions / Capital StructureDocument72 pagesChapter Two: Financing Decisions / Capital StructureMikias DegwalePas encore d'évaluation

- Capm AnalysisDocument18 pagesCapm Analysisnadun sanjeewaPas encore d'évaluation

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Document16 pagesAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiPas encore d'évaluation

- Cost of CapitalDocument33 pagesCost of CapitalMichaela San DiegoPas encore d'évaluation

- Fin103 LT4 JTA ComtechDocument3 pagesFin103 LT4 JTA ComtechJARED DARREN ONGPas encore d'évaluation

- Corporate Finance: Fifth Edition, Global EditionDocument55 pagesCorporate Finance: Fifth Edition, Global Editionkaylakshmi8314Pas encore d'évaluation

- Titman CH 15 - Capital Structure PolicyDocument92 pagesTitman CH 15 - Capital Structure PolicyIKA RAHMAWATIPas encore d'évaluation

- Wacc Practice 1Document3 pagesWacc Practice 1Ash LayPas encore d'évaluation

- 2023 CFA L2 Book 3 Equity FI Derivatives AIDocument104 pages2023 CFA L2 Book 3 Equity FI Derivatives AIPR100% (1)

- Unit 6 WACCDocument16 pagesUnit 6 WACCAnuska JayswalPas encore d'évaluation

- Creating and Measuring Shareholder WealthDocument4 pagesCreating and Measuring Shareholder WealthMANSIPas encore d'évaluation

- Fi Concession April 2023 Application of Financial Management TechniquesDocument12 pagesFi Concession April 2023 Application of Financial Management TechniquesBeninePas encore d'évaluation

- Finance and Investment Toolkit OverviewDocument46 pagesFinance and Investment Toolkit OverviewFrancisco López50% (2)