Académique Documents

Professionnel Documents

Culture Documents

Annex 1

Transféré par

Meet AhujaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Annex 1

Transféré par

Meet AhujaDroits d'auteur :

Formats disponibles

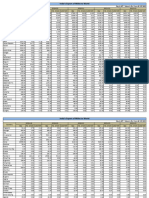

ANNEX-I

20

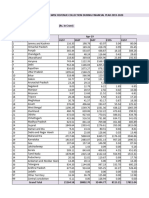

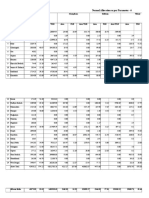

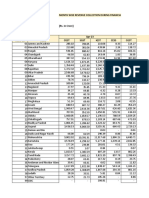

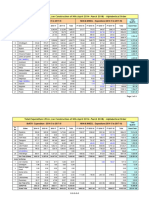

STATEMENT SHOWING STATE-WISE DISTRIBUTION OF NET PROCEEDS OF UNION TAXES AND DUTIES FOR BE 2010-2011

(Rs. in crores)

Sl. State Share Corporation Income Wealth Customs Union Other Total Share Service Grand

No. (per cent) tax tax@ tax Excise taxes & (per cent) Tax Total

* Duty Duties (4 to 9) * (10+12)

(0020) (0021) (0032) (0037) (0038) (0045) (0044)

1 2 3 4 5 6 7 8 9 10 11 12 13

1 Andhra Pradesh 6.937 6055.19 2692.50 13.23 2346.51 1911.17 -0.01 13018.59 7.047 1502.98 14521.57

2 Arunachal Pradesh 0.328 286.31 127.31 0.62 110.95 90.37 0.00 615.56 0.332 70.81 686.37

3 Assam 3.628 3166.82 1408.16 6.92 1227.21 999.53 -0.01 6808.63 3.685 785.94 7594.57

4 Bihar 10.917 9529.27 4237.28 20.82 3692.79 3007.67 -0.02 20487.81 11.089 2365.06 22852.87

5 Chhattisgarh 2.470 2156.02 958.69 4.71 835.50 680.49 0.00 4635.41 2.509 535.12 5170.53

6 Goa 0.266 232.19 103.24 0.51 89.98 73.28 0.00 499.20 0.270 57.59 556.79

7 Gujarat 3.041 2654.44 1180.32 5.80 1028.65 837.81 -0.01 5707.01 3.089 658.82 6365.83

8 Haryana 1.048 914.78 406.77 2.00 354.50 288.73 0.00 1966.78 1.064 226.93 2193.71

Receipts Budget, 2010-2011

9 Himachal Pradesh 0.781 681.72 303.13 1.49 264.18 215.17 0.00 1465.69 0.793 169.13 1634.82

10 Jammu & Kashmir 1.551 1353.84 602.00 2.96 524.64 427.31 0.00 2910.75 0.000 0.00 2910.75

11 Jharkhand 2.802 2445.82 1087.56 5.34 947.81 771.96 0.00 5258.49 2.846 607.00 5865.49

12 Karnataka 4.328 3777.84 1679.85 8.25 1463.99 1192.38 -0.01 8122.30 4.397 937.79 9060.09

13 Kerala 2.341 2043.42 908.62 4.46 791.87 644.95 0.00 4393.32 2.378 507.18 4900.50

14 Madhya Pradesh 7.120 6214.93 2763.53 13.58 2408.42 1961.59 -0.01 13362.04 7.232 1542.44 14904.48

15 Maharashtra 5.199 4538.12 2017.92 9.91 1758.62 1432.34 -0.01 9756.90 5.281 1126.33 10883.23

16 Manipur 0.451 393.67 175.05 0.86 152.56 124.25 0.00 846.39 0.458 97.68 944.07

17 Meghalaya 0.408 356.14 158.36 0.78 138.01 112.41 0.00 765.70 0.415 88.51 854.21

18 Mizoram 0.269 234.81 104.41 0.51 90.99 74.11 0.00 504.83 0.273 58.23 563.06

19 Nagaland 0.314 274.09 121.87 0.60 106.21 86.51 0.00 589.28 0.318 67.82 657.10

20 Orissa 4.779 4171.51 1854.90 9.11 1616.55 1316.63 -0.01 8968.69 4.855 1035.48 10004.17

21 Punjab 1.389 1212.44 539.12 2.65 469.84 382.67 0.00 2606.72 1.411 300.94 2907.66

22 Rajasthan 5.853 5108.99 2271.76 11.16 1979.84 1612.52 -0.01 10984.26 5.945 1267.95 12252.21

23 Sikkim 0.239 208.62 92.76 0.46 80.84 65.85 0.00 448.53 0.243 51.83 500.36

24 Tamil Nadu 4.969 4337.36 1928.65 9.47 1680.82 1368.98 -0.01 9325.27 5.047 1076.42 10401.69

25 Tripura 0.511 446.04 198.34 0.97 172.85 140.78 0.00 958.98 0.519 110.69 1069.67

26 Uttar Pradesh 19.677 17175.73 7637.34 37.52 6655.95 5421.08 -0.03 36927.59 19.987 4262.83 41190.42

27 Uttarakhand 1.120 977.63 434.71 2.14 378.85 308.56 0.00 2101.89 1.138 242.71 2344.60

28 West Bengal 7.264 6340.63 2819.42 13.85 2457.12 2001.26 -0.01 13632.27 7.379 1573.79 15206.06

TOTAL 100.00 87288.37 38813.57 190.68 33826.05 27550.36 -0.15 187668.88 100.00 21328.00 208996.88

* As per accepted recommendations of the Thirteenth Finance Commission, the State’s share has been fixed at 32% of the net proceeds of sharable Central Taxes.

@ Income tax includes Banking Cash Transaction Tax (BCTT).

http://indiabudget.nic.in

Vous aimerez peut-être aussi

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Manish RajPas encore d'évaluation

- Annex 4Document1 pageAnnex 4samjaaon1998Pas encore d'évaluation

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Nivedh VijayakrishnanPas encore d'évaluation

- Union Tax and DutiesDocument1 pageUnion Tax and DutiesahyaanPas encore d'évaluation

- Tax Collection On GST Portal 2019 2020Document9 pagesTax Collection On GST Portal 2019 2020Atiq PunjabiPas encore d'évaluation

- Marine Cargo Insurance Report by StateDocument6 pagesMarine Cargo Insurance Report by StateNaveen AlluPas encore d'évaluation

- Tax Collection On GST Portal 2019 2020Document16 pagesTax Collection On GST Portal 2019 2020Disha MohantyPas encore d'évaluation

- Month Wise Revenue Collection During Financial Year 2021-2022Document4 pagesMonth Wise Revenue Collection During Financial Year 2021-2022Ali NadafPas encore d'évaluation

- Allocation 2018-19 RevisedDocument67 pagesAllocation 2018-19 Revisedmahe pitchaiPas encore d'évaluation

- Tax Collection On GST Portal 2023 2024Document4 pagesTax Collection On GST Portal 2023 2024akhil4every1Pas encore d'évaluation

- StateWise Performance 2021-22Document1 pageStateWise Performance 2021-22sgrfgrPas encore d'évaluation

- Statewise Estimated Reserves of Coal, Lignite, Crude Oil, Natural Gas and Potential of Renewable Power in IndiaDocument9 pagesStatewise Estimated Reserves of Coal, Lignite, Crude Oil, Natural Gas and Potential of Renewable Power in IndiaAkhilesh KushwahaPas encore d'évaluation

- Circuito Tramo L C HF Q Le Le/Q (KM) (Pie/s) (M) (LPS) (KM)Document11 pagesCircuito Tramo L C HF Q Le Le/Q (KM) (Pie/s) (M) (LPS) (KM)dosnumerosPas encore d'évaluation

- Data FM FinalDocument16 pagesData FM FinaluttamkotdiyaPas encore d'évaluation

- SE S&P Mid-Cap Company Financial MetricsDocument80 pagesSE S&P Mid-Cap Company Financial MetricsAnjali BhatiaPas encore d'évaluation

- StateWise Performance 2020-21Document1 pageStateWise Performance 2020-2118212 NEELESH CHANDRAPas encore d'évaluation

- Quantity Between OGL & ETL (0/0 TO 8/0) : Rajdongari-Devnala-Chatva-Pipalpani-Tee Gaon Road KM 0/0 To 16/080Document8 pagesQuantity Between OGL & ETL (0/0 TO 8/0) : Rajdongari-Devnala-Chatva-Pipalpani-Tee Gaon Road KM 0/0 To 16/080popemiPas encore d'évaluation

- CEEW Whats Polluting Indias Air DatasheetDocument13 pagesCEEW Whats Polluting Indias Air DatasheetLaraib AhmadPas encore d'évaluation

- Actual Generation (MU) During December Actual Generation (MU) During April To DecemberDocument2 pagesActual Generation (MU) During December Actual Generation (MU) During April To DecemberHarikrishna MudaPas encore d'évaluation

- Coal Reserve 5 Tahun PertamaDocument2 pagesCoal Reserve 5 Tahun Pertamadani bayuPas encore d'évaluation

- Volume Calculation Sheet-2Document4 pagesVolume Calculation Sheet-2rocky3230Pas encore d'évaluation

- Data Dinkes 2019Document52 pagesData Dinkes 2019Yulia Hans Yopi UnjungPas encore d'évaluation

- FM Project2Document20 pagesFM Project2Triptasree GhoshPas encore d'évaluation

- 279985 - Profit And Loss Summary for ALL (1)Document4 pages279985 - Profit And Loss Summary for ALL (1)lipikavenkataPas encore d'évaluation

- Head Losses (Tables) : Ater YcleDocument1 pageHead Losses (Tables) : Ater YcleAnilduth BaldanPas encore d'évaluation

- 2.2 Solar FirmsDocument7 pages2.2 Solar FirmsBuddy The LabPas encore d'évaluation

- State Wise Farm Area 5 YearsDocument1 pageState Wise Farm Area 5 YearsVivek VatsPas encore d'évaluation

- Pro Reg AdvancesDocument3 pagesPro Reg Advancessm_1234567Pas encore d'évaluation

- Regression analysis of water flow dataDocument5 pagesRegression analysis of water flow dataAshley PeraltaPas encore d'évaluation

- ReportOptimizer-11446975 54 Ativos 3 Anos Max Min FreeDocument4 pagesReportOptimizer-11446975 54 Ativos 3 Anos Max Min FreeMaiquel de CarvalhoPas encore d'évaluation

- May 2019 A 1Document1 pageMay 2019 A 1felix florentinoPas encore d'évaluation

- Amount in Million Taka: Year Total Assets Current Assets Current Liabilities Reteined EarningsDocument4 pagesAmount in Million Taka: Year Total Assets Current Assets Current Liabilities Reteined Earningsযুবরাজ মহিউদ্দিনPas encore d'évaluation

- AWG Specifications TableDocument6 pagesAWG Specifications TableMaralo SinagaPas encore d'évaluation

- Settlement of IGST To State 2020 2021Document3 pagesSettlement of IGST To State 2020 2021S M SHEKAR AND COPas encore d'évaluation

- Volume Cilindros HorizontalDocument2 pagesVolume Cilindros HorizontalsmalealPas encore d'évaluation

- Total_Expenditure_NHDocument4 pagesTotal_Expenditure_NHSaikatDebPas encore d'évaluation

- Industry AnalysisDocument3 pagesIndustry AnalysisThunder PrakashPas encore d'évaluation

- Pulse Polio Immunization Programme Allocation and Expenditure by StateDocument2 pagesPulse Polio Immunization Programme Allocation and Expenditure by StateVidya GuptaPas encore d'évaluation

- India Millet Exporting DestinationDocument4 pagesIndia Millet Exporting DestinationAnvar DeenPas encore d'évaluation

- Curva de Margules: P (MMHG) X1 Y1 X2 Y2 Ɣ1 Ɣ2Document17 pagesCurva de Margules: P (MMHG) X1 Y1 X2 Y2 Ɣ1 Ɣ2José Leonardo Fernández BalderaPas encore d'évaluation

- Maryam Finance Project-1-11Document1 pageMaryam Finance Project-1-11Tutii FarutiPas encore d'évaluation

- Allocation of Funds (Disbursement)Document1 pageAllocation of Funds (Disbursement)Shashikant MeenaPas encore d'évaluation

- Future Levels For Thu, 25th Mar 2010: Expiry Date - 25th March 2010Document6 pagesFuture Levels For Thu, 25th Mar 2010: Expiry Date - 25th March 2010MansukhPas encore d'évaluation

- Visitor Arrivals to the Philippines by Country of Residence Jan-Jun 2021Document3 pagesVisitor Arrivals to the Philippines by Country of Residence Jan-Jun 2021JOHN CLEMILSON FRANCISCOPas encore d'évaluation

- Report As On 30.10.23Document10 pagesReport As On 30.10.23sachingowdacvPas encore d'évaluation

- Ejercicio Caso ABC Plantilla Dariela Zepeda 20191006742Document8 pagesEjercicio Caso ABC Plantilla Dariela Zepeda 20191006742Dariela ZepedaPas encore d'évaluation

- Pardon Supervision 2017Document1 pagePardon Supervision 2017Kakal D'GreatPas encore d'évaluation

- State Bank of India Profit & Loss 2009-2018Document4 pagesState Bank of India Profit & Loss 2009-2018prasadkh90Pas encore d'évaluation

- Status Hydro Electri Potentia in IndiaDocument1 pageStatus Hydro Electri Potentia in IndiahydelPas encore d'évaluation

- State Wise Release & ExpenDocument2 pagesState Wise Release & ExpenLalit Mohan PantPas encore d'évaluation

- IPC Cases 2008 - All StatesDocument1 pageIPC Cases 2008 - All StatessilkboardPas encore d'évaluation

- Residential bills at typical consumption levelsDocument1 pageResidential bills at typical consumption levelsManuel DinerosPas encore d'évaluation

- ACCC Conductor List 2019 v1.6Document6 pagesACCC Conductor List 2019 v1.6Mauricio MoralesPas encore d'évaluation

- Design of Pile Caps for G.P Office ConstructionDocument34 pagesDesign of Pile Caps for G.P Office ConstructionD.V.Srinivasa RaoPas encore d'évaluation

- Fundamentals of Heat and Mass Transfer, 7th Edition-1021-1030Document10 pagesFundamentals of Heat and Mass Transfer, 7th Edition-1021-1030Andres Eduardo Diaz MartinezPas encore d'évaluation

- Arrivals 2020Document3 pagesArrivals 2020Maria Jonnacis LinsanganPas encore d'évaluation

- Private LTD CompaniesDocument16 pagesPrivate LTD CompaniesanjankatamPas encore d'évaluation

- Analysis of Concrete Beam Subjected to Flexural LoadingDocument8 pagesAnalysis of Concrete Beam Subjected to Flexural LoadingJenina TangPas encore d'évaluation

- Cimenataciones OkkkDocument22 pagesCimenataciones OkkkAlin Del Castillo VelaPas encore d'évaluation

- United States Census Figures Back to 1630D'EverandUnited States Census Figures Back to 1630Pas encore d'évaluation

- KVB Challan PGDocument1 pageKVB Challan PGrevusk840Pas encore d'évaluation

- Tax Up34t5024Document1 pageTax Up34t5024Mohd AhtishamPas encore d'évaluation

- The Following Information Was Available To Reconcile Montrose Company S BookDocument2 pagesThe Following Information Was Available To Reconcile Montrose Company S BookAmit PandeyPas encore d'évaluation

- Aastha Realtors Vendor FormDocument2 pagesAastha Realtors Vendor Formshibani thomasPas encore d'évaluation

- Tax Evasion Vs Tax AvoidanceDocument2 pagesTax Evasion Vs Tax AvoidanceNurse NotesPas encore d'évaluation

- GSTR1 Excel Workbook Template-V1.0Document39 pagesGSTR1 Excel Workbook Template-V1.0palanisathiyaPas encore d'évaluation

- Paytm E-Ticket for Guwahati to Vijayawada flightDocument3 pagesPaytm E-Ticket for Guwahati to Vijayawada flightCHINNABABUPas encore d'évaluation

- CERTIFICATE OF RESIDENCY REQUIREMENTS FOR INDIVIDUALS - Filipino CitizenDocument2 pagesCERTIFICATE OF RESIDENCY REQUIREMENTS FOR INDIVIDUALS - Filipino CitizenGiselle GaudielPas encore d'évaluation

- Real Medical Bill ScanDocument1 pageReal Medical Bill Scanmiranda criggerPas encore d'évaluation

- WAY4 Overview SmallDocument8 pagesWAY4 Overview SmallDipanwita BhuyanPas encore d'évaluation

- Bluepay Max Business PlanDocument13 pagesBluepay Max Business PlanDineshPas encore d'évaluation

- ALVEO CHECKLIST - Indiv LocalDocument1 pageALVEO CHECKLIST - Indiv LocalLiv ValdezPas encore d'évaluation

- Adjusting Closing EntriesDocument10 pagesAdjusting Closing EntriesKathleen MarcialPas encore d'évaluation

- PAY SLIPDocument1 pagePAY SLIPSuryavanshi ChandanPas encore d'évaluation

- BPI Denied Tax Refund Due to Irrevocability RuleDocument2 pagesBPI Denied Tax Refund Due to Irrevocability RuleHarlenePas encore d'évaluation

- FATCA COMPLIANCEDocument13 pagesFATCA COMPLIANCEMuhammed AhmedPas encore d'évaluation

- NIL MidtermDocument28 pagesNIL MidtermAnonymous B0aR9GdNPas encore d'évaluation

- Statement of Account BBVADocument7 pagesStatement of Account BBVAchistopher freundPas encore d'évaluation

- Husky 2015Document12 pagesHusky 2015sonicbooahxxxPas encore d'évaluation

- Pooja ElectricalDocument1 pagePooja ElectricalSSK IndustriesPas encore d'évaluation

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsHarish Kumar JPas encore d'évaluation

- Accounting Information Systems CycleDocument25 pagesAccounting Information Systems CycleWildan RahmansyahPas encore d'évaluation

- BIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Document5 pagesBIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Jerwin DavePas encore d'évaluation

- GBP Statement: TransactionsDocument2 pagesGBP Statement: Transactions13KARATPas encore d'évaluation

- Ola BillDocument3 pagesOla BillMohit TanwarPas encore d'évaluation

- IRM Sect 21.7.13Document218 pagesIRM Sect 21.7.13joelvw100% (9)

- Current Account StatementDocument5 pagesCurrent Account Statementkit yong chenPas encore d'évaluation

- Tax 302 Business and Transfer Tax Finals Answer.pdfDocument29 pagesTax 302 Business and Transfer Tax Finals Answer.pdfsunthatburns00Pas encore d'évaluation

- Account Statement: Description DateDocument11 pagesAccount Statement: Description Dategaurang mishraPas encore d'évaluation

- 270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)yogarajanPas encore d'évaluation