Académique Documents

Professionnel Documents

Culture Documents

Final AR 2009-10 15

Transféré par

snitharwal060Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Final AR 2009-10 15

Transféré par

snitharwal060Droits d'auteur :

Formats disponibles

¼djksM+ #i;s esa½

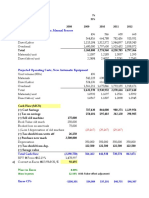

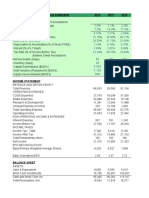

nl o"kksZa dh foÙkh; miyfC/k;k¡ Ten Years’ Financial Highlights (Rs. in crore)

2009-10 2008-09 2007-08 2006-07 2005-06 2004-05 2003-04 2002-03 2001-02 2000-01

izpkyu ifj.kke OPERATING RESULTS

fcØh Sales 7,247.30 7,387.70 5,968.47 5,554.53 5,358.19 4,097.60 3,753.39 3,535.63 3,107.64 3,048.49

ljdkj ls vFkZ&lgk;rk Subsidy from Government 9,561.27 25,545.60 6,194.35 4,775.58 4,584.74 3,299.38 2,336.69 2,739.29 2,174.31 2,246.61

dkjksckj Turnover 16,808.57 32,933.30 12,162.82 10,330.11 9,942.93 7,396.98 6,090.08 6,274.92 5,281.95 5,295.10

vU; jktLo Other Revenue 841.55 499.00 354.77 244.66 71.45 85.03 101.85 61.88 52.11 40.05

dqy vk; Total Income 17,650.12 33,432.30 12,517.59 10,574.77 10,014.38 7,482.01 6,191.93 6,336.80 5,334.06 5,334.25

csps x;s eky dh ykxr Cost of Sales 15,859.92 31,496.75 11,336.77 9,578.09 9,166.48 6,809.48 5,454.09 5,257.19 4,634.35 4,696.80

ewY;gzkl] C;kt ,oa Profit before Dep.,

vk;dj ls iwoZ ykHk Int. & I. Tax (PBDIT) 1,790.20 1,935.55 1,180.82 996.68 847.90 672.53 737.84 1,079.61 699.71 638.35

C;kt Interest 764.98 1,023.20 389.37 353.94 123.70 34.02 41.12 112.00 169.39 247.49

ewY;gzkl Depreciation 457.94 470.40 410.93 391.49 242.31 167.59 184.02 160.52 159.17 156.86

dj iwoZ ykHk ¼ihchVh½ Profit before Tax (PBT) 567.28 441.95 380.52 251.25 481.90 470.92 512.70 807.09 371.15 234.00

vk;dj ¼fuoy½ Income Tax (Net) 166.18 81.94 122.93 76.23 140.55 151.28 183.03 249.88 62.77 2.92

dj i'pkr ykHk ¼ih,Vh½ Profit after Tax (PAT) 401.10 360.01 257.59 175.02 341.35 319.64 329.67 557.21 308.38 231.08

ykHkka'k Dividend 85.18 85.10 84.53 84.45 84.36 83.92 80.16 86.33 83.82 50.13

lgdkjh f'k{kk fuf/k Cooperative Education Fund 4.01 3.59 2.57 1.75 3.41 2.98 2.52 5.56 3.07 2.17

nku Donations 0.50 1.75 0.75 0.25 1.00 0.25 1.15 1.25 1.55 12.45

/kkfjr ykHk Retained Profit 311.41 269.57 169.74 88.57 252.58 232.49 245.84 464.07 219.94 166.33

lzksr o fuf/k;ksa dk vuqiz;ksx SOURCES AND APPLICATION OF FUNDS

fuf/k;ksa ds lzksr Sources of Funds

bfDoVh 'ks;j iwt

a h Equity Share Capital 426.24 426.28 423.93 422.92 422.73 421.31 461.90 444.49 419.84 418.57

vkjf{kr o vf/k'ks"k Reserves & Surplus 3,844.26 3,532.59 3,264.73 3,218.92 3,132.66 2,879.84 2,647.68 2,829.02 2,365.93 2,146.80

fuoy lEifr Net Worth 4,270.50 3,958.87 3,688.66 3,641.84 3,555.39 3,301.15 3,109.58 3,273.51 2,785.77 2,565.37

_.k&nh?kkZof/kd Borrowing - Long Term 1,243.59 1,419.16 1,781.83 1,935.80 2,504.43 -- -- -- 321.31 675.20

&vYikof/kd - Short Term 10,164.42 11,249.70 4,850.68 4,403.09 2,400.92 533.10 890.00 984.57 808.14 888.76

&vkLFkfxr O;kikj dj - Deferred Trade Tax 124.16 133.92 143.13 147.23 130.04 113.99 103.93 88.79 68.65 49.79

vkLFkfxr dj ns;rk Deferred Tax Liability 516.78 542.12 534.19 534.02 458.39 421.25 425.43 -- -- --

yxh iwath FUNDS EMPLOYED 16,319.45 17,303.77 10.998.49 10,661.98 9,049.17 4,369.49 4,528.94 4,346.87 3,983.89 4,179.12

fuf/k;ksa dk vuqiz;ksx Application of Funds

fuoy LFkkbZ ifjlEifÙk;ka Net Fixed Assets

¼pkyw iwt

a hxr O;; lfgr½ (incl. Capital Work-in-Progress) 5,157.28 5,256.82 5,169.79 5,039.01 4,869.92 2,160.62 2,172.28 2,246.51 2,362.24 2,452.77

fuos'k Investments 7,531.28 7,552.95 1,416.73 740.46 776.16 690.73 695.08 442.22 266.22 266.22

pkyw ifjlEifÙk;ka Current Assets 5,822.51 7,672.99 5,775.74 6,071.97 4,748.98 2,603.98 2,564.02 2,674.41 2,144.07 2,221.59

pkyw ns;rk,a Current Liabilities 2,191.62 3,182.89 1,371.57 1,201.23 1,361.60 1,104.84 902.44 1,016.32 788.66 761.46

fuoy pkyw ifjlEifÙk;ka Net Current Assets 3,630.89 4,490.10 4,404.17 4,870.74 3,387.39 1,499.14 1,661.58 1,658.14 1,355.41 1,460.13

fofo/k O;; Miscellaneous Expenditure -- 3.90 7.80 11.77 15.70 19.00 -- -- -- --

¼ftUgsa cês[kkrs ugha Mkyk x;k½ (To the extent not written off)

yxh gqbZ fuoy ifjlEifÙk;ka NET ASSETS EMPLOYED 16,319.45 17,303.77 10,998.49 10661.98 9,049.17 4,369.49 4,528.94 4,346.87 3,983.87 4,179.12

13

Vous aimerez peut-être aussi

- O"Kz 2017&2018 Ds CTV Vuqeku Ij Forr Lfpo DK Le'Fr IkDocument21 pagesO"Kz 2017&2018 Ds CTV Vuqeku Ij Forr Lfpo DK Le'Fr Ikmca_javaPas encore d'évaluation

- O"Kz 2019&2020 Ds CTV Vuqeku Ij Forr Lfpo DK Le'Fr Ik : 1-Dj Jktlo 2 - DJ Fhkuu JktloDocument11 pagesO"Kz 2019&2020 Ds CTV Vuqeku Ij Forr Lfpo DK Le'Fr Ik : 1-Dj Jktlo 2 - DJ Fhkuu JktloNeeraj VermaPas encore d'évaluation

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsPas encore d'évaluation

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202Pas encore d'évaluation

- FinolexCablesFSA Final DRAFTDocument14 pagesFinolexCablesFSA Final DRAFTAbhisek MohantyPas encore d'évaluation

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaPas encore d'évaluation

- FFM-slide mẫu cũDocument17 pagesFFM-slide mẫu cũĐại HoàngPas encore d'évaluation

- Forecasting Project Template Spring 2021Document5 pagesForecasting Project Template Spring 2021Chenxi JingPas encore d'évaluation

- Group Project - Ambuja CementDocument18 pagesGroup Project - Ambuja CementLovie GuptaPas encore d'évaluation

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainPas encore d'évaluation

- NHPC LTDDocument9 pagesNHPC LTDMit chauhanPas encore d'évaluation

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaPas encore d'évaluation

- Facebook FSDocument30 pagesFacebook FSperezzzzmay06Pas encore d'évaluation

- Untitled Spreadsheet 1Document4 pagesUntitled Spreadsheet 1nptelcare80Pas encore d'évaluation

- Inside Page 120-160 2007-08Document20 pagesInside Page 120-160 2007-08Parth GaurPas encore d'évaluation

- BAV Final ExamDocument27 pagesBAV Final ExamArrow NagPas encore d'évaluation

- HDFC BankDocument13 pagesHDFC BankAnkit KejriwalPas encore d'évaluation

- Ten Years Performance For The Year 2006-07Document1 pageTen Years Performance For The Year 2006-07api-3795636Pas encore d'évaluation

- Ten Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Document2 pagesTen Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Undefined OrghoPas encore d'évaluation

- Cipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's FundDocument6 pagesCipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's Fundmanwanimuki12Pas encore d'évaluation

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngPas encore d'évaluation

- Hindalco IndsDocument129 pagesHindalco IndsRahul KolekarPas encore d'évaluation

- Tata Motors LTDDocument3 pagesTata Motors LTDRajesh BokadePas encore d'évaluation

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaPas encore d'évaluation

- Progress at A Glance For Last 10 YearsDocument1 pageProgress at A Glance For Last 10 YearsAbhishek KumarPas encore d'évaluation

- LKPD 2012 Audited JakartaDocument663 pagesLKPD 2012 Audited JakartapippinlamPas encore d'évaluation

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5Pas encore d'évaluation

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokanePas encore d'évaluation

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaPas encore d'évaluation

- FS AccountngDocument3 pagesFS Accountngperezzzzmay06Pas encore d'évaluation

- Ganancia (P: - Gastos Fina - Gastos FinaDocument7 pagesGanancia (P: - Gastos Fina - Gastos FinaLAURA SANCHEZ FOREROPas encore d'évaluation

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986Pas encore d'évaluation

- Amara Raja BatteriesDocument28 pagesAmara Raja Batteriesgaurav khandelwalPas encore d'évaluation

- 3 PDFDocument2 pages3 PDFJannine Gamuza EstilloroPas encore d'évaluation

- Balance Sheet of Jet AirwaysDocument2 pagesBalance Sheet of Jet Airwaysakhilesh718Pas encore d'évaluation

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDocument7 pagesBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniPas encore d'évaluation

- Ten Year Financial Summary PDFDocument2 pagesTen Year Financial Summary PDFTushar GoelPas encore d'évaluation

- Ra Bill 01 To 11Document7 pagesRa Bill 01 To 11Sarthak EnterprisesPas encore d'évaluation

- Rang Dong FS AnalysisDocument29 pagesRang Dong FS Analysischambtn21407caPas encore d'évaluation

- Annual Report 2023Document1 pageAnnual Report 2023missionupscias2016Pas encore d'évaluation

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangPas encore d'évaluation

- Tata MotorsDocument4 pagesTata MotorsVandana VishwakarmaPas encore d'évaluation

- Forecasting Project Template Spring 2021 (Final)Document10 pagesForecasting Project Template Spring 2021 (Final)Chenxi JingPas encore d'évaluation

- Capital Structure of Tata SteelDocument9 pagesCapital Structure of Tata SteelRaj KishorPas encore d'évaluation

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaPas encore d'évaluation

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaPas encore d'évaluation

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaPas encore d'évaluation

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Standalone Balance Sheet As Per Four Year Ended: Note No I Equity and Liabilities (1) Shareholders' FundsDocument8 pagesStandalone Balance Sheet As Per Four Year Ended: Note No I Equity and Liabilities (1) Shareholders' FundsPrabhudas GaikwadPas encore d'évaluation

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiPas encore d'évaluation

- Laga Ka SaransDocument4 pagesLaga Ka SaranslkovijayPas encore d'évaluation

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14Pas encore d'évaluation

- Statement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Document35 pagesStatement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Tinatini BakashviliPas encore d'évaluation

- NilkamalDocument14 pagesNilkamalNandish KothariPas encore d'évaluation

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Document4 pagesProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyPas encore d'évaluation

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYPas encore d'évaluation

- 02 04 EndDocument6 pages02 04 EndnehaPas encore d'évaluation

- Khushboo Tomar Altman Zscore FinalDocument9 pagesKhushboo Tomar Altman Zscore FinalKHUSHBOO TOMARPas encore d'évaluation

- Contemporary Economic Issues Facing The Filipino EntrepreneurDocument16 pagesContemporary Economic Issues Facing The Filipino EntrepreneurNicole EnriquezPas encore d'évaluation

- Efg Financial Products LTD Brandschenkestrasse 90, Ch-8002Document3 pagesEfg Financial Products LTD Brandschenkestrasse 90, Ch-8002api-25889552Pas encore d'évaluation

- Case 17 Risk and ReturnDocument6 pagesCase 17 Risk and Returnnicole33% (3)

- Concept Note ROCSIL Leather Products Manufacturing ProjectDocument3 pagesConcept Note ROCSIL Leather Products Manufacturing ProjectTumwine Kahweza ProsperPas encore d'évaluation

- Chapter 9 " Prospective Analysis" FINANCIAL ANALYSIS STATEMENTDocument23 pagesChapter 9 " Prospective Analysis" FINANCIAL ANALYSIS STATEMENTBayoe Ajip75% (4)

- Primo BenzinaDocument13 pagesPrimo BenzinaP3 Powers100% (1)

- Cost of Capital - The Effect To The Firm Value and Profitability Empirical Evidences in Case of Personal Goods (Textile) Sector of KSE 100 IndexDocument7 pagesCost of Capital - The Effect To The Firm Value and Profitability Empirical Evidences in Case of Personal Goods (Textile) Sector of KSE 100 IndexKanganFatimaPas encore d'évaluation

- Project Report On Awareness of Mutual FundDocument41 pagesProject Report On Awareness of Mutual FundDeep Bhalodia100% (1)

- Lse PDFDocument28 pagesLse PDFEmil AzhibayevPas encore d'évaluation

- S&P - Standard & Poor's Risk-Adjusted Capital Framework Provides Insight IntDocument6 pagesS&P - Standard & Poor's Risk-Adjusted Capital Framework Provides Insight IntMaas Riyaz MalikPas encore d'évaluation

- A Project Report On Derivatives (Futures & Options) : FOR Kotak Securities Pvt. LTDDocument78 pagesA Project Report On Derivatives (Futures & Options) : FOR Kotak Securities Pvt. LTDSandesh GadePas encore d'évaluation

- Option Pricing Using Binomial TreesDocument19 pagesOption Pricing Using Binomial TreesDhaka SylhetPas encore d'évaluation

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiPas encore d'évaluation

- Introduction To Accounting Principles: Financial Accounting Standards Board (FASB)Document11 pagesIntroduction To Accounting Principles: Financial Accounting Standards Board (FASB)Aamir KhanPas encore d'évaluation

- Basic Concept of Kurtosis and SkewnessDocument9 pagesBasic Concept of Kurtosis and SkewnessBadhandas0% (1)

- Cost of CapitalDocument15 pagesCost of Capitalসুজয় দত্তPas encore d'évaluation

- Consolidation - WorkbookDocument15 pagesConsolidation - WorkbookKhaihoan DuongPas encore d'évaluation

- SEC Vs Rothenberg Complaint 2018-08-20Document20 pagesSEC Vs Rothenberg Complaint 2018-08-20jonathan_skillingsPas encore d'évaluation

- Bonds: Formulas & ExamplesDocument11 pagesBonds: Formulas & ExamplesAnindito W WicaksonoPas encore d'évaluation

- Forms of Business OrgDocument14 pagesForms of Business OrgNald TropelPas encore d'évaluation

- Burgundy - MosDocument4 pagesBurgundy - MosvunguyenorbisPas encore d'évaluation

- Jenna - CVDocument2 pagesJenna - CVRajat GoyalPas encore d'évaluation

- International Business Review: Joonho Shin, Xavier Mendoza, Matthew A. Hawkins, Changbum ChoiDocument14 pagesInternational Business Review: Joonho Shin, Xavier Mendoza, Matthew A. Hawkins, Changbum ChoiJP InionesPas encore d'évaluation

- Thematic Indexing, Meet Smart Beta! Merging ESG Into Factor PortfoliosDocument14 pagesThematic Indexing, Meet Smart Beta! Merging ESG Into Factor PortfoliosHENI YUSNITAPas encore d'évaluation

- Company Law 2013 NotesDocument23 pagesCompany Law 2013 NotesKaran Asrani100% (1)

- ACCT 504 Final Exam AnswersDocument5 pagesACCT 504 Final Exam Answerssusanperry50% (2)

- Carter LBODocument1 pageCarter LBOEddie KrulePas encore d'évaluation

- Japanese Candlestick Charting Techniques - Second Edition - Steve NisonDocument20 pagesJapanese Candlestick Charting Techniques - Second Edition - Steve NisonKartick NarayanPas encore d'évaluation

- Financial Reporting & AnalysisDocument11 pagesFinancial Reporting & AnalysisSalman FarooqPas encore d'évaluation

- Supplementary KYC Information & FATCA-CRS Declaration - Entities & HUFDocument5 pagesSupplementary KYC Information & FATCA-CRS Declaration - Entities & HUFMohan TilakPas encore d'évaluation