Académique Documents

Professionnel Documents

Culture Documents

Zakat Calculator

Transféré par

Shahid MaqsoodTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Zakat Calculator

Transféré par

Shahid MaqsoodDroits d'auteur :

Formats disponibles

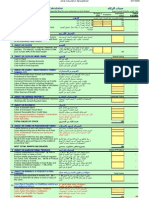

Zakat Calculator

Just fill-in the provided fields and Zakat payable will be calculated automatically!

The value of assets on which Zakat is payable should be valued using the following system:

1. Gold/Silver in any shape/form for any purpose (value after deducting cost of stones and impurities-Khot)

2. Value of land, house, building which is purchased for onward sale

3. Cash in hand, Deposits with Banks or with any other person as Amanat (Custody)

4a. Foriegn Currency

4b. Prize Bonds

4c. Insurance Premium already paid

4d. Amount Deposited/paid for Hajj

4e. Loans which are recievable

4f. Amount deposited against BC (Committee)

4g. Deposit against Imports (LC Margin)

4h. Payment made to banks for goods

4i. Investment as a partner in any business

4j. Savings certificates of all sorts (such as NIT, NDFC, FEBC)

4k. Provident Fund which is deposited with employer

4l. Raw materials

4m. Value of goods sold & payment of which is recievable

Total Value of Assets

DEDUCTIONS: You have to deduct the following before calculating Zakat Payable

5. Loans which are payable

6. Mehar Payable

7. Value of goods that are bought on credit

8. Balance installment of BC which you have already received

9. Salaries of staff which are payable for this month

10. Rent payable

11. Taxes Payable

12. Utility Bills Payable

13. Other Liabilities

Total Deductions

Net Value of Assets

Total Value of Assets

Less Total Deductions

Net Value on which Zakat is Payable

Zakat Payable = 2.50% of Net Value of Assets = ** Rs.

** All calculations are based on the Islamic Calendar Year. To calculate Zakat for the English Calendar Year, use 2.58% of Ne

Value of Assets.

ally!

wing system:

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

ayable

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

ar Year, use 2.58% of Net

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Custom Tambola Housie Tickets PDFDocument5 pagesCustom Tambola Housie Tickets PDFFaizan MotiwalaPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Pre Post TestDocument7 pagesPre Post TestFaizan MotiwalaPas encore d'évaluation

- License PremiumDocument1 pageLicense PremiumNguyen Viet Trung (FPL HCMK13.3)100% (1)

- Iris - Help by FBRDocument5 pagesIris - Help by FBRGulzar Ahmad RawnPas encore d'évaluation

- 1-25 BINGO: Safety First!Document17 pages1-25 BINGO: Safety First!Faizan MotiwalaPas encore d'évaluation

- Internship Report MTMDocument45 pagesInternship Report MTMusmanaltafPas encore d'évaluation

- CMA Positions: Dawn Sunday October 11, 2015 - Page 4Document27 pagesCMA Positions: Dawn Sunday October 11, 2015 - Page 4Faizan MotiwalaPas encore d'évaluation

- Limiting Factor AnalysisDocument5 pagesLimiting Factor AnalysisFaizan MotiwalaPas encore d'évaluation

- Spinning Project Profile FinalDocument23 pagesSpinning Project Profile FinalFaizan Motiwala67% (3)

- CBE Shedule Quarterly Winter 2015 FinalDocument1 pageCBE Shedule Quarterly Winter 2015 FinalFaizan MotiwalaPas encore d'évaluation

- Business Finance SyllabusDocument68 pagesBusiness Finance SyllabusKhalid Mahmood0% (1)

- برنامج حساب زكاه المالDocument3 pagesبرنامج حساب زكاه المالnewlife4me100% (10)

- Maintenance Schedule For Gas Genset - GE JENBACHERDocument5 pagesMaintenance Schedule For Gas Genset - GE JENBACHERrajputashi92% (12)

- Appointment of AuditorDocument16 pagesAppointment of Auditorshahnawaz243Pas encore d'évaluation

- Jumbo Touch Remote ImDocument18 pagesJumbo Touch Remote ImFaizan MotiwalaPas encore d'évaluation

- Et Set 4 Update 14 ScreenDocument2 pagesEt Set 4 Update 14 ScreenFaizan MotiwalaPas encore d'évaluation

- Spinning MillDocument6 pagesSpinning MillAnand Arumugam0% (1)

- ICSP Company Law Paper Suggested Answer 2013Document8 pagesICSP Company Law Paper Suggested Answer 2013Faizan MotiwalaPas encore d'évaluation

- Ets Ust 3 Update 14 ScreenDocument2 pagesEts Ust 3 Update 14 ScreenFaizan MotiwalaPas encore d'évaluation

- MPF Card FormDocument2 pagesMPF Card FormFaizan MotiwalaPas encore d'évaluation

- Chairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Document26 pagesChairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Faizan MotiwalaPas encore d'évaluation

- Budgeting ExampleDocument17 pagesBudgeting ExampleBikrOm BaRuaPas encore d'évaluation

- Formula SheetDocument2 pagesFormula SheetFaizan Motiwala100% (1)

- Professional CmaDocument3 pagesProfessional CmarehankhananiPas encore d'évaluation

- Operations Management IsDocument6 pagesOperations Management IsFaizan MotiwalaPas encore d'évaluation

- Sohail ResumeDocument2 pagesSohail ResumeFaizan MotiwalaPas encore d'évaluation

- Sohail ResumeDocument2 pagesSohail ResumeFaizan MotiwalaPas encore d'évaluation

- Operations Management IsDocument6 pagesOperations Management IsFaizan MotiwalaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)