Académique Documents

Professionnel Documents

Culture Documents

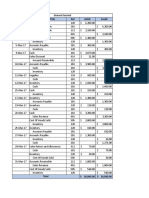

Bank Statement Books: Deposits and Credits Checks and Debits Cash Receipts Cash Disbursements

Transféré par

Steven Sanderson0 évaluation0% ont trouvé ce document utile (0 vote)

55 vues1 pageOne error was made in recording disbursements. Examine last month's bank reconciliation and list items that have not changed. Compare all recorded receipts per books to bank credits and list differences.

Description originale:

Titre original

TT 07-D5

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentOne error was made in recording disbursements. Examine last month's bank reconciliation and list items that have not changed. Compare all recorded receipts per books to bank credits and list differences.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

55 vues1 pageBank Statement Books: Deposits and Credits Checks and Debits Cash Receipts Cash Disbursements

Transféré par

Steven SandersonOne error was made in recording disbursements. Examine last month's bank reconciliation and list items that have not changed. Compare all recorded receipts per books to bank credits and list differences.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

PREPARING THE BANK RECONCILIATION

Bank Statement Books

Bank balance June 1 . . . . $10,000 Book balance June 1 . . . . . $10,150

Deposits and credits Checks and debits Cash Receipts Cash Disbursements

June 1 200.00 #209 10.00 June 10 $350.00 #210 $ 25.00

June 10 350.00 #210 25.00 June 20 425.00 #211 52.00

June 20 425.00 #211 52.00 #212 22.00

June 25 750.00 CM #213 199.00 #213 199.00

June 28 320.00 #216 205.00 June 28 320.00 #214 void

#217 650.00 June 30 275.00 #215 29.00

#218 200.00 Total $1,370.00 #216 205.00

#219 125.00 #217 560.00

#220 250.00 #218 200.00

NSF 125.00 #219 125.00

S.C. 6.00 #220 250.00

Total credits $2,045.00 Total debits $1,847.00 #221 60.00

#222 126.00

Bank balance June 30 . . . . $10,198 #223 82.00

Total $1,935.00

Book balance June 30 . . . . $9,585

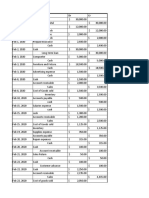

CM – Represents $725 Note Receivable May Bank Reconciliation

collection plus interest revenue of $50 Balance per bank statement $10,000

less bank charges of $25. NSF represents

$125 check from ABC Company Add: Deposits in transit 200

deposited on 6/20. 10,200

Less: Outstanding checks

#201 $40

HINT: One error was made in recording #209 $10 50

disbursements. Adjusted balance per bank $10,150

Procedures for Finding Differences between Bank and Book Balances:

1. Examine last month’s bank reconciliation and list items that have not changed, i.e.,

outstanding checks from prior month which have not cleared (again) or other

reconciling items which were not corrected (bank service charges).

2. Compare all recorded disbursements per books to bank debits (charges) and list

differences.

3. Compare all recorded receipts per books to bank credits and list differences.

4. Prepare bank reconciliation from data collected.

Copyright 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e T T 7–D

Vous aimerez peut-être aussi

- Vincent Fabella 1Document29 pagesVincent Fabella 1James Sy67% (3)

- Systems Understanding AidDocument12 pagesSystems Understanding AidPayton CraigPas encore d'évaluation

- Capital One Statement 211043021Document5 pagesCapital One Statement 211043021quannbui95Pas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesPas encore d'évaluation

- Lic Final ProjectDocument80 pagesLic Final Projectshaibaaz_ibm797354100% (3)

- Final Project - M 8116 PDFDocument133 pagesFinal Project - M 8116 PDFDinesh Murugan100% (1)

- Unit 18 Grammar ExercisesDocument4 pagesUnit 18 Grammar ExercisesMaria MontesPas encore d'évaluation

- Module 9 - Accounts and Financial ServicesDocument4 pagesModule 9 - Accounts and Financial ServicesAshleigh JarrettPas encore d'évaluation

- Benjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Document8 pagesBenjamin Mini-Mart CASH BOOK (Bank Columns) Date Particulars Fol Amounts$ Date Particulars Fol Amounts $Christine Ramkissoon100% (1)

- TYPES OF CHEQUES Accounts DepartmentDocument5 pagesTYPES OF CHEQUES Accounts DepartmentAshleigh JarrettPas encore d'évaluation

- TM 7 Tugas PDF Bank ConsiliationDocument2 pagesTM 7 Tugas PDF Bank ConsiliationNajla Aura KhansaPas encore d'évaluation

- Information Technology (PUNO)Document9 pagesInformation Technology (PUNO)Daniel Gabriel PunoPas encore d'évaluation

- Instructions: Do Chapter 2 - Problem 6Document18 pagesInstructions: Do Chapter 2 - Problem 6Christopher ColumbusPas encore d'évaluation

- WalshDocument6 pagesWalshapi-518242090Pas encore d'évaluation

- Quiz Audit of CashDocument3 pagesQuiz Audit of CashwesPas encore d'évaluation

- TaskDocument5 pagesTaskRachmadiyana YanaPas encore d'évaluation

- Item No. 23 Teresita BuenaflorDocument14 pagesItem No. 23 Teresita BuenaflorXiaoPas encore d'évaluation

- Supapo. Problem 1 10 ExcelDocument13 pagesSupapo. Problem 1 10 ExcelGidz RegalaPas encore d'évaluation

- TugasDocument4 pagesTugasrianiaffi02Pas encore d'évaluation

- Sheet 1Document10 pagesSheet 1Vinhant GonawanPas encore d'évaluation

- Problem 1-10Document14 pagesProblem 1-10Gidz RegalaPas encore d'évaluation

- Accounting CycleDocument13 pagesAccounting CycleJoshua PelegrinoPas encore d'évaluation

- Simulation 9 - Nikita SaxenaDocument9 pagesSimulation 9 - Nikita Saxenaapi-663766273Pas encore d'évaluation

- 1 BeltranDocument14 pages1 BeltranChristian Kyle Beltran100% (2)

- Ink Books SuppliesDocument63 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Ink Books SuppliesDocument81 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Bank ReconnnnDocument5 pagesBank ReconnnnRamm Raven Castillo100% (1)

- Practice SetDocument100 pagesPractice SetZamantha Oliveros100% (1)

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- Problem Item 23Document20 pagesProblem Item 23XiaoPas encore d'évaluation

- Introduction To Financial Accounting: Bank%ReconciliationsDocument24 pagesIntroduction To Financial Accounting: Bank%ReconciliationsJeffrey O'LearyPas encore d'évaluation

- Loan Schedule2Document2 pagesLoan Schedule2donato amyPas encore d'évaluation

- Tugas III Irensyah PayungbuaDocument4 pagesTugas III Irensyah PayungbuaWilliam MangumbanPas encore d'évaluation

- Irfan Fauzan Tugas 3Document25 pagesIrfan Fauzan Tugas 315 - Irfan Fauzan100% (1)

- Tugas 3 - 27190096 - Liussetiawan AndyDocument5 pagesTugas 3 - 27190096 - Liussetiawan AndyLiussetiawan AndyPas encore d'évaluation

- FA2 Revision Questions 2Document9 pagesFA2 Revision Questions 2miss ainaPas encore d'évaluation

- 4 Preparing A Bank ReconciliationDocument9 pages4 Preparing A Bank ReconciliationSamuel DebebePas encore d'évaluation

- Bank Statement Template 13Document2 pagesBank Statement Template 13AndroidPas encore d'évaluation

- Ink Books Supplies 2Document94 pagesInk Books Supplies 2Zamantha Oliveros100% (1)

- Solution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsDocument21 pagesSolution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsJovel Paycana100% (5)

- ABC Supermarket Accounting DataDocument7 pagesABC Supermarket Accounting Datawaweru karanjaPas encore d'évaluation

- FM SpreadsheetDocument6 pagesFM SpreadsheetMihiret GirmaPas encore d'évaluation

- PA T322WSB 5 - Group Assignment (Solution)Document8 pagesPA T322WSB 5 - Group Assignment (Solution)Hoang Khanh Linh NguyenPas encore d'évaluation

- Loan Schedule1Document1 pageLoan Schedule1donato amyPas encore d'évaluation

- Ch18 Bank Reconciliation Statements Extra PracticeDocument13 pagesCh18 Bank Reconciliation Statements Extra Practiceethanchow1978Pas encore d'évaluation

- Cash Flow StatementDocument11 pagesCash Flow Statementizleena.absklPas encore d'évaluation

- Date Particulars Dr. CR.: Answer 01Document7 pagesDate Particulars Dr. CR.: Answer 01Mursalin RabbiPas encore d'évaluation

- June Bank ReconciliationDocument1 pageJune Bank ReconciliationSteven SandersonPas encore d'évaluation

- Account Transactions: Vico - BSA 2204 - Hands-On ExercisesDocument3 pagesAccount Transactions: Vico - BSA 2204 - Hands-On ExercisesDianna Rose VicoPas encore d'évaluation

- Page Number 200 (P5-2A) Merchandising OperationsDocument4 pagesPage Number 200 (P5-2A) Merchandising OperationsAllensius HsjsjsPas encore d'évaluation

- Material - Gestión Financiera - Cash Flow Forecasting (Unsolved)Document6 pagesMaterial - Gestión Financiera - Cash Flow Forecasting (Unsolved)jessicaPas encore d'évaluation

- Chapter 7 WorksheetsDocument13 pagesChapter 7 Worksheetslaila hazariPas encore d'évaluation

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagPas encore d'évaluation

- Karima Sabilla Al HaqDocument2 pagesKarima Sabilla Al HaqNorazlina FitriahPas encore d'évaluation

- Bank Reconciliation Problems5-2Document4 pagesBank Reconciliation Problems5-2landonridenour0356Pas encore d'évaluation

- Lat 7 Knight&lesserDocument5 pagesLat 7 Knight&lesserNadratul Hasanah LubisPas encore d'évaluation

- HI5001 Extensive Exervises P1 T1 17Document5 pagesHI5001 Extensive Exervises P1 T1 17Md Jahid HossainPas encore d'évaluation

- Achmad Ardanu - Petty Cash-ReconciliationDocument8 pagesAchmad Ardanu - Petty Cash-ReconciliationAchmad ArdanuPas encore d'évaluation

- Accounting (AutoRecovered)Document11 pagesAccounting (AutoRecovered)ernest mwandihiPas encore d'évaluation

- Chapter 7Document4 pagesChapter 7Rani OktaviaPas encore d'évaluation

- GST Detail Accrual PDFDocument1 pageGST Detail Accrual PDFCristy Martin YumulPas encore d'évaluation

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonPas encore d'évaluation

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)

- HCMHR T CodesDocument8 pagesHCMHR T CodesManjunath HSPas encore d'évaluation

- McDonalds Marketing SwotDocument4 pagesMcDonalds Marketing SwotHarsh AhujaPas encore d'évaluation

- David Baldt DecisionDocument31 pagesDavid Baldt Decisionroslyn rudolphPas encore d'évaluation

- The Smiths Supplier Code of Business EthicsDocument6 pagesThe Smiths Supplier Code of Business EthicsAris SuwandiPas encore d'évaluation

- Appraisal of Bank Verification Number (BVN) in Nigeria Banking SystemDocument37 pagesAppraisal of Bank Verification Number (BVN) in Nigeria Banking SystemABDULRAZAQPas encore d'évaluation

- Term Report - Mahmood Iqbal-05157Document5 pagesTerm Report - Mahmood Iqbal-05157Mahmood IqbalPas encore d'évaluation

- 6 - Working Capital ManagementDocument4 pages6 - Working Capital ManagementChristian LimPas encore d'évaluation

- Aurangabad New Profile 2019-20Document16 pagesAurangabad New Profile 2019-20Gas GaminGPas encore d'évaluation

- OTC Derivatives ClearingDocument18 pagesOTC Derivatives ClearingStephen HurstPas encore d'évaluation

- Somya Bhasin 24years Pune: Professional ExperienceDocument2 pagesSomya Bhasin 24years Pune: Professional ExperienceS1626Pas encore d'évaluation

- Thesis AbstractDocument7 pagesThesis AbstractJianneDanaoPas encore d'évaluation

- Buffett On Japnese BusinessesDocument2 pagesBuffett On Japnese Businessesaman.sarupPas encore d'évaluation

- Credit Rating Agencies in IndiaDocument23 pagesCredit Rating Agencies in Indiaanon_315460204Pas encore d'évaluation

- IELTS Task 1Document12 pagesIELTS Task 1saidur183Pas encore d'évaluation

- Country Profile The BahamasDocument4 pagesCountry Profile The Bahamasapi-307827450Pas encore d'évaluation

- Problems 123Document52 pagesProblems 123Dharani RiteshPas encore d'évaluation

- RT Unification Shareholder CircularDocument357 pagesRT Unification Shareholder CircularLeon Vara brianPas encore d'évaluation

- Introduction Accrual Accounting PDFDocument118 pagesIntroduction Accrual Accounting PDFHi nice to meet you100% (1)

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahPas encore d'évaluation

- Chapter 3 - Business OwnershipDocument67 pagesChapter 3 - Business OwnershipBibiana Kee Kai NingPas encore d'évaluation

- Sr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountDocument1 pageSr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountBappi Al MunimPas encore d'évaluation

- Account StatementDocument10 pagesAccount StatementVinod KumarPas encore d'évaluation

- Week 1 LabDocument3 pagesWeek 1 LabSara ThompsonPas encore d'évaluation

- Joint Report by JP Morgan and Oliver Wyman Unlocking Economic Advantage With Blockchain A Guide For Asset ManagersDocument24 pagesJoint Report by JP Morgan and Oliver Wyman Unlocking Economic Advantage With Blockchain A Guide For Asset ManagersJuan JesúsPas encore d'évaluation

- BCG Matrix and GE Nine Cells MatrixDocument15 pagesBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Cash Basis Accounting Vs Accrual SystemDocument3 pagesCash Basis Accounting Vs Accrual SystemAllen Jade PateñaPas encore d'évaluation

- Book 1Document2 pagesBook 1agus suyadiPas encore d'évaluation