Académique Documents

Professionnel Documents

Culture Documents

Part II Jindal

Transféré par

Anamika Rai PandeyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Part II Jindal

Transféré par

Anamika Rai PandeyDroits d'auteur :

Formats disponibles

Part II-A

Para 1: Inadmissible input service cenvat credit on commission paid

Rs.66.86 lakh

As per Rule 2 (l) of Cenvat credit Rules 2004 “input service” means any

service (i) used by provider of taxable service for providing out put service or (ii)

used by manufacturer, whether directly or indirectly , in or in relation to the

manufacture of final product and clearance of final product up to the place of

removal and include service used in relation to setting up, modernization,

renovation or repair of a factory advertisement or sales promotion, market

research, storage upto place of removal, procurement of input, activities relating to

business such as accounting, auditing ,financing , recruitment and quality control,

coaching and training, computer networking, credit rating, share registry and

security, inward transportation of inputs or capital goods and outward

transportation up to the place of removal.

During scrutiny of records of input service cenvat credit of MS Jindal Saw Ltd

A-1, UPSIDC Industrial Area, Nand Gaon Road, Koshikala, Mathura pertaining to the

year 2008-09 and 2009-10, it was revealed that assessee has taken cenvat credit of

input service amounting to Rs.6686432 on sales commission paid in foreign

exchange to foreign service providers as given below:-

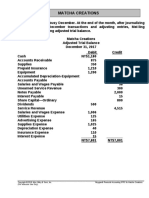

Entry No Date Value of cenvat credit

availed

590 6.3.09 1961300

591 6.3.09 2529197

592 6.3.09 2195935

Total 6686432

Since commission paid is not covered under the definition of input service,

the cenvat credit of Rs.6686432 was not admissible and required to be reversed

along with interest payable under Rule 14 of Cenvat Credit Rules 2004.

On being pointed out the assessee replied that service tax paid in relation to

advertisement or sales promotion, market research, activities relating to business

are covered under the definition of input services and therefore credit of cenvat of

Rs.6686432 paid on commission to foreign agent has rightly being claimed. The

reply is not tenable as in case of Chemplar Sanmer Ltd Vs Commissioner of Central

Excise Selam{2010(250)ELT 46 (Tri Chennai) it was held that the definition of input

service as including activities relating to business can not be interpreted to include

post manufacturing activities and commission paid on sales is post manufacturing

activities and hence not eligible for input service credit.

The matter is brought to the notice of department.

Vous aimerez peut-être aussi

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyPas encore d'évaluation

- EatggDocument8 pagesEatggAnamika Rai PandeyPas encore d'évaluation

- Q2. What Are Backing Assets?Document1 pageQ2. What Are Backing Assets?Anamika Rai PandeyPas encore d'évaluation

- Chemistry HydrocarbonDocument3 pagesChemistry HydrocarbonAnamika Rai PandeyPas encore d'évaluation

- Although Marathas Observe Major Hindu FestivalsDocument1 pageAlthough Marathas Observe Major Hindu FestivalsAnamika Rai PandeyPas encore d'évaluation

- Cs Manual2013Document270 pagesCs Manual2013zydusPas encore d'évaluation

- Classification of CustomsDocument2 pagesClassification of CustomsAnamika Rai PandeyPas encore d'évaluation

- EatggDocument8 pagesEatggAnamika Rai PandeyPas encore d'évaluation

- Financial Sector in IndiaDocument15 pagesFinancial Sector in IndiaAnamika Rai PandeyPas encore d'évaluation

- Ameworks IndiaDocument31 pagesAmeworks IndiaAnamika Rai PandeyPas encore d'évaluation

- 1Document23 pages1Anamika Rai PandeyPas encore d'évaluation

- K C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesDocument9 pagesK C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesAnamika Rai PandeyPas encore d'évaluation

- Explain The Major Societal Force Behind New MarketingDocument11 pagesExplain The Major Societal Force Behind New MarketingAnamika Rai Pandey100% (1)

- Basic Phases of AccountingDocument6 pagesBasic Phases of AccountingAnamika Rai PandeyPas encore d'évaluation

- International Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioDocument19 pagesInternational Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioAnamika Rai PandeyPas encore d'évaluation

- LiteratureDocument2 pagesLiteratureAnamika Rai PandeyPas encore d'évaluation

- Q. 1) Explain in Detail The Various Levels of Organization Culture. Ans: IntroductionDocument7 pagesQ. 1) Explain in Detail The Various Levels of Organization Culture. Ans: IntroductionAnamika Rai Pandey0% (1)

- LimitationsDocument4 pagesLimitationsAnamika Rai PandeyPas encore d'évaluation

- Advance Search:: Home Acts Implemented Details of The Acts Implemented The Industrial Employment Act, 1946Document3 pagesAdvance Search:: Home Acts Implemented Details of The Acts Implemented The Industrial Employment Act, 1946Anamika Rai PandeyPas encore d'évaluation

- Unit VIIIDocument16 pagesUnit VIIIAnamika Rai PandeyPas encore d'évaluation

- MIS Info. SystemDocument15 pagesMIS Info. SystemAkash KumarPas encore d'évaluation

- Classification of CustomsDocument2 pagesClassification of CustomsAnamika Rai PandeyPas encore d'évaluation

- Services Is The Fastest Growing Sector in IndiaDocument3 pagesServices Is The Fastest Growing Sector in IndiaAnamika Rai PandeyPas encore d'évaluation

- Introduction To Poet Alfred Tennyson (1809-1892), English Poet Often Regarded As The Chief Representative of TheDocument9 pagesIntroduction To Poet Alfred Tennyson (1809-1892), English Poet Often Regarded As The Chief Representative of TheAnamika Rai PandeyPas encore d'évaluation

- Archaeologists Often Utilize A Number of Dating TechniquesDocument6 pagesArchaeologists Often Utilize A Number of Dating TechniquesAnamika Rai PandeyPas encore d'évaluation

- Case Studies 1Document3 pagesCase Studies 1Anamika Rai Pandey100% (1)

- Factors Affecting Production Planning and ControlDocument7 pagesFactors Affecting Production Planning and ControlAnamika Rai PandeyPas encore d'évaluation

- Extra DbmsDocument10 pagesExtra DbmsAnamika Rai PandeyPas encore d'évaluation

- Managerial EffectivenessDocument3 pagesManagerial EffectivenessAnamika Rai Pandey100% (1)

- Action OrientedDocument10 pagesAction OrientedAnamika Rai PandeyPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Invitation To CPD On Predicting Corporate FailureDocument6 pagesInvitation To CPD On Predicting Corporate Failureyakubu I saidPas encore d'évaluation

- Evike Order 3939175Document3 pagesEvike Order 3939175Carlos CrisostomoPas encore d'évaluation

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraPas encore d'évaluation

- MAA763 Governance and Fraud: Revision T2 2017Document40 pagesMAA763 Governance and Fraud: Revision T2 2017MalikPas encore d'évaluation

- Essentials of College and University AccountingDocument121 pagesEssentials of College and University AccountingLith CloPas encore d'évaluation

- RACIDocument26 pagesRACImailtonoorul4114Pas encore d'évaluation

- 03-12-24 - Leadership Society Web ListingDocument16 pages03-12-24 - Leadership Society Web Listinga1976843Pas encore d'évaluation

- Chapter 7 Project Termination and Project Management Practices in BDDocument19 pagesChapter 7 Project Termination and Project Management Practices in BDbba19047Pas encore d'évaluation

- BIT 4206 ICT in Business and Society-1Document85 pagesBIT 4206 ICT in Business and Society-1James MuthuriPas encore d'évaluation

- Jakawali ParachuteDocument1 pageJakawali Parachuteparasailing jakartaPas encore d'évaluation

- Case Study-Design Thinking in IBMDocument50 pagesCase Study-Design Thinking in IBMSANYA KAPOORPas encore d'évaluation

- Unit 1 Iot An Architectural Overview 1.1 Building An ArchitectureDocument43 pagesUnit 1 Iot An Architectural Overview 1.1 Building An Architecturedurvesh turbhekarPas encore d'évaluation

- Assistant AccountantDocument4 pagesAssistant AccountantfahadPas encore d'évaluation

- Sample Barangay BudgetDocument17 pagesSample Barangay Budgetnilo bia100% (4)

- CPAR 92 AUD-1st PB SolDocument3 pagesCPAR 92 AUD-1st PB SolEmmanuel TeoPas encore d'évaluation

- SMP A3 PDFDocument6 pagesSMP A3 PDFMarlyn OrticioPas encore d'évaluation

- Teaching PowerPoint Slides - Chapter 16Document36 pagesTeaching PowerPoint Slides - Chapter 16Seo ChangBinPas encore d'évaluation

- Management 8th Edition Kinicki Solutions Manual 1Document66 pagesManagement 8th Edition Kinicki Solutions Manual 1rodney100% (52)

- Use Case: From Wikipedia, The Free EncyclopediaDocument6 pagesUse Case: From Wikipedia, The Free EncyclopediaLisset Garcia PerezPas encore d'évaluation

- PKGS Shipping BillDocument2 pagesPKGS Shipping BillAjay DarlingPas encore d'évaluation

- Pt. Patco Elektronik Teknologi Standard Operating Procedure PurchasingDocument8 pagesPt. Patco Elektronik Teknologi Standard Operating Procedure Purchasingmochammad iqbal100% (1)

- Pacl ScamDocument24 pagesPacl ScamAindrila ChatterjeePas encore d'évaluation

- The Rise of NFT FundraisingDocument36 pagesThe Rise of NFT FundraisingTrader CatPas encore d'évaluation

- Tribune 17th June 2023Document30 pagesTribune 17th June 2023adam shingePas encore d'évaluation

- GX Cloud Banking 2030 FsiDocument12 pagesGX Cloud Banking 2030 FsiMoidin AfsanPas encore d'évaluation

- frdA190220A1421665 PDFDocument2 pagesfrdA190220A1421665 PDFVeritaserumPas encore d'évaluation

- GPOA (PR Consultant)Document7 pagesGPOA (PR Consultant)Jeydrew TVPas encore d'évaluation

- E Commerce QuestionsDocument4 pagesE Commerce Questionsbharani100% (1)

- It Landscape: InsideDocument89 pagesIt Landscape: InsideBogdan StanciuPas encore d'évaluation

- 2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - LibroDocument82 pages2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - Librovallejo13Pas encore d'évaluation