Académique Documents

Professionnel Documents

Culture Documents

Obama Tax Plan: Michigan

Transféré par

The Heritage FoundationCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Obama Tax Plan: Michigan

Transféré par

The Heritage FoundationDroits d'auteur :

Formats disponibles

THE EFFECTS OF THE OBAMA TAX PLAN

Michigan

President Obama’s tax plan would allow portions TOTAL EMPLOYMENT

of the 2001 and 2003 tax cuts to expire, resulting in Annual Change in Jobs

steep tax hikes beginning in January 2011 for small

2011 2015 2020

businesses and those earning $250,000 or more. 0

The tax hikes would significantly affect the economy

–3,000

in Michigan, most notably in the number of jobs

and change in personal income. –6,000

–9,000

Among the results, from 2011 to 2020, the state

–12,000

of Michigan would:

• Lose, on average, 22,069 jobs annually. –15,000

• Lose, per household, $8,393 in total disposable

–18,000

personal income.

• See total individual income taxes increase by –21,000

$13,221 million. –24,000

–27,000

Source: Heritage Foundation calculations based on the IHS Global

Insight U.S. macroeconomic model, and data from the U.S. Census –30,000

Bureau and U.S. Department of Labor, Bureau of Labor Statistics.

–27,877

REAL DISPOSABLE INCOME TOTAL INDIVIDUAL INCOME TAXES

Annual Change per Household Annual Change in Millions of Dollars

$1,640.2

2011 2015 2020

$0 $1,800

$1,600

–$200

$1,400

–$400 $1,200

$1,000

–$600

$800

–$800 $600

$400

–$1,000

$200

–$1,200 $0

2011 2015 2020

–$1,062.38

Chart MI • Obama Tax Plan by State heritage.org

THE EFFECTS OF THE OBAMA TAX PLAN

Change in Employment in Michigan

Average Annual Change in Total

Employment, 2011 to 2020, by

Congressional District

Jobs Lost: 800–1,399

Jobs Lost: 1,400–1,599 4

Jobs Lost: 1,600–1,799

Jobs Lost: 1,800–2,320 2

10

5

State: 22,069 jobs lost annually on average

3 9

8

11

15

6 7

Source: Heritage Foundation calculations based on the IHS Global Insight U.S. macroeconomic model, and data from the U.S. Census Bureau and U.S.

Department of Labor, Bureau of Labor Statistics.

Map MI • Obama Tax Plan by State heritage.org

Vous aimerez peut-être aussi

- Obama Tax Plan: MassachusettsDocument2 pagesObama Tax Plan: MassachusettsThe Heritage FoundationPas encore d'évaluation

- Obama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsD'EverandObama’S Wonder Years: 8 Years of Lower Unemployment & Rising Stock MarketsPas encore d'évaluation

- Obama Tax Plan: VirginiaDocument2 pagesObama Tax Plan: VirginiaThe Heritage FoundationPas encore d'évaluation

- What is Your Net Worth?: How Long Can You Survive Without a Job?: Financial Freedom, #88D'EverandWhat is Your Net Worth?: How Long Can You Survive Without a Job?: Financial Freedom, #88Pas encore d'évaluation

- Obama Tax Plan: MinnesotaDocument2 pagesObama Tax Plan: MinnesotaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: North CarolinaDocument2 pagesObama Tax Plan: North CarolinaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: MarylandDocument2 pagesObama Tax Plan: MarylandThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: WisconsinDocument2 pagesObama Tax Plan: WisconsinThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: MissouriDocument2 pagesObama Tax Plan: MissouriThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: WashingtonDocument2 pagesObama Tax Plan: WashingtonThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: PennsylvaniaDocument2 pagesObama Tax Plan: PennsylvaniaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: LouisianaDocument2 pagesObama Tax Plan: LouisianaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: TennesseeDocument2 pagesObama Tax Plan: TennesseeThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: OklahomaDocument2 pagesObama Tax Plan: OklahomaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: KansasDocument2 pagesObama Tax Plan: KansasThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: NevadaDocument2 pagesObama Tax Plan: NevadaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: MaineDocument2 pagesObama Tax Plan: MaineThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: KentuckyDocument2 pagesObama Tax Plan: KentuckyThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: MontanaDocument2 pagesObama Tax Plan: MontanaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: MississippiDocument2 pagesObama Tax Plan: MississippiThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: New MexicoDocument2 pagesObama Tax Plan: New MexicoThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: Impact On HawaiiDocument2 pagesObama Tax Plan: Impact On HawaiiThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: Rhode IslandDocument2 pagesObama Tax Plan: Rhode IslandThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: Impact On IdahoDocument2 pagesObama Tax Plan: Impact On IdahoThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: WyomingDocument2 pagesObama Tax Plan: WyomingThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: Impact On DCDocument2 pagesObama Tax Plan: Impact On DCThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: VermontDocument2 pagesObama Tax Plan: VermontThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: Impact On AlaskaDocument2 pagesObama Tax Plan: Impact On AlaskaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: North DakotaDocument2 pagesObama Tax Plan: North DakotaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: New YorkDocument2 pagesObama Tax Plan: New YorkThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: NebraskaDocument2 pagesObama Tax Plan: NebraskaThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: OregonDocument2 pagesObama Tax Plan: OregonThe Heritage FoundationPas encore d'évaluation

- Obama Tax Plan: TexasDocument2 pagesObama Tax Plan: TexasThe Heritage FoundationPas encore d'évaluation

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsPas encore d'évaluation

- Spending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Document100 pagesSpending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Brian RiedlPas encore d'évaluation

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USAPas encore d'évaluation

- Tower 2009AR Dated 31 Mar 2010Document146 pagesTower 2009AR Dated 31 Mar 2010scho0577Pas encore d'évaluation

- 2013 Tax Bracket CalculatorDocument1 page2013 Tax Bracket Calculatorsalauddin1979Pas encore d'évaluation

- MHACY - Participants' Demographics As of 09.2021Document12 pagesMHACY - Participants' Demographics As of 09.2021AJ WoodsonPas encore d'évaluation

- Aruba Corp Overview DubaiDocument15 pagesAruba Corp Overview DubaiBronco MasoudPas encore d'évaluation

- Bangladesh Economy and DevelopmentDocument14 pagesBangladesh Economy and DevelopmentNafis Hasan khanPas encore d'évaluation

- Montgomery County Empower Montgomery ReportDocument7 pagesMontgomery County Empower Montgomery ReportAJ MetcalfPas encore d'évaluation

- Richmond Americas Alliance MarketBeat Multifamily Q1 2021Document2 pagesRichmond Americas Alliance MarketBeat Multifamily Q1 2021Kevin ParkerPas encore d'évaluation

- OSA City of Jackson Analysis PDFDocument7 pagesOSA City of Jackson Analysis PDFthe kingfishPas encore d'évaluation

- Budget TemplateDocument3 pagesBudget TemplateLeydy PerezPas encore d'évaluation

- 2018 Commercial Market OverviewDocument15 pages2018 Commercial Market OverviewedmontonjournalPas encore d'évaluation

- TF 10000094Document2 pagesTF 10000094eldhoisaacPas encore d'évaluation

- Tax Year 2020 StatisticsDocument127 pagesTax Year 2020 StatisticsAdam HarringtonPas encore d'évaluation

- Today's Market : Springfield Area Local Market Report, Third Quarter 2010Document7 pagesToday's Market : Springfield Area Local Market Report, Third Quarter 2010phatty34Pas encore d'évaluation

- Family Budget: Cash FlowDocument2 pagesFamily Budget: Cash FlowSyahrani Nuzuli SariPas encore d'évaluation

- January 2010 IssueDocument12 pagesJanuary 2010 IssueWSCFoundationPas encore d'évaluation

- Budget 2011 SummaryDocument6 pagesBudget 2011 SummaryManohar ReddyPas encore d'évaluation

- Family Budget1Document2 pagesFamily Budget1Mbadilishaji DuniaPas encore d'évaluation

- BookDocument1 pageBookHealt FitPas encore d'évaluation

- ch01 2Document21 pagesch01 2Jigar PatelPas encore d'évaluation

- Google PresentationDocument22 pagesGoogle Presentationcia100% (10)

- ES032 Assignment6Document6 pagesES032 Assignment6TerkPas encore d'évaluation

- IGMemo 031518Document2 pagesIGMemo 031518The Heritage FoundationPas encore d'évaluation

- Mandate For Leadership Policy RecommendationsDocument19 pagesMandate For Leadership Policy RecommendationsThe Heritage Foundation77% (30)

- 2018 Index of Military Strength CyberDocument16 pages2018 Index of Military Strength CyberThe Heritage Foundation100% (2)

- Sussex County Attorney's Right-to-Work OpinionDocument11 pagesSussex County Attorney's Right-to-Work OpinionThe Heritage FoundationPas encore d'évaluation

- 2018 Index of Military Strength JointDocument9 pages2018 Index of Military Strength JointThe Heritage FoundationPas encore d'évaluation

- Declassified FISA Abuse Memo PDFDocument4 pagesDeclassified FISA Abuse Memo PDFThe Heritage Foundation100% (1)

- Dep Sec Letter 41618Document3 pagesDep Sec Letter 41618The Heritage Foundation100% (1)

- 2018 Index of Military Strength SpaceDocument11 pages2018 Index of Military Strength SpaceThe Heritage FoundationPas encore d'évaluation

- 2018 Index of Military Strength Land DomainDocument14 pages2018 Index of Military Strength Land DomainThe Heritage FoundationPas encore d'évaluation

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength Naval DomainDocument15 pages2018 Index of Military Strength Naval DomainThe Heritage Foundation100% (2)

- Comparing GOP Health Care BillsDocument1 pageComparing GOP Health Care BillsThe Heritage Foundation100% (1)

- 2018 Index of Military Strength Air Domain EssayDocument15 pages2018 Index of Military Strength Air Domain EssayThe Heritage FoundationPas encore d'évaluation

- Conservatives Leaders' Letter To GuideStarDocument6 pagesConservatives Leaders' Letter To GuideStarThe Heritage Foundation100% (2)

- Booker-Brown Auto Lending Letter To The CFPBDocument2 pagesBooker-Brown Auto Lending Letter To The CFPBThe Heritage FoundationPas encore d'évaluation

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- Border Surge LetterDocument2 pagesBorder Surge LetterThe Heritage FoundationPas encore d'évaluation

- Coalition Letter IANA 8.10.16Document4 pagesCoalition Letter IANA 8.10.16The Heritage FoundationPas encore d'évaluation

- Daleiden TX ComplaintDocument2 pagesDaleiden TX ComplaintThe Heritage FoundationPas encore d'évaluation

- The Origin, Rise, and Fall of The First Government Sponsored Enterprise: The Federal Land Banks, 1916-1932 (By Judge Glock)Document29 pagesThe Origin, Rise, and Fall of The First Government Sponsored Enterprise: The Federal Land Banks, 1916-1932 (By Judge Glock)The Heritage FoundationPas encore d'évaluation

- Treasury Management Service Addendum Draft - Additional Requirements 06-2016Document2 pagesTreasury Management Service Addendum Draft - Additional Requirements 06-2016The Heritage FoundationPas encore d'évaluation

- Daleiden IndictmentDocument1 pageDaleiden IndictmentThe Heritage FoundationPas encore d'évaluation

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationPas encore d'évaluation

- Merritt TX ComplaintDocument2 pagesMerritt TX ComplaintThe Heritage FoundationPas encore d'évaluation

- Planned Parenthood Forensic Analysis ReportDocument14 pagesPlanned Parenthood Forensic Analysis ReportThe Heritage Foundation100% (1)

- California Civil Forfeiture ReformDocument8 pagesCalifornia Civil Forfeiture ReformThe Heritage FoundationPas encore d'évaluation

- Conservative Action Project MemoDocument7 pagesConservative Action Project MemoThe Heritage FoundationPas encore d'évaluation

- Merritt TX ComplaintDocument2 pagesMerritt TX ComplaintThe Heritage FoundationPas encore d'évaluation

- CAP Memo: Oppose Any Bill Funding Planned ParenthoodDocument5 pagesCAP Memo: Oppose Any Bill Funding Planned ParenthoodThe Heritage FoundationPas encore d'évaluation

- House Ways and Means Letter To Secretary LewDocument3 pagesHouse Ways and Means Letter To Secretary LewThe Heritage FoundationPas encore d'évaluation

- Schools Mentioned in Complaint Against MascotsDocument7 pagesSchools Mentioned in Complaint Against MascotsLansingStateJournalPas encore d'évaluation

- Request For Investigation - Department of JusticeDocument2 pagesRequest For Investigation - Department of JusticeMark JacksonPas encore d'évaluation

- Schuette EPA EmailDocument5 pagesSchuette EPA EmailprogressmichiganPas encore d'évaluation

- Estimated GEER Distribution by District 699737 7Document12 pagesEstimated GEER Distribution by District 699737 7Trevor DrewPas encore d'évaluation

- Lesson 2: History: Ccss - Ela-Literacy.W.4.7Document4 pagesLesson 2: History: Ccss - Ela-Literacy.W.4.7api-302452610Pas encore d'évaluation

- Rick KretzschmarDocument6 pagesRick Kretzschmarmtrudeau1974Pas encore d'évaluation

- Wisconsin To Michigan - 8 Ways To Travel Via Train, Plane, Bus, and CarDocument1 pageWisconsin To Michigan - 8 Ways To Travel Via Train, Plane, Bus, and Carlingfrank74Pas encore d'évaluation

- Educ 305 Lesson 6Document2 pagesEduc 305 Lesson 6api-273233127Pas encore d'évaluation

- Map of Chronic Wasting Disease Areas in MichiganDocument1 pageMap of Chronic Wasting Disease Areas in MichiganLansingStateJournalPas encore d'évaluation

- Were Free Lets Grow 1Document16 pagesWere Free Lets Grow 1Felipe Sierra100% (1)

- Warren Michigan History Part SixUpdatedDocument114 pagesWarren Michigan History Part SixUpdatedWesley E Arnold100% (1)

- MEA Salaries 08-09Document5 pagesMEA Salaries 08-09Rob LawrencePas encore d'évaluation

- STAT305 Lecture 2Document4 pagesSTAT305 Lecture 2Princess RosalesPas encore d'évaluation

- Michigan Hate Crimes 2019Document15 pagesMichigan Hate Crimes 2019WXYZ-TV Channel 7 DetroitPas encore d'évaluation

- Michigan State Senate MapDocument1 pageMichigan State Senate MapWXYZ-TV Channel 7 DetroitPas encore d'évaluation

- General ManagerDocument4 pagesGeneral Managerapi-121413332Pas encore d'évaluation

- Curriculum Vitae of Beverly TranDocument5 pagesCurriculum Vitae of Beverly TranBeverly TranPas encore d'évaluation

- Michigan Catholic Diocese MapDocument1 pageMichigan Catholic Diocese MapMadeline Ciak100% (1)

- Mental Health SitesDocument5 pagesMental Health SitesCommunityBridgesPas encore d'évaluation

- Map/List of Cooperative Weed Management Areas (CWMAs) in Northeast and Midwest PDFDocument2 pagesMap/List of Cooperative Weed Management Areas (CWMAs) in Northeast and Midwest PDFGreg John PetersonPas encore d'évaluation

- Iceman EVERYONE Results 2009Document158 pagesIceman EVERYONE Results 2009bmmillerPas encore d'évaluation

- Michigan Corrected Mediciaid Final Departmental Review For Crawley LawsuitDocument259 pagesMichigan Corrected Mediciaid Final Departmental Review For Crawley LawsuitBeverly TranPas encore d'évaluation

- 2019-20 KCC Men's Basketball Media GuideDocument16 pages2019-20 KCC Men's Basketball Media GuideKellogg Community CollegePas encore d'évaluation

- EO 2020-107 Workforce Development BoardDocument11 pagesEO 2020-107 Workforce Development BoardDevon Louise KesslerPas encore d'évaluation

- Battle CreekDocument177 pagesBattle CreekgeritywaPas encore d'évaluation

- ITSWC 2014 Final Program 3Document178 pagesITSWC 2014 Final Program 3David BravoPas encore d'évaluation

- Resume OnlyDocument1 pageResume Onlyapi-296194474Pas encore d'évaluation

- USA Physician DirectoryDocument265 pagesUSA Physician Directorysonukarma321Pas encore d'évaluation

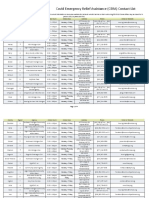

- Covid Emergency Relief Assistance (CERA) Contact ListDocument5 pagesCovid Emergency Relief Assistance (CERA) Contact ListSammy SaloomPas encore d'évaluation

- Greater Romulus Chamber of Commerce September 2012 NewsletterDocument8 pagesGreater Romulus Chamber of Commerce September 2012 NewslettergordhowePas encore d'évaluation