Académique Documents

Professionnel Documents

Culture Documents

Lampiran I Data Penelitian Variabel X (GCG) : Universitas Sumatera Utara

Transféré par

SubionoAkbarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lampiran I Data Penelitian Variabel X (GCG) : Universitas Sumatera Utara

Transféré par

SubionoAkbarDroits d'auteur :

Formats disponibles

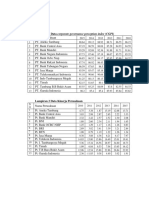

Lampiran i

Data Penelitian Variabel X (GCG)

skor penilaian CGPI

NO Nama Perusahaan 2007 2008 2009

1 PT Bank Mandiri (Persero) Tbk 88,66 90,07 90,65

2 PT CIMB Niaga Tbk 87,9 87,53 88,37

3 PT Jamsostek (persero) 85,96 85,87 80,77

4 PT Aneka Tambang (persero) Tbk 82,07 75,35 85,87

5 PT Elnusa Tbk 81,58 73,82 81,74

6 PT Adhi Karya (persero) Tbk 81,79 82,07 81,54

7 PT United Tractor Tbk 81,53 82,27 85,44

PT Tambang Batubara Bukit Asam (persero)

8 Tbk 80,87 81,74 82,27

9 PT Bakrieland Development Tbk 73,82 62,62 76,93

10 Bank Dki 76,93 80,3 76,61

11 PT kawasan Berikat Nusantara (persero) 82,07 73,4

12 PT Panorama Transportasi Tbk 64,3 68,71

13 PT Indocare Citrapasific 62,62

14 PT BUMI Resources Tbk 73,82

15 PT Telekomunikasi Indonesia Tbk 88,67

16 PT Bank Negara Indonesia Tbk 79,46 81,63

17 PT jasa Marga Tbk 81,62

18 PT Asuransi Jasa Indonesia Tbk 81,59

19 PT Garuda Indonesia Tbk 81,58

20 PT Indosat Tbk 82,53

21 PT Bank NISP Tbk 75,82

22 PT Wijaya Karya Tbk 84,79

23 PT BFI Finance Indonesia Tbk 81,53

24 PT Angkasa Pura (persero) 79,7

25 PT Pertamina (persero) 59,53

26 PT Pembangunan Jaya Ancol Tbk 57,53

27 PT Astra Graphia Tbk 80,3

28 PT Kalbe Farma Tbk 79,7

29 PT Bank Permata Tbk 78,85

30 PT Pelabuhan Indonesia II (persero) 73,4

Universitas Sumatera Utara

Lampiran ii

Data Penelitian Variabel Y (ROA) dari Perusahaan yang Menjadi Sampel

ROA

NO Nama Perusahaan 2007 2008 2009

1 PT Bank Mandiri (Persero) Tbk 0,013620872 0,01482212 0,0181327

2 PT CIMB Niaga Tbk 0,016104182 0,00661907 0,01470836

3 PT Jamsostek (persero) 0,218043135 0,099050785 0,05100882

4 PT Aneka Tambang (persero) Tbk 0,425035517 0,133542156 0,00871205

5 PT Elnusa Tbk 0,04631774 0,040319294 0,11073311

6 PT Adhi Karya (persero) Tbk 0,025755156 0,01589788 0,02940422

7 PT United Tractor Tbk 0,114825867 0,116455466 0,15642565

PT Tambang Batubara Bukit Asam

8 (persero) Tbk 0,182502631 0,279649435 0,33765026

9 PT Bakrieland Development Tbk 0,023508168 0,032645386 0,01140854

10 Bank Dki 0,006115011 0,00859281 0,00917093

Universitas Sumatera Utara

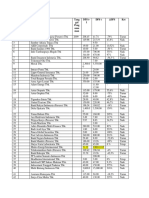

Lampiran iii

Descriptives

Total Skor Penerapan GCG dan ROA

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Good Corporate Governance 30 62.62 90.65 81.7647 5.83330

Return On Assets 30 .01 .43 .0856 .10774

Valid N (listwise) 30

Universitas Sumatera Utara

Lampiran iv

Regression

Variabel ROA

Variables Entered/Removedb

Variables Variables

Model Entered Removed Method

1 Ln_Good

Corporate . Enter

a

Governance

a. All requested variables entered.

b. Dependent Variable: Ln_Return On Assets

Model Summaryb

Adjusted R Std. Error of the

Model R R Square Square Estimate Durbin-Watson

1 .032a .001 -.035 1.30675 .848

a. Predictors: (Constant), Ln_Good Corporate Governance

b. Dependent Variable: Ln_Return On Assets

b

ANOVA

Model Sum of Squares df Mean Square F Sig.

1 Regression .051 1 .051 .030 .865a

Residual 47.812 28 1.708

Total 47.863 29

a. Predictors: (Constant), Ln_Good Corporate Governance

b. Dependent Variable: Ln_Return On Assets

Universitas Sumatera Utara

Residuals Statisticsa

Minimum Maximum Mean Std. Deviation N

Predicted Value -3.2769 -3.0708 -3.2180 .04173 30

Std. Predicted Value -1.413 3.527 .000 1.000 30

Standard Error of Predicted

.239 .889 .315 .124 30

Value

Adjusted Predicted Value -3.3388 -2.7687 -3.1959 .10640 30

Residual -1.91152 2.36595 .00000 1.28402 30

Std. Residual -1.463 1.811 .000 .983 30

Stud. Residual -1.504 1.842 -.008 1.008 30

Deleted Residual -2.02118 2.44816 -.02211 1.35199 30

Stud. Deleted Residual -1.541 1.929 -.003 1.023 30

Mahal. Distance .000 12.442 .967 2.260 30

Cook's Distance .000 .066 .027 .020 30

Centered Leverage Value .000 .429 .033 .078 30

a. Dependent Variable: Ln_Return On Assets

Universitas Sumatera Utara

Lampiran v

Variabel ROA

Universitas Sumatera Utara

Lampiran vi

One Sample Kolmogorov Smirnov Test

Variabel ROA

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 30

Normal Parametersa Mean .0000000

Std. Deviation 1.28401871

Most Extreme Differences Absolute .133

Positive .128

Negative -.133

Kolmogorov-Smirnov Z .730

Asymp. Sig. (2-tailed) .660

a. Test distribution is Normal.

Universitas Sumatera Utara

Lampiran vii

Scatterplot

Variabel ROA

Universitas Sumatera Utara

Lampiran viii

Autokorelasi

Variabel ROA

Model Summaryb

Adjusted R Std. Error of the

Model R R Square Square Estimate Durbin-Watson

a

1 .032 .001 -.035 1.30675 .848

a. Predictors: (Constant), Ln_Good Corporate Governance

b. Dependent Variable: Ln_Return On Aassets

Universitas Sumatera Utara

Lampiran ix

Tabel t

df 0.50 0.20 0.10 0.050 0.02 0.010 0.002

1 1.00000 3.07768 6.31375 12.70620 31.82052 63.65674 318.30884

2 0.81650 1.88562 2.91999 4.30265 6.96456 9.92484 22.32712

3 0.76489 1.63774 2.35336 3.18245 4.54070 5.84091 10.21453

4 0.74070 1.53321 2.13185 2.77645 3.74695 4.60409 7.17318

5 0.72669 1.47588 2.01505 2.57058 3.36493 4.03214 5.89343

6 0.71756 1.43976 1.94318 2.44691 3.14267 3.70743 5.20763

7 0.71114 1.41492 1.89458 2.36462 2.99795 3.49948 4.78529

8 0.70639 1.39682 1.85955 2.30600 2.89646 3.35539 4.50079

9 0.70272 1.38303 1.83311 2.26216 2.82144 3.24984 4.29681

10 0.69981 1.37218 1.81246 2.22814 2.76377 3.16927 4.14370

11 0.69745 1.36343 1.79588 2.20099 2.71808 3.10581 4.02470

12 0.69548 1.35622 1.78229 2.17881 2.68100 3.05454 3.92963

13 0.69383 1.35017 1.77093 2.16037 2.65031 3.01228 3.85198

14 0.69242 1.34503 1.76131 2.14479 2.62449 2.97684 3.78739

15 0.69120 1.34061 1.75305 2.13145 2.60248 2.94671 3.73283

16 0.69013 1.33676 1.74588 2.11991 2.58349 2.92078 3.68615

17 0.68920 1.33338 1.73961 2.10982 2.56693 2.89823 3.64577

18 0.68836 1.33039 1.73406 2.10092 2.55238 2.87844 3.61048

19 0.68762 1.32773 1.72913 2.09302 2.53948 2.86093 3.57940

20 0.68695 1.32534 1.72472 2.08596 2.52798 2.84534 3.55181

21 0.68635 1.32319 1.72074 2.07961 2.51765 2.83136 3.52715

22 0.68581 1.32124 1.71714 2.07387 2.50832 2.81876 3.50499

23 0.68531 1.31946 1.71387 2.06866 2.49987 2.80734 3.48496

24 0.68485 1.31784 1.71088 2.06390 2.49216 2.79694 3.46678

25 0.68443 1.31635 1.70814 2.05954 2.48511 2.78744 3.45019

26 0.68404 1.31497 1.70562 2.05553 2.47863 2.77871 3.43500

27 0.68368 1.31370 1.70329 2.05183 2.47266 2.77068 3.42103

28 0.68335 1.31253 1.70113 2.04841 2.46714 2.76326 3.40816

29 0.68304 1.31143 1.69913 2.04523 2.46202 2.75639 3.39624

30 0.68276 1.31042 1.69726 2.04227 2.45726 2.75000 3.38518

31 0.68249 1.30946 1.69552 2.03951 2.45282 2.74404 3.37490

32 0.68223 1.30857 1.69389 2.03693 2.44868 2.73848 3.36531

33 0.68200 1.30774 1.69236 2.03452 2.44479 2.73328 3.35634

34 0.68177 1.30695 1.69092 2.03224 2.44115 2.72839 3.34793

35 0.68156 1.30621 1.68957 2.03011 2.43772 2.72381 3.34005

36 0.68137 1.30551 1.68830 2.02809 2.43449 2.71948 3.33262

37 0.68118 1.30485 1.68709 2.02619 2.43145 2.71541 3.32563

38 0.68100 1.30423 1.68595 2.02439 2.42857 2.71156 3.31903

39 0.68083 1.30364 1.68488 2.02269 2.42584 2.70791 3.31279

40 0.68067 1.30308 1.68385 2.02108 2.42326 2.70446 3.30688

Universitas Sumatera Utara

Vous aimerez peut-être aussi

- Indiab Power Adani Power NTPC Reliance Power JSW Energy Tata PowerDocument4 pagesIndiab Power Adani Power NTPC Reliance Power JSW Energy Tata Power1987geoPas encore d'évaluation

- Developing Renewable Energy Mini-Grids in Myanmar: A GuidebookD'EverandDeveloping Renewable Energy Mini-Grids in Myanmar: A GuidebookPas encore d'évaluation

- Tata Group: Strategies For Effective Succession Planning and Internal Leadership TrainingDocument24 pagesTata Group: Strategies For Effective Succession Planning and Internal Leadership TrainingBhulakkadPas encore d'évaluation

- Porfolio Rebalancing ReportDocument3 pagesPorfolio Rebalancing ReportAayushi ChandwaniPas encore d'évaluation

- Lampiran 1 Data Corporate Governance Perception Index (CGPI)Document5 pagesLampiran 1 Data Corporate Governance Perception Index (CGPI)Melina GunawanPas encore d'évaluation

- Wirdawati-B2092221017-Tugas Statistik Untuk BisnisDocument5 pagesWirdawati-B2092221017-Tugas Statistik Untuk BisnisEMI PURWANIPas encore d'évaluation

- Handout Jan 24 Session-CoC and Capital StructureDocument3 pagesHandout Jan 24 Session-CoC and Capital StructureSatish KumarPas encore d'évaluation

- Desscriptive Questions: Statistical LabDocument4 pagesDesscriptive Questions: Statistical LabDarshan saklePas encore d'évaluation

- EPASX Q1 HoldingsDocument3 pagesEPASX Q1 Holdingszvishavane zvishPas encore d'évaluation

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathPas encore d'évaluation

- Sitti Norma, S.TR - Keb: Jumlah Sementara 6,888,027 159,593 Jumlah Halaman 1 6,888,027 159,593Document8 pagesSitti Norma, S.TR - Keb: Jumlah Sementara 6,888,027 159,593 Jumlah Halaman 1 6,888,027 159,593Nining Aprianthy NasirPas encore d'évaluation

- D - Bukti Pencapaian Indikator Kinerja 2023Document1 pageD - Bukti Pencapaian Indikator Kinerja 2023Faditia AmarulPas encore d'évaluation

- 'MITS6002 Business Analytics: Assignment 3Document11 pages'MITS6002 Business Analytics: Assignment 3ZERO TO VARIABLEPas encore d'évaluation

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Databacus IncPas encore d'évaluation

- Best Profitable StockDocument2 pagesBest Profitable Stockalkulith89Pas encore d'évaluation

- Ev-Ebitda Oil CompaniesDocument2 pagesEv-Ebitda Oil CompaniesArie Yetti NuramiPas encore d'évaluation

- Urgent Communication: 25% Public Holding Made Mandatory For Listed FirmsDocument9 pagesUrgent Communication: 25% Public Holding Made Mandatory For Listed FirmsA_KinshukPas encore d'évaluation

- Data Fundamental PBVu1 PERu10Document3 pagesData Fundamental PBVu1 PERu10Wildan MuliawanPas encore d'évaluation

- IDX Financial Data Ratios 2009Document8 pagesIDX Financial Data Ratios 2009Mohammad Noor SyahrielPas encore d'évaluation

- A Project Report ON: "Inventory Control & Store Management" INDocument16 pagesA Project Report ON: "Inventory Control & Store Management" INpremkumar7Pas encore d'évaluation

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)amanPas encore d'évaluation

- No Kode Emiten Nama Emiten Tang Gal Peng Umu Man DPS t-1 Dps T Dps KetDocument10 pagesNo Kode Emiten Nama Emiten Tang Gal Peng Umu Man DPS t-1 Dps T Dps KetFIEL027Pas encore d'évaluation

- Lamp IranDocument6 pagesLamp IranNuzulma JusyafitriPas encore d'évaluation

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000Pas encore d'évaluation

- Anggelia Syahputri - 3011911079 - UTS Praktikum Analisis Data StatistikDocument76 pagesAnggelia Syahputri - 3011911079 - UTS Praktikum Analisis Data StatistikWenny AnggitaPas encore d'évaluation

- FInal Report CBN March 2022Document4 pagesFInal Report CBN March 2022Angga Dwi PutrantoPas encore d'évaluation

- 200-300 ET 500 Company List 2022Document6 pages200-300 ET 500 Company List 20220000000000000000Pas encore d'évaluation

- BTMVC PvtSecCoDocument21 pagesBTMVC PvtSecCojapani08Pas encore d'évaluation

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)nerdmojoPas encore d'évaluation

- Beta Coefficient of ACIDocument6 pagesBeta Coefficient of ACIdebasisdattaPas encore d'évaluation

- DMT - Pula Graphite Memorandum - April2018.v2Document9 pagesDMT - Pula Graphite Memorandum - April2018.v2Rozalia PengoPas encore d'évaluation

- Ark Autonomous Technology & Robotics Etf Arkq Holdings PDFDocument1 pageArk Autonomous Technology & Robotics Etf Arkq Holdings PDFandrew2020rPas encore d'évaluation

- 01.03 Ark - Innovation - Etf - Arkk - HoldingsDocument2 pages01.03 Ark - Innovation - Etf - Arkk - HoldingsSalih GurdalPas encore d'évaluation

- Mabalacat City, Pampanga: Mabalacat City College Institute of Arts, Sciences and EducationDocument12 pagesMabalacat City, Pampanga: Mabalacat City College Institute of Arts, Sciences and EducationSofia Arceo SanchezPas encore d'évaluation

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianPas encore d'évaluation

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaPas encore d'évaluation

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasPas encore d'évaluation

- Factor Affecting Brand Switching in Telecom IndustryDocument24 pagesFactor Affecting Brand Switching in Telecom IndustryAnkit MauryaPas encore d'évaluation

- Watch List: Up List Width 300 and Text 700 RefreshDocument22 pagesWatch List: Up List Width 300 and Text 700 Refreshaximaccount7624Pas encore d'évaluation

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)mikiPas encore d'évaluation

- Lampiran 2Document7 pagesLampiran 2Nanda Juragan Sandal JepitPas encore d'évaluation

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000Pas encore d'évaluation

- Compare MEP All RankingDocument6 pagesCompare MEP All RankingJimmy WalkerPas encore d'évaluation

- Artikel Skripsi Mega Nur RoyaniDocument8 pagesArtikel Skripsi Mega Nur RoyanimeganrPas encore d'évaluation

- Σdemand ∈Previous Η Periods Η: Rosalijos, Reyman M. Bet-Mt2Document5 pagesΣdemand ∈Previous Η Periods Η: Rosalijos, Reyman M. Bet-Mt2reyman rosalijosPas encore d'évaluation

- Variables EnteredDocument2 pagesVariables EnteredAnas MahfudPas encore d'évaluation

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianPas encore d'évaluation

- Rajasthan Spinning and Weeving Mill: A Analytical Study ofDocument16 pagesRajasthan Spinning and Weeving Mill: A Analytical Study ofprateekksoniPas encore d'évaluation

- Jai Hanuman Plastic Industries 31.03.22Document4 pagesJai Hanuman Plastic Industries 31.03.22personalmailuse200Pas encore d'évaluation

- Genset+Charge Discharge Bussiness Case OperationDocument7 pagesGenset+Charge Discharge Bussiness Case OperationadisofaPas encore d'évaluation

- Descriptive StatisticsDocument1 pageDescriptive Statisticsnfajri20Pas encore d'évaluation

- Lecture7appendixa 12thsep2009Document31 pagesLecture7appendixa 12thsep2009Richa ShekharPas encore d'évaluation

- ACE - 66kV GIS 03.09.2022Document236 pagesACE - 66kV GIS 03.09.2022Chandan KumarPas encore d'évaluation

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarPas encore d'évaluation

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterPas encore d'évaluation

- Summer Training Report NTPC BARHDocument33 pagesSummer Training Report NTPC BARHAyush SinghPas encore d'évaluation

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Mila DiasPas encore d'évaluation

- Pergerakan Valuasi Saham LQ45 - 033022Document1 pagePergerakan Valuasi Saham LQ45 - 033022Raden AditPas encore d'évaluation

- Bse EsgDocument32 pagesBse Esgpoojaguptainida1Pas encore d'évaluation