Académique Documents

Professionnel Documents

Culture Documents

Davis Objection

Transféré par

marie_beaudetteDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Davis Objection

Transféré par

marie_beaudetteDroits d'auteur :

Formats disponibles

HEARING DATE: April 20, 2011 HEARING TIME: 10:00 A.M.

TARTER KRINSKY & DROGIN LLP Attorneys for Trevor P. Davis Debtor and Debtor-in-Possession 1350 Broadway, 11th Floor

New York, New York 10018

(212) 216-8000

Scott S. Markowitz, Esq.

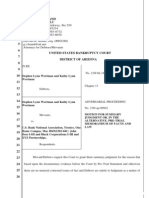

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK

------------------------------------------------------------- )(

In re:

Case No.: 10-16722 (SCC)

Chapter 11

TREVORP. DAVIS,

Debtor.

------------------------------------------------------------- )(

DEBTOR'S OBJECTION AND MEMORANDUM OF LAW IN OPPOSITION TO DIANE DAVIS' MOTION FOR APPOINTMENT OF A CHAPTER 11 TRUSTEE

AND ESTABLISHING A BUDGET FOR THE DEBTOR

TO: THE HONORABLE SHELLEY C. CHAPMAN UNITED STATES BANKRUPTCY JUDGE

Trevor P. Davis, debtor and debtor-in-possession (the "Debtor"), by and through his

counsel Tarter Krinsky & Drogin LLP, respectfully submits this objection and memorandum of

law in opposition to Diane Davis' ("Diane") motion for appointment of a Chapter 11 trustee

and/or to establish a budget (the "Motion").

PRELIMINARY STATEMENT

The Motion should be denied as it utterly fails to demonstrate "cause" for the Court to

appoint a Chapter 11 trustee pursuant to §1104(a)(1) of Title 11, United States Code (the

"Bankruptcy Code"). The Motion is comprised of nothing more than allegations, exaggerations

and half-truths. The Court should see the Motion for precisely what it is, a continuation of a

{Client\002981 \BANK298\003 5 53 74 .DOC; 1 }

hotly contested divorce proceeding. Although the Motion is 32 pages, the allegations related to factors relevant to appointment of a trustee boils down to the following. The Court should appoint a trustee because the Debtor (who at one time was a highly successful real estate developer whose family enjoyed the trappings of success) has suffered financial reversals and is unable to maintain the lifestyle his family became accustomed to. A trustee is warranted because the Debtor's assets declined prior to the Filing Date and the Debtor owns substantially all of his assets through non-debtor entities. A trustee is warranted because the Debtor continues to spend substantial monies to support his family. This is hardly the type of clear and convincing evidence that warrants the appointment of a trustee, especially in an individual Chapter 11 case. Since all of the Debtor's post-petition earnings are property of the estate, the appointment of a trustee raises serious constitutional issues. Section 1129(a)(14) of the Bankruptcy Code appears to require the Debtor to continue these payments. The Debtor is required to pay Diane $17,000 in unallocated tax free support. Since the parties are estranged, the Debtor, as part of a "nesting" arrangement, was required to obtain a separate apartment so that the Debtor and Diane could alternate residences so that the children would not have to move between apartments. The Debtor is obligated to pay all expenses of the farm property, including wages of any domestic staff. The Debtor is obligated to pay tuition for private school and college tuition for his four children, as well as all of their living expenses, transportation and entertainment. In essence, the Debtor is required to pay for all of his family'S expenses and pay Diane an additional $17,000 per month in unallocated tax free support. As Diane points out in the Motion, the Debtor currently has no income other than interest income from his investments.

The Debtor acknowledges and understands that it appears that he lives a lavish lifestyle.

Certainly, his standard of living is above that of the average person, whether a debtor or

{Client\002981 \BANK298\003553 74.DOC; I}

2

otherwise. However, much of the Debtor's expenses are related to his obligations to Diane and his children under the pendente lite order attached as Exhibit "B" to the Motion. The mortgage payment on the Debtor's primary residence (where Diane and the minor children reside) is approximately $26,000 per month. The common charges are $6,000 per month. The real estate taxes are $5,000 per month. In the divorce proceeding, the Debtor requested that the marital apartment be put up for sale. In 2009, approximately one year before the Chapter 11 filing, the divorce judge denied this request and ordered the Debtor to maintain all payments related to the marital apartment.

As will be demonstrated below, and at any evidentiary hearing conducted by the Court, contrary to the allegations made in the Motion, the Debtor has been making every effort to reduce his expenses where possible. The Debtor has negotiated for reduced rent for his office, cut back on his office staff, sold certain farm equipment and reduced other farm related expenses. Although it is true that the Debtor's investments have declined over the past two years, especially in December 2010 (due to an extreme increase in the IO-year treasury note), the Debtor continues to manage these funds and is making every effort to preserve his remaining cash. As the Motion acknowledges, the Debtor and Diane have not been able to agree to a settlement of the divorce proceeding. Without getting into detail and involving this Court in the divorce proceeding more than necessary, suffice it to say that Diane is unwilling to face the harsh reality that the Debtor has suffered severe financial setbacks over the last three years due to the real estate crash, which will undoubtedly dramatically change her standard of living. The appointment of a trustee will not change this in any way. The Motion is nothing more than a litigation tactic filed by a disgruntled spouse.

The Motion asserts, without any support, that the Debtor is somehow hiding his assets in

{Client\002981 \BANK298\00355374.DOC;1}

3

non-debtor limited liability companies. Nothing could be further from the truth. The Debtor has

made full and complete disclosure to this Court. In fact, the Debtor's monthly operating reports

include bank reconciliations from all of the accounts maintained by his non-debtor affiliates.

Diane's divorce attorney is extremely familiar and fully aware of all of the assets maintained in

the non-debtor affiliates. I Diane's divorce counsel has made several proposals in writing

offering to settle the equitable distribution claims which demonstrate that she has a very detailed

Pawling, New York, the family apartment located on 78th Street and Third Avenue in Manhattan,

understanding of the Debtor's financial affairs and assets. These assets consist of the farm in

the Debtor's membership interests in a condominium development at 1055 Park Avenue, an

interest in an undeveloped commercial condominium to be constructed by Toll Brothers at 65th

Street and Lexington Avenue, and an undeveloped piece of real estate in Anguilla.

In short, the appointment of a trustee is not warranted under the facts and circumstances

herein. The Debtor is willing to live by a reasonable budget, taking into consideration his court

ordered obligations, and the obvious fact that it cost more to maintain two households than to

maintain one. The Debtor has agreed to lifting of the automatic stay to permit the parties to

continue to litigate or settle the divorce proceeding. The Debtor is ready to continue to meet with

Diane and has even suggested that the parties resolve their differences through mediation, which

is often done in the bankruptcy courts. The Debtor has and continues to provide detailed

disclosure regarding his financial condition and Diane certainly has rights under Bankruptcy Rule

2004 to conduct discovery on these issues if she feels she is not receiving the disclosure she is

1 Any claims by Diane, or her counsel, that she has been unable to obtain pertinent financial records related to the Debtor's financial affairs or non-debtor affiliates is untrue. Diane's financial expert has been provided with virtually every document related to the Debtor's financial affairs and has met with the Debtor's in-house accountant on at least four occasions to obtain answers to numerous questions raised by the expert. Her financial expert has virtually unfettered access to the Debtor's financial records and obtains regular updates.

{Client\002981 \BANK298\00355374.DOC; I}

4

entitled to.

RELEVANT BACKGROUND

1. On December 21,2010, (the "Petition Date"), the Debtor filed a voluntary petition

for relief under Chapter 11 of the Bankruptcy Code. The Debtor continues to operate his businesses and manage his properties as a debtor-in-possession pursuant to §§1107 and 1108 of the Bankruptcy Code.

2. No trustee or examiner has been appointed. The United States Trustee has not

appointed an official committee of unsecured creditors.

3. The Debtor is a well-known real estate developer who has developed numerous

buildings, primarily on the Upper East Side of Manhattan. The Debtor's need for Chapter 11 relief is a direct result of the real estate crash. The Debtor invested a substantial portion of his liquid assets in two development projects at perhaps the worst time in the last thirty-five years. The Debtor acquired a development site at 65th Street and Lexington Avenue with the intention of developing luxury condominiums. The Debtor invested approximately $24,000,000 of his own cash and obtained an acquisition loan of approximately $17,000,000. The acquisition loan went into default and the Debtor was unable to obtain a construction loan due to the freeze in the credit markets after the Lehman bankruptcy filing. The acquisition lender commenced a foreclosure action, which was eventually resolved when Toll Brothers purchased the development site and paid off the acquisition lender. The Debtor's $24,000,000 in equity was wiped out and the Debtor's only interest is a retained ownership in the commercial condominium unit, which is subject to a mortgage in favor of Toll Brothers in the amount of $1,500,000. Toll Brothers has commenced development but the project will not be completed until next year.

4. As this Court is aware, the Debtor also owns, through a non-debtor entity, a

{Client\002981 \BANK298\00355374.DOC; I}

5

condominium development at 1055 Park Avenue, New York, New York. The Debtor acquired

the property in 2005 and obtained a construction loan in December 2007. The Debtor

contributed approximately $20,000,000 of his own capital to acquire this development site.

Disputes arose between the construction lender and the Debtor with respect to the funding of the

project, which eventually led to the Debtor having to obtain additional financing to complete the

project. The project is substantially complete but the Debtor has been unable to sell units as the

construction lender sold its loan to an investor who has taken an aggressive position and has not

consented to the release of units and has sought stay relief in this Court to commence a

foreclosure action. The Debtor is in the process of attempting to finalize a refinance of this

project, which will enable units to be sold and the loans to be paid.

DIANE HAS NOT DEMONSTRATED CAUSE TO APPOINT

A CHAPTER 11 TRUSTEE AS SHE HAS FAILED TO DEMONSTRATE FRAUD, INCOMPETENCE OR GROSS MISMANAGEMENT

5. The party seeking the appointment of a trustee for "cause" under § 11 04(a)(1) must

establish its case by clear and convincing evidence. In re Bayou Group, LLC, 564 F.3d 541, 546

(2nd Cir. 2009); In re Aardvark, Inc., 1997 WL 129346, *3, (D.Del. March 4, 1997); In re

Madison Management Group, Inc., 137 B.R. 275, 281 (Bankr. N.D.Ill. 1992). The appointment

of a trustee is considered to be an "extraordinary act," since, in the usual case, the debtor remains

a debtor-in-possession throughout reorganization. In re Ionosphere Clubs, Inc., 113 B.R. 164,

167 (Bankr. S.D.N.Y. 1991). The appointment of a trustee is an unusual remedy and "[t]he

standard for appointment is very high ... " Bayou, supra. The Court "must bear in mind that the

appointment of a trustee 'may impose a substantial financial burden on a hard pressed debtor

seeking relief under the Bankruptcy Code,' by incurring the expenditure of 'substantial

administrative expenses' caused by further delay in the bankruptcy proceedings." Bayou, 564

{Client\002981 \BANK298\00355374.DOC;1}

6

F.3d at 546-47 (quoting Midlantic Nat'l Bank v. Anchorage Boat Sales, Inc. (In re Anchorage Boat Sales, Inc.), 4 B.R. 635, 644 (Bankr. E.D.N.Y. 1980). A court's appointment of a trustee under § 11 04( a)(2) is more discretionary and allows a court to consider a variety of factors. Petit v. New England Mortgage Services, Inc., 182 B.R. 64 (D. Me. 1995) ("consideration under § 11 04( a)(2) entails the exercise of a spectrum of discretionary powers and equitable considerations"); In re Madison Management Group, Inc., 137 B.R. 275, 282 (Bankr. N.D.ILL. 1992) ("courts eschew rigid absolutes and look to the practical realities and necessities in considering applications under § 11 04( a)(2) of the Bankruptcy Code").

6. Section 1104(a)(I) defines "cause" to include "gross mismanagement of the

affairs of the debtor by current management, either before or after the commencement of the case." 11 U.S.c. §1104(a)(1). The use of the word "gross" in describing the degree of mismanagement necessary to justify a court's appointment of a Chapter 11 trustee denotes that the mismanagement serving as a basis for "cause" of a trustee's appointment must be more than the type of mismanagement that most likely caused the debtor to file a bankruptcy petition in the first place. See, In re Colorado - Ute Electric Association, Inc., 120 B.R. 164, 174 (Bankr. D. Colo. 1990) (stating that something more than garden-variety mismanagement is necessary to justify appointment of a trustee for cause); 7 Collier on Bankruptcy §1104.02[3][c] at 1104-12- 13 (15th ed. revised 1998).

7. Diane has made numerous allegations which she asserts constitute "cause" for the

appointment of a Chapter 11 trustee. Most of the allegations relate to the Debtor's living expenses and the fact that his cash has diminished somewhat in the last two years. For example, Diane asserts that the Debtor lives a lavish lifestyle which includes a $40,000, seven day vacation in the South of France, six months prior to his Chapter 11 filing. This vacation was with his

{Client\002981 \BANK298\003 5 53 74 .DOC; I }

7

daughter and cost more in the neighborhood of $12,000. Rather than his daughter attending camp, they chose this vacation when the Debtor had the opportunity to get away during the summer. Diane similarly complains about the Debtor's vacation around Christmas 2010 to Anguilla with his four children. This vacation was not $50,000, but was approximately $25,000, including airfare for the Debtor and his children? The trip to South Africa was when his father died. Diane complains that the Debtor spent $65,000 for a car for their son attending college. First, Diane practically berated the Debtor into purchasing a car for their son. See, Exhibit "A." Secondly, the Debtor traded in two used cars and paid the $30,000 balance to purchase an Audi for his son at Diane's behest. This too was done prior to the Chapter 11 filing. Diane asserts that the Debtor has the use of two luxurious residences in New York City and sometimes stays at the Carlyle Hotel. What she fails to explain is that she rarely allows the Debtor in the marital residence and the Debtor is required to maintain another residence under his "nesting" arrangement. Diane asserts that the Debtor recently caused the sales of various vehicles, including a Maybach, a Bentley, a Mini Cooper and a BMW. The Maybach was sold years ago and the Bentley was sold at least a year before the Chapter 11 filing. Prior to the Filing Date, the Debtor did sell certain farm equipment in order to reduce operating expenses as the Debtor no longer raises cattle at the farm. In short, the Debtor's living expenses are directly attributable to the fact he is obligated under the pendente lite order to continue to pay approximately $35,000 per month to service the marital residence, pay tuition and living expenses for four children, pay Diane $17,000 per month in unallocated tax free support, as well as substantially all of Diane's other living expenses. The Debtor has been imploring Diane to list the marital apartment for sale as it is simply unaffordable and continued mortgage payments eat away at the Debtor's available

2 The next week, Diane took her daughters for a one week vacation to Miami.

{Client\00298! \BANK298\00355374.DOC;!}

8

cash.

8. Diane asserts that the appointment of a trustee is warranted because as of the end

of December 2009, the Debtor had approximately $11,000,000 in cash in marketable securities.

By September 30, 2010, the amount had declined to approximately $9,600,000. Footnote 9 of

9. Many of the allegations made by Diane are simply inaccurate or greatly

the Motion indicates that Diane is aware that Bank of America offset a certificate of deposit in

the amount of $1,700,000 in reduction of its mortgage on the marital residence as part of a

forbearance agreement. The remainder of the decline was simply due to the fact that his

expenses exceed his income on a monthly basis. Diane further asserts that a trustee is warranted

because the Debtor's investment accounts now amount to approximately $7,200,000. What she

fails to understand is that the Debtor had invested a substantial amount of his cash in Fannie Mae

4% bonds.' In December 2010, the 10-year treasury interest rate jumped dramatically as a result

of action taken by the Federal Reserve. Because the Debtor could not afford to hold the bonds to

maturity, his portfolio declined significantly. The Debtor has subsequently reallocated his

investments and continues to slowly recover some of the losses as the market improves.

exaggerated. For example, in paragraph 9 of the Motion, Diane asserts that the Debtor has

primary, secondary and vacation residences. The Debtor does not have a vacation residence."

The property in Anguilla is undeveloped. The secondary residence is the "nesting" arrangement

which will end once the divorce is settled. Diane does not allow the Debtor unfettered access to

the primary residence. Diane asserts in paragraph 10 of the Motion that the Debtor's non-debtor

limited liability companies are losing substantial value as a result of the Debtor's risky business

3 Diane also fails to point out that she transferred $700,000 from the Debtor's stock account to herself and has failed to account for these funds.

4 Perhaps Diane is referring to the farm.

{Client\002981 \BANK298\003553 74.DOC;1 }

9

decisions. There is no evidence to support this allegation. Real estate development by nature is a risky business. Some of the most successful real estate developers have been humbled by the credit freeze and real estate crash between 2008 and 2010. Diane's complaining of the Debtor's risky real estate ventures is disingenuous as his success for many years has allowed her and her family to live luxuriously. Her claim that she only now realizes that the mortgage on the primary residence was cross-collateralized with the mortgage on the farm (both loans are with Bank of America) is hard to believe. Real estate developers often cross-collateralize assets when borrowing money from financial institutions. Certainly, this cannot constitute fraud, incompetence, or gross mismanagement.

10. Diane baldly asserts the Debtor is not seriously marketing the farm. Nothing

could be further from the truth. The Debtor has retained a well-known broker and is making every effort to sell the farm either as a single parcel or broken up into three parcels. The farm is subject to a mortgage in favor of Bank of America in the amount of approximately $14,600,000. M&T Bank holds a mortgage in the amount of approximately $2,500,000 against other portions of the farm. Diane wrongfully asserts that the mortgage encumbering the farm is in the approximate amount of $23,000,000. The Debtor stands ready, willing and able to sell the farm and pay-off the debt. Notwithstanding the marketing efforts, no offers have been made for the farm, as a whole or in parcels.

11. An example of the baseless allegations in the Motion is highlighted by the

allegations made in paragraph 31 of the Motion with respect to the 1055 Park Avenue project. Diane claims that she "believes that the Project could be completed if the Debtor were willing to make reasonable accommodations to the senior and/or junior lender." An explanation of what type of accommodations would be most helpful, as experienced real estate and bankruptcy

{Client\002981 \BANK298\00355374.00C; I}

10

lawyers have been working diligently to reach such an accommodation. The current senior lender has made it clear that he would like to foreclose or refinance the project in such a way as to wipe out the junior lender. The junior lender is unwilling to release its lien unless it receives substantial payment. The Debtor has been working virtually around the clock to finalize a refinance which would enable the Debtor to satisfy the senior lender, pay the junior lender an agreed discounted amount and sell units. This would benefit not only the Debtor, but Diane. If the Debtor is left with a substantial unsecured debt on his guaranty to the junior lender, this obligation is a marital debt which has to be accounted for in dividing the marital assets. Certainly Diane does not expect to take all of the marital assets and leave the Debtor with all of the marital debts.

12. Similarly, Diane makes unsubstantiated allegations that a trustee would be able to

invest $2,000,000 to develop the Anguilla property. The development where the Anguilla property is located is in bankruptcy. The statements that other uncompleted properties in the same development have sold for $2,500,000 is nothing more than a bald statement. The Debtor stands ready to sell this property should a reasonable offer be proffered. With respect to the farm, while it is true that the cost of maintaining the farm is a drain on the Debtor's resources, the Debtor is required to maintain the farm under the pendente lite order until it is sold. The Debtor has taken all reasonable steps to reduce these operating losses and the Debtor is not currently servicing Bank of America's mortgage. The allegations that the Debtor is not marketing the entire farm because he plans to develop "Farm Villas" is simply untrue. The Debtor abandoned this idea over five years ago (which was limited to only 20 acres) after conducting a feasibility study.

13. In paragraph 27 of the Motion, Diane asserts that if the matrimonial action were

{Client\002981 \BANK298\00355374.DOC; I}

11

permitted to proceed, the matrimonial court would likely take immediate steps to halt the alleged depletion of assets by the issuance of appropriate restraints. Here, again, there is no basis for such unsubstantiated statements. As Diane's counsel properly acknowledges, the divorce action has been pending for more than two years. The Debtor's Chapter 11 case has been pending for four months. If Diane's counsel felt so strongly about the Debtor's depletion of assets, why have they not proceeded in the state court to obtain such restraints?

THE APPOINTMENT OF A TRUSTEE WILL BE COSTLY AND DISRUPTIVE

14. As the Second Circuit specifically recognized in Bayou, the appointment of a

trustee may impose a substantial financial burden on a hard pressed debtor. The Debtor submits that this is especially heightened in an individual case in view of § 1115 of the Bankruptcy Code, which provides that all of the Debtor's post-petition earnings are property of the bankruptcy estate. If a trustee is appointed, the Debtor will have no ability to pay necessary living expenses, including various hefty support payments to his wife and tuition for his children. His postpetition earnings would be captured by the trustee. In In re Clemente, 409 B.R. 288 (Bankr. D. N.J. 2009), the court recognizing the constitutional issues related to the 13th Amendment vacated the Chapter 11 trustee appointment so that the Debtor could voluntarily convert to Chapter 7 so as to avoid constitutional issues. Here, the Debtor does not wish to convert to Chapter 7 but submits that the Court should carefully consider the appointment of a trustee under these circumstances. The Debtor's operating reports include detailed bank reconciliations reflecting all disbursements from his non-debtor affiliates. All disbursements are being made through the DIP account. The appointment of a trustee would clearly add a level of expense which is not warranted. This Court has other less drastic remedies. The Debtor is prepared to consent to some type of reasonable budget, recognizing that the Debtor cannot completely eliminate his

{Client\002981 \BANK298\003553 74.DOC;1}

12

spending, which is mostly attributable to his obligations under the pendente lite order. In In re

Roedemeier, 374 B.R. 264 (Bankr. D. Kan. 2007), the court ruled that a debtor's monthly

projected expenses should be based on a judicial determination of what expenses are necessary

under the debtor's particular circumstances, rather than being based on the average monthly

expenses of a family of comparable size. Obviously, very few individual debtors can afford to

pay $17,000 per month in tuition, $17,000 in unallocated tax free support to an estranged wife,

and $35,000 per month on debt service, real estate taxes and common charges with respect to the

marital residence. The United States Supreme Court has clearly indicated that an individual

debtor can utilize Chapter 11 to restructure their financial affairs. Here, the Debtor has

APPOINTMENT OF A TRUSTEE IS CONTRARY TO THE INTERESTS OF CREDITORS

substantial assets but he also has substantial liabilities, which he is attempting to resolve through

his Chapter 11 case.

15. Bankruptcy Code §1104(a)(2) provides that the appointment of a trustee IS

warranted if it is in the best interest of creditors.

16. In considering a request for the appointment of a trustee, the court must weigh the

benefits derived from the appointment against the costs of the appointment. In re Ionosphere

Clubs. Inc., 113 B.R. at 168 (Bankr. S.D.N.Y. 1990).

17. Diane points out that courts consider various factors to determine whether the

appointment of a trustee is warranted under § 1104(a)(2). Diane asserts in paragraph 48 of the

Motion that the Debtor has committed most, if not all, of these enumerated acts. However,

again, Diane fails to elaborate. Diane has not proffered that the Debtor has a history of

questionable transactions with affiliated companies. There is no evidence that the Debtor has

{Client\002981 \BANK298\00355374.DOC; I}

13

failed to maintain adequate records and provide prompt and complete disclosure. On the contrary, the Debtor has timely filed all of his operating reports, and the Debtor's in-house financial staff keeps detailed financial records of all aspects of the Debtor's finances. Diane has not explained what conflicts of interest are preventing him from discharging his fiduciary duty to creditors nor has she demonstrated that the Debtor made any fraudulent transfers or other transfers on the eve of bankruptcy. The Debtor has made no unauthorized post-petition transfers but has continued to operate in the ordinary course trying to reach an accommodation with the lenders on his only active real estate development. There is no evidence of lack of confidence in the Debtor's ability to manage his business and discharge his fiduciary duties. In fact, Zimco, which was been locked in a battle with the Debtor and whose actions precipitated the Chapter 11 filing, has filed pleadings opposing the appointment of a trustee so that the Debtor can continue to try and resolve the difficult issues with respect to the 1055 Park Avenue project.

18. In paragraph 52 of the Motion, Diane asserts that she was compelled to move by

order to show cause on June 4,2010 for an order pursuant to C.P.L.R. §3126 precluding the Debtor from presenting any evidence at trial with respect to the sale of his interests in his former business partnership. What Diane fails to disclose is that she withdrew this motion voluntarily.

CONCLUSION

This Motion is nothing more than a litigation tactic to force the Debtor to acquiesce to Diane's demands in the divorce proceeding. As can be seen from the stipulation annexed to the Motion as Exhibit "A," the Debtor has consented to stay relief to permit the state court to decide the equitable distribution issues. Whether the state court decides these issues or the parties settle, Diane will have a claim against the Debtor under well-established Second Circuit case law. This claim will be entitled to the highest priority under §507(a)(I) of the Bankruptcy Code. The

{Client\002981 \BANK298\00355374.DOC; I}

14

Debtor will have to deal with and satisfy these claims under any Chapter 11 plan. See,

§ 1129(a)(14). The appointment of a Chapter 11 trustee will not change this fact. The allegations

set forth in the Motion, most of which are simply untrue or greatly exaggerated, do not warrant

the drastic remedy of appointment of a Chapter 11 trustee only four months after the Chapter 11

filing on the eve of the Debtor's apparent refinance of the 1055 Park Avenue project. The Debtor

is prepared to continue to meet with Diane to try and reach a negotiated settlement. If a

settlement cannot be reached, the parties are free to proceed to trial in the state court. The Debtor

will continue to make the payments required under the pendente lite order and continue in his

efforts to reach a negotiated resolution with his other creditors, which is the primary goal of

Chapter 11.

WHEREFORE, it is respectfully requested that the Court deny the Motion to appoint a

Chapter 11 trustee, and grant the Debtor such other and further relief as the Court deems just and

proper.

Dated: New York, New York April 14,2011

TARTER KRINSKY & DROGIN LLP Attorneys for Trevor P. Davis Debtor and Debtor-in-Possession

By: /s/ Scott S. Markowitz

Scott S. Markowitz

1350 Broadway, 11 th Floor New York, New York 10018 (212) 216-8000

{Client\002981 \BANK298\00355374.DOC; I}

15

Vous aimerez peut-être aussi

- It's A Guy Thing: A Owner's Manual for WomenD'EverandIt's A Guy Thing: A Owner's Manual for WomenÉvaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Example of A Comfort LetterDocument5 pagesExample of A Comfort LetterZ_JahangeerPas encore d'évaluation

- In Re Pigg (Plaintiff's Trial Brief)Document5 pagesIn Re Pigg (Plaintiff's Trial Brief)richdebtPas encore d'évaluation

- Davis TrusteeDocument34 pagesDavis Trusteemarie_beaudettePas encore d'évaluation

- Verified Complaint Alles-FinalDocument56 pagesVerified Complaint Alles-FinalNancy Duffy McCarronPas encore d'évaluation

- In Re Pigg (Amended Complaint)Document6 pagesIn Re Pigg (Amended Complaint)richdebtPas encore d'évaluation

- RescissionNotice Fin Charge COMPLAINTDocument23 pagesRescissionNotice Fin Charge COMPLAINTLoanClosingAuditors100% (1)

- Legacy Construction (Hardy) BankruptcyDocument13 pagesLegacy Construction (Hardy) BankruptcyLas Vegas Review-JournalPas encore d'évaluation

- Response To San Diego Home Funding LLCDocument17 pagesResponse To San Diego Home Funding LLCNick CruzPas encore d'évaluation

- FTL 108951609v1Document3 pagesFTL 108951609v1Chapter 11 DocketsPas encore d'évaluation

- Douglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee ServicesDocument90 pagesDouglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee ServicesChariseB2012Pas encore d'évaluation

- 10000005743Document48 pages10000005743Chapter 11 DocketsPas encore d'évaluation

- Cordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Document4 pagesCordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Chapter 11 DocketsPas encore d'évaluation

- Trustee's Complaint Against Denny Hecker's Girlfriend, Christi RowanDocument10 pagesTrustee's Complaint Against Denny Hecker's Girlfriend, Christi RowannathanmhansenPas encore d'évaluation

- 2010 08 30 Whitaker V Deutsch Bank Violation of FDCPADocument3 pages2010 08 30 Whitaker V Deutsch Bank Violation of FDCPAgeoraw9588100% (1)

- Affidavit Pursuant To Local Rule 1007Document4 pagesAffidavit Pursuant To Local Rule 1007Anna BurnhamPas encore d'évaluation

- In Re Larry Loew, 11-13339-JNF (Bankr. D. Mass. Apr. 12, 2012)Document14 pagesIn Re Larry Loew, 11-13339-JNF (Bankr. D. Mass. Apr. 12, 2012)Venkat BalasubramaniPas encore d'évaluation

- United States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDocument20 pagesUnited States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDGWBCSPas encore d'évaluation

- COMPLAINT Victor JohnsonDocument38 pagesCOMPLAINT Victor JohnsonBernie KimmerlePas encore d'évaluation

- MRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017Document88 pagesMRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017FraudInvestigationBureau100% (2)

- Guingona V City Fiscal of ManilaDocument2 pagesGuingona V City Fiscal of ManilaHannah SyPas encore d'évaluation

- Sinbad's BankruptcyDocument3 pagesSinbad's BankruptcyGeri KoeppelPas encore d'évaluation

- NC Complaint 1Document14 pagesNC Complaint 1Xylon MillerPas encore d'évaluation

- Guinggona v. City FiscalDocument3 pagesGuinggona v. City Fiscal001noonePas encore d'évaluation

- TRO Temporary Restraining Order Pleadings 39-2Document13 pagesTRO Temporary Restraining Order Pleadings 39-2DUTCH551400100% (3)

- KT Group, LLC v. Christensen, Glaser, Fink, 10th Cir. (2012)Document13 pagesKT Group, LLC v. Christensen, Glaser, Fink, 10th Cir. (2012)Scribd Government DocsPas encore d'évaluation

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument11 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsPas encore d'évaluation

- Motion For SJDocument9 pagesMotion For SJGervais R. BrandPas encore d'évaluation

- PAULINO GULLAS, Plaintiff-Appellant, vs. THE PHILIPPINE NATIONAL BANK, Defendant-AppellantDocument12 pagesPAULINO GULLAS, Plaintiff-Appellant, vs. THE PHILIPPINE NATIONAL BANK, Defendant-AppellantGlaiza OtazaPas encore d'évaluation

- Michael Contreras GMAC LLC TRO Et AlDocument22 pagesMichael Contreras GMAC LLC TRO Et AlNick CruzPas encore d'évaluation

- Westmont Bank v. InlandDocument3 pagesWestmont Bank v. InlandTricia SandovalPas encore d'évaluation

- United States Bankruptcy Court Southern District of New York For PublicationDocument16 pagesUnited States Bankruptcy Court Southern District of New York For Publicationanna338Pas encore d'évaluation

- USCOURTS Nyed 1 - 12 CV 01460 0Document7 pagesUSCOURTS Nyed 1 - 12 CV 01460 0k47647223Pas encore d'évaluation

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument26 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsPas encore d'évaluation

- ObjectionBACHomeLoansClaim 11 12Document3 pagesObjectionBACHomeLoansClaim 11 12GrammaWendyPas encore d'évaluation

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument14 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsPas encore d'évaluation

- Comp pr2011 266Document19 pagesComp pr2011 266ht5116Pas encore d'évaluation

- Guingona Vs City Fiscal of ManilaDocument4 pagesGuingona Vs City Fiscal of ManilaLouPas encore d'évaluation

- Foreclosure Fraud Complaint Vs Wells FargoDocument61 pagesForeclosure Fraud Complaint Vs Wells FargoDavid StarkeyPas encore d'évaluation

- Insolvency by Proff MukubwaDocument43 pagesInsolvency by Proff MukubwaGumisiriza BrintonPas encore d'évaluation

- Verified ComplaintDocument28 pagesVerified ComplaintNancy Duffy McCarron100% (3)

- Borders' Bankruptcy PetitionDocument21 pagesBorders' Bankruptcy PetitionDealBook100% (1)

- Verified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissDocument38 pagesVerified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissBarry Eskanos100% (1)

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Document41 pagesRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsPas encore d'évaluation

- Pro Se Movant - Motion For Appointment of Ch. 11 TrusteeDocument120 pagesPro Se Movant - Motion For Appointment of Ch. 11 TrusteeSPas encore d'évaluation

- Mel Reynolds Sentencing MemoDocument67 pagesMel Reynolds Sentencing MemoMitch ArmentroutPas encore d'évaluation

- 10000001843Document110 pages10000001843Chapter 11 DocketsPas encore d'évaluation

- U S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtDocument19 pagesU S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtMelanie CohenPas encore d'évaluation

- Ken King Bankruptcy Petition Kenneth Roy King 6713 ColfaxDocument60 pagesKen King Bankruptcy Petition Kenneth Roy King 6713 ColfaxCamdenCanaryPas encore d'évaluation

- CIT Bankruptcy PetitionDocument30 pagesCIT Bankruptcy PetitionDealBook100% (1)

- Palm Financial Services Vs HeirsDocument10 pagesPalm Financial Services Vs HeirsHorace TolliverPas encore d'évaluation

- FFN PetitionDocument18 pagesFFN PetitionChapter 11 DocketsPas encore d'évaluation

- AFH ComplaintDocument14 pagesAFH Complaintalissa1318Pas encore d'évaluation

- 919 Prospect Response of Debtor To Tenant's Motion For Relief From Stay Et Al.Document21 pages919 Prospect Response of Debtor To Tenant's Motion For Relief From Stay Et Al.Anna BurnhamPas encore d'évaluation

- 2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4Document11 pages2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4api-360769610Pas encore d'évaluation

- Citadel Broadcasting's Bankruptcy PetitionDocument23 pagesCitadel Broadcasting's Bankruptcy PetitionDealBook100% (1)

- Memorandum in Support of Defendants Motion For Stay ofDocument43 pagesMemorandum in Support of Defendants Motion For Stay ofJohn ReedPas encore d'évaluation

- How to Win the Property War in Your Bankruptcy: Winning at Law, #4D'EverandHow to Win the Property War in Your Bankruptcy: Winning at Law, #4Pas encore d'évaluation

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsD'EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (12)