Académique Documents

Professionnel Documents

Culture Documents

Financial Records Storage Guidelines

Transféré par

Dennis Han0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues1 pageThis simple page would outline some of improtant list of itmes that must kept in a safe place in proper manner in order to comply with any accounting audits by government, prospective buyers, partners, investors and especially for your own purpose to go back and see what has been going on throughout the years..

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis simple page would outline some of improtant list of itmes that must kept in a safe place in proper manner in order to comply with any accounting audits by government, prospective buyers, partners, investors and especially for your own purpose to go back and see what has been going on throughout the years..

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

99 vues1 pageFinancial Records Storage Guidelines

Transféré par

Dennis HanThis simple page would outline some of improtant list of itmes that must kept in a safe place in proper manner in order to comply with any accounting audits by government, prospective buyers, partners, investors and especially for your own purpose to go back and see what has been going on throughout the years..

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

© Copyright Envision SBS. 2007. All rights reserved.

Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL

AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY,

THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL BE SUED IN A COURT OF LAW.

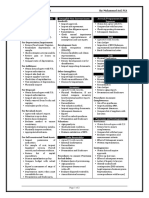

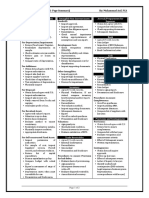

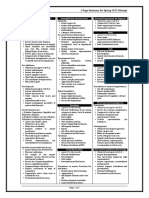

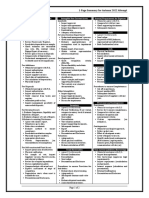

FINANCIAL RECORDS STORAGE GUIDELINES

Record Type Keep for

Income tax reports, protests, court briefs, appeal Indefinitely

Annual financial statements Indefinitely

Monthly financial statements 3 years

Books of account, such as the general ledger Indefinitely

Sub Ledgers 3 years

Canceled, payroll and dividend checks 6 years

Income tax payment checks Indefinitely

Bank reconciliations, voided checks, check stubs and register tapes 6 years

Sales records such as invoices, monthly statements, remittance

advisories, shipping papers, bills of lading and customers’ 6 years

purchase orders

Purchase records, including purchase orders and payment vouchers 6 years

Travel and entertainment records, including account books, diaries

6 years

and expense statements and receipts

Documents substantiating fixed-asset additions, depreciation

Indefinitely

policies and salvage values assigned to assets

Personnel and payroll records, such as payments and reports

to taxing authorities, including federal income tax

6 years

withholding, FICA contributions, unemployment taxes and

workers’ compensation insurance

Corporate documents, including certificates of incorporation,

corporate charter, constitution and bylaws, deeds and easements, stock,

stock transfer records, minutes of board of director meetings, retirement Indefinitely

and pension records, labor contracts and license, patent, trademark and

registration applications

Vous aimerez peut-être aussi

- Records Retention PolicyDocument3 pagesRecords Retention PolicyDonna BulgerPas encore d'évaluation

- Sample Document Retention and Destruction PolicyDocument3 pagesSample Document Retention and Destruction PolicyElyss SantiagoPas encore d'évaluation

- Records Retention PolicyDocument8 pagesRecords Retention PolicyWadek1960100% (1)

- Record RetentionDocument7 pagesRecord RetentionpinkpurpleicebabyPas encore d'évaluation

- Retention Periods Updated 15th May 2023Document2 pagesRetention Periods Updated 15th May 2023api-659596621Pas encore d'évaluation

- Retention and Disposal PolicyDocument18 pagesRetention and Disposal Policykarlen100% (1)

- A Business Guide: What To Shred and WhenDocument2 pagesA Business Guide: What To Shred and WhenAvinash ShelkePas encore d'évaluation

- Document Retention PolicyDocument13 pagesDocument Retention Policyjmontalvo8404Pas encore d'évaluation

- Document Retention Policy Template: Loyal Order of Moose EntitiesDocument7 pagesDocument Retention Policy Template: Loyal Order of Moose Entitiessivagnanam sPas encore d'évaluation

- Checklist - Due DiligenceDocument4 pagesChecklist - Due DiligenceShehzad AhmedPas encore d'évaluation

- Record Retention GuidelinesDocument7 pagesRecord Retention GuidelinesricciporchcoPas encore d'évaluation

- Record Retention Guide in The UKDocument5 pagesRecord Retention Guide in The UKArchive Management SystemsPas encore d'évaluation

- Due Diligence ChecklistDocument6 pagesDue Diligence ChecklistLauren HammondPas encore d'évaluation

- Record Retention Sample PolicyDocument10 pagesRecord Retention Sample Policysivagnanam sPas encore d'évaluation

- Policy For Preservation of Documents & Archival Process BAADocument5 pagesPolicy For Preservation of Documents & Archival Process BAAAnkita NegiPas encore d'évaluation

- Monitoring Tools - Loans and AdvancesDocument19 pagesMonitoring Tools - Loans and AdvancesShubhra SaxenaPas encore d'évaluation

- Statutory Requirments To Follow While Conducting Statutory AuditDocument6 pagesStatutory Requirments To Follow While Conducting Statutory Auditmanishkhemka666Pas encore d'évaluation

- Checklist For Statutory AuditDocument6 pagesChecklist For Statutory Auditnirav_poptani0% (1)

- Accounting and Bookeeping ManualDocument8 pagesAccounting and Bookeeping ManualFahim FarhanPas encore d'évaluation

- Due Dilligence Check ListDocument4 pagesDue Dilligence Check Listrajesh.joshi100% (2)

- Recordkeeping For Tax Purposes 2021Document2 pagesRecordkeeping For Tax Purposes 2021Finn KevinPas encore d'évaluation

- Audit PlanDocument9 pagesAudit Planananda_joshi5178Pas encore d'évaluation

- 05 Summary v2Document14 pages05 Summary v2yasserPas encore d'évaluation

- BBB Records Retention ScheduleDocument1 pageBBB Records Retention ScheduleFrank MaradiagaPas encore d'évaluation

- CAF 09 - Procedures Sheet By: Muhammad Asif, FCADocument2 pagesCAF 09 - Procedures Sheet By: Muhammad Asif, FCAsidra awanPas encore d'évaluation

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Muhammad YousafPas encore d'évaluation

- What To Records To Keep and WhyDocument6 pagesWhat To Records To Keep and Whyjose barrionuevoPas encore d'évaluation

- PPIB Initial RequisitionDocument5 pagesPPIB Initial Requisitionkathaana_15806Pas encore d'évaluation

- Policy On Document Retention 2015 JSPLDocument9 pagesPolicy On Document Retention 2015 JSPLseeram varmaPas encore d'évaluation

- Substantive Procedures 1-Page Summary For Spring 2022 AttemptDocument2 pagesSubstantive Procedures 1-Page Summary For Spring 2022 AttemptAmeenPas encore d'évaluation

- Company Law - Registers L0 Records - Notes MADocument19 pagesCompany Law - Registers L0 Records - Notes MAShyam SundarPas encore d'évaluation

- Request ListDocument21 pagesRequest ListHadi SumartonoPas encore d'évaluation

- Checklist BOB Supply Chain FinanceDocument3 pagesChecklist BOB Supply Chain FinanceKartik KumarPas encore d'évaluation

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Ali OptimisticPas encore d'évaluation

- Explain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageDocument5 pagesExplain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageBeyonce SmithPas encore d'évaluation

- Due Diligence - ChecklistDocument7 pagesDue Diligence - ChecklistAlex YanPas encore d'évaluation

- VouchingDocument5 pagesVouchingHimanshu AggarwalPas encore d'évaluation

- Engagement Letter - Bookkeeping and Tax Filing - NON VATDocument6 pagesEngagement Letter - Bookkeeping and Tax Filing - NON VATDv Accounting100% (2)

- Audit Statement Checklist File in Xls FormatDocument6 pagesAudit Statement Checklist File in Xls FormatTushar AmruskarPas encore d'évaluation

- Home Loan Lap Login ChecklistDocument1 pageHome Loan Lap Login ChecklistAditya KharePas encore d'évaluation

- Record Retention PolicyDocument4 pagesRecord Retention PolicymontalvoartsPas encore d'évaluation

- Hlbitc/Nha/Audit/002 Director FinanceDocument5 pagesHlbitc/Nha/Audit/002 Director FinanceSherazImtiazPas encore d'évaluation

- Audit SlideDocument22 pagesAudit SlideVaradan K RajendranPas encore d'évaluation

- 08 - Advances, Deposits, Prepayments and Other ReceivablesDocument4 pages08 - Advances, Deposits, Prepayments and Other ReceivablesAqib SheikhPas encore d'évaluation

- Policy On Preservation of DocumentsDocument9 pagesPolicy On Preservation of DocumentsArun KCPas encore d'évaluation

- Checklist For AuditDocument22 pagesChecklist For Auditaishwarya raikar100% (2)

- General List of Documents Initially Required For Legal Due Diligence ExaminationDocument2 pagesGeneral List of Documents Initially Required For Legal Due Diligence ExaminationMark PesiganPas encore d'évaluation

- Entrepreneurship Q2 M7Document17 pagesEntrepreneurship Q2 M7Primosebastian TarrobagoPas encore d'évaluation

- Assignment On Reviewing and Drafting Observations For Material Contract & Labour Law Matters in Due DiligenceDocument11 pagesAssignment On Reviewing and Drafting Observations For Material Contract & Labour Law Matters in Due DiligenceAryan SharmaPas encore d'évaluation

- Audit ProgramDocument3 pagesAudit ProgramNelnel Garcia100% (1)

- 8941C.11 Prepared by Client List - 31 December 2014Document6 pages8941C.11 Prepared by Client List - 31 December 2014WILD๛SHOTッ tanvirPas encore d'évaluation

- 50 - Due Diligence Checklist - 1Document6 pages50 - Due Diligence Checklist - 1Pavan KumarPas encore d'évaluation

- 50 - Due Diligence Checklist - 1Document6 pages50 - Due Diligence Checklist - 1Nikita ShahPas encore d'évaluation

- Property, Plant, Equipment: Substantive Audit Test (Procedures)Document10 pagesProperty, Plant, Equipment: Substantive Audit Test (Procedures)jexPas encore d'évaluation

- Substantive Audit For AssetsDocument7 pagesSubstantive Audit For AssetsHenry MapaPas encore d'évaluation

- Audit Programme 1Document20 pagesAudit Programme 1Neelam Goel0% (1)

- CARO2020Document8 pagesCARO2020CA Paramesh HemanathPas encore d'évaluation

- End of Term RevisionDocument12 pagesEnd of Term Revisionamarashah182Pas encore d'évaluation

- Shred It Guide To Document Retention1Document2 pagesShred It Guide To Document Retention1Sankalpa NagamuwaPas encore d'évaluation

- The First Amendment Handbook - LibelDocument12 pagesThe First Amendment Handbook - LibelDennis HanPas encore d'évaluation

- Economic Demo Profile SummaryDocument1 pageEconomic Demo Profile SummaryDennis HanPas encore d'évaluation

- Development Assistance HandbookDocument70 pagesDevelopment Assistance HandbookDennis HanPas encore d'évaluation

- FDIC Loan Modification ProgramDocument19 pagesFDIC Loan Modification ProgramKyle AndersonPas encore d'évaluation

- Landmark Communications, Inc. - 3200 Peachtree Industrial BLVD., Suite 301, Duluth, GA 30096Document14 pagesLandmark Communications, Inc. - 3200 Peachtree Industrial BLVD., Suite 301, Duluth, GA 30096Dennis HanPas encore d'évaluation

- Ag Gwinnett Pop Survey 2-13-07Document3 pagesAg Gwinnett Pop Survey 2-13-07Dennis HanPas encore d'évaluation

- Ag Atlanta 06 Pop Survey Profile 2-13-07Document3 pagesAg Atlanta 06 Pop Survey Profile 2-13-07Dennis HanPas encore d'évaluation

- NEWS BD RAE Letter of Intent-Press-release1Document2 pagesNEWS BD RAE Letter of Intent-Press-release1Anthony D.Pas encore d'évaluation

- Cable Selection Table For CapacitorDocument1 pageCable Selection Table For CapacitorShashiSharmaPas encore d'évaluation

- API 572 Practise QuestionDocument58 pagesAPI 572 Practise Questionbelonk_182100% (6)

- Granulation Process Basic UnderstandingDocument3 pagesGranulation Process Basic UnderstandingRainMan75Pas encore d'évaluation

- Pamphlet InsideDocument1 pagePamphlet Insideapi-2408549370% (1)

- Amsoil Synthetic CVT Fluid (CVT)Document2 pagesAmsoil Synthetic CVT Fluid (CVT)amsoildealerPas encore d'évaluation

- Switchyard Equipments, Switching Schmes & LayoutsDocument66 pagesSwitchyard Equipments, Switching Schmes & LayoutsPraveen Kumar88% (17)

- CBLMDocument37 pagesCBLMDTVS Inc.Pas encore d'évaluation

- Research Paper CalamansiDocument7 pagesResearch Paper Calamansih040pass100% (1)

- Clase No. 24 Nouns and Their Modifiers ExercisesDocument2 pagesClase No. 24 Nouns and Their Modifiers ExercisesenriquefisicoPas encore d'évaluation

- اطلع علي زتونة 3 ع مراجعة الترم الثاني 2024Document60 pagesاطلع علي زتونة 3 ع مراجعة الترم الثاني 2024ahmad sholokPas encore d'évaluation

- AJINOMOTO 2013 Ideal Amino Acid Profile For PigletsDocument28 pagesAJINOMOTO 2013 Ideal Amino Acid Profile For PigletsFreddy Alexander Horna Morillo100% (1)

- Principles in Biochemistry (SBK3013)Document3 pagesPrinciples in Biochemistry (SBK3013)Leena MuniandyPas encore d'évaluation

- A-Level: Psychology 7182/1Document20 pagesA-Level: Psychology 7182/1Queen Bee (Tt)Pas encore d'évaluation

- 2018 Haar Wavelet For Solving The Inverse Point Kinetics EquationsDocument8 pages2018 Haar Wavelet For Solving The Inverse Point Kinetics EquationsGeraldinPas encore d'évaluation

- Introduction To Destructive & Nondestructive TestingDocument38 pagesIntroduction To Destructive & Nondestructive Testingshubham sinhaPas encore d'évaluation

- FACSDocument8 pagesFACSKarthick ThiyagarajanPas encore d'évaluation

- MCQ Questions For Class 10 Science Periodic Classification of Elements With AnswersDocument30 pagesMCQ Questions For Class 10 Science Periodic Classification of Elements With AnswersAymen WaelPas encore d'évaluation

- Evaluation of Bond Strenght of Dentin Adhesive at Dry and Moist Dentin-Resin Interface PDFDocument4 pagesEvaluation of Bond Strenght of Dentin Adhesive at Dry and Moist Dentin-Resin Interface PDFOpris PaulPas encore d'évaluation

- Micromechanical Testing of Thin Die: (Nordson DAGE UK)Document2 pagesMicromechanical Testing of Thin Die: (Nordson DAGE UK)Thanalachmy GopiPas encore d'évaluation

- Cvmmethod 101220131950 Phpapp02Document20 pagesCvmmethod 101220131950 Phpapp02AlibabaPas encore d'évaluation

- Bar Exam Questions Week 1Document30 pagesBar Exam Questions Week 1Mark Bantigue100% (1)

- Reticular AbscessDocument4 pagesReticular AbscessSasikala KaliapanPas encore d'évaluation

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDrsex DrsexPas encore d'évaluation

- Fischer General-CatalogueDocument108 pagesFischer General-Cataloguebo cephusPas encore d'évaluation

- Mechanical Pumps: N. HilleretDocument12 pagesMechanical Pumps: N. HilleretAmrik SinghPas encore d'évaluation

- DexaDocument36 pagesDexaVioleta Naghiu100% (1)

- Major Laishram Jyotin SinghDocument3 pagesMajor Laishram Jyotin SinghSpongebob SquarepantsPas encore d'évaluation

- Imperial SpeechDocument2 pagesImperial SpeechROJE DANNELL GALVANPas encore d'évaluation

- Structural Tanks and ComponentsDocument19 pagesStructural Tanks and ComponentsRodolfo Olate G.Pas encore d'évaluation