Académique Documents

Professionnel Documents

Culture Documents

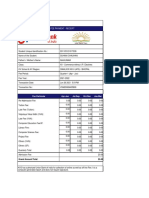

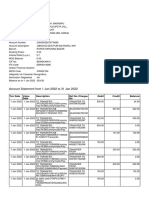

Excel Budget Project Tanya May

Transféré par

api-316478827Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Excel Budget Project Tanya May

Transféré par

api-316478827Droits d'auteur :

Formats disponibles

Introduction to Management Accounting

Solutions Manual

Problems: Set A

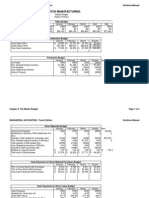

P9-59A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Requirements

1. Prepare a schedule of cash collections for January, February, and March, and for the quarter

in total.

2. Prepare a production budget.

3. Prepare a direct materials budget.

4. Prepare a cash payments budget for the direct material purchases from Requirement 3.

5. Prepare a cash payments budget for conversion costs.

6. Prepare a cash payments budget for operating expenses.

7. Prepare a combined cash budget.

8. Calculate the budgeted manufacturing cost per unit.

9. Prepare a budgeted income statement for the quarter ending March 31.

Solution:

Given

Sales Budget

December

Unit sales

January

7,000

Unit selling price

Total sales Revenue

8,000

10 $

70,000

10

80,000

Req. 1

Cash Collections (30%)

Credit Collections (70%)

Total Cash Collections

Cash Collections

January

$24,000

$

56,000

$80,000

February

$27,600

$

64,400

$92,000

Req. 2

Unit Sales

Production Budget

January

8,000

Chapter 9: The Master Budget and Responsibility Accounting

February

9,200

Introduction to Management Accounting

Plus: Desired ending inventory

Total needed

Less: Beginning Inventory

Units to produce

Solutions Manual

2,300

10,300

2,000

8,300

2,475

11,675

2,300

9,375

Req. 3

Direct Materials Budget

January

February

Units to be produced

8,300

9,375

Quantity of DM needed per unit

2

2

Quantity of DM needed for production

16,600

18,750

Desired ending inventory of DM

1,875

1,970

Total quantity of DM needed

18,475

20,720

Beginning inventory of DM

1,660

1,875

Quantity of DM to purchase

16,815

18,845

Cost per pound

3

3

Total cost of DM purchases

$50,445

$56,535

Unit Sales

Desired End Inventory (25%)

Total Needed

Beginning Inventory

Units to produce

DM Needed per unit

DM needed for production

10% of DM

April

9,700

2,125

11,825

2,425

9,400

2

18,800

May

8,500

Req. 4

Schedule of Expected Cash DisbursementsMaterial Purchases

January

February

December purchases (from accounts

payable)

January Purchases

February Purchases

March Purchases

Total Disbursements

$42,400

$10,089

$52,489

Chapter 9: The Master Budget and Responsibility Accounting

$40,356

$11,307

$51,663

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

January

February

Rent (fixed)

$5,000

$5,000

Other fixed MOH

$3,000

$3,000

Variable Conversion Costs

9960

11,250

Total payments for conversion costs

$17,960

$19,250

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

January

February

Variable operating expenses

$

8,000 $

9,200

Fixed Operating Expenses

$

1,000 $

1,000

Total Disbursements

$

9,000 $

10,200

Req. 7

Cash Balance - Beginning

Add Cash Collections

Total Cash Available

Less Cash Disbursements:

Direct Materials Purchases

Conversion Costs

Operating Expenses

Equipment Purchases

Tax Payment

Total Disbursements

Excess of Cash

Financing

Borrowings

Repayments

Interest Payments

Total Financing

Cash Balance - Ending

Interest: 4000 X 0.01 X 3 Months

12,000 x .01 x 2 months

Combined Cash Budget

January

February

$4,500

$4,051

80,000

92,000

84,500

96,051

52,489

17,960

9,000

5,000

84,449

51

51,663

19,250

10,200

12,000

10,000

103,113

-7,062

4,000

12,000

4,000

$4,051

12,000

$4,938

120

240

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Total interest

Solutions Manual

$280

Req. 8

Budgeted Manufacturing Cost per Unit

Direct Materials (2lbs x $2)

$4.00

Coversion Costs

$1.20

Fixed MOH (.80)

$0.80

Cost of manufacturing ea. Unit

$6.00

Req. 9

Silverman Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales

COGS

Gross Profit

Operating Expenses

Depreciation

Opertaing Income

Less Interest Expense

Less provision for income taxes

Net Income

271,000

-162,600

108,400

30,100

4,800

73,500

-280

21,966

$51,254

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

(60 min.) P 9-59A

ves 2 & 3)

March, and for the quarter

from Requirement 3.

Budget

February

March

9,200

April

9,900

10

10

92,000

99,000

March

$29,700

$

69,300

$99,000

March

9,900

May

9,700

###

$

97,000

8,500

$

10

85,000

Quarter

$81,300

$

189,700

$271,000

Quarter

27,100

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

2,425

12,325

2,475

9,850

March

9,850

2

19,700

1880

21,580

1,970

19,610

3

$58,830

Material Purchases

March

$45,228

$11,766

$56,994

Solutions Manual

2,425

29,525

2,000

27,525

Quarter

27,525

2

55,050

1,880

56,930

1,660

55,270

3

$165,810

Quarter

$42,400

$50,445

$56,535

$11,766

$161,146

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Conversion Costs

March

$5,000

$3,000

11820

$19,820

Quarter

$15,000

$9,000

$33,030

$57,030

perating Expenses

March

$

9,900

$

1,000

$

10,900

Quarter

27,100

3,000

30,100

$

$

$

March

$4,938

99,000

103,938

Quarter

$4,500

271,000

275,500

56,994

19,820

10,900

16,000

161,146

57,030

30,100

33,000

10,000

291,276

-15,776

103,714

224

5000

-280

4,720

$4,944

Solutions Manual

21,000

0

-280

20,720

$4,944

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

10

Vous aimerez peut-être aussi

- 2014 TaxReturnDocument25 pages2014 TaxReturnNguyen Vu CongPas encore d'évaluation

- Master Budget Defined & ExplainedDocument20 pagesMaster Budget Defined & ExplainedYsabelle Sacriz100% (1)

- Bar Questions in Taxation 1987-2001Document62 pagesBar Questions in Taxation 1987-2001Carlos Ryan RabangPas encore d'évaluation

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraPas encore d'évaluation

- Unknown PDFDocument2 pagesUnknown PDFMadalina MadaPas encore d'évaluation

- Mobile Services Tax Invoice BreakdownDocument3 pagesMobile Services Tax Invoice BreakdownValencia MabenPas encore d'évaluation

- Fa Mod1 Ont 0910Document511 pagesFa Mod1 Ont 0910subash1111@gmail.comPas encore d'évaluation

- Philippine VAT and Percentage Tax RatesDocument41 pagesPhilippine VAT and Percentage Tax RatesKim AranasPas encore d'évaluation

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolPas encore d'évaluation

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Handout: Course Code and Name: Unit Code: Unit TitleDocument10 pagesHandout: Course Code and Name: Unit Code: Unit TitleGabriel ZuanettiPas encore d'évaluation

- Invoice: Hollyhill Industrial Estate Hollyhill, Cork Ireland VAT No: GB 117223643Document1 pageInvoice: Hollyhill Industrial Estate Hollyhill, Cork Ireland VAT No: GB 117223643Marian BlnPas encore d'évaluation

- Manila Mandarin Hotels Vs CommissionerDocument2 pagesManila Mandarin Hotels Vs CommissionerEryl Yu100% (1)

- ACCA F9 Formula Sheet SummaryDocument16 pagesACCA F9 Formula Sheet SummaryLesh GaleonnePas encore d'évaluation

- Master Budget ProjectDocument10 pagesMaster Budget Projectapi-268950886Pas encore d'évaluation

- Budget Project LLDocument10 pagesBudget Project LLapi-220037346Pas encore d'évaluation

- Accounting E-Portfolio FinalDocument8 pagesAccounting E-Portfolio Finalapi-310911560Pas encore d'évaluation

- Managerial Accounting ProjectDocument11 pagesManagerial Accounting Projectapi-271746126Pas encore d'évaluation

- Budget AssignmentDocument10 pagesBudget Assignmentapi-248058538Pas encore d'évaluation

- Excel Project P9-59aDocument3 pagesExcel Project P9-59aapi-272100463Pas encore d'évaluation

- ProblemsDocument4 pagesProblemsapi-316770820Pas encore d'évaluation

- TuyjDocument51 pagesTuyjagnesPas encore d'évaluation

- Characteristics of A Budget: Cash ReceiptsDocument11 pagesCharacteristics of A Budget: Cash ReceiptsMukesh ManwaniPas encore d'évaluation

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument10 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Budgetary Control and Activity Based Costing ExplainedDocument41 pagesBudgetary Control and Activity Based Costing Explainedanupams3Pas encore d'évaluation

- ACCA MA - Fma Study School Budgeting Part B SolutionsDocument16 pagesACCA MA - Fma Study School Budgeting Part B Solutionsmaharajabby81Pas encore d'évaluation

- Wasatch ManufacturingDocument12 pagesWasatch Manufacturingapi-301899907Pas encore d'évaluation

- Accounting Chapter 9 Eportfolio ExcelDocument12 pagesAccounting Chapter 9 Eportfolio Excelapi-273030710Pas encore d'évaluation

- Financial PlanDocument54 pagesFinancial PlanTeku ThwalaPas encore d'évaluation

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Document12 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Budgetary Control and Activity Based Costing ExplainedDocument41 pagesBudgetary Control and Activity Based Costing ExplainedRohit ChandakPas encore d'évaluation

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaPas encore d'évaluation

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Pas encore d'évaluation

- Hailey Fernelius ch9 Excel ProjectDocument4 pagesHailey Fernelius ch9 Excel Projectapi-242652884Pas encore d'évaluation

- Complete the Accounting Cycle Case StudyDocument16 pagesComplete the Accounting Cycle Case Studydeepak.agarwal.caPas encore d'évaluation

- Material BudgetDocument37 pagesMaterial BudgetRahul SardaPas encore d'évaluation

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Pas encore d'évaluation

- Chapter 04 - 12thDocument16 pagesChapter 04 - 12thSarah JamesPas encore d'évaluation

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1Pas encore d'évaluation

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Wasatch Manufacturing Master BudgetDocument6 pagesWasatch Manufacturing Master Budgetapi-255137286Pas encore d'évaluation

- Anggaran Berdasarkan Fungsi Dan AktivitasDocument42 pagesAnggaran Berdasarkan Fungsi Dan AktivitasAri SuryadiPas encore d'évaluation

- Cash Budgeting and Fraud Management: Topic 4Document16 pagesCash Budgeting and Fraud Management: Topic 4sv03Pas encore d'évaluation

- Abigail Foss - Comprehensive Problem - Master BudgetDocument15 pagesAbigail Foss - Comprehensive Problem - Master Budgetapi-325954956Pas encore d'évaluation

- p9-60 PsimasinghDocument8 pagesp9-60 Psimasinghapi-241811190Pas encore d'évaluation

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparrePas encore d'évaluation

- ACTG101 Adjusting EntriesDocument63 pagesACTG101 Adjusting EntriesPrincess Ann PunoPas encore d'évaluation

- CASH BUDGET PREPARATIONS Lesson Material and Activity SheetsDocument8 pagesCASH BUDGET PREPARATIONS Lesson Material and Activity SheetsLee Arne BarayugaPas encore d'évaluation

- Cash & Liquidity MGTDocument19 pagesCash & Liquidity MGTsabijagdishPas encore d'évaluation

- Week 3Document14 pagesWeek 3John PerkinsPas encore d'évaluation

- Short-Term Financial Planning GuideDocument23 pagesShort-Term Financial Planning GuideRao786Pas encore d'évaluation

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mPas encore d'évaluation

- Working Capital ManagementDocument67 pagesWorking Capital ManagementAam aadmiPas encore d'évaluation

- MHDDocument6 pagesMHDSakariyeFaroolePas encore d'évaluation

- A 201 Chapter 12Document14 pagesA 201 Chapter 12blackprPas encore d'évaluation

- finance assignmentDocument13 pagesfinance assignmentrefilwedema2023Pas encore d'évaluation

- Q7Document4 pagesQ7Sundaramani Saran100% (2)

- EportfolioDocument8 pagesEportfolioapi-220792970Pas encore d'évaluation

- Dmp3e Ch03 Solutions 02.17.10 FinalDocument83 pagesDmp3e Ch03 Solutions 02.17.10 Finalmichaelkwok1Pas encore d'évaluation

- ACCT504 Case Study 1Document15 pagesACCT504 Case Study 1sinbad97100% (1)

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartPas encore d'évaluation

- AE24 Lesson 5Document9 pagesAE24 Lesson 5Majoy BantocPas encore d'évaluation

- Assignment BriefDocument10 pagesAssignment BriefNguyen Dac ThichPas encore d'évaluation

- Acct 2020 Excel Budget Problem Student TemplateDocument12 pagesAcct 2020 Excel Budget Problem Student Templateapi-249190933Pas encore d'évaluation

- Tax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6Document1 pageTax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6VIDHI JAINENDRASINH RANAPas encore d'évaluation

- Receipt - 8 - 13 - 2021 12 - 00 - 00 AMDocument1 pageReceipt - 8 - 13 - 2021 12 - 00 - 00 AMSuhani ChauhanPas encore d'évaluation

- Unicredit vs. IngDocument3 pagesUnicredit vs. IngAlina AndrioaePas encore d'évaluation

- DT 5Document83 pagesDT 5AnkitaPas encore d'évaluation

- Tax Lien SaleDocument29 pagesTax Lien SaleRhett MillerPas encore d'évaluation

- TOEFL Additional Score Report Request FormDocument2 pagesTOEFL Additional Score Report Request Formvishwa tejaPas encore d'évaluation

- Mr. Shyam Singh's bank account statement and detailsDocument3 pagesMr. Shyam Singh's bank account statement and detailsShyamPas encore d'évaluation

- Mivi Collar Classic Neckband With Fast Charging Bluetooth HeadsetDocument1 pageMivi Collar Classic Neckband With Fast Charging Bluetooth HeadsetRajnish SinghPas encore d'évaluation

- Gacer, Ann Mariellene L. (Assignment No.2) TaxDocument6 pagesGacer, Ann Mariellene L. (Assignment No.2) TaxAnn Mariellene Gacer50% (2)

- Engineering EconomyDocument47 pagesEngineering EconomyChris Thel MayPas encore d'évaluation

- Deliveroo Order Receipt 2031511209Document2 pagesDeliveroo Order Receipt 2031511209jak.g.lewisPas encore d'évaluation

- Non - SDS ChecklistDocument2 pagesNon - SDS ChecklistAnkit GuptaPas encore d'évaluation

- Transaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRDocument20 pagesTransaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRMOHAMMAD IQLASHPas encore d'évaluation

- Preview W8 W9 PDFDocument1 pagePreview W8 W9 PDFEugene ChoiPas encore d'évaluation

- Ju 1Document1 pageJu 1lesly malebranchePas encore d'évaluation

- Laundry - System Analysis and Design - (Excel Linking)Document10 pagesLaundry - System Analysis and Design - (Excel Linking)JO SAPas encore d'évaluation

- VAT AssignmentDocument3 pagesVAT AssignmentReema KumariPas encore d'évaluation

- Ola ReceiptDocument3 pagesOla Receiptjyotsna jhaPas encore d'évaluation

- 64309445932019499Document76 pages64309445932019499Prabhat SharmaPas encore d'évaluation

- MP6 y IIAex ZOex 7 YaDocument6 pagesMP6 y IIAex ZOex 7 YaSrikanth MarrapuPas encore d'évaluation

- Depreciation RecaptureDocument3 pagesDepreciation RecaptureNiño Rey LopezPas encore d'évaluation

- Account Maintenance and Transaction Fees L BPIDocument4 pagesAccount Maintenance and Transaction Fees L BPISebastian GarciaPas encore d'évaluation