Académique Documents

Professionnel Documents

Culture Documents

US Internal Revenue Service: f5500sp - 2002

Transféré par

IRSDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US Internal Revenue Service: f5500sp - 2002

Transféré par

IRSDroits d'auteur :

Formats disponibles

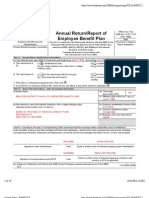

Official Use Only

Annual Return of Fiduciary

SCHEDULE P OMB No. 1210-0110

(Form 5500) of Employee Benefit Trust

This schedule may be filed to satisfy the requirements under section 6033(a) for

an annual information return from every section 401(a) organization exempt from

tax under section 501(a).

2002

Filing this form will start the running of the statute of limitations under

This Form is

section 6501(a) for any trust described in section 401(a) that is exempt from

Open to Public

Department of the Treasury

tax under section 501(a).

Inspection.

▼

Internal Revenue Service File as an attachment to Form 5500 or 5500-EZ.

For the trust calendar year 2002

or fiscal trust year beginning MM / D D / Y Y Y Y and ending MM / D D / Y Y Y Y

Please type or print

1a Name of trustee or custodian

b Number, street, and room or suite no. (If a P.O. box, see the instructions for Form 5500 or 5500-EZ.)

c City or town State ZIP code

2a Name of trust

b Trust's employer identification number

3 Name of plan if different from name of trust

4 Have you furnished the participating employee benefit plan(s) with the trust financial information required

to be reported by the plan(s)? ................................................................................................................................ Yes No

▼

5 Enter the plan sponsor's employer identification number as shown on Form 5500 or 5500-EZ ...

Under penalties of perjury, I declare that I have examined this schedule, and to the best of my knowledge and belief it is true, correct, and complete.

Signature of fiduciary

▼

SIGN HERE MM / D D / Y Y Y Y

▼

Date

For Paperwork Reduction Act Notice and OMB Control Nos., see the inst. for Form 5500 or 5500-EZ. Cat. No. 13504X Schedule P (Form 5500) 2002

2 5 0 2 0 0 0 1 0 A

v5.0

Vous aimerez peut-être aussi

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- US Internal Revenue Service: f5500sp - 2000Document1 pageUS Internal Revenue Service: f5500sp - 2000IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sp - 1991Document1 pageUS Internal Revenue Service: f5500sp - 1991IRSPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument8 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- US Internal Revenue Service: f5500sb - 2003Document7 pagesUS Internal Revenue Service: f5500sb - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sp - 2003Document1 pageUS Internal Revenue Service: I5500sp - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sp - 2004Document1 pageUS Internal Revenue Service: I5500sp - 2004IRSPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument4 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- US Internal Revenue Service: F5500se - 1999Document3 pagesUS Internal Revenue Service: F5500se - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSPas encore d'évaluation

- US Internal Revenue Service: f5500 - 2002Document6 pagesUS Internal Revenue Service: f5500 - 2002IRSPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument4 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2001Document2 pagesUS Internal Revenue Service: f5500sr - 2001IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2003Document2 pagesUS Internal Revenue Service: f5500sr - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2000Document2 pagesUS Internal Revenue Service: f5500sr - 2000IRSPas encore d'évaluation

- Retirement & Pension Plan For NYCDCC Employees 2006Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2006Latisha WalkerPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument5 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Carpenters Welfare Fund 2006Document16 pagesCarpenters Welfare Fund 2006Latisha WalkerPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument7 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Carpenters Annuity Fund 2006Document20 pagesCarpenters Annuity Fund 2006Latisha WalkerPas encore d'évaluation

- 2006 Form 5500 Carpenter Pension PlanDocument22 pages2006 Form 5500 Carpenter Pension PlanLatisha WalkerPas encore d'évaluation

- US Internal Revenue Service: f5500sf - 1999Document1 pageUS Internal Revenue Service: f5500sf - 1999IRSPas encore d'évaluation

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerPas encore d'évaluation

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerPas encore d'évaluation

- Carpenters Vacation Fund 2006Document14 pagesCarpenters Vacation Fund 2006Latisha WalkerPas encore d'évaluation

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument5 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Carpenters Vacation Fund 2007Document8 pagesCarpenters Vacation Fund 2007Latisha WalkerPas encore d'évaluation

- 2007 Form 5500 Carpenter Pension PlanDocument21 pages2007 Form 5500 Carpenter Pension PlanLatisha WalkerPas encore d'évaluation

- Retirement & Pension Plan For NYCDCC Employees 2007Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2007Latisha WalkerPas encore d'évaluation

- Union Security Trust Fund 2007Document10 pagesUnion Security Trust Fund 2007Latisha WalkerPas encore d'évaluation

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document16 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellPas encore d'évaluation

- US Internal Revenue Service: f5500sf - 1997Document1 pageUS Internal Revenue Service: f5500sf - 1997IRSPas encore d'évaluation

- Retirement Plan of Trustees 2006Document13 pagesRetirement Plan of Trustees 2006Latisha WalkerPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2004Document6 pagesUS Internal Revenue Service: I1040sf - 2004IRSPas encore d'évaluation

- Instructions For Form 990-EZ: Department of The TreasuryDocument16 pagesInstructions For Form 990-EZ: Department of The TreasuryIRSPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2003Document6 pagesUS Internal Revenue Service: I1040sf - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2001Document6 pagesUS Internal Revenue Service: I1040sf - 2001IRSPas encore d'évaluation

- Union Security Trust Fund 2006Document10 pagesUnion Security Trust Fund 2006Latisha WalkerPas encore d'évaluation

- Resolve 990 Federal Financial Disclosure - 2009Document13 pagesResolve 990 Federal Financial Disclosure - 2009ResolvePas encore d'évaluation

- US Internal Revenue Service: I990sa - 1998Document8 pagesUS Internal Revenue Service: I990sa - 1998IRSPas encore d'évaluation

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document13 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellPas encore d'évaluation

- US Internal Revenue Service: f5500st - 1999Document2 pagesUS Internal Revenue Service: f5500st - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2000Document6 pagesUS Internal Revenue Service: I1040sf - 2000IRSPas encore d'évaluation

- Filing PDFDocument82 pagesFiling PDFjgalenPas encore d'évaluation

- Instructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanDocument6 pagesInstructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanIRSPas encore d'évaluation

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document14 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellPas encore d'évaluation

- F 5500 SsaDocument3 pagesF 5500 SsaIRSPas encore d'évaluation

- Instructions For Schedule A (Form 990 or 990-EZ)Document10 pagesInstructions For Schedule A (Form 990 or 990-EZ)IRSPas encore d'évaluation

- US Internal Revenue Service: F5500si - 2003Document3 pagesUS Internal Revenue Service: F5500si - 2003IRSPas encore d'évaluation

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329Pas encore d'évaluation

- Form 5500 Annual Return/Report of Employee Benefit Plan: X X X X X X X X X X X XDocument12 pagesForm 5500 Annual Return/Report of Employee Benefit Plan: X X X X X X X X X X X XkmccoynycPas encore d'évaluation

- Short Form Return of Organization Exempt From Income TaxDocument16 pagesShort Form Return of Organization Exempt From Income TaxHalosPas encore d'évaluation

- 990 SBH 2016 Public Disclosure PDFDocument55 pages990 SBH 2016 Public Disclosure PDFAl FalackPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 1999Document7 pagesUS Internal Revenue Service: I1040sf - 1999IRSPas encore d'évaluation

- Form 1040 Schedule BDocument1 pageForm 1040 Schedule BGwo GwppyPas encore d'évaluation

- US Internal Revenue Service: f5500 - 1995Document6 pagesUS Internal Revenue Service: f5500 - 1995IRSPas encore d'évaluation

- Instructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlDocument14 pagesInstructions For Schedule A (Form 990 or 990-EZ) : Pager/SgmlIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSPas encore d'évaluation

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)