Académique Documents

Professionnel Documents

Culture Documents

Crown Hd&Amp SHLDR

Transféré par

mr12323Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Crown Hd&Amp SHLDR

Transféré par

mr12323Droits d'auteur :

Formats disponibles

&

FUTURES

Trading Strategies

OPTIONS

The Crown pattern

Heres a way to use some specific

calculations to improve the odds

of trading a variation of a classic

chart pattern on an intraday basis.

BY DENNIS BOLZE

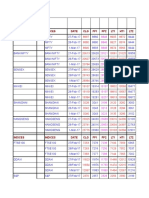

FIGURE 1 FROM HEAD-AND-SHOULDERS TO

BULL CROWN

lassic chart patterns

such as triangles, flags,

pennants, head-andshoulders and double

bottoms are interpreted as continuation or reversal patterns that signal a

move in a certain direction when they complete.

However, as more people become aware of a pattern, its effectiveness

decreases. A pattern can become distorted and subject to false breakouts a move in the expected direction that quickly fails and takes the

market in the opposite direction. Over time, more experienced traders

started using pattern setups to exploit uninformed traders trapped by

false breakouts.

In a way, the head-and-shoulders (H&S) pattern is itself a failed retest.

As shown, in the top pattern in Figure 1 (right), the market moves up,

pulls back, then rallies again to point C, taking out the previous high. On

the next pullback, price makes a pivot low (point D) at about the same

level as the previous pullback low.

However, on the following rally, price fails to take out the point-C

high and makes a lower pivot high at point E a failed test of the previous (point C) high. Traders typically look to short the market when it

breaks down below point D. Simple and clean, right?

Not really. In his 1935 book, Profits In The Stock Market , H. M. Gartley

wrote about a pattern that has been called the Gartley ever since. The

Gartley pattern is a failed H&S characterized by the Fibonacci relationships (see The Fibonacci series, opposite page) of the patterns different price swings.

The Gartley pattern follows the path of a typical H&S pattern, except

that instead (in the case of an H&S top) of resulting in a downside price

60

The Bull Crown pattern (bottom) is similar to

the head-and-shoulders formation, but it incor porates Fibonacci relationships that make iden tifying and trading the pattern easier.

(Head) C

(Right shoulder)

(Left shoulder) A

Head-and-shoulders pattern

C

.618

of C-D

E-1

1.272

of B-C

D-1

Bull Crown pattern

www.activetradermag.com January 2004 ACTIVE TRADER

reversal, price turns back up. Once the H&S

traders get short and price breaks below

point D, the market rallies 1.272 or 1.618

times the preceding downswing to make a

new high. This forces the short sellers to

cover and further fuels the rally.

The Gartley pattern illustrates the difficulty of knowing whether a pattern that

looks like a typical H&S pattern will actually follow through as expected or take off in

the opposite direction. As a result, trading

the basic H&S pattern is a 50-50 proposition

at best.

The crown pattern is an H&S variation

that uses Fibonacci relationships to better

identify turning points. Also, by augmenting the crown pattern with the TIKI indicator (see The TICK/TIKI indicator, right)

and other tools, you can dramatically

improve the odds associated with trading

the standard H&S pattern.

Crown patterns

The crown formation, which can occur at

tops (bull crown) or bottoms (bear crown),

is similar to the H&S, but the two patterns

have important differences. The top of

Figure 1 shows the classic H&S formation,

in which pivot-low D and pivot-high E

form at about the same level as previous

comparable pivot points B and A.

In a bull crown pattern, pivot D extends

below the previous pivot, forming a downswing that usually extends 1.272 times the

previous leg up (B-C). Price then rallies .618

of the distance from C to D-1, creating pivot

E-1 (see the pattern at the bottom of Figure 1).

The formation of pivot D-1 well below

the previous pivot breaks the patterns price

symmetry and establishes momentum in

the opposite direction. When price rallies to

form E-1, it is actually making a normal .618

Fibonacci retracement before continuing

lower. The degree of quantification and

expectation provided by applying Fibonacci

calculations gives the crown formation an

edge over the standard H&S pattern.

Figure 2 (p. 62) shows a complete bull

crown pattern. Most traders will still consider this an H&S-type pattern because, for the

most part, they are only looking at the left

and right shoulders (and, of course, the head

in the middle). However, the fact that the

pivot low after the right shoulder extends

well below the pivot after the left shoulder

The TICK/TIKI indicator

The TICK is a short-term (intraday) indicator that measures the bullish (upticking) or bearish (down-ticking) activity in NYSE stocks throughout the day.

TIKI is the symbol for the same indicator calculated on Dow Jones Industrial

Average (DJIA) stocks; some data services also calculate the TICK for Nasdaq

stocks.

The TICK/TIKI is a breadth indicator that gives traders an intraday look at

the internal strength or weakness of the market that is, the strength or

weakness beyond whether the overall market is up on a point or percentage

basis. By comparing the number of stocks advancing to stocks declining, the

indicator reflects the markets up or down momentum at a given moment.

For example, if the DJIA index is up marginally but down-ticking stocks are

consistently outnumbering up-ticking stocks (and the number of down-ticking stocks is increasing, reflected by a downtrending TIKI indicator), it is likely only a relative handful of strong stocks are propping up the overall market. When buying completes in these stocks, a down move may result.

Two contrarian uses of the TICK/TIKI indicator are to look for divergence

between price and the indicator, and to use high or low TICK/TIKI readings

to identify momentum extremes similar to how many traders use oscillators such as the relative strength index (RSI) or stochastics to locate overbought and oversold points.

A divergence occurs when price makes a new high (or low) but the

TICK/TIKI makes a lower high (or higher low), failing to confirm the price

move and warning of slackening momentum. A related phenomenon would be

a steady trend in the TICK/TIKI that runs counter to the trend of the market.

Extreme high or low TICK/TIKI readings can accompany market climaxes.

Because the TICK/TIKI is a snapshot of the market at a given moment (and

is thus very volatile), it can be deceptive. As a result, the TICK/TIKI is commonly smoothed with a 10-period moving average to remove some of its

noise and better reveal the indicators direction and patterns.

The Fibonacci series

The Fibonacci series is a number progression in which each successive number is the sum of the two immediately preceding it: 1, 2, 3, 5, 8, 13, 21, 34

and so on.

As the series progresses, the ratio of a number in the series divided by the

immediately preceding number approaches 1.618 (1.62), the so-called golden mean found in the dimensions of the Parthenon, the Great Pyramid, and

many natural phenomena. The inverse, .618 (.62), has similar significance.

Some traders use fairly complex variations and combinations of Fibonacci

numbers to generate price forecasts; a basic approach is to use ratios

derived from the series to calculate likely price targets. The most commonly used ratios are .382, .50, .618, .786, 1.00, 1.272 and 1.618. Depending on

circumstances, other ratios, such as .236 and 2.618, occasionally are used.

For example, if a stock broke out of a trading range and rallied from 25 to

55, potential retracement levels could be calculated by multiplying the distance of the move (30 points) by Fibonacci ratios say, .38, .50 and .62

and then subtracting the results from the high of the price move. In this

case, retracement levels of 43.60 [55 (30*.38)], 40 [55 (30*.50)] and 36.40

[55 (30*.62)] would result.

continued on p. 62

ACTIVE TRADER January 2004 www.activetradermag.com

61

&

FUTURES

Trading Strategies continued

OPTIONS

FIGURE 2 BULL CROWN

Bull crowns resemble head-and-shoulders patterns, but the pivot low (D) fol lowing the head (C) extends well below the pivot low preceding the head (B).

C

December 2003 S&P E-Mini futures

1,052.00

(ESZ03), one-minute

1,050.00

1,048.00

D

1,046.00

1,044.00

10:54

11:18

11:42

12:06

12:40

13:02

13:26

13:50

TIKI

14:14

20.00

0.00

-20.00

10:54

11:18

11:42

12:06

12:30

12:54

13:18

13:42

14:06

(as much as 1.618 of the B-C upswing)

improves the odds of an eventual downside reversal.

Bear crowns are equivalent patterns

that occur after down moves and signal

upside reversals. The relationship

between the price swings is the same as

that for bull crowns. For simplicity, the

remainder of the article will discuss bull

crowns.

Pattern rules

Crown patterns can be traded using

only a handful of rules. First, for a bull

crown to form the market must be rallying. The market should then pull back

and turn back up, forming points A and

B, as shown in Figure 2. In this case,

price closed above the 20-period moving average at point A, then closed

below the 20-period moving average at

point B. Once price has moved to a new

high, takes out point A and closes above

Source: Fibonacci Trader

The Ergodic Candlestick Oscillator (ECO)

he Ergodic Candlestick Oscillator (ECO), which is

described in William Blaus book, Momentum,

Direction, and Divergence (John Wiley & Sons, 1995),

incorporates two concepts: double smoothing and the

Candlestick Indicator (CSI).

Double smoothing: To create a smoothed price series while

minimizing the lag associated with moving averages, Blau

applied an initial exponential moving average (EMA) to price,

and then performed a second double smoothing of the first

EMA using a second EMA.

An EMA is a type of weighted moving average that uses a

smoothing constant (a) to emphasize more recent prices.

Here is the formula for an EMA:

EMA = (1-a)P + a(EMA

(t-1) )

where

P = price

EMA (t-1) = yesterdays EMA

The following formula shows how the smoothing constant

relates to the lookback period of a simple moving average (SMA):

a = 2/(n+1)

where

n = the lookback period for a simple moving average

For example, to create the EMA equivalent of a 20-day SMA

you would use a smoothing constant of .095 (2/[20+1]).

Double-smoothed price (EMA Double) uses the EMA of the

closing price:

62

EMA

Double

= (1-a) EMA + a(EMA

Double(t-1))

where

EMA Double(t-1) = yesterdays EMA value

Blau uses the notation EMA(EMA(P,r),s) for the doublesmoothed price series; s represents the shorter-term period length for one EMA, r represents a longer-term period

length for the second EMA, and P represents price.

The next step in creating the ECO is calculating the

Candlestick Indicator (CSI), which is the double-smoothed difference between the open and close of each price bar divided by the double-smoothed difference between each bars

high and low. The result is multiplied by 100:

CSI = [(EMA(EMA (close-open,r),s)/(EMA(EMA (highlow,r),s)]*100

The CSI measures momentum based on how each bar closes relative to its range. Closes at the upper end of each bars

range and above the opening price indicate strength. Closes

at the lower end of each bar and below the opening price

indicate weakness.

A trend in either direction will produce persistent positive

or negative readings, and the double-smoothing technique

will create a smooth indicator line that rises if the market is

in an uptrend and falls if it is in a downtrend.

One benefit for intraday traders is the CSI calculation does

not reference the previous bars close. Consequently, large

opening price gaps will not cause the indicator to fluctuate

dramatically.

www.activetradermag.com January 2004 ACTIVE TRADER

FIGURE 3 ANOTHER TOOL

The Ergodic Candlestick Oscillator (ECO, middle panel) signals the condition for a

short trade when the indicator histogram drops below its moving average (dots).

C

the 20-period moving average (point C),

watch for another pullback.

At this point, price must do two

things: 1) close below the 20-period

moving average; and 2) trade below

point B. When it takes out point B it

should extend either 1.272 or 1.618 times

the upswing from point B to point C,

subtracted from point C (measured from

high to low). This forms point D. (Note:

When measuring the Fibonacci extensions, the move is considered valid if it is

between the next lowest and next highest Fibonacci ratio.)

When point D is established, look for

the market to rally and close above the

20-period moving average, as well as

retrace .618 of the down move from

point C to point D. At point E an official

bull crown has formed meaning, the

pattern is having a crowning effect on

the bull move or swing.

After a crown pattern is established, the

TIKI indicator is used to trigger a trade.

When price has rallied .618 of the point

C to point D swing and closed above the

20-period moving average, look for a

TIKI reading of +24 or greater and for

price to hold steady.

At this point, look to short the market.

The futures are in the process of retesting

the high (point C) and the cash market,

represented by the DJIA, is giving it all it

has. For example, a TIKI reading of 28

means 29 Dow stocks are being bought

and only one is being sold (29 - 1 = 28). If

28 up-ticking big board stocks cant push

the DJIA up, odds are the current up

swing will fail the second the TIKI fails.

The second major indicator used in

this approach is the HiLo Activator. The

HiLo Activator is a moving average that

is above price in a downtrending market

and below price in an uptrending market, providing a trailing stop point as a

position progresses. The indicator is, by

default, a 21-period moving average of

the lows or highs, depending on where

the market closes. If price closes above

the HiLo Activator, the indicator is a

moving average of the lows; when the

market closes below the HiLo Activator,

the indicator flips and becomes a moving average of the highs. After price has

retraced to point E and the TIKI reaches

continued on p. 67

1,052.00

1,050.00

1,048.00

D

1,046.00

1,044.00

10.65

ECO

3.08

-4.50

10:54

11:18

11:42

12:06

12:40

13:02

13:26

13:50

14:14

TIKI

20.00

0.00

-20.00

10:54

Intraday momentum

December 2003 S&P E-Mini futures

(ESZ03), one-minute

11:18

11:42

12:06

12:30

12:54

13:18

13:42

14:06

Source: Fibonacci Trader

FIGURE 4 BULL CROWN SHORT TRADE

After a short trade is triggered, partial profits are taken when the TIKI indi cator makes an extreme (-24 or lower) reading in the opposite direction. The

HiLo Activator then functions as a trailing stop.

1,040

December 2003 S&P E-Mini futures (ESZ03), five-minute

C

E

B

Initial stop placement

1,039

Cover remaining position

when HiLo flips back

1,038

1,037

1,036

1,035

1,034

Trade entry on flip of the HiLo Activator.

TIKI

1,033

30.00

ACTIVE TRADER January 2004 www.activetradermag.com

-10.00

F

11:45

12:21

12:57

Source: Fibonacci Trader

10.00

13:33

14:09

14:45

15:21

-30.00

63

&

FUTURES

OPTIONS

Trading Strategies continued from p. 63

+24 or higher, watch for the HiLo

Activator to flip to the short side.

An additional tool

The Ergodic Candlestick Oscillator

(ECO) is another indicator that can confirm momentum is wavering when price

is retesting the high of the pattern. This

is signaled by a declining ECO that falls

below its moving average, as is the case

at point E in Figure 3 (p. 63).

The ECO is a momentum indicator

similar to tools such as stochastics and

the moving average convergence-divergence (MACD) indicator. Figure 3 shows

the ECO as a histogram, with a 34-period moving average represented by the

dots accompanying each bar. For more

information,

see

The

Ergodic

Candlestick Oscillator (p. 62).

If the Ergodic Candlestick Oscillators

moving average is above the indicator

histogram, it validates a short trade.

After entry, use the HiLo Activator to

trail the stop. It can be adjusted as to

how much room you want to give the

trailing stop for example, exiting a

trade on a move two, three or four ticks

above the HiLo Activator.

Exit half the position when a TIKI

reading of -24 or lower occurs (+24 or

higher for a long trade after a bear

crown), as shown at point F in Figure 4.

The HiLo Activator then functions as a

trailing stop on the remaining contracts.

(Covering the entire position after a TIKI

reading of -30 is another viable option.)

If you do not have the HiLo Activator,

you can calculate a 20-period moving

average of the highs and a separate 20period moving average of the lows.

Alternately, you can use a simple 20period moving average and enter a trade

when price closes below or above the

average (others may choose to wait until

the entire bar is above or below the average). Of course, everyone should backtest to find what works best within the

context of his or her overall trading style.

Figure 5 (below) shows a bear crown in

the S&P 500 E-Mini futures. Trade entry

For information on the author see p. 10.

When the trailing stop indicator flipped below price after swing low E, a long

trade was entered. The initial risk point is the preceding swing low at point C.

1,042

December 2003 S&P E-Mini futures (ESZ03), five-minute

1,041

Cover trade before close

1,040

Trade entry on flip of the HiLo Activator.

F

1,039

1,038

1,037

D

B

1,036

1,035

A

C

1,034

Initial stop placement

TIKI

1,033

30.00

Trade entry

Enter the trade (at the market) when the

most recent price bar closes lower and

the HiLo Activator flips in the direction

of the trade just after point E. The initial

stop placement is above the last pivot

high; if the risk presented by the trade is

higher, pass on the trade.

Improving the odds

Bull and bear crowns combine several

analytical tools: By adding Fibonacci calculations and market internals to this

chart formation, you can improve the

odds of capturing a reversal when the

market retests its most recent high or low.

When the pattern has fulfilled its

Fibonacci requirements, the TIKI shows

whether the market is giving its all

when price has stalled. When the TIKI

fails, a trade is signaled.

FIGURE 5 BEAR CROWN LONG TRADE

Time frame

Crown patterns can form in any market

and on any time frame. However the

longer the time frame, the more risk you

must assume.

When day trading the S&P500 E-Mini

(or other E-Mini futures contracts), try

using either one-, three- or five-minute

charts (55-, 233-, and 377-tick charts) to

find trade setups.

The TIKI chart should always be a

one-minute chart, in order to identify the

pattern completion on as timely a basis

as possible. Once a crown pattern presents itself, it is important the TIKI have

a reading of +24 or higher (-24 or lower

for bear crowns) to complete it. (The horizontal lines on the TIKI chart at the bottom of Figure 4, p. 63, are set to +22 and

22 to make it easier to see extreme readings of +24/-24.)

occurred just after the pullback to point E

when the HiLo Activator flipped below

the price series and the TIKI hit -24. Half

the position was liquidated when the

TIKI registered a +24 reading at point F,

and the remainder of the position was

exited on the close.

10.00

-10.00

-30.00

11:48

12:24

13:00

13:36

14:12

14:48

15:24

Source: Fibonacci Trader

ACTIVE TRADER January 2004 www.activetradermag.com

67

Vous aimerez peut-être aussi

- The Power of Habit - Charles DuhiggDocument5 pagesThe Power of Habit - Charles DuhiggmanargyrPas encore d'évaluation

- The Revelation of HellDocument18 pagesThe Revelation of HellEric Dacumi100% (12)

- HEAVEN AND THE ANGELS by H.A. BakerDocument138 pagesHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- Chifbaw Oscillator User GuideDocument12 pagesChifbaw Oscillator User GuideHajar Aswad KassimPas encore d'évaluation

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- At ActiveDocument3 pagesAt Activemr12323Pas encore d'évaluation

- Daily stock market indices and bank stocks dataDocument34 pagesDaily stock market indices and bank stocks datamr12323Pas encore d'évaluation

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323Pas encore d'évaluation

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- GN 5 41Document1 pageGN 5 41mr12323Pas encore d'évaluation

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Pas encore d'évaluation

- Nifty Super Trend Back Test Results 2008 To 2013Document176 pagesNifty Super Trend Back Test Results 2008 To 2013mr12323Pas encore d'évaluation

- Revision of Pension (c116063)Document1 pageRevision of Pension (c116063)mr12323Pas encore d'évaluation

- Tims Trading MaximsDocument1 pageTims Trading Maximsmr12323Pas encore d'évaluation

- ProFx 4 User Manual PDFDocument20 pagesProFx 4 User Manual PDFMelque ResendePas encore d'évaluation

- Astro PreditDocument1 pageAstro Preditmr12323Pas encore d'évaluation

- 0510 ColeDocument21 pages0510 Colemr12323Pas encore d'évaluation

- F9D1 ManualDocument18 pagesF9D1 Manualmr12323Pas encore d'évaluation

- BitcoinsDocument45 pagesBitcoinsSwadhin Sonowal100% (1)

- Scope of AnatomyDocument25 pagesScope of Anatomymr12323Pas encore d'évaluation

- Cyprus financial crisis impacts banking system tradingDocument1 pageCyprus financial crisis impacts banking system tradingmr12323Pas encore d'évaluation

- GN 5 38Document1 pageGN 5 38mr12323Pas encore d'évaluation

- Cheatsheet Fib ElliottDocument12 pagesCheatsheet Fib ElliottYano0% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Tradeonix 2.0: (An Updated Version of Tradeonix)Document17 pagesTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- Traders World 20101Document10 pagesTraders World 20101satish sPas encore d'évaluation

- Barclay and Hendershott-Price Discovery and Trading After HoursDocument33 pagesBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelPas encore d'évaluation

- Profit from Financial Markets with PZ Trend Following SuiteDocument24 pagesProfit from Financial Markets with PZ Trend Following Suitemr12323Pas encore d'évaluation

- Wolfe Wave Dashboard Install GuideDocument4 pagesWolfe Wave Dashboard Install Guidemr12323Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Forex Literature ReviewDocument6 pagesForex Literature Reviewafmzhpeloejtzj100% (1)

- Problems of Raising FinanceDocument14 pagesProblems of Raising FinanceOKhwanambobi Lucas WafulaPas encore d'évaluation

- What is Bitcoin? The Beginner's Guide to Understanding BitcoinDocument4 pagesWhat is Bitcoin? The Beginner's Guide to Understanding BitcoinDevonPas encore d'évaluation

- Paper 1.4Document137 pagesPaper 1.4vijaykumartaxPas encore d'évaluation

- BPI Family Savings Bank Vs SMMCIDocument1 pageBPI Family Savings Bank Vs SMMCIManila LoststudentPas encore d'évaluation

- National Cooperative Insurance Society NigeriaDocument2 pagesNational Cooperative Insurance Society NigeriaChristopher Azuka100% (2)

- Yoga FuturesDocument2 pagesYoga FuturesNeha SharmaPas encore d'évaluation

- Principles of Economics 7Th Edition Frank Solutions Manual Full Chapter PDFDocument30 pagesPrinciples of Economics 7Th Edition Frank Solutions Manual Full Chapter PDFJenniferWashingtonfbiqe100% (8)

- Equitable Mortgage DeedDocument3 pagesEquitable Mortgage DeedchandrashekharPas encore d'évaluation

- Round: 5 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 5 Dec. 31, 2024: Selected Financial StatisticsYadandla AdityaPas encore d'évaluation

- Summary (NEW Lease)Document3 pagesSummary (NEW Lease)Anonymous AGI7npPas encore d'évaluation

- Ketan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School KolkataDocument13 pagesKetan Parekh: Prepared by - Mohit Bothra PGDM-07 Globsyn Business School Kolkatamohitbothra50% (4)

- Strong Tie RatiosDocument2 pagesStrong Tie RatiosHans WeirlPas encore d'évaluation

- Putting Carbon Markets To Work On The Path To Net ZeroDocument84 pagesPutting Carbon Markets To Work On The Path To Net ZeroCeren Arkancan100% (2)

- Mudassar Ahmed SP19-BBA-186 Assignment 4Document5 pagesMudassar Ahmed SP19-BBA-186 Assignment 4Raja MohsinPas encore d'évaluation

- Answer For T3 FMRDocument4 pagesAnswer For T3 FMRYehHunTeePas encore d'évaluation

- 02a. Shares Capital IDocument5 pages02a. Shares Capital IYuganiya RajalingamPas encore d'évaluation

- Property Inspection Reference GuideDocument58 pagesProperty Inspection Reference Guideritbhai100% (1)

- Topic:-Green Bonds in India-Performance, Scope and Future Scenario in The CountryDocument5 pagesTopic:-Green Bonds in India-Performance, Scope and Future Scenario in The Countryrishav tiwaryPas encore d'évaluation

- Sample Paper 1 MCQ AccDocument2 pagesSample Paper 1 MCQ AccDRPas encore d'évaluation

- Contempo LessonDocument10 pagesContempo LessonAnonymous c5qeC1jJ5Pas encore d'évaluation

- Comptroller Steals $53 Million From City Funds: EthicsDocument4 pagesComptroller Steals $53 Million From City Funds: EthicsChess NutsPas encore d'évaluation

- Outreach Networks Case StudyDocument9 pagesOutreach Networks Case Studymothermonk100% (3)

- Major Heads & Allocation Structure in Indian RailwaysDocument3 pagesMajor Heads & Allocation Structure in Indian RailwaysSri Nagesh KumarPas encore d'évaluation

- Final Report Allied BankDocument70 pagesFinal Report Allied BankIfzal Ahmad100% (6)

- Amazon Company ReportDocument9 pagesAmazon Company ReportjonsnowedPas encore d'évaluation

- Funds Flow Statement Analysis of Mind Links IT R&D Labs Pvt LtdDocument61 pagesFunds Flow Statement Analysis of Mind Links IT R&D Labs Pvt LtdNagireddy Kalluri81% (32)

- Employment FormatDocument3 pagesEmployment Formatalan90% (49)

- The value of an unlevered firmDocument6 pagesThe value of an unlevered firmRahul SinhaPas encore d'évaluation

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)