Académique Documents

Professionnel Documents

Culture Documents

Cash Flow

Transféré par

adsakljfnmdskl0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues1 pageCopyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues1 pageCash Flow

Transféré par

adsakljfnmdsklDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

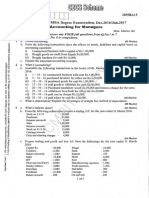

Cash Flow Analysis

APPLICANT'S NAME: ___________________________________________

Daily Weekly Monthly Monthly Totals

Income from Business (Gross)

Business 1 -

Business 2 -

Business 3 -

Total Business Income (A) - - - -

Business Expenses

Raw Materials/Purchases -

Business 1 -

Business 2 -

Business 3 -

Labor -

Rent -

Utilities (electricity & water) -

Transportation -

Fuel -

Loan Payments -

Food

Others -

Others -

Others -

Total Business Expenses (B) - - - -

Net Business Income (C=A-B) - - - -

Other Household Income

Salaries -

Pension -

Others -

Others -

Total, Other Household Income (D) - - - -

Total Business & HH Income (E=C+D) - - - -

Household Expenses

Food -

Cooking gas -

Clothing -

Education and School Allowance -

Utilities (elect., telephone, water) -

Fuel -

Housing/Rent -

Transportation -

Family gathering/outings -

Medical / Dental -

Insurance -

Taxes/licenses -

Others -grocery -

Others (Cell and Cable) -

Sub-Total - - - -

Miscellaneous (10%) - - - -

Total Household Expenses (F) - - - -

NET BUSINESS & HH INCOME (G=E+F) - - - -

((H) ) ((I) ) ((J) )

DEBT CAPACITY ANALYSIS

Equivalent of DAILY net income -

Equivalent of WEEKLY net income - ((weekly net bus & HH inc divided by 7 days) )

Equivalent of MONTHLY net income - ((monthly net bus & hh income divided by 28 days) )

Amount Available for Debt Service -

Adjusted Repayment Capacity 20% 50%

Available for loan payment -

Conditions of the loan:

Mode FALSE

Number of payment 90

Amount of amortization -

Total amount available for loan payment -

Principal Amount -

Interest Rate (based on term) 15%

Interest Due -

*TIP: Negative Business and Household Income indicates that the corresponding mode of payment is not possible based

on the borrowers cash flow.

Prepared by: Noted by:

DO BM

Date: _____________________________

Vous aimerez peut-être aussi

- Acceptance&discharge-State Home Mortgage, Atlanta, GaDocument13 pagesAcceptance&discharge-State Home Mortgage, Atlanta, GaTiyemerenaset Ma'at El82% (17)

- Sample Payday Loan ApplicationDocument6 pagesSample Payday Loan ApplicationAdrian Keys86% (7)

- Hustler USA - Anniversary 2023Document138 pagesHustler USA - Anniversary 2023ธนวัฒน์ ปิยะวิสุทธิกุล67% (6)

- Chap 006Document14 pagesChap 006Adi SusiloPas encore d'évaluation

- Wealth Expropriation Example:: Example of The "Myers Under-Investment Problem", AKA The DebtDocument8 pagesWealth Expropriation Example:: Example of The "Myers Under-Investment Problem", AKA The DebtalimithaPas encore d'évaluation

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsArie KristionoPas encore d'évaluation

- Household Budget PlannerDocument8 pagesHousehold Budget PlannersumithPas encore d'évaluation

- Business-Budget 12monthsDocument6 pagesBusiness-Budget 12monthsReza KurniaPas encore d'évaluation

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsSRINIPas encore d'évaluation

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsSadia RahmanPas encore d'évaluation

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsEyob SPas encore d'évaluation

- Budgeting and Forecasting: and The Impact On ProfitabilityDocument33 pagesBudgeting and Forecasting: and The Impact On ProfitabilityHassan AzizPas encore d'évaluation

- Anggaran BisnisDocument4 pagesAnggaran BisnisAlfiani FadillahPas encore d'évaluation

- EFY Bussiness BudgetDocument4 pagesEFY Bussiness BudgetFinance Dental JayaPas encore d'évaluation

- Business BudgetDocument5 pagesBusiness Budgetbasel abduPas encore d'évaluation

- Annual Business Budget TemplateDocument5 pagesAnnual Business Budget TemplateTJ 17 ChannelPas encore d'évaluation

- 2021 April Budget: Minilec India Pvt. LTDDocument4 pages2021 April Budget: Minilec India Pvt. LTDShantanu ParanjapePas encore d'évaluation

- 2022 Budget: (Company Name)Document6 pages2022 Budget: (Company Name)Raffy Pax Galang RafaelPas encore d'évaluation

- Template BudgetDocument2 pagesTemplate Budgetene_andreyPas encore d'évaluation

- Bussines BudgetDocument2 pagesBussines BudgetMUHAMMAD RABBIL ALBADRIPas encore d'évaluation

- Business-Budget & OverheadDocument6 pagesBusiness-Budget & OverheadALAF SINERGI SDN BHDPas encore d'évaluation

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1Olivia OctoficePas encore d'évaluation

- Cashflow Analysis: Daily Weekly Semi-Monthly Monthly Monthly TotalsDocument5 pagesCashflow Analysis: Daily Weekly Semi-Monthly Monthly Monthly TotalsRommel A. RosalesPas encore d'évaluation

- Business Review TemplateDocument24 pagesBusiness Review TemplateAllen LucañasPas encore d'évaluation

- Weekly Expense ReportDocument1 pageWeekly Expense ReportJessica KlingPas encore d'évaluation

- Tax Calculator (Salary Format)Document2 pagesTax Calculator (Salary Format)Muhammed Abul Kalam AcmaPas encore d'évaluation

- Profit and Loss ProjectionDocument3 pagesProfit and Loss ProjectionDokumen SayaPas encore d'évaluation

- 3-Year Profit and Loss Projection: Merca OnlineDocument3 pages3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoPas encore d'évaluation

- Weekly Expense ReportDocument2 pagesWeekly Expense ReportmrbroPas encore d'évaluation

- Weekly Expense Report (Company Name / Logo) : Employee Name: Email: Phone: Manager Name: Purpose: Department: LocationDocument2 pagesWeekly Expense Report (Company Name / Logo) : Employee Name: Email: Phone: Manager Name: Purpose: Department: LocationTaufik RohmanPas encore d'évaluation

- Weekly Expense ReportDocument2 pagesWeekly Expense ReportA Wahid KemalPas encore d'évaluation

- Personal Monthly Budget: IncomeDocument20 pagesPersonal Monthly Budget: Incomehuhah303Pas encore d'évaluation

- Azurea Spa - Bohol Yearly Budget TemplateDocument2 pagesAzurea Spa - Bohol Yearly Budget TemplateAzurea SpaPas encore d'évaluation

- Annual Budget Forecast TemplateDocument2 pagesAnnual Budget Forecast Templaterowena balaguerPas encore d'évaluation

- Personal Monthly BudgetDocument4 pagesPersonal Monthly BudgetShashankNageshPas encore d'évaluation

- Contract Account FormatDocument4 pagesContract Account FormatrayguntanPas encore d'évaluation

- Profit and Loss Statement 1Document1 pageProfit and Loss Statement 1diyoha2Pas encore d'évaluation

- Project Management Budget Template - roD380MkzjGDLI4Document4 pagesProject Management Budget Template - roD380MkzjGDLI4mulugetaPas encore d'évaluation

- Anexo 3 - Plantilla PresupuestalDocument4 pagesAnexo 3 - Plantilla PresupuestalDann PerezPas encore d'évaluation

- Budget Tabela S DJ 10122020Document122 pagesBudget Tabela S DJ 10122020Djurdjina PetkovicPas encore d'évaluation

- Income Statement - MonthlyDocument11 pagesIncome Statement - MonthlyRickyPas encore d'évaluation

- Personal Life Map Portfolio Fall 2018Document236 pagesPersonal Life Map Portfolio Fall 2018Ian KelsoPas encore d'évaluation

- Breakeven and Profit-Volume-Cost AnalysisDocument4 pagesBreakeven and Profit-Volume-Cost AnalysisNu SPas encore d'évaluation

- Income Tax Calculator FY 2023 24Document1 pageIncome Tax Calculator FY 2023 24Balamurali KirankumarPas encore d'évaluation

- Nigerian PAYE Calculator 4.0Document2 pagesNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- Budget Template FINALDocument5 pagesBudget Template FINALRaden RoyishPas encore d'évaluation

- BookkeepingDocument4 pagesBookkeepingAriel MercialesPas encore d'évaluation

- Profit and Loss Statement Template (Excel)Document1 pageProfit and Loss Statement Template (Excel)MicrosoftTemplates100% (7)

- Personal Monthly BudgetDocument4 pagesPersonal Monthly BudgetnadyaPas encore d'évaluation

- Profit Loss StatementDocument1 pageProfit Loss StatementhmarcalPas encore d'évaluation

- Difference - Monthly Income: Housing EntertainmentDocument4 pagesDifference - Monthly Income: Housing EntertainmentKhay KhayPas encore d'évaluation

- Operating Cash Flow CalculatorDocument6 pagesOperating Cash Flow CalculatorGomv ConsPas encore d'évaluation

- Personal Monthly Budget: IncomeDocument17 pagesPersonal Monthly Budget: IncomeSultan Gos 3Pas encore d'évaluation

- Financial Projections Template 04Document7 pagesFinancial Projections Template 04AryanPas encore d'évaluation

- Income Statement Template: Click Here To Create in SmartsheetDocument2 pagesIncome Statement Template: Click Here To Create in SmartsheetGomiPas encore d'évaluation

- Cashflow Forecast - QuaterlyDocument1 pageCashflow Forecast - QuaterlyRickyPas encore d'évaluation

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplateSolomon Ahimbisibwe100% (1)

- CERF Income and Expenditure Statement Template 2019Document1 pageCERF Income and Expenditure Statement Template 2019aboud islamPas encore d'évaluation

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoPas encore d'évaluation

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoPas encore d'évaluation

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoPas encore d'évaluation

- Untitled SpreadsheetDocument8 pagesUntitled SpreadsheetAretha DawesPas encore d'évaluation

- Weekly Budget: Total Income Total Expenses NETDocument2 pagesWeekly Budget: Total Income Total Expenses NETAndrew MartiniPas encore d'évaluation

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraPas encore d'évaluation

- Econ 1Document1 pageEcon 1josieth santosPas encore d'évaluation

- UntitledDocument53 pagesUntitledapi-228714775Pas encore d'évaluation

- Bank of The Philippine IslandsDocument40 pagesBank of The Philippine IslandsRed Christian PalustrePas encore d'évaluation

- Solution of 16MBA13 Accounting For Managers (I Sem MBA) December 2016 by Hema Vidya CS PDFDocument22 pagesSolution of 16MBA13 Accounting For Managers (I Sem MBA) December 2016 by Hema Vidya CS PDFSahil KhanPas encore d'évaluation

- Jadual Pembayaran Bulanan Pinjaman Peribadi Cash PlusDocument1 pageJadual Pembayaran Bulanan Pinjaman Peribadi Cash PlusNOR AZIMA BINTI SHAARI MoePas encore d'évaluation

- Summer Internship ReportDocument69 pagesSummer Internship ReportShobhitShankhalaPas encore d'évaluation

- Mortgage Comparison WorksheetDocument3 pagesMortgage Comparison WorksheetNancy SuárezPas encore d'évaluation

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghPas encore d'évaluation

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanPas encore d'évaluation

- Dacutanan, Donna Belle G. Bsed English Se 1-2Document2 pagesDacutanan, Donna Belle G. Bsed English Se 1-2Donna Belle Gonzaga DacutananPas encore d'évaluation

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainDocument65 pagesStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainSourav SenPas encore d'évaluation

- Annual Report 2011 Eitzen ChemicalsDocument88 pagesAnnual Report 2011 Eitzen Chemicals1991anuragPas encore d'évaluation

- 11th Integrated Rating 230410 133522Document369 pages11th Integrated Rating 230410 133522soumya sethyPas encore d'évaluation

- Public Education ReformDocument14 pagesPublic Education Reformazsid7Pas encore d'évaluation

- MFD Exam 500 QusDocument40 pagesMFD Exam 500 QusArvindKumarPas encore d'évaluation

- Janki SingDocument72 pagesJanki SingJankiPas encore d'évaluation

- Central Bank of The Philippines vs. Court of AppealsDocument4 pagesCentral Bank of The Philippines vs. Court of AppealsphiaPas encore d'évaluation

- Ejercicios de Buenas Practicas en Materias de G.corporativosDocument41 pagesEjercicios de Buenas Practicas en Materias de G.corporativosmargarethPas encore d'évaluation

- Secured Trans-Comm PaperDocument17 pagesSecured Trans-Comm PaperSemsudPas encore d'évaluation

- Gatchalian Realty, Inc Vs AngelesDocument21 pagesGatchalian Realty, Inc Vs AngelesJerome Arañez100% (1)

- Analysis of Bonds With Embedded Options: Chapter SummaryDocument29 pagesAnalysis of Bonds With Embedded Options: Chapter SummaryasdasdPas encore d'évaluation

- Debts Under Hindu Law1 PDFDocument12 pagesDebts Under Hindu Law1 PDFVivek Rai100% (3)

- Chapter 7 - Promissory NotesDocument7 pagesChapter 7 - Promissory NotesIzny KamaliyahPas encore d'évaluation

- Advanced Financial Accounting and ReportingDocument10 pagesAdvanced Financial Accounting and ReportingMary Rose RamosPas encore d'évaluation