Académique Documents

Professionnel Documents

Culture Documents

12 Month P - L Account Projection

Transféré par

Shivaram KrishnanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

12 Month P - L Account Projection

Transféré par

Shivaram KrishnanDroits d'auteur :

Formats disponibles

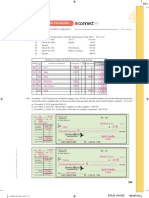

Twelve-month profit and loss projection Enter your Company Name here Fiscal Year Begins Jan-04

LY

.%

4

4

-04

4

04

4

4

-04

4

A

4

y-0

g-0

v-0

AR

p-0

b-0

n-0

r-0

t-0

l-0

B/

r-

IND

%

n

%

Ma

Ma

Ap

Au

No

YE

Oc

De

Se

Fe

Ju

Ju

Ja

%

Revenue (Sales)

Category 1 - - - - - - - - - - - - -

Category 2 - - - - - - - - - - - - -

Category 3 - - - - - - - - - - - - -

Category 4 - - - - - - - - - - - - -

Category 5 - - - - - - - - - - - - -

Category 6 - - - - - - - - - - - - -

Category 7 - - - - - - - - - - - - -

Total Revenue (Sales) 0 0.0 0 0.0

Notes 0 0.0

on Preparation 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0

Cost of Sales Note: You may want to print this information to use as reference later. To delete these

Category 1 - instructions,

- click the- border of this text- box and then press

- the DELETE key.

- - - - - - - -

Category 2 - - should change "category

You - - 2", etc. labels to

1, category - the actual names

- of your sales - - - - - - -

Category 3 - categories.

- Enter sales

- for each category

- for each month. - The spreadsheet- will add up total - - - - - - -

annual sales. In the "%" columns, the spreadsheet will show the % of total sales contributed

Category 4 - by- each category. - - - - - - - - - - -

Category 5 - - - - - - - - - - - - -

COST OF GOODS SOLD (also called Cost of Sales or COGS): COGS are those expenses

Category 6 - - - - - - - - - - - - -

directly related to producing or buying your products or services. For example, purchases of

Category 7 - -

inventory -

or raw materials, - wages (and payroll

as well as the - -

taxes) of employees directly - - - - - - -

Total Cost of Sales 0 - 0 involved

- in producing

0 - your products/services,

0 - are 0included

- in COGS. 0 These- expenses0usually - 0 - 0 - 0 - 0 - 0 - 0 -

go up and down along with the volume of production or sales. Study your records to

determine COGS for each sales category. Control of COGS is the key to profitability for most

Gross Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

businesses, so approach this part of your forecast with great care. For each category of

product/service, analyze the elements of COGS: how much for labor, for materials, for

Expenses

packing, for shipping, for sales commissions, etc.? Compare the Cost of Goods Sold and

Salary expenses - Gross

- Profit of your various

- sales categories.

- Which are -most profitable, and

- which are least -- - - - - - -

Payroll expenses -

and-

why? Underestimating

-

COGS can- lead to under pricing,

-

which can destroy

-

your ability to- - - - - - -

earn a profit. Research carefully and be realistic. Enter the COGS for each category of sales

Outside services - for- each month. In the- "%" columns, the - spreadsheet will- show the COGS as- a % of sales - - - - - - -

Supplies (office and dollars for that category.

- - - - - - - - - - - - -

operating)

GROSS PROFIT: Gross Profit is Total Sales minus Total COGS. In the "%" columns, the

Repairs and maintenance - -

spreadsheet - Gross Profit as -a % of Total Sales.-

will show - - - - - - - -

Advertising - - - - - - - - - - - - -

OPERATING EXPENSES (also called Overhead): These are necessary expenses which,

Car, delivery and travel - however,

- are not directly

- related to making

- or buying your

- products/services.

- Rent, utilities, - - - - - - -

Accounting and legal - telephone,

- interest, and

- the salaries (and

- payroll taxes) of

- office and management

- employees - - - - - - -

are examples. Change the names of the Expense categories to suit your type of business

Rent - and your accounting system. You may need to combine some categories, however, to stay -

- - - - - - - - - - -

Telephone - within

- the 20 line limit

- of the spreadsheet.

- Most operating- expenses remain- reasonably fixed - - - - - - -

regardless of changes in sales volume. Some, like sales commissions, may vary with sales.

Utilities - - - - -

Some, like utilities, may vary with the time of year. Your projections should -reflect these - - - - - - -

Insurance - fluctuations.

- The only - rule is that the projections

- should simulate

- your financial

- reality as - - - - - - -

nearly as possible. In- the "%" columns,- the spreadsheet -will show Operating Expenses as a -

Taxes (real estate, etc.) - - - - - - - - -

% of Total Sales.

Interest - - - - - - - - - - - - -

Depreciation - NET

- PROFIT: The spreadsheet

- will subtract

- Total Operating

- Expenses from - Gross Profit to - - - - - - -

calculate Net Profit. In the "%" columns, it will show Net Profit as a % of Total Sales.

Other expenses (specify) - - - - - - - - - - - - -

Other expenses (specify) - INDUSTRY

- AVERAGES:- The first column,

- labeled "IND. -%" is for posting average

- cost - - - - - - -

factors for firms of your size in your industry. Industry average data is commonly available

Other expenses (specify) - - - - - - - - - - - - -

from industry associations, major manufacturers who are suppliers to your industry, and local

Misc. (unspecified) - colleges,

- Chambers -of Commerce, and- public libraries. One - common source - is the book - - - - - - -

Total Expenses 0 - 0 Statement

- Studies

0 published

- annually

0 -by Robert Morris

0 Associates.

- 0It can be

- found in 0major - 0 - 0 - 0 - 0 - 0 - 0 -

libraries, and your banker almost surely has a copy. It is unlikely that your expenses will be

exactly in line with industry averages, but they can be helpful in areas in which expenses may

Net Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

be out of line.

Vous aimerez peut-être aussi

- Balance Sheet With ExplanationDocument2 pagesBalance Sheet With ExplanationTrinadh KPas encore d'évaluation

- Profit and Loss Projection 1yr 0 0 GPDocument1 pageProfit and Loss Projection 1yr 0 0 GPGary PearsPas encore d'évaluation

- Maximum SIMPLE and 401k contribution limitsDocument2 pagesMaximum SIMPLE and 401k contribution limitsRocaHardPas encore d'évaluation

- BplanDocument40 pagesBplanAshhad hussainPas encore d'évaluation

- Small Business Cash Flow ProjectionDocument3 pagesSmall Business Cash Flow ProjectionFauzi AzwarPas encore d'évaluation

- 20 - Balance Sheet Note, Examples and PDocument6 pages20 - Balance Sheet Note, Examples and PMatthew HogesPas encore d'évaluation

- Company Name: Employee Name: Designation: Month: Year: Earnings DeductionsDocument1 pageCompany Name: Employee Name: Designation: Month: Year: Earnings Deductionsnivrutti bhamarePas encore d'évaluation

- Voucher Package - 0000177054 PDFDocument5 pagesVoucher Package - 0000177054 PDFNickMillerPas encore d'évaluation

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementMircea TeodorescuPas encore d'évaluation

- Profit & Loss StatementDocument1 pageProfit & Loss StatementNabila Ayuningtias100% (1)

- Massachusetts Diploma Privilege Petition With APPENDIXDocument198 pagesMassachusetts Diploma Privilege Petition With APPENDIXDiploma Privilege for MAPas encore d'évaluation

- 1799 - Vehicle Application (R0118)Document2 pages1799 - Vehicle Application (R0118)sarapreppyhandbookPas encore d'évaluation

- Ssa 3369Document10 pagesSsa 3369Allison CriderPas encore d'évaluation

- Cma Cpa PlanDocument7 pagesCma Cpa PlanRyan DoPas encore d'évaluation

- Do Your Own - A Manual For The Entrepreneur - Business PlanDocument132 pagesDo Your Own - A Manual For The Entrepreneur - Business PlanNadia Zafar100% (2)

- Date of Issue Mon July 13 2020 Your Reference: 3200237: Property No: 5257806 Payment No: 52578060007Document6 pagesDate of Issue Mon July 13 2020 Your Reference: 3200237: Property No: 5257806 Payment No: 52578060007Nir AlonPas encore d'évaluation

- Cert of InsuranceDocument1 pageCert of Insuranceapi-297993513Pas encore d'évaluation

- Wells Fargo Wireless Auction October 14Document22 pagesWells Fargo Wireless Auction October 14ray745Pas encore d'évaluation

- Classified Example Company Balance SheetDocument1 pageClassified Example Company Balance Sheetchitranjan10Pas encore d'évaluation

- Facebook Marketing Course OverviewDocument1 pageFacebook Marketing Course Overviewhiteshi patelPas encore d'évaluation

- QDYNAMICS GLOBAL CORPORATION PAYROLL REPORTDocument7 pagesQDYNAMICS GLOBAL CORPORATION PAYROLL REPORTAdriana CarinanPas encore d'évaluation

- Downtown Rochester Task Force - April Draft Action Plan Recommendations 4.27.23Document5 pagesDowntown Rochester Task Force - April Draft Action Plan Recommendations 4.27.23randyPas encore d'évaluation

- Chief Financial Officer CfoDocument5 pagesChief Financial Officer Cfoapi-121402956Pas encore d'évaluation

- End-Of-Chapter ProblemsDocument9 pagesEnd-Of-Chapter ProblemsSheila CortezPas encore d'évaluation

- Waffle House Profit Loss Statement 2016Document1 pageWaffle House Profit Loss Statement 2016Anida AhmadPas encore d'évaluation

- 2012 Tax Rate ReportDocument88 pages2012 Tax Rate ReportZoe GallandPas encore d'évaluation

- CHART of ACCOUNTS Service BusinessDocument3 pagesCHART of ACCOUNTS Service BusinessDiana Rosales CalPas encore d'évaluation

- Income Statement of Mercantile Bank Limited and NRB Commercial BankDocument4 pagesIncome Statement of Mercantile Bank Limited and NRB Commercial BankmahadiparvezPas encore d'évaluation

- Invoice for Midtronics CTA-4000 Test Equipment - $500 Balance DueDocument1 pageInvoice for Midtronics CTA-4000 Test Equipment - $500 Balance DueskynetwirelessPas encore d'évaluation

- Bpo CSR - Bpo PerspectiveDocument10 pagesBpo CSR - Bpo PerspectiveyogasanaPas encore d'évaluation

- Business Plan Template For A Startup BusinessDocument27 pagesBusiness Plan Template For A Startup BusinessIffby Web Solutions100% (1)

- Inc and Bal SheetDocument13 pagesInc and Bal SheetSanjay MehrotraPas encore d'évaluation

- Business Plan TemplateDocument5 pagesBusiness Plan TemplateRola OnrPas encore d'évaluation

- Principles of Finance For Small BusinessDocument24 pagesPrinciples of Finance For Small BusinessSenelwa AnayaPas encore d'évaluation

- Bill DiscountingDocument17 pagesBill Discountingjohar_priyanka3723100% (1)

- Two Wheeler Insurance Policy DetailsDocument4 pagesTwo Wheeler Insurance Policy DetailsShashanth Kumar (CS - OMTP)Pas encore d'évaluation

- 1099 Ing PDFDocument3 pages1099 Ing PDFAnonymous wznsTFAMKMPas encore d'évaluation

- Equipment Inventory ListDocument6 pagesEquipment Inventory ListYared gebiPas encore d'évaluation

- Bank Reconciliation Statement ExampleDocument15 pagesBank Reconciliation Statement ExampleImran ZulfiqarPas encore d'évaluation

- Evidence of Insurance: ProvisionsDocument2 pagesEvidence of Insurance: ProvisionsAnonymous 0Gkzb5100% (1)

- Basics of Word Processing: 36:: Data Entry OperationsDocument23 pagesBasics of Word Processing: 36:: Data Entry OperationsAnonymous WPFh6lMi8ZPas encore d'évaluation

- Illinois LLC Articles of OrganizationDocument2 pagesIllinois LLC Articles of OrganizationRocketLawyerPas encore d'évaluation

- Business Plan TemplateDocument7 pagesBusiness Plan TemplateRohan LabdePas encore d'évaluation

- Solutions To Self-Study Problems: Chapter 1 The Individual Income Tax ReturnDocument84 pagesSolutions To Self-Study Problems: Chapter 1 The Individual Income Tax ReturnTiffy LouisePas encore d'évaluation

- Comm Card Best PracticeDocument62 pagesComm Card Best PracticerpillzPas encore d'évaluation

- Self Assessment of Final PracticumDocument3 pagesSelf Assessment of Final Practicumapi-294900383Pas encore d'évaluation

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- Strayer University HSA 505 Complete CourseDocument14 pagesStrayer University HSA 505 Complete Coursejustquestionanswer0% (2)

- Invoice Redacted PacketDocument20 pagesInvoice Redacted PacketwonderfulmachinePas encore d'évaluation

- Sample Profit and Loss StatementDocument2 pagesSample Profit and Loss StatementElisabet Halida WahyarsiPas encore d'évaluation

- Sample Volunteer Training AgendaDocument1 pageSample Volunteer Training AgendaAPIAVotePas encore d'évaluation

- Odisha Road Safety Action PlanDocument62 pagesOdisha Road Safety Action PlaniabhisekPas encore d'évaluation

- 2022 Financial StatementsDocument19 pages2022 Financial StatementsThe King's UniversityPas encore d'évaluation

- CC DCBDocument7 pagesCC DCBHugo DivalPas encore d'évaluation

- Plan Plan Plan Premium: Important Questions Answers Why This MattersDocument12 pagesPlan Plan Plan Premium: Important Questions Answers Why This Mattersapi-252555369Pas encore d'évaluation

- Stuart Jacob Resume'10Document3 pagesStuart Jacob Resume'10Pace Lattin - Ethical MarketingPas encore d'évaluation

- Bates BoatyardDocument3 pagesBates BoatyardCherryl ValmoresPas encore d'évaluation

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityD'EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityPas encore d'évaluation

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrKatu2010Pas encore d'évaluation

- Profit and Loss Projection 1yr 0Document1 pageProfit and Loss Projection 1yr 0Suraj RathiPas encore d'évaluation