Académique Documents

Professionnel Documents

Culture Documents

Delhi Dvat Registration Information

Transféré par

Nikhil KasatCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Delhi Dvat Registration Information

Transféré par

Nikhil KasatDroits d'auteur :

Formats disponibles

Delhi Vat DVAT Registration

DVAT Registration

Delhi Value Added Tax or in short DVAT is a tax applicable on sale of goods within Delhi. Any

person with turnover within Delhi exceeding Rs. 10,00,000 is required to be registered under

DVAT and is liable to collect and pay DVAT tax to the Delhi Government. Further, any person

purchasing or selling good from/to outside Delhi is also liable to be registered under DVAT in

addition to registration under Central Sales Tax Act (CST).

A person can also apply for voluntary DVAT registration with or without CST even if he is not

required take compulsory registration.

There are two types of DVAT registration i.e.

Normal DVAT Registration

Registration under DVAT Composition Scheme

DVAT Composition Scheme

DVAT Composition scheme is a easy version of DVAT introduced with DVAT Act for easy

compliance by small businessmen. This scheme is applicable to small dealers only i.e. dealers

with turnover less than Rs. 40 Lakhs (Rs. 40,00,000). Further, the dealer should only Purchase or

Sale goods within the state of Delhi only. The salient feature of DVAT Composition scheme is

given below

Applicability of DVAT Composition Scheme

Turnover of Dealer should not exceed Rs. 40 Lakhs (Rs. 40,00,000)

The dealer should exclusively sell / purchase goods within the State of Delhi

Terms & Conditions of DVAT Composition Scheme

The dealer can purchase goods only from other Registered Dealers within Delhi only

after payment of full VAT

Composition Dealer cannot claim any credit of VAT paid on purchase of goods

Composition Dealer cannot charge VAT to its customers on the invoice

VAT liability of Composition Dealer shall be 1% of its total turnover

DVAT Registration Procedure

1. Prepare documents required for DVAT registration

2. Arrange for DVAT Surety (More Details Here)

3. File From DVAT 4 along with all documents and surety with DVAT Department

4. If also require CST registration file Form A along with DVAT 4

5. Get DVAT Registration Certificate along with TIN Number

6. Vat Inspector will visit your business premises within 15 days of TIN Registration

DVAT Registration Documents

The documents required for DVAT Registration are different depending on the constitution of the

dealer i.e. weather the dealer is a Proprietorship, Partnership, Company or any other

organisation. The documents required for DVAT registration for each different type of

organisation structure is given below. Any documents required for reduction of DVAT Surety is

to be given in addition to the documents mentioned below.

For Proprietorship

Identity Proof of Proprietor

3 Photographs of Proprietor

Address Proof of Proprietor

Address Proof of Proprietorship

o if self owned then copy of Electricity Bill / Property Tax Receipt / Sale Deed

o if rented then NOC from Landlord, Rent Agreement, Electricity Bill / Property

Tax Receipt / Sale Deed of Landlord

Bank Account Details and Latest Bank Statement of Proprietorship

List of Goods to be dealt in along with goods required for packing, if any

For Partnership

Identity Proof of all Partners

3 Photographs of all Partners

Address Proof of all Partners

Address Proof of Partnership

o if self owned then copy of Electricity Bill / Property Tax Receipt / Sale Deed

o if rented then NOC from Landlord, Rent Agreement, Electricity Bill / Property

Tax Receipt / Sale Deed of Landlord

PAN Card of Partnership Firm

Bank Account Details and Latest Bank Statement of Partnership

Copy of Partnership Deed

List of Goods to be dealt in along with goods required for packing, if any

For Company

Identity Proof of all Directors

3 Photographs of all Directors

Address Proof of all Directors

Address Proof of Company

o if self owned then copy of Electricity Bill / Property Tax Receipt / Sale Deed

o if rented then NOC from Landlord, Rent Agreement, Electricity Bill / Property

Tax Receipt / Sale Deed of Landlord

Bank Account Details and Latest Bank Statement of Company

Memorandum & Articles of Association

Board Resolution

List of Goods to be dealt in along with goods required for packing, if any

DVAT Surety

For DVAT registration it is compulsory to provide surety of Maximum Rs. 1,00,000 and

Minimum Rs. 50,000 to the DVAT Department. The surety can be provided in various modes

which are provided below, however, the more popular modes are either in way of Registered

Dealer Surety i.e. where another registered dealer provides surety bond or Bank Guarantee. The

method of determination of surety is also provided below.

Modes of Providing DVAT Surety

Registered Dealer Surety

Bank Guarantee

Fixed Deposits

Cash Deposit with DVAT Department

Determination of DVAT Surety Amount

The Surety for DVAT registration has been prescribed at Rs. 1,00,000. However, the same can be

reduced to a minimum of Rs. 50,000 by providing the documents mentioned below. The amount

of surety reduced is also mentioned against each document.

Reduction sought (Maximum reduction available Rs. 50,000)

1. Proof of ownership of principle place of business Rs.30,000

2. Proof of ownership of residential property by proprietor/ managing partner Rs. 20,000

3. Copy of passport of proprietor/ managing partner Rs. 10,000

4. Copy of Permanent Account Number in the name of the business allotted by the Income

Tax Department Rs. 10,000

5. Copy of last electricity bill (The bill should be in the name of the business and for the

address specified as the main place of business in the registration form) Rs. 10,000

6. Copy of last telephone bill (The bill should be in the name of the business and for the

address specified as the main place of business in the registration form) Rs. 5,000

From:

Ramesh kumar verma

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Income Declaration Scheme Rules, 2016: Form 1Document9 pagesIncome Declaration Scheme Rules, 2016: Form 1Nikhil KasatPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Types of Stamps and Some Concepts of Stamp DutyDocument5 pagesTypes of Stamps and Some Concepts of Stamp DutyNikhil Kasat100% (3)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Black Money BillDocument30 pagesBlack Money BillNikhil KasatPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- CA Result AnalysisDocument1 pageCA Result AnalysisNikhil KasatPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

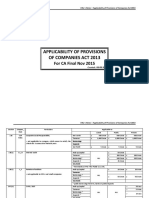

- ApplicabiliTY of ProvisionsDocument3 pagesApplicabiliTY of ProvisionsNikhil KasatPas encore d'évaluation

- Some Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Document21 pagesSome Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Nikhil KasatPas encore d'évaluation

- CA Final Writing Professional Ethics AnswersDocument2 pagesCA Final Writing Professional Ethics AnswersNikhil KasatPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Fees Calculation For Increase in Authorised Share Capital Form SH 7, Only For GujaratDocument10 pagesFees Calculation For Increase in Authorised Share Capital Form SH 7, Only For GujaratNikhil KasatPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hedging With Financial DerivativesDocument30 pagesHedging With Financial DerivativesNikhil KasatPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Curriculum VitaeDocument13 pagesCurriculum VitaeNikhil KasatPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Agricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheDocument9 pagesAgricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheNikhil KasatPas encore d'évaluation

- SN Vertical Due Dates Particular Consequence of Non ComplianceDocument1 pageSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Cusoms Valuation MaterialDocument8 pagesCusoms Valuation MaterialNikhil KasatPas encore d'évaluation

- August Month CompliancesDocument1 pageAugust Month CompliancesNikhil KasatPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Privileges To Small CompaniesDocument2 pagesPrivileges To Small CompaniesNikhil KasatPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Defamation Under Common LawDocument6 pagesDefamation Under Common LawNikhil KasatPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Civil Law - Animo Notes PDFDocument86 pagesCivil Law - Animo Notes PDFNakalimutan Na Fifteenbillionsaphilhealth LeonardoPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Deregistration/ Change of Address FormDocument2 pagesDeregistration/ Change of Address Formpoetdb1594Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- New FIDIC White Book - The Key ChangesDocument4 pagesNew FIDIC White Book - The Key ChangesKarthiktrichyPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Somalia FishDocument22 pagesSomalia FishOmar AwalePas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- San Miguel Corporation vs. NLRC, 403 SCRA 418Document2 pagesSan Miguel Corporation vs. NLRC, 403 SCRA 418Judel MatiasPas encore d'évaluation

- Demand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Document3 pagesDemand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Muchangi KamitaPas encore d'évaluation

- Law 11Document49 pagesLaw 11Clairisse LumabanPas encore d'évaluation

- Pano Michael DuPree SuspensionDocument4 pagesPano Michael DuPree SuspensionNational Content DeskPas encore d'évaluation

- Bayang Vs CA Rule 3Document2 pagesBayang Vs CA Rule 3Rowela Descallar100% (1)

- Case Comment - State Bank of India v. Indexport Registered and ORS On 30 April, 1992Document2 pagesCase Comment - State Bank of India v. Indexport Registered and ORS On 30 April, 1992Editor IJTSRDPas encore d'évaluation

- Remedies Outline: Competitive, Smothering Competition. Contrarily, Brunswick'sDocument4 pagesRemedies Outline: Competitive, Smothering Competition. Contrarily, Brunswick'sHannah ElizabethPas encore d'évaluation

- RM 1509e GB WW 1116-18Document888 pagesRM 1509e GB WW 1116-18Mr.K chPas encore d'évaluation

- Civil Procedure Case DigestDocument1 pageCivil Procedure Case Digestkemsue1224Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- 4 Miciano vs. BrimoDocument2 pages4 Miciano vs. BrimoPat Neyra100% (3)

- Internal Rules and ProcedureDocument61 pagesInternal Rules and Procedurepotski413Pas encore d'évaluation

- Columbia Pictures Vs CADocument5 pagesColumbia Pictures Vs CAMara VinluanPas encore d'évaluation

- Crima Şi Criminalitateaameninţare Gravă A Dezvoltării Armonioase Şi Echilibrate A Statului RomânDocument262 pagesCrima Şi Criminalitateaameninţare Gravă A Dezvoltării Armonioase Şi Echilibrate A Statului RomânAlexandra Ana IenovanPas encore d'évaluation

- NP Vs Vera - GISTDocument1 pageNP Vs Vera - GISTRommel Mancenido LagumenPas encore d'évaluation

- Assignment 2Document16 pagesAssignment 2Shagun Vishwanath100% (1)

- Surya Prakash Khatri and Ors Vs Madhu Trehan and Od010566COM602944Document20 pagesSurya Prakash Khatri and Ors Vs Madhu Trehan and Od010566COM602944Rishabh KumarPas encore d'évaluation

- Tendernotice 1Document4 pagesTendernotice 1alokPas encore d'évaluation

- Gas Service GuidebookDocument36 pagesGas Service GuidebookAnonymous ub0Yzv1PCPas encore d'évaluation

- Tort LawDocument3 pagesTort LawChamara SamaraweeraPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Book 1Document2 pagesBook 1Wena Mae CristobalPas encore d'évaluation

- Basis For Conclusions ISAs 800 805 Rev and Red PDFDocument11 pagesBasis For Conclusions ISAs 800 805 Rev and Red PDFSanath FernandoPas encore d'évaluation

- Language and The Law Linguistic Inequality in AmericaDocument244 pagesLanguage and The Law Linguistic Inequality in AmericaLAVPas encore d'évaluation

- 041-Globe Mackay Cable and Radio Corporation v. NLRC, G.R. No. 74156, Jan 29, 1988Document4 pages041-Globe Mackay Cable and Radio Corporation v. NLRC, G.R. No. 74156, Jan 29, 1988Jopan SJPas encore d'évaluation

- Air Asia ComplaintDocument29 pagesAir Asia ComplaintPGurusPas encore d'évaluation

- Education Labour Relations Council (ELRC) - Policy Handbook For EducatorsDocument463 pagesEducation Labour Relations Council (ELRC) - Policy Handbook For EducatorsBonginkosi Mathebula100% (1)

- C TPAT SecurityDocument5 pagesC TPAT SecurityShafiqulHasanPas encore d'évaluation

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooD'EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooÉvaluation : 5 sur 5 étoiles5/5 (2)