Académique Documents

Professionnel Documents

Culture Documents

NPV of A Borders - AP

Transféré par

pillai21Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NPV of A Borders - AP

Transféré par

pillai21Droits d'auteur :

Formats disponibles

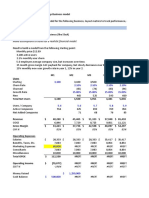

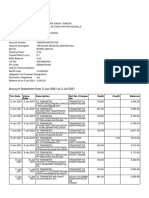

Borders: Brand Lifetime Value Spreadsheet (all values are 12 months)

Current Scenario (39

Estimates Under New Year 2 Year 3 Year 4 Year 5 Year 6

weeks ended Model

10/30/10)

Customers (Borders Reward Program) 40,000,000 44,000,000 48,400,000 53,240,000 58,564,000 64,420,400 70,862,440 Number of Customers that signed for Borders Reward Program

Average Marketing expense per customer 10.48 10.79 11.12 11.45 11.80 12.15 12.51

Interest Expense 3.01% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00%

Customer Growth Rate 10.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% % of consumers that buy from Borders increase every year

Rate of Revenue Growth -15.03% 10% 10.0% 10.0% 10.0% 10.0% 10.0% Driven by launch of higher value products and increase in market share

Avg. Items Bought Per Trip 1.0 1.0 1.0 1.0 1.0 1.0 1.0

Avg. Times Bought Per Year 3.8 5 5.0 5.0 5.0 5.0 5.0

Gross Margin 18.15% 22.60% 22.6% 22.6% 22.6% 22.6% 22.6% Goes up/down with raw material, labor, transit costs, product mix

Operating Cost Increases 3% 3% 3.0% 3.0% 3.0% 3.0% 3.0% Goes up/down based on your firm's ability to negotiate lower media rates

Discount Factor 8% 8% Goes up/down) based on benchmark performance (S&P, DJIA, USTreasury Bonds)

Total Brand or Product Current With New Model Year 2 Year 3 Year 4 Year 5 Year 6

Avg. Dollars Spent Per Item $9.98 $10.98 $11.98 $12.98 $13.98 $14.98 $15.98 Revenue / Number of unique customers / Items per trip/ Times bought per year

Revenue $ 1,516,960,000 $ 2,415,600,000 $ 2,899,160,000 $ 3,455,276,000 $ 4,093,623,600 $ 4,825,087,960 $ 5,661,908,956 Your Brand's latest actual revenue or forecast

Gross Profit $ 275,328,240 $ 545,925,600 $ 655,210,160 $ 780,892,376 $ 925,158,934 $ 1,090,469,879 $ 1,279,591,424

Operating Expense $ 419,200,000 $ 431,776,000 $ 444,729,280 $ 458,071,158 $ 471,813,293 $ 485,967,692 $ 500,546,723 Your Brand's fair share of SG&A and Ad costs to reach existing consumers

Interest Expense $ 45,660,496 $ 48,312,000 $ 57,983,200 $ 69,105,520 $ 81,872,472 $ 96,501,759 $ 113,238,179 Cost of short and long term debt after coming out of bankruptcy

Net Profit $ (189,532,256) $ 65,837,600 $ 152,497,680 $ 253,715,698 $ 371,473,168 $ 508,000,428 $ 665,806,522

Net Present Value (NPV) $1,149,935,035 $2,017,331,096

Per Customer Current With New Model Year 2 Year 3 Year 4 Year 5 Year 6

Revenue $ 38 $ 55 $ 60 $ 65 $ 70 $ 75 $ 80

Gross Profit $ 7 $ 12 $ 14 $ 15 $ 16 $ 17 $ 18

Operating Expense $ 10 $ 10 $ 9 $ 9 $ 8 $ 8 $ 7

Interest Expense $1.14 $1.10 $1.20 $1.30 $1.40 $1.50 $1.60

Net Profit $ (5) $ 1 $ 3 $ 5 $ 6 $ 8 $ 9

Net Present Value (NPV) $18 $33

Vous aimerez peut-être aussi

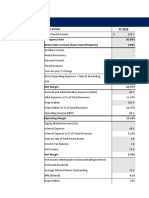

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoPas encore d'évaluation

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobPas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument32 pagesAll Dollar Values in Millions: Operating InformationanuPas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument14 pagesAll Dollar Values in Millions: Operating InformationShubham SharmaPas encore d'évaluation

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaPas encore d'évaluation

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaPas encore d'évaluation

- Zorbas ExcelDocument23 pagesZorbas ExcelRoderick Jackson Jr100% (5)

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarPas encore d'évaluation

- Sneaker 2013 ExcelDocument8 pagesSneaker 2013 ExcelMehwish Pervaiz67% (6)

- High GrowthDocument30 pagesHigh GrowthAbhinav PandeyPas encore d'évaluation

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01Extreme TourismPas encore d'évaluation

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- UAV Mar Y15Document2 pagesUAV Mar Y15Ngọc ÁnhPas encore d'évaluation

- Intrinsic Value Discounted Cash Flow CalculatorDocument18 pagesIntrinsic Value Discounted Cash Flow CalculatorAndrew LeePas encore d'évaluation

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaPas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument18 pagesAll Dollar Values in Millions: Operating InformationAlejandro Gonzales RivasPas encore d'évaluation

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaPas encore d'évaluation

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01koenigPas encore d'évaluation

- Snap IPODocument16 pagesSnap IPOKaran NainPas encore d'évaluation

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikPas encore d'évaluation

- Apple TTMDocument25 pagesApple TTMQuofi SeliPas encore d'évaluation

- Manisha Haldar - The Fashion Channel IIMT 2019 Student WorksheetDocument2 pagesManisha Haldar - The Fashion Channel IIMT 2019 Student WorksheetyyyPas encore d'évaluation

- S16 - Scenario Manager - NPV - ClassDocument11 pagesS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHPas encore d'évaluation

- Assumptions - : Amazon Cashflow & Profit ForecastDocument22 pagesAssumptions - : Amazon Cashflow & Profit Forecastlengyianchua206Pas encore d'évaluation

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Document4 pagesMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583Pas encore d'évaluation

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgePas encore d'évaluation

- PPC Forecast ModelDocument7 pagesPPC Forecast ModelOpeyemi Akinkunmi BeckleyPas encore d'évaluation

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket carePas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument15 pagesAll Dollar Values in Millions: Operating InformationJose Hines-AlvaradoPas encore d'évaluation

- DCF ConeDocument37 pagesDCF Conejustinbui85Pas encore d'évaluation

- Intrinsic Value Calculator (Discounted Earnings Per Share Method 10 Years)Document6 pagesIntrinsic Value Calculator (Discounted Earnings Per Share Method 10 Years)Martin RodriguezPas encore d'évaluation

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Numbers and NarrativesDocument15 pagesNumbers and NarrativesPravin AwalkondePas encore d'évaluation

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterPas encore d'évaluation

- DCF Textbook Model ExampleDocument6 pagesDCF Textbook Model ExamplePeterPas encore d'évaluation

- Pepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsDocument28 pagesPepsico, Inc. (Nasdaqgs:Pep) Financials Key StatsJulio CesarPas encore d'évaluation

- Axial 5 Minute DCF ToolDocument11 pagesAxial 5 Minute DCF ToolziuziPas encore d'évaluation

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaPas encore d'évaluation

- 17 Product Development EconomicsDocument18 pages17 Product Development EconomicsandrreaskinzPas encore d'évaluation

- Team Corleone - NMIMS Mumbai - FinancialsDocument6 pagesTeam Corleone - NMIMS Mumbai - FinancialsAkram MohiddinPas encore d'évaluation

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current InputsÃarthï ArülrãjPas encore d'évaluation

- FcffevaDocument6 pagesFcffevaShobhit GoyalPas encore d'évaluation

- MSFT Valuation 28 Sept 2019Document51 pagesMSFT Valuation 28 Sept 2019ket carePas encore d'évaluation

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroPas encore d'évaluation

- Sample MD&ADocument12 pagesSample MD&AChris BrubakerPas encore d'évaluation

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaPas encore d'évaluation

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138Pas encore d'évaluation

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- CDL Ar2013Document224 pagesCDL Ar2013lizPas encore d'évaluation

- WWE q1 2020 Trending SchedulesDocument6 pagesWWE q1 2020 Trending SchedulesHeel By NaturePas encore d'évaluation

- Valuation Model1 by Mihir KumarDocument15 pagesValuation Model1 by Mihir KumarMannaPas encore d'évaluation

- 07 12 Sensitivity Tables AfterDocument30 pages07 12 Sensitivity Tables Aftermerag76668Pas encore d'évaluation

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurPas encore d'évaluation

- 04 06 Public Comps Valuation Multiples AfterDocument19 pages04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanPas encore d'évaluation

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaPas encore d'évaluation

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakPas encore d'évaluation

- Intrinsic Value Spreadsheet 1Document12 pagesIntrinsic Value Spreadsheet 1Soham AherPas encore d'évaluation

- vAJ1-DCF Spreadsheet FreeDocument6 pagesvAJ1-DCF Spreadsheet FreesumanPas encore d'évaluation

- Abc CompanyDocument3 pagesAbc CompanyJOHN MITCHELL GALLARDOPas encore d'évaluation

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsD'EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsPas encore d'évaluation

- User 570959Document27 pagesUser 570959kyngmanii24Pas encore d'évaluation

- 06 Estimate For Bhargav Shah R5 - 20200808 - Ibsc - COST REVIEWDocument1 page06 Estimate For Bhargav Shah R5 - 20200808 - Ibsc - COST REVIEWIB SCPas encore d'évaluation

- 94 165 1 SMDocument28 pages94 165 1 SMKetut Agus Mas SuryadinataPas encore d'évaluation

- Bergerac D3D3D3Systems: The Challenge of Backward IntegrationDocument4 pagesBergerac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanPas encore d'évaluation

- APUSH SynthesisDocument1 pageAPUSH SynthesisthaticeskatergirlPas encore d'évaluation

- IOM - Handte Vortex DualDocument30 pagesIOM - Handte Vortex Duallavanesh1996Pas encore d'évaluation

- Project Report On Grocery Shop: Mrs Atsü PhomDocument5 pagesProject Report On Grocery Shop: Mrs Atsü PhomShyamal DuttaPas encore d'évaluation

- Deloitte - Esport Study 2022 enDocument36 pagesDeloitte - Esport Study 2022 enDominikPas encore d'évaluation

- Account Usage and Recharge Statement From 10-Nov-2021 To 06-Dec-2021Document19 pagesAccount Usage and Recharge Statement From 10-Nov-2021 To 06-Dec-2021Unique Dubai General TradingPas encore d'évaluation

- Lesson 4 Development of Business Plan NOTESDocument5 pagesLesson 4 Development of Business Plan NOTESShunuan HuangPas encore d'évaluation

- Assignment Number 2 Sherwin FernandezDocument3 pagesAssignment Number 2 Sherwin FernandezJake Floyd MoralesPas encore d'évaluation

- Narender Kumar Arora & DrsDocument180 pagesNarender Kumar Arora & DrsSudhir SinhaPas encore d'évaluation

- L3.3 - Comparative AdvantageDocument1 pageL3.3 - Comparative Advantage12A1-41- Nguyễn Cẩm VyPas encore d'évaluation

- Jyske Bank Jun 24 FX Spot OnDocument29 pagesJyske Bank Jun 24 FX Spot OnMiir ViirPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)mhb hussainPas encore d'évaluation

- Jenkins Un EncryptedDocument287 pagesJenkins Un EncryptedAndreaBas69% (13)

- Assignment # 1 STUDENT ID: mc090201864 MKT 501 (Marketing Management) SolutionDocument2 pagesAssignment # 1 STUDENT ID: mc090201864 MKT 501 (Marketing Management) SolutionImranPas encore d'évaluation

- The Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Document3 pagesThe Effects of Changes in Foreign Exchange Rates: Solutions To Quiz 2Cyrine Miwa RodriguezPas encore d'évaluation

- Assorted Steel Bars and Metal Sheets: Deformed Reinforcing Steel BarDocument2 pagesAssorted Steel Bars and Metal Sheets: Deformed Reinforcing Steel BarVon San JosePas encore d'évaluation

- ViewServiceBook AspxDocument4 pagesViewServiceBook AspxBablu JiPas encore d'évaluation

- Practical Manual On Farm Management Production and Resource EconomicsDocument60 pagesPractical Manual On Farm Management Production and Resource Economicssaurabh r33% (3)

- NETWOERTHSDocument3 pagesNETWOERTHSVIJAY PAREEKPas encore d'évaluation

- ACCT5013 M5 LectureDocument40 pagesACCT5013 M5 LecturegregPas encore d'évaluation

- Account Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanatan ThakurPas encore d'évaluation

- HEJCL23Document10 pagesHEJCL23idilsagal2021Pas encore d'évaluation

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarPas encore d'évaluation

- Perkembangan Kebijakan Hukum Pertam-Bangan Mineral Dan Batubara Di IndonesiaDocument34 pagesPerkembangan Kebijakan Hukum Pertam-Bangan Mineral Dan Batubara Di IndonesiaHerold Riwaldo SitindaonPas encore d'évaluation

- Liebherr Crane Liccon Service TrainingDocument20 pagesLiebherr Crane Liccon Service Trainingcalvin100% (53)

- QuizDocument3 pagesQuizReymark MoresPas encore d'évaluation

- Response SummaryDocument6 pagesResponse SummarySheena MachinjiriPas encore d'évaluation