Académique Documents

Professionnel Documents

Culture Documents

Capital Markets - 8/15/2008

Transféré par

Russell KlusasDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Markets - 8/15/2008

Transféré par

Russell KlusasDroits d'auteur :

Formats disponibles

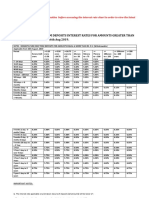

August 15, 2008

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 6.21% to 6.36% 75% 6.05% to 6.25%

7 Yr. 80% 6.20% to 6.50% 75% 6.40% to 6.65%

10 Yr. 80% 6.39% to 6.61% 75% 6.55% to 6.85%

15 Yr. 80% 6.81% to 7.56% 75% 6.85% to 7.35%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 6.26% to 6.65% 75% 5.90% to 6.25%

5 Yr. 80% 6.41% to 6.71% 75% 6.05% to 6.35%

7 Yr. 80% 6.42% to 6.72% 75% 6.40% to 6.65%

10 Yr. 80% 6.38% to 6.68% 75% 6.55% to 6.85%

15 Yr. 80% 6.94% to 7.81% 75% 6.85% to 7.35%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 8-15-2008

Term Leverage Max. Interest Rates

3-Year Swap: 3.72% 5-Year Treasury: 3.10%

5 Yr. 75% 6.25% to 6.55%

5-year Swap: 4.10% 7-Year Treasury: 3.49%

7 Yr. 75% 6.45% to 6.65%

7-Year Swap: 4.35% 10-Year Treasury: 3.83%

10 Yr. 75% 6.65% to 6.90%

10-Year Swap: 4.58% 30-Day Libor: 2.47%

15 Yr. 75% 6.95% to 7.45%

Prime: 5.00% 90-Day Libor: 2.81%

Bridge Floating Leverage Max. Spread Over Libor

Stabilized 75% 225 to 300

Re-Position 80% 275 to 350

(*Portfolio Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

8-15-08 The 10-year U.S. Treasury rate

dropped to 3.84 percent from last week’s

3.92 percent reflecting falling commodity

prices and reduced concern over inflation.

Speculation that the Fed will raise interest

rates later this year slackened amid reports

of sluggish growth. However, three-, five-

and seven-year agency mortgage rates

showed a significant increase of as much as

30 basis points.

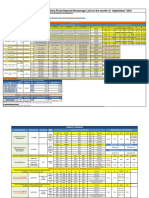

Recent Transactions

1242-1246 Third St. 17229 Lemon St. 3598 Martin Luther King Blvd. 1320 W. Kingsley Rd.

Retail - Neighborhood Retail - Strip Center Industrial/Light Warehouse Multi-Family Garden Apts.

Santa Monica, CA Hesperia, CA Los Angeles, CA Garland, TX

$10,100,000 $4,750,000 $2,465,000 $1,100,000

5.99% Interest rate 6.73% Interest, fixed 7-year term, 240 bps, 1.2 dscr 6.29% Interest

120-mos. term/120-mos. amort. 70% LTV, Refinance 300-mos. term/300-mos. amort. refinance

For more information, contact:

William Hughes

Senior Vice President / Managing Director

Newport Beach, CA

Office: (949) 851-3030

whughesl@marcusmillichap.com

Terms, rates and conditions subject to change. www.MMCapCorp.com

Vous aimerez peut-être aussi

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsD'EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsPas encore d'évaluation

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasPas encore d'évaluation

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasPas encore d'évaluation

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 5/30/2008Document1 pageCapital Alert - 5/30/2008Russell KlusasPas encore d'évaluation

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasPas encore d'évaluation

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasPas encore d'évaluation

- Multi-Family Loan Programs $3 MillionDocument1 pageMulti-Family Loan Programs $3 MillionRussell KlusasPas encore d'évaluation

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasPas encore d'évaluation

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasPas encore d'évaluation

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdPas encore d'évaluation

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikPas encore d'évaluation

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaPas encore d'évaluation

- Bank A: Housing Loan Property Equity LoanDocument6 pagesBank A: Housing Loan Property Equity LoanRaesa BadelPas encore d'évaluation

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanPas encore d'évaluation

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Document1 pageEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaPas encore d'évaluation

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggPas encore d'évaluation

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakPas encore d'évaluation

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaPas encore d'évaluation

- Bank A: Housing Loan Property Equity LoanDocument5 pagesBank A: Housing Loan Property Equity LoanRaesa BadelPas encore d'évaluation

- HDFC RatesDocument4 pagesHDFC RatesdesikanttPas encore d'évaluation

- Capital Alert - 2/1/2008Document1 pageCapital Alert - 2/1/2008Russell KlusasPas encore d'évaluation

- BankingDocument4 pagesBankingBhavin GhoniyaPas encore d'évaluation

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sPas encore d'évaluation

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatPas encore d'évaluation

- Yield CurveDocument3 pagesYield CurveRochelle Anne OpinaldoPas encore d'évaluation

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasPas encore d'évaluation

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553Pas encore d'évaluation

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZPas encore d'évaluation

- Capital Markets - 3/07/2008Document1 pageCapital Markets - 3/07/2008Russell KlusasPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenPas encore d'évaluation

- Cho RM 73 2020-21Document1 pageCho RM 73 2020-21Steve WozniakPas encore d'évaluation

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanPas encore d'évaluation

- Excel FormatDocument38 pagesExcel FormatSaad QureshiPas encore d'évaluation

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanPas encore d'évaluation

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaPas encore d'évaluation

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaPas encore d'évaluation

- UntitledDocument5 pagesUntitledPhương Hiền NguyễnPas encore d'évaluation

- Interest Rates On Deposits Above Rs 2 Crs Wef 15092022Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 15092022Manish bishnoiPas encore d'évaluation

- (Effective January 09, 2019) : Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 1 Crore To 25 CroreDocument1 page(Effective January 09, 2019) : Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 1 Crore To 25 Crorekidwhokids sPas encore d'évaluation

- Capital Markets - 3/14/2008Document2 pagesCapital Markets - 3/14/2008Russell KlusasPas encore d'évaluation

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaPas encore d'évaluation

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaPas encore d'évaluation

- FD RatesDocument3 pagesFD Rates22satendraPas encore d'évaluation

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilPas encore d'évaluation

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerPas encore d'évaluation

- UntitledDocument1 pageUntitledഓൺലൈൻ ആങ്ങളPas encore d'évaluation

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SPas encore d'évaluation

- Sbi Intt RatesDocument1 pageSbi Intt Rateschampa dasPas encore d'évaluation

- Yes Bank FD Rates - 5.6.21Document1 pageYes Bank FD Rates - 5.6.21Chandan SahaPas encore d'évaluation

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasPas encore d'évaluation

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasPas encore d'évaluation

- Milwaukee - Office - 8/7/08Document4 pagesMilwaukee - Office - 8/7/08Russell KlusasPas encore d'évaluation

- DesMoines Submarket - Retail - 10/1/2007Document2 pagesDesMoines Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- Chicago - Southwest Submarket - Retail - 1/1/2008Document2 pagesChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasPas encore d'évaluation

- Milwaukee - Retail - 4/1/2008Document4 pagesMilwaukee - Retail - 4/1/2008Russell KlusasPas encore d'évaluation

- Milwaukee - Retail Construction - 4/1/2008Document3 pagesMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Indianapolis - Apartment - Construction - 4/1/2008Document3 pagesIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Chicago - Retail - 4/1/2008Document4 pagesChicago - Retail - 4/1/2008Russell KlusasPas encore d'évaluation

- Chicago - South Submarket - Retail - 7/1/2007Document2 pagesChicago - South Submarket - Retail - 7/1/2007Russell KlusasPas encore d'évaluation

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- Chicago - Near West Submarket - Retail - 7/1/2007Document2 pagesChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasPas encore d'évaluation

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Evansville - Apartment - 1/1/2008Document2 pagesEvansville - Apartment - 1/1/2008Russell KlusasPas encore d'évaluation

- AJE QuizDocument4 pagesAJE QuizJohn cookPas encore d'évaluation

- NpoDocument4 pagesNpoChelsea Anne Vidallo100% (2)

- 12 Economic Lyp 2016 Delhi Set2 PDFDocument20 pages12 Economic Lyp 2016 Delhi Set2 PDFAshish GangwalPas encore d'évaluation

- UPASDocument3 pagesUPASimteaj39730% (1)

- Weber Meadowview Corporation Bylaws May 31, 2014 Approved FinalDocument18 pagesWeber Meadowview Corporation Bylaws May 31, 2014 Approved FinalMattGordonPas encore d'évaluation

- Tambunting Pawnshop Vs CIRDocument9 pagesTambunting Pawnshop Vs CIRbraindead_91Pas encore d'évaluation

- KYCDocument2 pagesKYCRamkumarPas encore d'évaluation

- Puyat and Sons Vs City of ManilaDocument4 pagesPuyat and Sons Vs City of ManilaJohn Jeffrey L. Ramirez100% (1)

- Proposal: Dzari Hasbullah Bin AB WahabDocument6 pagesProposal: Dzari Hasbullah Bin AB WahabDzari Hasbullah Ab wahabPas encore d'évaluation

- West Coast Paper Mills LTDDocument9 pagesWest Coast Paper Mills LTDSneha SinghalPas encore d'évaluation

- Power GridDocument397 pagesPower Gridrajesh.bhagiratiPas encore d'évaluation

- 1st Amendment To Valvino Operating AgreementDocument6 pages1st Amendment To Valvino Operating AgreementJeff BoydPas encore d'évaluation

- Tally Model Question PaperDocument2 pagesTally Model Question PaperMahaveer Choudhary100% (1)

- Placido Cidito Ledesma Mapa JRDocument2 pagesPlacido Cidito Ledesma Mapa JRArnel MorallosPas encore d'évaluation

- 15 County Clerk Judge Attorney Fraud Title 18 Crimes Generic For Ideas ONLYDocument8 pages15 County Clerk Judge Attorney Fraud Title 18 Crimes Generic For Ideas ONLYAriesWayPas encore d'évaluation

- Documentary Stamp Tax BIR Form 200-OTDocument1 pageDocumentary Stamp Tax BIR Form 200-OTNGITPAPas encore d'évaluation

- Sales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingDocument67 pagesSales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingRishav Ch100% (1)

- Full Download Pfin3 3rd Edition Gitman Solutions ManualDocument36 pagesFull Download Pfin3 3rd Edition Gitman Solutions Manualc3miabutler100% (31)

- Module 6 - Profit Planning (Budgeting)Document82 pagesModule 6 - Profit Planning (Budgeting)CristinePas encore d'évaluation

- Chapter 14 Notes - Primary Markets and UnderwritingDocument5 pagesChapter 14 Notes - Primary Markets and UnderwritingMaria Zakir100% (1)

- 01 Alternative InvestmentsDocument61 pages01 Alternative InvestmentsSardonna Fong0% (1)

- BEA Associates - Enhanced Equity Index FundDocument17 pagesBEA Associates - Enhanced Equity Index FundKunal MehtaPas encore d'évaluation

- 62 US Soft Drink MarketDocument20 pages62 US Soft Drink MarketViktoria BerezhetskayaPas encore d'évaluation

- Abu L&T SoaDocument2 pagesAbu L&T Soaமானங்கெட்ட மனசுPas encore d'évaluation

- (9781484372142 - The Future of China's Bond Market) The Future of China's Bond Market PDFDocument438 pages(9781484372142 - The Future of China's Bond Market) The Future of China's Bond Market PDFՏԿ եւ ՄՏՀ 2020 Առաջին հոսքPas encore d'évaluation

- Brookdale Public White Paper February 2015Document18 pagesBrookdale Public White Paper February 2015CanadianValuePas encore d'évaluation

- "Land Investment at Its Best": Here's What Makes It A Rewarding InvestmentDocument4 pages"Land Investment at Its Best": Here's What Makes It A Rewarding InvestmentKetan BhanushaliPas encore d'évaluation

- Company Law Notes - 13 March, 2022Document117 pagesCompany Law Notes - 13 March, 2022AmrutaPas encore d'évaluation

- Psa 500Document19 pagesPsa 500Anthony FinPas encore d'évaluation

- Micro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaDocument30 pagesMicro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaRajendra LamsalPas encore d'évaluation