Académique Documents

Professionnel Documents

Culture Documents

18 Account Test Model Sums

Transféré par

ganayCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

18 Account Test Model Sums

Transféré par

ganayDroits d'auteur :

Formats disponibles

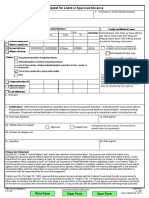

UPp TuNu LQd 1

\kR R (16k R B _X 1)

Kn R = 58

Kn R (A) lT Kn

(LL : Tp NokR R (RtL-L).

2. UjRlTdLXm Total Service

LdL : RVt\ TdLXeLs

1. 18 YVd u Tnv Nov

2. Wd Bl Nov (Dusting & Posting)

3. L (Overstayal) l TT

4. ANRWQl (EOL / LLP) uN Cu

5. RtL-L dLm (Suspension)

(RiPQ / LLP BdLRlThP)

3. SLW Rl TdLL Net Qualifying Service

h : VR YhPw (YZdLU] Kn) VR)

AW Bi (3 URm Rp 1 ; 9 URm Rp 2)

AW Bi R-h Tid

4. R NmT[m + DP (GP)

SP

1-4-2007

12000 + 50% DP

1-4-2008

1 2200 + 50% DP

5. LP UR NmT[m (Last Pay Drawn)

SA NWN NmT[m (18300 x 2 (&) 18,000 87/10

6. TKnVm (Service Pension) 60 A.Bd

7.

8.

9.

50 AW Bi Gp KnVm

Rl KnVm Commuted Pension

(COP = 40% 1-7-96 Rp 31-3-03 YW)

\dLlThP KnVm Reduced Pension

(l : R. J. lTm 2500 Gp 2500x12x8371)

Rl Ul Communted Value

(G.P.LQd RWp 12x10.46)

mT KnVm : Family Pension Rp 7 YPm

(Um 1275 (1.1.06 Rp 3050, -h 6570

(RtT) 23,100)

7 YPm Lj

10. \l Kn TdLP Deathcum Retirement

Gravity (A, B 50 Gp 50/4)

-h : 3.5 XhNm RtT 10 XhNm

KnV : 32, 45, 49

02-05-1950

+58

31-05-2008 URd LP

05-01-1972

27-04-36 YPm

CpX

CpX

CpX

20-01-00 (150 Ss)

00-01-00

07-02.36 X 2 = 72 A.B

x2 =

60 : DCRG d = 66 : RiPdP

UjRm

18,000 (GP YoRoX DP YW)

18,300 (CuUih)

L.U.D.N. / 2 x A.B / 60

1800 / 2 x 60/60 = 9150

9150

9150 x 50/60

TuNu x 1/3

9180 x 1/3

3050

9150 (-) 3050 = 6100

Rl KnVm x 12 x 8.371

3050 x 12 x 8.371

Enhanced FP = L.U.N. x 56/18,300 x 50 % = 9150

Normal FP = L.U.N. x 30/1830 x 30% = 5400

(L.U.N. x H) x A.B 14

18300 + .H. % x 66/4.

PADASALAI

UPp - 2 Joining, Time (JJ) On Transfer FR 105, 106, 107.

1. Nu]p l

2. RVl LXm (GpX Fdm)

3. Cl : 500 . d / 400

4. Tk : 90 .d / 130

5. UjR ShLs R

6. AjR Ss UWp NokR

7. AkR RV NokRp D R

8. Nu] : PAY+PP+SP

9. UW : Pay+PP+SP

10. CCPjp \kR (JTPAY)

R :

31-12-00

01-01-01

01-03-01

01-05-01

04-06-2005 Ys An (FN) (Gl Ys RX)

6 Ss (Fixed) (eLs Rp 7, 8, 9, 10, 11, 12)

2 Ss (13, 14, OtdZU)

1 Ss (15 NqYn)

9 Ss Lj (\YLs : 25 d 1 Ss)

16-6-05 RuZU FN

9, 10, 11, 14, 15 = 5 Ss Nu O.

11,000

DA10%

HRA700 CCA600 FTA500

12,000

DA10%

HRA500 CCA400 FTA300

11,000

DA1100% HRA500 CCA400 R CpX.

UPp - 3 DhV l (E4) l : 8, 9, 10, 11, 14, 15

D GjR / R

EL Cl

[dLm

D Cl -hP 240 Ss

235

30-06-01 = D.. uNol 6x2

235 + 15

240 RiYRp

ML 20 Ss GjRp (EL LV)

235 + 15

ML LV

LLP 20 Ss GjRp (EL 1/10)

235 + 13

10 S[d 1 Ss

D u Nol

240 + 15

8 Ss i

01-08-01

EL NWiPo 15 Ss

240

255 - 15

01-09-01

PAL NkR AYpl 10 Ss

240

ML LV

01-10-01

ndLR JT (Unavailed) = 3 Ss

240 + 3

01-10-01

EL 9 Ss - GjRp

234

01-01-02

31-03-02 : EL : 3 URm x 2

240 -h

l NmT[m (Kn) C\kRLX

ToX = ELDA+PAL90 (50/- X TAR PAY)

(Cp MA, NW)

30 JjRUR U]m

UPp - 4 CPUt\ TVQlThVp : PAY Ap : 9900 + SP300, Bp 10500

2p \ = 9900 (SPNW : PP Nm) R :

R :

X : 2

iPp : 1925 Kg

NYLo = 1

DA : 75

TX 75Kg

WU Lw.

El]o

R

LhPQm

.H.

I..

..

.N.

1.LQd

1.6.01

700+20

75

75

10+5

2.mTm

1.12.01

CpX

6URm

Lj NpYRp

3.ULu

4-9-11

1080

150

CpX

20+10

ULs U

Lp

CpX

75

CpX

CpX

3.TVs

6.01

190

CpX CpX

5+3

4.hNUu

X

LhPQm.500 W-p1925x20P+75Kg x 608

5.YL]m

LoUXw 300Kg x 50.5

6.JhUjR RL 300d

UjRm

1990

300

75

45

www.Padasalai.Net - Page No - 1

J.U.R:950

J.U. UjRm

885

=

430

1500

950

950

TA TABLE (R AhPYQ) : PP Nm : SP NW 1-4-09 Rp Ps .H.

X

Pay+P

G.P.

DA

R.D.A.

NYLo

.N.(Kg.)

UXw

Jh UjR RL

1.

10000

6600

100

200

2

4300+200

1.50P

600 (61m Rp 1200)

2.

5000

4400

75

150

1

1925+75

0.90P

450(61m Rp 950)

3.

3050

1900

50

100

960+40

0.75P

300(61m Rp 650)

4.

3050

1900

40

80

960+40

0.75P

150(61m Rp 350)

l : W-p PAY : 5500 Rp I Class : 10,000 Rp II Class : 15000 Rp : I Class ACLm TVQlThVp Pay :

13000 R : W 1 : DA : 100 Nu]d : 200 Nu]-k \lTYRp II C( DA) = 100 ; Lo

UXw 1 Km = .5 : .. 10,5.

R

Rp

YW

Fo

..

LhPQm

..N.

R.N.

.T.

UjRm

3/8 PM

Nu]

ICC Ac

500

IICC AC

100

10+5

115

4/5 AM

LY NoRp

IICC AC

100

10+5

115

6/7 AM

LY U.T.

Lo

60

IICC AC

100

10+5

115

7

AW \ l (CL U)

10+5

115

8/9 AM

U.T. LY

l

60

IICC AC

100

10+5

115

9/3 PM

LY

Tv

100

40

100

10+5

115

10/7 PM

LY

Wp

300

290

100

10+5

115

11/5 PM

Nu]

100

10+5

115

11k R 50(-) 3k R 200 (A) 1 Ss CL : 6 Ss 9 Ud 670

19/7 AM

Nu] Yo

Tv

140

51

100

10+5

115

20/9 PM

Yo Nu]

Tv

140

100

10+5

115

UjRm

UPp 6 : NmT[ oQVm : 1-4-02 Pay Old : 7600; Scale : 6000 - 200 - 10000

1-1-03p, 6500 - 250 - 12000 Lp VU]m 10 AjR X : 6500

1. Ro X : 7600 + 200 = 7800 r X : .....+..... (PP) 6750, 7000, 7250, 7500

2. TR EVo : 7600 + 5 = 7950 AjR X : 8750, 8000, 8250, 8500.

3. Ce Uih Rd lTmRkRp 8150, 9000.

(1) TR EVo Rp : 7600d AjR X : 7750 A.(1)

(2) im CeUih Rp 7800 + 5% = 8190 AjR X :

4. AR vL-p TR EVo = 5% : 1 BiVo m.

5. lTm : BiVo Rp 2 Uih T\Xm.

UPp 7 : 6th Pay Commission : 1.7.2005 : Pay : 20500 + PP500 (Scale : 15000-400)

R

Ro

GP

NEWPAY

CeUih

Pay

1-1-06

ETVm x 1.66

1-4-06

Ro X Gp + 3%

1-6-06

TR EVo Gp + 3 % + GPD

Option

206p Pay + 3% 3% + GPD

6B : DOJ : 30.9.2005 Next Increment Due 01.07.2086 AYo 1.2.06 Rp EL 30/ LLP 5m URm (1URm Gm..)

GjRp 01.11.2006 (40 ShLs) AjR YPm 1.10.2007p YPm 1.11.2007p AYPV AjR BiVYo

6 URm jRm G] EjRW YZe]p 1.10.2008p YWYiV CuUih 6 URm 140 Ym. \u [

u Gp AjR YPm 1.10.2008-V Ym \u[Pu Gp RPokRs 01.04.2009pRu Ym.

PADASALAI

31-12-2005 YW OLD DA :

01-4-06 Rp DA

1-4-98 = 16%

1-10-01 = 49%

R

OLD DA

NEW DA

R

OLD DA NEW DA

1-7-98 = 22%

1-7-03 = 52%

01-01-06

24%

1-7-08

54%

10%

1-1-99 = 32%

1-2-04 = 55%

01-07-06

29%

2%

1-1-09

64%

22%

1-7-99 = 37%

1-7-04 = 59%

01-01-07

35%

6%

1-7-09

27%

1-1-00 = 38%

1-1-05 = 61%

01-07-07

41%

9%

1-1-00

35%

1-7-00 = 41%

1-9-05 = 64%

01-01-08

47%

12%

1-7-00

45%

1-1-01 = 43%

1-7-05 = 67%

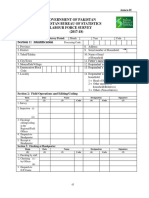

2. ARREAR STATEMENT 01-01-07 Rp 31-05-09 YW 102.00

Date

Pay

DA

Total

Pay

DP

DA

Total

Difference

1.1.06

10770

10770

4500

2250

24%

8370

2400

1.7.06

11100

2%

11322

4600

2300

29%

8901

2426

1.1.07

11100

6%

11766

4600

2300

35%

9315

2451x6

1.7.07

11440

9%

12470

4700

2350

41%

9941

2529x6

1.1.08

11440

12%

12813

4700

2300

47%

10364

2449x6

1.7.08

11790

16%

14676

4800

2400

54%

11085

2588x6

1.1.09

11290

22%

14384

4800

2400

84%

11808

2576x5

3. TuNu LQdp LuUih P DOJ V Yj RWdP.

2. DOJ = 1.6.75 Pay Date 1.10.05 AjR CeUih 1.4.06p YW.

1-10-2006p Ru Ym, LQdXV Bi Ro 1.1 Nulu, 1.1.06p Ym.

4. Death Model : Nop C\kRp : FP. DCRG : CWi Uhm Li dLm.

Li dL PRX :1. Pension 2. COP 3.CV

5. DCRG NokR 1 . YPjts C\kRp

= 2 UR NmT[m + DA

5 YPjts C\kRp

= 6 UR NmT[m + DA

20 YPjts C\kRp

= 12 UR NmT[m + DA

20 YPm Lj

= A.B / 2 Rm (-h 33 YPm)

6. FP YZdLmTp Rp 7 YPm = 50% \ 30% 7 YPjts C\kRp 50% CpX.

7. lT Kn LQd : jVNm CWi

1. Net Service EPu VR YhPw (YZdLU] Kn R (-) VR R (-h 5 YPm)

2. Commuted Value : 10-46 (A) 8.371 YW. Table / AjR YVlT RW.

l : AjR YV ToX = lT Kn R (-) \kRR.

8. TA LQdp : Incidental Charge : (IC) : U-, u T NXd HQ DA-p T (E.m) 13000 HQ

: Nu]Vp DA=8200 (Ps DA) ( DA)=100. C Wp, Tv, TVQjt Uhm ; Lo, l TVQjt

PV : Lml to Lml, 160 ..ds CkRm IC Ei. Transferp Uhm Self-d, CWi

DA (Em) X 2 Gp 37.50 + 37.50

9. Terminal Charges (TC/FR) : LQdp RS/BS Wm .. Es[ GukRp Uhm X 1,2d

Nu] : .10, \ CPm : . 5; X 3,4d Nu] : .5 ;

10. Wp dLh : 5 YV Rp 11 YV YW : Tv-p 3 YV Rp 11 YV YW = dLh B]p

TvCWp CWim YV 1, 2, 3, 4dm D.A Ei.

11. Fixed TA : . 300 per month : Min. Tour : 20 Days; EL : 12 Days : Duty : 18 Days Fixed TA

Fourmula = Duty Days 18 x Min. Days 20/Month Days 30 = 12 Day

www.Padasalai.Net - Page No - 2

Vous aimerez peut-être aussi

- Account Subordinate Officers Part 1Document6 pagesAccount Subordinate Officers Part 1ganayPas encore d'évaluation

- AppoDocument1 pageAppoganayPas encore d'évaluation

- Executive Office ExamDocument8 pagesExecutive Office ExamganayPas encore d'évaluation

- GMC Clerk Cum Computer Operator Solution 20-10-2013Document8 pagesGMC Clerk Cum Computer Operator Solution 20-10-2013ganayPas encore d'évaluation

- New Syllabus Knowledge in Access To Computer Diploma STDDocument4 pagesNew Syllabus Knowledge in Access To Computer Diploma STDmaadurimPas encore d'évaluation

- 23 02 2014 General StudiesDocument52 pages23 02 2014 General StudiesMani CksPas encore d'évaluation

- Online Application For IDE MBA ExaminationDocument2 pagesOnline Application For IDE MBA ExaminationganayPas encore d'évaluation

- M.B.a. Institute of Distanc..Document2 pagesM.B.a. Institute of Distanc..ganayPas encore d'évaluation

- Recruitment and Promotion Norms 2014Document92 pagesRecruitment and Promotion Norms 2014ganayPas encore d'évaluation

- Partions & TroubleshootingDocument16 pagesPartions & TroubleshootingganayPas encore d'évaluation

- Blackberry Business ProposalDocument14 pagesBlackberry Business ProposalganayPas encore d'évaluation

- Synology NASDocument20 pagesSynology NASganayPas encore d'évaluation

- Pride of IndiaDocument104 pagesPride of IndiaSwathi KommanaPas encore d'évaluation

- Obc FormDocument5 pagesObc Formsurya069100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sthira Solns PVT LTD, BangaloreDocument25 pagesSthira Solns PVT LTD, Bangaloreshanmathieswaran07Pas encore d'évaluation

- Sick Leave Form For Rafiullah PDFDocument1 pageSick Leave Form For Rafiullah PDFRafiullahPas encore d'évaluation

- BOH4MM Unit 4 Case Study Analysis ABC Mobility (For Marking)Document11 pagesBOH4MM Unit 4 Case Study Analysis ABC Mobility (For Marking)Sara SPas encore d'évaluation

- Douglas Mcgregor Theory X and yDocument5 pagesDouglas Mcgregor Theory X and yAnonymous CwJeBCAXp100% (2)

- Organizational Behaviour II: Assignment-Ii Section - C Group-5Document6 pagesOrganizational Behaviour II: Assignment-Ii Section - C Group-5Arnab BhattacharyaPas encore d'évaluation

- cpd-2016010g QSD PQSL Procurement Series 2016 (1) - Contractual Arrangement PDFDocument24 pagescpd-2016010g QSD PQSL Procurement Series 2016 (1) - Contractual Arrangement PDFahtin618Pas encore d'évaluation

- Questionnaire 2017-18 (Final) With Report PDFDocument16 pagesQuestionnaire 2017-18 (Final) With Report PDFMuhammad AsifPas encore d'évaluation

- 2011 NLRC Rules of ProcedureDocument75 pages2011 NLRC Rules of ProcedureJ.N.Pas encore d'évaluation

- Instrumentation & Control Servicing NC IIDocument63 pagesInstrumentation & Control Servicing NC IInezzer ziej trioPas encore d'évaluation

- Test of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Document44 pagesTest of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Falguni PurohitPas encore d'évaluation

- Integrity Trade Services, Inc. v. Integrity Employment Partners, LLCDocument48 pagesIntegrity Trade Services, Inc. v. Integrity Employment Partners, LLCJohn TaggartPas encore d'évaluation

- Ramim Exploration LETTER OF APPOINTMENT PDFDocument3 pagesRamim Exploration LETTER OF APPOINTMENT PDFPARAGPas encore d'évaluation

- LEAVE FORM-Rev3Document4 pagesLEAVE FORM-Rev3Khen Khen PoPas encore d'évaluation

- AU TVET Strategy enDocument40 pagesAU TVET Strategy enRajih AbduselamPas encore d'évaluation

- Introduction To Human Resource ManagementDocument17 pagesIntroduction To Human Resource Managementolivia hoPas encore d'évaluation

- Operations Management: Unit 2Document44 pagesOperations Management: Unit 2Tân Trịnh LêPas encore d'évaluation

- Trade Union ProjectDocument50 pagesTrade Union ProjectRavi Joshi93% (15)

- Labrel Cases MidtermsDocument219 pagesLabrel Cases MidtermsReuben EscarlanPas encore d'évaluation

- A) Based On The Content of Letter Appointment Above, Which Employment Laws or Acts Are Not Being Complied by Syarikat Zumaju SDN BHDDocument8 pagesA) Based On The Content of Letter Appointment Above, Which Employment Laws or Acts Are Not Being Complied by Syarikat Zumaju SDN BHDLee ChloePas encore d'évaluation

- Atok Big Wedge Mutual Benefit Association V Atok Big Wedge Mining Company Incorporated PDF FreeDocument2 pagesAtok Big Wedge Mutual Benefit Association V Atok Big Wedge Mining Company Incorporated PDF FreeArnold Jr AmboangPas encore d'évaluation

- Case Analysis of Solving The Labor Dilemma in A Joint Venture in JapanDocument7 pagesCase Analysis of Solving The Labor Dilemma in A Joint Venture in JapanKimberly FordePas encore d'évaluation

- Sample Call Center Cover LetterDocument2 pagesSample Call Center Cover LetterKristine RiojaPas encore d'évaluation

- Performance Management Assignment: InfosysDocument8 pagesPerformance Management Assignment: InfosysTanushri MishraPas encore d'évaluation

- Thalasha Brown Resume Copy Copy 1Document2 pagesThalasha Brown Resume Copy Copy 1api-482577310Pas encore d'évaluation

- University of The Immaculate Concepcion, Inc. v. Secretary of Labor & EmploymentDocument12 pagesUniversity of The Immaculate Concepcion, Inc. v. Secretary of Labor & EmploymentSamuel ValladoresPas encore d'évaluation

- FOE - Promotion of A Venture - Unit-2Document8 pagesFOE - Promotion of A Venture - Unit-2Rashmi Ranjan PanigrahiPas encore d'évaluation

- Business COMMUNICATION + CHANGESDocument56 pagesBusiness COMMUNICATION + CHANGESDavinchi Davinchi DaniPas encore d'évaluation

- 1UPSCPORTALMagazineCivil Services 2009 Pre Special PDFDocument113 pages1UPSCPORTALMagazineCivil Services 2009 Pre Special PDFManda Swamy100% (1)

- EXISTING RECRUITMENT PROCESS OF ABC (PVT.) LTD PDFDocument14 pagesEXISTING RECRUITMENT PROCESS OF ABC (PVT.) LTD PDFHappy RPas encore d'évaluation

- Qatar - Housing PolicyDocument4 pagesQatar - Housing PolicyMohammed ZubairPas encore d'évaluation