Académique Documents

Professionnel Documents

Culture Documents

Corporate Fin Assignment

Transféré par

Godana Chuchu IsmailDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Fin Assignment

Transféré par

Godana Chuchu IsmailDroits d'auteur :

Formats disponibles

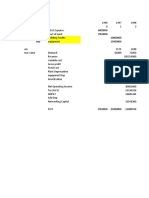

Abdullahi Godana Ismail-0722941 corporate finance assignment

machinery

Q (yards) price revenue v.c plant dep dep

1 100,000 30 3000000 1800000 50000 200000

2 100,000 30 3000000 1872000 90000 320000

3 100,000 30 3000000 1946880 72000 192000

4 100,000 30 3000000 2024760 57600 115200

5 100,000 30 3000000 2105750 46100 115200

year 0 year 1 year 2 year 3 year 4 year 5

machinery cost -1,000,000

plant refurbishing -500,000

investment in NWC -300,000

sales revenue 3000000 3000000 3000000 3000000 3000000

less V.C 1800000 1872000 1946880 2024760 2105750

less F.C 300,000 300,000 300000 300000 300000

less plant dep 50000 90000 72000 57600 46100

less machinery dep 200000 320000 192000 115200 115200

EBIT 650,000 418,000 489120 502440 432950

less tax 227500 146300 171192 175854 151532.5

N.I 422,500 271,700 317928 326586 281417.5

add plant dep 50000 90000 72000 57600 46100

add machinery dep 200000 320000 192000 115200 115200

672,500 681,700 581928 499386 442717.5

sale of land 600,000

NWC 300000

Cashflow -1,800,000 672,500 681,700 581928 499386 1,342,718

NPV at @ 12% = $837,361.43

Based on the above calculated NPV, Mr. Jojo should NOT recommend submitting the bid to the navy at

the proposed $30 per yard. He should recommend that the land and plant to be sold at $1.5 million which

is almost double the income compared to making the duffel canvas.

$1,500,000 – $837,361.43 = $662,638.57

Vous aimerez peut-être aussi

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Benihana ReportDocument33 pagesBenihana ReportAnuradhaSaliyaAmarathungaPas encore d'évaluation

- Calculate The Revised Product Cost For The Four (4) Pens Based On The Activity Information Collected by Dempsey?Document1 pageCalculate The Revised Product Cost For The Four (4) Pens Based On The Activity Information Collected by Dempsey?Harshad SavantPas encore d'évaluation

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitPas encore d'évaluation

- Acctg. For Special Transactions - 2018 - TocDocument12 pagesAcctg. For Special Transactions - 2018 - Tocbassmastah0% (1)

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaPas encore d'évaluation

- Budgeting SolutionsDocument9 pagesBudgeting SolutionsPavan Kalyan KolaPas encore d'évaluation

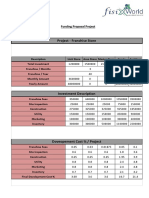

- Funding Proposal ProjectDocument4 pagesFunding Proposal ProjectSatvir SinghPas encore d'évaluation

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaPas encore d'évaluation

- Day8 (My)Document9 pagesDay8 (My)Jhilmil JeswaniPas encore d'évaluation

- 1) The Sunk Costs Are As FollowDocument2 pages1) The Sunk Costs Are As FollowLucky LuckyPas encore d'évaluation

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaPas encore d'évaluation

- Unit 14, 15 and 16 - SolutionDocument5 pagesUnit 14, 15 and 16 - SolutionHemant bhanawatPas encore d'évaluation

- Mr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Document9 pagesMr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Santhosh Kumar BattaPas encore d'évaluation

- Depreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible AssetsDocument14 pagesDepreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible Assetshitesh184Pas encore d'évaluation

- Ciron PharmaceuticalsDocument4 pagesCiron PharmaceuticalsShishir ToshniwalPas encore d'évaluation

- Less: Variable Less: Variable Less: VariableDocument16 pagesLess: Variable Less: Variable Less: VariableHarshithaPas encore d'évaluation

- CF - Baldwin ExampleDocument2 pagesCF - Baldwin ExampleSanjai CttPas encore d'évaluation

- Income Statement: Cost of Goods Sold 540,000 768000 999600 1300920Document4 pagesIncome Statement: Cost of Goods Sold 540,000 768000 999600 1300920ASIF RAFIQUE BHATTIPas encore d'évaluation

- Section C BEP 3-12-2021Document4 pagesSection C BEP 3-12-2021Ankita JoshiPas encore d'évaluation

- MockDocument5 pagesMockamna noorPas encore d'évaluation

- SOLUTIONS-WPS Office PDFDocument3 pagesSOLUTIONS-WPS Office PDFJoventino NebresPas encore d'évaluation

- Seminar XIIDocument67 pagesSeminar XIINeko IvanishviliPas encore d'évaluation

- Investment Analysis ExercisesDocument4 pagesInvestment Analysis ExercisesAnurag SharmaPas encore d'évaluation

- Sales Budgeting (Dec 16)Document5 pagesSales Budgeting (Dec 16)Jaganath Reddy GFkKwVvllyPas encore d'évaluation

- (MCOF19M018) CF ProjectDocument8 pages(MCOF19M018) CF ProjectFaaiz YousafPas encore d'évaluation

- Demand Price Total Revenue Total Costs Profit/LossDocument3 pagesDemand Price Total Revenue Total Costs Profit/Losskemche610Pas encore d'évaluation

- Sales 4000000 4000000 Costs (%) 0.733333 0.75 Op Proft 1066667 1000000Document5 pagesSales 4000000 4000000 Costs (%) 0.733333 0.75 Op Proft 1066667 1000000shivmsPas encore d'évaluation

- ExcellentDocument8 pagesExcellentMamatPas encore d'évaluation

- Coprate Finance (Case Study) : Ansa Abrar MCOF19M019 3 RegularDocument7 pagesCoprate Finance (Case Study) : Ansa Abrar MCOF19M019 3 RegularFaaiz YousafPas encore d'évaluation

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyPas encore d'évaluation

- Financial and Non Financial MeasurementDocument49 pagesFinancial and Non Financial MeasurementArun ThomasPas encore d'évaluation

- Deals PlanDocument9 pagesDeals PlanVarun AkashPas encore d'évaluation

- MGT368 Final ProjectDocument12 pagesMGT368 Final ProjectMd. Rakibul Hasan 1721132Pas encore d'évaluation

- Assignment 1 20 F-0023Document7 pagesAssignment 1 20 F-0023maheen iqbalPas encore d'évaluation

- Particulars: Dr. To Purchase Husk Tree Sin Jojoba Oil Cotton Sheet To Carrage Inward To WagesDocument76 pagesParticulars: Dr. To Purchase Husk Tree Sin Jojoba Oil Cotton Sheet To Carrage Inward To WagesPS FITNESSPas encore d'évaluation

- CMA-Budgeting Assignment: Chosen Production IndustryDocument5 pagesCMA-Budgeting Assignment: Chosen Production IndustryJ I Anik BertPas encore d'évaluation

- Mr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Document7 pagesMr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Ajay KumarPas encore d'évaluation

- Assumptions:: 11. Financial PlanDocument5 pagesAssumptions:: 11. Financial PlanAkib xabedPas encore d'évaluation

- phạm thị phương thảo i3b exercise session 8Document2 pagesphạm thị phương thảo i3b exercise session 8Thao Pham Thi PhuongPas encore d'évaluation

- Midterms Exam On FAR SolmanDocument6 pagesMidterms Exam On FAR SolmanNhajPas encore d'évaluation

- Model Grace CorporationDocument9 pagesModel Grace CorporationEhtisham AkhtarPas encore d'évaluation

- MA - ExcelDocument7 pagesMA - ExcelKushal KaushikPas encore d'évaluation

- Cash BudgetDocument12 pagesCash BudgetUzzal AhmedPas encore d'évaluation

- Alano Julius N. TM 205 - Financial and Cost Analysis For Technology Managers 2018-20700 S (9:00AM-12:00PM)Document1 pageAlano Julius N. TM 205 - Financial and Cost Analysis For Technology Managers 2018-20700 S (9:00AM-12:00PM)Julius AlanoPas encore d'évaluation

- Capital Budgeting of Sneakers and PersistanceDocument8 pagesCapital Budgeting of Sneakers and Persistancesaifullahlatif2018Pas encore d'évaluation

- September 2013 NPVDocument6 pagesSeptember 2013 NPVShahriar KabirPas encore d'évaluation

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohPas encore d'évaluation

- Danshui CaseDocument9 pagesDanshui CaseNIKHIL CHAVANPas encore d'évaluation

- Budget PracticeDocument4 pagesBudget PracticeKarim KhalifiPas encore d'évaluation

- Calculations Tata NanoDocument5 pagesCalculations Tata NanovighneshmehtaPas encore d'évaluation

- ROI CALCULATION - MBA MKT 1 - Shivam JadhavDocument4 pagesROI CALCULATION - MBA MKT 1 - Shivam JadhavShivam JadhavPas encore d'évaluation

- MADocument11 pagesMANurbergen YeleshovPas encore d'évaluation

- Dairy ProjectDocument8 pagesDairy ProjectPraveen SinghPas encore d'évaluation

- TEST3Document13 pagesTEST3Jonathan FaustinoPas encore d'évaluation

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesPas encore d'évaluation

- Assignment Submitted By: Neeraj Dani Section A-MBA General Management FMS-MBA-2020-22-008 Assignment 1Document3 pagesAssignment Submitted By: Neeraj Dani Section A-MBA General Management FMS-MBA-2020-22-008 Assignment 1Neeraj DaniPas encore d'évaluation

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarPas encore d'évaluation

- Yum YumDocument2 pagesYum YumSurbhi KambojPas encore d'évaluation

- Project Report Dary FarmDocument7 pagesProject Report Dary FarmAbdul Hakim ShaikhPas encore d'évaluation

- Power Markets and Economics: Energy Costs, Trading, EmissionsD'EverandPower Markets and Economics: Energy Costs, Trading, EmissionsPas encore d'évaluation

- Hillsboro Summary Portland Home Values by Zip Code Courtesy of Listed-2-SoldDocument3 pagesHillsboro Summary Portland Home Values by Zip Code Courtesy of Listed-2-SoldAndrewBeachPas encore d'évaluation

- A) Instituted, Dispute B) Established, Doubt C) Entrenched, Barricade D) Began, AcceptanceDocument3 pagesA) Instituted, Dispute B) Established, Doubt C) Entrenched, Barricade D) Began, AcceptanceShaswata ChoudhuryPas encore d'évaluation

- Financial Analysis and ManagementDocument19 pagesFinancial Analysis and ManagementMohammad AnisuzzamanPas encore d'évaluation

- Iwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerDocument6 pagesIwan Kurniawan, Se, Ak, Mba, Ca: Finance Director/CFO/GM Finance/Financial ControllerGreen Sustain EnergyPas encore d'évaluation

- List of TransactionsDocument4 pagesList of TransactionsRahul Kumar100% (2)

- 12 05 04 ALPonz DI Matt Bradford's Promise Not To Investigate Any of My Unrebuttable Evidence of A Ponzi SchemeDocument3 pages12 05 04 ALPonz DI Matt Bradford's Promise Not To Investigate Any of My Unrebuttable Evidence of A Ponzi SchemeTom CahillPas encore d'évaluation

- Option Spreads Made EasyDocument8 pagesOption Spreads Made EasyJon Rambo100% (1)

- Garanti Bank - Leveraging Technology To Advance in BusinessDocument20 pagesGaranti Bank - Leveraging Technology To Advance in BusinessKorhan CoskunPas encore d'évaluation

- Assignment 3 Lump-Sump LiquidationDocument1 pageAssignment 3 Lump-Sump LiquidationchxrlttxPas encore d'évaluation

- Cosmetics Manufacturing Business PlanDocument63 pagesCosmetics Manufacturing Business PlanShihabul Islam ShihabPas encore d'évaluation

- Biodiesel Plant DesignDocument10 pagesBiodiesel Plant Designsukanta60100% (1)

- Magicbreakout+: Forex Trading StrategyDocument30 pagesMagicbreakout+: Forex Trading StrategyConstantinePas encore d'évaluation

- Non-Current Assets Held For Sale Discontinued OperationsDocument32 pagesNon-Current Assets Held For Sale Discontinued Operationsnot funny didn't laughPas encore d'évaluation

- Karunanidhi Rule and Family Wealth EstimationDocument17 pagesKarunanidhi Rule and Family Wealth EstimationVaseegaran Scientist100% (1)

- Mco 03 Block 02 1559781031Document112 pagesMco 03 Block 02 1559781031arushichananaPas encore d'évaluation

- Exit StrategyDocument2 pagesExit StrategyMuhammad KashifPas encore d'évaluation

- Stie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDocument13 pagesStie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDwi Merry WijayantiPas encore d'évaluation

- DIVERSIFICATIONDocument72 pagesDIVERSIFICATIONshaRUKHPas encore d'évaluation

- Dabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18Document3 pagesDabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18VIJAY KUMARPas encore d'évaluation

- Pid 39 Panchratna 14 Jul-Sep17Document21 pagesPid 39 Panchratna 14 Jul-Sep17pmlprasadPas encore d'évaluation

- Absurd Monetary SystemDocument3 pagesAbsurd Monetary SystemMubashir HassanPas encore d'évaluation

- Draft Report On City of Toronto's Financial FutureDocument55 pagesDraft Report On City of Toronto's Financial FutureToronto StarPas encore d'évaluation

- Vodafone V 1.1Document12 pagesVodafone V 1.1Nimesh BarotPas encore d'évaluation

- Pdic Invitation To Bid SampleDocument1 pagePdic Invitation To Bid SampleHeinzller GinezPas encore d'évaluation

- 7893 28385 2 PBDocument12 pages7893 28385 2 PBk58 Duong Thi HangPas encore d'évaluation

- J95. Islamic Shariah Market Principles - QRFMDocument16 pagesJ95. Islamic Shariah Market Principles - QRFMfahad100% (1)

- Innovation's Nine Critical Success Factors:: by Prof. Vijay GovindarajanDocument10 pagesInnovation's Nine Critical Success Factors:: by Prof. Vijay GovindarajankirandatarPas encore d'évaluation

- MHBJHBDocument3 pagesMHBJHBShashank DoveriyalPas encore d'évaluation