Académique Documents

Professionnel Documents

Culture Documents

Appendix Ameritrade

Transféré par

Linnéa EkrothDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Appendix Ameritrade

Transféré par

Linnéa EkrothDroits d'auteur :

Formats disponibles

Appendix

Ameritrade

Course 644, Corporate Finance and Value Creation

Erik Bjrk, 23079

Olle Matto, 23207

Linna Ekroth, 23166

Lisa Elander, 23113

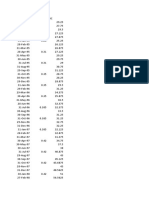

Table 1: Calculation of firm returns

Date!

Charles Schwab!

"

Shares! Price!

Dividend! Stock Split !

30-sep-87"

29121" 15,875"

- "

1"

1"

30-okt-87"

29121" 7,875"

- "

1"

1"

30-nov-87"

29121" 6,625"

- "

1"

31-dec-87"

25388" 6,000"

- "

1"

29-jan-88"

25388" 6,500"

- "

1"

29-feb-88"

25388" 9,000"

- "

1"

31-mar-88"

25388" 7,375"

- "

1"

29-aug-97"

176422" 42,750"

"

"

"

"

E*Trade!

Price!

"

X!

0,050 "

"

Dividend! Stock Split!

"

30-aug-96"

30-sep-96"

29393" 10,500"

29539" 13,188"

- "

- "

1"

31-okt-96"

29539" 11,125"

- "

1"

29-nov-96"

29539" 10,938"

- "

1"

29-aug-97"

30958" 32,125"

- "

1"

Date!

"

"

"

Quick & Reilly!

"

Shares! Price!

Dividend! Stock Split!

X!

6318" 15,000"

30-mar-84"

6318" 14,875"

- "

1"

30-apr-84"

6318" 17,125"

- "

1"

31-maj-84"

6318" 17,375"

- "

1"

29-jun-84"

6318" 18,000"

0,050 "

1"

29-aug-97"

38664" 34,250"

0,060 "

1"

0,050 "

"

0,045340"

0,051610"

-0,017060"

-0,036450"

0,052990"

0,013940"

0,065730"

-0,036450"

"

Rt!

Rm!

-0,14609

9291"

-0,00833

3333"

1"

0,151260

504"

1"

0,014598

54"

1"

0,038848

921"

1"

0,307047

619"

1"

1"

"

"

"

Waterhouse Investor Services!

"

Shares! Price!

Dividend! Stock Split!

"

Y!

- "

30-jun-87"

31-jul-87"

2572" 8,000"

2572" 8,250"

- "

- "

1"

1"

31-aug-87"

2572" 7,500"

- "

1"

30-sep-87"

2572" 8,000"

- "

1"

11501" 37,875"

"

"

- "

"

"

1"

"

X!

2572" 6,938"

"

0,070410"

- "

29-maj-87"

30-sep-96"

"

-0,072900"

Rm!

0,256"

-0,15643

0088"

1"

-0,01680

8989"

1"

0,053278

689"

1"

Y!

29-feb-84"

Date!

-0,224870"

"

Rt!

1"

"

X!

6318" 17,625"

"

"

Y!

31-jan-84"

"

Rm!

"

Shares!

"

"

Rt!

-0,50393

7008"

-0,15873

0159"

1"

-0,09433

9623"

1"

0,083333

333"

1"

0,384615

385"

1"

-0,18055

5556"

1"

-0,08936

1702"

1"

1"

Date!

"

"

Y!

1"

"

-0,039170"

0,013450"

0,002730"

-0,052350"

0,023590"

-0,036450"

"

Rt!

0,153070

049"

1"

1" 0,03125"

-0,09090

9091"

1"

0,066666

667"

1"

0,013377

926"

1,0"

"

"

Rm!

0,043830"

0,044050"

0,037230"

-0,020740"

0,052990"

Not. Years between the first four and last for each company has been hidden, firm returns

Rt are calculated as advised in assignment, Rm is the VW NYSE index from exhibit 6

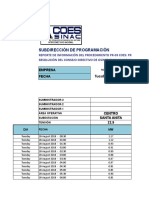

Table 2: Calculation of asset beta and project cost of

capital

TAX RATE!

35%"

Debt Beta!

0,25"

D/E!

rf!

Ameritrade!

Beta!

10,31"-"

Charles Schwab!

Cov(x, market)! Var(rm)!

Beta!

0,001408714" 0,0006133" 2,2969806"

6,61%"

D/V!

0,91"

D/V!

rf-rm!

7,39%"

Debt Beta assumptions!

0"

0,125"

0,25"

return (A)! return (A)! return (A)! Unl. Beta! Unl. Beta! Unl. Beta!

2,0984002 2,1108585 2,1233169

59"

93"

26"

22,12%" 22,21%" 22,30%"

0,080"

Debt Beta assumptions!

0"

0,125"

0,25"

Unl. Beta! Unl. Beta! Unl. Beta!

2,1132222" 2,1197222" 2,1262222"

Quick & Reilly!

Cov(x, market)! Var(rm)!

Beta!

0,001351834" 0,0006133" 2,2042343"

D/V!

Debt Beta assumptions!

0"

0,125"

0,25"

0,00"

Unl. Beta! Unl. Beta! Unl. Beta!

2,2042343" 2,2042343" 2,2042343"

Waterhouse Investor Services!

Cov(x, market)! Var(rm)! Eq Beta!

D/V!

0,001863688" 0,0005842" 3,1899101"

0,38"

Debt Beta assumptions!

0"

0,125"

0,25"

Debt Beta assumptions!

0"

0,125"

0,25"

Unl. Beta! Unl. Beta! Unl. Beta!

1,9777443" 2,0086193" 2,0394943"

Not. For more information regarding assumptions, choice of debt betas, etc. see

memorandum

Table 3: Comparison of calculated project cost of capital

and expected return according to Ameritrade manager and

CEO

Expected Return and Cost of Capital

0,45

0,4

0,35

0,3

0,25

0,2

0,125

0,15

0,1

0,05

0

Cost of Capital (debt Cost of Capital Cost Cost of Capital (debt

beta=0)

of Capital (debt

beta=0,25)

beta=0,125)

CEO E( r )

Manager E( r )

Vous aimerez peut-être aussi

- Invitation Letter For Investment Into The CompanyDocument2 pagesInvitation Letter For Investment Into The CompanyS Tunkla Echaroj50% (2)

- Case Study On Lenovo and Ibm Lenovo Mergers and AcquisitionsDocument28 pagesCase Study On Lenovo and Ibm Lenovo Mergers and AcquisitionsLê Trần CảnhPas encore d'évaluation

- InfoDocument450 pagesInfoKen HagadusPas encore d'évaluation

- Scams That Rattled Indian Stock MarketDocument22 pagesScams That Rattled Indian Stock MarketvinithaPas encore d'évaluation

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalPas encore d'évaluation

- Top 250 CompaniesDocument7 pagesTop 250 CompaniesadityakhadkePas encore d'évaluation

- Financial ModelingDocument16 pagesFinancial ModelingMateen AhmedPas encore d'évaluation

- Estimating Beta Value.: Tax RateDocument16 pagesEstimating Beta Value.: Tax Ratesanz0875% (4)

- Port Mana 3 1 1Document194 pagesPort Mana 3 1 1LE TUAN ANH DAOPas encore d'évaluation

- Port ManaDocument110 pagesPort ManaLE TUAN ANH DAOPas encore d'évaluation

- Price Weighted Index: DewanDocument12 pagesPrice Weighted Index: DewanHameed Ullah KhanPas encore d'évaluation

- Daily MarginDocument2 pagesDaily MarginAnil ParidaPas encore d'évaluation

- 11 Interest Calculation On DepositsDocument3 pages11 Interest Calculation On DepositsAbhishek Kumar SinghPas encore d'évaluation

- 30 M 60 BLNDocument1 page30 M 60 BLNborneo borneoPas encore d'évaluation

- INTERCO ProjectDocument60 pagesINTERCO ProjectFougnigue Serin SiluePas encore d'évaluation

- Format Excel Program PGJDocument6 pagesFormat Excel Program PGJathok illahPas encore d'évaluation

- A Study On Risk and Return Analysis of Axis Bank A Report Submitted To DR - HIMANSHU BAROTDocument19 pagesA Study On Risk and Return Analysis of Axis Bank A Report Submitted To DR - HIMANSHU BAROTMit chauhanPas encore d'évaluation

- Irias Samuel S2 Tarea GrupalDocument13 pagesIrias Samuel S2 Tarea GrupalAntonio ValerianoPas encore d'évaluation

- Ford DataDocument6 pagesFord DataTom BolhoodPas encore d'évaluation

- EcolabDocument9 pagesEcolabPew DUckPas encore d'évaluation

- Assignment No. 5 Maaz FMDocument43 pagesAssignment No. 5 Maaz FMshehry .CPas encore d'évaluation

- 202,444,019.00 71 Bulan 202,444,019.00Document2 pages202,444,019.00 71 Bulan 202,444,019.00Meizu M6Pas encore d'évaluation

- UntitledDocument29 pagesUntitledAsskkkPas encore d'évaluation

- Month Gross Payout Tax 15-Dec-21 - 48,960,000Document2 pagesMonth Gross Payout Tax 15-Dec-21 - 48,960,000KumaraswamyPas encore d'évaluation

- 2G - Raw - 2018-10-17 00 - 00 - 00-2018-10-17 16 - 30 - 00Document3 137 pages2G - Raw - 2018-10-17 00 - 00 - 00-2018-10-17 16 - 30 - 00Bayusander SupertrampPas encore d'évaluation

- 3MDocument9 pages3MPew DUckPas encore d'évaluation

- Commodity22903 MCX MarginDocument2 pagesCommodity22903 MCX Margindps_1976Pas encore d'évaluation

- Target Bulan Depan Rate Target AtasDocument3 pagesTarget Bulan Depan Rate Target Atasanto donlotPas encore d'évaluation

- (Jan 2009 To Aug 2010) : PeriodDocument13 pages(Jan 2009 To Aug 2010) : PeriodSmriti TrivediPas encore d'évaluation

- Month Units Produced Monthly Plant Cost Prediction Value ErrorDocument15 pagesMonth Units Produced Monthly Plant Cost Prediction Value ErrorVishal SiwalPas encore d'évaluation

- Salary and Raises 11-16-2010Document10 pagesSalary and Raises 11-16-2010Matthew JosephPas encore d'évaluation

- TBDocument2 080 pagesTBkirubaharanPas encore d'évaluation

- HersheyDocument9 pagesHersheyPew DUckPas encore d'évaluation

- Data Tamu Ota 2024Document13 pagesData Tamu Ota 2024FaizinPas encore d'évaluation

- Data Tamu Ota 2023Document11 pagesData Tamu Ota 2023FaizinPas encore d'évaluation

- Javeria AssignmentDocument60 pagesJaveria AssignmentMuhammad UmairPas encore d'évaluation

- FD DevanshDocument32 pagesFD DevanshSubodh MohapatroPas encore d'évaluation

- ArthurDocument1 pageArthurkarina dalessioPas encore d'évaluation

- CryptoDocument11 pagesCryptoWeavemanila Inc Ann HernandezPas encore d'évaluation

- Date Change Gain Avg Gain RS QQQQ Close 14-Day RSIDocument4 pagesDate Change Gain Avg Gain RS QQQQ Close 14-Day RSIpiyushnkumar3755Pas encore d'évaluation

- Rigi File OHAAmHRezV Updated ExcelDocument15 pagesRigi File OHAAmHRezV Updated Excelakki777Pas encore d'évaluation

- IX GlobalDocument2 pagesIX GlobalPRATIK ATWALPas encore d'évaluation

- Ipon ChallengeDocument1 pageIpon Challenge4 Express Mover Marketing CompanyPas encore d'évaluation

- IMP Historical Data 1Document4 pagesIMP Historical Data 1Minh TongPas encore d'évaluation

- HumanaDocument9 pagesHumanaPew DUckPas encore d'évaluation

- "Active Equity Portfolio Construction Is About Thoroughly Understanding The Return ObjectivesDocument4 pages"Active Equity Portfolio Construction Is About Thoroughly Understanding The Return ObjectivesAHMAD NAWAZPas encore d'évaluation

- Month Speaker Keyboard Mouse HDDDocument4 pagesMonth Speaker Keyboard Mouse HDDAngelo ValdezPas encore d'évaluation

- Latihan 3 Linear RegressionDocument3 pagesLatihan 3 Linear RegressionilhamPas encore d'évaluation

- Broullon TP ENSDocument2 pagesBroullon TP ENSthomaspaviottotoPas encore d'évaluation

- This Week World Stock Market Closed IndexDocument4 pagesThis Week World Stock Market Closed IndexWei ChenPas encore d'évaluation

- Pair Trading AmeyDocument75 pagesPair Trading Ameypanzer864Pas encore d'évaluation

- Ul-Mall A-Pr03-28082018Document8 pagesUl-Mall A-Pr03-28082018Prospero Alfonso Cumpa GuzmanPas encore d'évaluation

- Analyst DataDocument36 pagesAnalyst Dataveda20Pas encore d'évaluation

- Equity HdfcbankDocument11 pagesEquity Hdfcbankxebahat916Pas encore d'évaluation

- Sales Chart-WPS OfficeDocument2 pagesSales Chart-WPS OfficeJINTALAN CARLO12 TVPas encore d'évaluation

- Earth Quake 8 Oct, 2005 Date Kse-100 ReturnsDocument6 pagesEarth Quake 8 Oct, 2005 Date Kse-100 ReturnsMuhammad FaizanPas encore d'évaluation

- Loan Payment DetailDocument8 pagesLoan Payment DetailGayan IndunilPas encore d'évaluation

- Title: Cash Flow Scheduled Vs Cash Flow ActualDocument1 pageTitle: Cash Flow Scheduled Vs Cash Flow Actualbishu70Pas encore d'évaluation

- 26 HDFC Beta Two Time PeriodsDocument9 pages26 HDFC Beta Two Time PeriodsprernaPas encore d'évaluation

- Days Investment ROI Total Referral Fees Withdrawal Total Investment EarningsDocument1 pageDays Investment ROI Total Referral Fees Withdrawal Total Investment EarningsSay VierPas encore d'évaluation

- Msci BrazilDocument10 pagesMsci Brazilpatrick-lee ellaPas encore d'évaluation

- SouvenirSales MultiplicativeDocument57 pagesSouvenirSales MultiplicativeKunal JainPas encore d'évaluation

- Futures Daily Cumulative Margin Margin Call Day Price Gain Gain BalanceDocument1 pageFutures Daily Cumulative Margin Margin Call Day Price Gain Gain BalanceAr110Pas encore d'évaluation

- PasigDocument14 pagesPasigAimee Buenaventura DoninaPas encore d'évaluation

- Research Assignment 2Document4 pagesResearch Assignment 2Willard ChivindaPas encore d'évaluation

- Banking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Document7 pagesBanking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Ashraf AliPas encore d'évaluation

- Barrons - May 25 2020Document96 pagesBarrons - May 25 2020啊影Pas encore d'évaluation

- Hedge Fund StrategiesDocument13 pagesHedge Fund StrategiesptselvakumarPas encore d'évaluation

- Differences Between A Limited Liability Partnership and A General PartnershipDocument1 pageDifferences Between A Limited Liability Partnership and A General PartnershipHanenFamPas encore d'évaluation

- Silence Is The Best Answer of All Stupid Questions: Smile Is The Best Reaction in All Critical SituationDocument1 pageSilence Is The Best Answer of All Stupid Questions: Smile Is The Best Reaction in All Critical SituationNaseem AkhtarPas encore d'évaluation

- Hindalco IndustriesDocument12 pagesHindalco Industriesnkumar_411861Pas encore d'évaluation

- CPhI TYO Exhibitors 090421-436Document18 pagesCPhI TYO Exhibitors 090421-436Prasoon SimsonPas encore d'évaluation

- Cayman Islands Monetary Authority: Bank List - Category B BanksDocument3 pagesCayman Islands Monetary Authority: Bank List - Category B BanksGarbo BentleyPas encore d'évaluation

- Which of The Following Restructuring Activities Does Not Result in An Expansion of A FirmDocument21 pagesWhich of The Following Restructuring Activities Does Not Result in An Expansion of A Firmsonika740% (10)

- FIN 201 Chapter 1Document24 pagesFIN 201 Chapter 1Affan AhmedPas encore d'évaluation

- Less Than Wholly Owned REPORTDocument40 pagesLess Than Wholly Owned REPORTrichelledelgadoPas encore d'évaluation

- Eike Batista BiographyDocument9 pagesEike Batista BiographyGEORGEGeekPas encore d'évaluation

- Introduction To Company Law Note 6 of 7 Notes: Merger & TakeoverDocument22 pagesIntroduction To Company Law Note 6 of 7 Notes: Merger & TakeoverMusbri MohamedPas encore d'évaluation

- Anon PE Audit - Draft Report - April 19 2010Document40 pagesAnon PE Audit - Draft Report - April 19 2010PGurusPas encore d'évaluation

- Sample - Chapter 7 - Problem 35 (Due 10.18.20)Document2 pagesSample - Chapter 7 - Problem 35 (Due 10.18.20)Tenaj KramPas encore d'évaluation

- How To Read A Value Line ReportDocument15 pagesHow To Read A Value Line ReportJamie GiannaPas encore d'évaluation

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Document11 pages1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahPas encore d'évaluation

- PLDT 4q2017 Financial Statements PDFDocument156 pagesPLDT 4q2017 Financial Statements PDFAhs DawnPas encore d'évaluation

- Soal Akl1Document7 pagesSoal Akl1Khazanah UmiPas encore d'évaluation

- Sri Lanka Gazzette-2019-01-18 (I-IIB) EDocument27 pagesSri Lanka Gazzette-2019-01-18 (I-IIB) ERucki DeenPas encore d'évaluation

- Security Bank: History of The CompanyDocument6 pagesSecurity Bank: History of The CompanyKathlyn Cher SarmientoPas encore d'évaluation

- Bse 20191204Document50 pagesBse 20191204BellwetherSataraPas encore d'évaluation

- Infrastructure Leasing & Financial Service LimitedDocument3 pagesInfrastructure Leasing & Financial Service LimitedShivam MittalPas encore d'évaluation