Académique Documents

Professionnel Documents

Culture Documents

Indian Income Tax Rates (AY 1998-99 To 2011-12)

Transféré par

Himanshu0%(1)0% ont trouvé ce document utile (1 vote)

8K vues5 pagesTax rates for AY 2009-10 Surcharge removed for individuals from the assessment year 2009-10 Individuals and HUF Slab (Rs.) less than 1,50,000 Nil 1,50,000 to 3,00,000 (TI - 1,50,000) 10% 3,00, 000 to 5,00,000 15,000 + (TI -3,00,000) 20% Greater than 5,00, 000 55,000 + (+ (TI -5,00,00) 30% Senior Citizens (Individuals aged above 65 years) Slab (rs.

Description originale:

Titre original

Indian Income Tax Rates (AY 1998-99 to 2011-12)

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTax rates for AY 2009-10 Surcharge removed for individuals from the assessment year 2009-10 Individuals and HUF Slab (Rs.) less than 1,50,000 Nil 1,50,000 to 3,00,000 (TI - 1,50,000) 10% 3,00, 000 to 5,00,000 15,000 + (TI -3,00,000) 20% Greater than 5,00, 000 55,000 + (+ (TI -5,00,00) 30% Senior Citizens (Individuals aged above 65 years) Slab (rs.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0%(1)0% ont trouvé ce document utile (1 vote)

8K vues5 pagesIndian Income Tax Rates (AY 1998-99 To 2011-12)

Transféré par

HimanshuTax rates for AY 2009-10 Surcharge removed for individuals from the assessment year 2009-10 Individuals and HUF Slab (Rs.) less than 1,50,000 Nil 1,50,000 to 3,00,000 (TI - 1,50,000) 10% 3,00, 000 to 5,00,000 15,000 + (TI -3,00,000) 20% Greater than 5,00, 000 55,000 + (+ (TI -5,00,00) 30% Senior Citizens (Individuals aged above 65 years) Slab (rs.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 5

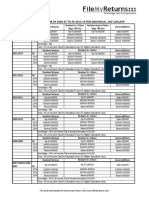

Tax Rates in India

Tax rates for AY 2011-12

Individuals & HUF

Slab (Rs.) Tax (Rs.)

less than 1,60,000 Nil

1,60,000 to 5,00,000 (TI - 1,60,000) * 10%

5,00,000 to 8,00,000 34,000 + (TI - 5,00,000) * 20%

Greater than 8,00,000 94,000 + (TI – 8,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,90,000 Nil

1,90,000 to 5,00,000 (TI - 1,90,000) * 10%

5,00,000 to 8,00,000 31,000 + (TI - 5,00,000) * 20%

Greater than 8,00,000 91,000 + (TI – 8,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,40,000 Nil

2,40,000 to 5,00,000 (TI - 2,40,000) * 10%

5,00,000 to 8,00,000 26,000 + (TI - 5,00,000) * 20%

Greater than 8,00,000 86,000 + (TI – 8,00,000) * 30%

Tax rates for AY 2010-11

Individuals & HUF

Slab (Rs.) Tax (Rs.)

less than 1,60,000 Nil

1,60,000 to 3,00,000 (TI - 1,60,000) * 10%

3,00,000 to 5,00,000 14,000 + (TI - 3,00,000) * 20%

Greater than 5,00,000 54,000 + (TI – 5,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,90,000 Nil

1,90,000 to 3,00,000 (TI - 1,90,000) * 10%

3,00,000 to 5,00,000 11,000 + (TI - 3,00,000) * 20%

Greater than 5,00,000 51,000 + (TI – 5,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,40,000 Nil

2,40,000 to 3,00,000 (TI - 2,40,000) * 10%

3,00,000 to 5,00,000 6,000 + (TI - 3,00,000) * 20%

Greater than 5,00,000 46,000 + (TI – 5,00,000) * 30%

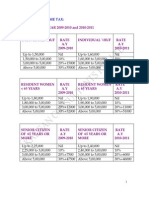

Tax rates for AY 2009-10

Surcharge removed for individuals from the assessment year 2009-10

Individuals & HUF

Slab (Rs.) Tax (Rs.)

less than 1,50,000 Nil

1,50,000 to 3,00,000 (TI - 1,50,000) * 10%

3,00,000 to 5,00,000 15,000 + (TI - 3,00,000) * 20%

Greater than 5,00,000 55,000 + (TI – 5,00,000) * 30%

Women aged 65 years or less

Slab (Rs.) Tax (Rs.)

less than 1,80,000 Nil

1,80,000 to 3,00,000 (TI - 1,80,000) * 10%

3,00,000 to 5,00,000 12,000 + (TI - 3,00,000) * 20%

Greater than 5,00,000 52,000 + (TI – 5,00,000) * 30%

Senior Citizens (Individuals aged above 65 years)

Slab (Rs.) Tax (Rs.)

less than 2,25,000 Nil

2,25,000 to 3,00,000 (TI - 2,25,000) * 10%

3,00,000 to 5,00,000 7,500 + (TI - 3,00,000) * 20%

Greater than 5,00,000 47,500 + (TI – 5,00,000) * 30%

Tax rates for AY 2008-09

Individuals & HUF

Surcharge on Income Tax

Slab (Rs.) Tax (Rs.)

(if TI > Rs.10 Lakhs)

less than 1,10,000 Nil Nil

1,10,000 to 1,50,000 (TI - 1,10,000) * 10% 10%

1,50,000 to 2,50,000 4,000 + (TI - 1,50,000) * 20% 10%

Greater than 2,50,000 24,000 + (TI - 2,50,000) * 30% 10%

Women aged 65 years or less

Surcharge on Income Tax (if

Slab (Rs.) Tax (Rs.)

TI > Rs.10 Lakhs) (Rs.)

less than 1,45,000 Nil Nil

1,45,000 to 1,50,000 (TI - 1,45,000) * 10% 10%

1,50,000 to 2,50,000 500 + (TI - 1,50,000) * 20% 10%

Greater than 2,50,000 20,500 + (TI - 2,50,000) * 30% 10%

Senior Citizens (Individuals aged above 65 years)

Surcharge on Income Tax (if

Slab (Rs.) Tax (Rs.)

TI > Rs.10 Lakhs) (Rs.)

less than 1,95,000 Nil Nil

1,95,000 to 2,50,000 (TI - 1,95,000) * 20% 10%

Greater than 2,50,000 11,000 + (TI - 2,50,000) * 30% 10%

Education Cess has to be added on Income-tax and Surcharge @ 2% from AY 2004-05

and 3% from AY 2007-08

Tax rates for AY 2006-07 & AY 2007-08

Individuals & HUF

Surcharge on Income Tax

Slab (Rs.) Tax (Rs.)

(if TI > Rs.10 Lakhs)

less than 1,00,000 Nil Nil

1,00,000 to 1,50,000 (TI - 1,00,000) * 10% 10%

1,50,000 to 2,50,000 5,000 + (TI - 1,50,000) * 20% 10%

Greater than 2,50,000 25,000 + (TI - 2,50,000) * 30% 10%

Women aged 65 years or less

Surcharge on Income Tax (if

Slab (Rs.) Tax (Rs.)

TI > Rs.10 Lakhs) (Rs.)

less than 1,35,000 Nil Nil

1,35,000 to 1,50,000 (TI - 1,35,000) * 10% 10%

1,50,000 to 2,50,000 1,500 + (TI - 1,50,000) * 20% 10%

Greater than 2,50,000 21,500 + (TI - 2,50,000) * 30% 10%

Senior Citizens (Individuals aged above 65 years)

Surcharge on Income Tax (if

Slab (Rs.) Tax (Rs.)

TI > Rs.10 Lakhs) (Rs.)

less than 1,85,000 Nil Nil

1,85,000 to 2,50,000 (TI - 1,85,000) * 20% 10%

Greater than 2,50,000 13,000 + (TI - 2,50,000) * 30% 10%

Tax Rates for AY 2004-05 & AY 2005-06

Surcharge on Income Tax

Slab (Rs.) Tax (Rs.)

(If TI > Rs.8.50 Lakhs) (Rs.)

less than 50,000 Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% 10%

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% 10%

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% 10%

Tax Rates for AY 2003-04

Surcharge on Income Tax

Slab (Rs.) Tax (Rs.)

(If TI > Rs.60,000) (Rs.)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% 5%

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% 5%

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% 5%

Tax Rates for AY 2002-03

Surcharge on Income Tax

Slab (Rs.) Tax (Rs.)

(If TI > Rs.60,000)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% 2%

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% 2%

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% 2%

Tax Rates for AY 2001-02

Surcharge Surcharge

Slab (Rs.) Tax (Rs.)

TI > 60,000 TI > 1,50,000

Less than 50,000 Nil Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% 12% 17%

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% 12% 17%

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% 12% 17%

Tax Rates for AY 2000-01

Surcharge on Income Tax (If

Slab (Rs.) Tax (Rs.)

TI > Rs.60,000) (Rs.)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% 10%

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% 10%

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% 10%

Tax Rates for AY 1999-2000

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (Rs.)

Less than 50,000 Nil Nil

50,000 to 60,000 (TI - 50,000) * 10% Nil

60,000 to 1,50,000 1,000 + (TI - 60,000) * 20% Nil

Greater than 1,50,000 19,000 + (TI - 1,50,000) * 30% Nil

Tax Rates for AY 1998-99

Slab (Rs.) Tax (Rs.) Surcharge on Income Tax (Rs.)

Less than 40,000 Nil Nil

40,000 to 60,000 (TI - 40,000) * 10% Nil

60,000 to 1,50,000 2,000 + (TI - 60,000) * 20% Nil

Greater than 1,50,000 20,000 + (TI - 1,50,000) * 30% Nil

Vous aimerez peut-être aussi

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Document4 pagesIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalPas encore d'évaluation

- Income Tax Rates SlabsDocument2 pagesIncome Tax Rates Slabspankaj_adv5314Pas encore d'évaluation

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraPas encore d'évaluation

- Income Tax Slab For Ay 11Document1 pageIncome Tax Slab For Ay 11mmmukhtarPas encore d'évaluation

- Tax RatesDocument1 pageTax RatesJitendra VyasPas encore d'évaluation

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelPas encore d'évaluation

- Types of TaxesDocument15 pagesTypes of TaxesNischal KumarPas encore d'évaluation

- Unit 1 Topic 2ndDocument2 pagesUnit 1 Topic 2ndAnjali. 1999Pas encore d'évaluation

- Slab Rates IncometaxDocument8 pagesSlab Rates IncometaxPPEARL09Pas encore d'évaluation

- Income Tax Slabs 2007-08 To 2010-11Document4 pagesIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaPas encore d'évaluation

- ASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)Document4 pagesASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)sayyedasif56Pas encore d'évaluation

- Income Tax Slab 2011-2012Document2 pagesIncome Tax Slab 2011-2012Nand Kishore DubeyPas encore d'évaluation

- Chidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariDocument10 pagesChidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariAnkit JainPas encore d'évaluation

- Sekhar (Tax)Document42 pagesSekhar (Tax)sekhar_majiPas encore d'évaluation

- Income Tax Rates For The Past 10 YearsDocument10 pagesIncome Tax Rates For The Past 10 YearsTarang DoshiPas encore d'évaluation

- Income TaxDocument1 pageIncome TaxManoj KPas encore d'évaluation

- 80.1cm (32) HD Flat TV FH4003 Series 4Document6 pages80.1cm (32) HD Flat TV FH4003 Series 4Jose JohnPas encore d'évaluation

- Income Tax Slab Fy 2020-21Document1 pageIncome Tax Slab Fy 2020-21Nabhya's FamilyPas encore d'évaluation

- Income Tax Slab Fy 2009-10Document1 pageIncome Tax Slab Fy 2009-10naveenPas encore d'évaluation

- Tax Rates For IndividualsDocument2 pagesTax Rates For Individualspiyushpandey451876Pas encore d'évaluation

- Income TaxDocument2 pagesIncome TaxsunilgswmPas encore d'évaluation

- Income Tax Rates For Financial Year 2010-11Document2 pagesIncome Tax Rates For Financial Year 2010-11tekleyPas encore d'évaluation

- Tax Sheet - A.Y 2024-25Document3 pagesTax Sheet - A.Y 2024-25bajajvanshica23Pas encore d'évaluation

- Direct Taxes CIA 1Document5 pagesDirect Taxes CIA 1Swathy AjayPas encore d'évaluation

- Income Tax SlabDocument2 pagesIncome Tax SlabAnonymous Ur3kifA2D8Pas encore d'évaluation

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalPas encore d'évaluation

- Individual, HUF, AOP or BOIDocument4 pagesIndividual, HUF, AOP or BOIABC 123Pas encore d'évaluation

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612Pas encore d'évaluation

- Comparison of Tax Liabilities PreDocument2 pagesComparison of Tax Liabilities Presandipon1Pas encore d'évaluation

- Taxable - Income - Formula - Excel - TemplateDocument8 pagesTaxable - Income - Formula - Excel - TemplateFaizan AhmadPas encore d'évaluation

- Amendments DT 2016Document70 pagesAmendments DT 2016dbp9050Pas encore d'évaluation

- Tds Rate Chart 10 11Document6 pagesTds Rate Chart 10 11harry_mewadaPas encore d'évaluation

- Radhika Associates: Tax Consultants Roshan Choudhary KolkataDocument8 pagesRadhika Associates: Tax Consultants Roshan Choudhary KolkataPrakash RanaPas encore d'évaluation

- CS Professional DT Revision For Dec 19Document117 pagesCS Professional DT Revision For Dec 19Vineela Srinidhi DantuPas encore d'évaluation

- TaxTables20062010Document2 pagesTaxTables20062010Moazam FakeyPas encore d'évaluation

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarPas encore d'évaluation

- Income Tax Rates PDFDocument1 pageIncome Tax Rates PDFAditi SharmaPas encore d'évaluation

- Income Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)Document6 pagesIncome Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)vashishthanuragPas encore d'évaluation

- India Income Tax Slab Rate 2017 18Document1 pageIndia Income Tax Slab Rate 2017 18minushastri33Pas encore d'évaluation

- Income Tax Slab FY 2014-15Document3 pagesIncome Tax Slab FY 2014-15zveeraPas encore d'évaluation

- EURION - Union BudgetDocument3 pagesEURION - Union BudgetEurion ConstellationPas encore d'évaluation

- Tax CalculatorDocument3 pagesTax CalculatorRohit KumarPas encore d'évaluation

- Income Tax Calculator FY 2023 24 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2023 24 Age Below 60 Years 1naveed ansariPas encore d'évaluation

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurPas encore d'évaluation

- UntitledDocument5 pagesUntitledRwings JeansPas encore d'évaluation

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaPas encore d'évaluation

- Income Tax RatesDocument1 pageIncome Tax RatesshubhozPas encore d'évaluation

- Union Budget of IndiaDocument6 pagesUnion Budget of Indiashalinivd3Pas encore d'évaluation

- Direct Tax BlogDocument3 pagesDirect Tax BlogArpit GuptaPas encore d'évaluation

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarPas encore d'évaluation

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRPas encore d'évaluation

- India Income Tax Slabs 2013Document1 pageIndia Income Tax Slabs 2013nkprasathPas encore d'évaluation

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessPas encore d'évaluation

- Income TaxDocument5 pagesIncome TaxAshish NarulaPas encore d'évaluation

- Tax Planning - 303912216Document89 pagesTax Planning - 303912216choudharysandeep501Pas encore d'évaluation

- Tax Slab Important Changes For The Fy 2015 16 For IndividualDocument8 pagesTax Slab Important Changes For The Fy 2015 16 For IndividualSudhir BansalPas encore d'évaluation

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarPas encore d'évaluation

- Income TaxDocument4 pagesIncome Taxsai santhoshPas encore d'évaluation

- BW TablesDocument39 pagesBW TablesNandeesh Kodimallaiah100% (1)

- Answers 142-162Document19 pagesAnswers 142-162AKHLAK UR RASHID CHOWDHURYPas encore d'évaluation

- The Definition of Small Business ManagementDocument2 pagesThe Definition of Small Business ManagementKul DeepPas encore d'évaluation

- FABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedDocument23 pagesFABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedJayson MejiaPas encore d'évaluation

- Ruma GhoshDocument26 pagesRuma GhoshhritamgemsPas encore d'évaluation

- Basic Accounting SystemDocument37 pagesBasic Accounting SystemGetie TigetPas encore d'évaluation

- Uses Cashflow From The Collateral Asset To Pay To Bondholders. So This New Bond Is Called CoveredDocument2 pagesUses Cashflow From The Collateral Asset To Pay To Bondholders. So This New Bond Is Called CoveredSarah DanaPas encore d'évaluation

- Post Trade Investment Banking OutsourcingDocument40 pagesPost Trade Investment Banking Outsourcingdemkol002Pas encore d'évaluation

- VDL JV 2011 Uk ScreenDocument60 pagesVDL JV 2011 Uk ScreenRoberto BarbianiPas encore d'évaluation

- Chapter I and Chapter IiDocument32 pagesChapter I and Chapter IiDhanya vijeeshPas encore d'évaluation

- Option StrategiesDocument13 pagesOption StrategiesArunangshu BhattacharjeePas encore d'évaluation

- Electricity Power Industry - Key Success Factors: Business Risk Assessment RegulationDocument2 pagesElectricity Power Industry - Key Success Factors: Business Risk Assessment Regulationanubhav saxenaPas encore d'évaluation

- TNEB Online Payment PDFDocument1 pageTNEB Online Payment PDFpavanPas encore d'évaluation

- Chapter 6 Power Point - ASSIGNDocument10 pagesChapter 6 Power Point - ASSIGNmuluPas encore d'évaluation

- IndiaBanks GoldilocksWithAMinorBump20230310 PDFDocument26 pagesIndiaBanks GoldilocksWithAMinorBump20230310 PDFchaingangriteshPas encore d'évaluation

- PAYE2012 DemoDocument110 pagesPAYE2012 DemoNorvee ReyesPas encore d'évaluation

- Case-Study - Laura Ashley.Document16 pagesCase-Study - Laura Ashley.inesvilafanhaPas encore d'évaluation

- Investment Property: Conceptual Framework and Reporting StandardDocument3 pagesInvestment Property: Conceptual Framework and Reporting StandardMeg sharkPas encore d'évaluation

- Inventories and Investment Theories v2Document10 pagesInventories and Investment Theories v2Joovs JoovhoPas encore d'évaluation

- Curriculum Vitae: Career ObjectiveDocument3 pagesCurriculum Vitae: Career Objectiveknack marketechPas encore d'évaluation

- E Banking Consumer BehaviourDocument118 pagesE Banking Consumer BehaviourMohammed JashidPas encore d'évaluation

- Petition For Extraordinary Writ of Mandate, Application For Temporary Stay...Document61 pagesPetition For Extraordinary Writ of Mandate, Application For Temporary Stay...robertian100% (3)

- Unit 8 Adjusting EntriesDocument8 pagesUnit 8 Adjusting EntriesRey ViloriaPas encore d'évaluation

- Developing An Effective Business Case For A Warehouse Management SystemDocument16 pagesDeveloping An Effective Business Case For A Warehouse Management SystemJovan ĆetkovićPas encore d'évaluation

- OPPT IntroductionDocument5 pagesOPPT IntroductionP2P FoundationPas encore d'évaluation

- PPEDocument18 pagesPPECarl Yry BitzPas encore d'évaluation

- International Finance PresentationDocument29 pagesInternational Finance PresentationY.h. TariqPas encore d'évaluation

- SAP Dictionary HRDocument714 pagesSAP Dictionary HRFilippos StamatiadisPas encore d'évaluation

- Universiti Teknologi MaraDocument2 pagesUniversiti Teknologi MaraAZRIL HAIRIE CHAIRIL ASYRAFPas encore d'évaluation

- Z XEb RUG5 R REHu 5 XyDocument89 pagesZ XEb RUG5 R REHu 5 XysvkrocksPas encore d'évaluation