Académique Documents

Professionnel Documents

Culture Documents

Assignment

Transféré par

Karim RezaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assignment

Transféré par

Karim RezaDroits d'auteur :

Formats disponibles

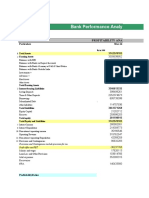

2009 2008

ROE calculation

3.1 ROE= Net income 995561 176533

(Net icome)/(SH equity) SH equity 4430882 22.47% 3426277 5.15%

3.1.1 Traditional approach

Net profit mergin 0.13 0.028

Asset turnover 0.436 0.348

ROA 0.05 0.009744

ROE Financial Leverage 3.9 19.50% 5.2 5.07%

3.1.2 Alternative approach

NOPAT 891935 394437.22

Sales 7543725 6211938

ROE= Net Interest expense

(NOPAT/Sales)+ after tax 574474 217904.22

{(NOPAT/Sales)-

(Net inte expense/Net debt)* Net debt 10466063 11256024

(Net debt/Equity)} Equity 4430882 26.00% 3426277 20%

ROE on Traditional approach ROE on Traditional approach

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Year 2009 Year 2008

Vous aimerez peut-être aussi

- Operating Working Capital (INV+AR-AP)Document33 pagesOperating Working Capital (INV+AR-AP)Neethu Nair40% (5)

- A) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011Document4 pagesA) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011MANAV ROY100% (2)

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierPas encore d'évaluation

- DDM Federal BankDocument15 pagesDDM Federal BankShubhangi 16BEI0028Pas encore d'évaluation

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanPas encore d'évaluation

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyD'EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyÉvaluation : 5 sur 5 étoiles5/5 (1)

- ACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/EDocument10 pagesACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/Estudymat12Pas encore d'évaluation

- Mercury Case ExhibitsDocument10 pagesMercury Case ExhibitsjujuPas encore d'évaluation

- Bank Performance Analysis With Risk RatiosDocument8 pagesBank Performance Analysis With Risk RatiosSurbhî GuptaPas encore d'évaluation

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303Pas encore d'évaluation

- L&T - Ratios - StandaloneDocument5 pagesL&T - Ratios - StandaloneinduPas encore d'évaluation

- Kalyani HW - Danaysha TulsianiDocument10 pagesKalyani HW - Danaysha TulsianiAryaman JainPas encore d'évaluation

- HBL-Vertical & Horizontal AnlyisDocument10 pagesHBL-Vertical & Horizontal AnlyismughalsairaPas encore d'évaluation

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekarePas encore d'évaluation

- Sourses of Funds: Balance Sheet 2010 2009Document4 pagesSourses of Funds: Balance Sheet 2010 2009Deven PipaliaPas encore d'évaluation

- Itc Limited: Equity AnalysisDocument15 pagesItc Limited: Equity AnalysisrskatochPas encore d'évaluation

- Bank Performance Analysis - Sahil Badaya PGFB1942Document10 pagesBank Performance Analysis - Sahil Badaya PGFB1942Surbhî GuptaPas encore d'évaluation

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhPas encore d'évaluation

- (Billions) : Q2 2012 Data, Except Where NotedDocument17 pages(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikPas encore d'évaluation

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaPas encore d'évaluation

- Hitung ProyeksiDocument3 pagesHitung ProyeksiDwinanda HarsaPas encore d'évaluation

- Sun and Crocs ValuationDocument7 pagesSun and Crocs ValuationKshitishPas encore d'évaluation

- Godrej Agrovet Ratio Analysis 17-18Document16 pagesGodrej Agrovet Ratio Analysis 17-18arpitPas encore d'évaluation

- Go Rural FM AssignmentDocument31 pagesGo Rural FM AssignmentHumphrey OsaigbePas encore d'évaluation

- Income Statement: Excess CashDocument9 pagesIncome Statement: Excess CashAlejandra San Roman AmadorPas encore d'évaluation

- Zara & Its Key Competitors Gap H&M Benetton ZaraDocument1 pageZara & Its Key Competitors Gap H&M Benetton ZaraTarun SachdevaPas encore d'évaluation

- Group 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Document20 pagesGroup 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Reeja Mariam MathewPas encore d'évaluation

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Document6 pagesIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91Pas encore d'évaluation

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaPas encore d'évaluation

- Customised Dupont AnalysisDocument1 pageCustomised Dupont AnalysisbhuvaneshkmrsPas encore d'évaluation

- Normalized Measures - Revenues and Profit Market Value and AssetsDocument15 pagesNormalized Measures - Revenues and Profit Market Value and AssetsNikith NatarajPas encore d'évaluation

- Financials at GlanceDocument1 pageFinancials at GlanceSrikanth Marriboyanna MPas encore d'évaluation

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenPas encore d'évaluation

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarPas encore d'évaluation

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemPas encore d'évaluation

- Accounts Assignement 21MBA0106Document4 pagesAccounts Assignement 21MBA0106TARVEEN DuraiPas encore d'évaluation

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversPas encore d'évaluation

- Mercury Action Athletic Synergies & AssumptionsDocument10 pagesMercury Action Athletic Synergies & AssumptionsSimón SegoviaPas encore d'évaluation

- FM Group 10Document5 pagesFM Group 10Anju tpPas encore d'évaluation

- Afs - QTLDocument6 pagesAfs - QTLKashif SaleemPas encore d'évaluation

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaPas encore d'évaluation

- Keppel Pacific Oak US REIT Financial StatementsDocument155 pagesKeppel Pacific Oak US REIT Financial StatementsAakashPas encore d'évaluation

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamPas encore d'évaluation

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarPas encore d'évaluation

- L&T Standalone FinancialsDocument4 pagesL&T Standalone FinancialsmartinajosephPas encore d'évaluation

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexPas encore d'évaluation

- ProblemsDocument6 pagesProblemsAarti SaxenaPas encore d'évaluation

- Shreya Jain - PGFC1935 - Performance AnalysisDocument13 pagesShreya Jain - PGFC1935 - Performance AnalysisSurbhî GuptaPas encore d'évaluation

- Keyratio 2009Document1 pageKeyratio 2009Kishore SinghPas encore d'évaluation

- Particulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeDocument4 pagesParticulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeShruti SrivastavaPas encore d'évaluation

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranPas encore d'évaluation

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaPas encore d'évaluation

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliPas encore d'évaluation

- FAA Ratio AnalysisDocument4 pagesFAA Ratio AnalysisRishav BhattacharjeePas encore d'évaluation

- Ruchi, Purvi & Anam (FM)Document7 pagesRuchi, Purvi & Anam (FM)045Purvi GeraPas encore d'évaluation

- Financials at GlanceDocument1 pageFinancials at Glancekanwal23Pas encore d'évaluation

- Common Size Analysis: Hul Profit and Loss StatementDocument7 pagesCommon Size Analysis: Hul Profit and Loss Statementamlan dasPas encore d'évaluation

- CaseDocument11 pagesCaseMariam OkropiridzePas encore d'évaluation