Académique Documents

Professionnel Documents

Culture Documents

Govt of Punjab, Finance Department, Pay Revision, 2005

Transféré par

tariqravian93%(14)93% ont trouvé ce document utile (14 votes)

16K vues7 pagesREVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION - 2005 Of CIVIL EMPLOYEES OF PUNJAB GOVERNMENT (B5-1 TO 22)

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentREVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION - 2005 Of CIVIL EMPLOYEES OF PUNJAB GOVERNMENT (B5-1 TO 22)

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

93%(14)93% ont trouvé ce document utile (14 votes)

16K vues7 pagesGovt of Punjab, Finance Department, Pay Revision, 2005

Transféré par

tariqravianREVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION - 2005 Of CIVIL EMPLOYEES OF PUNJAB GOVERNMENT (B5-1 TO 22)

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 7

No.FD.

PC-2-112005 GOVERNMENT OF THE PUNJAB ANANCEDEPARTMENT

Dated Lahore, the 16th July, 2005

From:

Mr. Salman Siddique,

Principal Secretary(Finance & Taxation), Finance Secretary.

To

1. 2. 3. 4. 5. 6. 7 ..

8. 9. 10. 11. 12. 13.

All Administrative Secretaries to Government of the Punjab; The Principal Secretary to Governor, Punjab, Lahore;

The Principal Secretary to Chief Minister, Punjab, Lahore; The Military Secretary to Governor, Punjab, Lahore;

All District Coordination Officers in the Punjab;

All Heads of Attached Departments,Government of the Punjab; The Registrar, Lahore High Court, Lahore;

All District and Session Judges in the Punjab;

The Secretary, Punjab Public Service Commission, Lahore; The Secretary, Punjab Provincial Assembly, Lahore;

The Chief Pilot, VIP Flights, Lahore.

The Director General Audit & Accounts (Works), Lahore. The Provincial Director, Local Fund Audit, Punjab, Lahore.

Subject:

REVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION - 2005 Of CIVIL EMPLOYEES OF PUNJAB GOVERNMENT (B5-1 TO 22)

Sir,

I am directed to 'state that the Governor of the Punjab has

been pleased to sanction the revision of Basic Pay Scales, AUowances and

Pension - 2005 for civil employees of the Government of the Punjab in BPS-1

to BPS-22, with effect from 01-07-2005, as detailed below: -

PART-I: BASIC PAY SCALES

2. Basic Pay Scales:

The revised Basic Pay Scales, 2005 shall replace the existing Basic Pay Scales, 2001 as shown in the Annexure.

3~ Fixation of Pay of the Existing Employees:

i) The basic pay of an employee in service on 30.6.2005 shall be fixed in the revised Basic Pay Scale on point to point basis i.e. at. the stage corresponding to that occupied by him above the minimum of 2001 Basic Pay Scales ..

ii) The corresponding stage for.fixation of basic pay in the aforesaid manner in respect of an employee whose pay was fixed beyond the maximum of the relevant scale as a result of discontinuation of move over policy under the 2001 Basic Pay Scales scheme shall be determined on notional extension basis i.e. by treatinq the amount of personal pay drawn by him on so" June, 2005, as part of his basic pay scale and the amount beyond the maximum of the prescribed stage in the revised Basic Pay Scales, shall be allowed as personal pay,

- 2 -

4., Annual Increment:

Annual increment shall continue to be admissible subject to the existing conditions; on 1 st of December each year. However, the first annual increment of existing employees in Basic Pay Scales, in which their pay is fixed on 01-07-2005, shall accrue on the 1 st December, 2005.

PART-II: ALLOWANCES

5. Special Additional Allowance:

Special Additional Allowance shall continue to be admissible at frozen level on existing conditions.

6. Special Relief Allowance and Adhoc Relief:

Special Relief Allowance and Adhoc Relief sanctioned with effect from 1.7.2003 and 1.7.2004" respectively shall stand frozen at the level of their admissibility as on 30.6.2005 and the amount shall continue to be admissible to the entitled recipients till further orders but it will cease to be admissible to new entrants joining Government "service on or after 1.7.2005 as well as to those employees to whom it was ceased to be admissible under the

. existing conditions,

'7. House Rent Allowance:

House Rent Allowance shall be admissible with reference to the revised Basic Pay Scales,2005 subject to the existing conditions.

8. Medical AIIowa:nce:

Medical Allowance shall be admissible @ Rs.425/- p.m. subject to the existing conditions.

9. Conveyance Allowance:

a) Conveyance Allowance shall be admissible on revised rates as follows:

BPS RATES

1-4 Rs. 340/- prri

5-10 Rs. 46OU1_!!____

11-15 Rs. 680/- pm

16-20 Rs.12401 - pm b) Conveyance Allowance @ Rs.1240/- per month shall also be admissible to those SPS-21"& 22 officers who are not sanctioned . official vehicle.

'10 Other;Special Pays I S.,eci~ A1lowanc~s:.

The rates of Special Pays and Special Allowances shall be revised as detailed below:-

i) Entertainment Allowance:

.BPS .. Existing -Revised I

19 Nil Rs.SOO l: pm ..

2.0 ';<Rs,48Dj- _Q_m Rs.600j-' pm

.' 21 " RS':525,f - pm Rs. 700/ _; .pm

-, '.;1,22 ..... Rs::7251 - pm Rs:~75! it pm. .

, ~ --.'

- 3 -

ii) Daily Allowance:

I BPS Existing Revised

~ 1-4· Ordinary Special Ordinary Specia

80/- 110/- 125/-1 2-00

l- 5-11 __ ~LOOI- ____ _l2_QL._ .. _.~} 55/ ___ L ___ ~~~~?~_()

--_-_ .. _._-

12-16 180/ - 200/- 280/ - . 365

17-18 320/- 350}- 500/- 640

--

19-20 400/- 450/- 625/- 825

21-22 450/- 550/- 700/- I 1000 Special rates shall also be allowed at Muzaffarabad & Mirpur . AJ&K in addition to those places at which special rates are already admissible.

iii]: Transportation/Mileage Allowance:

Transportation Existing Revised

_!) Motor Car Rs.1.20 /- per k.m. Rs.2/pe~~."...

ii) Motor Cycle Rs.0.40/- per k.rn. Rs.Lr per k.

jScooter -

Mileage Allowance

i) Personal Car /Taxi Rs.3/- per krn. Rs.5/per k

ii] Motor Cycle / Rs. 1/- per km. Rs.2/perk

Scooter

iii) Bicycle / Animal Rs.0.75/- per km. Rs.1/per k

back/foot

I iv) Public Transport Rs.0.37 -per km Rs.1/per k

(BPS-6 & below)

Rs.0.50 /- per km.

r---- . (BPS-7 & above). Rs.Ly per k

Travel b~ Air Govt. servan ts in Govt. serva

BPS-17 and those in BPS-l7 r;

in receipt of pay of. above.

Rs.5400 & above

Carriage of Paisa 0.148 per Rs.,O.008 pe

Personal! km per kg (or 2.96· km per kg

Effects on paisa per km per

transfer! unit of 20 kg.)

Recruitment ,

·1

I

-~

n:!_' __ --l

..

~: I

m. I

m. I

ill. J

nts &

.. --j

r I

__j

. iv) QualificationP~_:

--

Qualification Existing Revised

i) SAS Accountant Rs.200/-pm Rs. 400/-pm

ii) Part-III (IeMA/ ICWA) Nil Rs. 400/ - Em !

iii) ICMA/ICWA Nil Rs 1200/.~~

iv) Chartered Accountant Nil Rs. 1300/ - J2m

v} Staff College/NOe. Rs.750/;-.pm Rs.I0QQJ~~

vi) Advanced Course In Rs.200/ - pm Rs. 500/- pm !

NIPA I v) Senior Post Allowance:

BPS .. Existing Revi

20 Rs.850/- prn Rs.IIOO

21 .. ,Rs.925/ - pm Rs.1200

22 "Rs. 1200/ - pm Rs.1600 S~d

I:: m

- m

l : pm

' ", "

'- 4 -

vi) Deputation! ,Addl. Charge Allowance:

Existing Revised

Deputation @ 20% of. the @ 20% ofth

Allowance minimum of the Basic Pay

Pay. Scale of the I subj:ct to

.deputationist maximum 0

irrespective of .the Rs.6000/- P

pay scale of the

post against which ....

he IS working on

deputation

,

Additional @ 20% of basic pay .@ 200/9 of th

Charge Allowance upto a maximum of Basic-Pay ._

Rs.1100j - PM. subject to

- maximum' 0

Rs.6000/- P M.

Vll

"'

Nurses u to BS-16

viii) PSP Uniform Allowance:

Existing Revised I

Rs.250j- pm Rs.1200j- ~~_j

ix) Special Pay to PSs/PAs:

Existing Revised

Private Secretaries to

Ministers / Chief Secretary j

Chairman, P&D Board/ ACS:

i] From the Cadre of Private . Rs.300j - pm RsAOO/:- pm I

Secretaries in 8S-16 I

ii) From other sources in Rs.375/- pm Rs:SOO /- pm I

BS-'J7 !

Private Secretaries to Rs.225/- pm ,~:~OOi- pm I

Secretaries .. ,

PAs to Ministers Rs.150/- pm Rs.200j- pm i

PAs to Chief Secretary/ACSj" , Rs.120l:.pm Rs, 160/ - 'pm I

:. ~

Secretaries / Addl. Secretaries ! x] .Instructional Allowance:

Existing Revised

20% of the Basic Pay i] 20% of the Basic Paysubject to

subject to. maximum of the maximum of'Rs.5000/- per I

Rs.2000/- per month. month to- those Instructors imparting in service training to the officers in BPS-17 & above who are already in receipt of this allowance. ~.

ii) 20% of the Basic Pay subject to the maximum of Rs.3000 / - pm. to those Instructors imparting In service training to the employees; I up to B8-16, who are already in receipt of this allowance .

. -----~

- 5 -

xi) Washing Allowance for Police Force:

Revised RS.I00 - m

xii) Contingent Allowances:

The Integrated Allowance @ RS.150/- pm shall be admissible to Naib Oasids, Qasids,' Daftries, Farashes, Chowkidars, Sweepers and Sweepresses, w.e.f. 1.7.2005. The Wash.ing Allowance and Dress Allowance admissible to Naib. Qasids, Frashes, Chowkidars, Sweepers and Sweepresses shall stand abolished under this scheme.

\

11. The following allowances in respect of civil employees shall stand abolished under this scheme:

•

Name of Allowance Present Rate I

I

i) Cash Handling Allowance Rs.25/- to Rs.75/- prn.

ii) Telecom Allowance Rs.150/ - pm.

iii) Copier / Photo stat Allowance Rs.50/- prn. PART-III: PENSION

12.

-,

~

J

13. Commutation shall be admissible up to a maximum of 35% of Gross Pension, at the option of the pensioner. Admissibility of monthly pension shall be increased from the existing' 60% to 65% of Gross Pension.

An increase @ 10% 'shall be allowed on the amount of pension being drawn by the existing pensioners as well as to those civil

employees who would draw pension under the revised Basic Pay Scales, 2005 .:

14. The increases allowed on pension @ 15% and 8% w.e.f. 1.7.2003 and 1.7.2004 respectively shall not be admissible to the civil employees who would draw pension under the revised Basic Pay Scales, 2005.'

Option:

15.

a) All the' existing civil employees (8S-1 to 22) of -the provincial government shall, withinSO--dan from the date of issue of this notification, exercise ail option in writing and communicate it to the Accountant General Punjab/District Accounts Office/DOG concerned, as the case may be either to continue to draw salary in the existing Basic Pay scales, in which he is already. drawing or in. the revised Basic Pay Scales and penslonzcommutatlon scheme, 2005a8 specified in this notitication. Option once exercised shall be final.

b) An existing employee as aforesaid, wh.o does not exercise and communicate such an option within the specified- time limit, shall be deemed to have opted for

..

the revised Basic Pay Scales - 2005.

- 6 -

16. All existing rules/orders on the subject shall be' deemed to have been modified to the extent indicated above. AU existing ruiesJ orders not so modified shalt continue to be in force under this scheme.

Anomalies:

1"7. An Anomaly Committee shall be set up in the Finance Department (Requlations Wing) to resolve' the anomalies if any, arising in the implementation of the revised Basic Pay Scales-2005.

Your obedient servant,

!!L . &, ;/:' Itp}~_

( RUKliSANA NADEEM BHUTTA ) DEPUrt SECRETARY (PC)

NO. ~ DATE EVEN

A copy is forwarded for information and necessary action to:-

1. The Accountant General, Punjab, Lahore.

2. All District Accounts Officers in the Punjab.

{ TARCQ MUHAMMAD MIP~ } SECTION OFFICER (PC)

,.

NO. & DAilE EVEN

A copy is forwarded for information to:-

1. Finance Secretary, Government of Sindh, Karachi.

2. Finance Secretary, Government of NVVFP, Peshawar.

3. Finance Secretary. Government of Balochistan, Quetta.

4, Finance Secretary, Azad Government of the State of Jammu & Kashmir, Muzaffarabad.

5. Regulation Wing, Finance Division; Government of Pakistan.

Islamabad,

c..._

~ ~.,..

t a-: "'nJm~

( TARIQ" HAMM MIRZ.A )

SECTION OFFICER (~C)

.....

"

r

ANNEXURE TO FINANCE DEPARTMENT'S NOtiFICATiON NO. FD.PC.2·1/2005, DATEQ_:J§:07-2005

19835

14

Vous aimerez peut-être aussi

- Acr Instructions (U)Document84 pagesAcr Instructions (U)Sagheer Ahmed100% (1)

- Finance Department Notifications-2007 (550-706)Document84 pagesFinance Department Notifications-2007 (550-706)Humayoun Ahmad Farooqi50% (2)

- PunJab Traveling Allowance RulesDocument121 pagesPunJab Traveling Allowance RulesHumayoun Ahmad FarooqiPas encore d'évaluation

- Revised Deputation PolicyDocument12 pagesRevised Deputation PolicyAwais Farrukh Butt80% (10)

- Civil Servants (Appointment, Promotion and Transfer) Rules 1989 PDFDocument12 pagesCivil Servants (Appointment, Promotion and Transfer) Rules 1989 PDFibrahim khanPas encore d'évaluation

- Preliminary Report of Delimitation 2023Document39 pagesPreliminary Report of Delimitation 2023Syed Muhammad Wajeeh100% (1)

- Retired Free Supply FormDocument8 pagesRetired Free Supply Formmwmalhr6654Pas encore d'évaluation

- The Punjab Judicial Services Rules, 1994Document7 pagesThe Punjab Judicial Services Rules, 1994Sea Shores58% (12)

- Punjab Govt Notifies Senior Bureaucrats TransfersDocument7 pagesPunjab Govt Notifies Senior Bureaucrats TransferszakadurraniPas encore d'évaluation

- Guidelines For PTI Overseas Intra Party Elections (PTI ITALY Elections 2015)Document11 pagesGuidelines For PTI Overseas Intra Party Elections (PTI ITALY Elections 2015)PTI OfficialPas encore d'évaluation

- SSC FinalgazetteDocument622 pagesSSC FinalgazetteAfaq AffaqPas encore d'évaluation

- ACR Form 1-15Document2 pagesACR Form 1-15Faheem Ullah100% (5)

- Summary For The Chief MinisterDocument8 pagesSummary For The Chief MinisterFraz InamPas encore d'évaluation

- WAPDA Financial Powers BookDocument113 pagesWAPDA Financial Powers BookWaheed Ahmad0% (1)

- Bhawalpur Order W.P No. 353-357-358-359 & 360 Before Lahore High Court, Bahawalpur Bench.Document10 pagesBhawalpur Order W.P No. 353-357-358-359 & 360 Before Lahore High Court, Bahawalpur Bench.saad.ahmed00012Pas encore d'évaluation

- Punjab Govt Conduct Rules (U)Document82 pagesPunjab Govt Conduct Rules (U)Humayoun Ahmad Farooqi67% (3)

- CP FormsDocument4 pagesCP FormsZain Ul Hassan83% (12)

- Esta - Code PROCEDURE FOR SELECTIONDocument4 pagesEsta - Code PROCEDURE FOR SELECTIONMuhib Ullah KhanPas encore d'évaluation

- Rahim Yar Khan Candidate ListDocument14 pagesRahim Yar Khan Candidate ListPTI OfficialPas encore d'évaluation

- CP's Coding ListDocument10 pagesCP's Coding ListSibtain Ul HassanPas encore d'évaluation

- PTCL Disconnection LetterDocument1 pagePTCL Disconnection LetterNaafay I.T ConsultantsPas encore d'évaluation

- Website Analysis of www.meoisb.comDocument79 pagesWebsite Analysis of www.meoisb.comEngr Faizan100% (6)

- Detailed Report On 5 Years Performance of KPK Govt.Document34 pagesDetailed Report On 5 Years Performance of KPK Govt.Insaf.PK100% (3)

- FAFEN GE-2024 Turnout Analysis FinalDocument4 pagesFAFEN GE-2024 Turnout Analysis Finalnsb.taurusianPas encore d'évaluation

- Government of Pakistan-Esta Code-Chapter-6Document51 pagesGovernment of Pakistan-Esta Code-Chapter-6Tahir Khan100% (7)

- Government of Pakistan-Esta Code-Chapter-6aDocument58 pagesGovernment of Pakistan-Esta Code-Chapter-6aTahir Khan100% (2)

- Punjab Govt. Contract Policy 2004Document20 pagesPunjab Govt. Contract Policy 2004Muhammad Naeem80% (5)

- Paying Membership and Election Process For PTI CanadaDocument3 pagesPaying Membership and Election Process For PTI CanadaPTI OfficialPas encore d'évaluation

- Sindh Benevolent Fund BoardDocument2 pagesSindh Benevolent Fund BoardLaw DepartmentPas encore d'évaluation

- Comments On Labour Wing by LawsDocument1 pageComments On Labour Wing by LawsInsaf.PK100% (3)

- Supreme Court Bill ReconsiderationDocument3 pagesSupreme Court Bill ReconsiderationArif Alvi100% (1)

- Annual Confidential Report FormDocument18 pagesAnnual Confidential Report Formsyed.jerjees.haider87% (31)

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12Pas encore d'évaluation

- Supreme Court Extends Benefits of Judgment to All Civil ServantsDocument3 pagesSupreme Court Extends Benefits of Judgment to All Civil ServantsSajid Mahsud75% (4)

- Oft34buc2lq1c4zzfauf25qxDocument2 pagesOft34buc2lq1c4zzfauf25qxSumit Agarwal0% (1)

- Seed Company Registration Procedure in PakistanDocument2 pagesSeed Company Registration Procedure in PakistanMhsin Qayyum100% (1)

- Organisation of International Chapters by Laws 2019-FinalDocument15 pagesOrganisation of International Chapters by Laws 2019-FinalInsaf.PKPas encore d'évaluation

- Customer Copy: Defence Housing Authority Quetta Main Airport Road Quetta PB1-5M-Res-57-4Document10 pagesCustomer Copy: Defence Housing Authority Quetta Main Airport Road Quetta PB1-5M-Res-57-4Naeem Ahmed KcciPas encore d'évaluation

- Letter To PM On Journalists PersecutionDocument3 pagesLetter To PM On Journalists PersecutionArif Alvi100% (1)

- Application for Enrolment as an AdvocateDocument6 pagesApplication for Enrolment as an AdvocateMajid Khakhrani50% (2)

- Promotion Policy 2018Document20 pagesPromotion Policy 2018ibrahim khanPas encore d'évaluation

- Elections Bill Returned To Parliament LetterDocument2 pagesElections Bill Returned To Parliament LetterArif Alvi100% (3)

- Constitution of PTI 2019Document99 pagesConstitution of PTI 2019Insaf.PK80% (5)

- SC VerdictDocument5 pagesSC VerdictKhawaja BurhanPas encore d'évaluation

- REVISED DEPUTATION POLICY of WAPDADocument12 pagesREVISED DEPUTATION POLICY of WAPDAMuhammad Sarmad Ahsan100% (1)

- DRAFT LIST OF POLLING STATIONS AND VOTER DETAILS IN NA-154-MULTAN-IDocument156 pagesDRAFT LIST OF POLLING STATIONS AND VOTER DETAILS IN NA-154-MULTAN-ISyed mujtaba Haider sherazi100% (2)

- 19th FAS QAT Modified 1 1 PDFDocument298 pages19th FAS QAT Modified 1 1 PDFAhmad Raza100% (1)

- PAK Boiler Rules 2009Document14 pagesPAK Boiler Rules 2009Ovais100% (1)

- Free Elecricity Supply FormDocument2 pagesFree Elecricity Supply FormzararPas encore d'évaluation

- NBP-Roshan Ghar Solar Finance - BusinessDocument13 pagesNBP-Roshan Ghar Solar Finance - Businessmusman0075Pas encore d'évaluation

- Government of Sindh Finance DepartmentDocument8 pagesGovernment of Sindh Finance DepartmentNaeem Rao100% (1)

- Travelling Allowance RevisedDocument4 pagesTravelling Allowance RevisedvenkatasubramaniyanPas encore d'évaluation

- Service Conditions - SBI - As On June 2008Document73 pagesService Conditions - SBI - As On June 2008ashiquekumar100% (1)

- 7THCPCDocument8 pages7THCPCRaj KumarPas encore d'évaluation

- GO236 - 01.06.2009 - Finance Department (Pay Cell)Document6 pagesGO236 - 01.06.2009 - Finance Department (Pay Cell)elanthamizhmaranPas encore d'évaluation

- FBOA Achieves Landmark Settlement Victory of Our UnityDocument14 pagesFBOA Achieves Landmark Settlement Victory of Our UnityPar MatyPas encore d'évaluation

- IOCL CompensationDocument50 pagesIOCL CompensationAbhishek Agrawal80% (5)

- Chapter - Iv Salary Structure and Administration: 1. Scales of PayDocument9 pagesChapter - Iv Salary Structure and Administration: 1. Scales of PaySaurabhPas encore d'évaluation

- Facility To Bank EmployeeDocument4 pagesFacility To Bank EmployeePRAMODPas encore d'évaluation

- KSFE travel allowance revisionDocument2 pagesKSFE travel allowance revisionJossymon JosephPas encore d'évaluation

- 27361pay Revision RulesDocument136 pages27361pay Revision Rulesguddu_bhai100% (1)

- Delegation of Financial Rules 2006 AmendedDocument360 pagesDelegation of Financial Rules 2006 AmendedHumayoun Ahmad Farooqi100% (1)

- A Universal Turing Machine: Fall 2005 Costas Busch - RPI 1Document59 pagesA Universal Turing Machine: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Aab A Ab S S Asb S: Grammars With at Most One Variable at The Right Side of A ProductionDocument43 pagesAab A Ab S S Asb S: Grammars With at Most One Variable at The Right Side of A ProductiontariqravianPas encore d'évaluation

- The Post Correspondence Problem: Fall 2003 Costas Busch - RPI 1Document58 pagesThe Post Correspondence Problem: Fall 2003 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Turing's Thesis: Fall 2005 Costas Busch - RPI 1Document69 pagesTuring's Thesis: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Time ComplexityDocument33 pagesTime ComplexitytariqravianPas encore d'évaluation

- Single Accepting State For Nfas: Fall 2005 Costas Busch - Rpi 1Document31 pagesSingle Accepting State For Nfas: Fall 2005 Costas Busch - Rpi 1tariqravianPas encore d'évaluation

- Regular Pumping ExamplesDocument31 pagesRegular Pumping ExamplestariqravianPas encore d'évaluation

- Non-Regular Languages: (Pumping Lemma)Document46 pagesNon-Regular Languages: (Pumping Lemma)tariqravianPas encore d'évaluation

- Recursively Enumerable and Recursive Languages: Fall 2005 Costas Busch - RPI 1Document55 pagesRecursively Enumerable and Recursive Languages: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Regular Expressions: Fall 2005 Costas Busch - RPI 1Document34 pagesRegular Expressions: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Non-Deterministic Finite Automata: Fall 2005 Costas Busch - RPI 1Document115 pagesNon-Deterministic Finite Automata: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Parsing: Fall 2005 Costas Buch - RPI 1Document37 pagesParsing: Fall 2005 Costas Buch - RPI 1tariqravianPas encore d'évaluation

- PDA Accept Context FreeDocument69 pagesPDA Accept Context FreetariqravianPas encore d'évaluation

- Dec Id AbilityDocument45 pagesDec Id AbilitytariqravianPas encore d'évaluation

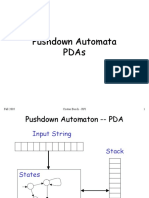

- Pushdown Automata Pdas: Fall 2005 Costas Busch - RPI 1Document90 pagesPushdown Automata Pdas: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Other Models of ComputationDocument72 pagesOther Models of ComputationtariqravianPas encore d'évaluation

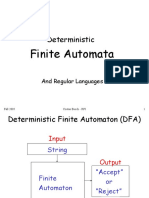

- Deterministic: Finite AutomataDocument56 pagesDeterministic: Finite AutomatatariqravianPas encore d'évaluation

- NP-complete Languages: Fall 2005 Costas Busch - RPI 1Document51 pagesNP-complete Languages: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Mathematical Preliminaries: Fall 2005 Costas Busch - RPI 1Document45 pagesMathematical Preliminaries: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- NP Complete ReductionsDocument24 pagesNP Complete ReductionstariqravianPas encore d'évaluation

- Automata LanguagesDocument23 pagesAutomata LanguagestariqravianPas encore d'évaluation

- Decidable Regular Context FreeDocument16 pagesDecidable Regular Context FreetariqravianPas encore d'évaluation

- CSCI-2400 Models of Computation: Fall 2005 Costas Busch - RPI 1Document18 pagesCSCI-2400 Models of Computation: Fall 2005 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Context Free Pumping ExamplesDocument55 pagesContext Free Pumping ExamplestariqravianPas encore d'évaluation

- Deterministic PDA: Fall 2003 Costas Busch - RPI 1Document24 pagesDeterministic PDA: Fall 2003 Costas Busch - RPI 1tariqravianPas encore d'évaluation

- Context Free PumpingDocument74 pagesContext Free PumpingtariqravianPas encore d'évaluation

- Context Free PropertiesDocument35 pagesContext Free PropertiestariqravianPas encore d'évaluation

- DENR V DENR Region 12 EmployeesDocument2 pagesDENR V DENR Region 12 EmployeesKara RichardsonPas encore d'évaluation

- CHAPTER 4 - Basic Numbering System of Police ReportsDocument4 pagesCHAPTER 4 - Basic Numbering System of Police ReportsAilyne CabuquinPas encore d'évaluation

- Barangay Hearing NoticeDocument2 pagesBarangay Hearing NoticeSto Niño PagadianPas encore d'évaluation

- Court rules bankruptcy notice invalid due to limitation periodDocument10 pagesCourt rules bankruptcy notice invalid due to limitation periodFelix NatalisPas encore d'évaluation

- Mullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlDocument20 pagesMullane vs. Central Hanover Bank & Trust Co., Trustee, Et AlAngelica LeonorPas encore d'évaluation

- Honda Cars ApplicationDocument2 pagesHonda Cars ApplicationHonda Cars RizalPas encore d'évaluation

- Milton Ager - I'm Nobody's BabyDocument6 pagesMilton Ager - I'm Nobody's Babyperry202100% (1)

- Cod 2023Document1 pageCod 2023honhon maePas encore d'évaluation

- Financial Report For IntramuralsDocument2 pagesFinancial Report For IntramuralsRosa Palconit0% (1)

- Deuteronomy SBJT 18.3 Fall Complete v2Document160 pagesDeuteronomy SBJT 18.3 Fall Complete v2James ShafferPas encore d'évaluation

- International Law Obligation of States to Enact Legislation to Fulfill Treaty TermsDocument17 pagesInternational Law Obligation of States to Enact Legislation to Fulfill Treaty TermsFbarrsPas encore d'évaluation

- Assignment No 1. Pak 301Document3 pagesAssignment No 1. Pak 301Muhammad KashifPas encore d'évaluation

- TominiDocument21 pagesTominiChiara D'AloiaPas encore d'évaluation

- Hacienda LuisitaDocument94 pagesHacienda LuisitanathPas encore d'évaluation

- Lc-2-5-Term ResultDocument44 pagesLc-2-5-Term Resultnaveen balwanPas encore d'évaluation

- AHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadDocument8 pagesAHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadPatrick AdamsPas encore d'évaluation

- G.O.MS - No. 578 Dt. 31-12-1999Document2 pagesG.O.MS - No. 578 Dt. 31-12-1999gangaraju88% (17)

- Oxford Research Encyclopedia of Latin American History: CloseDocument21 pagesOxford Research Encyclopedia of Latin American History: CloseemirohePas encore d'évaluation

- Tonog Vs CADocument2 pagesTonog Vs CAAllen So100% (1)

- Magnitude of Magnetic Field Inside Hydrogen Atom ModelDocument6 pagesMagnitude of Magnetic Field Inside Hydrogen Atom ModelChristopher ThaiPas encore d'évaluation

- Pre-Trial Brief of ProsecutionDocument3 pagesPre-Trial Brief of ProsecutionJoan PabloPas encore d'évaluation

- Brandon Civil War Relic Show Vendor FormDocument2 pagesBrandon Civil War Relic Show Vendor FormSCV Camp 265Pas encore d'évaluation

- Revised Guidelines PD 851Document4 pagesRevised Guidelines PD 851Abegail LeriosPas encore d'évaluation

- Chem Office Enterprise 2006Document402 pagesChem Office Enterprise 2006HalimatulJulkapliPas encore d'évaluation

- Tanveer SethiDocument13 pagesTanveer SethiRoshni SethiPas encore d'évaluation

- Durable Power of Attorney Form For Health CareDocument3 pagesDurable Power of Attorney Form For Health CareEmily GaoPas encore d'évaluation

- Non-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandDocument1 pageNon-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandVictor Victor100% (2)

- QSPOT571423: Create Booking Within 24 HoursDocument2 pagesQSPOT571423: Create Booking Within 24 HoursNaimesh TrivediPas encore d'évaluation

- Ns Ow AMp GTB JFG BroDocument9 pagesNs Ow AMp GTB JFG Broamit06sarkarPas encore d'évaluation

- Canadian Administrative Law MapDocument15 pagesCanadian Administrative Law MapLeegalease100% (1)