Académique Documents

Professionnel Documents

Culture Documents

MF0017-Merchant Banking and Financial Services

Transféré par

Solved AssignMentsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MF0017-Merchant Banking and Financial Services

Transféré par

Solved AssignMentsDroits d'auteur :

Formats disponibles

Spring-2016

Get solved assignments at nominal price of

Rs.125 each.

Mail us at: subjects4u@gmail.com or contact at

09882243490

Master of Business Administration - MBA Semester 4

MF0017-Merchant Banking and Financial Services

(Book ID: B1815)

Assignment (60 Marks)

Note: Answers for 10 marks questions should be approximately of 400

words. Each question is followed by evaluation scheme. Each Question

carries 10 marks 6 X 10=60.

Q1. Rating methodology is used by the major Indian credit rating

agencies. Explain the main factors of that are analyzed in detail by

the credit rating agencies.

(Business risk analysis, financial analysis, Management evaluation,

Geographical analysis, Regulatory and competitive environment, Fundamental

analysis) 2, 2, 2,2,1,1

Answer. Rating Methodology used by the major Indian credit rating

agencies is more or less the same. The rating methodology involves an

analysis of all the factors affecting the creditworthiness of an issuer company

e.g. business, financial and industry characteristics, operational efficiency,

management quality, competitive position of the issuer and commitment to

new projects etc. A detailed analysis of the past financial statements is made

to assess the performance and to estimate the future earnings. The companys

ability to service the debt obligations over the

Q2. Give the meaning of the concept of venture capital funds. Explain

the features of venture capital fund.

(Meaning of venture capital funds, Features of venture capital funds) 3, 7

Answer. Venture capital is the money provided by investors to start firms

and small businesses with long-term growth potential. This is a very important

source of funding for start-ups that do not have access to capital markets. It

typically entails high risk for the investor, but it has the potential for aboveaverage returns.

Q3. Hire purchase is one of the important concepts. There are certain

features of hire purchase agreement so explain the points of it.

Differentiate between hire purchase and leasing.

(Concept of hire purchase, Differences between hire purchase and leasing) 5, 5

Answer. In a hire purchase system, the buyer acquires the property by

promising to pay in monthly, quarterly and half-yearly installments. The period

of payment has to be fixed while signing the hire sale agreement. Though the

buyer acquires the asset after signing the agreement, the title of ownership

remains with the vendor until the buyer pays the entire liability. When the

buyer pays the entire installment and any other obligation according to hire

purchase agreement, only then the title of ownership of goods would be

transferred to the hirer. If the hirer makes any default in the payment of any

installment, the hire vendor has the right to repossess the goods. In this case,

the amount that is already paid so far by the hirer will be forfeited.

Q4. Explain the concept of Depository receipts. Write down the

difference between American Depository Receipts (ADR) and Global

Depository Receipts (GDR) also mention the issues involved in

ADR/GDR.

(Explanation of Depository Receipts, Differences between ADR and GDR, Issues

involved in ADR/GDR) 4, 3, 3

Answer. Depository receipts are securities that are traded in foreign

currency. These receipts are issued by the foreign bank or institution which

acts as a depository of shares issued by a domestic company.

Depository receipts can be classified into sponsored and unsponsored ones.

Q5. What is Online Trading? Explain the process of online trading.

(Measuring and explanation of Online Trading, Explanation of process of Online

trading) 6, 4

Answer. Online trading is one of the crucial financial services provided by

financial institutions and merchant bankers. For example, Indiabulls Securities

Limited is one of Indias foremost stock brokerage house having a pan India

presence. The organization is a pioneer in providing online stock trading

platform in India and currently has a customer base of seven lacs customers.

Q6. Write short notes on:

a. Depository Participants

b. Benefits of Depository Systems

Answer. a. Depository Participants: All the functions performed by

depositories are actually executed by the depository participants (DPs). All

activities related to recording of allotment of securities, transfer of securities

etc. are executed through depository participants and no investor can directly

open an account with a depository. A depository can enter into an agreement

with various depository participants who would work as agents of the

depository. Depository Participant works as an intermediary between the

investor and depository and they are called as

Spring-2016

Get solved assignments at nominal price of

Rs.125 each.

Mail us at: subjects4u@gmail.com or contact at

09882243490

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 10 Fs Discount Rate in Project AnalysisDocument6 pages10 Fs Discount Rate in Project AnalysisMohammed HeshamPas encore d'évaluation

- Getachaw BPSM Individual AssignmentDocument5 pagesGetachaw BPSM Individual AssignmentGeetachoo Mokonnin DhugumaaPas encore d'évaluation

- Theory and Practice 08 04 PDFDocument100 pagesTheory and Practice 08 04 PDFHạng VũPas encore d'évaluation

- Money Money: Keynesian Roi DeterminationDocument3 pagesMoney Money: Keynesian Roi DeterminationRajat JadhavPas encore d'évaluation

- Final15 SolDocument7 pagesFinal15 SolStowe EighmyPas encore d'évaluation

- Mapping The HR Value PropositionDocument23 pagesMapping The HR Value Propositioncreator29Pas encore d'évaluation

- F1 TNMDocument35 pagesF1 TNMNguyễn Lê MinhPas encore d'évaluation

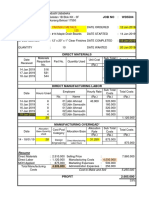

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriPas encore d'évaluation

- Mirco IIDocument87 pagesMirco IIChristine KaberaPas encore d'évaluation

- Market Structures and Pricing DecisionsDocument24 pagesMarket Structures and Pricing DecisionsKimberly parciaPas encore d'évaluation

- Microeconomics Lecture NotesDocument26 pagesMicroeconomics Lecture NotesNamanya BetrumPas encore d'évaluation

- Investment Centers and Transfer PricingDocument9 pagesInvestment Centers and Transfer PricingMohammad Nurul AfserPas encore d'évaluation

- Chapter 6 Franchise QDocument20 pagesChapter 6 Franchise QNguyên Bùi100% (1)

- ECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Document11 pagesECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Phan Hồng VânPas encore d'évaluation

- Demand TheoryDocument13 pagesDemand TheoryRiTu SinGhPas encore d'évaluation

- EC3332 Tutorial 3 AnswersDocument3 pagesEC3332 Tutorial 3 AnswersKabir MishraPas encore d'évaluation

- Introduction To Manufacturing ProcessesDocument27 pagesIntroduction To Manufacturing ProcessesJohn Philip NadalPas encore d'évaluation

- Mgt211 Updated Quiz 1 2021 We'Re David WorriorsDocument18 pagesMgt211 Updated Quiz 1 2021 We'Re David WorriorsDecent RajaPas encore d'évaluation

- Microstructure PDFDocument7 pagesMicrostructure PDFflavioPas encore d'évaluation

- 1 ECONTWO IntroductionDocument20 pages1 ECONTWO IntroductionNang Kit SzePas encore d'évaluation

- h1 Public Finance - Meaning Scope DistinctionDocument4 pagesh1 Public Finance - Meaning Scope DistinctionRajiv VyasPas encore d'évaluation

- Multi PageDocument92 pagesMulti PageturtlebellyPas encore d'évaluation

- Labour Market ReformsDocument9 pagesLabour Market ReformsGauri RaoPas encore d'évaluation

- Inference and Arbitrage: The Impact of Statistical Arbitrage On Stock PricesDocument33 pagesInference and Arbitrage: The Impact of Statistical Arbitrage On Stock PriceshanniballectterPas encore d'évaluation

- GODREJ Social MarketingDocument8 pagesGODREJ Social MarketingVikas BansalPas encore d'évaluation

- Mivumba in Kampala/Used Clothes TradeDocument49 pagesMivumba in Kampala/Used Clothes TradeMegan GarnerPas encore d'évaluation

- UnemploymentDocument30 pagesUnemploymentNorman StricksonPas encore d'évaluation

- Benihana SimulationDocument4 pagesBenihana SimulationishanPas encore d'évaluation

- Time and Decision - Chapter 1, Economic and Psychological Perspectives On Intertemporal ChoiceDocument12 pagesTime and Decision - Chapter 1, Economic and Psychological Perspectives On Intertemporal ChoiceRussell Sage FoundationPas encore d'évaluation

- Mobile Banking in IndiaDocument9 pagesMobile Banking in IndiaNaveen DsouzaPas encore d'évaluation