Académique Documents

Professionnel Documents

Culture Documents

School of Management University Sains Malaysia ACADEMIC SESSION 2014/2015

Transféré par

Wan CheeTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

School of Management University Sains Malaysia ACADEMIC SESSION 2014/2015

Transféré par

Wan CheeDroits d'auteur :

Formats disponibles

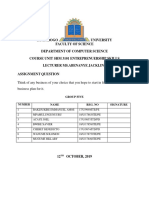

SCHOOL OF MANAGEMENT

UNIVERSITY SAINS MALAYSIA

ACADEMIC SESSION 2014/2015

SEMESTER II

COURSE NAME

: Strategic Management

COURSE CODE

: ATW 393E/4

YEAR OF STUDY

:3

PREPARED FOR

LECTURER: Dr. Hasliza Abdul Halim

PREPARED BY:

Group 4C

Group Assignment

: KOSSAN

NAME

Gan Lay Ying

MATRIC.NO

115204

IC.NUMBER

920912-07-5454

Koo Yaw Loong

115229

920904-08-5505

Lim Gaik Xian

115246

921013-08-5696

Tan Yik Min

115361

921231-08-6144

ATW 393 E/4 Strategic Management

Acknowledgement

First of all, we would like to express our deepest appreciation to our respected

Strategic Management lecturer, Dr. Hasliza Abdul Halim for providing us valuable

information and experience views in completing this assignment. She inspired us

greatly to work in this project. Dr. Hasliza is always ready and willing to assists us in

handing all sorts of problems we are facing in this project. With assisted and guided

from Dr. Hasliza, we are able to complete this project successfully and submit on time.

Continuously, we would like to grab this opportunity to express our great

appreciation to University Sains Malaysia for provide us with a good environment

and facilities such as speedy wifi and computer available in library for us to complete

this project.

Lastly, we are great that we have a chance to involve in this project because

through this project we had learned different method to deal with problem that we

face in this project. In addition, we also appreciate the cooperation of the group

members throughout this project and all of us have given our best and show our high

commitment in completing this project on time.

Page 2

ATW 393 E/4 Strategic Management

TABLE OF CONTENT

No.

1.

2.

Title

Acknowledgement

Table of Content

Pages

2

3

Chapter 1

3.

4.

5.

6.

1.0

1.1

1.2

2.0

7.

8.

2.4

2.5

9.

3.0

10.

3.4

11.

4.0

12.

13.

14.

15.

16.

4.5

Company Background

Vision Statement of Kossan

Current Vision Statement of Kossan

Discussion on Vision Statement of Kossan

Formulate New Vision Statement

Mission Statement of Kossan

Current Mission Statement of Kossan

Discussion on Mission Statement of Kossan

Formulate New Vision Statement

Chapter 2

Kossans SWOT Analysis External Analysis

2.1 Opportunities

2.2 Threat

2.3 Kossans Opportunity and Threats (Company Profile

Matrix)

Kossans Competitive Profile Matrix (CPM)

Kossans Strategic Group Map

Chapter 3

Kossans SWOT Analysis- Internal Analysis

3.1 Strengths

3.2 Weaknesses

3.3 Kossans Strengths and Weaknesses (Company Profile

Matrix)

Weighted Competitive Strength Assessment

Chapter 4

Kossans Financial Ratio Analysis

4.1 Part 1: Profitability Ratio

4.2 Part 2: Liquidity Ratio

4.3 Part 3: Leverage Ratio

4.4 Part 4: Market Analysis Ratio

Comparison of Financial Performance in the Malaysian

Rubber Glove Industry

Chapter 5

5.0 Formulate Strategies

5.1 SWOT Matrix

5.2 SPACE Matrix

5.3 Boston Consulting Group (BCG) Matrix

Chapter 6

References

Appendix

Soft Copy

4

5

5-6

6

7

7-8

8

9-11

11-13

13-14

15-17

18

19-20

20-21

22-23

23-25

26-29

30-33

33-35

36-37

38-42

43-46

47-49

50-52

53-55

56

Page 3

ATW 393 E/4 Strategic Management

Chapter 1

Company Background & Formulate Vision and Mission Statement of Kossan

1.0

Company Background

Kossan Rubber Industries Bhd had emerged as one of the worlds largest

manufacturers for industrial rubber products and disposable latex gloves nowadays.

Kossan Rubber Industries Bhd was established in year 1979, headquartered is located

in Wisma Kossan in Klang. Besides, Kossan was one of the companies in Malaysia to

venture into glove manufacturing and Kossan had introduced the first glove

production line on August in year 1988.

Kossan is currently under management of Dato Haji Mokhtar Bin Haji Samad

(Chairman) and the current Chief Executive Officer is Dato Lim Kuang Sia a

Malaysia aged 62 was appointed as CEO of Kossan on 22 February 2002 and Mr. Lim

Kuang Yong was appointed as executive director which currently oversee the Gloves

Division.

Moreover, Kossan had joined the Main Board of Bursa Malaysia in year 1996

and had classified as one of the fastest growing companies in Malaysia. Kossans

possessed strong reputation of high quality product had made Kossan extends its

business networks to more than 160 countries around the world. In other words,

Kossan products mainly distributed in countries such as United Stated of America,

United Kingdom, Japan, Korea, Europe, China, Middle East, Scandinavian countries,

Australia, Canada, Asia Pacific and Latin America.

Besides, Kossan had continuously improved its company business process and

enhance its business strategic with a group of employees and good management teams

to ensure that they able continuously deliver good value to its entire shareholder. With

all of these afford, Kossan had achieved numerous key awards including Malaysia

Investors Relations Award in year 2011 and SME Recognition Award in year 2010.

In the same year, Kossan was also awarded The Edge Billion Ringgit Club for the

highest Return on Equity over three years in the industrial products. Lastly, Kossan

had be recognized as Asia Pacifics most reputable companies and gained award in 9th

Asia Pacific International Honesty Enterprise Keris Award 2010.

In a nutshell, in year 2014, Kossan is ranked at 50th in the most valuable

Malaysia brands.

Page 4

ATW 393 E/4 Strategic Management

1.1

Vision Statement of Kossan

a.

Current Vision Statement of Kossan

Vision statement defined as a set of ideas of organization aimed to achieved

and accomplished in the future. Basically, a vision statement prioritizes the current

status of the organization and point the direction of where the organization wishes to

go. Therefore, it set as a long term statement and a well- conceived vision statement

able inspire employees and motive them so that they commit themselves to

accomplish the organization goals.

The corporate vision statement of Kossan is to be the world class market in

rubber products driven by technological advancement, people value and continual

improvement to deliver long term and sustainable growth. The vision of Kossan

reflect that Kossan dedicated to provide an professional and excellent services of

technical rubber products and glove products to valued customer with good quality

assurance of product and timely delivery to ensure that all valued customer are

satisfied with Kossans products and services presented.

b.

Discussion on Vision Statement of Kossan

In our opinion, there are several effective elements that Kossans vision

possessed which are directional, focused, desirable and easy to communicate. First of

all, the vision statement of Kossan is directional because Kossans vision statement is

forward looking. We can understand that the direction of Kossan aimed to provide the

high quality medical gloves through anticipate the needs of the medical healthcare

community and continuously make improvement in every aspect of products and

service so that Kossan can gain integrity from valued customer in order to recognized

as a trusted company by valued customer. Therefore, we can understand that Kossan

keep on moving themselves toward world class market leader by continuously invest

in improvement programs such as cost reduction, product quality improvement,

develop unique products in order to enhance its company internal strength. For

example, Kossan had implemented automation such as Automation Stripping of

Gloves, Packaging Automation for Sterile Gloves and upgrading the R&D facilities

such as used High-Performance Liquid Chromatography (HPLC) test and Fourier

Transform Infrared Spectrophotometer (FTIR) test on their production lines to ensure

Page 5

ATW 393 E/4 Strategic Management

high productivity and consistency quality of glove product with lower reject rate by

optimizing the input resource to meet the current and future trends of healthcare

community.

Besides, in the vision statement of Kossan, we can grasp that Kossan is much

focused. This can be further explained that Kossan is strive to providing diverse glove

products in various field such as home care, medical examination, emergency,

chemotherapy, surgical procedure, dental care, diagnostic& laboratory and industry

glove strive to meet the needs of healthcare community. Therefore, we can understand

that Kossan had clearly classified its glove product where the classification of the

glove product is specific enough for manager as a guideline in making decision and

allocate the company resources. A good classification of the healthcare and medical

gloves enables Kossan manager makes decision and allocates the resource well in

order to optimizing the production of glove.

Moreover, Kossan current vision is desirable which indicates that the

directional path makes good business sense. We can understand that Kossan is always

concern the products solution in order to continuously deliver good medical gloves to

safeguard its users and Kossan also always concern the benefits of every party and

consistently enrich its shareholder. This enables Kossan continuously build strong

relationships with its customer, employees, shareholder and business partner.

Last but not least, the current vision of Kossan is easy to communicate

because it clearly states the intention and the goal of the company to be achieved in

the future. In other words, we can understand that Kossan wanted to be the leader in

the glove industry and based on the vision statement Kossan have successfully

presented its companys vision to the decision makers and employees which all of the

employees of Kossan hold the mutual goals to assists Kossan achieved the vision

company goals. In brief, a distinct vision statement can bring all of the employees

focus and accomplished the organizational goals.

Below is the new vision statement that we formulate:

To become preeminent player in rubber glove industry that bring

customer to the highest degree satisfaction for every aspect in order to maintain

long term sustainability growth.

Page 6

ATW 393 E/4 Strategic Management

1.2

Mission Statement of Kossan

a.

Current Mission Statement of Kossan

A mission is a written declaration of a companys core purpose and usually

remains the same over time. The mission should lead the decisions and actions of the

company where it stated the overall goal of the company. The mission also describes

the companys present business scope and purpose which are who we are, what we

do and why we are here.

The current Kossans mission statement is:

i.

Keeping a healthy growth through teamwork

ii.

Opting to be competitive through the provision of good services and quality

innovative products

iii.

Striving towards our own vision with full commitment and dedication

iv.

Stepping up the welfare, competency and professionalism of our employees

v.

Aspiring creativity and innovation in our entire business process

vi.

Navigating towards a sustainable low carbon footprint environment

b.

Discussion on Mission Statement of Kossan

In our opinion, the mission statement of Kossan is specific because the

mission statement able to convey who we are, what we do and why we are here.

Kossans mission statement is able convey the meaning of who we are which

Kossan is a rubber glove manufacturer that produce rubber or medical gloves to the

customer and distribute its rubber glove products to 160 countries around the world.

Furthermore, Opting to be competitive through provision of good services

and quality innovative products and Aspiring creativity and innovation on our

entire business process had convey the meaning of what Kossan do. Moreover,

Striving towards our vision with full commitment and dedication and Navigating

towards a sustainable low carbon footprint environment indicated that Kossan

dedicated to provide a superior quality of rubber glove to its customer and reduce

environment effect through effort of all of the employees in Kossan.

Last but not least, the mission of Kossan Keeping a healthy growth through

teamwork is directional and these statements provide direction to managers, decision

Page 7

ATW 393 E/4 Strategic Management

makers in order to archived long term success in rubber glove industry. On overall,

we can conclude that the mission of Kossan is able to convey who are we, what we

do and why we are here.

However, there is one shortcoming on the mission statement of Kossan which

is the mission mostly focus on the shareholders value and employees value. This

indicated that Kossan should highlight on the customers value in future.

Below are the new mission statements that we formulated:

K- Keeping a healthy growth through team work

O- Opting to maximize customer value and employee welfare

S- Shaping an environmental friendly rubber product industry

S- Striving to be leader in rubber industry in the world

A- Aspiring to develop more creative and high technology products

N- Navigating towards Malaysia's vision 2020

In overall, Kossan is trying their best in deliver the best services and rubber

glove products to its valued customer where they implement the best technologies to

ensure the high quality rubber gloves.

Page 8

ATW 393 E/4 Strategic Management

Chapter 2

Kossans SWOT Analysis (External Analysis); Kossans Company Profile

Matrix; Competitive Profile Matrix and Strategic Group Map

2.0

Kossans Opportunities and Threats (External Analysis)

SWOT analysis is a strategic planning tool and useful technique that examines

the strengths, weaknesses, opportunities and threats that affecting the business

operation. The SWOT analysis assists company evaluates issues within and outside of

the company and provides an outline for strategic decision making. Strength and

weaknesses are considered as internal factors to a company while opportunities and

threats as external factors.

External analysis comprises opportunity and threats which considered as

external environment to the company. Thus, opportunity is the external characteristics

which company can use it to achieve successful and gain competitive advantages

while threats are the external factors which may be potential source of failure to the

company.

2.1

Kossans Opportunity

Opportunities are beneficial situations in the external environment and arise of

opportunity enables business gain competitive advantages by making use of

opportunities.

i.

World demand for rubber gloves is growing

Nowadays, the world demand for rubber gloves is growing in every corner

around the world. Based on the Global Rubber Gloves Market Report 2014 edition,

we notice that the demand for rubber gloves around the worlds is increase

continuously. The key factors that driving the growth of the global rubber gloves

includes rising the number of ageing population, rise in hygiene standards, improved

healthcare awareness, improvement in global economic growth and increasing

potential of emerging markets. For instance, according to the Malaysian Rubber

Glove Manufacturers Association (MARGMA) expected that global demand for

rubber gloves at healthy industry will continue to grow at the rate of 8% to 10% per

annum. This indicates that Malaysia faces healthy increase in rubber gloves demand

for following year which providing a growing opportunity for Kossan company.

Page 9

ATW 393 E/4 Strategic Management

ii.

Expand production capacity in Malaysia and emerging market.

Currently, Malaysia is one of the largest supplier of rubber products especially

gloves to 120 countries around the world. Due to the resilient global demand for

rubber gloves, glove manufacturers have responded by boost up capacity expansion as

well as improve product mix to remain competitive. In year 2014, the production

capacity of gloves was approximately 20 billion pieces where the actual gloves

production is 16 billion pieces and this indicates that demand is outstrip supply.

However, the volume of gloves will grow to 29 billion pieces in 2016 and 32 billion

pieces in year 2017 and the growing volume of gloves provides an opportunity for

Kossan to expand its production capacity. For instance, Kossan expects to double its

gloves production capacity to 32 billion pieces in year 2017 to meet the rising demand

and the

production expansion is also expected to sustaining Kossan earning growth

by 20% to 25% for next three years. In addition, Kossan aims that Vietnam as another

country for its expansion plan because Vietnam is one of the emerging rubber

producers in the world. Moreover, the reasons of Kossan choose Vietnam is due to the

availability of tax incentives and lower labor costs in the country.

iii.

Landbank expansion

Currently, Kossan had completed two land acquisitions in year 2013 which

comprising 9.3 acres in Kapar and 56 acres in Batang Berjuntai. This land banking is

a long term plan for Kossans expansion strategy especially for the plans of adds

another new plant in the future. This indicates that Landbank expansion provides an

opportunity to Kossan to boost up its production capacity. In brief, Kossan is planning

to build up 8 new plants in order to achieve its targeted production capacity of 32

billion pieces of gloves in year 2017.

iv.

Decrease in prices of Latex

As we know Malaysia remains the largest supplier of rubber gloves with an

estimated global market share of 62% and we know that supplier always seek for

cheaper raw material for the purpose of reduce the production costs of gloves. In

related to this, decreasing the prices of raw material such as latex provides an

opportunity for Kossan to boost up its sales value by offered the cheaper selling prices

due to the lower raw material costs and its helps Kossan reduce production costs as

well. According to Malaysia Rubber Board, the natural rubber latex price had dropped

from RM 8.89/kg in year 2011 to RM 4.60/kg in year 2015. This indicates that

Page 10

ATW 393 E/4 Strategic Management

Kossan potentially achieved the greater sales value in following year (2015) as the

lower raw material costs enables Kossan offer cheaper selling prices of gloves where

cheaper selling prices of glove able attract more buyers which directly helps boost up

the revenues of Kossans glove division.

2.2

Kossans Threats

Threats are unbeneficial situations in the external environment and arise of threats

able jeopardize the reliability and profitability of the organizations business.

i.

Strong completion in rubber glove industry

Strong competition in rubber glove industry is one of the threats for Kossan

Company. Malaysia is the largest exporter and producer of rubber gloves in the world

which is supplying 60.65% of the global requirements to rubber gloves. There is

strong competition between Kossan and other rubber glove industry in Malaysia such

as Latexx, Supermaxx, Hartalega and Top glove to differentiate own company in

terms of good bargaining power, branding and high value product. Top glove become

giant supplier with more bargaining power through gaining the highest market share

which is 27% among rubber glove industry in Malaysia and is planning to step up its

capacity to 43.1bn pieces in 2014. Supermax is the largest Original Brand

Manufacturer (OBM) rubber glove maker in Malaysia with 68% of its revenue

coming from its own brand. More and more glove maker shift toward premium

segment which includes powder frees nitrile gloves and nitrile gloves. Hartalega is the

world's largest nitrile glove producer which enjoys the highest profit margin among

its peers. There is also strong competition between Kossan and other rubber glove

industry in foreign country such as Thailand and Indonesia. This is because Thailand

and Indonesia offer cheaper labor cost and abundance of latex to produce rubber

glove compare to Malaysia. Thus, Kossan should produce high quality of rubber

glove to be competitive advantage among competitors.

ii.

Government policy factor

Government policy factor is another threat for Kossan Company.

Implementation minimum wage policy by government on July 2013 and increase in

electricity tariff by 17% effective January 2014 increase production cost of rubber

glove industry. There is another expected worst factor for Kossan which is 20%

Page 11

ATW 393 E/4 Strategic Management

increase in natural gas price in May 2014. Kossan face high pressure arising from

escalating production cost which give them a tough operating environment. This is

because rising production cost indirectly lead them face pricing pressure in this rubber

glove industry and will affect their operating profit. Thus, Kossan have to put much

effort on conduct some improvement program to minimize production cost and

improve quality of their rubber glove product.

iii.

High bargaining power of buyers

High bargaining power of buyers is the main threat for Kossan. Kossan are

predominantly original equipment manufacturers (OEM) with 95% in rubber glove

industry Malaysia who mainly sell their products to multinational healthcare

corporates (MNCs) such as Ansell, Kimberly Clark, Cardinal Health, Medline and

Microflex. All of these international brands have been establish a very strong foothold

in global healthcare market. This situation making Kossan face difficulties to build

their own brands, especially in some established western countries. High dependence

on MNCs eventually increases buyer bargaining power. Brand owners easily to switch

their orders for rubber glove from manufacturer to manufacturer or from one country

to another country especially on the period that capacity surplus is rising.

iv.

Pricing competition

Pricing competition is a threat for Kossan too. All glove makers in rubber

glove industry are boosting up their supply and want to produce more balance product

mix to take advantage from the rising demand for nitrile glove on the global. This

situation will lead to oversupply of rubber glove and potentially trigger a price war.

Thus, glove makers should halt certain production line and regulate their production

output to avoid oversupplying that cause price war.

v.

Foreign exchange rate risk

Foreign exchange rate risk is also the main threat for Kossan Company.

Currency fluctuation is a domestic issue and totally outside the control of exporter.

Currency fluctuations could hamper the growth of rubber gloves. A stronger RM

against US dollar is negative for the glove manufacturer given that more than 90% of

their revenues are from export businesses and their products are denominated in US$.

Therefore, Kossan Company is more emphasized more on export business thus

stronger ringgit against U.S. dollar will eventually hurt their business profit. Thus,

Page 12

ATW 393 E/4 Strategic Management

Kossan can mitigate the risk of currency fluctuation through forward contract which is

fix exchange rate against fluctuation.

2.3

Kossans Opportunities and Threats (Company Profile Matrix)

Opportunities

1 World demand for rubber gloves is growing

2 Expand production capacity in Malaysia and

emerging market

3 Landbank expansion

4 Decrease in price of Latex

5

6

7

8

9

Threats

Strong Competition

Government Policy Factor

High Bargaining power of Buyers

Price Competition

Currency Malaysia Fluctuation

Total

Table 1: Kossans Company Profile Matrix

Weight

Score

0.20

0.10

Kossan

Rating

Total

Score

4

0.80

3

0.30

0.10

0.10

3

4

0.30

0.40

0.20

0.05

0.10

0.10

0.05

1

2

1

2

2

1

0.40

0.05

0.20

0.30

0.05

2.80

Rating score: 4 - Major Strength; 3 - Minor Strength; 2 - Major Weakness; 1 - Minor

Weakness

Justification:

In overall, Kossan obtain the total score of 2.80. According to the table above,

we can know that world demand for rubber gloves is growing achieved the second

highest weight score which is 0.20 from the overall weight scores. This indicates that

the growth demand of rubber gloves provides an opportunity for Kossan to achieved

consistent growth in revenue and earnings in future which its rate as major strength.

Moreover, expand production capacity in Malaysia and emerging market, Landbank

expansion and decrease in price of Latex gained the weight score 0.10 respectively.

This is because Kossan aimed to meet the rising demand of gloves which is supply

meet with the demand of global needs, thus capacity expansion and Landbank

expansion also consider as important factor for Kossan and its is minor strength got

Kossan. Besides, decrease in prices of Latex achieved the weight score of 0.10 and

rate as minor strength for Kossan. This is because decrease in prices of Latex will

lower the raw material costs of Kossan and reduce the production costs.

Page 13

ATW 393 E/4 Strategic Management

On the other hand, from the table above, strong competition is the highest

weight score which is 0.20 and following by high bargaining power of buyers and

price competition which is 0.10 and then the lowest weigh score are government

policy factor currency Malaysia fluctuation which is 0.05. Strong competition, high

bargaining power of buyer and price competition also rate as major strength. This is

because Kossan has many rubber glove industrys competitors in and outside country

to compete gaining market share to become top leader in this industry. High

bargaining power of buyers lead to buyer easily switches to competitors. Price

competition leads to oversupply of rubber glove. Government policy factor and

currency Malaysia fluctuation are minor weaknesses for Kossan. Government

implement minimum wage policy has increasing production cost of rubber glove.

Kossan try to minimize this problem by conduct some improvement program for cost

reduction on products. Currency Malaysia fluctuation leads to unstable exchange rate

that will affect Kossans business profit.

Page 14

ATW 393 E/4 Strategic Management

2.4

Kossans Competitive Profile Matrix (CPM)

Critical Success Factors

Weight

Score

Kossan

Top Glove

Supermaxx

Rating Total Rating Total Rating Total

score

Score

Score

1. Quality/product/performance

0.20

1.60

1.80

1.60

2. Reputation and Image

0.10

0.80

0.90

0.80

3. Global expansion

0.15

1.35

1.35

1.20

4. New product innovation

0.15

1.05

1.20

0.90

5. Technological skills

0.15

1.20

1.35

1.20

6. Financial Performance

0.15

1.20

1.20

1.20

7. Global Distribution Network

0.10

0.80

0.90

0.70

capability

Total

8.00

8.70

7.60

Table 2: Kossans Competitive Profile Matrix

1 Very weak 10 Very strong

Justification:

1.

Quality/ product/performance

Quality/product/performance has the highest weigh score which is 0.20 shows

that this is an important critical success factor. Top Glove scored 9 whereas Kossan

and Supermaxx scored 8. Top Glove gets the highest rating score because it placed a

lot of emphasis R&D to produce a wide and diversified range of high quality products

and is the largest rubber glove manufacturer. Kossan and Suppermaxx score 8

because have less product line and production capacity compare with Top Glove.

2.

Reputation and Image

Reputation and image had the weigh score of 0.10. Top Glove scored highest

which is 9 compare to Kossan and Supermaxx which is rated as 8. Top Glove is world

class leader and biggest market share in rubber glove industry so its reputation and

image must be high. Kossan and Supermaxx also has a good reputation and image

because both of this company also ranked as top four in rubber glove industry

Malaysia which can deliver quality products for customer.

Page 15

ATW 393 E/4 Strategic Management

3.

Global Expansion

Global expansion had the weigh score of 0.15. Top Glove and Kossan scored

highest which are 9 whereas Supermaxx scored 8. Top Glove is exporting to 195

countries and produces 40.3 billion pair of glove annually which is located at

Malaysia, Thailand, and China. Kossan is exporting to 160 countries and producing a

stunning 3.9 billion pieces of gloves per annum. Both of these companies have strong

global expansion. On the other hand, Supermax currently exports to over 145

countries worldwide in the regions of America, has six own distribution centre United

States of America, Brazil, Europe, Australia and Canada. Supermaxx focus more on

export instead of expansion in foreign country.

4.

New product innovation capability

New product innovation capability had the weigh score of 0.15. Top Glove

scored the highest which is 8, followed by Kossan scored 7 and the lowest is

Supermaxx which is 6. Top Glove has invested substantially in machineries to ensure

that they can fully adopt the latest manufacturing techniques to produce good quality

of new products. Kossan carried out R&D and use high technology to innovate new

product such as invention of the industrys lightest weight NBR powder free glove (3

gram). Supermax continues its efforts on niche marketing and creates brand

differentiation through product innovation. Top Glove still is the best in product

innovation because Top Glove is largest manufacturer in the world and invested

heavily on technology on new product innovation.

5.

Technological Skill

The technological skill is weighted as 0.15. Top Glove is ranked as 9 in this

aspect while Kossan and Supermaxx are ranked as 8. This is because overall three of

the company has continuous improvement on the technology to improve the quality of

their products. Besides that, they have put efforts in implementing automation

technology to their production line to increase the efficiency.

6.

Financial Performance

Moreover, the financial performance is weighted 0.15 and three of the

companies are ranked as 8. According to the financial ratio that we have calculated,

Top Glove and Kossan still need to improve their management in liquidity of the

Page 16

ATW 393 E/4 Strategic Management

company because their ratio are extremely higher than other company while the

earning per share of Supermaxx is dropped year by year.

7.

Global Distribution Network

Global distribution network is weighted as 0.1 and Kossan, Top Gloves and

Supermaxx ranked as 8, 9 and 7 respectively. Kossan products are exported to more

than 160 countries worldwide; Top Glove products are exported to more than 195

countries worldwide; while Supermaxx products are exported to more than 145

countries worldwide. These three companies are putting efforts in exploring the new

market.

Page 17

ATW 393 E/4 Strategic Management

2.5

Kossans Strategic Group Map

High

Top Glove

Kossan

Distribution

Coverage

Latexx

Supermax

Hartalega

YTY

Brightway

High

Low

Competitive Pricing

Two key factors: (i) Distribution Coverage (ii) Competitive Pricing

Company Name

1.

2.

3.

4.

5.

6.

7.

Top Glove

Hartalega

Kossan

Latexx

YTY Group

Brightway

Supermaxx Manufacturing

Total

Revenue in year 2013

(RM in Billion)

RM 2,313,234,000

RM 1,032,035,687

RM 1,307,292,000

RM 427,387,154

RM 523,391,000

RM 193,219,100

RM 1,048,150,699

RM 6,844,709,640

Market Share (%)

33.80

15.08

19.10

6.24

7.65

2.82

15.31

100

*Assume that the revenue of the seven companies made up the overall revenue (100%)

of the industry in year 2013.

**All of the revenues mentioned above are quoted from respective companys annual

report 2013.

Page 18

ATW 393 E/4 Strategic Management

Chapter 3:

Kossans SWOT Analysis (Internal Analysis), Kossan Company Profile Matrix

(CPM) and Weighted Competitive Strength Assessment

3.0

Kossans Strength and Weaknesses (Internal Analysis)

An internal analysis is a review of an organizations strength and weaknesses.

A specific and detailed internal analysis allowed company have a good sense on its

basic competencies. Identify a companys strengths and weaknesses are important for

achieving goals which to help meet the requirements of potential customers and also

accomplish the organizations objectives.

3.1

Kossans Strength

Strengths are the beneficial aspects of the organization or the internal capabilities of

an organization that enables business to accomplish the organizations mission. Thus,

identify the characteristics and analyzing the strengths of a business is important

because these are the basis of pursue continued success in competitive business

environment.

i.

Profit Margin increase year by year

Based on the financial data that we have calculated we found that profit

margin of Kossan is increasing year by year. This is a very good strength of Kossan

because it is a good sign of improvement for Kossan. Profit margin is the differences

between net revenue and total expenses. Therefore, when profit margin increased, it

shows that either increasing of net revenue or decreasing of total expenses or

combination of both. A higher profit margin indicates that Kossan has a better control

over its costs compared with the competitors.

ii.

Good financial performance

Next, we noticed that Kossan has a good financial performance after review

the annual report of Kossan. Despite the challenging operating environment, it was

reported that the Kossan has achieved record growth in revenue and earnings for the

year 2013. During the year, Kossan reported a 30.1% growth in earnings which tops

all its peers within the glove manufacturing industry. In this current market

environment, this is a strong validation of Kossans business strategies.

Page 19

ATW 393 E/4 Strategic Management

iii.

Optimization of Production Process

Furthermore, Kossan has strength of optimization of production process. The

improved performance in overall profitability was significantly attributed to higher

glove demand across all Kossans product-mix, more effective cost control and better

production efficiency coupled with coordinated efforts in capacity expansion and

continuous research and development. Now, Kossan has 9 new production lines to

meet the demand of the market. This will increase the competitive advantages of

Kossan to fulfill the demand and compete with the rivals.

iv.

Variety of rubber glove products

In addition, Kossan has produced variety of products. Besides gloves, Kossan

also has produced other rubber products such as roller, PU product, colored EPDM

granules and so on. Variety of products lines is strength for Kossan because when one

of the product lines is down, Kossan still has other product line to support the

operation. It will not bring a huge effect for the financial and operation. If Kossan too

dependable to one product line, they will be meet bankrupt when there are serious

problem in that product line.

v.

Practice Corporate Social Responsibilities

Moreover, Kossan is also practicing Corporate Social Responsibilities (CSR).

This very encourageable because we should not only focus on driving sustainable

profit growth and interrupted returns for the shareholders but also need to caring

about the social and the environment. Kossan had organized many activities to

encourage the CSR such as charity visit to caring home in Klang, employees

engagement program, and so on. This will attracts the investors to invest in Kossan

and increase the loyalty of employees and customers.

vi.

Investing in human capital and Research and Development (R&D)

Last but not least, Kossan has put efforts in investing of human capital and

R&D. Human capital is a very important asset for a company because they are the

people who manage the operation. Besides that, R&D can help to improve the

production line and help to reduce the cost of production. Kossan was doing well in

this part. Therefore, Kossan can maintain its Top 5 in the rubber industry.

Page 20

ATW 393 E/4 Strategic Management

3.2

Kossans Weaknesses

Weaknesses are the internal attributes that prevent business form accomplish the

organizations mission. These weaknesses are the factors that will deteriorate

influences on the organizational success and growth. Therefore, analyzing the

weaknesses of organization enables business minimize and eliminate its weakness as

weaknesses are controllable.

i.

Increase of production cost

Based on the analysis, we notice that increase of production costs considered

as one of the weakness that Kossan faced. Basically, the increase of Kossans

production costs are resulted from the increase of utilities cost such as gas and

electricity. As we know Kossan is a manufacturer company that produces rubber

gloves, therefore a lots of electricity was required during the manufacturing process

and this causes Kossan have to undertake the higher production costs of rubber gloves.

For instance, based on the data that we founded, Malaysias current average tariff rate

is 33.5 sen per kWh (kilowatt-hour) which is 8.5 sen or 25.3% that below the real cost

which 42 sen per kWh. Therefore, if government gradually remove the fuel

subsidiaries, the indicative tariff rate would be increase to around 42 sen per kWh.

This

indicated

that

Kossan

will

face

the

increase

of

utilities

costs.

Moreover, minimum wages policy was established on 1 January 2013 by government

had incurred increases of the Kossans labour cost which also contributes to the

increase of production cost. Lastly, the natural gas price was approximately increase

around 20% in year 2014 also risen the production costs of Kossan.

ii.

Shortage of worker

Expansion of capacity requires more workers to run the production process.

On the other hand, Kossan lacks of skilled foreign worker, especially in production

process, as foreign labor constitutes a big portion of glove manufacturers workforce.

Besides, efficiency of technology has prompted glove manufacturers to reduce the

using of manpower and move towards automation. This will allow Kossan to enjoy

the benefits of economies of scale.

Page 21

ATW 393 E/4 Strategic Management

iii.

Low Automation

"We're looking to transform our operations to another level. That's why we

need to build high efficiency plants and have extra capacity to include far more

automation and to do away with foreign workers. The glove industry will no longer be

labour intensive going forward and the output per worker can be high as the whole

production line, including packing, can be automated. For the next two years, workers

in the glove industry could be cut down by some 40%." the CEO Lim Kuang Sia said.

This shows that Kossan has great dependence on workers and that contributes to

higher labor cost. Higher degree of dependence on worker may cause worker to have

more bargaining power against employer. We can also know that Kossan has not yet

ready for optimize automation and not yet greatly benefit from technology.

3.3

Kossans Strength and Weaknesses (Company Profile Matrix)

Strength

1

2

3

4

5

6

Weight

Score

Increase of Profit Margin

Good financial performance

Optimization of Production Process

Variety of Product

Practice Corporate Social Responsibilities

Investing in Human Capital and R&D

Weaknesses

4 Increase of Production Cost

5 Shortage of Worker

6 Low Automation

0.20

0.15

0.10

0.10

0.05

0.10

0.15

0.15

0.10

Total

Kossan

Strength

Total

Rating

9

1.80

8

1.20

8

0.80

8

0.80

7

0.35

7

0.70

8

7

6

1.20

1.05

0.60

8.50

1 Very weak 10 very strong

Justification:

In overall, Kossan obtain the total score of 7.9. From the table above, the

strength which is increase of profit margin was weighted 0.2 scores and Kossan gains

9 scores because the profit margin of Kossan is increased from year 2011 to 2013 and

this indicated that Kossan has a good control over its costs and able to generate more

income with each dollar of sales. Good financial performance is set a weight of 0.15

and Kossan gains 8 scores because from the overall financial management Kossan

Page 22

ATW 393 E/4 Strategic Management

was done well in this area. Next, optimization of production process, variety of

product and investing in human capital and R&D are set at weight of 0.1 and Kossan

gains 8 scores, 8 scores and 7 scores respectively. This is because Kossan had put

efforts in innovation in those areas so that they can maintain Top 5 in the rubber

industry. Lastly, practice corporate social responsibilities is set at weight of 0.05 and

Kossan gains 7 scores because Kossan had been involved in CSR contribution since

many years ago.

In addition, based on the table above, increase of production cost, shortage of

labor and low automation of Kossan has been weigthed 0.10 respectively. Increase of

production has been rated the highest score, which is 8, among the three weaknesses

because higher production cost will have greater impact on company, such as lower

profit and lower market share. Shortage of worker was rated 7 and low automation

rated the least score, which is 7, among the three weaknesses. The last two

weaknesses have smaller impact than that of production cost.

3.4

Weighted Competitive Strength Assessment

A competitive strength assessment is important for a company this is because its act

as a tool for a company to assess the companys competitive situation.

KSF/Strength

Measure

Quality/Product

performance

Reputation and Image

Financial Resources

Technological skills

Global Distribution

Network

Global Market Share

New Product

Innovation

Sum of Weights

Overall Strength

Rating

Weight

Kossan

Strength

Score

Rating

Top Glove

Strength

Score

Rating

Supermaxx

Strength

Score

Rating

0.20

1.60

1.80

1.60

0.15

0.15

0.10

8

8

8

1.20

1.20

0.80

9

8

9

1.35

1.20

0.90

8

8

8

1.20

1.20

0.80

0.15

1.20

1.35

1.05

0.10

0.80

0.90

0.70

0.15

1.05

1.20

0.90

1.0

Rating Scale: 1 Very weak

7.85

8.70

7.45

10 Very strong

Page 23

ATW 393 E/4 Strategic Management

Justification:

i.

Quality/products performance

Quality or product performance is a very important key success factor for a

company and hence it is weighted 0.20. Kossan and Supermaxx are rated 8 while Top

Glove is rated 9 as its products performance outperforms its competitors. Kossan and

Supermaxx have relatively same quality of products.

ii.

Reputation and image

Reputation and image is weighted 0.15.Kossan and Supermaxx having the

almost same level of reputation and image so they are rated 8. Top Glove gained the

greatest market share in Malaysias rubber industry. This has built up its strong

company reputation and image. Thus, Top Glove is rated 9. These companies are one

of the top 10 companies in Malaysias rubber industries.

iii.

Financial Resources

Financial resource is important for a company to keep operating so it is

weighted 0.15. Kossan, Top Glove and Supermaxx are rated 8 as they have different

strengths in their financial performances. They are able to use the financial resources

available to generate higher than moderates net profit margin.

iv.

Technological skill

Technological skills in a key towards cost effectiveness and it is weighted 0.10.

Kossan and Sopermaxx are rated 8 while Top Glove is rated 9. Top Gloves

technological skill has outperforms its competitors and thus it is able to lower its cost

and achieve higher profit than its competitors do.

v.

Global Distribution Network

Global distribution network gained the weigh score which is 0.15 shows that it

also plays an important role for company to operate its business. Top Glove had

scored 9; Kossan scored 8 and Supermaxx get the lowest scored which is 7. The

reason that Top Glove gets the highest score is because Top Glove had distribute its

product over 195 countries and this indicates that Top glove have strongest distributes

network against Kossan and Supermaxx which is 160 countries and 145 countries.

Page 24

ATW 393 E/4 Strategic Management

vi.

Global Market Share

Global market share weighted the score of 0.10. Top Glove gained the highest

score which is 9; followed by Kossan 8 and the lowest score is Supermaxx which is 7.

The bigger market share means the greater performance had done by the company

against others company in the industry. The market capitalization of Top Glove

achieved RM 2,313,234,000 billion, Kossan achieved RM 1,307,292,000 billion and

Supermaxx achieved RM1, 048,150,699 billion. This indicated that Top Glove

achieved the highest market share in rubber glove industry as Top Glove gained the

high profit in rubber glove compare to Kossan and Supermaxx.

vii.

New Product Innovation

New product innovation is important for company to sustain themselves in this

competitive business environment. Thus, new product innovation had weighed score

of 0.15. Top Glove scored the highest score of 8; followed by Kossan 7 and

Supermaxx gained the lowest score of 6. The reason that Top Glove gained the best in

the product innovation is because Top Glove always upgrades its current rubber glove

products which Top Glove had around 19 rubber gloves with different quality and

function compare to Kossan and Supermaxx.

Page 25

ATW 393 E/4 Strategic Management

Chapter 4:

Kossans Financial Ratio Analysis and Comparison of Financial Performance in

the Malaysian Rubber Glove Industry

4.0

Kossans Financial Ratio Analysis

There is several purpose of company to calculate financial ratio. Financial ratios can

be an important tool for business owners and managers to measure their progress

toward reaching the company goals. Besides that, financial ratios can enable company

to examine the relationships between items and measure that relationship.

4.1

PART 1: Profitability Ratios

Kossan

Year/ RM

Operating Profit Margin

2011

MYR

(RM 000)

43,930

139,414

= 0.32

Net Profit Margin

42,954

139,414

= 0.31

Return On Assets

42,954

233,806

= 0.18

Return On Shareholders

42,954

Equity

215,969

= 0.20

Earnings Per Share

89,192

318,644

= 0.28

Table 1:

Kossans Profitability ratios

2012

MYR

(RM 000)

2013

MYR

(RM 000)

46,888

153,140

= 0.31

45,595

153,140

= 0.30

45,595

258,291

= 0.18

45,595

232,888

= 0.20

102,163

318,620

= 0.32

166,268

286,444

= 0.58

166,426

286,444

= 0.58

166,426

381,236

= 0.44

166,426

362,229

= 0.46

136,422

639,468

= 0.21

Page 26

ATW 393 E/4 Strategic Management

Operating Profit Margin

70%

60%

50%

40%

Operating Profit Margin

30%

20%

10%

0%

2011

Figure 1.1

1.

2012

2013

Kossans Operating Profit Margin

Operating Profit margin

Operating profit margin is calculated by using operating income divide sales

revenue. It is a measure of profitability and it is also a measure of managerial

flexibility and competency. The higher the operating margin, the more profitable a

companys core business.

Operating profit margin shows the profitability of current operations without

regard to interest charges and income taxes. Higher is better and the trend should be

upward. Kossans operating profit margin dropped from year 2011 to 2012 which is

from 32% 31% and increase back to 58% in 2013. This shows that Kossan operated

well in year 2013.

Net profit margin

70%

60%

50%

40%

Net profit margin

30%

20%

10%

0%

2011

Figure 1.2

2.

2012

2013

Kossans Net profit Margin

Net Profit Margin

Net profit margin is calculated by using net income divide net sales. It also

known as net income as a percentage of net sales is to measure the profitability of

sales. It is to evaluate how efficient a company is and how well it controls its costs.

Page 27

ATW 393 E/4 Strategic Management

Net profit margin shows after-tax profits per dollar of sales. Kossans net

profit margin had also decreased from 31% in year 2011 to 30% in year 2012 and

increased back to 58% in 2013. While net profit margin indicates how well a

company can generate net income from revenue, we can see that Kossan did well in

generating net income, may be resulted from expansion of capacity.

Return on assets

0.5

0.4

0.3

Return on assets

0.2

0.1

0

2011

Figure 1.3

3.

2012

2013

Kossans Return on Assets

Return on Assets

Return on assets is the ratio of annual operating income to the average total

assets of a company. This ratio is important in measuring the productivity of assets by

the returns provided.

Return on assets of Kossan remain stable at 0.18 in year 2011 and 2012 and

increased to 0.44 in year 2013. Kossan did well in utilizing its assets while increasing

its assets.

Return on shareholders' equity

0.5

0.4

0.3

Return on shareholders'

equity

0.2

0.1

0

2011

Figure 1.4

2012

2013

Kossans Return on Shareholders Equity

Page 28

ATW 393 E/4 Strategic Management

4.

Return on Shareholders Equity

Return on equity is the amount of net income returned as a percentage of

average shareholders equity. This ratio is used to measure the rate of return on

stockholders' investment that shows the efficient management of a company at using

its assets to generate earnings.

Kossans return on shareholders equity also remain stable at 0.20 in year

2011 and 2012 and climbed back to 0.46 in year 2013. Kossan has had improvement

in financing its shareholders investment.

Earning Per Share

RM0.35

RM0.30

RM0.25

RM0.20

Earning Per Share

RM0.15

RM0.10

RM0.05

RM0.00

2011

Figure 1.5

5.

2012

2013

Kossans earning per share

Earnings Per Share(EPS)

Earnings per share can be obtained by dividing the profits after taxes by the

weighted average number of issued ordinary shares. These shows that the earnings

available to the owners of each share of common stock. This ratio serves as an

indicator of a company's profitability in determining the market share's price.

Earnings per share (EPS) shows the earnings generated from the share.

Although Kossans EPS had increased from RM0.28 in year 2011 to RM0.32 in year

2012, but it dropped to RM0.21 in year 2013. Kossan has to revise its business

strategy to generate more income from its shares.

Page 29

ATW 393 E/4 Strategic Management

4.2

PART 2: Liquidity Ratios

Kossan

Year/ RM

Current Ratio

Quick ratio

Cash Ratio

Working Capital

2011

MYR

(RM 000)

2012

MYR

(RM 000)

2013

MYR

(RM 000)

174,553

13,203

= 13.22

174,553- 16,753

13,203

= 11.95

33,084

13,203

= 2.51

174.553- 13,203

= 161,350

202,433

20,771

= 9.75

202,433- 14,678

20,771

= 9.04

68,344

20,771

= 3.29

202,433- 20,771

= 181,662

322,464

14,801

= 21.79

322,464- 15,100

14,801

= 20.77

50,976

14,801

= 3.44

322,464- 14,801

= 307,663

Table 2:

Kossans Liquidity ratios

Figure 2.1

Kossans Current Ratio

Current Ratio

25

20

15

Current Ratio

10

5

0

2011

1.

2012

2013

Current Ratio

Current ratio can be calculated by using current assets divided by current

liabilities. Basically, current ratio is used to test the liquidity of a company ad measure

the ability of the company to pays its short-term obligation. The higher the ratio, the

more capable the company is paying its obligations. Figure 2.1 had shown that the

current ratio of Kossan from year 2011 to year 2013.

Kossans current ratio has decreased from 13.22 in year 2011 to 9.75 in year

2012 and increased to 21.79 in year 2013. The current ratio above 1 shows better

Page 30

ATW 393 E/4 Strategic Management

liquidity of company because its means total current assets are exceed total current

liabilities. However, based on the ratio that we calculated, Kossan current ratio shows

abnormally high value of current ratio which indicated existence of underutilized

resources in the company.

Quick Ratio

25

20

15

Quick Ratio

10

5

0

2011

Figure 2.2

2.

2012

2013

Kossans Quick ratio

Quick ratio

Quick ratio can be calculated by using current assets- inventories divided by

current liabilities. Basically, quick ratio is an indicator of a company short-term

liquidity and it used for measures a companys ability to meet its short-term

obligations with its most liquid assets. Figure 2.2 had shown the quick ratio of Kossan

from year 2011 to year 2013.

In year 2011 the quick ratio of Kossan was 11.95 and decrease to 9.04 in year

2012. However, it was increase again to 20.77 in year 2013. This means that in year

2011, 2012 and 2013 Kossan has 11.95, 9.04 and 20.77 of liquid assets available to

cover the current liabilities in each year respectively. This means that Kossan has no

problem in meeting its financial obligation.

Page 31

ATW 393 E/4 Strategic Management

Cash Ratio

4

3

Cash Ratio

2

1

0

2011

Figure 2.3

3.

2012

2013

Kossans Cash Ratio

Cash ratio

Cash ratio can be calculated by using cash divided by current liabilities.

Basically, cash ratio is measure the ability of company to repay its current liabilities

by only using cash. Figure 2.3 had shown the cash ratio of Kossan from year 2011 to

year 2013.

Cash ratio that above 1 means that the company able pay all its current

liabilities. Kossan had achieved cash ratio of 2.51 in year 2011, 3.29 in year 2012 and

3.44 in 2013. This shows that Kossan cash ratio had increased year by year which

mainly due to the company having more cash and cash equivalent asset over the year.

Working capital

350,000

300,000

250,000

200,000

Working capital

150,000

100,000

50,000

0

2011

Figure 2.4

4.

2012

2013

Kossans working capital

Working Capital

Working capital can be calculated by using current assets minus current

liabilities. Positive working capital means that company has enough capital to run its

day to day operations and has sufficient short-term financial term to cover current

Page 32

ATW 393 E/4 Strategic Management

liabilities. Figure 2.4 had shown the working capital of Kossan from year 2011 to year

2013.

The working capital of Kossan had increased from 161,350 in year 2011 to

181,662 in year 2012. However, the working capital in year 2013 had increased into

307,663. In brief, the working capital of Kossan increase by year and its indicated that

Kossan have sufficient short term assets to cover its short term liabilities.

4.3

PART 3: Leverage Ratios

Kossan

Year/ RM

2011

MYR

(RM 000)

17,837

Total debt-to-assets

233,806

ratio

= 0.076

17,837

Total debt-to-equity

215,969

ratio

= 0.083

14,859

Average

Collection

139,414/365

Period

= 38.90 (39 days)

Table 3:

Kossans Leverage Ratios

2012

MYR

(RM 000)

25,403

258,291

= 0.098

25,403

232,888

= 0.109

19,878

153,140/365

= 43.38 (44 days)

2013

MYR

(RM 000)

19,007

381,236

= 0.050

19,007

362,229

= 0.052

24,571

286,444/365

= 31.31 (32days)

Total debt-to-assets ratio

0.1

0.08

0.06

0.04

0.02

0

2011

2012

2013

Total debt-to-asset ratio

Figure 3.1

1.

Kossans Total debt-to-assets ratio

Total Debt-to-assets ratio

Total debt-to-assets ratio is an indicator of financial leverage. It was calculated

by dividing companys total liabilities by its total assets. If the ratio is less than 1,

Page 33

ATW 393 E/4 Strategic Management

most of the companys assets are financed through equity. On the other hand, if the

ratio greater than 1, most of the companys assets are financed by debts. Therefore,

the higher the ratio, the higher the financial risk will be associated with the company.

Based on Figure 3, the ratio is increased from year 2011 to 2012 then dropped

in year 2013. This means that Kossan had inquired assets through debts in year 2012

while in year 2013 Kossan inquired most of the companys assets through equity.

However, the ratio of Kossan is less than 1 so the financial risk that associated with

the company is low. Kossan is managed their assets well.

Total debt-to-equity ratio

0.12

0.1

0.08

0.06

0.04

0.02

0

2011

2012

2013

Total debt to equity ratio

Figure 3.2

2.

Kossans Total debt-to-equity ratio

Total debt-to-equity-ratio

Total debt-to-equity ratio measure the riskiness of a companys financial

structure. It was calculated by dividing the companys total liabilities by the total

equity. A high total debt-to-equity ratio indicated that a company was aggressive in

financing its growth with debt.

Based on Figure 3.2, the ratio is increased from year 2011 to 2012 and

decreased in year 2013. The ratio shows that Kossan was done well in managing its

equity and financial issues because Kossan did not need to acquire more debt to

manage the cash shortfall or use the debt to repurchase stocks.

Page 34

ATW 393 E/4 Strategic Management

Average Collection Period

45

40

35

30

25

20

15

10

5

0

2011

2012

2013

Average Collection Period

Figure 3.3

3.

Kossans Average collection period

Average Collection Period

The average collection period defined as the average number of days that

needed to collect the invoiced amount from the customers. This is used to measure the

effectiveness of companys credit granting policies and collection effort.

It is

calculated by dividing the average accounts receivables by the average credit sales per

day (annual sales divided by 365 days).

From the Figure 3.3, the average collection period increased from 2011 to

2012 and decreased in year 2013. The increasing of average collection period maybe

due to looser credit policies, worsening economy and reduced of collection effort. On

the other hand, the decreasing of average collection period maybe due to tighter credit

policies, reduced of term and increased of collection effort. However, Kossan

maintains the period among 30 days to 45 days and this is considered good

management in the collection debts.

Page 35

ATW 393 E/4 Strategic Management

4.4

PART 4: Market Analysis Ratio

Kossan

Year/ RM

2011

MYR

(RM 000)

Dividend Yield

0.08

1.625

= 4.92%

Price Earning Ratio

1.625

0.28

= 5.8

Table 4:

Kossans Market Analysis Ratio

2012

MYR

(RM 000)

2013

MYR

(RM 000)

0.04

1.65

= 2.42%

1.65

0.32

= 5.16

0.07

4.32

= 1.62%

4.32

0.21

= 20.52

Dividend yield

6.00%

5.00%

4.00%

3.00%

Dividend yield

2.00%

1.00%

0.00%

2011

Figure 4.1

1.

2012

2013

Kossans Dividend yield

Dividend Yield

Dividend yield can be calculated by using annual dividend per share divided

by its market price per share. Dividend yield means the percentage of after tax profit

paid out as dividends. The higher the dividend paid out, the more mature and well

establish of a company. Figure above shows dividend yield from years 2011 until

2013.

Dividend yield of Kossan shows unstable growth throughout years 2011 to

years 2013. Dividend yield in 2011 was 4.92% and decreased to 2.42% in 2012 and

then continued dropped to 4.92% in 2013. This trend indicates that Kossan has

unstable earnings growth due to strong competition from its competitor in rubber

glove industry that lead to Kossan paid out lesser and lesser from year to year.

Page 36

ATW 393 E/4 Strategic Management

Price earning ratio

25

20

15

Price earning ratio

10

0

2011

Figure 4.2

2.

2012

2013

Kossans Price earnings ratio

Price Earnings Ratio

Price-earnings ratio can be calculated using market price per share divided by

annual earnings per share. A faster-growing or less risky firm tends to have higher

price-earnings ratios than slower growing or more risky firms. P-e ratios above 20

indicate strong investor confidence in a firms outlook and earnings growth whereas

firms whose future earnings are at risk or likely to grow slowly typically have ratios

below 12.

Price-earnings ratio of Kossan in 2013 was the best among three years. P-e

ratio in 2011 was 5.8 and decreased to 5.16 in 2012 but suddenly boost up to 20.52 in

2013. This shows that Kossan has a strong firms outlook that increases investor

confidence and more stable future earnings growth due to its good technology and

variety of product line in 2013.

Page 37

ATW 393 E/4 Strategic Management

4.5

Comparison of Financial Performance in the Malaysian Rubber Glove

Industry.

Part 1: Profitability ratio

2012

Kossan

Top Glove

Supermaxx

Net Profit Margin

0.30

0.96

Return On Assets

0.18

0.32

0.01

Return On

0.20

0.32

0.01

0.32

0.35

0.18

Shareholders Equity

Earnings Per

Share(EPS)

In year 2012, Top Glove got the highest net profit margin, 0.96 or 96%,

among the three companies compared followed by Kossan 0.30 or 30% while the data

of Supermaxx is not available here. This shows that Top Glove has better operating

system and sales than the other two companies do.

Top Glove got 0.32, followed by Kossan, 0.18 and then Supermaxx, 0.01. Top Glove

has stronger capability in utilizing its assets than Kossan and Supermaxx do.

Supermaxx did very poor in this part that may result from its excess assets which are

not utilized.

The return on shareholders equity of Top Glove is the highest, 0.32, followed

by Kossan, 0.20 then Supermaxx, 0.01. Top Glove has well used its shareholders

equity at the right places such as investment and assets while Supermaxx did not do

so. Supermaxx may hold too much equity in hand and did not use it wisely.

The EPS of Top Glove highest among the companies compared, which is 0.35

followed by Kossan, 0.32 and Supermaxx, 0.18. The amount of ordinary share was

just enough for the companies to generate greater earnings.

Page 38

ATW 393 E/4 Strategic Management

2013

Kossan

Top Glove

Supermaxx

Net Profit Margin

0.58

0.95

0.68

Return On Assets

0.44

0.19

0.03

Return On

0.46

0.19

0.04

0.21

0.23

0.18

Shareholders Equity

Earnings Per

Share(EPS)

Net profit margin of Top Glove has dropped to 0.95, yet did not bring much

impact and it is still the highest score among the three companies compared. The net

profit margin of Supermaxx and Kossan has increased to 0.68 and 0.58 respectively.

This shows that they have tried hard in improving their business performance

especially in their products variability and performance.

Return of assets of Top Glove has dropped to 0.19 while Supermaxx and

Kossan have experienced an increase in that, which are 0.03 and 0.44 respectively.

Kossan has increased and well used its assets in year 2013 and thus has the highest

return on assets among the three companies. The decrease of return on assets of Top

Glove may result from its decrease in its assets.

Return on shareholders equity of Top Glove has decreased to 0.19 which may

due to decrease in equity provided by shareholders. Supermaxx and Kossan have had

improvement. They got 0.04 and 0.46 respectively. Kossan had its equity increase in

year 2013.

Top Glove and Kossan have experienced decrease in EPS, which are 0.23 and

0.21 respectively, while Supermaxx still maintaining at 0.18. In year 2013, both Top

Glove and Kossan were unable to generate greater EPS that may due to increase in

ordinary share.

Page 39

ATW 393 E/4 Strategic Management

PART 2: Liquidity Ratio

2012

Kossan

Top Glove

Supermaxx

Current Ratio

9.75

4.79

10.66

Cash Ratio

3.29

0.84

0.02

In year 2012, we noticed that the current ratio of Top Glove gained the lowest

current ratio that is 4.79 which indicates that Top Glove had sufficient ability to pays

its obligations. However, based on the table above, we also noticed that Kossan and

Supermaxx current ratio shows abnormally high value which is 9.75 and 10.66

respectively. This showed that this two company is too liquid and they had

underutilized its resources which is they do not uses its assets effectively.

Moreover, the cash ratio of Kossan showed the highest among Top Glove and

Supermaxx. Kossan had achieved cash ratio of 3.29 which indicated that Kossan able

repay its current liabilities by using cash where Top Glove and Kossan are less

capable to its current liabilities by using cash.

2013

Current Ratio

Cash Ratio

Kossan

Top Glove

Supermaxx

21.79

21.93

5.10

3.44

1.28

0.01

In year 2013, we noticed that the current ratio of Top Supermaxx gained the

lowest current ratio that is 5.10 which indicates that Supermaxx had sufficient ability

to pays its obligations. However, based on the table above, we also noticed that

Kossan and Top Glove current ratio shows abnormally high value which is 21.79 and

21.93 respectively. This showed that this two company is too liquid and they had

underutilized its resources which is they do not uses its assets effectively.

Moreover, the cash ratio of Kossan showed the highest among Top Glove and

Supermaxx. Kossan had achieved cash ratio of 3.44 which indicated that Kossan able

repay its current liabilities by using cash where Top Glove and Kossan still less

capable to its current liabilities by using cash.

Page 40

ATW 393 E/4 Strategic Management

PART 3: Leverage Ratios

2012

Total

debt-to-asset

ratio

Total debt to equity

ratio

Kossan

Top Glove

Supermaxx

0.098

0.00178

0.22

0.109

0.00178

0.28

In year 2012, the total debt-to-asset ratio for Top Glove is the lowest among

the three companies. However, the total debt-to-asset ratio for Kossan, Top Glove and

Supermaxx is less than 1 and the data shows that most of their assets are financed

through equity. Three of the companies are considered as have low financial risk

associated with company.

On the other hand, the total debt-to-equity ratio for Top Glove is the lowest

among the three companies. The ratio for total debt-to-asset and debt-to-equity of Top

Glove are same because Top Glove financed their assets and equity equally through

debts. However, Supermaxx shows that they are more aggressive in financing the

companys growth with debts.

2013

Total

debt-to-asset

ratio

Total debt to equity

ratio

Kossan

Top Glove

Supermaxx

0.050

0.00202

0.23

0.052

0.00202

0.30

In year 2013, the debt-to-asset ratio for Top Glove is still the lowest among

three companies but the ratio has increased compared with year 2012 and this

condition also happen in Supermaxx. Kossan is the only one company where the ratio

has decreased. This means that Kossan has improved their management on financing

and reduced the financing assets through debt.

Furthermore, the debt-to-equity ratio for Supermaxx is the highest among the

three companies. The ratio for Top Glove and Supermaxx are increased from year

2012 to 2013. It shows that they are increasing the financing of equity through debt

while Kossan reduce the depending on debt to finance the growth of company. This

means that Kossan is managing their growth better than Top Glove and Supermaxx.

Page 41

ATW 393 E/4 Strategic Management

Part 4: Market Analysis Ratio

2012

Dividend Yield

Price Earnings Ratio

Kossan

Top Glove

Supermaxx

2.42%

2.70%

2.7%

5.16

17.20

11.0

In year 2012, Top Glove and Supermaxx had same dividend yield which

was2.70% whereas Kossan dividend yield was 2.42%. It showed that Supermaxx and

Top Glove were more matured, well established and more stable earning growth

compare to Kossan because both of these companies had higher dividend point than

Kossan. Besides, Top Glove achieved the highest price earnings ratio which was

17.20, and then followed by Supermaxx, 11.0 and Kossan had the least price earnings

ratio which was 5.16. Top Glove was the fastest growing and less risky company

compared to Supermaxx and Kossan because it had the higher price earnings ratio

compared to both of these companies.

2013

Kossan

Top Glove

Supermaxx

Dividend Yield

1.62%

2.80%

3.1%

Price Earnings Ratio

20.52

17.90

9.8

In year 2013, dividend yield of Kossan had decreased to 1.62% whereas

dividend yield of Top Glove and Supermaxx had increased to 2.80% and 3.10%

respectively compare to 2012. Supermaxx had the highest dividend yield among 3

companies. It shows that Supermaxx experiencing a more matured and stable earnings

growth in 2013 whereas Kossan experiencing unstable earnings growth due to strong

competition in rubber glove industry that lead to Kossan paid out lesser and lesser

dividend from year 2012 to year 2013. Besides, Kossan achieved the highest price

earnings ratio among 3 companies among 2013 which was 20.52 and it was totally

different with 2012 which Kossan had the lowest price earnings ratio, 5.16 in 2012

whereas Supermaxx had decreased to 9.80% and Top Glove had increased slightly to

17.90%. It shows that Kossan had a stronger firms outlook that increases investor

confidence and less risky company in 2013 compare with other 2 competitors.

Page 42

ATW 393 E/4 Strategic Management

Chapter 5:

Formulate Strategies SWOT Matrix; SPACE Matrix and BCG Matrix

5.1

SWOT Matrix

SWOT Analysis is a useful technique that use for evaluate companys

strengths, weaknesses, opportunity and threats. In order to examine the companys

SWOT where these technique assists our group to come out construct strategies for

Kossan Company. A SWOT Matrix for Kossan is constructed as below.

Internal Strength (S)

Internal Weakness (W)

1. Profit Margin increased

year by year

2. Good financial performance