Académique Documents

Professionnel Documents

Culture Documents

Tax 1 Valencia Solman For Chap 2

Transféré par

Yeovil PansacalaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax 1 Valencia Solman For Chap 2

Transféré par

Yeovil PansacalaDroits d'auteur :

Formats disponibles

3

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

CHAPTER 2

TAX ADMINISTRATION

Problem 2 1 TRUE OR FALSE

1. True

2. False not the BIR, but the Department of Finance

3. False the BIR is responsible to collect national taxes only.

4. False The review shall be made by the Court of Justice.

5. True

6. True

7. False The Secretary of Justice and the Courts also interprets the provisions of the Tax

Code.

8. False the fact that taxes are self-assessing the BIR assessment is necessary to ensure

the reliability of the ITR.

9. False the BIR or the Government is not allowed by law to appeal to the CTA. (Acting Collector

of customs vs. Court of Appeals, Oct. 31, 1957)

10. True

11. False Appeal to the SC shall be made within 15 days from the receipt of the decision of

the CTA.

12. False the CIR can conduct a jeopardy assessment when there are no accounting

records.

13. True

14. False the taxpayer needs to waive first his right on the secrecy of bank deposits before

BIR can inquire into his bank deposits.

15. True

Problem 2 2 TRUE OR FALSE

1. False there must be a Letter of Authority.

2. False the supporting documents must be submitted to the BIR within 60 days from the

date a protest is filed.

3. True

4. True

5. False destraint as a tax collection method is applicable only to personal property.

6. False criminal violations already filed in court are not subject to compromise.

7. True

8. False, collection must be within 5 years

9. True

10. False-redemption period is within 1 year from date of auction sale.

11. True

12. True

Problem 2 3 TRUE OR FALSE

1. False there is no need to pay additional registration fee for transfer of business

registration.

2. True

3. False the initial bond required for manufacturers and importers of articles subject to

excise tax is P100,000.

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

4.

5.

6.

7.

8.

9.

10.

11.

False informers reward is subject to 10% final withholding tax.

True

True

True

True

False Seizure

False Forfeiture

False not allowed because the second cousin is within the 6 th degree of relative by

consanguinity.

12. False collection tax cases filed in courts are subject to compromise.

13. True

Problem 2 4

1. C

2. B

3. B

4. D

5. C

6. C

7. B

8. B

9. C

10. D

11. A

12. D

Problem 2 5

1. B

2. A

3. D

4. C

5. D

6. D

7. C

8. C

9. A

10. A

Problem 2 6

1. B

2. A

3. A

4. B

5. D

6. C

7. B

8. A

9. C

10. A

11. A

12. A

Problem 2 7

Case A:

April 15, 2014 - The return, statement or declaration can be modified, changed

or amended from within three years from the date of filing as long as no tax investigation has

been served to the taxpayer. (Sec. 6(A), NIRC)

Case B:

October 20, 2015 - If the tax deficiency is due to simple neglect, the

prescriptive period of tax assessment is within 3 years starting from the date of filing the return

(Sec. 203, NIRC), or its amendment.

Case C:

April 15, 2025 - If the ITR is fraudulent or no tax return was filed, the tax may

be assessed, or a proceeding in court for the collection of such tax may be filed without

assessment at any time within ten (10) years after the discovery of the falsity, fraud or omission.

(Sec. 222 (a), NIRC)

Case D:

April 15, 2022 - If the ITR is fraudulent or no tax return was filed, the tax may

be assessed, or a proceeding in court for the collection of such tax may be filed without

assessment at any time within ten (10) years after the discovery of the falsity, fraud or omission.

(Sec. 222 (a), NIRC)

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Case E:

No need to appeal. The prescribed period of filing for the refund is already

expired. The filing of refund should have been made within two years after the payment of tax or

penalty. It was filed within 2 years, one month, and 5 days after the date of erroneous payment,

hence, not appealable anymore.

Case F:

May 5, 2013. The filing of refund was appropriately made within the 2 year

prescribed period. The denial was received on April 5, 2013. The filing of appeal to CTA should

be made within 30 days from the receipt of denial from the BIR.

Case G:

August 2, 2017. The date of grant for refund was received on August 1, 2012.

The refund check (dated July 15, 2012) should be encashed within 5 years from the date the

grant for refund was delivered (August 1, 2012). The check should be encashed from August 1,

2012 to August 1, 2017. It will be forfeited on August 2, 2017.

Case H:

July 31, 2017. For tax credit, the five year prescriptive period should start from

the date of issuance. In this case, the date of issuance should be the date of tax credit certificate.

The expiry date would therefore start on July 31, 2017.

Case I:

August 20, 2011. If the BIR has no response after the submission of supporting

documents to serve as evidence for the protest, the last day to appeal to the CTA should be made

within 30 days from the lapse of the 180 day period from the submission of the supporting

documents.

Computation of days:

After January 22, 2011

January

February

March

April

May

June

July

Total number of days as of July 21

Plus 30 days after the 180 days

July

August

Total day on August 20

Days

9

28

31

30

31

30

21

180

10

20

30

Case J:

May 4, 2011. The last day to appeal to the CTA should be made within 30 days

from the receipt of the denial of the BIR. The 30 days is determined as follows:

Days

First denial of the BIR March 22, 2011

to 2nd request for reconsideration March 30, 2011

8

nd

2 denial of the BIR April 12, 2011

to May 4, 2011 to complete the 30 day period

22

Total days as of May 4, 2011

30

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Case K:

June 25, 2011. The appeal to CTA should be made within 15 days from date of

unfavorable decision from CTA was received (June 10 plus 15 days).

Case L:

July 10, 2011. The appeal to SC should be made within 15 days from date of

receipts of the unfavorable decision of CTA (June 25 plus 15 days).

Case M:

March 1, 2011. Within 1 year from the date of sale.

Problem 2 8

B

Original business registration and renewal of business registration are subject to P500 each. The

transfer of registration requires no additional registration fee to be paid by the taxpayer. (Sec. 243,

NIRC)

Problem 2 9 D

All criminal violation may be compromised except: (a) those already filed in court, or (2) those

involving fraud. (Sec. 204 (B), NIRC)

Problem 2 10

D

Income tax payable

Multiplied by minimum compromise rate due bankruptcy

Minimum amount of compromise

P1,000,000

20%

P 200,000

Problem 2 11

D

Amount of tax liability

Surcharges

Interest

Advertising cost

Price if purchase by the Government

P150,000

25,000

20,000

5,000

P200,000

Problem 2 12

D

1. Letter C

Actual excise tax on the first 6 months

Multiplied by statutory increase in rate

Required bonds on the last 6 months

P200,000

2

P400,000

If after 6 months of operation, the amount of initial bond is less than the

amount of the total excise tax paid during the period, the amount of the bond

shall be adjusted to twice the tax actually paid for the period. [Sec. 160 (A),

NIRC]

2.

Not in the choices, P400,000

Actual excise tax on the first year applicable to

the second year (P200,000 + P250,000)

P450,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Less: Excess of bonds over actual excise tax

Bonds paid first year (P100,000 + P400,000)

Actual excise tax first year

Net actual amount of bond for the second year

(450,000)

P500,000

50,000

P400,000

The bond for the succeeding years of operation shall be based on the actual

total excise tax paid during the year immediately preceding the year of

operation. [Sec. 160 (B), NIRC]

Problem 2 13

C

X is not entitled to receive the informers reward because being a first cousin, he is Bs (an RDO)

relative within the 6th degree of consanguinity.

A public official or government employee or his relative within the 6 th degree of consanguinity

shall not be entitled to the informers reward of 10% based on the tax revenue recovered or

P1,000,000. whichever is lower. This informers reward, once awarded shall be subject to a final

withholding tax of 10%. (Sec. 282, NIRC)

Problem 2 14

1. Letter D

Sales price

Less: Total amount per assessment

P2,500,000

Surcharge (P2,500,000 x 25%)

625,000

Interest (P2,500,000 x 20% x 3/12)

125,000

Net amount after public taxes, penalties and interest

Less: Capital gains tax (P4,000,000 x 6%)

P 240,000

DST (P4,000,000 x 1.5%)

60,000

Cost of advertising

20,000

Excess amount to be returned to X

2.

Letter C

Purchase price

Add: Interest (P4,000,000 x 15% x 9/12)

Redemption price

P4,000,000

3,250,000

P 750,000

320,000

P 430,000

P4,000,000

450,000

P4,450,000

The redemption price is comprised of the purchase price plus 15% interest

per annum from the date of purchase to the date redemption. (Sec. 214,

NIRC)

3.

Letter C

Total rent income (P60,000 x 9 months)

Less: Interest expense to redeem the property

Excess income

P540,000

450,000

P 90,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

The owner shall not, however, be deprived of the possession of the said

property and shall be entitled to the rents and other income thereof until the

expiration of the time allowed for its redemption. (Sec. 214, NIRC)

Problem 2 15

C

Statutory fine (P250,000 x 2)

P500,000

Any taxpayer whose property has been placed under constructive distraint, and disposed the

same without the knowledge and consent of the Commissioner shall be punished by a fine of not

less than twice the value of the property sold, encumbered or disposed of, but not less than

P5,000 or suffer imprisonment of not less than 2 years and 1 day but not more than 4 years or

both. (Sec. 206, NIRC)

The P5,000 fine is applicable only when the computed amount (selling price x 2) is lower than

P5,000.

Problem 2 16

C

Proceeds from sale

Less: Basic tax assessed

Accrued interest from April 15, 200x to

July 15, 200x (P300,000 x 20% x 3/12)

Documentary stamp tax

Advertisement

Amount to be refunded to Mr. Poe

Problem 2 17

D

Proceeds from sale (P1,500/0.005)

Less: Basic tax assessed

Accrued interest from April 15, 200x to

July 15, 200x (P275,000 x 20% x 3/12)

Documentary stamp tax

Advertisement

Amount to be refunded to Mr. Ligot

Problem 2 18

C

Total surcharge (P10,000 x 25%)

P 350,000

P300,000

15,000

1,500

1,000

317,500

P 32,500

P 300,000

P275,000

13,750

1,125

1,000

290,875

P 9,125

P2,500

25% surcharge shall be imposed for late filing of the return and late payment of the tax. (Sec. 5,

Rev. Regs. No. 12-99)

Problem 2 19

C

Interest (P10,000 x 20% x 2.5/12)

P416.67

The computation of interest is based on unpaid basic tax. (RMC No. 4699)

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Problem 2 20

C

Basic tax

Surcharges:

For late filing and payment (25%)

For filing in wrong RDO (25%)

Interest (P10,000 x 20% x 2.5/12)

Total amount due

Problem 2 21

D

Income tax due per return

Add: Surcharge for willful neglect to file the

and late payment (P100,000 x 50%)

Interest from April 15, 200B to

June 30, 200C (P100,000 x 20% x 14.5/12)

Total amount due, June 30, 200C

P10,000

P2,500

2,500

5,000

417

P15,417

P100,000

P50,000

24,167

74,167

P174,167

Late filing and late payment of tax is a taxpayers willful neglect if the payment is made only after

the notification of the BIR. Such violation is subject to 50% surcharge plus 20% interest per

annum computed from the due date of the tax until the date of payment. (Rev. Regs. No. 12-99,

Sec. 5.3)

Problem 2 22

B

Income tax due per return

Add: Surcharge for late filing and late payment

- simple neglect (P100,000 x 25%)

Interest from April 15, 200B to

June 30, 200B (P100,000 x 20% x 2.5/12)

Total amount due (excluding compromise penalty)

P100,000

P25,000

4,167

29,167

P129,167

If the violation is late filing and late payment of tax, only one 25% surcharge shall be imposed for

late filing of the return and late payment of the tax plus 20% interest per annum computed from

the due date of the tax until the date of payment. (RMC No. 46-99; Sec. 5, Rev. Regs. No. 12-99)

Problem 2 23

A

Unpaid tax due

Additions to tax:

Surcharge (P1,000,000 x 50%)

Interest from April 15, 200B to December 31,

200C (P1,000,000 x 20% x 1 year & 6.5 mos.)

Total amount due as of December 31, 200C

Add: Excess amount

P1,000,000

P500,000

341,666

841,667

P1,841,667

158,333

10

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Total selling price

Add: Statutory interest rate to redeem (P2,000,000 x 15%)

Total amount needed to redeem the real property

P2,000,000

300,000

P2,300,000

The redemption of the property sold through public auction shall be made within one year from

the date of sale subject to a statutory redemption interest rate of 15% per annum. (Sec. 214,

NIRC)

Problem 2 24

B

Basic amount due per assessment

Add: Surcharge for simple neglect

to pay on time (P80,000 x 25%)

Interest (P80,000 x 20% x 45/360 days)

Total required payment on June 30, 200A

P 80,000

P 20,000

2,000

22,000

P102,000

[Sec. 248(A)(3) and Sec. 249(B)(3), Rev. Regs. No. 12-99, Sept. 6, 1999]

Problem 2 25

C

Unpaid income tax due (P3,000,000 P1,000,000)

Additions to tax:

Surcharge (P2,000,000 x 50%)

Interest (P2,000,000 x 20% x 3/12)

Total amount due as of August 15, 200B

P2,000,000

P1,000,000

100,000

1,100,000

P3,100,000

Concealment of income is a form of fraud. A false or fraudulent return is subject to a surcharge

of 50% based on the unpaid tax or the deficiency tax. [Sec. 248 (B), NIRC]

Problem 2 26

D

Income tax due per ITR

Divided by installments allowed

Tax due on 1st installment

Less: Tax credit

Tax payable 1st installment

P8,000

2

P4,000

3,000

P1,000

When the tax due is in excess of P2,000, the taxpayer other than a corporation may elect to pay

the tax in two equal installments (Sec. 56(A)(2), NIRC).

Problem 2 27

1.

Letter A

11

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

Income tax due per return, April 15, 200B

Less: 1 st installment, April 15, 200B

Balance as of April 15, 200B

Add: Interest from April 15, 200B to May 15, 200B

(P750,000 x 20% x 1/12)

Total amount due, May 15, 200B

2.

P1,000,000

250,000

P 750,000

12,500

P 762,500

Letter C

Balance as of May 15, 200B

Add: Interest from May 15, 200B to June 15, 200B

(P500,000 x 20% x 1/12)

Total amount due, June 15, 200B

Less: 3 rd installment, June 15, 200B

(P250,000 + P8,333)

Balance as of June 15, 200B

Add: Interest from June 15, 200B to July 15, 200B

(P250,000 x 20% x 1/12)

4th and final installment

P 500,000

8,333

P 508,333

258,333

P 250,000

4,167

P 254,167

Problem 2 28

Yes, because the prescriptive period of filing the written protest is within 30 days from receipt of

assessment. Pay the related tax. Compromise is not a remedy because tax fraud is not subject

to compromise.

Problem 2 29

1

Taxable income

.

Add: Discrepancies per investigation:

Undeclared rental income

Nondeductible interest expenses

Nondeductible bad debt expense

Undocumented representation expenses

Taxable income per investigation

Multiplied by income tax rate

Income tax due

Less: Income tax paid per return

Balance

Add: 50% Surcharge for filing a fraudulent return

(P330,000 x 50%)

20% interest per annum from April 15, 2010

to April 15, 2011 (P330,000 x 20%)

Total amount due

2

.

Total amount due

Add: 25% Surcharge for late payment

P1,000,00

0

P450,000

300,000

200,000

150,000

1,100,000

P2,100,000

30%

P 630,000

300,000

P 330,000

P165,000

66,000

231,000

P 561,000

P561,000

12

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

Chapter 2: Tax Administration

(P561,000 x 25%)

20% Interest per annum from April 15, 2011

to June 15, 2011 (P561,000 x 20% x 2/12)

Total amount due (excluding suggested

compromise penalty for late payment)

P140,250

18,700

158,950

P719,950

Problem 2 30

a. The cash reward of Miss Wan as tax informer would be P1,000,000, the maximum amount

of reward.

b.

The informers reward remains payable, hence, Miss Wan will received the maximum reward

of P1,000,000.

c.

The final income tax to be withheld from the reward of Miss Wan would be 10% of

P1,000,000 or P100,000.

Problem 2 31

a. The tax violations of Miss San Tago are the following:

1. Unregistered business (Sec. 236 [A], NIRC.)

2. Non-issuance of commercial invoice (Sec. 237, NIRC.)

3. Ignoring the summon (Sec. 5, NIRC.)

b.

Miss San Tagos minimum financial penalties if convicted:

1. For operating an unregistered business

2. For not issuing commercial invoices

3. Failure to obey summon

Total minimum

P 5,000

1,000

5,000

P11,000

Problem 2 32

None. There is no surcharge to be imposed to Orville Corporation because the error was

corrected before payment and the payment was made on time.

The income tax due is computed as follows:

Corrected gross receipts (P2,000,000/75%)

Corrected allowable deductions (P1,500,000/1.35)

Taxable income per audit

Multiply by percent of tax for 201B

Income tax due

Problem 2 33

1.

Principal factory

Warehouses (P500 x 9)

Branches (P500 x 30)

Total annual registration fee January 31, 200B

P 2,666,667

1,111,111

P 1,555,556

30%

P 466,667

500

4,500

15,000

P20,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

13

Chapter 2: Tax Administration

2.

Total annual registration fee January 31, 200B

Surcharges (20,000 x 25%)

Interest (P20,000 x 20% x 6/12)

Total amount due July 30, 200B

Problem 2 34

Amount of tax liability

Surcharges

Interest

Advertising cost

Price if purchase by the Government

Problem 2 35

Case 1 Financial incapability due to corporate insolvency.

Delinquent accounts

Pending cases under administrative protest

Criminal violation not filed in courts

Total basic tax

Multiplied by applicable compromise rate

Amount of compromise

P20,000

5,000

2,000

P27,000

P100,000

25,000

20,000

5,000

P150,000

P 500,000

900,000

1,000,000

P2,400,000

20%

P 480,000

Case 2 Financial incapability due to surplus deficit resulting to impairment in original capital

by at least 50%.

Delinquent accounts

P 500,000

Pending cases under administrative protest

900,000

Criminal violation not filed in courts

1,000,000

Total basic tax

P2,400,000

Multiplied by applicable compromise rate

40%

Amount of compromise

P 960,000

Case 3 Doubtful validity of assessment.

Delinquent accounts

Pending cases under administrative protest

Criminal violation not filed in courts

Total basic tax

Multiplied by applicable compromise rate

Amount of compromise

Problem 2 36

P 500,000

900,000

1,000,000

P2,400,000

40%

P 960,000

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS)

SUGGESTED ANSWERS

14

Chapter 2: Tax Administration

a.

Yes, because the offered compromise amount of P100,000 exceeds the required minimum

amount of P25,000, (P250,000 x 10%).

b.

Since distraint is imposed only on personal property, the personal property with a value of

P100,000 shall be subjected to distraint.

c.

Yes, levy of real property and distraint of personal property can be done simultaneously (Sec.

207B of the Tax Code). See also Section 205 of NIRC.

d.

No, the unpaid portion will remain as tax liability of Lugui because Miss Lugui did not avail

of the compromise tax settlement. The remedy by distraint of personal property and levy on

realty may be repeated if necessary until the full amount due, including all expenses, is

collected (Sec. 217, NIRC).

Vous aimerez peut-être aussi

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- IKEA Expansion in South Africa - Entry StrategiesDocument29 pagesIKEA Expansion in South Africa - Entry StrategiesLoredana Ivan100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)D'EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Évaluation : 3.5 sur 5 étoiles3.5/5 (17)

- Operational Auditing A Complete Guide - 2021 EditionD'EverandOperational Auditing A Complete Guide - 2021 EditionPas encore d'évaluation

- Intro To Consumption TaxesDocument50 pagesIntro To Consumption TaxesKheianne DaveighPas encore d'évaluation

- Income Taxation - Ampongan (SolMan)Document25 pagesIncome Taxation - Ampongan (SolMan)John Dale Mondejar77% (13)

- Exclusions From Gross IncomeDocument63 pagesExclusions From Gross IncomegeorgePas encore d'évaluation

- Pedragosa, Jericho B. July 21, 2016 AC 501 Government AccountingDocument3 pagesPedragosa, Jericho B. July 21, 2016 AC 501 Government AccountingJericho PedragosaPas encore d'évaluation

- Revised Tax QuestionsDocument25 pagesRevised Tax QuestionssophiaPas encore d'évaluation

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsPas encore d'évaluation

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnPas encore d'évaluation

- Rules on excise tax for cosmetic proceduresDocument8 pagesRules on excise tax for cosmetic proceduresCaroline Claire BaricPas encore d'évaluation

- ABEJUELA - BSMA 3-5 (Assignment 1)Document3 pagesABEJUELA - BSMA 3-5 (Assignment 1)Marlou AbejuelaPas encore d'évaluation

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamillePas encore d'évaluation

- TAX 56 - Business and Transfer TaxesDocument8 pagesTAX 56 - Business and Transfer TaxesAl JovenPas encore d'évaluation

- Theory of Accounts - Valix - CinEquityDocument10 pagesTheory of Accounts - Valix - CinEquityMaryrose Gestoso0% (1)

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- 7.3.1 Topic Test Questions AnswersDocument34 pages7.3.1 Topic Test Questions AnswersliamdrlnPas encore d'évaluation

- Installment Basis: Page 1 of 7Document7 pagesInstallment Basis: Page 1 of 7Kenneth Bryan Tegerero Tegio100% (1)

- Review Business and Transfer TaxDocument201 pagesReview Business and Transfer TaxReginald ValenciaPas encore d'évaluation

- BuyGasCo Legal Team AssessmentDocument3 pagesBuyGasCo Legal Team AssessmentLeslie RondinaPas encore d'évaluation

- Auditor faces pressure to ignore inventory and receivables issuesDocument3 pagesAuditor faces pressure to ignore inventory and receivables issuesDeny SusantoPas encore d'évaluation

- Tax Deductions GuideDocument14 pagesTax Deductions GuideJEPZ LEDUNAPas encore d'évaluation

- Income Taxation by NickAduana (Answer Key)Document113 pagesIncome Taxation by NickAduana (Answer Key)Samantha Andrea Grefaldia100% (2)

- OPT QuizDocument5 pagesOPT QuizAngeline VergaraPas encore d'évaluation

- Module 2 - Asset Based Valuation For Going Concern Opportunities Part 1Document2 pagesModule 2 - Asset Based Valuation For Going Concern Opportunities Part 1Marlou AbejuelaPas encore d'évaluation

- Risk-Based Internal Auditing and Identifying Operational RisksDocument5 pagesRisk-Based Internal Auditing and Identifying Operational RisksMaricar PinedaPas encore d'évaluation

- Nfjpia Nmbe RFBT 2017 AnsDocument9 pagesNfjpia Nmbe RFBT 2017 AnsSamieePas encore d'évaluation

- ACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Document21 pagesACFrOgC2r9bE9HvuYvxYtUf46A7BnwrhdqbDelEEwU ZdG-lkedjoc9wabHHL2kMRBzhHg1gW W7Elizalen MacarilayPas encore d'évaluation

- Chapt 12+Income+Tax+ +corporations2013fDocument15 pagesChapt 12+Income+Tax+ +corporations2013fLouie De La Torre100% (4)

- TBChap 005Document278 pagesTBChap 005Anonymous Vf6qSiePas encore d'évaluation

- VHWODocument6 pagesVHWOJodie Sagdullas100% (1)

- Auditing Theory QuizDocument9 pagesAuditing Theory QuizMilcah Deloso SantosPas encore d'évaluation

- LawDocument43 pagesLawMARIAPas encore d'évaluation

- Q5 Items of Gross IncomeDocument10 pagesQ5 Items of Gross IncomeNhaj0% (2)

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XelenePas encore d'évaluation

- CTDI Tax Formatting QuestionsDocument13 pagesCTDI Tax Formatting QuestionsMaryane AngelaPas encore d'évaluation

- c2 2Document3 pagesc2 2Kath LeynesPas encore d'évaluation

- MASDocument46 pagesMASKyll Marcos0% (1)

- Quiz 1: Tax 3 Final Period QuizzesDocument10 pagesQuiz 1: Tax 3 Final Period QuizzesJhun bondocPas encore d'évaluation

- VAT AND OPT Monthly EXAMDocument20 pagesVAT AND OPT Monthly EXAMAlexandra Nicole IsaacPas encore d'évaluation

- 6a Pred Working Cap MGT 2Document9 pages6a Pred Working Cap MGT 2SamPas encore d'évaluation

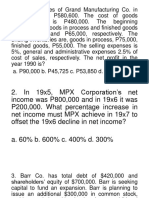

- Grand Manufacturing net profit calculationDocument10 pagesGrand Manufacturing net profit calculationRichfredlyn Moreno100% (1)

- INTGR TAX 009 DeductionsDocument6 pagesINTGR TAX 009 DeductionsJohn Paul SiodacalPas encore d'évaluation

- Buygasco 1Document6 pagesBuygasco 1Jane ChungPas encore d'évaluation

- Consumption Tax On Sales (Percentage Tax)Document32 pagesConsumption Tax On Sales (Percentage Tax)Alicia Feliciano100% (1)

- Business and Transfer Taxation by Valencia and Roxas-Solution ManualDocument4 pagesBusiness and Transfer Taxation by Valencia and Roxas-Solution ManualFiona Manguerra81% (32)

- Chapter 3Document61 pagesChapter 3Allaiza Mhel Arcenal EusebioPas encore d'évaluation

- Chapter 2 Inc Tax 6th EditionDocument12 pagesChapter 2 Inc Tax 6th EditionJocel Ann GuerraPas encore d'évaluation

- All 1-14Document54 pagesAll 1-14Engel Racraquin BristolPas encore d'évaluation

- Chapter 1 To 4Document27 pagesChapter 1 To 4Karla Barbacena100% (1)

- Chapt-2 Tax AdminDocument7 pagesChapt-2 Tax Admingiopar08100% (1)

- Arellano University Income Tax QuizDocument8 pagesArellano University Income Tax QuizKim RoquePas encore d'évaluation

- Rev CTA 8835 8790 Chevron Holdings Inc vs. CIRDocument20 pagesRev CTA 8835 8790 Chevron Holdings Inc vs. CIRJerome Delos ReyesPas encore d'évaluation

- Qeourt: L/epublir of Tbe TlbilippinesDocument7 pagesQeourt: L/epublir of Tbe TlbilippineswewPas encore d'évaluation

- Ampongan SolmanDocument25 pagesAmpongan SolmanNikolina100% (2)

- Wassim Zhani Income Taxation of Corporations (Chapter 18)Document14 pagesWassim Zhani Income Taxation of Corporations (Chapter 18)wassim zhaniPas encore d'évaluation

- DocxDocument7 pagesDocxJames DiazPas encore d'évaluation

- TAX Preweek (B44)Document19 pagesTAX Preweek (B44)LeiPas encore d'évaluation

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Taxation (Tax)Document10 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Taxation (Tax)joycePas encore d'évaluation

- Taxpayer Remedies and the Assessment CycleDocument22 pagesTaxpayer Remedies and the Assessment CycleRussell Stanley Que GeronimoPas encore d'évaluation

- Government Accounting Manual AcknowledgementDocument493 pagesGovernment Accounting Manual Acknowledgementnicah100% (1)

- Tax laws and principlesDocument7 pagesTax laws and principlesYeovil Pansacala100% (2)

- Chapter 15 Excise TaxDocument3 pagesChapter 15 Excise Taxjhienell0% (1)

- Key Answer of Chapter 22 of Nonprofit Organization by GuereroDocument8 pagesKey Answer of Chapter 22 of Nonprofit Organization by GuereroArmia MarquezPas encore d'évaluation

- Tax2-2013 (Valencia) Solman Chapter 16 - Documentary StampDocument3 pagesTax2-2013 (Valencia) Solman Chapter 16 - Documentary StampYeovil PansacalaPas encore d'évaluation

- AUDITING THEORY MCQs ON ANALYTICAL PROCEDURES AND TESTS OF DETAILSDocument21 pagesAUDITING THEORY MCQs ON ANALYTICAL PROCEDURES AND TESTS OF DETAILSYeovil Pansacala67% (3)

- Advance Accounting 2 Chapter 12Document16 pagesAdvance Accounting 2 Chapter 12Mary Joy Domantay0% (2)

- Chapter 1 - Intro To IrtDocument2 pagesChapter 1 - Intro To IrtJuan Agustin Mendoza0% (1)

- Aman Gupta: Email: Male, 24 Years Contact: # 9412717211, 9650886310 ObjectiveDocument4 pagesAman Gupta: Email: Male, 24 Years Contact: # 9412717211, 9650886310 ObjectiveRoberta WaltonPas encore d'évaluation

- Limitations I Nthe Power To TaxDocument3 pagesLimitations I Nthe Power To TaxJoshua AmahitPas encore d'évaluation

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulPas encore d'évaluation

- Inflation Causes and ConsequencesDocument7 pagesInflation Causes and ConsequencesKwasi Owusu-AnsahPas encore d'évaluation

- Aboriginal Business ModelDocument92 pagesAboriginal Business ModelLamont JohnsonPas encore d'évaluation

- Exemptions from withholding tax on compensation under ₱90K and ₱250KDocument2 pagesExemptions from withholding tax on compensation under ₱90K and ₱250KrjPas encore d'évaluation

- Tax Lates JurisprudenceDocument19 pagesTax Lates JurisprudenceJoni PurayPas encore d'évaluation

- 2-5hkg 2007 Jun QDocument11 pages2-5hkg 2007 Jun QKeshav BhuckPas encore d'évaluation

- General Banking Law CompilationDocument6 pagesGeneral Banking Law CompilationCristinePas encore d'évaluation

- Karnataka Motor Vehicles Amendment Act, 2001Document10 pagesKarnataka Motor Vehicles Amendment Act, 2001Kushwanth KumarPas encore d'évaluation

- HonsDocument49 pagesHonsAASHUTOSH KASHYAPPas encore d'évaluation

- Chapter 07Document27 pagesChapter 07Rollon NinaPas encore d'évaluation

- Mutual Shoe Company v. Commissioner of Internal Revenue, 238 F.2d 729, 1st Cir. (1956)Document7 pagesMutual Shoe Company v. Commissioner of Internal Revenue, 238 F.2d 729, 1st Cir. (1956)Scribd Government DocsPas encore d'évaluation

- CFAP 6 AARS Winter 2017Document3 pagesCFAP 6 AARS Winter 2017shakilPas encore d'évaluation

- Netherby PLC Manufactures A Range of Camping and Leisure EquipmentDocument2 pagesNetherby PLC Manufactures A Range of Camping and Leisure EquipmentAmit PandeyPas encore d'évaluation

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaPas encore d'évaluation

- Agreement Draft For Sub ContractDocument6 pagesAgreement Draft For Sub ContractBittudubey officialPas encore d'évaluation

- Draft: A Vision For Missouri's Transportation Future - Appendix, November 2013Document266 pagesDraft: A Vision For Missouri's Transportation Future - Appendix, November 2013nextSTL.comPas encore d'évaluation

- Imperator: Rome Guide OverviewDocument280 pagesImperator: Rome Guide OverviewJefferson Rodrigo Fernandes PereiraPas encore d'évaluation

- Less: Deduction@30%: © The Institute of Chartered Accountants of IndiaDocument12 pagesLess: Deduction@30%: © The Institute of Chartered Accountants of IndiaAashish soniPas encore d'évaluation

- Project Management Plan For Project Duplicated & Obsolete Asset CleanDocument35 pagesProject Management Plan For Project Duplicated & Obsolete Asset CleanalinaPas encore d'évaluation

- Tax RTP May 2020Document35 pagesTax RTP May 2020KarthikPas encore d'évaluation

- Awareness On E-Filing and Tax ReturnsDocument51 pagesAwareness On E-Filing and Tax ReturnsHemanth kumar100% (1)

- 61 Yale LJ14Document32 pages61 Yale LJ14Bruno IankowskiPas encore d'évaluation

- Lesson 1-4 FOA1&2Document40 pagesLesson 1-4 FOA1&2Rica Mae ParamPas encore d'évaluation

- NEW REV Contract GMK-Consortium SLP and JDIDocument14 pagesNEW REV Contract GMK-Consortium SLP and JDIGarryPas encore d'évaluation

- Par B 9 CIR vs. United Salvage Tower PhilsDocument4 pagesPar B 9 CIR vs. United Salvage Tower PhilsCyruz TuppalPas encore d'évaluation

- Delhi HT 01-12-2022Document32 pagesDelhi HT 01-12-2022Hemabh ShivpuriPas encore d'évaluation

- Welcome To Bajaj Allianz Family: Insured Name Policy Number Sumit Kumar Verma 12-8450-0000066186-03Document8 pagesWelcome To Bajaj Allianz Family: Insured Name Policy Number Sumit Kumar Verma 12-8450-0000066186-03nnikita2807Pas encore d'évaluation