Académique Documents

Professionnel Documents

Culture Documents

Calculating IRR

Transféré par

Ziwho NaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Calculating IRR

Transféré par

Ziwho NaDroits d'auteur :

Formats disponibles

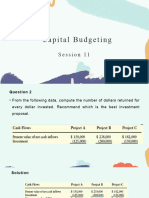

Calculate the IRR for the project

Year 0 1 2 3 4 5

Profit -1,500,000 800,000 600,000 400,000 200,000 100,000

DF 10% 0.909 0.826 0.751 0.683 0.621

PV -1,500,000 727200 495600 300400 136600 62100

NPV -1,500,000 -772,800 -277,200 23,200 159,800 221,900

Year 0 1 2 3 4 5

Profit -1,500,000 800,000 600,000 400,000 200,000 100,000

DF 20% 0.833 0.694 0.579 0.482 0.402

PV -1,500,000 666400 416400 231600 96400 40200

NPV -1,500,000 -833,600 -417,200 -185,600 -89,200 -49,000

(b-a)

(20-10)

= 18.19

What are two advantages of using IRR as an investment appraisal tool?

The IRR is the annual percentage return achieved by a project, at which the sum of the

discounted cash inflows over the life of the project is equal to the sum of the capital invested.

Advantages of IRR are:

1. The value to a business of calculating the IRR is that its decision-makers are able to see

the level of interest that a project can withstand.

2. It calculates Break-even, IRR calculates an alternative cost of capital including an

appropriate risk premium.

Would you approve the project? Explain your answer.

The IRR for the project of launching a new product is 18.19, which is considerably a low internal

rate of return. Internal rates of return are commonly used to estimate the desirability of projects.

The higher a project's internal rate of return, the more desirable it is to undertake the project. Any

project with a lower IRR represents a lower rate of return. Hence the company will not be able to

gain their invested amount with a lower rate of IRR. Therefore, this project cannot be approved.

Vous aimerez peut-être aussi

- Case Solution On Eco PlasticDocument8 pagesCase Solution On Eco PlasticFilthy Rich100% (1)

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashPas encore d'évaluation

- Investment Appraisal: A Simple IntroductionD'EverandInvestment Appraisal: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (6)

- Marketing Plan of Beauty SpotDocument39 pagesMarketing Plan of Beauty SpotZiwho Na100% (2)

- Internal Rate of ReturnDocument4 pagesInternal Rate of Returnram_babu_59Pas encore d'évaluation

- Consumer Behavior: Short Case StudyDocument13 pagesConsumer Behavior: Short Case StudyZiwho Na33% (3)

- Ferraro SPA - Strategic ManagementDocument57 pagesFerraro SPA - Strategic ManagementZiwho Na100% (1)

- FinMan PDFDocument7 pagesFinMan PDFPrincess Engreso100% (1)

- Audit of ReceivablesDocument48 pagesAudit of Receivablescarl fuerzasPas encore d'évaluation

- Khusela LodgeDocument44 pagesKhusela LodgeRosie Elzas100% (1)

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaPas encore d'évaluation

- Business Plan of SaloonDocument31 pagesBusiness Plan of SaloonZiwho Na75% (8)

- The Venture Capital Method: How VCs Determine Required OwnershipDocument19 pagesThe Venture Capital Method: How VCs Determine Required OwnershipHoang KimPas encore d'évaluation

- Spreadsheet Exercise-Drillago CompanyDocument4 pagesSpreadsheet Exercise-Drillago CompanyQueenie MillorPas encore d'évaluation

- PC Ch. 11 Techniques of Capital BudgetingDocument22 pagesPC Ch. 11 Techniques of Capital BudgetingVinod Mathews100% (2)

- Capital BudgetingDocument25 pagesCapital BudgetingAnkit JindalPas encore d'évaluation

- Year Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskDocument3 pagesYear Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskAkshaya LakshminarasimhanPas encore d'évaluation

- Assignment 2 - Strategic Financial Management - Abdulhakeem MustafaDocument7 pagesAssignment 2 - Strategic Financial Management - Abdulhakeem MustafaHakeem SnrPas encore d'évaluation

- Analyzing Investment Projects with NPV, IRR, MIRRDocument15 pagesAnalyzing Investment Projects with NPV, IRR, MIRRRussiell DanoPas encore d'évaluation

- Comparing NPVs of Projects S and L at different WACC ratesDocument8 pagesComparing NPVs of Projects S and L at different WACC ratesThanuja BhaskarPas encore d'évaluation

- Financial EvaluationDocument5 pagesFinancial EvaluationAbebe GetanehPas encore d'évaluation

- Capital budgeting techniques in ExcelDocument51 pagesCapital budgeting techniques in ExcelMohammad RekabderPas encore d'évaluation

- Excercise 1 AnswersDocument3 pagesExcercise 1 AnswersfaisalPas encore d'évaluation

- 2.1 - Case Study PT Layara - Capital BudgetingDocument3 pages2.1 - Case Study PT Layara - Capital BudgetingDaniel TjeongPas encore d'évaluation

- Me 5.4 RMDocument12 pagesMe 5.4 RMPawan NayakPas encore d'évaluation

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03Pas encore d'évaluation

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanPas encore d'évaluation

- Calculate loan EMI and outstanding balance over timeDocument3 pagesCalculate loan EMI and outstanding balance over timeShirish BaisanePas encore d'évaluation

- Evaluating Capital Investments Using Time Value of Money TechniquesDocument5 pagesEvaluating Capital Investments Using Time Value of Money TechniquesPrathmesh AmbulkarPas encore d'évaluation

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryPas encore d'évaluation

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALPas encore d'évaluation

- INF3708 Assignment 2Document4 pagesINF3708 Assignment 2kayodeodusholaPas encore d'évaluation

- Corporate Finance JUNE 2022Document7 pagesCorporate Finance JUNE 2022Rajni KumariPas encore d'évaluation

- Capital Rationing: Reporter: Celestial C. AndradaDocument13 pagesCapital Rationing: Reporter: Celestial C. AndradaCelestial Manikan Cangayda-AndradaPas encore d'évaluation

- 3 - Case Study PT Layara - Capital Budgeting - Smemba 7Document3 pages3 - Case Study PT Layara - Capital Budgeting - Smemba 7CAPas encore d'évaluation

- Biruk Zewdie AFM AssignmentDocument3 pagesBiruk Zewdie AFM AssignmentBura ZePas encore d'évaluation

- Capital Budgeting SumsDocument14 pagesCapital Budgeting Sumssunny patwaPas encore d'évaluation

- Evaluating TechniquesDocument13 pagesEvaluating TechniquesMario YyyyPas encore d'évaluation

- Financial Management Session 14Document24 pagesFinancial Management Session 14Shivangi MohpalPas encore d'évaluation

- Fin Strategy Ass 1Document3 pagesFin Strategy Ass 1mqondisi nkabindePas encore d'évaluation

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaPas encore d'évaluation

- Capital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallyDocument14 pagesCapital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallybhaskkarPas encore d'évaluation

- Fundamental of Business & Finance Term Project Financial ReportDocument6 pagesFundamental of Business & Finance Term Project Financial ReportAfaq BhuttaPas encore d'évaluation

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYPas encore d'évaluation

- Nestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingDocument5 pagesNestle Lanka PLC Project Eco Packaging: 1. Capital BudgetingSara100% (1)

- Financial Management-Coursework 2Document11 pagesFinancial Management-Coursework 2Tariq KhanPas encore d'évaluation

- Week7 KirtiKirti Section06Document6 pagesWeek7 KirtiKirti Section06hani.sharma324Pas encore d'évaluation

- Cmie Word FileDocument11 pagesCmie Word FileAniruddha ChakrabortyPas encore d'évaluation

- Net Present Value: Time Value of MoneyDocument4 pagesNet Present Value: Time Value of MoneyChris tine Mae MendozaPas encore d'évaluation

- International Capital Budgeting - Raja Rani Scooters - Template For Students-1Document12 pagesInternational Capital Budgeting - Raja Rani Scooters - Template For Students-1Dhananjay SinghalPas encore d'évaluation

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GIPas encore d'évaluation

- Chapter 5Document25 pagesChapter 5Ephrem ChernetPas encore d'évaluation

- BDM AssignmentDocument11 pagesBDM AssignmenttatualynaPas encore d'évaluation

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoPas encore d'évaluation

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniPas encore d'évaluation

- Capital Budgeting 1Document37 pagesCapital Budgeting 1Sana SarfarazPas encore d'évaluation

- Tutorial 2 Ans RevDocument2 pagesTutorial 2 Ans RevLoh Jin WenPas encore d'évaluation

- March June 2022-PlatformDocument4 pagesMarch June 2022-PlatformOlivier MPas encore d'évaluation

- Reo Afst TryDocument4 pagesReo Afst TryAEDRIAN LEE DERECHOPas encore d'évaluation

- Basic Model-01Document6 pagesBasic Model-01Sambit SarkarPas encore d'évaluation

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03Pas encore d'évaluation

- Corporate FinanceDocument8 pagesCorporate FinanceLavina AgarwalPas encore d'évaluation

- NPV & IRR TemplateDocument7 pagesNPV & IRR TemplateDimas AriotejoPas encore d'évaluation

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargPas encore d'évaluation

- Unit 4 Discussion - Investment AppraisalDocument5 pagesUnit 4 Discussion - Investment AppraisalMerlia KumdanaPas encore d'évaluation

- Question OneDocument16 pagesQuestion OneShesha Nimna GamagePas encore d'évaluation

- Business Decision Making Payback Period and Net Present Value EvaluationDocument6 pagesBusiness Decision Making Payback Period and Net Present Value Evaluationnawal zaheerPas encore d'évaluation

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingPas encore d'évaluation

- JUNE 2022 INDIVIDUAL ASSIGNMENT – CALCULATING WACC AND CAPITAL RATIONINGDocument13 pagesJUNE 2022 INDIVIDUAL ASSIGNMENT – CALCULATING WACC AND CAPITAL RATIONINGyany kamalPas encore d'évaluation

- Scrib 1Document11 pagesScrib 1Honey MolatoPas encore d'évaluation

- Operations Management at BigwaveDocument2 pagesOperations Management at BigwaveZiwho NaPas encore d'évaluation

- Problems Related To Managing GrowthDocument10 pagesProblems Related To Managing GrowthZiwho NaPas encore d'évaluation

- Trade Exhibition Project ManagementDocument13 pagesTrade Exhibition Project ManagementZiwho Na88% (8)

- Risk ManagementDocument10 pagesRisk ManagementZiwho NaPas encore d'évaluation

- WBSStructureDocument1 pageWBSStructureZiwho NaPas encore d'évaluation

- Capital Budgeting MethodsDocument32 pagesCapital Budgeting MethodsDarth VaderPas encore d'évaluation

- Fundamentals of Engineering Economics 3rd Edition Park Solutions ManualDocument21 pagesFundamentals of Engineering Economics 3rd Edition Park Solutions Manualjadehacr7u100% (25)

- Theory of FirmsDocument17 pagesTheory of FirmsWasif AzizPas encore d'évaluation

- Net Present ValueDocument21 pagesNet Present ValueMatthew LgkaroPas encore d'évaluation

- BUS322Tutorial9 SolutionDocument15 pagesBUS322Tutorial9 Solutionjacklee1918100% (1)

- Project Managmt Cash Flow Payback PeriodDocument29 pagesProject Managmt Cash Flow Payback PeriodPhebieon MukwenhaPas encore d'évaluation

- Corporate Finance Assignment: Participants Name: Zeeshan Hussain Haris Ali Adil Farooq Fahad AnjumDocument4 pagesCorporate Finance Assignment: Participants Name: Zeeshan Hussain Haris Ali Adil Farooq Fahad AnjumDN OtakuPas encore d'évaluation

- Economics 4N04 2013 Final Version PDFDocument197 pagesEconomics 4N04 2013 Final Version PDFAlessio ScarabelliPas encore d'évaluation

- Investment Office ANRS: Project Profile On The Establishment of Carpet Making PlantDocument25 pagesInvestment Office ANRS: Project Profile On The Establishment of Carpet Making Plantabel_kayel100% (2)

- Standard Bicycles Exceptional Item TreatmentDocument40 pagesStandard Bicycles Exceptional Item TreatmentkazukiPas encore d'évaluation

- Assignment - Stocks and CBDocument2 pagesAssignment - Stocks and CBGhulam HassanPas encore d'évaluation

- Econ PE ProblemBkDocument19 pagesEcon PE ProblemBkMustafa OmarPas encore d'évaluation

- Investment Decisions and Financial Performance of Matatu Saccos in NairobiDocument11 pagesInvestment Decisions and Financial Performance of Matatu Saccos in NairobiJoram MutuaPas encore d'évaluation

- Corporate Finance: Capital BudgetingDocument17 pagesCorporate Finance: Capital BudgetingpayataPas encore d'évaluation

- LBO AnalysisDocument7 pagesLBO AnalysisLeonardoPas encore d'évaluation

- Capital BudgetingDocument78 pagesCapital BudgetingAnkit Jain100% (1)

- SampleDocument96 pagesSampleTirth ShahPas encore d'évaluation

- Examiners' Commentaries 2014: FN3092 Corporate FinanceDocument19 pagesExaminers' Commentaries 2014: FN3092 Corporate FinanceBianca KangPas encore d'évaluation

- Firm Investment DecisionsDocument20 pagesFirm Investment DecisionsMaaz WahidPas encore d'évaluation

- Financial Management-2Document292 pagesFinancial Management-2benard owinoPas encore d'évaluation

- 1 ADocument11 pages1 AmurugesanramasamyPas encore d'évaluation

- Chapter 11 SynopsisDocument7 pagesChapter 11 SynopsissajedulPas encore d'évaluation

- CapitalBudgeting - Solved ProblemsDocument7 pagesCapitalBudgeting - Solved ProblemsDharmesh GoyalPas encore d'évaluation

- BPP-Advanced Table Help ScribdDocument30 pagesBPP-Advanced Table Help ScribdPalo Alto Software100% (1)