Académique Documents

Professionnel Documents

Culture Documents

CH Zafar

Transféré par

Shahaan ZulfiqarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH Zafar

Transféré par

Shahaan ZulfiqarDroits d'auteur :

Formats disponibles

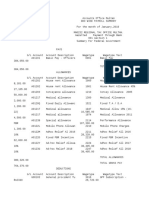

OFFICE OF THE

CHIEF COMMISSIONER INLAND REVENUE

REGIONAL TAX OFFICE, MULTAN

No.CCIR/RTO/

Dated:-

Member (IR-Operations),

Federal Board of Revenue,

Islamabad.

Subject:

ISSUANCE OF REFUND IN THE CASE OF M/S ASIA POULTRY FEED (PVT)

LTD MULTAN AMOUNTING TO RS. 12,530,267 TAX YEAR 2012.

Please refer to the subject cited above.

The Commissioner Inland Revenue Special Zone has reported vide letter No. 821 dated:

09.09.2015 that Asia Poultry Feed (Pvt) Ltd apply for Income Tax Refund for the tax year 2012 on

25.02.2013. After verification of deduction of tax under different heads, unit officer forwarded the cases

to Additional Commissioner on 09.12.2014. After examination by the Additional Commissioner the case

was forwarded to Commissioner Inland Revenue Special Zone Mr. Ahmad Shuja Khan for administrative

approval on 17.12.2014 which is still pending. During this period (from 17.12.2014 to date), the

Commissioner neither granted administrative approval nor confronted discrepancies to the taxpayer.

The undersigned repeatedly in weekly/monthly meeting directed the Commissioner

Inland Revenue to finalize the pending refund claim on merit in terms of provision of law but the same

were not complied with. The undersigned faced embarrassment before the AR of the taxpayer time and

again due to non compliance of the Commissioner.

Keeping in view of the above it is requested that the performance allowance of Mr.

Ahmad Shuja Khan Commissioner Inland Revenue Special Zone Multan may be discontinued

immediately. His services may be placed at the disposal of FBR and suitable substitute may please be

provided.

CHIEF COMMISSIONER

Copy to:

SA to Chairman, Federal Board of Revenue, Islamabad for information

CHIEF COMMISSIONER

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarPas encore d'évaluation

- NO Marriage CertificateDocument5 pagesNO Marriage CertificateShahaan ZulfiqarPas encore d'évaluation

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para NO Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara NO Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarPas encore d'évaluation

- 114 CasesDocument29 pages114 CasesShahaan ZulfiqarPas encore d'évaluation

- Drra 12Document966 pagesDrra 12Shahaan ZulfiqarPas encore d'évaluation

- 2011-12 - Dac 14.01.2020Document38 pages2011-12 - Dac 14.01.2020Shahaan ZulfiqarPas encore d'évaluation

- 2013-14 - Multan 25112019Document47 pages2013-14 - Multan 25112019Shahaan ZulfiqarPas encore d'évaluation

- 2017-18 - 17.08.2020 Multan Audit ReportDocument25 pages2017-18 - 17.08.2020 Multan Audit ReportShahaan ZulfiqarPas encore d'évaluation